Solana's TVL reached 66% of Ethereum's in September this year, with staking amounts exceeding $58 billion.

Author: OurNetwork

Translation: ShenChao TechFlow

Editor's Note

This week, we co-hosted the first on-chain data hackathon with Artemis, a one-day chart-building competition that brought together data analysts, developers, and investors from across the industry, aimed at revealing stories that can only be presented through on-chain data.

Today's content includes a collection of industry-level reports from the hackathon submissions.

Stablecoins: Ethena, MakerDAO, Curve | Layer 2 Solutions: Base, Arbitrum, Celo | Cross-Chain Bridges: LiFi | Staking: Ethereum vs Solana

Stablecoins

Delleon Mcglone | Twitter | Artemis Dashboard

Decentralized Stablecoin Giants: USDe Market Cap Reaches $1.56 Billion, Q3 Performance Mixed

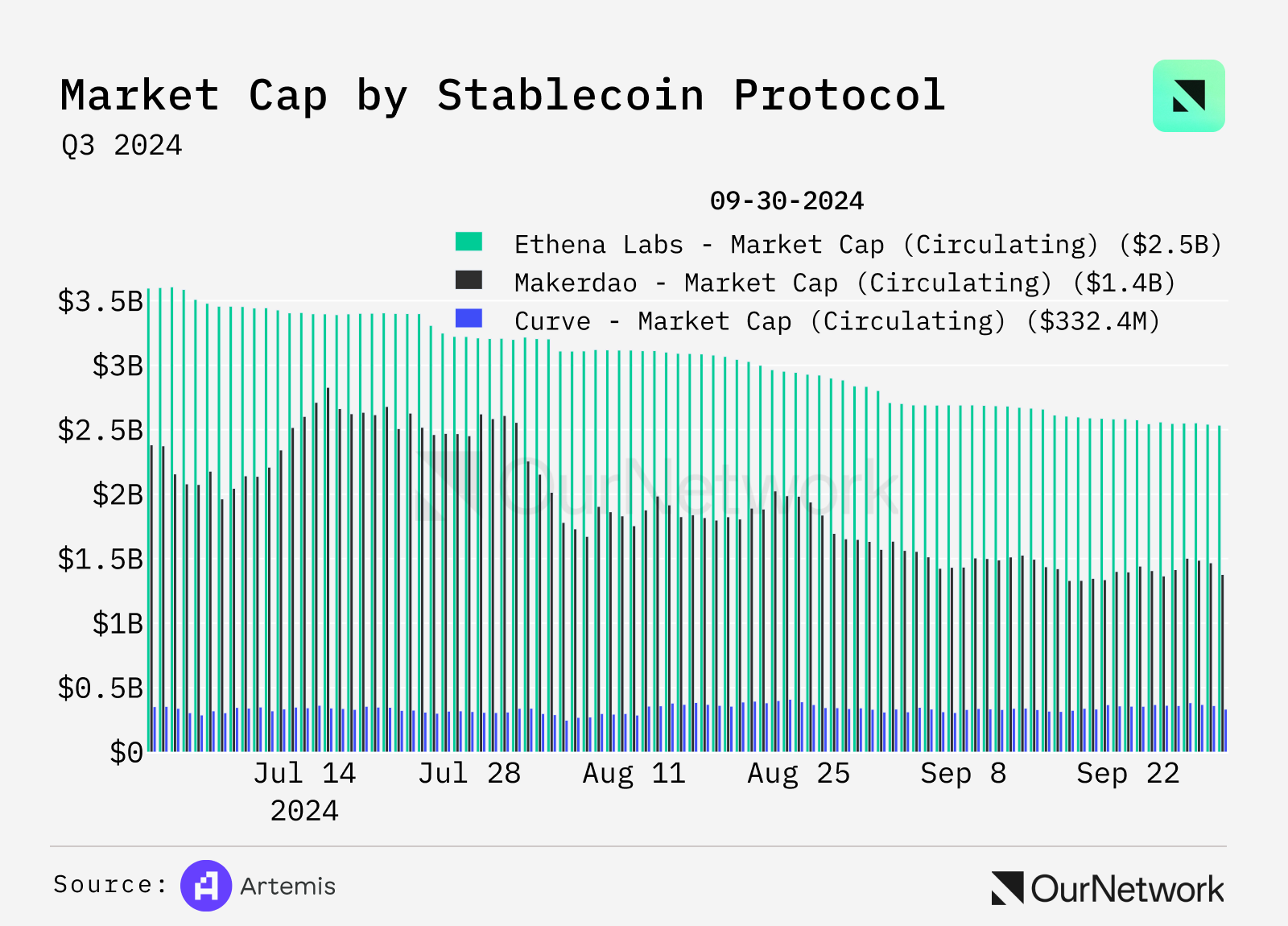

- Ethena consistently holds the highest market cap at $3.1 billion, followed by MakerDAO (now known as Sky) with a market cap of $2.16 billion, while Curve has the smallest but most stable market cap at $351.4 million. All three protocols show a downward trend, with Ethena's market cap declining the most significantly from $3.61 billion to $2.54 billion (-29.64%). This downward trend continues with MakerDAO, which fell from $2.3 billion to $1.5 billion (-45%), while Curve saw a slight increase from $352 million to $359 million (+1.99%). Ethena's market cap decline is primarily influenced by regulatory uncertainty, reduced liquidity (-35.33%), and market cap decline (-24.2%).

