Are listing fees reasonable? What are the risks?

Written by: Iris, Liu Honglin, Mankun Law Firm

Which Web3 project doesn't issue tokens! But how to issue them? Which virtual asset exchange to use? This is a question that Web3 project teams must seriously consider. Often, Web3 project teams choose to list on top-tier crypto exchanges. The reasons are:

- In the eyes of users, being listed on such exchanges = the exchange affirms the project's value = the token will definitely rise = buy it!

- In the eyes of the project team, listing on a top exchange = user approval + exchange support = getting rich.

This brings up another issue: listing fees. Considering that in recent years, even when listed on top exchanges, the market performance of projects may not necessarily improve, many Web3 projects must consider cost-effectiveness when listing—are the listing fees appropriate? Additionally, if I pay a high fee, besides listing my token on your platform, what other "support" can guarantee my returns?

This week, a new round of "battles" over listing fees has begun, and this article will let Mankun lawyers share some insights.

Sky-high Listing Fees

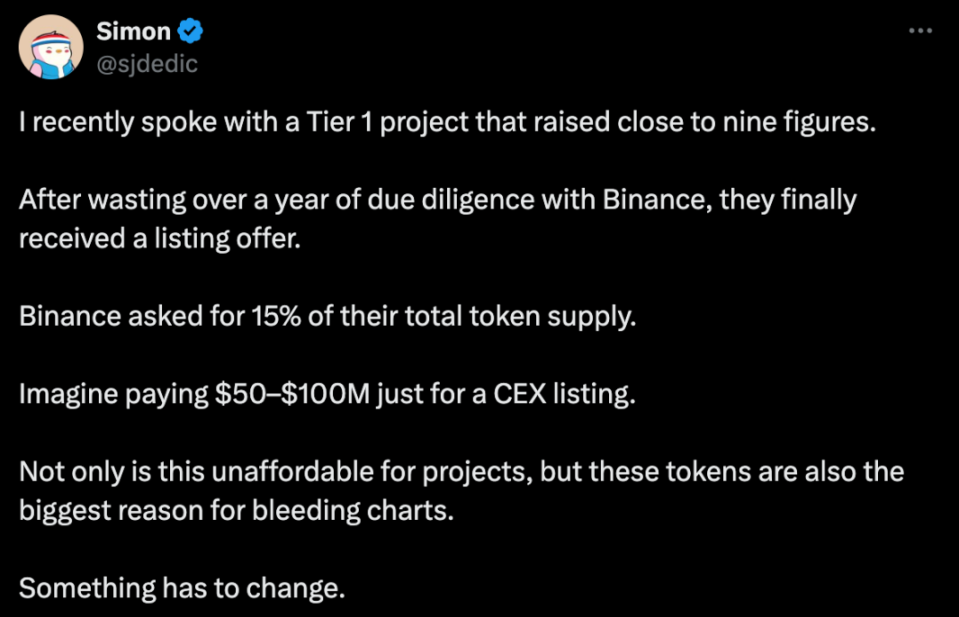

Although many crypto exchanges do not publicly disclose listing fees, there is usually only an application entry and contact information for listing. However, the potential cost of "listing fees" has long circulated in the market. This time, the direct confrontation between Binance and Coinbase has ignited the topic of listing fees, with many crypto KOLs joining the discussion.

The incident originated on November 1, when the CEO of cryptocurrency consulting and investment firm Moonrock Capital revealed on Twitter that Binance had proposed a "15% token" listing condition to a leading project team—equating to approximately $50 million to $100 million based on market capitalization. This news instantly caused a stir in the market, and rumors about Binance's "sky-high listing fees" quickly spread, with KOLs taking sides. Some believe that such "sky-high listing fees" stem from the immense power of top exchanges, while others argue that the listing model of centralized exchanges is harming the long-term interests of project teams, users, and the market, even sparking discussions about the necessity of decentralized exchanges (DEX).

