Author: andrew.moh, Crypto KOL

Compiled by: Felix, PANews

Recently, securing a spot on mainstream crypto exchanges (especially Binance) has become a true catalyst for projects.

“When Binance?” or “When listing on Binance?” have become common phrases in the crypto community. Two key factors driving this phenomenon are:

· Liquidity

As one of the largest centralized exchanges in the world, Binance boasts exceptional liquidity, ensuring seamless and large-scale trading.

Listing on Binance can enhance a project's appeal and trading activity.

· Reputation

Binance's branch, Binance Labs, is a benchmark for industry credibility. When a project receives recognition from Binance Academy, it significantly boosts user awareness. With Binance's support, user trust skyrockets.

“If Binance is investing, this project must be a winner.”

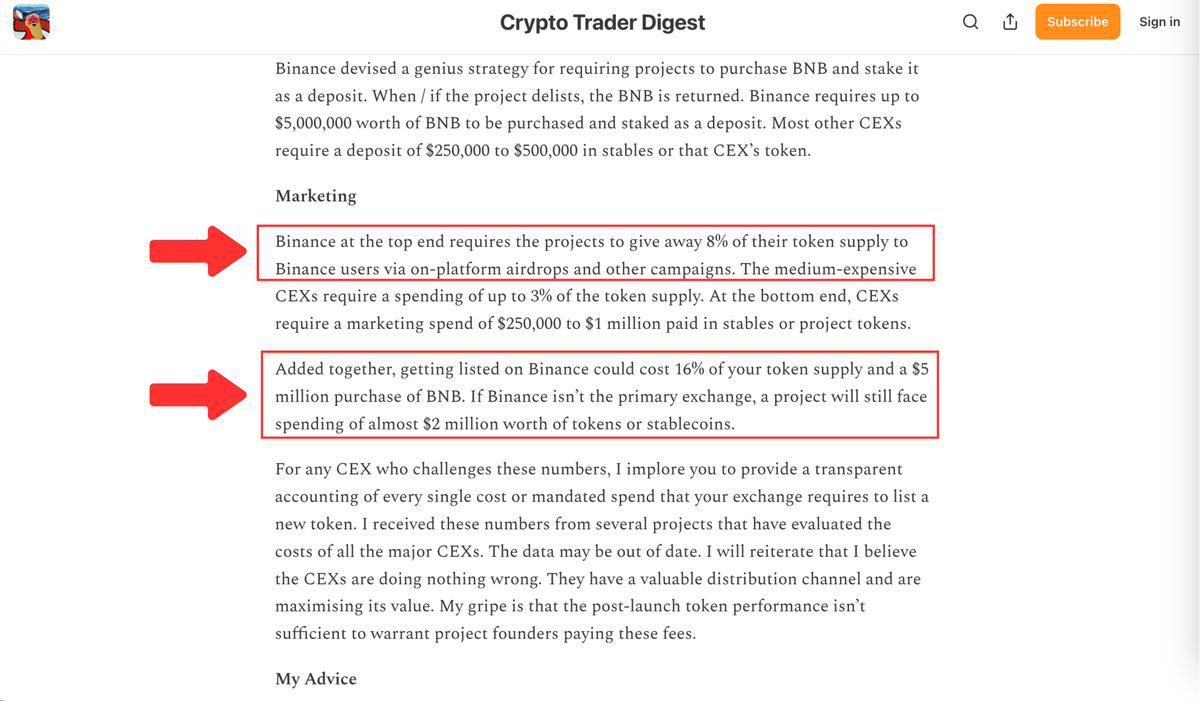

Previously, BitMEX co-founder Arthur Hayes stated that the listing fee charged by Binance can be as high as 8% of the total token supply, and projects are required to purchase and stake BNB, which is returned upon delisting, amounting to about $5 million (other exchanges require deposits of $250,000 to $500,000 in stablecoins or their tokens).

Related reading: Arthur Hayes to crypto projects: Instead of trying every way to get listed on Binance, why not go directly to DEX

Projects wanting to list on Binance or other exchanges must invest substantial funds.