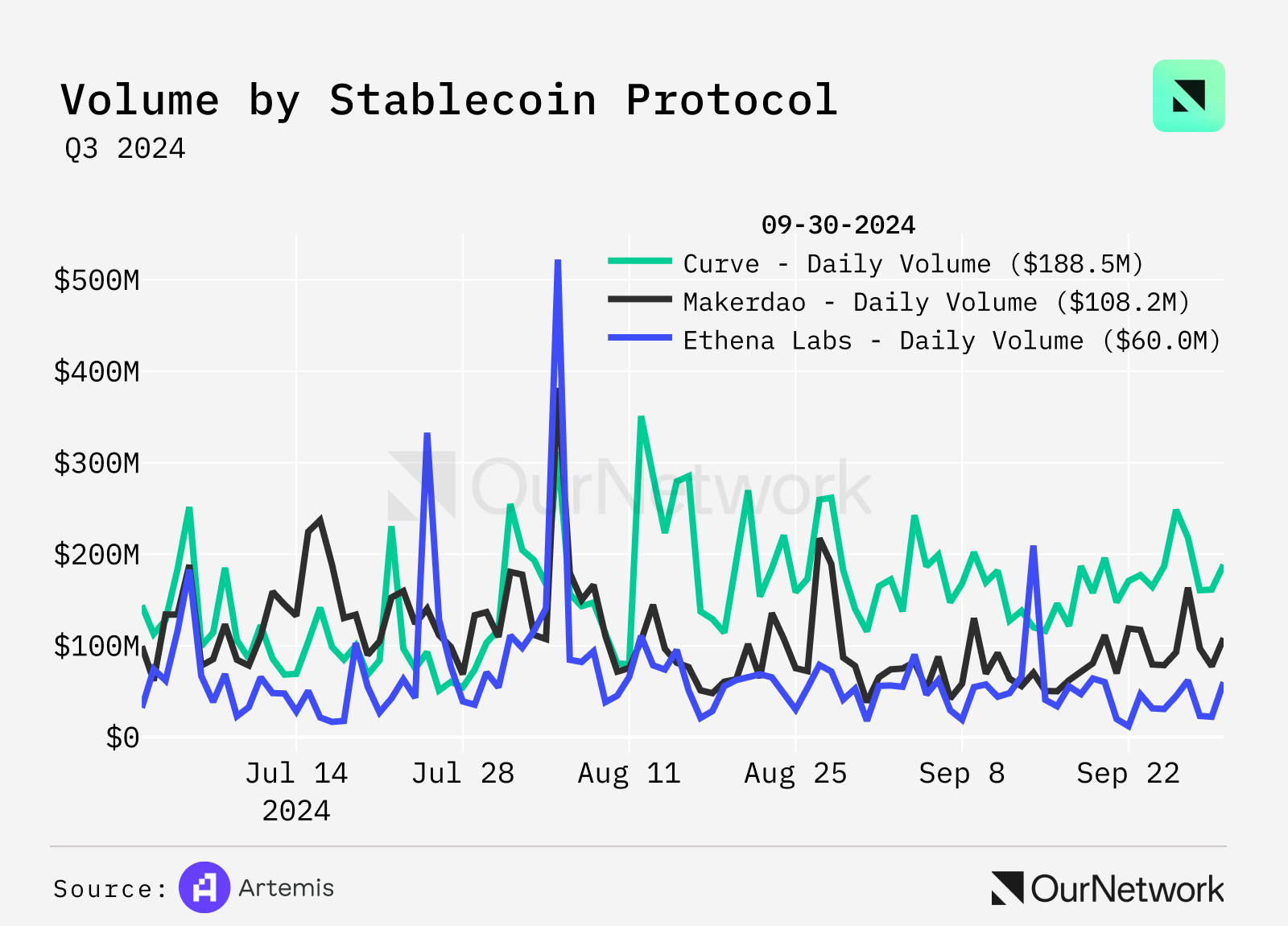

- In terms of trading volume for decentralized stablecoins, Curve leads, accounting for about 60% of the market for these protocols. MakerDAO ranks second with a daily trading volume of $100 million, making up 25% of the total; while Ethena Labs has an average daily trading volume of $50 million, accounting for 15%, with occasional peaks in trading volume.

