At 3 AM tonight (UTC+8), the Federal Reserve will announce its interest rate decision for November, and a 25 basis point rate cut has almost become a foregone conclusion. However, due to the impact of Trump's victory in the U.S. presidential election, the market's focus has shifted from the magnitude of the Fed's rate cut to the number of rate cuts.

During the campaign, Trump proposed three major policy goals: tax cuts, immigration restrictions, and increased tariffs. If Trump takes office and fulfills his promise of fiscal expansion, it will widen the U.S. government's fiscal deficit, leading to rising inflation. Although Powell has emphasized that the Federal Reserve is a non-political institution and will not participate in politics in any way, the consequences of Trump's expansionary fiscal policy will force the Fed to change its monetary policy. As JPMorgan stated, Trump's ability to reshape the Federal Reserve may only gradually materialize over time.

It is reported that the interest rate market still predicts that the Federal Reserve will cut rates twice more this year, each by 25 basis points, but has already reduced bets on the Fed cutting rates next year, expecting a cumulative rate cut of 100 basis points by September next year.

Stimulated by the favorable outcome of the U.S. election, BTC is currently near its historical high, with market sentiment extremely greedy, intensifying the long-short battle. According to AICoin (aicoin.com) analysis, if the Federal Reserve cuts rates by 25 basis points as expected tonight, it is unlikely to cause significant volatility, but attention should be paid to Powell's speech at 3:30 AM. If he reiterates his stance or reveals more information about rate adjustments, it may reshape confidence in the interest rate market, and BTC could experience significant volatility. For specific opportunities, please see below.

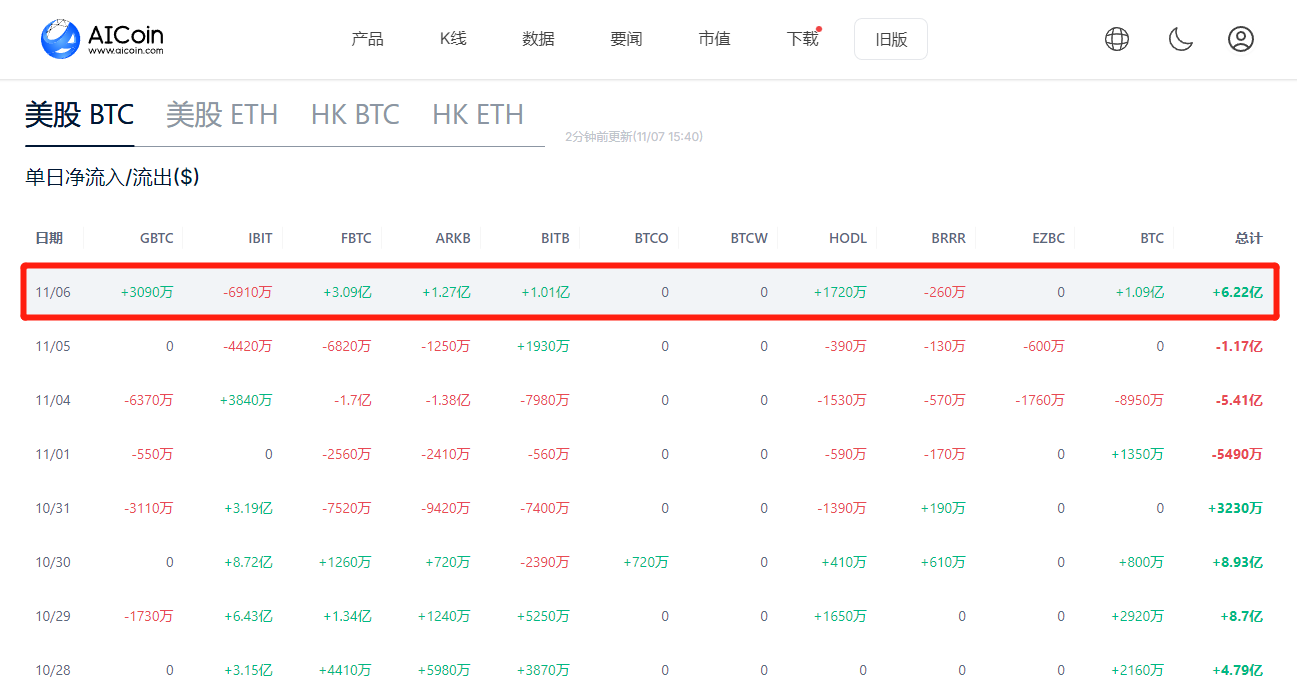

Large-scale funds flow into spot BTC ETF

Stimulated by Trump's election victory, a large amount of funds flowed into the U.S. spot Bitcoin ETF market yesterday, with a cumulative net inflow of $622 million. Among them, FBTC, ARKB, and BITB all saw inflows of over $100 million, but IBIT has turned into a major outflow, with $69.1 million flowing out.

Coinbase BTC premium turns positive

After a month, the Coinbase BTC premium has turned positive, with the premium rate at 0.0607% as of the time of writing, reaching a two-month high. According to AICoin analysis, a positive Coinbase premium means that U.S. traders are holding spot positions, making BTC's rise more stable. However, the change in premium may also be influenced by the election; previously, during the general election period, traders used USDT to bet on the election results, leading to a negative premium, which has now returned to a normal state.

