How to Choose the Right Tools in Different Market Conditions?

Although October is not a fixed month for price increases in the crypto market, some years have indeed shown outstanding market performance. For example, in October 2020, Bitcoin rose by about 28%, laying a solid foundation for the subsequent bull market. In October 2021, Bitcoin surged even more, reaching an all-time high of approximately $66,900 on the 20th. This October, Bitcoin has once again gained momentum, breaking through the $70,000 mark. Many analysts point out that the crypto market often performs well in the fourth quarter, which may be closely related to factors such as active trading at the end of the year and heightened market sentiment.

With the upward momentum of Bitcoin, Meme coins and the "golden dog" narrative are thriving, with new narratives emerging from goats to geese; VC-backed projects are also making a strong comeback, with major products launched by Worldcoin, Uniswap, ApeCoin, and others. Meanwhile, the continuous inflow of funds into Tether and Bitcoin ETFs has provided the market with more liquidity and volatility, enhancing the overall market vitality… A series of positive market trends are paving the way for the arrival of a new market.

However, regardless of the stage of the "Bitcoin bull market," it is crucial for users to respond to different market conditions. For instance, understanding which tools can achieve stable returns, which tools are suitable for all market conditions, which tools are better for short-term trading, which tools are suitable for on-chain transactions, and which tools support redemption at any time, rather than predicting market trends based on intuition. To help users better understand and utilize tools, this article will outline the top 10 CeFi products from OKX and their applicable market conditions, hoping users can respond more flexibly to the changing market environment and establish their own tool system.

1. Strategy Products

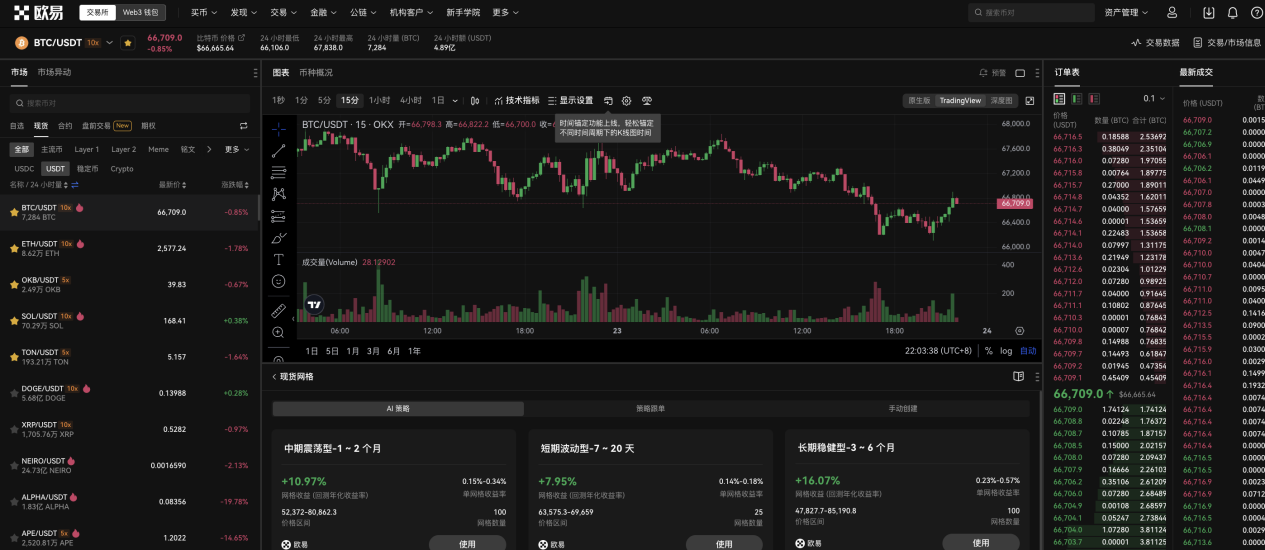

OKX trading strategy products are a set of tools that help users achieve automated and customized trading, suitable for different market conditions and trading needs. The core features are to reduce manual operations and improve trading efficiency, gradually becoming a favored trading model among users. OKX offers dozens of strategy products, including grid trading, Martingale, coin accumulation, bottom-fishing, arbitrage orders, iceberg orders, and time-weighted orders, making it one of the most mature platforms providing multiple strategies in the market, with low fees and easy operations. Next, we will briefly describe a few strategies.

1. Spot Grid: Buy low and sell high within a specific range, suitable for volatile and upward-trending markets

Strategy Overview: The spot grid strategy is an automated trading tool that helps users profit from market fluctuations by executing "buy low and sell high" operations within a specific price range. Users only need to set the highest and lowest prices of the range and choose the number of grids. The strategy will divide the range into multiple small grids, automatically placing orders within each grid. As the market fluctuates, the strategy continuously buys and sells within the range, capturing profits from price movements. OKX provides both manual and intelligent creation modes: users can set parameters themselves or use system-recommended intelligent grid strategy parameters to help quickly deploy strategies.

Applicable Scenarios: The core of the spot grid strategy is "buy low and sell high" to earn profits in volatile markets, making it particularly suitable for volatile or upward-trending markets. In these market environments, the strategy can effectively capture every small fluctuation and accumulate profits. However, if the market shows a one-sided downward trend, the strategy may face the risk of losses due to continuous low buying, so caution is needed in a downward market.