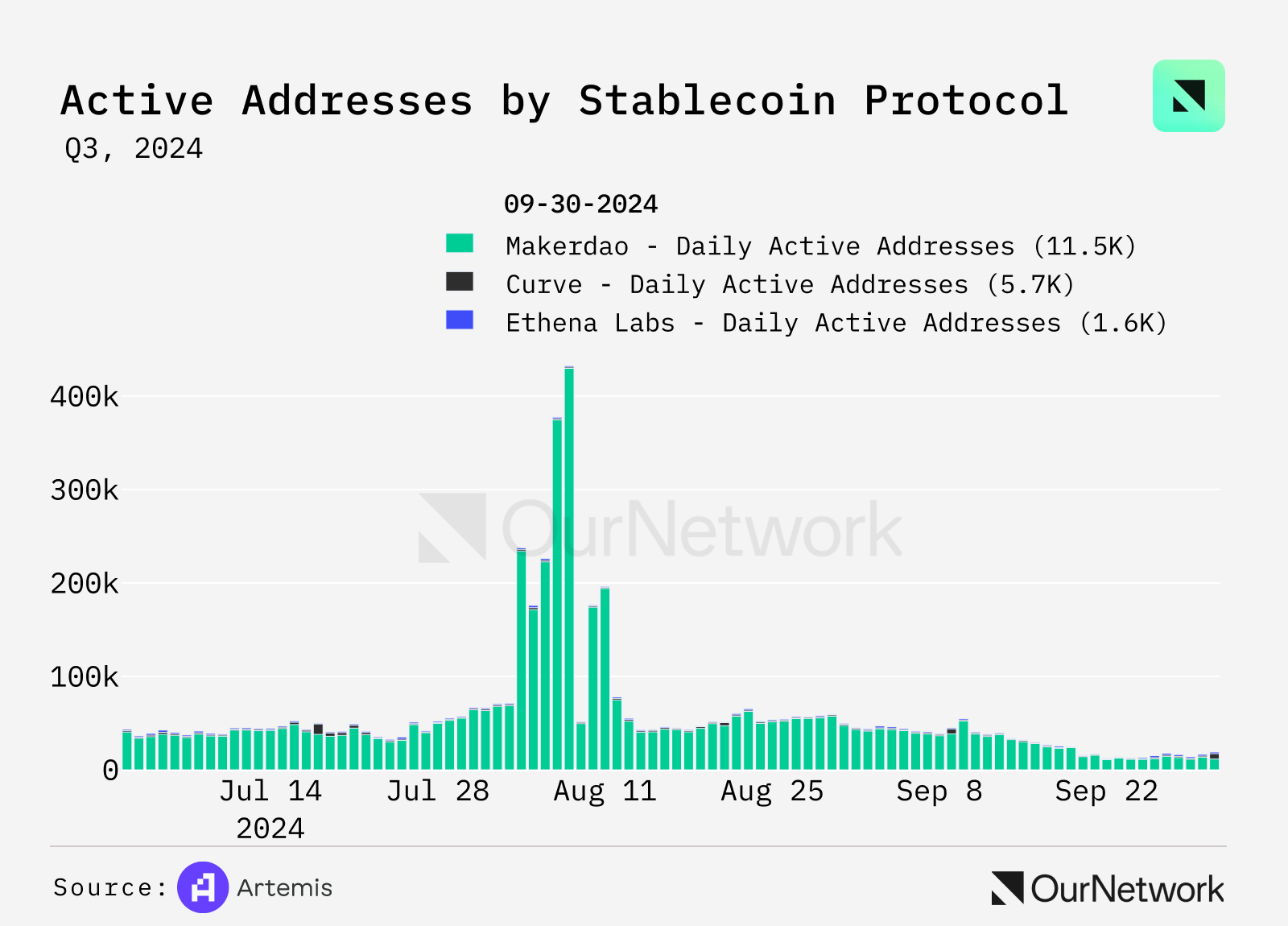

- MakerDAO consistently leads in usage, with about 90% of daily active addresses (DAAs), averaging around 50,000 addresses per day. On August 10, DAAs saw a significant spike, reaching nearly 450,000, an increase of 800% over the average. In contrast, Curve and Ethena have much lower activity, with daily active addresses below 5,000.

- Trading Highlights: The surge in MakerDAO active addresses on August 10 may have been triggered by Grayscale's announcement of the establishment of a MakerDAO investment trust fund. This news increased interest and activity within the ecosystem. The event led to a price increase of 7.47%, an increase in active addresses, and an influx of short-term holders. This event highlights how institutional participation can significantly impact blockchain activity and token prices.

Layer 2s

Cody | Twitter | Artemis Dashboard

Base Performs Strongly in the L2 Space, Daily Active Addresses Exceed 1 Million, TVL Surpasses $2 Billion, Daily Transactions Exceed 5 Million

