Although Bitcoin may rise in the long term, it does not mean that its price will not experience severe fluctuations, nor does it mean that all altcoins will benefit similarly; the key lies in reasonably controlling the scale of investment.

Author: Arthur Hayes

Translation: Deep Tide TechFlow

(The views expressed in this article are solely those of the author and should not be used as the basis for investment decisions, nor should they be considered investment advice.)

Want to know more? Follow the author on Instagram and X

In the first two weeks of October, I went skiing on New Zealand's South Island. My guide and I spent last ski season in Hokkaido, and he assured me that New Zealand is one of the best places in the world for backcountry skiing. I believed him, so we set off from Wanaka and spent two weeks chasing powder snow and spectacular ski lines. The weather was very cooperative, and I skied down several magnificent peaks and traversed huge glaciers. Additionally, I improved my knowledge of alpine climbing.

The storms on the South Island are extremely fierce. Once the weather turns bad, you can only stay at home or in a mountain lodge. To pass the time, one day my guide held a class on avalanche science. I have undergone avalanche training multiple times since my first backcountry adventure in British Columbia as a teenager, but I had not participated in a formal certification course.

This knowledge is both fascinating and sobering, as the more you learn, the more you realize that there are always risks when skiing in avalanche terrain. Therefore, our goal is to keep the risks within acceptable limits.

The course covered different types of snow layers and how they can lead to avalanches. One of the most terrifying scenarios is the persistent weak layer (PWL), which can trigger a persistent slab avalanche when pressure is applied.

In avalanche science, a persistent weak layer (PWL) refers to a specific layer within the snowpack that remains structurally weak for an extended period, significantly increasing the risk of avalanches. These layers are particularly dangerous because they can be deeply buried within the snowpack, remaining unstable for long periods until triggered by additional pressure (such as a skier passing by or new snowfall). Understanding the existence of PWLs is crucial for predicting avalanches, as they are often the cause of large, deep, and deadly avalanches.

The post-World War II geopolitical situation in the Middle East resembles a PWL under the modern global order, with trigger points often related to Israel. From the perspective of financial markets, the "avalanches" we are concerned about include fluctuations in energy prices, impacts on global supply chains, and whether hostile actions between Israel and other Middle Eastern countries (especially Iran or its proxies) could lead to the use of nuclear weapons.

As investors and traders, we find ourselves in a dangerous yet exciting situation. On one hand, with China having begun large-scale money printing and re-inflation activities, major economies are lowering interest rates and increasing money supply. This is the time to take on the greatest long-term risks, and clearly, I am referring to cryptocurrencies. However, if tensions between Israel and Iran continue to escalate, leading to the destruction of oil fields in the Persian Gulf, the closure of the Strait of Hormuz, or the detonation of nuclear weapons, the crypto market could suffer a severe blow. As the saying goes, war is not investable.

I face a choice: should I continue to sell fiat currency to buy cryptocurrencies, or should I reduce my cryptocurrency holdings and hold cash or U.S. Treasury bonds instead? If this is indeed the beginning of a new bull market for cryptocurrencies, I do not want to miss the opportunity. But I also do not want to suffer heavy losses if Bitcoin drops 50% in a day due to a financial market avalanche triggered by Israel and Iran. Bitcoin will always rebound, but I am more concerned about some worthless assets in my portfolio… like meme coins.

I want to guide readers through a simple scenario analysis to understand my thought process when considering how to allocate the Maelstrom portfolio.

Scenario Analysis

Scenario 1: The conflict between Israel and Iran gradually evolves into a small-scale military confrontation. Israel continues its assassination operations, while Iran's response consists of some predictable, non-threatening missile strikes. No critical infrastructure is destroyed, and no nuclear strikes occur.

Scenario 2: The conflict between Israel and Iran escalates, ultimately leading to the destruction of some or all Middle Eastern oil infrastructure, the closure of the Strait of Hormuz, and even nuclear attacks.

In Scenario 1, the persistent weak layer remains stable, but in Scenario 2, it fails, leading to a collapse of the financial markets. We focus on the second scenario because it poses a threat to my portfolio.

I will assess the impact of the second scenario on the crypto market, particularly Bitcoin. Bitcoin is the reserve asset in the cryptocurrency space, and the entire crypto market will fluctuate accordingly.

