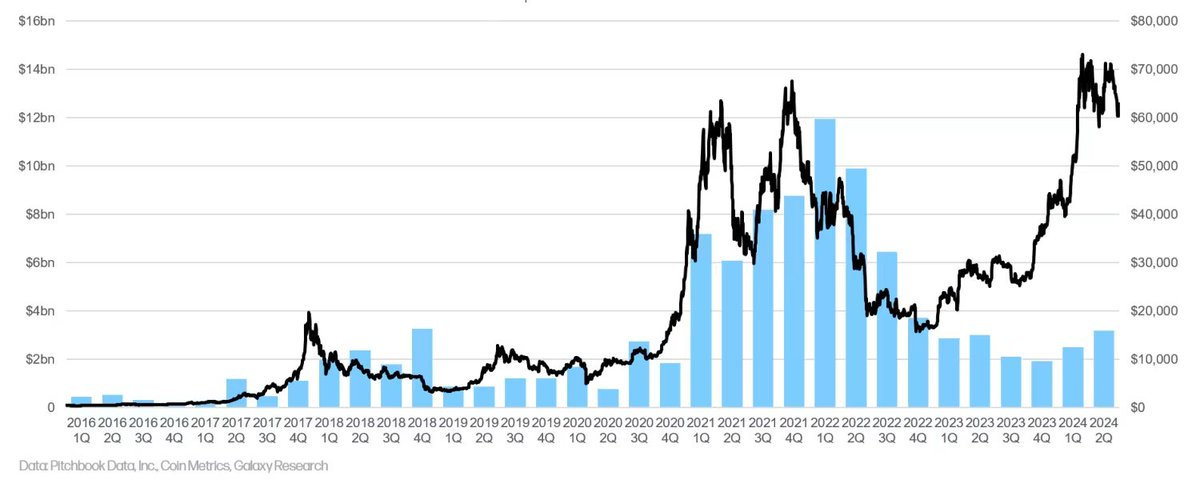

Investment scale does not completely synchronize with BTC prices; most investments have flowed into NFTs, gaming, and DAOs, followed by infrastructure.

Author: Edgy - The DeFi Edge

Translation: Deep Tide TechFlow

This is the strangest cycle yet—no one can predict what will happen next

At times like this, it can be helpful to understand the movements of others. Therefore, I spent the entire weekend researching the recent activities of those venture capital bigwigs.

I know some of you might think, “They are just casting a wide net and profiting from early investments.”

In fact, I don’t think they are the smartest people, especially after experiencing the last cycle. But we should still pay attention to them: because they do have an information advantage, ample funds, and are closer to the project developers than we are.

I wonder:

Are they making any interesting moves?

Are they as enthusiastic about altcoins as we are?

Or do they still hold some legacy coins?

So, my friend Edgy condensed hours of research into a simple five-minute read.

Let’s take a look at what these suited speculators are up to.

Notes:

Do not simply mimic the actions of venture capitalists. They have better trading opportunities, and their strategies differ from ours. The information here is just to help us better understand other participants in this field.

We cannot track all wallets. We have done our best through crowdsourced tagging and our own on-chain analysis, but it is impossible to capture all movements.

We selected some funds and sorted them by size. We will introduce each fund's total balance, main assets, smaller assets, and some interesting recent actions.

Top Crypto Venture Capital Firms and Their Holdings

- ### a16z ($482.3 million)

Main Assets:

UNI: $436 million

OP: $31 million

COMP: $14 million

Smaller Assets: ETH ($14,000), COLLE ($6,000)

a16z is one of the largest holders of UNI in the market. They have enough influence to veto proposals, as their 4% UNI can reach a quorum. They have held UNI for years. Recently, a16z's wallet saw a change with the initial unlocking of their OP, which they have held.

- Galaxy Digital ($364.5 million) ------------------------

Main Assets:

BTC: $194 million

ETH: $115 million

USDC: $40 million

USDT: $5 million

AVAX: $4 million

USDC: $1.3 million

AAVE: $1.14 million

Notable Smaller Assets ($100,000 - $150,000): MKR, OXT, UNI, TOKE

They generate a large volume of trades, mainly for stablecoins and BTC. They may be diversifying tokens and engaging in some arbitrage strategies. Recently, they withdrew $3.3 million worth of AVAX from Binance.

- Jump Trading ($286.4 million) ----------------------

Main Assets:

USDC: $78 million

USDT: $70.38 million

stETH: $70.38 million

ETH: $54.9 million

T: $2.15 million

WETH: $1.24 million

SHIB: $1.2 million

SNX: $1.16 million

Smaller Holdings: ($200,000 - $700,000) include MKR, LDO, GRT, DAI, UNI, KNC, HMT, BNB, CVX, COMP, INJ, MNT.

Jump's portfolio is primarily composed of ETH and stablecoins, which is common in venture capital. Notably, they also hold Threshold Network, SHIB, and SNX.

While some claim Jump has exited the crypto space, they are still actively engaged in various operations. They have also started depositing ETH into LMAX, a crypto exchange catering to institutions.

- Wintermute ($159.8 million) --------------------

Main Assets:

USDC: $16.6 million

WBTC: $11.15 million

PEPECOIN: $10.52 million

ETH: $10.39 million

USDT: $9.11 million

TKO: $4.67 million

CBBTC: $4.63 million

MATIC: $4.41 million

BMC: $4.36 million

NEIRO: $3.48 million

Smaller Assets: ($200,000 - $3 million) include BASEDAI, TON, ZK, MOG, stETH, ARB, ENA, ARKM, APE, LDO, ONDO, etc.