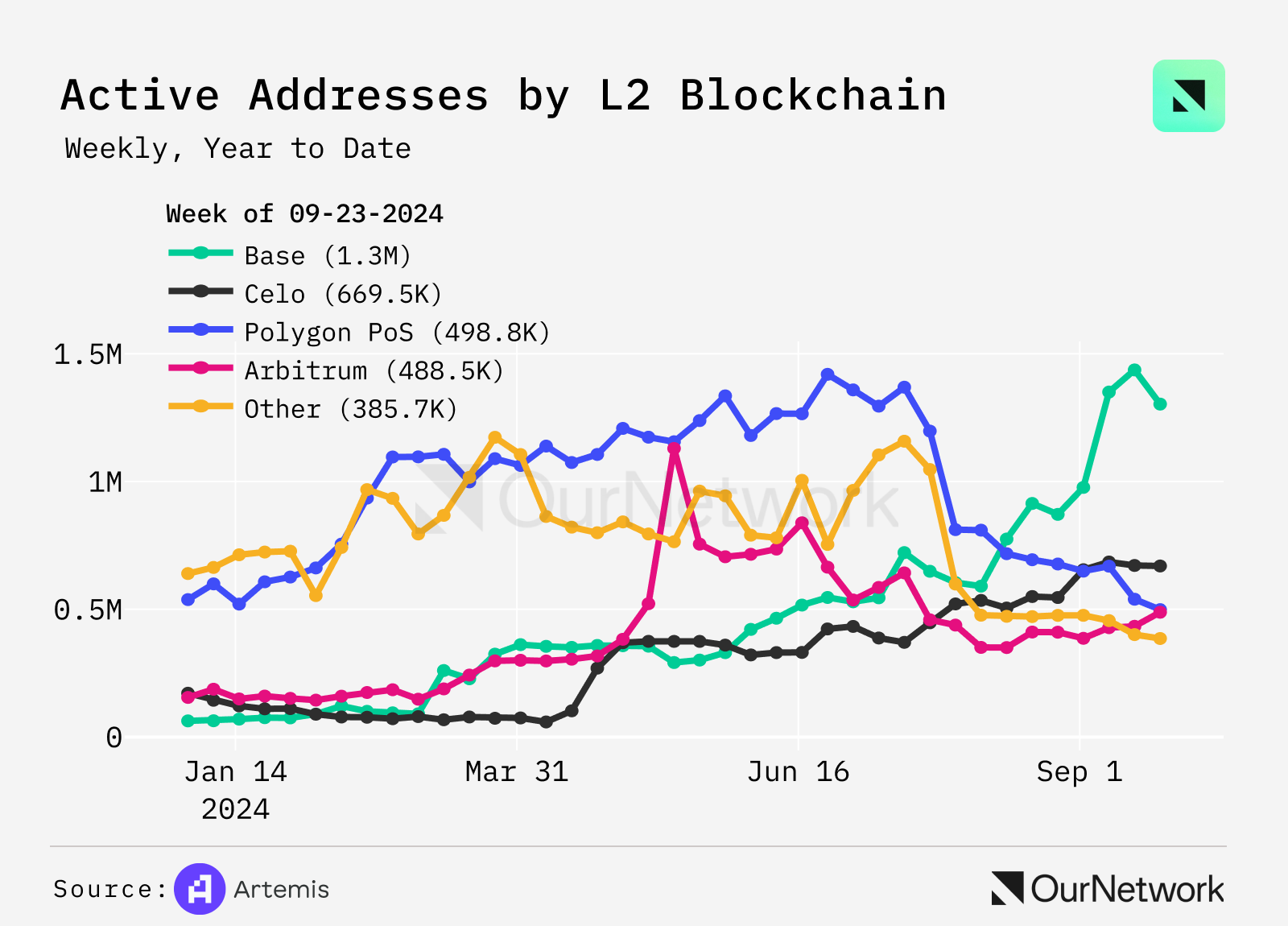

- The competition in L2 is intensifying, with Base experiencing a surge in daily active users to over 1.5 million in September, driven by its Onchain Summer event. During the same period, Polygon's daily active addresses decreased by 65% from 1.4 million to 500,000. Although Celo has the lowest average DEX trading volume among all L2s, its stablecoin usage in Africa continues to grow, leading to a surge in daily active addresses to over 680,000, ranking third.

A mature DeFi ecosystem is an important indicator of the health of L2 networks and product-market fit.