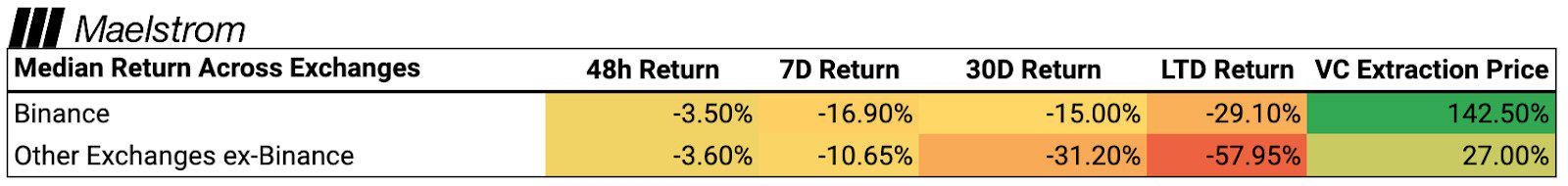

Many TGE projects with high FDV often lead to retail investors suffering losses.

Meanwhile, venture capital firms profit handsomely, selling at prices as high as 142.5%.

VanEck pointed out that investment funds are overly focused on short-term gains, affecting users and projects. Hayes advised caution when prioritizing listings on Binance.

However, projects listed on Binance often succeed due to strong communities and technology. More and more truly valuable projects are aligning with this trend.

Nevertheless, the high listing fees force projects and VCs to pursue short-term profits, negatively impacting investor performance in 2024.

So the question remains: Is listing on Binance a sure driver of price increases?

Price increases will depend on many key factors, not just listing on Binance, including:

Market conditions

Project quality

Hype surrounding its narrative

And so on.

1. Market Conditions

Market conditions are the biggest direct factor affecting token prices.