What worries me more is that, since the U.S. has committed to deploying THAAD missile defense systems in Israel, Israel may escalate its offensive. Israel may be planning a large-scale strike, anticipating a strong response from Iran. Therefore, they are requesting U.S. President Biden to send reinforcements. Moreover, the more Israel publicly states that it will not attack Iran's oil or nuclear facilities, the more I suspect that this is precisely their true intention.

According to Reuters, the U.S. announced on Sunday that it would send troops and advanced missile defense systems to Israel, a very rare deployment aimed at strengthening Israel's air defense capabilities after suffering Iranian missile attacks.

Risk 1: Physical Destruction of Bitcoin Mining Machines

War is highly destructive. Bitcoin mining machines are the most valuable and important physical assets in cryptocurrency. What kind of damage would they face if war breaks out?

In this analysis, the main assumption is about the region to which the conflict will spread. Although the war between Israel and Iran is merely a proxy war between the U.S./EU and China/Russia, I assume that both sides are unwilling to engage in direct combat. It is preferable to confine the conflict to these Middle Eastern countries. Moreover, the final combatants are all nuclear powers. The U.S., as the most aggressive global military power, has never directly attacked another nuclear power. This indicates some issues, as the U.S. is the only country that has ever used nuclear weapons (to end World War II, they forced Japan to surrender through nuclear explosions). Therefore, it is reasonable to assume that actual military conflict will be limited to the Middle East.

The next question is whether there are countries in the Middle East that engage in significant Bitcoin mining. According to some media reports, Iran is the only country where Bitcoin mining is thriving. According to various sources, Iranian Bitcoin miners account for 7% of global hash power. If Iran's hash power drops to 0% due to internal energy shortages or missile attacks on facilities, what would be the impact? Essentially none.