Example: Suppose a user plans to use the BTC/USDT spot grid strategy on the OKX platform.

1) Market Judgment: The user believes that Bitcoin's price will fluctuate between $25,000 and $30,000 in the near future. Since the market is in a volatile state, the user decides to adopt the spot grid strategy to buy low and sell high, thus profiting from the fluctuations.

2) Parameter Settings:

• Trading Pair: BTC/USDT

• Price Range: Set the minimum buying price for Bitcoin at $25,000 and the maximum selling price at $30,000.

• Number of Grids: The user divides the range into 10 small grids, with each grid's width being (30,000 - 25,000) / 10 = 500 USDT. Thus, the system will set automatic buy and sell orders at every 500 USDT price interval.

• Investment Amount: The user invests 2 BTC as the initial capital for the grid strategy. Part of the funds is used to buy BTC, and part is used to sell USDT.

3) Strategy Operation:

• As Bitcoin's price fluctuates between $25,000 and $30,000, the system will automatically buy BTC when the price drops below a certain level and sell BTC when the price rises above a certain level. For example, when the BTC price drops to $26,000, the system will automatically execute a buy order; when the price rebounds to $27,000, the system will automatically sell to realize the profit from the price difference.

4) Operation Results:

• If Bitcoin's price continues to fluctuate within this range, the strategy will continuously buy low and sell high, allowing the user to profit from the fluctuations of each grid. For instance, if the strategy runs while the BTC price drops from $26,500 to $25,500 and then rebounds to $28,000, the system will buy low and sell high within different grids, capturing multiple small profits.

5) Extracting Profits or Adjusting:

• Users can extract profits from grid arbitrage at any time during the strategy's operation or manually stop or adjust the strategy based on market changes. If the market begins to show a one-sided downward trend, the user may consider adjusting the grid parameters or pausing the strategy to avoid losses.

Advantages Summary: The spot grid strategy can sensitively capture small fluctuations in the market, reducing manual intervention for users, allowing the system to automatically execute trading plans, and simultaneously supporting users to customize parameters and choose system-recommended intelligent grid configurations, meeting the needs of different levels of users.

Usage Method: 1) Log in to OKX and go to the trading page 2) Select "Spot Grid" in the "Strategy Trading Mode" 3) Enter the highest price, lowest price, and number of grids for the price range on the trading page, or choose intelligent parameter recommendations, then confirm the amount and create the grid strategy. The invested funds will be isolated from the trading account and used exclusively for this strategy. 4) After successfully creating the strategy, users can view and manage the running grid strategy in the strategy bar at the bottom of the trading page. Additionally, during the strategy's operation, users can extract profits from grid arbitrage at any time or manually stop the strategy.

Direct Tool Access:

https://www.okx.com/zh-hans/trade-spot-strategy/btc-usdt#ordtype=grid

2. Contract Grid: More suitable for large fluctuations in a bull market or pin bars, with higher flexibility and fault tolerance

Strategy Overview: The contract grid strategy is a trading strategy that automatically executes buy low and sell high (or sell high and buy low) operations within a specific price range, specifically for contract trading. Users only need to set the highest and lowest prices of the range and determine the number of grids, and the strategy will automatically calculate the buy and sell prices for each grid and place orders automatically. When the market price fluctuates, the strategy will buy or sell according to the set price range, capturing profits from the fluctuations.

Applicable Scenarios: The core of the contract grid is arbitrage in volatile markets, making it particularly suitable for predicting volatile markets over a longer period. Based on this, the contract grid strategy can also be set according to the user's market inclination: long grids only perform long and flat operations, suitable for upward-trending markets. Short grids only perform short and flat operations, suitable for downward-trending markets. Neutral grid strategies open short/flat positions above the price range and long/flat positions below, suitable for situations where the market direction cannot be clearly determined.

Example: Refer to the spot grid, no need to elaborate further.

However, it is worth noting that the contract grid allows users to use leverage, meaning they can gain more trading power with less capital. This means users can achieve larger profits from smaller price fluctuations, but they also face higher risks. Generally, the contract grid requires users to provide margin and faces liquidation risks (i.e., when prices fluctuate significantly, positions may be forcibly liquidated), while the spot grid does not have this risk, as trading is entirely based on the user's assets and will not be forcibly liquidated due to market fluctuations.

Advantages Summary: This strategy executes automatically without the need for manual market monitoring. Compared to the spot grid, the contract grid can timely buy low and sell high in response to upward, downward, or volatile markets. Users can choose suitable long or short operation strategies based on their judgment of market direction, making this strategy more suitable for large fluctuations in a bull market or pin bars, with overall higher flexibility and fault tolerance. The spot grid is more stable, suitable for users who are unwilling to take on leverage risks.

Usage Method: 1) Open the OKX PC client or APP, go to the "Trading" page 2) Select "Contract Grid" in the "Strategy Trading Mode" 3) On the trading page, enter parameters such as the highest price, lowest price, and number of grids, or directly use the system-recommended intelligent parameters. After confirming the amount, click to create 4) After the grid strategy is created, the invested funds will be isolated from the trading account and used exclusively for this strategy. 5) Users can view, manage, and extract profits generated by the grid strategy in the "Strategy" option at the bottom of the trading page, or stop the strategy at any time.