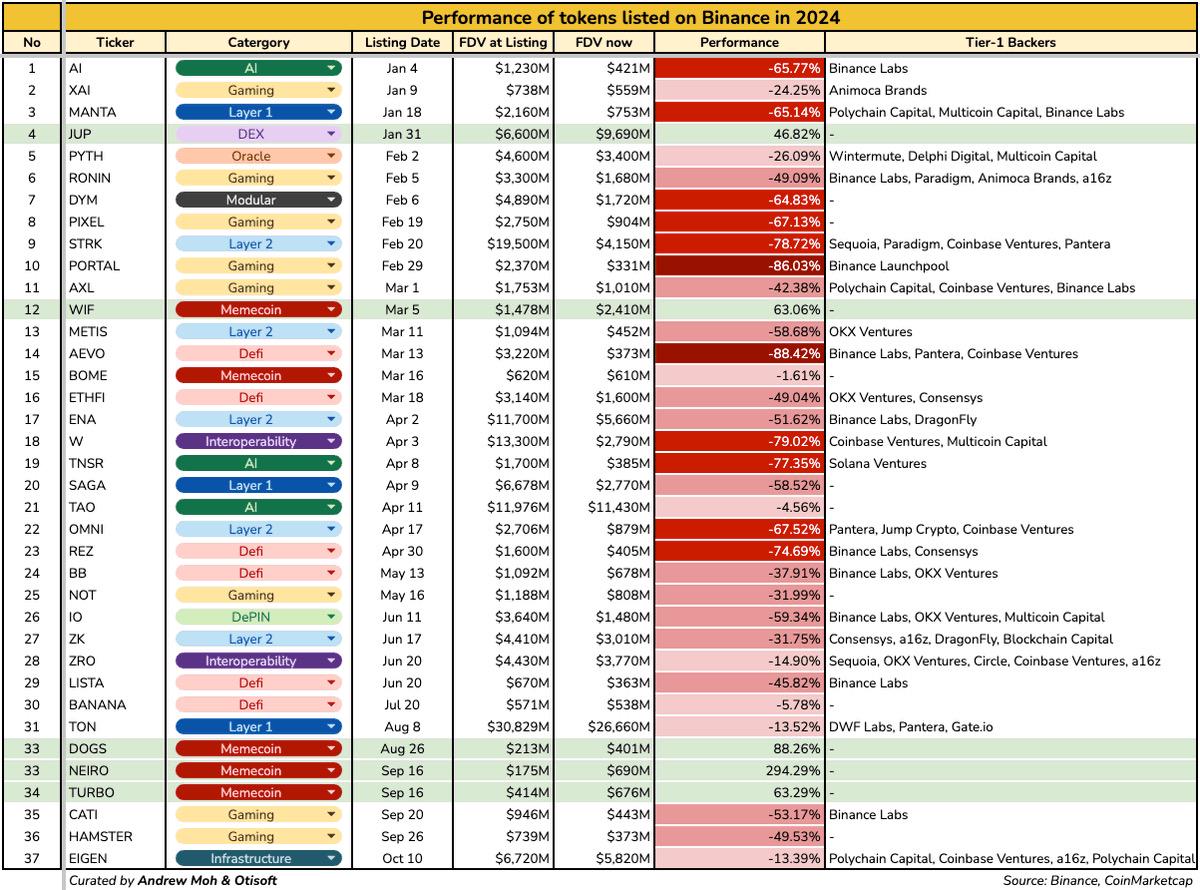

The table below shows:

Of the 37 tokens listed on Binance in 2024, all but 5 are in a "loss" state.

NEIRO has risen 294% since its listing on September 16, with an FDV of about $690 million.

Most tokens listed on Binance in 2024 have seen declines, with over half dropping at least 30-80%.

The worst performer is AEVO, which has dropped over 88% since its first listing in February.

So how should we view tokens listed on Binance?

From these statistics, you might lose trust in every project listed on Binance. (If you invested in projects listed on Binance in 2024, your current win rate is only 13.5%.)

This is a normal phenomenon due to market conditions.

BTC is close to $70,000 and has risen from $42,000. But why are almost all altcoins still in a downward trend?

2. Project Quality

You might think that Binance Labs is a reputable VC firm. Projects wanting to list on Binance are not just financial stories. They also mean:

High/innovative product quality

Large community

Binance Labs conducts strict reviews of each project to ensure that only the best projects are selected.

The seed label on Binance applies to:

Innovative new tokens aimed at trading new tokens while protecting other tokens from volatility risks.

Innovative tokens with potential for future listings.

But Binance always issues announcements related to monitoring labels. If a project is listed on Binance but

Has high volatility and low liquidity tokens

Low market cap projects

Delisting risks

Suspicious operations that endanger users

They will be added to the monitoring label.

If this situation continues, these projects will be delisted from Binance. If this happens, it will be a disaster for the projects and their holders.

3. Hype Surrounding the Narrative

As we enter 2024, Web3 users are buzzing about "narratives." From AI, DePIN to RWA, each narrative contains a story that promises to lead the trend, and the crypto industry is rapidly moving towards mass adoption.

But you can see the market's reaction to these narratives. Almost all current narratives have their highlights, but most are in trouble.

From the table above, it can be seen that 4 out of 5 rising projects are meme projects. Memes seem to be the magic ticket to attract millions of users.

According to CMC data, among the top 100 by market cap, there are 11 meme projects.

- 7 of the memes have a market cap exceeding $1 billion.

It is expected that in the next bull market, at least 3 more meme projects will reach a market cap of $1 billion.

Conclusion

Listing on Binance seems to be the dream of every Web3 project, but it is not just a price issue. Projects listed on Binance may undergo careful scrutiny from top VCs.

However, the development status of a project does not guarantee success. If users only invest in projects listed on Binance, it may be time to reconsider investment strategies. Price narratives are not everything, so it is advisable to invest wisely and stay clear-headed.

Related reading: Analyzing the listing effects of the top five exchanges: How much can they drive up token prices? How long will it last?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。