User demand is shifting from "block space" to "wallet space," and attention will become the most valuable resource in the crypto economy.

Written by: Robbie Petersen, Delphi Digital Researcher

Translated by: Luffy, Foresight News

Throughout the history of cryptocurrency development, value capture within the blockchain stack has been a key topic of discussion. The core debate has remained between the protocol layer and the application layer, but there is a third layer that most people overlook: wallets.

The "fat wallet" theory posits that as protocols and applications "slim down," whoever possesses the two most valuable resources—distribution and order flow—will capture more value. As the ultimate front end, no one is better positioned than wallets to monetize this value.

This article will explore the "fat wallet" theory in three steps. First, we will outline three structural trends that will continue to drive the commoditization of the protocol and application layers. Second, we will explore various ways wallets can profit, including Payment for Order Flow (PFOF) and Decentralized Application Distribution Services (DaaS). Finally, we will discuss why Jupiter and Infinex may outcompete wallets in the battle for users.

Slimming Down Protocols and Applications

The question of where value will ultimately converge within the blockchain stack can be simplified into a straightforward framework. For each corresponding layer of the stack, ask yourself the following question:

If products at this layer increase fees, will users leave to choose cheaper alternatives?

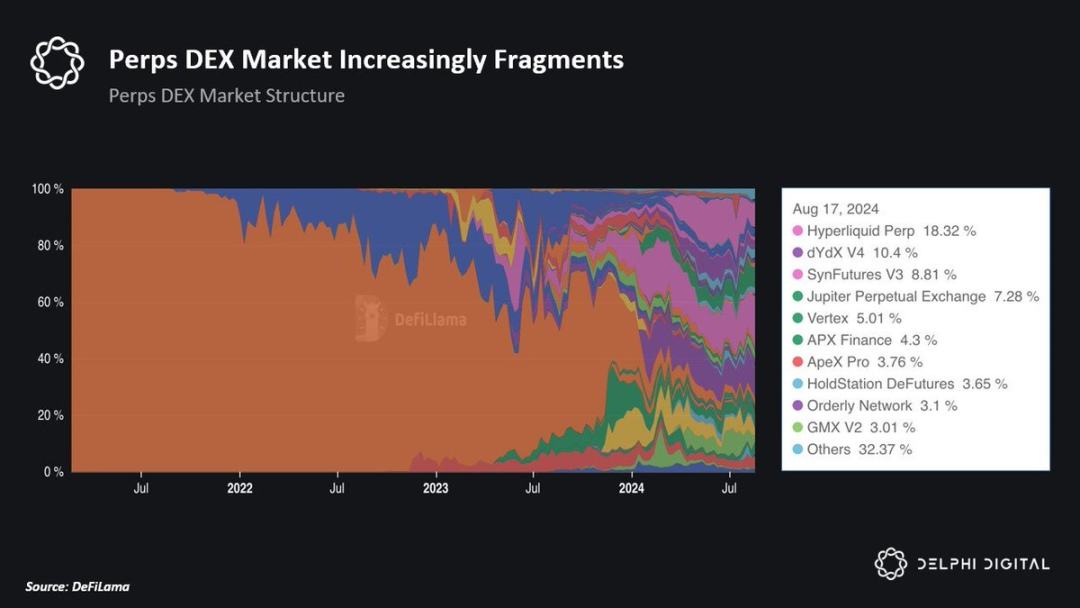

In simple terms, if Arbitrum raises its rates, will users switch to other protocols (like Base), and vice versa? Similarly, at the application layer, if dYdX raises its rates, will users turn to other indistinguishable perpetual DEXs?

Based on this logic, we can identify the places with the highest switching costs, thereby determining who possesses strong pricing power. Likewise, we can use this framework to identify the places with the lowest switching costs, thus determining which layer of the stack will become increasingly commoditized over time.

Historically, protocols have held strong pricing power, but I believe this is changing. Today, there are three structural trends that are increasingly "weakening" the protocol layer:

- Multi-chain applications and chain abstraction: As applications deploy across multiple chains to remain competitive, the cross-blockchain user experience will become increasingly indistinguishable, which in turn will lower the switching costs at the protocol layer. Additionally, by abstracting cross-chain bridges, chain abstraction will further compress switching costs. Therefore, applications will no longer be constrained by the network effects of a single chain; rather, chains will increasingly be constrained by the traffic distribution of applications.