Direct Tool Access:

https://www.okx.com/zh-hans/trade-swap-strategy#ordtype=contract_grid

3. Intelligent Arbitrage: More suitable for long-term positive funding rates and high liquidity trading pairs, low-risk earning of funding fees

Strategy Overview: The intelligent arbitrage strategy is designed to achieve stable returns by hedging against market price fluctuations. The core principle is to use a delta-neutral strategy by holding opposite and equal positions in the spot and contract markets to hedge against price change risks. Users primarily profit from the funding fees collected during the holding period (e.g., returns under positive funding rates). Once the strategy is running, it can consistently help users earn the funding fees paid by long positions to short positions in contracts. This strategy is particularly suitable for bull markets. OKX's intelligent arbitrage strategy includes two modes: first, a custom mode where users can choose high annual return strategies and set their own take-profit points; second, an intelligent mode where the system automatically recommends better strategies and intelligently manages take-profit and stop-loss operations, although this feature is not yet online.

Applicable Scenarios: The intelligent arbitrage strategy is especially suitable for mainstream cryptocurrencies that have a positive funding rate over the long term. This is because, under the design mechanism of funding rates, many mainstream cryptocurrencies typically maintain a positive funding rate, meaning users can earn funding fee income over the long term by holding positions in these cryptocurrencies. In the custom mode, users should choose trading pairs with a long-term positive funding rate and high liquidity to minimize slippage costs and enhance overall returns. Therefore, this strategy is suitable for users who wish to achieve stable returns in high-volatility markets, especially those who do not have the time or experience to manage strategies manually.

Example: Suppose a user plans to use the BTC intelligent arbitrage strategy on the OKX platform; they can create and run the strategy simply by entering the amount.

In terms of the strategy itself, taking BTC as an example, if a user uses 2,100 USDT for arbitrage when the BTC spot price is 65,000 USDT, the system will perform the following operations:

1) Invest 2,000 USDT in the spot market to buy BTC (0.03077 BTC).

2) Invest 100 USDT to short the BTC/USDT perpetual contract (20x leverage).

Assuming the current funding rate is 0.01% and the BTC price is 65,000 USDT:

3) Funding fees are charged every 8 hours, three times a day, resulting in an annual collection of 2,000 * 0.01% USDT * 3 * 365 = 219 USDT.

4) The annualized return is 219 / 2100 = 10.43%.

Advantages Summary: Users can better utilize the intelligent arbitrage strategy to hedge against price risks while steadily earning funding fee income. However, it is important to note that while the intelligent arbitrage strategy has a low risk of long-term operation, there are still risks such as slippage during liquidation, delta inconsistency, and forced liquidation of contract short positions.

Usage Method: 1) Log in to OKX, go to the trading page, and select the strategy trading mode. 2) Choose intelligent arbitrage in the strategy options. 3) Select the trading cryptocurrency and enter the amount, then click to create the strategy. 4) After successfully creating the strategy, users can view and manage the running grid strategy in the strategy bar at the bottom of the trading page. Additionally, users can stop the strategy at any time during its operation.

Direct Tool Access:

https://www.okx.com/zh-hans/trade-swap-strategy#ordtype=smart_arbitrage

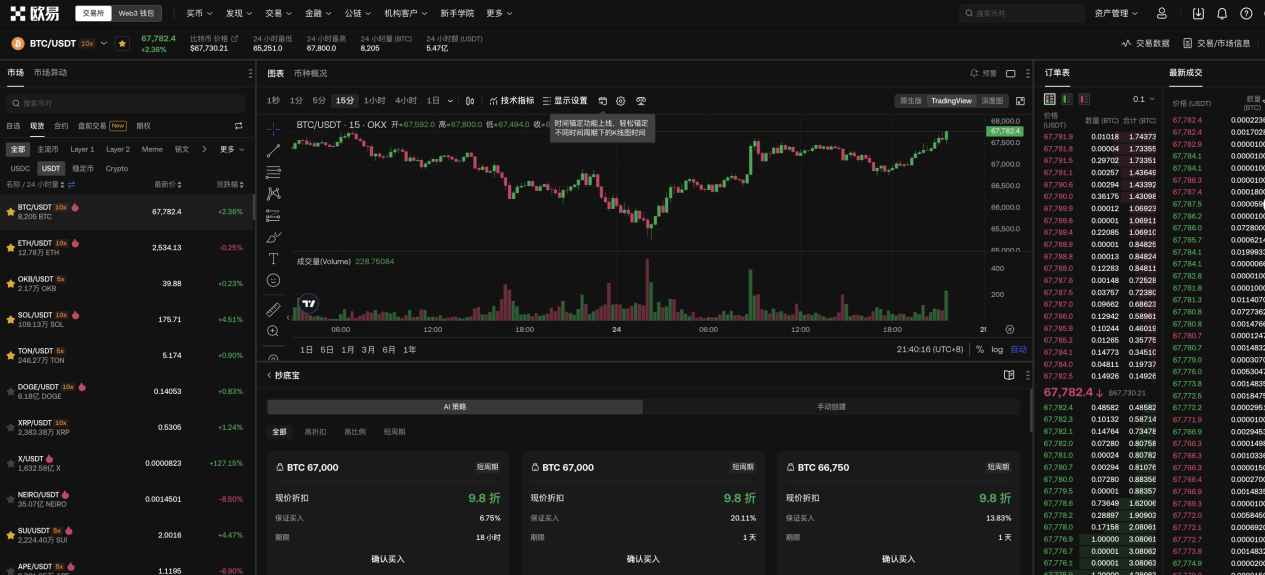

4. Bottom-Fishing and Top-Selling: No need to monitor the market constantly, suitable for users who want to sell high or buy low

