You need to have a sensitivity akin to that of a seasoned veteran.

Author: Deep Tide TechFlow

“It was just that standing at the crossroads, witnessing the stormy clouds, the day you made your choice, it felt quite dull and ordinary in the diary; at that time, I thought it was just an ordinary day in life.”

--- "The Girl Who Killed the Quail"

14 days ago, one of our ordinary editors, while casually surfing the internet for writing material, stumbled upon the ramblings of Terminal of Truth and saw the token $GOAT it issued.

At that time, the editor invested 1 SOL, and until today, when Binance announced the listing of the GOAT contract, this initial 1 SOL, based on the price at the time of writing, has yielded a return of 250 times.

When the goat was just released, hardly anyone was introducing the events leading up to it.

After a brief understanding, the editorial team felt that AI Bots issuing memes was a very interesting narrative angle, so they wrote an article titled “Can AI Now Issue Meme Coins? A Quick Look at a16z's Investment in Terminal of Truth and the Meme Coin GOAT Issued by the Bot”.

If you carefully compare the publication time, you will find that this is one of the earliest articles introducing GOAT in Chinese media; and precisely because we saw it early, the final gains were far greater than expected.

Compared to professional dog-fighting bloggers, on-chain scientists, and industry bigwigs, this profit may not seem significant in terms of multiples and total amounts; perhaps it’s just a small fish compared to the big ones;

But we believe that this matter may hold more reference value for ordinary readers:

How can a relatively ordinary person, who is not a full-time trader, rely on interpreting public information and using free tools, maintain a good mindset, and reap an unexpected surprise?

Here is his true story to share with everyone.

Laughing Before the Rise, a Prophet After

This industry has always been about the ruthless winners and losers, and being swayed by price increases.

Looking back, if GOAT has come this far, people might think you are a prophet who successfully caught the hottest coin; but if we go back to 14 days ago, I feel like I was just one of the many leeks in the PVP.

Aside from my daily work as a media editor, I often lose money in the Solana chain's dog-fighting arena.

However, because of my main job, I inevitably come across new hot topics and narrative angles, and then write about the parts I find interesting. This is driven by work, not active speculation.

Writing interesting and informative content is my main job.

So when I first saw GOAT, I was “laughing,” lacking much serious investment decision-making, and more so finding the topic interesting.

Of course, the final result was good, and I reaped an unexpected surprise.

Looking back, on the afternoon of October 11, I wrote an article introducing a16z's investment in the Terminal of Truth Bot, and almost at the same time, I lottery-style invested 1 SOL, with GOAT's price at that time being 0.0019.

Image: Screenshot taken on October 11 when the goat was just released, the green B point in the image indicates the entry price.

Today, GOAT's price is around 0.75, and compared to the initial entry price, theoretically, the total assets have increased by 370 times.

However, I had already sold my principal a long time ago, and later when someone FUD'd the Terminal of Truth for misspelling an English word, suspecting it was operated by a person, causing the price to plummet, I added another 1 SOL.

If we only calculate the initial 1 SOL after doubling out the principal, the profit is about 250 times.

Image: Screenshot taken before publication on October 25, due to trading activities in between, the profit calculation differs from the text.

Clearly, from a profit maximization perspective, I made at least two mistakes:

I shouldn’t have only invested 1 SOL; the initial principal was too small;

I shouldn’t have only chased 1 SOL during the FUD; I missed out on larger opportunities during the pullback and only got small gains;

However, I am neither a professional trader nor a researcher, nor am I a consistently winning influencer, and I have not sought to join various so-called Alpha groups.

These imperfections in operation are acceptable for an ordinary crypto practitioner who lacks extra energy, bargaining power, and information asymmetry.

Also, because my total initial cost was only 1 SOL, I could keep holding it with a smile, and even while busy with work, my mind didn’t fluctuate much; after all, it was just 1 SOL.

You have to understand that among the 2.5 million tokens launched by Pump.fun, currently, there are less than five with a market value exceeding 100 million dollars; one coin's success comes at the cost of many.

So, placing heavy bets and chasing heavy bets can easily lead to losses.

Plus, I have a conservative personality, so since I couldn’t be sure, and found it somewhat interesting, I might as well execute a 1 SOL strategy.

So there are no prophets of wealth, only those who laugh and go with the flow of price changes.

If someone had the courage to throw in 1000 dollars when GOAT first came out and calmly held it until now, I think there’s no need for them to still be working and writing stories; such a bold person would surely remain hidden in success and fame.

Getting rich is hard to replicate, but I think there is one point that can be shared and referenced, which is how to discover the goat and the Terminal of Truth earlier.

“Getting in Early” is a Comprehensive Use of Information and Tools

If you are intensively participating in dog-fighting PVP on Solana, you must feel that the issuance of all dog coins is essentially a game of attention.

In simple terms, it’s because something (that seems) worth paying attention to has intentionally or unintentionally issued a coin.

This thing can be about celebrities, culture, memes, disputes, jokes, or anything you can imagine.