- Maturity of the MEV supply chain: While MEV will never be completely eliminated, there are many initiatives at both the application layer and near the base layer that are redistributing MEV extracted from users. Importantly, as the MEV supply chain continues to mature, value will increasingly accumulate within the MEV supply chain and then be captured by applications with the most exclusive user order flow. This means that protocols will lose bargaining power, while the status of front ends and wallets will rise.

- Rise of the agent paradigm: In a world where transactions are primarily executed by agents and "solvers" rather than humans, attracting this agent flow will become a necessary condition for survival in blockchain. Importantly, since agents and "solvers" are programmed to focus on optimizing best execution, protocols will no longer compete around intangible assets like "consistency." Instead, transaction fees and liquidity will become paramount, further "weakening" the protocol layer as protocols are forced to compress fees and incentivize liquidity to remain competitive.

Thus, revisiting our initial question: If a protocol raises its fees, will users leave to seek cheaper alternatives? While this may not be apparent today, I believe that as switching costs continue to compress, the answer for an increasing number of protocols will be: YES.

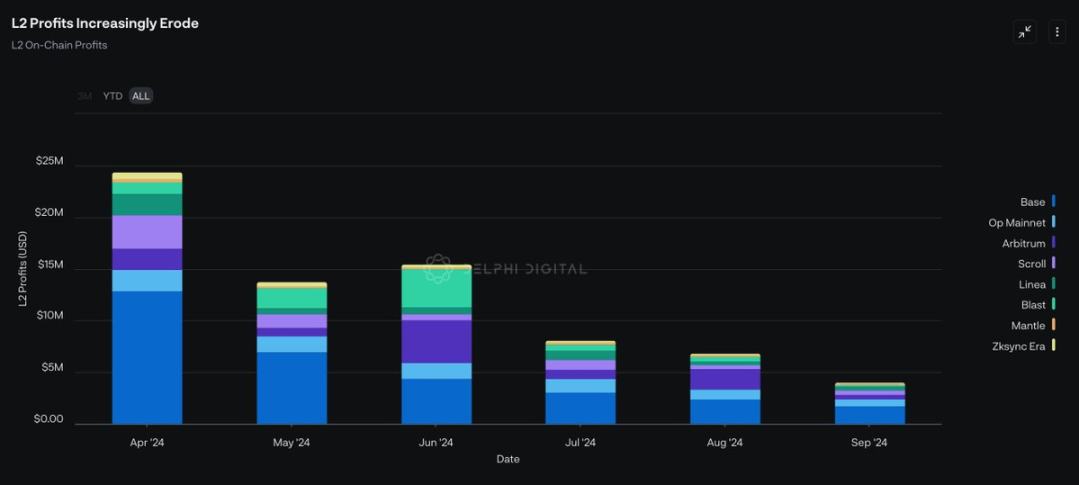

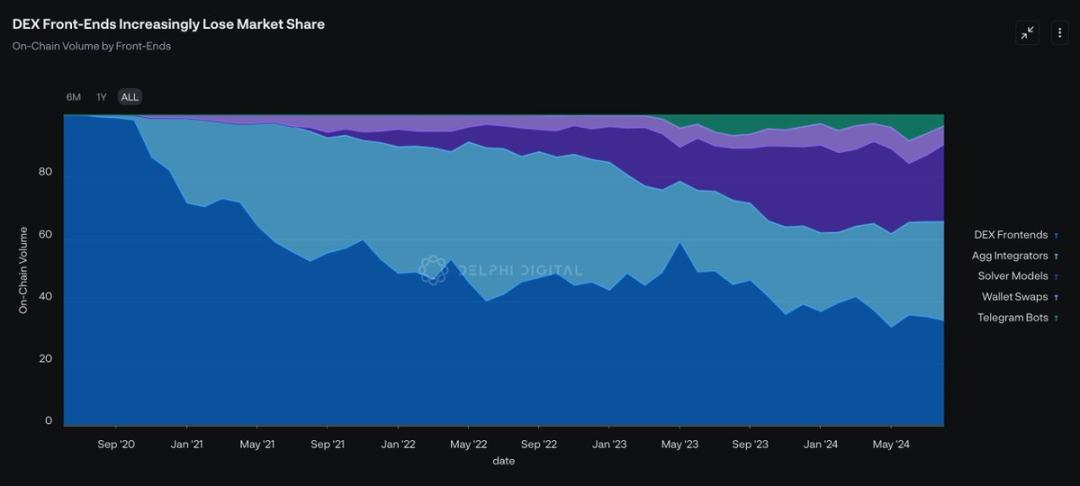

Data source: Dune Analytics @0xKofi

Intuitively, one might think that if protocols are weakened, applications must inevitably become stronger. While applications will certainly reclaim some value, the theory of "fat applications" itself is simplistic. Different vertical applications accumulate value in different ways; the question should not be "Will applications become fatter?" but rather "Which specific applications?"