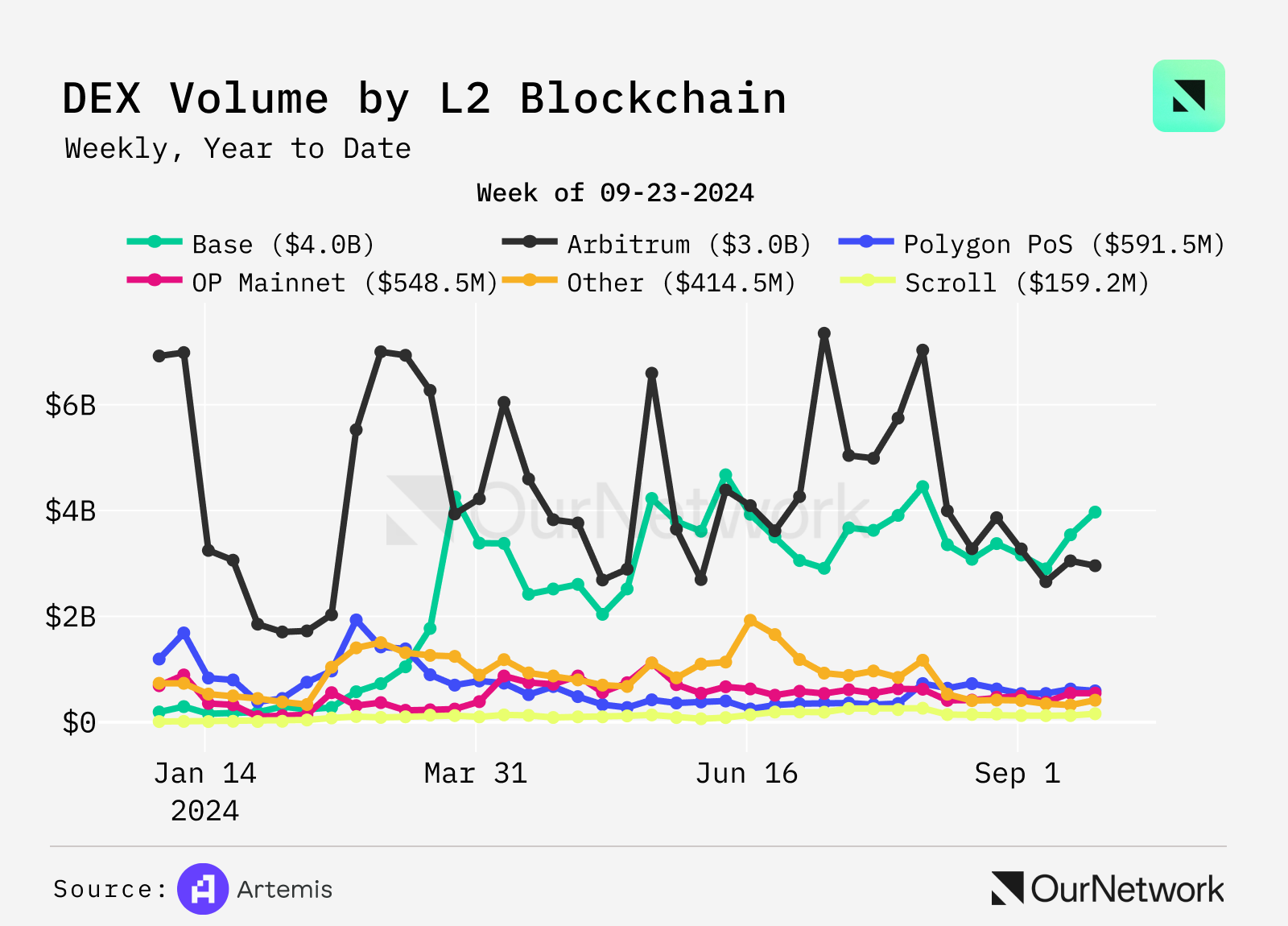

In terms of DEX trading volume: Base leads this category, with a 7-day trading volume exceeding $4 billion in September, thanks to the growth of its on-chain leading decentralized exchange Aerodrome. Arbitrum follows closely as a major center for derivatives trading, with a 7-day trading volume of $3.5 billion. In contrast, the total trading volume of all other L2s during the same period was only $1.9 billion.