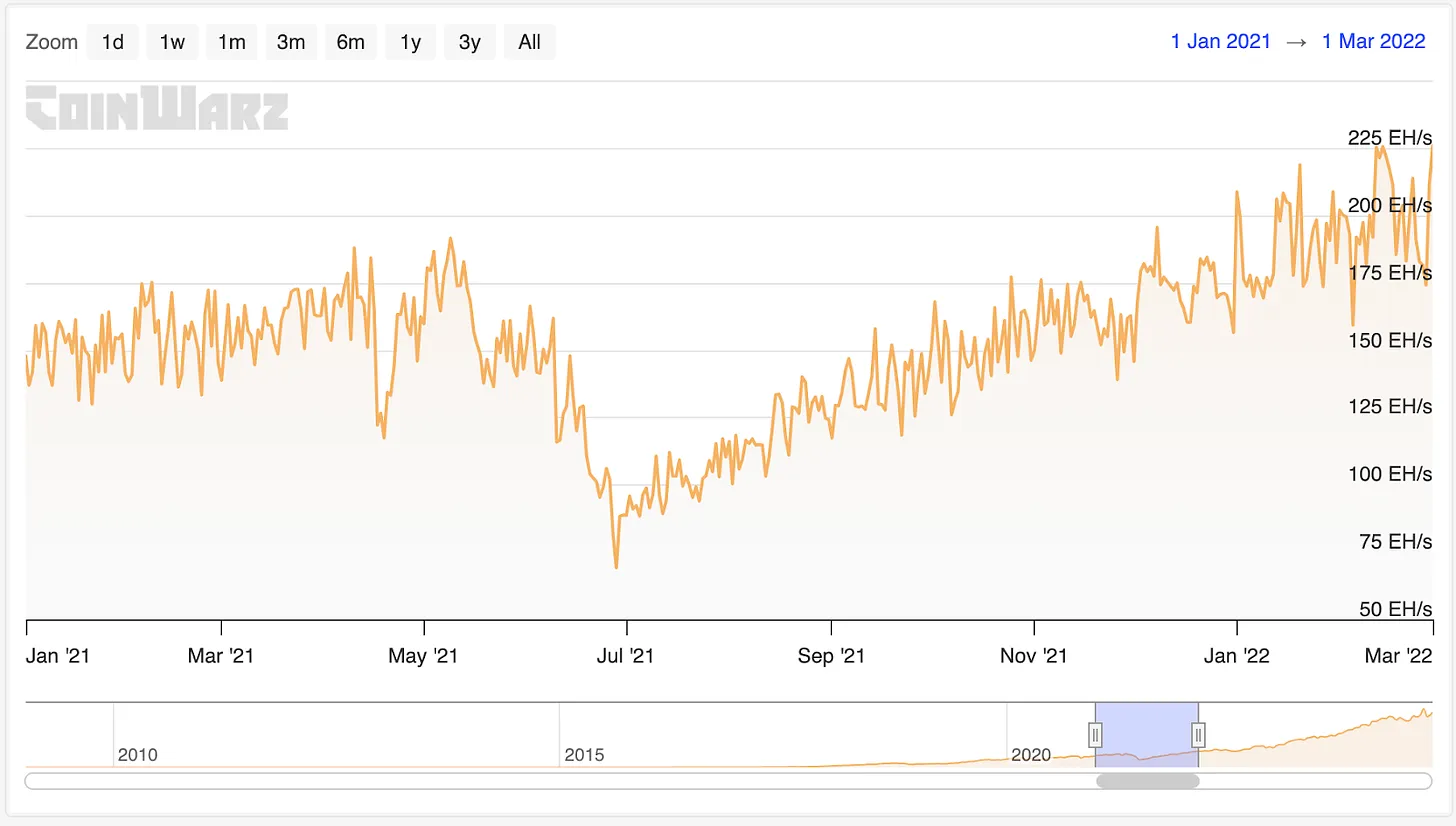

This is a graph of Bitcoin network hash power from January 2021 to March 2022.

Do you remember when China banned Bitcoin mining in mid-2021, and hash power quickly dropped by 63%? The hash power recovered to the peak in May 2021 within just eight months. Miners either migrated out of China, or participants from other countries increased their hash power due to more favorable economic conditions. Most importantly, Bitcoin reached an all-time high in November 2021. The severe drop in network hash power had no significant impact on the price. Therefore, even if Iran were completely destroyed by Israel or the U.S., leading to a global hash power reduction of up to 7%, it would not affect Bitcoin.

Risk 2: Severe Increase in Energy Prices

Next, we need to consider what would happen if Iran retaliated by destroying major oil and gas fields. The Achilles' heel of the Western financial system is the shortage of cheap hydrocarbons. Even if Iran could destroy Israel, it would not stop the war. Israel is merely a useful and expendable vassal of the U.S. hegemonic system. If Iran wants to strike at the West, it must destroy hydrocarbon production and prevent tankers from passing through the Strait of Hormuz.

Oil prices would skyrocket, driving up all other energy prices, as oil-deficient countries would use alternative energy sources to sustain their economies. So, how would the fiat price of Bitcoin change? It would rise accordingly.

Bitcoin can be viewed as energy stored in digital form. Therefore, when energy prices rise, the fiat currency value of Bitcoin will also increase. The profitability of Bitcoin mining will not change, as all miners face rising energy prices simultaneously. For some large industrial miners, it may become difficult to obtain energy due to government requests for utility companies to invoke force majeure clauses and cancel contracts. However, if hash power decreases, mining difficulty will also lower, allowing new entrants to potentially profit even at higher energy prices. The elegance of this mechanism designed by Satoshi Nakamoto will be fully demonstrated.