As I mentioned in "A New Framework for Moats in the Cryptocurrency Market," the unique structural differences of crypto applications (forkability, composability, and token-based value acquisition) can lower the entry barriers and costs for emerging competitors. Therefore, while a few applications possess some non-trivially replicable attributes, cultivating moats and maintaining market share is extremely difficult for crypto applications.

Returning to our initial framework: If an application raises its fees, will users turn to cheaper alternatives? I believe 99% of applications will face this question. Therefore, I expect that most applications will struggle to capture value, as flipping the fee switch will inevitably lead users to the next indistinguishable application offering more generous incentives.

Finally, I believe the rise of AI agents and solvers will impact applications similarly to how it impacts protocols. Given that agents and "solvers" primarily optimize for execution quality, I expect applications will also be forced to compete fiercely for agent flow. While liquidity network effects should create a winner-takes-all scenario in the long run, I anticipate that applications will experience a race to the bottom in the short and medium term.

This raises the question: If both protocols and applications are continuously weakened, where will value re-aggregate?

The "Fat Wallet" Theory

The simplest answer is: whoever owns the end users wins. While theoretically, this could be any front end, including applications, the "fat wallet" theory posits that no one is closer to the user than wallets.

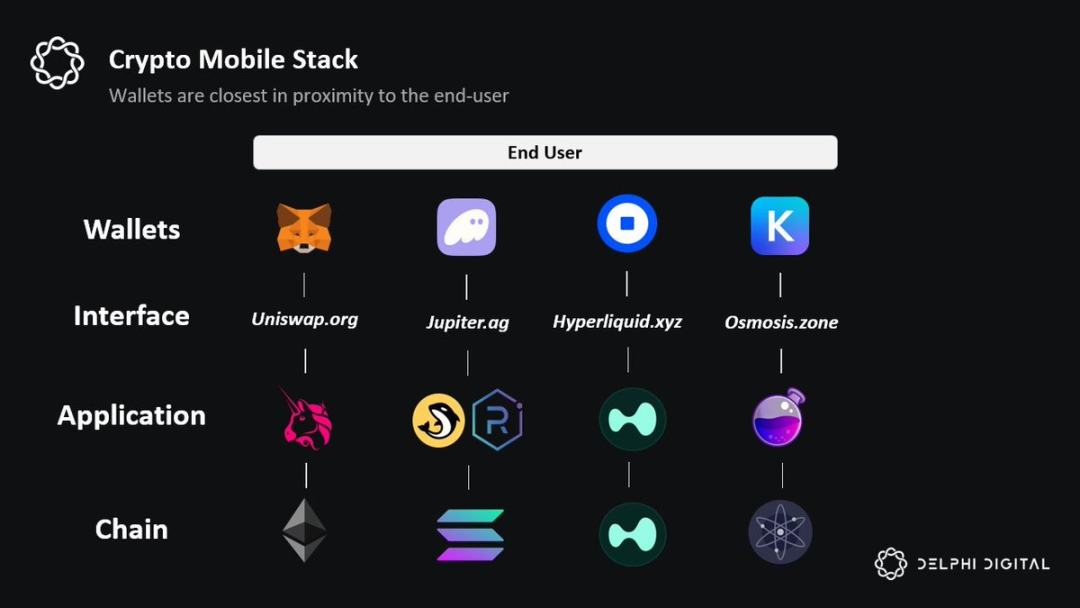

Wallets dominate the mobile user experience in cryptocurrency: To understand who owns the end users in the mobile network, the best litmus test is to ask the following question: Which Web2 application do users ultimately interact with? While most users "interact" with the front end of Uniswap to trade, they still access that front end through a wallet application. This means that if mobile devices dominate the cryptocurrency user experience, wallets will only continue to strengthen their connection with end users.

