In its weekend market analysis, QCP Capital drew attention to mixed messages from recent U.S. economic data. The core Personal Consumption Expenditures (PCE) index—a primary gauge for inflation—ticked up just above expectations at 2.7% year-over-year, slightly higher than the 2.6% projected.

Meanwhile, QCP Capital analysts noted that the Non-Farm Payroll (NFP) report pointed to an unexpected dip, with only 12,000 jobs added versus the 110,000 anticipated. Despite the surprising NFP numbers, the U.S. unemployment rate held steady at 4.1%, leading to a jump in market expectations for a Federal Reserve rate cut in November, now seen as having a 96.4% chance of happening.

The Fed is expected to cut rates by a quarter point two days after Election Day. QCP analysts remarked that despite these conflicting signals, U.S. equities ended Friday in positive territory, buoyed by Amazon’s robust earnings. In addition, QCP highlighted how U.S. Treasury yields initially dropped in response to the NFP report but quickly reversed, climbing to a four-month high.

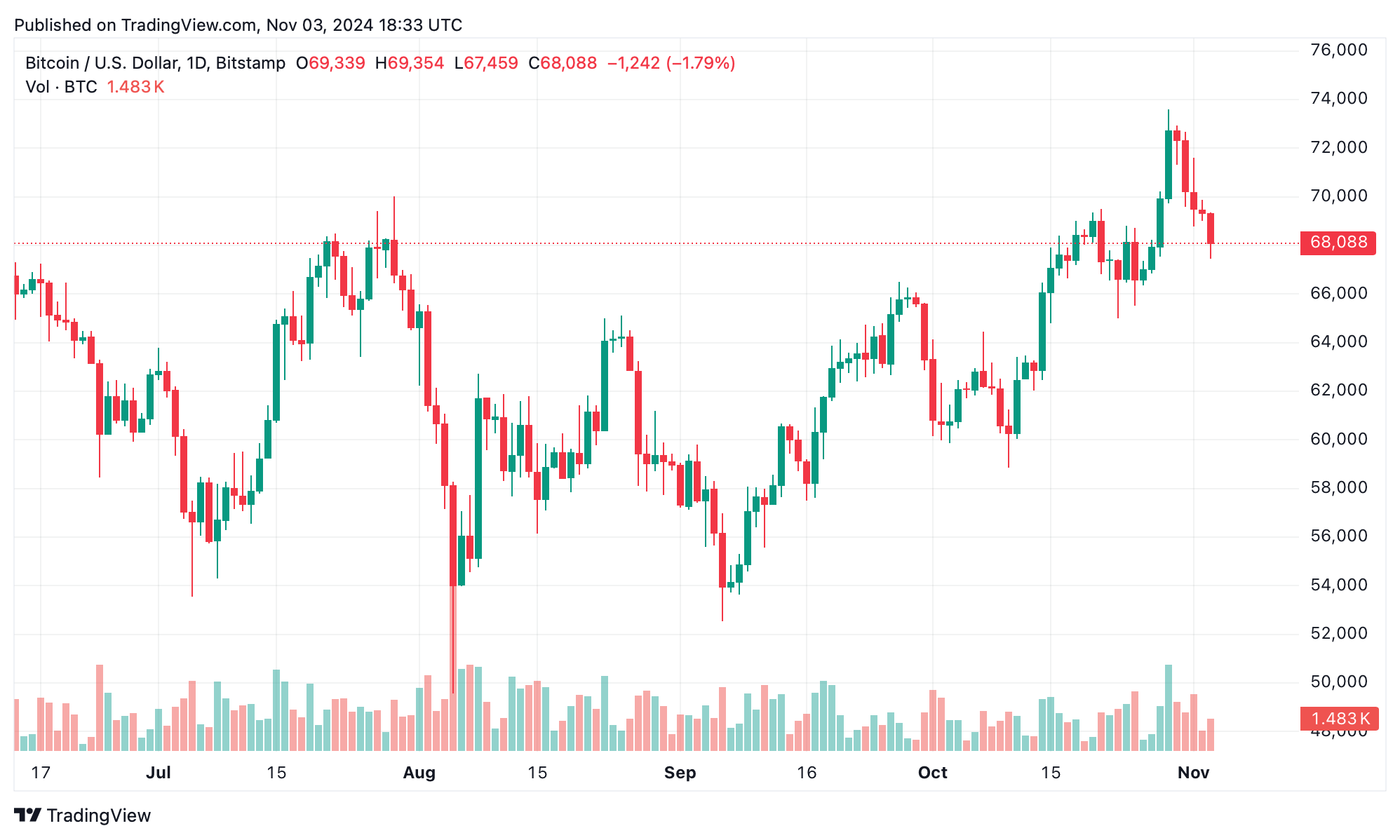

In the commodities sector, oil prices made slight gains amid rising geopolitical tensions, with reports of a possible Iranian response to Israel. Bitcoin (BTC) continued its upward movement, coming close to its all-time high, while ethereum (ETH) remained relatively quiet. QCP analysts credited bitcoin’s recent performance to robust ETF inflows, with over $2.1 billion pouring into bitcoin ETFs during the week.

Blackrock‘s Ishares Bitcoin Trust saw an $872 million inflow in a single day, the largest since its launch this year. Although BTC briefly dipped below $69,000 on Friday, QCP reported ongoing interest, as open interest (OI) in BTC futures and options reached $40.65 billion and $25.3 billion, respectively—a jump of 24.2% and 36.8% since early October. Looking forward to U.S. election week, QCP’s market strategists highlighted increased volatility around bitcoin.

The options market currently shows BTC’s seven-day implied volatility at 74.4%, a steep rise from the previous week’s realized volatility of 41.4%. This gap suggests a notable risk premium tied to the election’s unpredictable outcome. QCP also observed that while Trump currently holds a slight edge in betting markets, both candidates’ standings have been fluid, hinting at a potential “sell-the-news” reaction post-election, reminiscent of previous market patterns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。