Fundraising and ballots go hand in hand.

Written by: Gyro Finance

Trump has a new move.

On October 15, the Trump family's DeFi project World Liberty Financial token WLFI officially went on sale. Prior to this, the project had been promoted for nearly two months, with all four members of the Trump family involved. Trump himself has repeatedly appeared on Space and X to rally support, seemingly becoming a new generation of crypto spokesperson.

However, compared to its ambitious fundraising target of nearly $300 million, the first day's token sales only exceeded $10 million, leaving a significant gap to the goal. The market has shown signs of desensitization to promises made so easily, leading to a trend of reduced betting on Trump, not to mention the previous controversies surrounding nepotism in the project.

On the other hand, with only 20 days until the election, the precise emergence of the crypto project at this time seems to carry a different meaning.

On October 15, the World Liberty Financial token WLFI officially launched, opening public sales to whitelist users, and just one day prior, the project team live-streamed an introduction, claiming there were over 100,000 qualified whitelist users.

Looking back at the project's development, the pre-launch began as early as two months ago. First, Trump's second son Eric Trump suddenly expressed his love for DeFi, followed by his eldest son Donald Trump Jr. posting that DeFi is the future to show loyalty. On August 16, the eldest son opened a Telegram channel for the crypto project called The DeFiant Ones, with continuous teasers to whet the market's appetite.

Finally, on August 29, the project unveiled its vague outline, with Eric Trump announcing the launch of World Liberty Financial (WLFI). Important guest Trump naturally added fuel to the fire by releasing project-related videos, while also reiterating the slogan of America's crypto capital.

Despite claiming to return the power of finance to the people, in reality, even until the token's release, the project's official white paper has yet to appear, with only a "golden paper" for introduction, leaving specific technical details and operational methods unclear. According to a roadmap obtained by The Block, combined with the golden paper, one can glimpse a corner of the project.

World Liberty Financial is led by co-founders Steve and Zach Witkoff, Folkman, and Chase Herro, aiming to promote the large-scale adoption of digital assets through a compliant one-stop alternative financial platform. Users can borrow and lend cryptocurrencies, create liquidity pools, and trade using stablecoins. The Trump family is deeply involved in the project, with Trump referred to as the "Chief Cryptocurrency Advocate" in the white paper draft, while his two eldest sons serve as "Web3 Ambassadors," and the youngest son naturally takes on the role of "DeFi Visionary."

The roadmap shows the project is divided into three phases. The first phase is built on the Ethereum lending platform Aave on Scroll, focusing on crypto banking, which has already been initiated. The second phase involves integration with exchanges, allowing users to consume through on-chain proof of KYC protocols; specifically, the project plans to create a credit card focused on stablecoins. The final phase is the tokenization of real-world assets, potentially returning to its roots in real estate projects.

While the project's plans are vague, the token distribution is quite clear. 63% of the token supply will be sold to the public, with 17% allocated for user rewards and 20% for the team. This initial token sale aims to raise $300 million, selling 20% of the token supply at a fully diluted valuation of $1.5 billion, with a total token supply of 20 billion. To avoid SEC regulation, the project token sale adopts Regulation D, limiting the sale scale and targeting only accredited investors, and the tokens cannot be transferred again, but token holders retain governance voting rights over the project's development.

From the first day's sales situation, as of October 16 at 3:30 PM, approximately 730.53 million WLFI tokens have been sold, with a remaining token quantity of 12.69 billion. At a price of $0.015 per token, the sales amount is approximately $10.9579 million. For a brand new project, the first day's fundraising results are already impressive, but when compared to the project's original $300 million plan, it is indeed far from sufficient.

As for why the market is no longer buying in, the reasons are quite direct. For a project with a non-transferable token and an unclear white paper, spending lavishly carries high risks. On the other hand, the project itself has many points of contention.

First is the project team. Although the Trump family is fully involved, as traditional real estate giants, they clearly lack crypto experience, as can be seen from the titles in the white paper, which mostly serve as mascots to increase influence while waiting to collect money. In this context, the actual project operation naturally falls to the co-founders.

Among the co-founders, Folkman and Chase Herro both come from Dough Finance, a DeFi project established in April this year based on AAVE, but it suffered a flash loan attack on July 12, resulting in a theft of $2 million, and the project is now essentially stagnant. With this as a background, there are rumors that WLFI will directly reuse code, bringing security risks. Additionally, Folkman has a history of founding courses aimed at attracting women for dating, which significantly lowers market trust and professionalism in him.

Chase Herro's reputation is equally questionable; he was imprisoned for drug-related offenses in his youth, sold weight loss pills and get-rich-quick courses, and launched another crypto trading business called Pacer Capital ten years ago, which no longer exists.

With the actual operators' reputations in ruins, the Trump family members being crypto novices, and the tokens being non-transferable and only for governance purposes, the project's fundamental purpose quickly comes into question.

Some industry analysts believe that the project is merely a way for Trump to expand fundraising channels, and in a deeper sense, an alternative method of political donations. This assertion is not unfounded; compared to the typically more well-funded Democrats, the Republican Party faces significant obstacles in fundraising. According to Federal Election Commission documents, as of July 31, Harris's team had raised $770 million and spent $440 million, while Trump's team raised $570 million and spent $310 million. According to the latest data, from July 1 to September 30, Harris's team raised $633 million, an amount and speed that are rare even in elections, while Trump raised only $350 million in the third quarter, highlighting a stark disparity.