Wallets are where users are: Crypto applications are essentially financial. Unlike Web2, almost every on-chain transaction is some form of financial transaction. Therefore, the account layer is crucial for crypto users. Additionally, there are unique features at the wallet layer: payments, native yield on idle user deposits, automated portfolio management, and other consumer use cases, such as crypto debit cards.

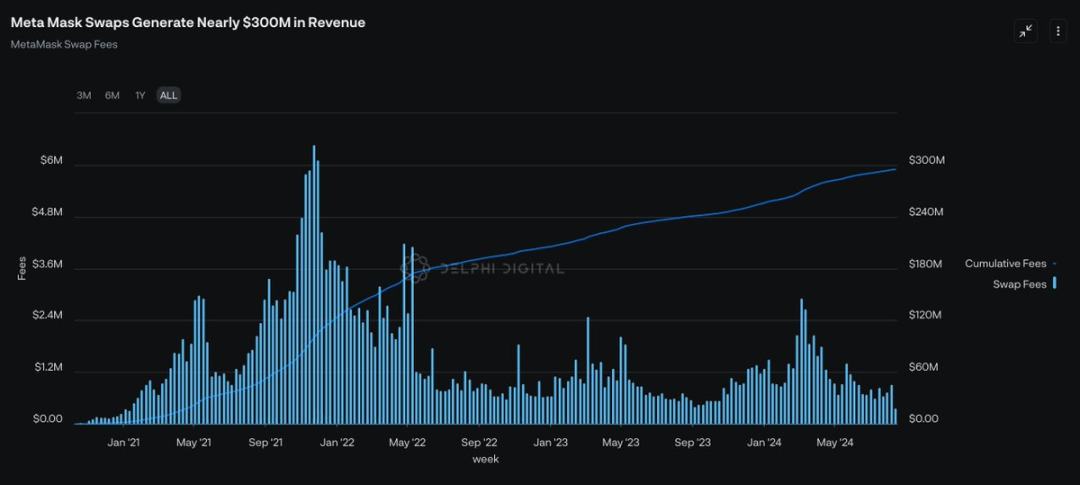

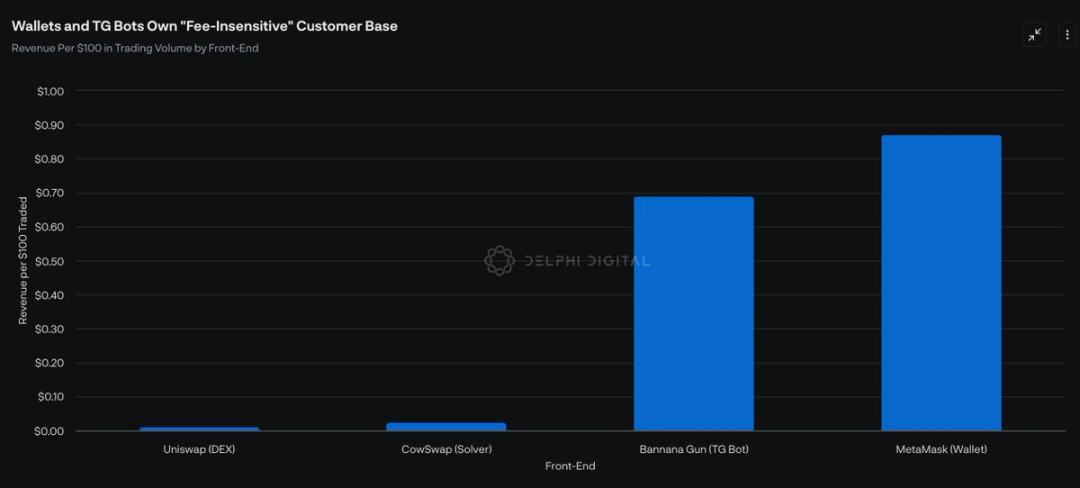

The switching costs for wallets are astonishingly high: While theoretically, switching wallets is as simple as copying and pasting a seed phrase, for most ordinary people, this remains a psychological hurdle. Given the high level of trust users have in wallet providers, I believe brand and "affinity" are powerful sources of moat at the wallet layer. Revisiting our initial question: If a wallet raises its fees, will users turn to cheaper alternatives? The answer seems to be: "NO." The swap feature within the MetaMask wallet charges a fee of 0.875%, yet there are still a large number of users.