Current price far from BTC's maximum pain point

AICoin index data shows that this week's maximum pain point for BTC options is 68,000, and for ETH, it is 2500, both far from the current price, and caution is needed regarding potential selling pressure from options.

The maximum pain point for options refers to the price at which the option buyers incur the maximum loss and the sellers make the most profit at expiration. When the current price is above the maximum pain point, it indicates that the market's current price deviates from the price most desired by option sellers, who are usually institutional investors. They may attempt to manipulate the market to push the underlying asset's price toward the maximum pain point to achieve maximum profit. However, this does not mean that the price will drop sharply in the short term; rather, it suggests that there is significant upward pressure in the future, and the risk of market volatility also increases.

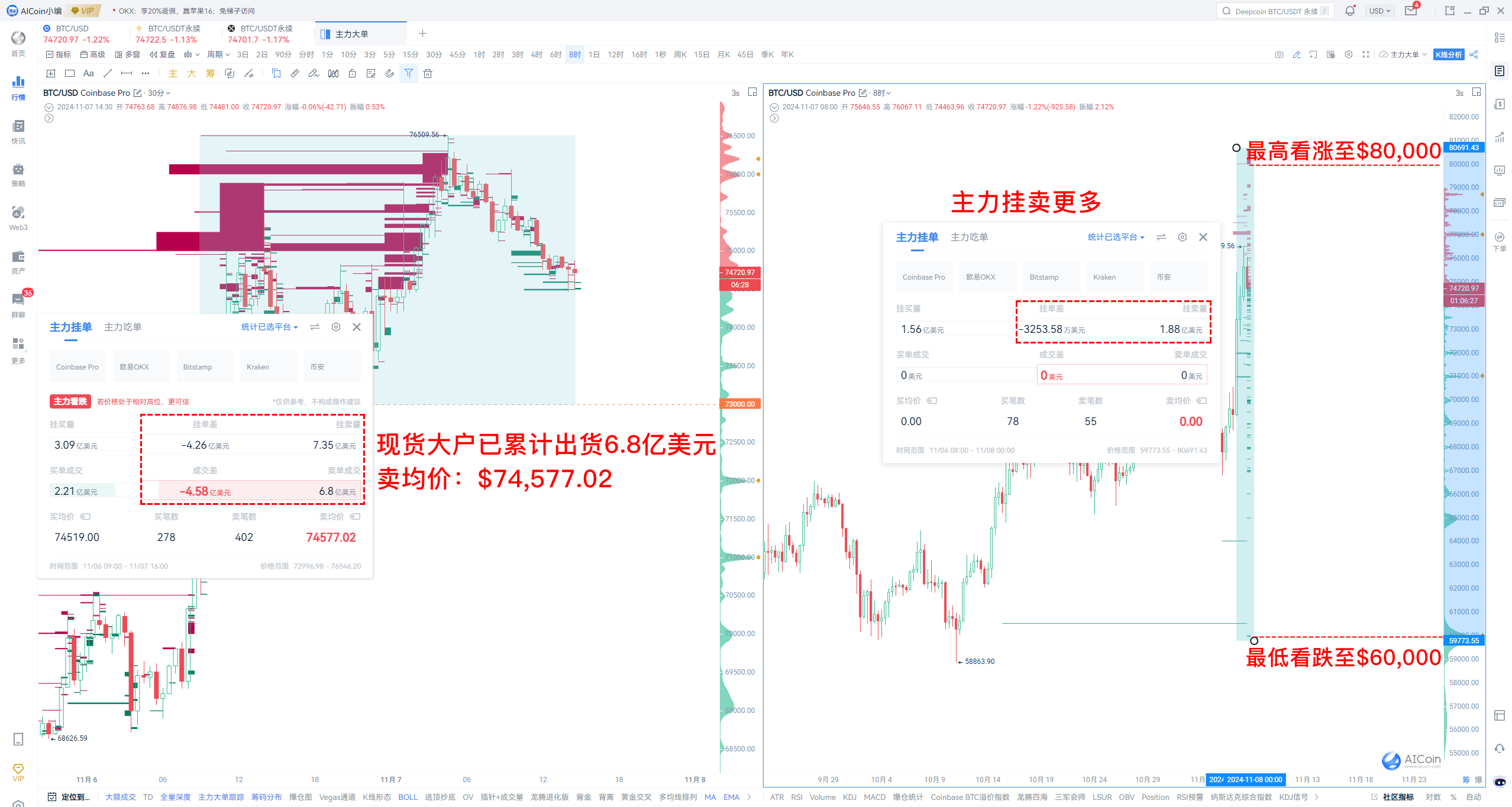

Increased selling pressure, but the main players remain bullish

After BTC surged past $73,000 yesterday, large spot holders continued to sell, with a cumulative sell-off of $680 million at an average selling price of $74,577.02. Selling pressure has surged, but according to the main orders, large holders remain bullish, placing sell orders of $188 million above the current price, with a maximum bullish outlook of $80,000.