Wintermute stands out in the meme coin space. Their largest holding is PEPECOIN (not PEPE, but another meme coin), and they also have significant investments in meme coins like MOG, NEIRO, COQ, APU, SHIB, BENJI, etc.

They are known for their market activity in meme coins. Recently, Wintermute's wallet showed accumulation of CBBTC (Coinbase BTC) and BTC, and they transferred over $6 million worth of SHIB to Binance.

- Pantera Capital ($161.15 million) --------------------------

Main Assets:

ONDO: $15.2 million

ETHX: $4.4 million

SD: $1.11 million

ECOX: $941,600

LDO: $388,000

PERC: $375,000

NOTE: $274,000

Recently, Pantera transferred nearly $3 million worth of MATIC to Coinbase. They also moved $1 million worth of LDO to Anchorage, a platform designed for institutional crypto staking services.

Notably, most of their ETH has been transferred to centralized exchanges. Additionally, we observed a 56% decline in the investment value of ONDO. Pantera is one of the early private investors in ONDO.

- Blockchain Capital ($67.1 million) ---------------------------

Main Assets:

AAVE: $32.8 million

UNI: $18.35 million

ETH: $4.16 million

UMA: $2.12 million

SAFE: $1.89 million

1INCH: $1.88 million

COW: $1.62 million

FORT: $1.31 million

USDC: $1 million

Smaller Assets: ($100,000 - $600,000) include SUSHI, BAL, PSP, USDC, PERP.

Blockchain Capital's largest holding is AAVE, which they have held for many years. With its recent price uptrend, it may be worth further attention. They also transferred over $5 million worth of ETH to Anchorage, similar to Pantera.

- Spartan Group ($35.38 million) ----------------------

Main Assets:

PENDLE: $16.93 million

GAL: $2.65 million

MNT: $2.49 million

OP: $1.4 million

IMX: $1.18 million

WILD: $1.09 million

GRT: $1.04 million

AEVO: $982,000

USDC: $841,000

PTU: $800,000

RBN: $778,000

1INCH: $700,000

Smaller Assets: ($100,000 - $500,000) include MAV, CHESS, MPL, G, DYDX, ALI, BETA, PSTAKE, ETH.

Spartan Group primarily bets on Pendle. Besides that, they have not engaged in many substantial trades, mainly conducting arbitrage strategies through USDC. Interestingly, they transferred all BEAM assets to the upcoming chain Sophon, where users can start depositing assets for airdrop rewards.

- DeFiance Capital ($33.6 million) -------------------------

PYUSD: $20 million

LDO: $6.08 million

BEAM: $3.94 million

USDC: $1.1 million

TBILL: $1.04 million

Smaller Assets: ($50,000 - $300,000) include VIRTUAL, AVAX, BAL, MCB, USDT, INSUR.

DeFiance has made significant investments in gaming tokens. Their recent transactions involve multiple payments from Shrapnel (a Web3 shooting game). They have also accumulated a large amount of ETH from Morpho.

Some Venture Capital Trends We Observed

Common Holdings: a16z, Jump, Wintermute, and Blockchain Capital prefer top DeFi tokens (such as UNI and AAVE), ETH, and stablecoins. Possibly due to the bear market, they are more focused on liquidity and DeFi protocols.

Long-term Holding: a16z and Blockchain Capital are steadfast holders, having held UNI and AAVE for many years.

Stablecoin Arbitrage: They are all engaging in stablecoin arbitrage, as evidenced by their large volume of stablecoin transactions.

Bitcoin Layer 2 Investments: Bitcoin Layer 2 continues to attract significant investment. BTC L2 companies and projects raised $94.6 million, a 174% increase quarter-over-quarter.

Early Stage Transactions: Early-stage transactions still dominate. Nearly 80% of investment capital and seed pre-round transactions account for 13% of all transactions.

Investment Trends: Despite the massive hype for NFTs and GameFi in 2021, the industry has cooled down by 2024. Venture capital is now more inclined towards trends like AI, infrastructure, and even memes. We recently browsed an interesting report from Galaxy on venture capital trends for 2024.

Here are some highlights:

Venture capital investment has significantly decreased compared to the same period in 2021-2022. However, in the second quarter of 2024, venture capital investment reached $3.19 billion, a 28% increase quarter-over-quarter.

Notably, the investment scale does not completely synchronize with BTC prices.

In the past, this correlation was more pronounced, but now it seems that the liquidity of venture capital has declined.

Most investments have flowed into NFTs, gaming, and DAOs, followed by infrastructure.

“In the second quarter of 2024, companies and projects in the ‘Web3/NFT/DAO/metaverse/gaming’ category raised the largest share of crypto venture capital, accounting for 24% of total investment, totaling $758 million. Within this category, Farcaster and Zentry were the two largest transactions, raising $150 million and $140 million, respectively.”

I hope this in-depth analysis provides you with profound insights into how venture capital operates in the crypto space.

The key to analysis lies in observing their behavior to capture potential trends in advance and understand how they operate. Do not simply replicate venture capital operations; instead, use it as a resource to enhance your research capabilities.

The following tools made this research possible:

We put a lot of effort into writing this article.

If you would like to see this series of articles continue to be published, please support us by interacting with this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。