Author: flow, crypto researcher

Translated by: zhouzhou, BlockBeats

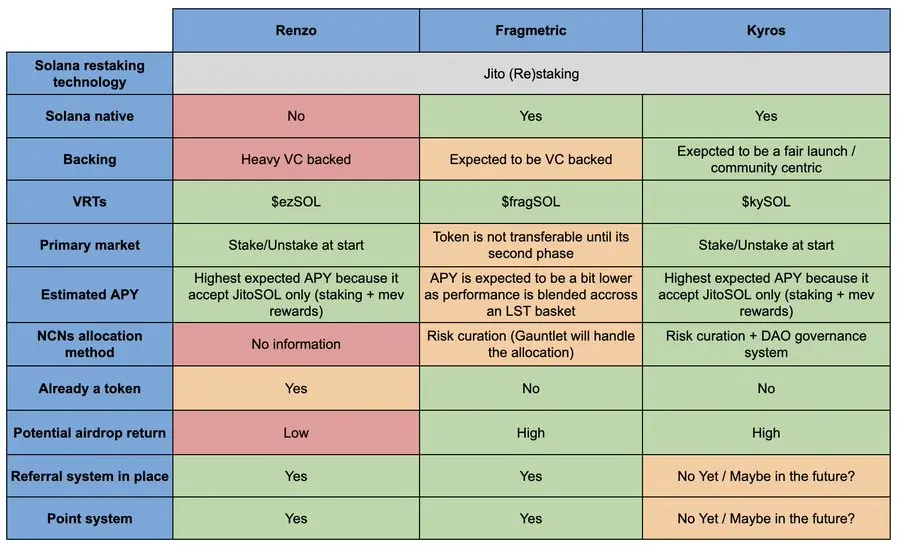

Editor's Note: This article introduces Jito Labs' re-staking protocol Jito (Re)staking launched on Solana. This technology allows the use of staked SOL assets to earn higher yields and potentially participate in airdrops. Users can re-stake SOL through three providers (Renzo, Fragmetric, and Kyros), each differing in risk, liquidity, and potential returns. The article compares their features in detail and recommends choosing Kyros, which supports fair launches and has potential airdrop returns.

Below is the original content (reorganized for readability):

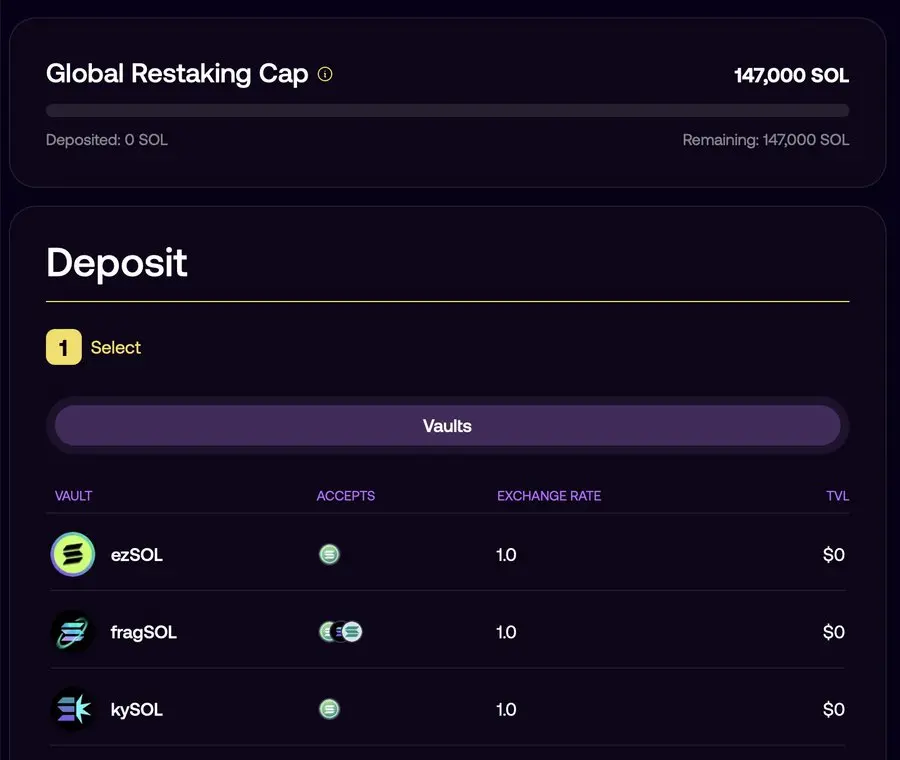

After successfully creating the largest liquid staking protocol on Solana, Jito Labs brings another significant development: the launch of a new re-staking protocol—Jito Re-staking. This re-staking project went live today and is about to open for deposits, with an initial re-staking cap of approximately $25 million (147,000 SOL). For those looking to earn higher annualized yields on SOL and hoping to seize airdrop opportunities, this is a very attractive opportunity in the current market.