Chain abstraction: While chain abstraction is technically a tricky issue, one of the more compelling solutions is to address chain abstraction at the wallet layer. The idea of easily accessing any application on any chain through a single account balance seems particularly intuitive. Solutions like oneBalance, Brahma, Polaris, Particle Network, Ctrl Wallet, and Coinbase's smart wallet are all moving towards this vision. In the future, I expect more teams will meet user needs through wallet-layer chain abstraction.

Unique synergy with AI: While I expect AI agents will increasingly commoditize the rest of the blockchain stack, users will still need to authorize agents to execute transactions on their behalf. This means the wallet layer is best positioned to become the normative front end for AI agents. Integrating AI into the account layer also includes outcomes like automated staking, yield farming strategies, and more.

Having outlined "why" wallets will own the end-user relationship, let’s consider "how" they will monetize this relationship.

Monetization Opportunities

The first opportunity for wallets to profit is through owning user order flow. As I mentioned earlier, while the MEV supply chain will continue to evolve, one thing will inevitably become true: value will disproportionately accrue to those who have access to the most exclusive order flow.

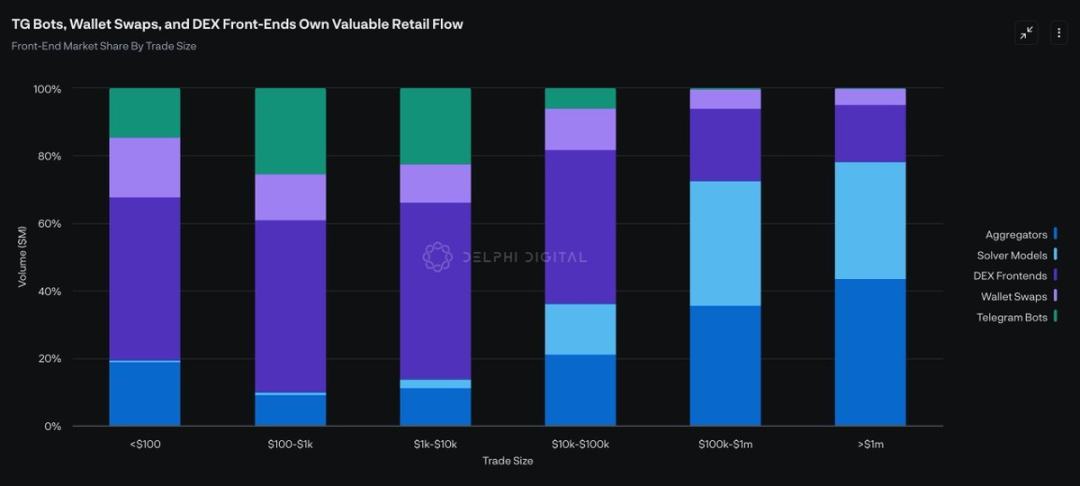

Today, the front ends that hold the majority of order flow by trading volume are solvers and DEXs. However, this chart alone does not reveal any nuances. It is important to understand that not all order flow is equal. There are two types of order flow: (1) fee-sensitive order flow and (2) fee-insensitive order flow.

Generally speaking, solvers and aggregators dominate "fee-sensitive" order flow. Given that the trading volumes of these users typically exceed $100, execution is important to them. These traders will not accept even a 10 basis point excess fee. Therefore, "fee-sensitive" traders represent a lower-value customer segment. Although these trades account for a large share of the front-end market by trading volume, the value generated per $1 transaction is much lower.

In contrast, wallet swaps and TG bots have a more valuable user base: "fee-insensitive" traders. These traders are not paying for execution but for convenience. Therefore, paying 50 basis points for a trade is inconsequential for these users. As a result, TG bots and wallet swaps generate significantly higher revenue per $1 of trading volume.