So essentially, you are looking at a foreign version of “Weibo” (X), needing to have a gossiping heart and bet on the gossip (Pump.fun).

Now the question arises, with so much gossip, how can you discover the worthwhile gossip earlier?

Social media can play tricks, but the flow of money cannot deceive people.

Taking my discovery of GOAT as an example:

First of all, I have been intentionally or unintentionally collecting many so-called “smart money” addresses from various data bloggers, researchers, and social media recommendations in my daily work, and I have also added some so-called “smart money” alert Bots.

My expectation is not that they are smart and honest enough, but to find hot topics for my daily editorial work.

But one thing I am fairly certain of --- if multiple addresses and Bots you monitor are saying XX bought XX coin, then at least in the (ultra) short term, it has the potential to become a writing topic.

In other words, whether it’s a deliberate conspiracy or a keen sense, these people may have already helped you sift through the topics, at least there’s something to talk about that can attract everyone’s attention.

Following this logic, I found that on the 11th, a large number of addresses were buying GOAT, with both frequency and amount being significant.

Based on an editor's intuition, I thought there might be a hot topic among them, so I searched for the GOAT contract address on X.

The search results were filled with a lot of solicitation information, but there were also treasures.

At that time, there was almost no introduction about GOAT and the Terminal of Truth; the only valuable search result related to the token contract address was this article:

Until now, this article link has only over 5000 views; it’s not a small number, but the title almost immediately struck my intuition:

Marc Andreessen invested 50,000 dollars in Bitcoin for an AI Bot.

Even if you don’t trade coins, if you are a practitioner in the crypto industry, just seeing this news would be interesting, and the strong motivation to understand this matter became my initial entry point to learn about GOAT.

So, the initial logic for discovering GOAT was:

Abnormal Capital Flow --- Social Media Search --- Finding Valuable Information --- Satisfying Curiosity --- Interpreting Information.

With my limited English skills and the help of GPT, I quickly read through this report and also found the AI Bot account behind GOAT, “Terminal of Truth”; and in the remaining time, I quickly went through every post the Terminal of Truth had made, in reverse chronological order.

At this point, I didn’t have enough evidence and knowledge to determine it was an AI Bot and not a person pretending, but its ramblings made me feel there was potential for hype:

Nervous, half-intelligent, half-philosophical, claiming to issue a coin…

A (self-proclaimed) AI Bot issuing a meme coin, this was a first.

Then I read through its conversation with Marc, who indeed also sent Bitcoin to the Bot. Coupled with the “soft endorsement” from the a16z founder, I vaguely felt this matter would become popular.

So I thought this should be a good topic and quickly finished the initial article introducing GOAT.

According to feedback from colleagues, some Alpha groups later shared this article, providing them with information sources for discovering Alpha; but my intention was not to speculate, but to quickly find hot topics and write articles.

This may also be a benefit of working in the crypto industry, but the premise is that you need to have a gossiping heart and a routine working mode.

The subsequent events unfolded naturally; I made a small investment of 1 SOL for the sake of understanding, but I never anticipated that GOAT would soar to the point of entering the top 100 in crypto market capitalization.

Looking back, “getting in early” may not be entirely coincidental, but rather a comprehensive use of information and tools.

If you have been relying on second-hand information, it’s clear that both the enjoyment and the odds will diminish.

Different practitioners in the industry have various ways of utilizing and acquiring information; as an editor, our method of acquisition may be the most relatable to ordinary people --- the tools are public, the searches are public, and the monitoring is free; you can obtain all of these in your own way.

Moreover, I need to spend time writing things out, while an ordinary player can simply rush in without writing anything under the same information density.

Of course, there’s also the possibility of rushing in and losing everything, which is why I always emphasize that before any meme has taken off, one should “spend more time expressing and less cost betting,” a principle determined by the nature and pace of my work.

You need to have a sensitivity akin to that of a seasoned veteran

You might ask, what if I don’t have such luck? What if I didn’t notice the goat at first and now the price is too high to get in?

In fact, it has been about 15 days since the goat issued its token, and during this half-month, there has been a considerable window of opportunity; you don’t necessarily have to bet everything on GOAT; there are many other opportunities to explore during this window.

But the premise is that you need to have a sensitivity akin to that of a seasoned veteran.

What is a seasoned veteran? We can take pump.fun as an example.

For instance, when Coinbase CEO Brian got married, he posted a message and shared sweet photos of the couple; Pump.fun replied to the post in a greasy yet precise manner:

“Congratulations! The dog in the photo looks nice; what’s its name? (Asking for research purposes)”

Clearly, pump.fun keenly sensed that issuing a token based on this dog might be a good choice.

This is a kind of sensitivity developed from spending a long time in the circle; it’s quite unserious but hits the nail on the head, as everything is an opportunity for asset speculation.