Originally, the center of this debate was Binance, but a tweet from Coinbase co-founder Brian Armstrong also pulled the top exchange into the fray. Armstrong stated that "Coinbase's listing is free," but before he could finish, Andre Cronje, co-founder of Sonic Labs, jumped in to reveal that Binance did not charge them a listing fee; instead, Coinbase had proposed a fee requirement that even reached the tens of millions. Instantly, the debate escalated from "Do top exchanges charge sky-high listing fees?" to "Who is charging, and who charges more?"

However, some questioned whether Andre Cronje encountered a fake Coinbase employee, but Andre Cronje stated he could publicly share all communication records. During this time, Binance's He Yi also tweeted that there are no listing fees, and if there are any doubts, one can refer to the tokens already listed; Binance has set up token distribution introductions, and whether they charge 15% can be seen at a glance.

So far, the question of "Is there a listing fee or not?" actually has no definitive conclusion. However, this clash over listing fees inevitably leads to reflection on what role virtual currency exchanges play in the crypto industry. What support do the listing services provided by exchanges actually include? Do these supports affect market price trends and even impact the rights of ordinary users? Mankun lawyers believe that the hidden impacts of these behind-the-scenes operations are the more concerning issues.

Exchange Listing Applications

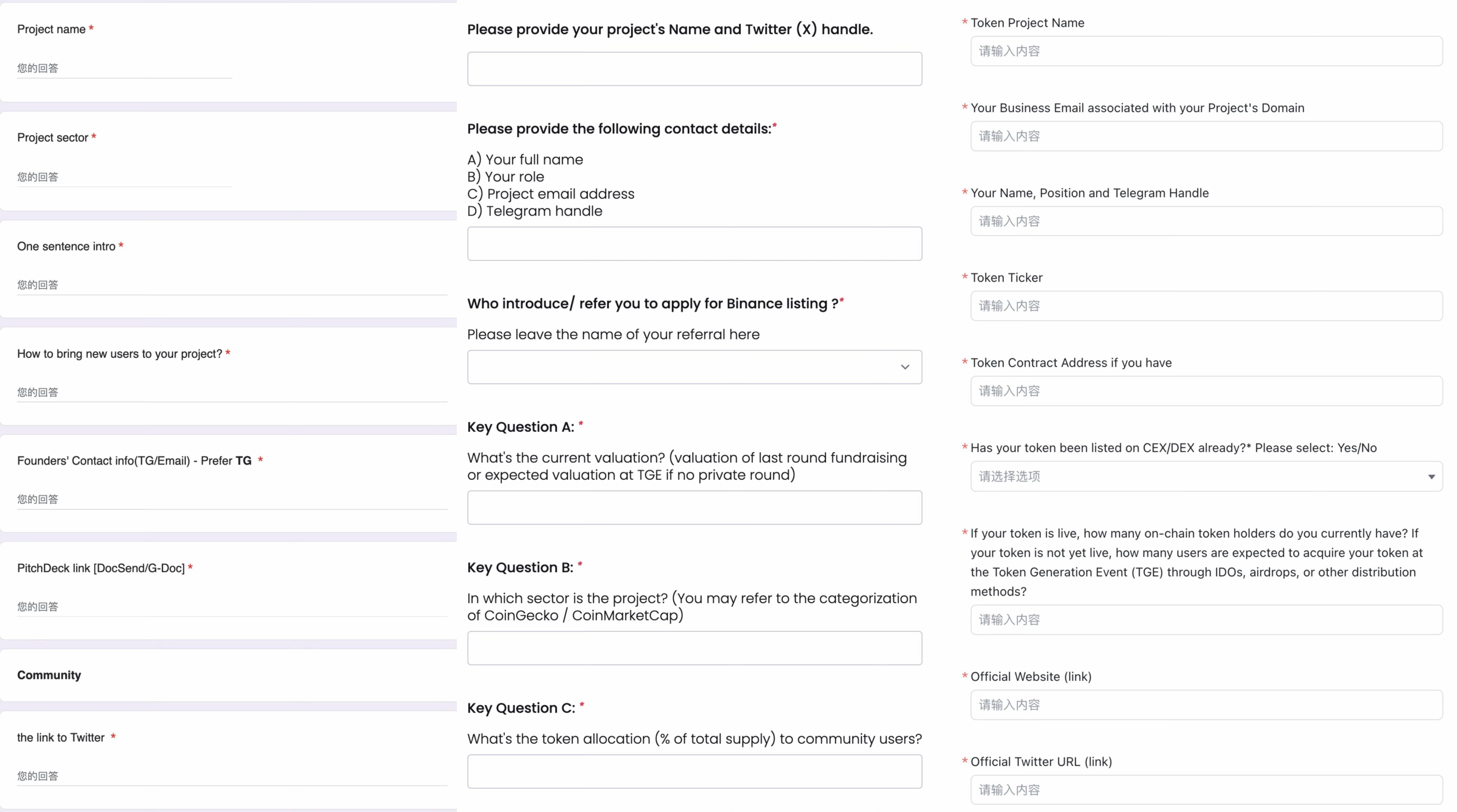

To gain a deeper understanding of the current listing process for virtual currency exchanges, Mankun lawyers attempted basic application operations on several well-known trading platforms such as Binance, Coinbase, and OKX.

* Screenshots of application pages from some platforms

In the initial application stage, Web3 project teams can only fill out an application form to submit basic information about the project and token for the platform's review. As many people online criticize, the information is completely opaque; at this stage, applicants usually find it difficult to learn specific details about listing services, fees, etc. Everything is left to "fate," waiting for the listing support team's contact. Typically, in the early stages of communication with the platform, project teams may be asked to sign a non-disclosure agreement prohibiting the disclosure of specific information and communication records related to the listing (this is also why Andre Cronje stated he could disclose information, as he did not sign relevant confidentiality clauses).

Although all listing information is confidential, there is no wall that doesn't let the wind through. Based on communications between the Mankun lawyer team and industry insiders, combined with several articles online, a basic understanding of the listing fees and corresponding services of current mainstream exchanges can be pieced together:

1. Technical Fees and Integration Support

Technical fees are the basic fees charged by the platform, usually settled in stablecoins. This fee is mainly used for the platform's technical team to adapt and integrate the project token, including reviewing the token contract, compatibility testing, and technical support. The technical fees vary among different exchanges, primarily depending on the complexity of the integration and the required security standards.

2. Marketing Fees and Promotion

How to gain traffic after listing? This is a headache for many project teams, and the marketing services of exchanges can partially address this need. The marketing services of exchanges typically include media promotion, airdrops, liquidity mining, user incentive activities, etc. To this end, exchanges often require project teams to provide a certain amount of tokens as rewards for promotion. Such airdrop activities are effective in increasing project exposure and attracting new users, but Web3 project teams must also consider whether this "airdrop" will bring excessive selling pressure.

3. Margin

Margin is another important fee, usually also paid in stablecoins. Exchanges often require project teams to deposit a certain amount of margin to ensure that the token price does not experience significant fluctuations. This means that if the token performs poorly in the market after listing and the price falls below a certain standard, the exchange may not refund the margin as a "safety net" to compensate for the platform's liquidity loss. This fee is a considerable burden for project teams, but from the exchange's perspective, such a margin mechanism can protect the platform's image and filter out more stable projects.

Additionally, some exchanges also provide market-making services for Web3 project teams. Although market-making services typically do not fall under standard listing services, many project teams consider them an additional means to enhance token liquidity and market performance.

Overall, while Web3 project teams may not face the "listing fee" that most people think of when listing on exchanges, other aspects will still involve fee issues. Each of these aspects serves its purpose, and at least on the surface, these listing services seem to be aimed at ensuring the security, liquidity, and attraction of more users for Web3 projects on the platform.

Potential Risks of Listing Services

However, Mankun lawyers believe that behind this combination of services, there may also be some significant potential risks—once exchanges and project teams reach a tacit understanding on interests, listing may turn into a venue for "joint market-making." So, how do these "services" affect the fairness of the market? Here, Mankun lawyers raise some of their own questions:

Promotion Marketing: Will it create a false impression of short-term traffic?