Looking ahead, if wallets can leverage the trends mentioned above and continue to maintain their relationship with end users, I expect the wallet swap feature will continue to eat into the market share of other front ends. More importantly, even if they can only increase market share by 5%, it will have a significant impact, as wallet swaps generate revenue nearly 100 times that of DEX front ends for every $100 traded.

The second opportunity for wallets to profit from their proximity to end users is through Distribution as a Service (DaaS).

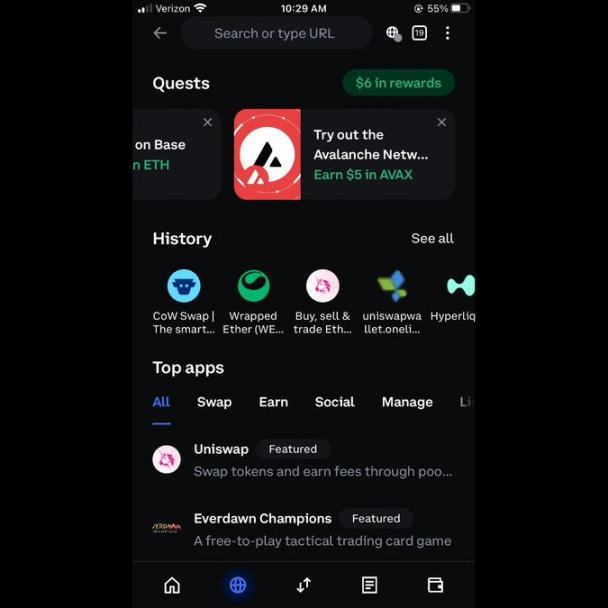

In addition to serving as the normative front end for users to interact on-chain, applications ultimately rely on wallets as distribution channels, especially in the mobile network. Therefore, similar to how Apple monetizes through iOS, wallets can enter into exclusive agreements with applications in exchange for distribution services. For example, wallet providers could establish their own app stores and charge applications through some revenue-sharing agreements.

Similarly, wallet providers can also guide users to specific applications in exchange for some economic sharing. This approach has the advantage over traditional advertising in that users can seamlessly make purchases and interact with applications directly from the wallet. Coinbase seems to be exploring a similar path by launching "featured" applications and in-wallet "tasks."

Wallets can also promote the development of emerging blockchains by sponsoring user transactions, thereby gaining some economic returns. For instance, perhaps Bearachain simply wants users to join their blockchain. They could pay Metamask fees to sponsor cross-chain fees and gas fees on Bearachain. Given that wallets ultimately own the end users, they can negotiate some favorable terms.

As more users utilize wallets as their primary on-chain gateway, we can see a shift in demand from "block space" to "wallet space," as attention becomes the most valuable resource in the crypto economy.

Challenges Facing Fat Wallets

Finally, while wallets have a clear competitive advantage in the race for end users, I am still excited about the prospects of two alternative front ends:

- Jupiter: Through their DEX aggregator, Jupiter has already been able to cultivate strong relationships with end users. This can be seen as the best starting point for them to build other related products in the cryptocurrency space, including their perps DEX, Launchpad, native LST, and the recent RFQ/Solver product. I am particularly excited about the release of the Jupiter mobile app, as it could allow them to capture end users in the mobile environment ahead of wallets.

- Infinex: By acting as a front-end aggregator for applications on EVM chains and Solana, Infinex aims to provide a CEX-like experience while retaining principles such as non-custodial and permissionless. Infinex will initially offer spot trading and staking services, with plans to integrate perpetual contracts, options, lending, margin trading, yield farming, and fiat on-ramp features. By abstracting the account layer and using Web2 familiar features (such as keys), I believe Infinex has the potential to replace wallets as the normative crypto front end.

While I am not yet clear on who will ultimately win the battle for end users, it is becoming increasingly evident that (1) user attention and (2) exclusive order flow will continue to be the most scarce and thus monetizable resources in the crypto economy. Whether it is wallets or alternative front ends like Infinex or Jupiter, I expect that the king of value capture in the crypto space will be the projects that possess both of these resources.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。