Before introducing how to maximize this opportunity, let’s briefly review the basic principles of Jito Re-staking.

What is Jito Re-staking

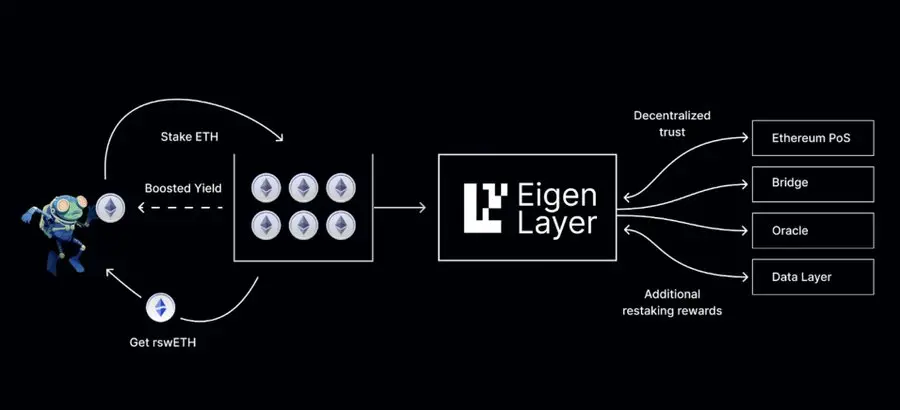

In simple terms, re-staking refers to using already staked assets to provide security for specific decentralized services again. While it may seem unimportant, it is actually one of the most promising innovations of this cycle. The concept was pioneered by EigenLayer and first launched on the Ethereum mainnet in June 2023.

An example illustrating how re-staking works

Today, Jito finally brings this new technology to Solana through its re-staking solution.

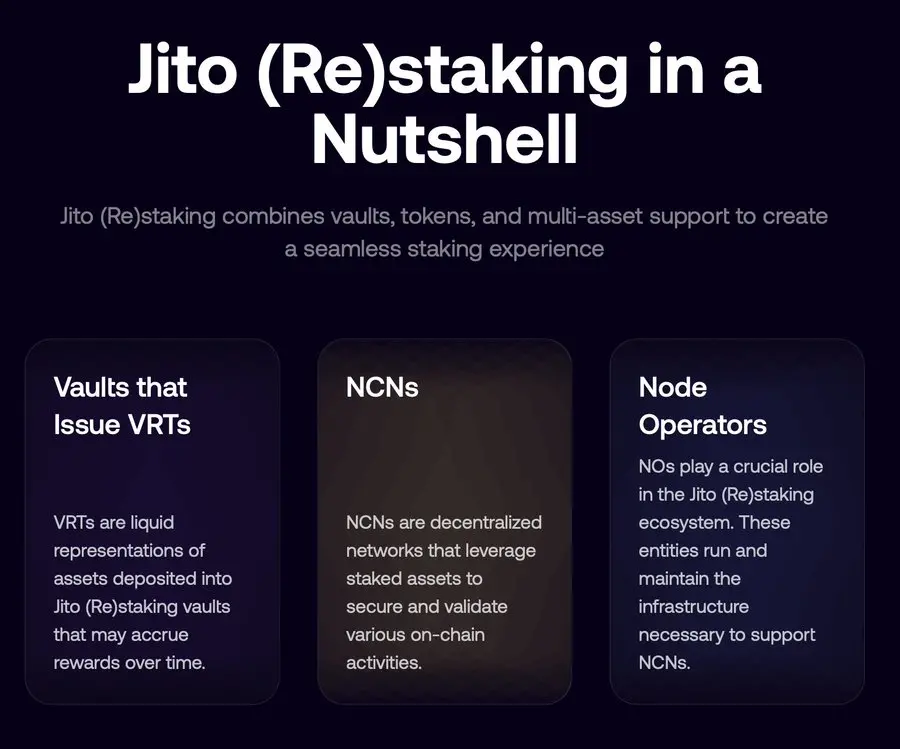

Diagram of the components of Jito Re-staking

Core Components of the Jito Re-staking Framework

The Jito Re-staking framework consists of two main components: the re-staking program and the vault program. They can be viewed as two independent entities that collaborate to provide a flexible and scalable infrastructure for creating and managing staked assets, vault receipt tokens (VRT), and node consensus operators (NCN). VRT is Jito's term for liquid re-staking tokens, while NCN is similar to the active validation services in EigenLayer, representing entities that will utilize the Jito re-staking solution.

