Trump's probability of winning has increased, and the crypto industry may soon welcome a wave of positive news.

Written by: Wenser, Odaily Planet Daily

As the U.S. election approaches, the future direction of the crypto market, which is greatly influenced by U.S. political and economic factors, has become a focal point of market attention.

Will Bitcoin's price break new highs as hoped? Will Ethereum's price continue to show weakness? Will the Solana ecosystem's meme coin craze continue? Can altcoin markets gradually warm up? In this article, Odaily Planet Daily will analyze the current situation of the U.S. election and the existing views on the crypto market for readers' reference.

Latest Polls: Trump Leads Temporarily, Harris Follows Closely

Overall, Republican presidential candidate Trump currently leads in election support, but the margin is small; Democratic presidential candidate and current Vice President Harris is slightly behind.

Analysis of U.S. Election Rules: 270 Electoral Votes are Key

According to U.S. election rules, the 50 states have a certain number of electoral votes, totaling 538 nationwide. A candidate must win 270 or more electoral votes to win. Except for two states (Nebraska and Maine), all states use a "winner-takes-all" rule, meaning that once a candidate receives the majority of votes in that state, they will receive all of that state's electoral votes. Most states overwhelmingly support one party, so the focus of campaigning usually falls on about a dozen battleground states, known as "swing states."

Historically, the key to determining success in U.S. elections has been seven "swing states," which together hold 94 electoral votes, and their results will decide the presidency.

Latest Polls: Trump's Support Reaches 52%

The latest polls show Trump leading Harris, with 52% of voters supporting Trump for president.

Previously, Trump led Harris by 47% to 45% in a Wall Street Journal poll.

In the latest poll conducted by the Financial Times, Trump leads Harris on U.S. economic issues.

The latest betting information from the crypto prediction market Polymarket shows Trump's winning probability at 60.7%, while Harris's is at 39.4%.

According to information from the well-known U.S. political election website RCP, the selected combination of Trump/Vance is expected to secure more key votes in swing states, potentially leading to a total of 312 electoral votes and a final victory.

U.S. Election Polling Prediction Results

Market Views: Trump's Election Probability Highly Correlated with Crypto Asset Price Trends

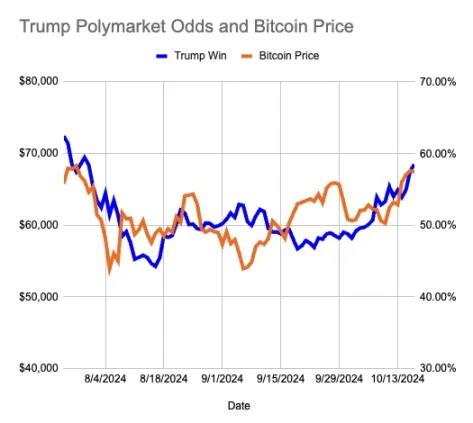

Previously, Monad's growth head Intern stated that the probability curve of Trump on Polymarket is highly positively correlated with Bitcoin's price trends.

The chart selected data from March to October this year

QCP Capital previously pointed out in a report that as Trump's chances of winning increase, the market expects his crypto policies to be more favorable than Harris's, further strengthening the positive correlation between crypto assets and Trump's victory.

As analyzed by Galaxy Research, although Harris is more favorable towards cryptocurrency policy than current President Biden, she is still far behind Trump in market perception. After all, Harris has promised to improve the regulatory environment for the U.S. crypto industry but takes a more cautious stance on issues like taxation, Bitcoin mining, and self-custody, while Trump supports Bitcoin mining and promises to protect self-custody rights.

Bitfinex Alpha's research report also noted that the correlation between Bitcoin's price trends and Trump's election probability has strengthened, as investors assess the potential impact of a Republican victory on future crypto regulations, making the crypto market more sensitive to the U.S. election. Additionally, the open interest (OI) of Bitcoin perpetual contracts and futures contracts has surged to a historical high of over $40 billion, reflecting increased speculative activity, indicating that the current price trend is largely driven by leveraged futures positions rather than spot market demand.

Key Figures Behind the Candidates: Musk Bets $75 Million, Gates Donates $50 Million

The U.S. presidential election naturally involves not only political choices but also various aspects of the U.S. economy, and the key to victory lies in support from funds, resources, and momentum. By examining the "key figures" behind Trump and Harris, we may gain insight into the preferences in the U.S. political and economic landscape.

Musk: The "First Person" to Rally for Trump

According to documents from the Federal Election Commission, Elon Musk donated $75 million to a political action committee supporting Trump. Moreover, last Thursday, Musk campaigned for Trump in the swing state of Pennsylvania; he subsequently urged Pennsylvania voters to express their support for Trump through various campaign signs and announced at an event that from that day (October 19) until Election Day on November 5, he would randomly distribute $1 million to a registered Pennsylvania voter who signed a petition for the "America PAC." The first winner was announced that day.

It must be said that Musk has contributed significantly to Trump's campaign, both financially and personally, and it's no wonder Trump previously stated, "Thank you, Elon Musk, for your tremendous support."