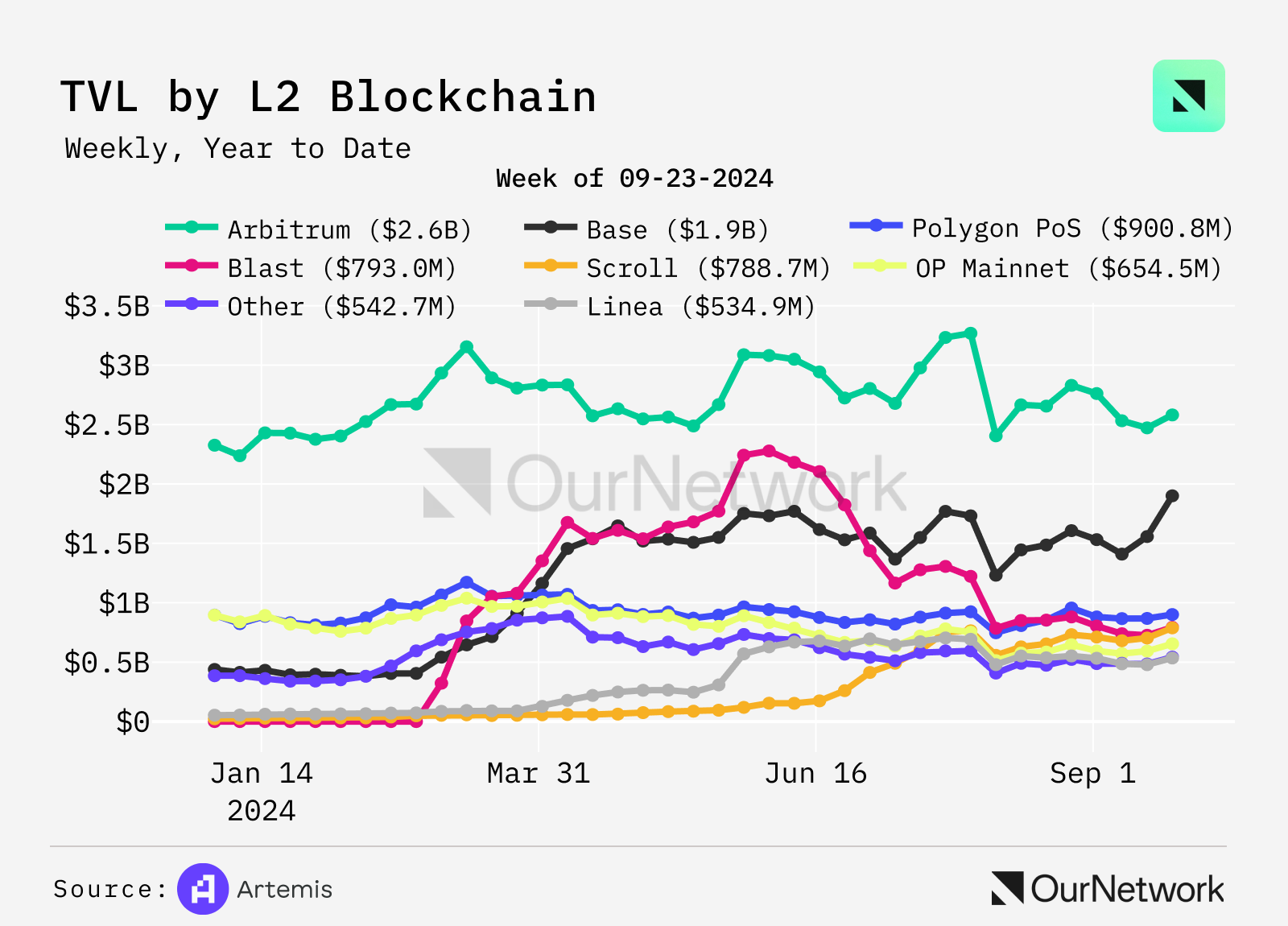

In terms of TVL: Arbitrum leads with a TVL of $2.5 billion, while Base's TVL is $2.2 billion. Polygon, Scroll, and Blast have TVLs ranging from $750 million to $990 million, further demonstrating the dominance of Base and Arbitrum in the L2 DeFi space.