Strategy Overview: The bottom-fishing strategy is a method that guarantees the purchase of a certain proportion of cryptocurrencies at a discounted price upon expiration. When using the bottom-fishing strategy, users can choose from three system modes: high discount rate, short lock-in period, and high guarantee ratio, or a custom mode. The top-selling strategy guarantees the sale of a certain proportion of cryptocurrencies at a high price upon expiration. When using the top-selling strategy, users can choose from high premium rate, short lock-in period, and high guarantee ratio system modes or a custom mode. Both strategies have zero transaction fees, but funds will be locked until the expiration date.

Applicable Scenarios: The top-selling strategy is suitable for users who expect the market to peak and want to automatically sell at high prices to avoid asset losses. If the market price at expiration reaches the top-selling price, the user's cryptocurrency will be sold at the top-selling price, but only the guaranteed proportion of the position will be sold, with the remaining funds returned to the user's account; if the market price at expiration is greater than or equal to the top-selling price, the user's cryptocurrency will be sold at the top-selling price, with the sold quantity equal to the ordered quantity. The bottom-fishing strategy is suitable for users who are optimistic about a market rebound and want to automatically buy at low prices to achieve bottom-fishing positioning. If the market price at expiration is greater than the bottom price, the user's cryptocurrency will be sold at the bottom price, but only the guaranteed proportion of the position will be bought, with the remaining funds returned to the user's account; if the market price at expiration is less than or equal to the bottom price, the user's cryptocurrency will be sold at the bottom price, with the bought quantity equal to the ordered quantity.

Example:

Top-selling case: Suppose the current price of BTC is 20,000 USDT, and a user chooses to trade a card with a top-selling price of 22,000 USDT, a guarantee ratio of 20%, and a lock-in period of 3 days; the user locks in a selling quantity of 1 BTC. At the time of expiration:

• If the BTC price at expiration is 21,000 USDT, the user will transact at 22,000 USDT, selling 0.2 BTC, and the remaining locked funds will be returned to the user's account.

• If the BTC price at expiration is 23,000 USDT, the user will transact at 22,000 USDT for the full amount, selling 1 BTC.

Bottom-fishing case: Suppose the current price of BTC is 20,000 USDT, and a user chooses to trade a card with a bottom price of 19,000 USDT, a guarantee ratio of 20%, and a lock-in period of 3 days; the user locks in a buying quantity of 1 BTC. At the time of expiration:

• If the BTC price at expiration is 21,000 USDT, the user will transact at 19,000 USDT, buying 0.2 BTC, and the remaining locked amount will be returned to the user's account;

• If the BTC price at expiration is 18,000 USDT, the user will transact at 19,000 USDT for the full amount, buying 1 BTC.

Advantages Summary: The advantage of the top-selling strategy: it helps users automatically sell cryptocurrencies when the market price reaches the set high point, locking in profits and preventing asset shrinkage due to subsequent price corrections, thus avoiding the risk of price declines. Moreover, there is no need to monitor the market constantly, as the system will automatically execute the predetermined operations, optimizing fund management. The advantage of the bottom-fishing strategy: it helps users automatically buy cryptocurrencies at set low prices when the market is expected to rebound. This helps users capture market lows and prevents missed opportunities. Users do not need to monitor the market to seize opportunities and can accumulate more assets through the bottom-fishing strategy, effectively increasing their holdings.

Usage Method: 1) Log in to OKX, go to the trading page 2) Then select the strategy trading mode - bottom-fishing or top-selling. 3) Then select the cryptocurrency, strategy mode, and amount to complete the setup.

Direct Tool Access:

Bottom-Fishing:

https://www.okx.com/zh-hans/trade-spot-strategy#ordtype=lvf_buy

Top-Selling:

https://www.okx.com/zh-hans/trade-spot-strategy#ordtype=lvf_sell

5. Coin Accumulation: Intelligent Rebalancing to Capture Opportunities from Hot Rotations

Strategy Overview: The coin accumulation strategy is an automated strategy that performs intelligent dynamic rebalancing within a user-selected cryptocurrency portfolio. Dynamic rebalancing helps maintain a constant proportion of each cryptocurrency in the user's accumulation portfolio. Users can choose two rebalancing modes to trigger rebalancing, namely fixed time intervals and changes in cryptocurrency market values, which are the proportional balance and timed balance modes.

Applicable Scenarios: The market often experiences rotations between cryptocurrencies or sectors, where several cryptocurrencies rise and then start to correct, while others begin to rise. If users simply hold their cryptocurrencies without action, they may miss out on most profits due to price corrections. However, if they take profits from the first few rising cryptocurrencies while buying other potential cryptocurrencies, they not only lock in profits but also increase their holdings in potential cryptocurrencies. This cycle can yield additional returns from the portfolio.

Example:

Proportional Balance Case: Suppose a user chooses this mode

1) Set Parameters

• Cryptocurrency Allocation: BTC | 50%; ETH | 30%; SOL | 20%

• Balance Mode: Proportional Balance | 10%

• Investment Amount: 10,000 USDT

2) Strategy Operation

• First Stage - Exchange for Target Cryptocurrencies. The invested 10,000 is exchanged for BTC worth 5,000 USDT (market price 1,000, i.e., 5 BTC), ETH worth 3,000 USDT (market price 500, i.e., 6 ETH), and SOL worth 2,000 USDT (market price 100, i.e., 20 SOL).