Bill Gates: Secretly Donated About $50 Million to Harris's Campaign

Former U.S. billionaire Bill Gates, who has largely stayed out of politics for decades, recently indicated that he privately donated about $50 million to the nonprofit organization Future Forward, which supports Vice President Harris's campaign. This donation was originally intended to be secret. A person familiar with Gates's thoughts revealed that this year, in private conversations with friends and others, he expressed concern about the prospect of Trump being re-elected, although he emphasized that he could work with any candidate.

Billionaire Bill Ackman: Will Help as Much as Possible if Trump is Elected

Billionaire Bill Ackman stated that both Harris and Trump are like the best candidates in the world, making it difficult to choose because they are both outstanding. If Trump is elected president, many very capable businesspeople would want to join his government, and he would do everything he could to help him, but he would not become a member of the government. He believes Trump (if elected president) will have no trouble assembling a very capable team.

a16z Founders: Each Donated $2.5 Million to Trump's Campaign

According to the latest documents submitted to the Federal Election Commission, a16z founders and venture capitalists Marc Andreessen and Ben Horowitz each donated $2.5 million to a super political action committee supporting Trump. The two announced their support for Trump in July. Andreessen also donated an additional $844,600 to Trump's campaign team and the Republican Party, which is the federal government's limit.

Billionaire Tim Draper: Bets on Both Sides with Similar Donation Amounts

Billionaire and American venture capitalist Tim Draper previously clarified, "I have donated to both Harris and Trump's campaign teams, and the amounts are roughly equal, allowing my wife and me to meet both candidates and make a more informed decision. Both candidates have the right starting points, and although they will set different paths for America, I optimistically believe that either path will be a positive step. I support both candidates."

Overall, those friendly to the crypto industry are more supportive of Trump, while those related to traditional venture capital institutions tend to hedge their bets or support Harris.

Market Views: Most Believe Trump's Victory is Beneficial for Crypto, Few Believe Any Winner Will Promote Crypto Development

Looking at the current market views, most research institutions and related organizations hold an optimistic attitude towards the development of the crypto market under Trump's administration; a small number believe that whether Trump or Harris wins, both will promote further development of the crypto industry; but there are very few opinions suggesting that Trump's victory may lead to a decline in the crypto market.

Traditional Institutions: Optimistic About the Crypto Market Under Trump

A research report from Citibank stated that in the upcoming U.S. election, a comprehensive victory for the Republican Party would be the most favorable outcome for Coinbase and the broader crypto market, while a Harris victory and a divided Congress could lead to increased uncertainty in the digital asset industry.

Geoff Kendrick, head of digital asset research at Standard Chartered Bank, stated that Bitcoin is showing strong upward momentum and may approach its historical high of $73,800 before the U.S. election. The potential price increase is driven by various factors, including a steepening U.S. Treasury yield curve, inflows into spot Bitcoin ETFs, and rising probabilities of Trump's victory. Current data shows Trump's winning probability at 56.3%, and the probability of a comprehensive Republican victory at 39%, which could create favorable conditions for risk assets, including Bitcoin. Additionally, the open interest for $80,000 call options in the Bitcoin options market has recently increased, indicating that institutional investors are optimistic about Bitcoin's mid-term upward potential.

BNP Paribas stated in a report that the outcome of the U.S. election early next month will determine the near-term outlook for the dollar. If Republican candidate Trump becomes president and the Republicans control Congress, it will be the most positive outcome for the dollar.

Crypto Enthusiasts: Trump Will Drive Bitcoin Prices to $100,000

Jeff Park, head of alpha strategy at crypto asset management firm Bitwise, predicts that if Trump wins the U.S. presidential election in November, Bitcoin's price could rise to $92,000. He stated that based on a chart plotting Bitcoin prices against Trump's winning odds on Polymarket and applying some "merged arbitrage-style probability mathematics," the results indicate that Bitcoin's price is likely to soar after Trump wins the election. Additionally, early Bitcoin investor Erik Finman stated that he believes Trump's victory could push Bitcoin's price to $100,000, "His policies will ignite the crypto market and drive significant growth across the entire sector."

SOFA.org director Augustine Fan stated, "As attention turns to the results of the U.S. election, the most favorable outcome for cryptocurrency would be a Trump victory, along with a Republican sweep of the House and Senate, making it possible for the Trump-Vance supported digital asset reform plan to pass in Congress." Jung added, "If Trump's dominance continues and the Federal Reserve signals a more dovish stance, we may see new momentum for Bitcoin in the weeks following these events."

Blockchain analytics firm Nansen's CEO Alex Svanevik argued that the primary condition for the largest bull market in history in 2025 is Trump's victory in the presidential election.

Neutral View: Whoever Wins Will Lead to Economic Risks and Market Declines

Mike Wilson, chief U.S. equity strategist at Morgan Stanley, stated that while some believe Trump's victory would negatively impact economic growth and the stock market, a Harris win could lead to disappointment on Wall Street. Polls indicate a 50% chance of this scenario occurring. However, Wilson pointed out the risk of a market decline that could also accompany a Trump victory.