From the perspective of funding channels, Harris's external fundraising primarily comes through the Carey Committee, while Trump relies on SuperPACs. Although both allow unlimited donations, the former can additionally add a "direct donation" feature, allowing funds to be directly donated to candidates and parties, while the latter can only be used for unlimited expenditures on advertising and promotion, making its funding efficiency lower than that of Harris's team.

Based on the above reasons, Trump's sudden increase in crypto channels on the eve of the election is quite reasonable; the token sale itself is a way to make quick money, which does not match the project's intended $300 million high financing. After all, not every project dares to set such high targets right after the token goes on sale, especially based on governance tokens. Of course, this also means that the project's success or failure is closely tied to Trump's election, and the subsequent benefits gained are more important to donors. However, from the current perspective, the Trump family still holds high hopes for the project and has set its sights on the stablecoin as a crypto cash cow.

On the other hand, Trump's launch of the crypto project at this time further solidifies his own crypto inclination, reflecting in reality, adding more authenticity to Trump's often exaggerated declarations, which is beneficial for gaining key support in the crypto field.

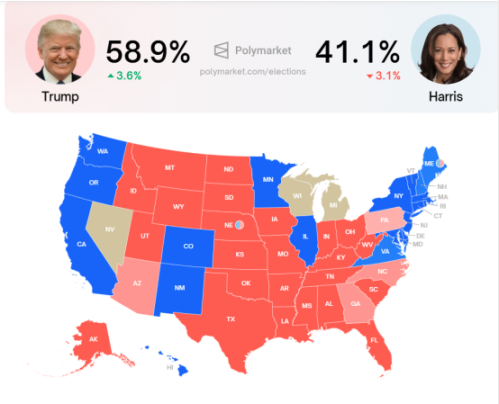

It is precisely because of this political tint that the project has not been widely praised. However, in terms of winning probability, although as of October 10, Harris still leads Trump by 2 percentage points in polls with a 49% approval rate, according to crypto prediction markets, Trump has already surpassed Harris, boasting a 58.9% winning probability, significantly distancing himself from Harris by 17 percentage points. In key swing states, Trump has also regained the lead, surpassing Harris in Michigan, Pennsylvania, and Nevada, leading in 6 out of 7 swing states. If this trend continues, Trump may be just one step away from winning the election.

It is worth noting that a very key supporter of Trump in this election is a long-time friend of crypto—Elon Musk. It is reported that from July 3 to September 5, Elon Musk donated $75 million to the America PAC supporting Trump, although this is lower than the previously claimed $45 million monthly donation, it still makes him one of Trump's largest donors.

However, it is quite strange that before 2020, Musk was very dissatisfied with Trump's withdrawal from the Paris Climate Agreement and publicly stated he was a supporter of the Democrats. In 2022, the two even became targets of mutual criticism online, with Musk openly stating that Trump should retire. Trump responded by saying Musk was merely a "businessman reliant on government subsidies," and used very harsh language to mock Musk's previous requests for project subsidies at the White House.

After Trump was assassinated in July this year, the two suddenly reversed their attitudes, clearly turning enemies into friends. In August, Musk and Trump had a conversation on Space, aimed at promoting him, attracting millions of viewers; in October, Musk even appeared at a Trump campaign event to show support, even publicly offering to buy votes, stating that voting would earn $47. Coupled with the high donation, Musk has indeed shown full support.

As for the reasons behind their reconciliation, Musk stated that he supports Trump because the current Democratic Party's views and values do not align with his own. Musk believes that the Democratic Party's tolerance of racial diversity has accelerated the division in the U.S., and the subsequent Biden administration's weakness in clean energy and electric vehicle initiatives, as well as various attacks on SpaceX and Twitter, have solidified his determination to side with the Republicans.

On the other hand, aside from the pressure from government orders and regulatory directions, Musk himself seems to have a strong interest in politics. From this perspective, choosing Trump, whose political foundation has not yet been fully established and is far from the entrenched bureaucratic establishment, clearly aligns more with Musk's conditions in terms of business interests and political prospects. Currently, Trump has already changed his previous attitude, promising to support electric vehicles and stating that Musk could serve as the Minister of Cost Reduction after he takes office.

However, there is no turning back once the arrow is shot; public figures openly taking sides naturally entails significant risks and backlash. Musk has publicly mentioned that if Trump loses, he may face severe retaliation from the Democrats, potentially leading to personal safety issues. In this context, Musk's strong support becomes particularly understandable.

For anyone involved in politics, elections are a gamble; until the end, it is hard to say who will win. In this, the various verbal battles from the campaign side are merely appetizers, while the unseen bloody struggles behind the scenes are the real stage. Any action by politicians is built on interests and votes.

Musk's friendship is just like that; the establishment of the crypto project is no different. Whether the newly launched DeFi project World Liberty Financial can truly serve crypto in the future, perhaps no one really cares.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。