• Second Stage - Trigger Balance. Assume the BTC market price rises to 1,500, while ETH and SOL prices remain unchanged. At this point, the market value proportions of each cryptocurrency are: 60%: 24%: 16%, with BTC's proportion deviating by ≥ 10%, triggering a balance. The strategy will then sell 0.83334 BTC and buy 1.5 ETH and 5 SOL to restore the market value proportions to the target proportions. After this balancing operation, the holdings will be 4.16666 BTC (market value 6,250 USDT), 7.5 ETH (market value 3,750 USDT), and 25 SOL (market value 2,500 USDT).

Timed Balance Case: Suppose a user chooses this mode

1) Set Parameters

• Cryptocurrency Allocation: BTC | 50%; ETH | 30%; SOL | 20%

• Balance Mode: Timed Balance | 4 hours

• Investment Amount: 10,000 USDT

2) Strategy Operation

• First Stage - Exchange for Target Cryptocurrencies. The invested 10,000 is exchanged for BTC worth 5,000 USDT (market price 1,000, i.e., 5 BTC), ETH worth 3,000 USDT (market price 500, i.e., 6 ETH), and SOL worth 2,000 USDT (market price 100, i.e., 20 SOL).

• Second Stage - Trigger Balance. Assume that after 4 hours, the BTC market price rises to 1,500 USDT, while the prices of ETH and SOL remain unchanged. At this point, the market value proportions of each cryptocurrency are: 60%: 24%: 16%, with BTC's proportion deviating by ≥ 3%, triggering a balance. The strategy will then sell 0.83334 BTC and buy 2.5 ETH and 5 SOL to restore the market value proportions to the target proportions. After this balancing operation, the holdings will be 4.16666 BTC (market value 6,250 USDT), 7.5 ETH (market value 3,750 USDT), and 25 SOL (market value 2,500 USDT).

Advantages Summary: This helps users avoid missing out on profit opportunities due to fixed positions during market rotations. The advantage of this strategy lies in its ability to leverage exchange rate fluctuations between different cryptocurrencies to earn and accumulate coins.

Usage Method: 1) After entering the OKX web or app, select "Strategy Trading Mode" on the "Trading" page, then select Coin Accumulation. 2) Input parameters on the trading page, confirm the amount, and create the Coin Accumulation strategy. (The funds invested after creating the Coin Accumulation strategy will be isolated from the trading account and used independently in the strategy.) 3) After creation, you can view and manage the strategy in the "Strategy" section at the bottom of the trading page.

Direct Tool Access:

https://www.okx.com/zh-hans/trade-spot-strategy#ordtype=smart_portfolio

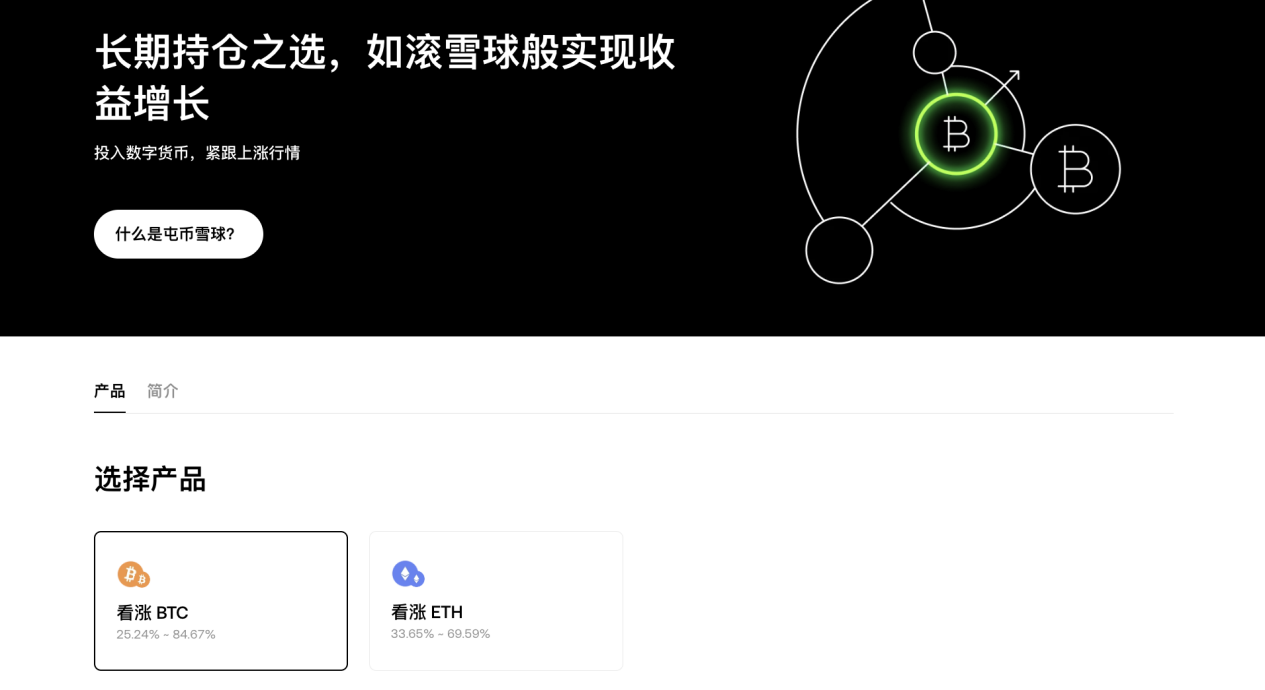

II. Coin Earning Products

Coin earning is a one-stop service platform created by OKX to help users discover various cryptocurrency holding product opportunities, including simple coin earning, structured products, and on-chain coin earning, providing users with a rich selection of products. Among them, 1) Simple coin earning is a product designed by OKX to help users with idle digital assets earn with low barriers to entry, offering both flexible and fixed-term options. 2) Structured products include Dual Currency Win, Seagull, Shark Fin, Snowball, and Coin Accumulation Snowball, which are innovative financial tools for earning returns from the derivatives market. Users can choose products based on current market conditions and risk preferences, and all structured products on OKX currently have no transaction fees. 3) OKX's on-chain coin earning offers selected staking and DeFi protocols to help users earn on-chain rewards.

6. Dual Currency Win: Suitable for users who are uncertain about market direction but wish to earn returns

Product Introduction: Dual Currency Win is a non-principal-protected structured product created by OKX that helps users earn additional returns while buying or selling digital currencies at target prices. Currently, OKX has launched ETH/BTC currency-based Dual Currency Win, supporting BTC and ETH investments for low buying and high selling. Compared to USDT currency-based Dual Currency Win, it offers a new way to earn returns, zero fees for converting between the two major cryptocurrencies, continuous interest, and eliminates the risk of missing market opportunities due to conversion to USDT, helping users hold cryptocurrencies without worries.

Applicable Scenarios: This product is more suitable for volatile or sideways markets, where the market trend is relatively stable, and prices fluctuate within a certain range. When users are uncertain about future price trends, they can choose Dual Currency Win. As long as the price does not reach the preset trigger price at expiration, users can lock in returns regardless of whether the underlying asset's price rises or falls.

Example: Suppose a user plans to use ETH/BTC currency-based Dual Currency Win on the OKX platform. The main advantage in a bull market is that they can earn returns without worrying about being "washed out" of their position.

1) Market Judgment:

The user believes that the ETH/BTC price may slightly decline in the short term and wants to use the Dual Currency Win product to earn returns while increasing their BTC holdings, but they do not want to miss the opportunity to hold due to market fluctuations (i.e., they do not want to be "washed out").

2) Product Selection: The user chooses OKX's currency-based Dual Currency Win - High Sell ETH/BTC

• Current ETH Price: 0.03 BTC

• Target Price: 0.02 BTC

• Duration: 1 day

• Expected Return: Reference annualized 21.40%

3) Two Possible Outcomes:

• Expiration Price ≥ 0.02 BTC: If the ETH/BTC price does not fall below 0.02 at expiration, the user's ETH will be sold at the target price (0.02 BTC), and they will receive the corresponding amount of BTC. At the same time, they will also earn the expected annualized return.

• Expiration Price < 0.02 BTC: If the ETH/BTC price falls below 0.02 at expiration, the user will retain their ETH holdings and simultaneously earn returns in ETH (reference annualized 21.40%).

4) Result Analysis: One advantage of this strategy is that regardless of how the ETH/BTC price fluctuates, users can steadily earn annualized returns through the Dual Currency Win product. In a bull market, users will not miss the opportunity to hold ETH because even if the ETH price does not reach the target price, they still maintain their position. Additionally, if the ETH price reaches or exceeds the target price, users will be able to sell ETH smoothly and gain more BTC in a bull market. When the market is expected to decline or be volatile, users can earn returns and flexibly respond to market fluctuations through this low-risk strategy without missing opportunities to increase their holdings due to significant price movements.

Advantages Summary: OKX's Dual Currency Win supports users in exchanging between different popular cryptocurrencies without slippage. This means that users will not be affected by market fluctuations during the exchange, ensuring price stability for currency conversion while also earning annualized returns. Furthermore, regardless of how the market fluctuates, as long as the expiration price reaches the user's set target price, OKX will ensure the agreed buying or selling of digital currencies, helping users lock in profits. Additionally, users can freely customize the Dual Currency Win product according to their needs, choosing different cryptocurrencies, durations, target prices, etc., allowing for a more personalized experience.

Usage Method: 1) Log in to OKX, go to the financial page. 2) Then select Structured Products - Dual Currency Win. 3) After confirming the cryptocurrency, duration, target price, etc., input the subscription amount to proceed.