The main function of the re-staking program is to manage the creation of node consensus operators (NCN), the user selection mechanism, and the reward distribution and penalty mechanisms. This part is invisible to users and can be seen as the core support of the Jito re-staking solution.

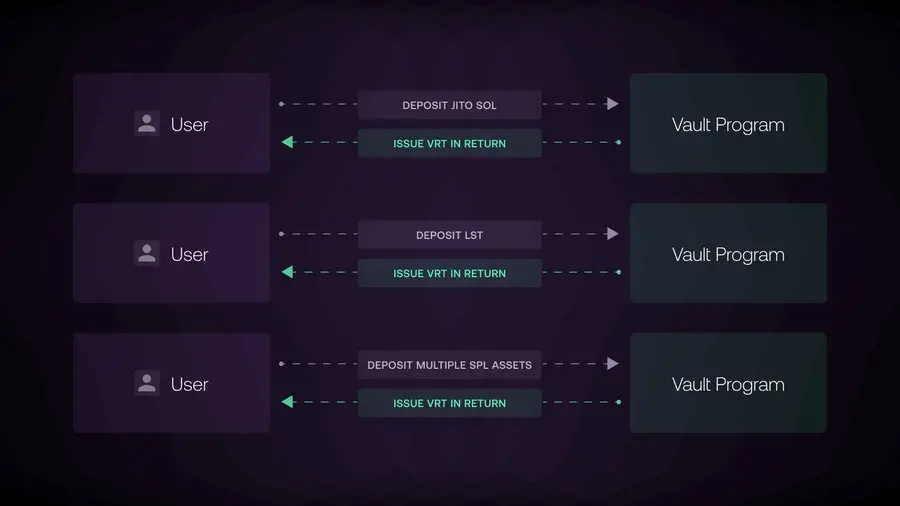

The vault program is responsible for managing liquid re-staking tokens (VRT) and customizing different re-staking strategies through DAO or automated protocols. This is the main interface for users to participate in re-staking. It can be likened to the re-staking role of EigenLayer being performed by the re-staking program on Solana, while the vault program acts as a liquidity layer between users and the core re-staking protocol.

Image showing how the vault program works

3 VRT Providers

In the initial phase, Jito is collaborating with three VRT providers: RenzoProtocol ($ezSOL), fragmetric ($fragSOL), and KyrosFi ($kySOL), which will collectively allocate an initial cap of 147,000 SOL. Therefore, any user wishing to re-stake SOL through Jito will need to choose among these three VRT providers.

Image of the landing page for Jito (Re)staking

Here is a summary of the main features of each VRT provider:

How to Choose the Right VRT for SOL Re-staking?

When choosing which VRT to use, the key is to find the best risk-return ratio.

Here is an analysis of each provider:

Risk: In terms of risk, the main focus is on protocol penalties (i.e., penalty risk) and liquidity risk. Given the current low number of NCNs and the early stage, it can be assumed that all providers have similar risk levels. Renzo and Kyros accept the most liquid JitoSOL, while Fragmetric accepts a wider variety of liquid staking tokens (LST), which may increase its liquidity risk. Additionally, Renzo and Kyros' VRT will have liquidity from the start, while Fragmetric's tokens are initially non-transferable. Therefore, in terms of risk, Renzo and Kyros have the lowest risk, while Fragmetric has slightly higher risk.

APY Returns: The expected APY for each project is similar, but it can be assumed that Renzo and Kyros, by only using JitoSOL, may have slightly higher expected APY than Fragmetric, though the difference will not be significant.

Airdrop Potential: Given that all VRTs have similar risks and expected returns, the key factor in choosing a specific VRT is the potential for airdrop rewards. Renzo already has tokens, and while re-staking may earn some future airdrop points, the potential is relatively low. In contrast, Kyros and Fragmetric currently have no tokens, indicating higher airdrop potential.

Further Analysis of the Differences Between Kyros and Fragmetric:

Fragmetric's Features: Expected to receive venture capital support, may follow a high FDV, low circulation model; leans towards a technical and decentralized user base; collaborates with risk management company Gauntlet; tokens are initially non-transferable; accepts multiple LSTs.

Kyros's Features: Supported by SwissBorg, helping to distribute $kySOL and potentially collaborating with major participants in Solana; may raise funds through a fair community-driven token model; has not yet started large-scale promotion; NCN distribution method may be based on DAO voting; supports JitoSOL.

Overall, KyrosFi appears more attractive in several aspects. First, the support from SwissBorg makes it easier to distribute $kySOL and opens doors for collaboration with major partners in Solana. Second, Kyros may adopt a fair launch approach. Finally, Kyros is relatively low-key at the moment, making its airdrop return potential more appealing.

Of course, this is a personal opinion for reference only, and I hope this analysis helps you make a more informed decision when choosing to re-stake SOL.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。