Finding Memecoins with High Trading Volume and Strong Liquidity, Especially Those with a Market Cap Over $100 Million

Author: Crypto Radahn

Translation: Deep Tide TechFlow

Cryptocurrency has been evolving for over a decade. During this time, each bull market has brought new hot topics.

The hot topic in 2017 was ICOs, while in 2021 it was DeFi, GameFi, and NFTs. So, what new trends might the bull market of 2024 bring? One possible hot topic is Memecoins.

Why Memecoins?

Memecoins have little to no practical use or added value in the crypto space. They are rife with scams and do not solve any real problems. So why are they so popular now? The short answer is:

Memecoins are community-driven. Compared to utility coins backed by venture capital that may be sold off to retail investors, investors are now more inclined to trust the Memecoins community.

Using low-cost Layer 1 (L1) and Layer 2 (L2) chains like Solana and Arbitrum, transaction costs are nearly zero.

Celebrity endorsements and memes are better at attracting audiences, thus driving the popularity of Memecoins.

So now you understand why Memecoins are a current area of interest. But how do we determine which Memecoins are high quality and which are low quality (or even outright scams)? To help you understand, we have summarized a few simple steps to filter out potential coins.

Step 1 — Strong Community and Fan Base

A strong community and fan base can enhance the survival chances of Memecoins. To assess this, you can focus on the following points:

Is there a large and active community on X (Twitter), Telegram, and Discord?

Is the project team active in the comments section and engaging with the community?

Is there a unique identity formed around a particular meme (e.g., the frog of $PEPE or the dog of $DOGE)?

Step 2 — Token Distribution

To effectively check this, you can use the free version of Bubblemaps: input the Memecoins you are interested in and their respective blockchain. Then, check the distribution of their tokens. If the bubble chart shows many colors, is clustered, and large, it indicates that many tokens are held by a few entities, which means there could be a significant sell-off.

In summary, look for token distributions that are evenly spread (deep colors on the bubble chart) and not clustered (bubbles not connected).

Step 3 — Token Holders

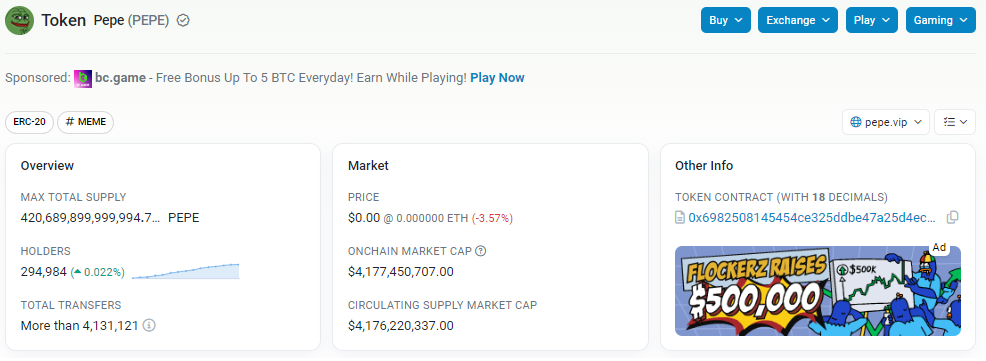

The number of holders of promising Memecoins will gradually increase over time. You can look for an upward trend in the number of holders by checking blockchain explorers like Etherscan. Here is an example regarding $PEPE:

Source: Etherscan

Step 4 — Trading Volume and Liquidity

Look for Memecoins with high trading volume and strong liquidity, especially those with a market cap over $100 million. In short, focus on the following metrics:

Trading volume should exceed 8%-10% of the market cap.

Liquidity should exceed 2%-4% of the market cap.

You can find this information on DexScreener.

Step 5 — Historical Performance

Memecoins that have previously experienced a drop of about 80% can only perform well under the following conditions:

Whales have not sold off.

The community provides support.

The number of holders continues to increase.

Conclusion

So, this is the guide on how to pick the strongest Memecoins in the market. However, please be sure to proceed with caution before fully committing.

Disclaimer

The information provided by Altcoin Buzz does not constitute financial advice and is for educational, entertainment, and reference purposes only. Any information or strategy is based on the risk tolerance of the author/reviewer, which may differ from yours. We are not responsible for any investment losses directly or indirectly resulting from the use of the information provided. Bitcoin and other cryptocurrencies are high-risk investments; please conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。