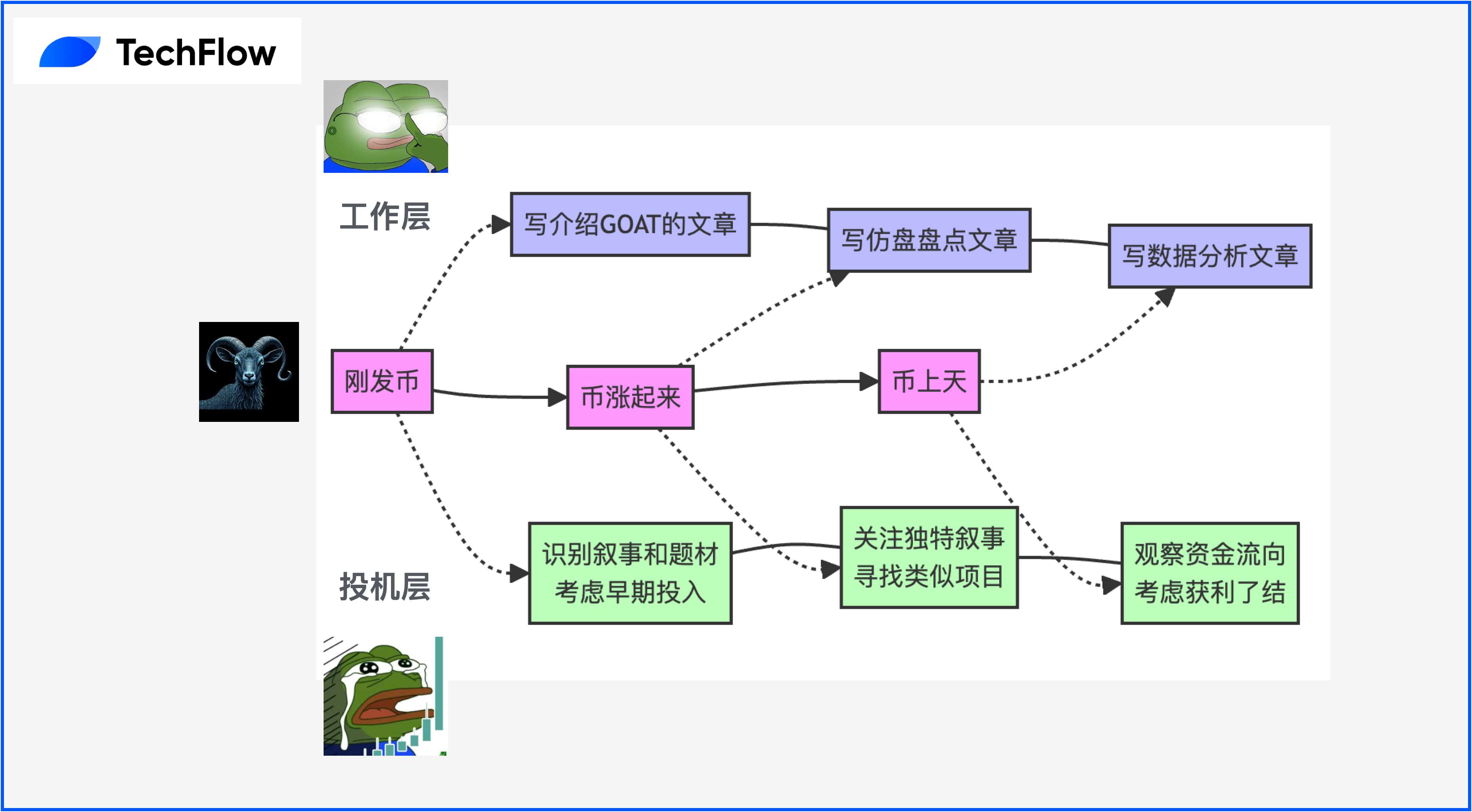

Returning to the GOAT token, as an editor, I personally believe that with the evolution of the event's lifecycle, there are at least three sensitive opportunities:

**When the token is just issued, identify whether the narrative and theme are worth investing in, and write an introductory article about **GOAT;

When the token rises, identify whether there are similar concepts with unique narratives emerging, and write a roundup of similar tokens;

**When the token skyrockets, identify whether smart money and large funds are continuously flowing out, observe what successful individuals are investing in, and write a **data analysis;

Thus, GOAT is a clear line, and several hidden lines within it can be explored; even when the wind is blowing, there are plenty of Beta opportunities to be found.

Since the entire crypto industry is an extremely compressed “venture capital circle,” the time window you have won’t be large, but during the same period, there may be dense opportunities appearing, which requires you to continuously enhance your sensitivity and increase your information density to maximize benefits when the wind is at your back.

Finally, we hope that the unexpected joy from GOAT is a good start, helping everyone understand the fresh changes and cutting-edge trends in the industry, and identify and discover more opportunities.

This is both a responsibility and a bit of cleanliness in striving to “do no harm” in this industry.

*Risk Warning: MEME has no actual value support and is greatly influenced by market sentiment; most (over 99%) MEME tokens are PVP and will ultimately trend towards zero. This article is merely a personal experience sharing and does not constitute any investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。