Analysts from trading and financial services firm Presto indicated that the U.S. election could trigger a collapse in the bond market, which would also affect other assets like Bitcoin. Jones expressed optimism for Bitcoin, gold, commodities, and Nasdaq stocks in the current risk environment. Analysts believe that both Republican candidate Trump and Democrat Harris have committed to "fiscal extravagance," leading to rising government debt levels, which exacerbates the risk of a bond market collapse. Additionally, the "2024 Bitcoin Bill," currently awaiting Congressional approval, could help stabilize U.S. debt and even stabilize the global financial system.

Neutral View: Whoever Wins Will Benefit the Crypto Industry

Haseeb Qureshi, managing partner at crypto venture fund Dragonfly Capital, stated, "Regardless of who wins, the post-election environment should be favorable for potential crypto IPOs." He noted that while Trump may push the SEC to adopt a more supportive stance towards cryptocurrencies, Harris might "replace Gensler with her own picks, which should lead to a more lenient regulatory environment for cryptocurrencies in the U.S."

David Lawant, research director at crypto market maker FalconX, stated, "I think the market consensus is that regardless of the election outcome, Bitcoin is likely to perform well. Our analysis shows that the options activity around the upcoming election exhibits a clear bullish bias." Republican candidate and former President Trump openly supports cryptocurrencies, leading Bitcoin to be viewed as a so-called "Trump trade." His Democratic opponent, current Vice President Harris, has promised to support a regulatory framework for the industry, contrasting with the Biden administration's crackdown on it. Non-political factors, such as further interest rate cuts by the Federal Reserve, are seen as contributing to the optimistic sentiment.

Mick Mulvaney, who served as acting director of the Office of Management and Budget under Trump, stated that cryptocurrency is an industry that "breaks the American political mold" because it appeals to both Democrats and Republicans.

Opposing View: Harris Will Hinder More Crypto ETF Applications

Two ETF experts indicated that if Democratic presidential candidate Harris wins in the November election, XRP and SOL ETF applications may not yield results. Bloomberg senior ETF analyst Eric Balchunas stated, "If Harris wins, it won't be approved, regardless of who the issuer is." Some industry experts believe that the entry of asset management giant BlackRock into the competition to launch Bitcoin and Ethereum ETFs significantly increases the chances of SEC approval for them—though it remains unclear how much influence BlackRock actually has.

Balchunas noted that if former President Trump wins the election, there will be a "considerable opportunity" for more cryptocurrency ETFs to emerge, regardless of whether BlackRock joins Bitwise, VanEck, and other companies looking to expand cryptocurrency ETFs beyond BTC and ETH.

Opposition View: The Trump Trade Hinders Cryptocurrency, Cooling Bitcoin's Rally

As Trump leads Harris in prediction markets, U.S. Treasury yields and the dollar have recently surged. Investors are curbing bets on loose monetary policy, as a Trump victory would likely implement growth measures on an already strong U.S. economy. With the financial environment tightening relatively, Bitcoin has experienced its first weekly decline in three weeks.

IG Australia market analysts stated that stock market sell-offs, a rising dollar, and increasing yields all indicate a tightening financial environment, which is not favorable for cryptocurrencies. Some may point out that the financial environment has been loose from the start, but the speed of tightening is more important. The co-founder of digital asset derivatives trading liquidity provider Orbit Markets stated that a Trump victory could lead to higher U.S. Treasury yields, ultimately negatively impacting risk assets. However, expectations of a softening regulatory stance from the Trump administration towards the crypto industry should still be a more significant factor.

Conclusion: Bitcoin May Rally After a Pullback Before the Election

Currently, there is a strong call for Trump's victory, and beyond the crypto industry's eager anticipation, traditional financial markets are also showing signs of this—according to Barclays, European stock markets have already reflected the possibility of a Trump win. The firm noted that since early spring this year, a basket of European exporters, particularly those most affected by tariffs, has underperformed the benchmark Stoxx Europe 600 index by 15%, indicating that European markets have somewhat priced in a Trump victory.

Data from Polymarket, regarded as a "crypto barometer," also supports this possibility, with users Fredi 9999, Theo 4, PrincessCaro, and Michie collectively betting $30 million that Trump will win the 2024 presidential election; another Polymarket user, zxgngl, recently placed a bet of over $5 million on Trump's victory. Analysts point out that the influx of over $35 million in bets may have significantly boosted Trump's winning odds.

Although venture capitalist and Polymarket seed round investor Alex Marinier stated that it is entirely possible "some big players are making large bets to sway the market"; the founder of prediction market Kalshi, Tarek Mansour, recently argued that these results are accurate rather than manipulated, based on comparable data from Kalshi. He stated, "The median bet for Harris is higher than for Trump," with Harris's median bet at $85 and Trump's at $58. An increasing number of people are betting on Trump's victory, and the 20-point lead reflected on Polymarket corresponds roughly to the number of bettors. Given the current total betting amount of over $2.4 billion on Polymarket, Trump's winning odds may have been clearly demonstrated in this data.

Thanks to a series of crypto-friendly statements made by Trump previously, combined with the gradual dissemination of various positive news before the election, it may drive the crypto market, including Bitcoin, to experience a brief pullback before rising again and potentially reaching new highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。