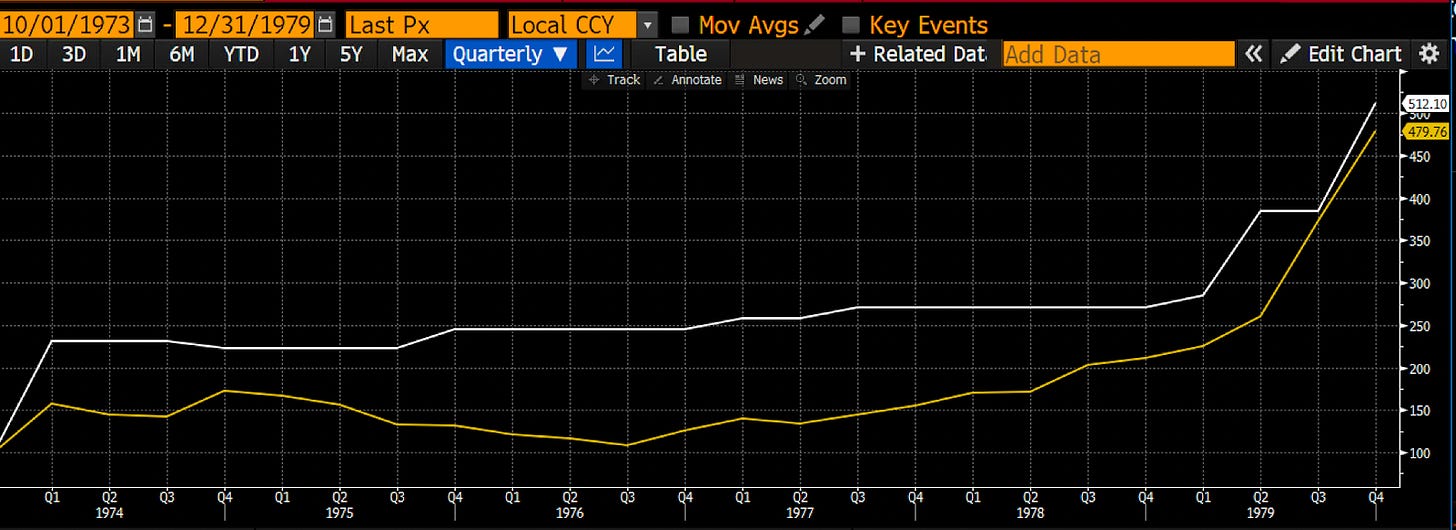

If you want a historical example that showcases the resilience of hard currency under energy shocks, look at the trading of gold from 1973 to 1982. In October 1973, Arab nations imposed an oil embargo on the U.S. in retaliation for its support of Israel during the Yom Kippur War. In 1979, Iran's oil supply exited the global market due to the revolution that overthrew the Western-backed king and established the current theocratic regime.

Spot oil prices (white) and gold prices (yellow) relative to the dollar benchmark index set at 100. Oil prices rose by 412%, while gold prices nearly caught up with their increase, reaching 380%.

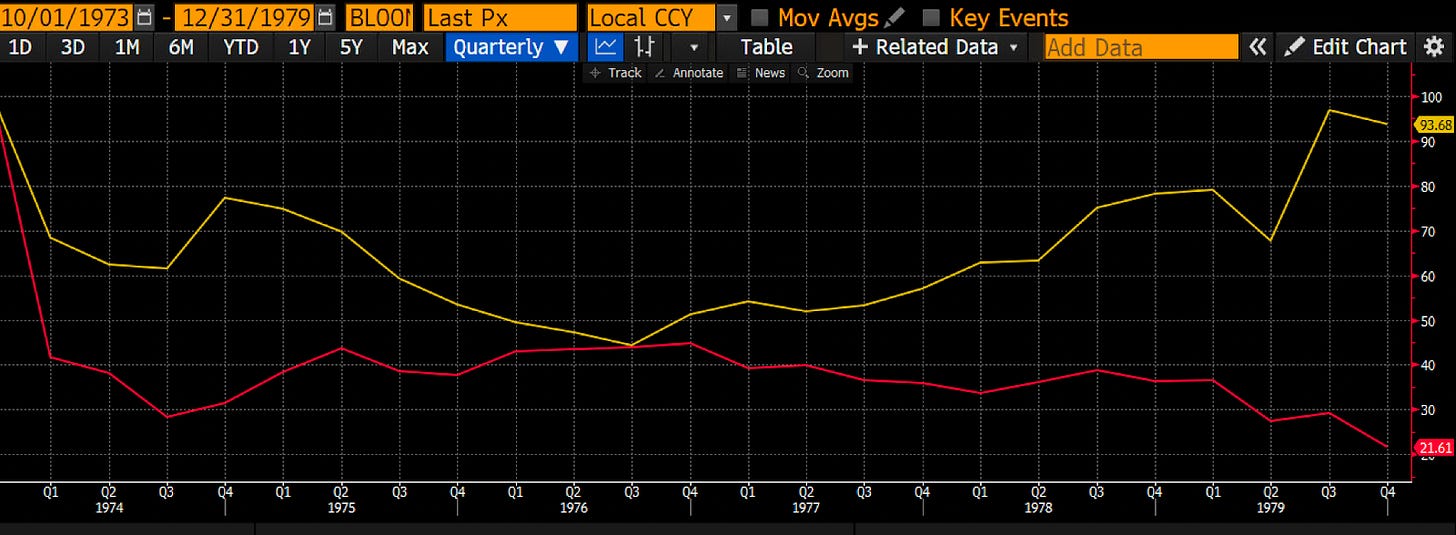

This is a comparison of gold prices (gold) and the S&P 500 index (red) divided by oil prices, with a baseline of 100. The purchasing power of gold only decreased by 7%, while the purchasing power of stocks fell by 80%.