Main sell order usage: Before execution (the price needs to rise to execute the sell order), bullish; after execution, bearish. Experience it immediately: https://www.aicoin.com/vip/

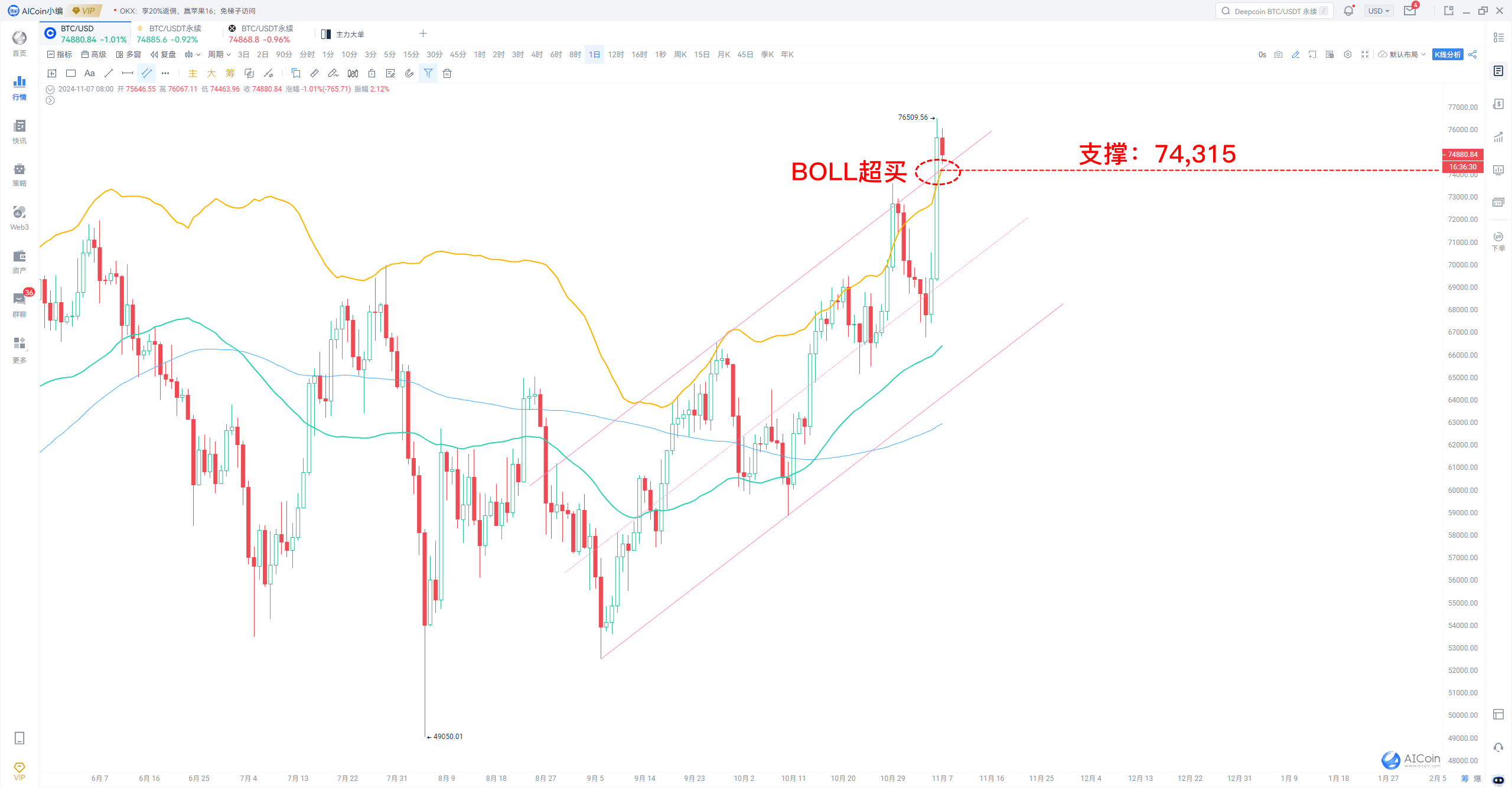

Multiple timeframes show BTC is at a critical position

• 1 hour

MACD has formed a divergence signal (divergence resonance), while BTC has dipped to touch the EMA24 moving average but closed above it, receiving support from the peak of the chips (point: 74,467).

Moving average usage: Dips that do not break the moving average indicate a rebound; rises that do not break the moving average indicate a pullback.

• 12 hours

RSI (12) shows a top divergence, but the chip peak at $74,275 provides support.

• Daily level

The price has broken through the upper Bollinger Band (40,2), forming an overbought signal, while also breaking through the upper edge of the upward parallel channel. The latest candlestick is a bearish candle, and attention should be paid to the trend line and Bollinger Band upper edge support (point: $74,315).

• Support zone: $74,275~$74,315; further support can be observed at the chip peak or moving average points.

• Resistance levels: $76,000, $77,000; further resistance can be observed at the main sell order points of the spot market.

Data is for reference only and does not constitute any investment advice!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。