The marketing fees after listing are often used for airdrops, liquidity mining, and other user incentive activities. Undoubtedly, such mechanisms can rapidly increase the circulation and trading volume of tokens in the short term, bringing high attention to the project. However, we must consider one question: is this initial traffic sustainable in the long term or just a short-term "false fire"?

If such high incentives are used in the early stages of listing, it may quickly push up the token price, triggering ordinary users' chasing mentality, thus creating a "good" market performance in the short term. However, once the airdrop rewards for the token are exhausted, liquidity may significantly decrease, and market prices may come under pressure, significantly increasing the investment risks for ordinary users.

Margin: Protecting the market or a hidden "risk minefield"?

In the process of listing on exchanges, margin is often seen as a "protective umbrella" for the market. Project teams generally need to pay a certain amount of margin to ensure that the token price remains relatively stable in the early stages, preventing drastic declines due to insufficient liquidity or market fluctuations. On the surface, margin provides short-term support for the token, creating a "stable" image, which undoubtedly attracts more investors, especially those retail investors confident in short-term stability.

However, the effect of margin support is not lasting. Once the project team or exchange stops the support operation, or the margin funds are exhausted, the token price may instantly lose support. For retail investors, this "support" creates a false impression of price stability in the early stages, making it easy for them to enter at high prices. Once the support is withdrawn and price support disappears, retail investors' assets may quickly shrink, and risks may suddenly increase. This situation poses potential risks not only to ordinary investors but may also exacerbate market volatility, leading to broader panic.

Market Making: Fueling liquidity or controlling prices?

Market-making services are ostensibly designed to provide liquidity support for project teams, helping tokens maintain smooth trading on exchanges. However, in the worst-case scenario, if exchanges and project teams collude to influence market sentiment by adjusting trading volumes and controlling liquidity, market-making services may become a covert means of price manipulation. Many market makers have faced regulatory scrutiny and market criticism due to such concerns.

For retail investors, rapid increases in trading volume often signal bullish market conditions, prompting them to enter at high prices. However, the reality is that trading volume may not be driven by genuine demand but rather a fabricated liquidity illusion created through market-making services. This manipulation could ultimately lead to retail investors being trapped at high prices, bearing higher risks, while exchanges and project teams reap liquidity profits behind the scenes.

What appears to be normal trading fluctuations in the market may hide the meticulous arrangements of market-making services, especially when retail investors lack sufficient information transparency. This "gentle" price guidance is not only unfair to retail investors but may also raise questions about the authenticity of the market, attracting regulatory attention.

Mankun Lawyers' Recommendations

In summary, while listing services are auxiliary tools to help projects launch smoothly, in the absence of transparency and regulation, exchanges and project teams may reach tacit agreements to influence market price trends through market-making services, margins, and marketing activities, even misleading retail investors. Therefore, Mankun lawyers recommend:

For Web3 project teams, when choosing exchanges, they should be cautious about the listing process, prioritizing platforms with high transparency and clear service offerings. At the same time, project teams should strictly adhere to information disclosure principles to avoid promotional activities that may mislead investors, thereby maintaining their brand reputation.

For virtual currency exchanges, the transparency of the listing process, public disclosure of fees, and strengthening external regulation not only help enhance market fairness but also effectively protect the rights of ordinary investors. Exchanges should establish a comprehensive disclosure mechanism, clearly defining the content and fee standards of each listing service to reduce negative market speculation. Additionally, introducing compliant external audits or regulatory bodies can ensure that trading activities comply with market rules, enhancing the overall trust in the industry.

For individual investors, before investing in tokens, investors must carefully analyze the fundamentals of the project to avoid being misled by short-term market fluctuations and high-frequency airdrop activities. For newly listed tokens with significant price volatility, investors are advised to remain rational and patient, avoiding blind chasing of price increases to mitigate potential risks. At the same time, investors should pay attention to the market activities of relevant projects and the transparency of exchanges to make more rational investment decisions.

Through these multi-layered recommendations, Mankun lawyers hope to further promote the transparency and compliance of the virtual asset market, maintain the long-term healthy development of the market, and provide solid support for the innovative ecosystem of Web3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。