Assuming either side removes Middle Eastern hydrocarbons from the market, the Bitcoin blockchain will continue to operate, and its price will at least maintain its value relative to energy, and it will certainly rise in fiat currency terms.

I have discussed physical and energy risks; now let’s explore the final monetary risk.

Risk 3: Currency

The key question is how the United States will respond to the conflict. Both the Democratic and Republican parties firmly support Israel. Even when innocent civilians suffer losses during the Israeli military's attempts to destroy Iran and its proxies, the political elite in the U.S. will continue to support Israel. The U.S. supports Israel by providing weapons. Since Israel cannot afford the cost of weapons needed to fight Iran and its proxies, the U.S. government pays American arms manufacturers like Lockheed Martin through borrowing. Since October 7, 2023, Israel has received $17.9 billion in military aid.

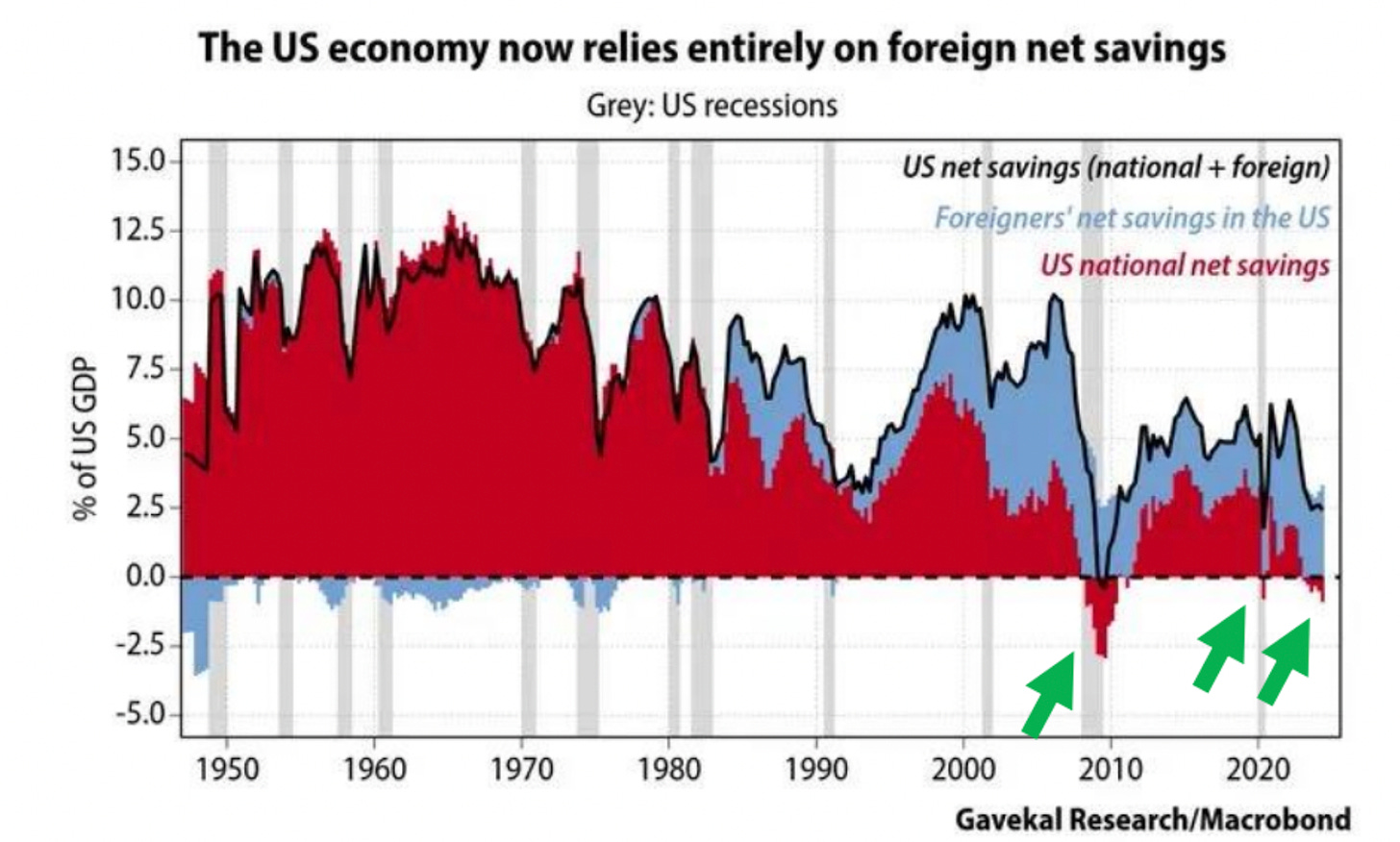

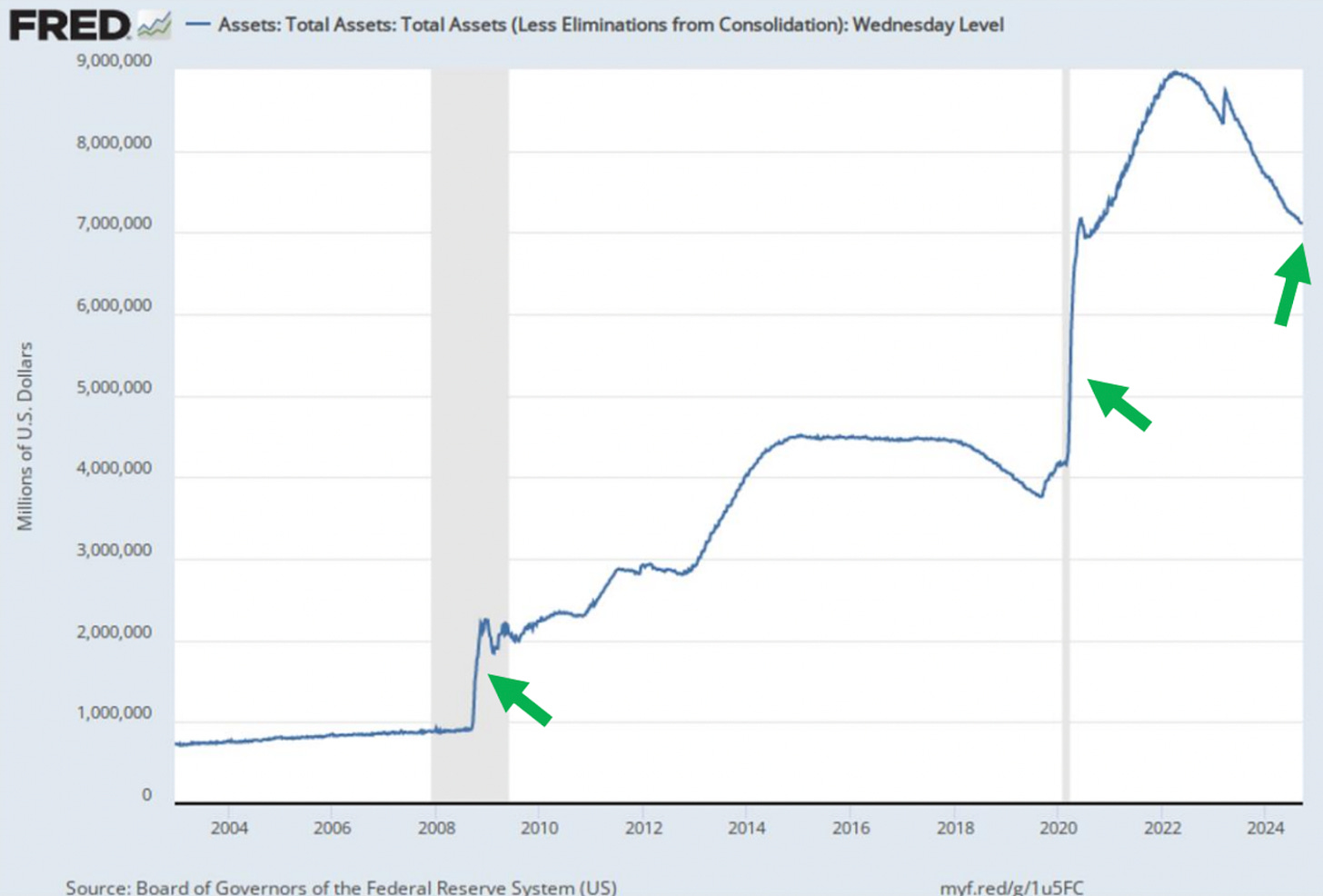

The U.S. government procures through borrowing rather than saving. This is the message conveyed in the above image. To provide free weapons to Israel, the debt-laden U.S. government needs to borrow more. The question is, when national savings are negative, who will buy this debt? The green arrows in the image indicate periods when U.S. national net savings were negative. Luke Gromen points out that these arrows correspond to the sharp expansion of the Federal Reserve's balance sheet.

The U.S. plays the role of the war king in supporting Israel's military actions, thus requiring more borrowing. Just like after the 2008 global financial crisis and the COVID-19 lockdowns, the balance sheets of the Federal Reserve or the commercial banking system will sharply increase to absorb the new debt issuance.

How will Bitcoin respond to another significant expansion of the Federal Reserve's balance sheet?