Direct Tool Access:

https://www.okx.com/zh-hans/earn/dual

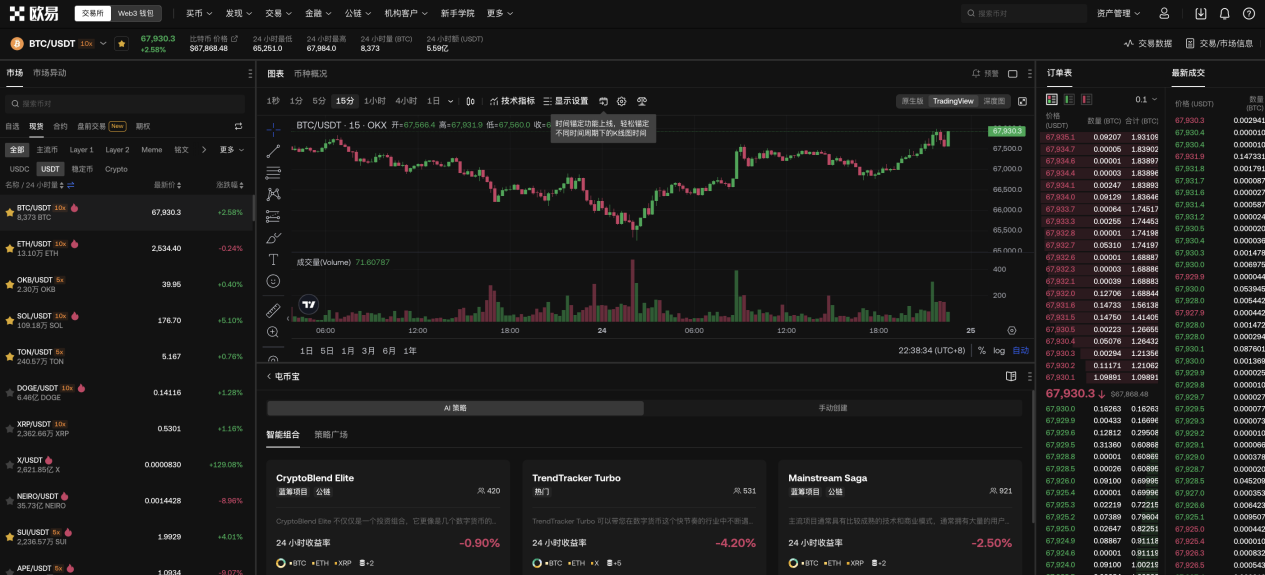

7. Coin Accumulation Snowball: More suitable for rising and volatile markets

Product Introduction: Coin Accumulation Snowball is a single cryptocurrency structured product that helps users trade selected digital currencies and earn returns in a rising market. Users will have three possible settlement scenarios: early profit-taking, maximum profit, and warning, allowing for growth in holdings while providing some risk protection.

Applicable Scenarios: OKX's Coin Accumulation Snowball is more suitable for users holding cryptocurrencies for the medium to long term, helping to ensure returns and avoid risks from extreme declines in volatile or steadily growing markets.

Example:

1) Market Judgment: Suppose a user believes that the price of BTC will remain relatively stable in the coming days but is likely to rise.