This is the result of Bitcoin's price divided by the Federal Reserve's balance sheet, with a baseline of 100. Since Bitcoin's inception, its performance has exceeded the growth of the Federal Reserve's balance sheet by 25,000%.

We know that war triggers inflation. We understand that the U.S. government needs to borrow money to sell weapons to Israel. We also know that the Federal Reserve and the U.S. commercial banking system will purchase this debt by printing money and expanding their balance sheets. Therefore, it is foreseeable that as the war intensifies, the fiat price of Bitcoin will rise significantly.

Regarding Iran's military spending, will China and Russia support Iran's war efforts in some way? China is willing to purchase hydrocarbons from Iran, and both China and Russia sell goods to Iran, but these transactions are not conducted through credit. From a more realistic perspective, I believe China and Russia may play a cleanup role. They will publicly condemn the war but will not take effective measures to prevent Iran's destruction.

Israel is not keen on nation-building. Instead, they may hope to provoke the Iranian regime to collapse due to public unrest through attacks. In this way, especially China, can employ its usual diplomatic means to offer loans to the newly established weak Iranian government, utilizing Chinese state-owned enterprises to help rebuild the country. This is essentially what Chinese President Xi Jinping has promoted during his tenure through the Belt and Road Initiative. Thus, Iran, rich in minerals and hydrocarbon resources, would fully integrate into China's economic sphere. China could find a new market in the Global South to dump its surplus production of high-quality, low-cost manufactured goods. In exchange, Iran would provide China with cheap energy and industrial raw materials.

From this perspective, the support from China and Russia would not increase the supply of global fiat currency. Therefore, this would not have a significant impact on the fiat price of Bitcoin.