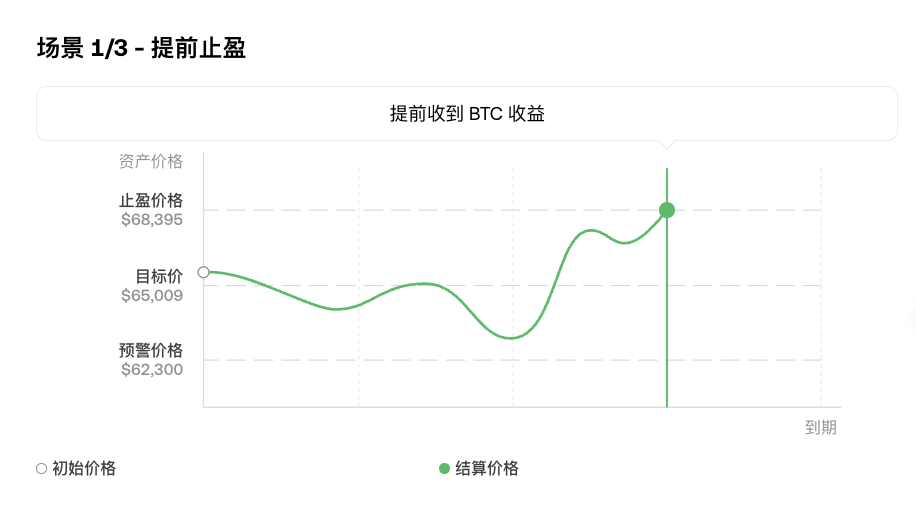

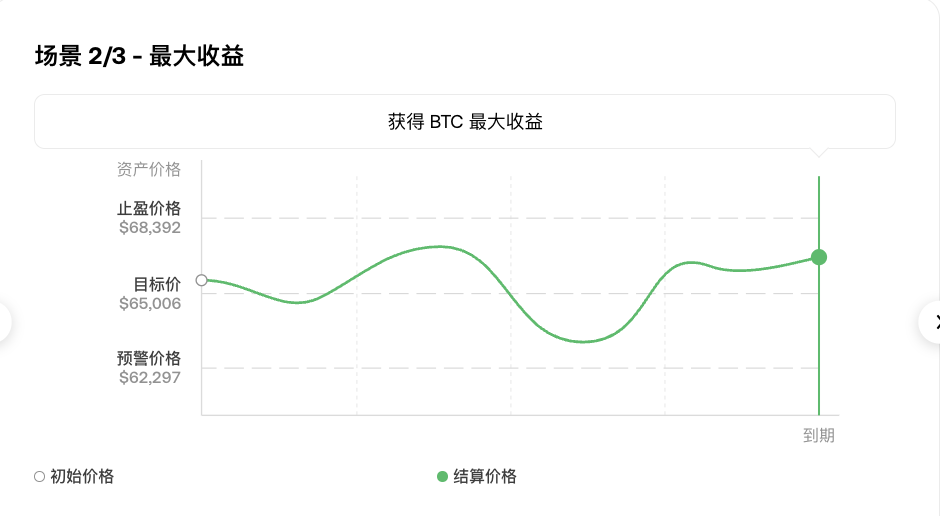

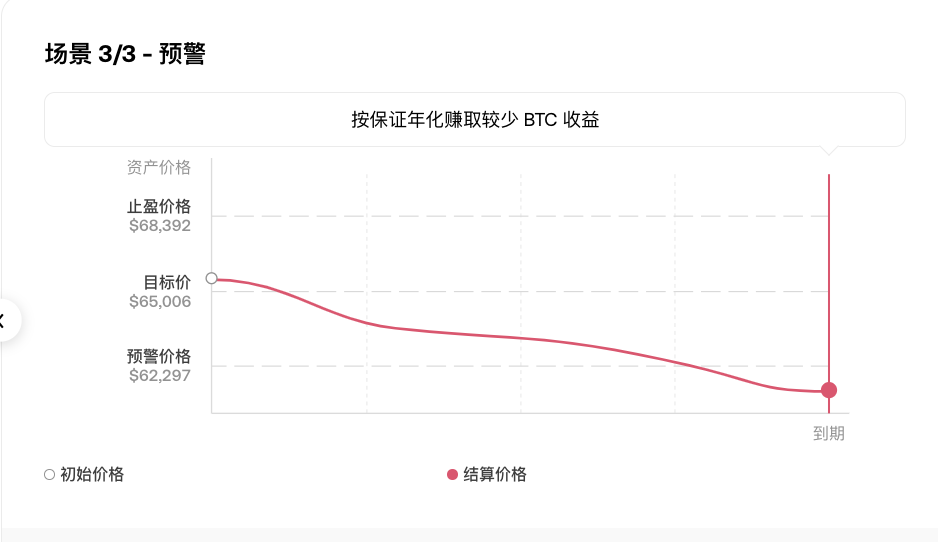

2) Product Operation: The user enters the Coin Accumulation Snowball product on OKX, selecting a 7-day duration, an annualized return rate of 25.25%, an initial price of $64,997, a target price of $65,007, a profit-taking price of $68,393, and a warning price of $62,300, then inputs the subscription amount to participate immediately.

3) Operation Results: After subscribing to this product, three possible scenarios will occur:

Scenario 1: If the cryptocurrency price breaks above the profit-taking price on any day, the user's order will be settled early, and they will receive a return.

Return Amount: Subscription Amount × (1 + Annualized Return Rate × Duration / 365)

Scenario 2: If the cryptocurrency price remains between the profit-taking price and the warning price, the user will earn the maximum profit and receive a return on the settlement date.

Return Amount: Subscription Amount × (1 + Annualized Return Rate × Duration / 365)

Scenario 3: If the cryptocurrency price breaks below the warning price on any day, the user's order will be settled early.

Return Amount: Subscription Amount × [(Settlement Price / Target Price) + (Annualized Return Rate × Duration / 365)]

Advantages Summary: 1) No Currency Conversion: Users can invest in BTC or ETH, and regardless of market fluctuations, the currency for returns remains unchanged, simplifying operations without worrying about the complexities of currency conversion. 2) Guaranteed Annualized Returns: Regardless of the market's settlement situation, users can earn returns in all settlement scenarios, providing stable annualized returns and reducing risks. 3) Daily Early Profit-Taking Opportunities: Users can observe market dynamics daily, track the profit-taking price, and flexibly take profits based on market conditions to lock in earnings. 4) Price Drop Protection Mechanism: When the price drops significantly and breaks the warning price, the system will automatically settle the order, providing users with additional security. 5) Low Threshold: The minimum investment threshold is very low, requiring only 0.0004 BTC or 0.005 ETH to participate, suitable for all types of users. 6) Zero Fees: Apart from the invested principal, users do not need to pay any additional fees, ensuring maximum returns.

Usage Method: 1) Log in to OKX, go to the financial page. 2) Then select Structured Products - Coin Accumulation Snowball. 3) After confirming the cryptocurrency, duration, target price, etc., input the subscription amount to proceed, which is very simple and convenient.

Direct Tool Access:

https://www.okx.com/zh-hans/earn/snowball-hodl

The above only highlights some of OKX's CeFi products. In addition to strategy products and coin earning products, the OKX platform also offers a rich variety of lending products, copy trading products, and more, which can comprehensively meet users' diverse needs and help them flexibly respond to market fluctuations. Users can download the OKX APP: https://www.okx.com/zh-hans/download or visit the OKX official website: https://www.okx.com/zh-hans to experience it immediately.

III. Disclaimer

This content is for reference only and does not constitute and should not be considered as (i) investment advice or recommendations, (ii) an offer or solicitation to buy, sell, or hold digital assets, or (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Digital assets (including stablecoins and NFTs) are subject to market fluctuations, involve high risks, and may depreciate or even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation and risk tolerance. Please consult your legal/tax/investment professionals regarding your specific circumstances. Not all products are available in all regions. For more details, please refer to the OKX Terms of Service and Risk Disclosure & Disclaimer. The OKX Web3 mobile wallet and its derivative services are governed by separate terms of service. You are responsible for understanding and complying with the applicable laws and regulations in your local area.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。