The intensification of the Middle Eastern conflict will not destroy any key physical infrastructure supporting cryptocurrencies. As energy prices soar, the value of Bitcoin and cryptocurrencies will rise. Hundreds of billions or even trillions of newly printed dollars will once again drive a bull market in Bitcoin.

Cautious Trading

While Bitcoin may rise in the long term, this does not mean that its price will not experience severe fluctuations, nor does it mean that all altcoins will benefit similarly. The key lies in reasonably controlling the scale of investment.

I am prepared for the severe market value fluctuations of every investment I hold. As some readers know, I have invested in several meme coins. When Iran launched missiles at Israel, I decisively cut back on these investments because the response of crypto assets to escalating conflict is difficult to predict in the short term. I realized that my investment scale was too large because I would be very frustrated if I lost all my funds in some joke-like cryptocurrencies. Currently, the only meme coin I hold is the Church of Smoking Chicken Fish (ticker: SCF). R'amen.

I have not asked Maelstrom's investment director Akshat to slow down or stop our investment pace in pre-sale tokens. For the idle funds held by Maelstrom, I plan to stake them on Ethena to earn substantial returns while waiting for the right opportunity to enter various liquidity altcoins.

As a trader, the worst practice is to trade based on who you think is on the "right" side in a war. This approach leads to failure because both sides of the war will face financial repression, asset confiscation, and destruction. The wisest course of action is to first ensure the safety of yourself and your family, and then invest capital in tools that can withstand fiat currency depreciation and maintain their purchasing power in energy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。