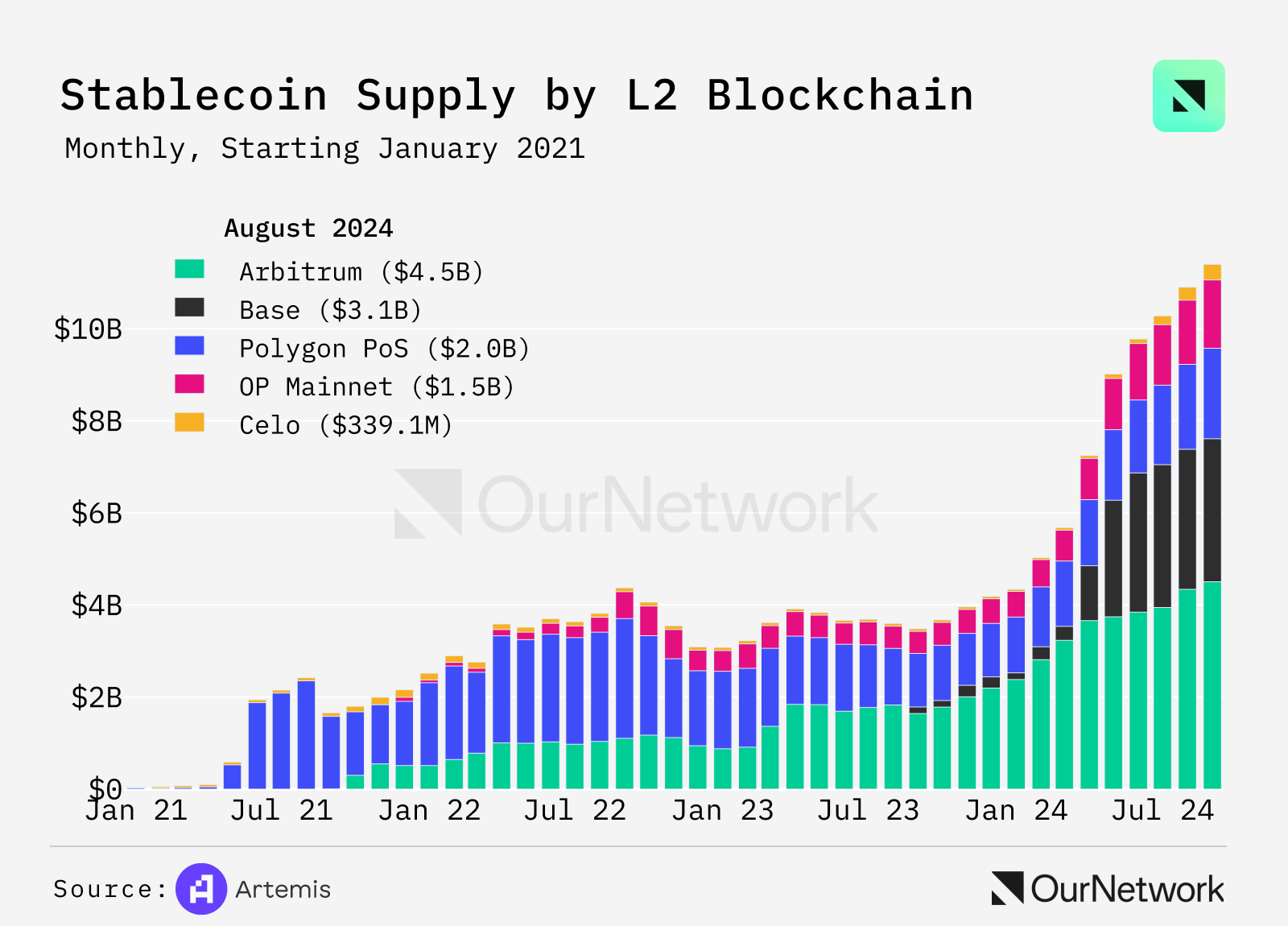

- In the past 30 days, the total trading volume of stablecoins on L2 reached $344.7 billion, involving 5.2 million wallets, with an average transaction amount of $1,936.46. The supply of stablecoins on L2 grew from $4.3 billion at the beginning of the year to $11.4 billion, an increase of 165%. Of this, 68% of the supply is concentrated in Arbitrum ($4.4 billion) and Base ($3.4 billion), followed by Polygon ($1.8 billion), OP Mainnet ($1.4 billion), and Celo ($300 million).

Bridging

Anthony Loya | Twitter | Dune Dashboard

Li.Fi v2 Surpasses 8.7 Million Cross-Chain Transactions

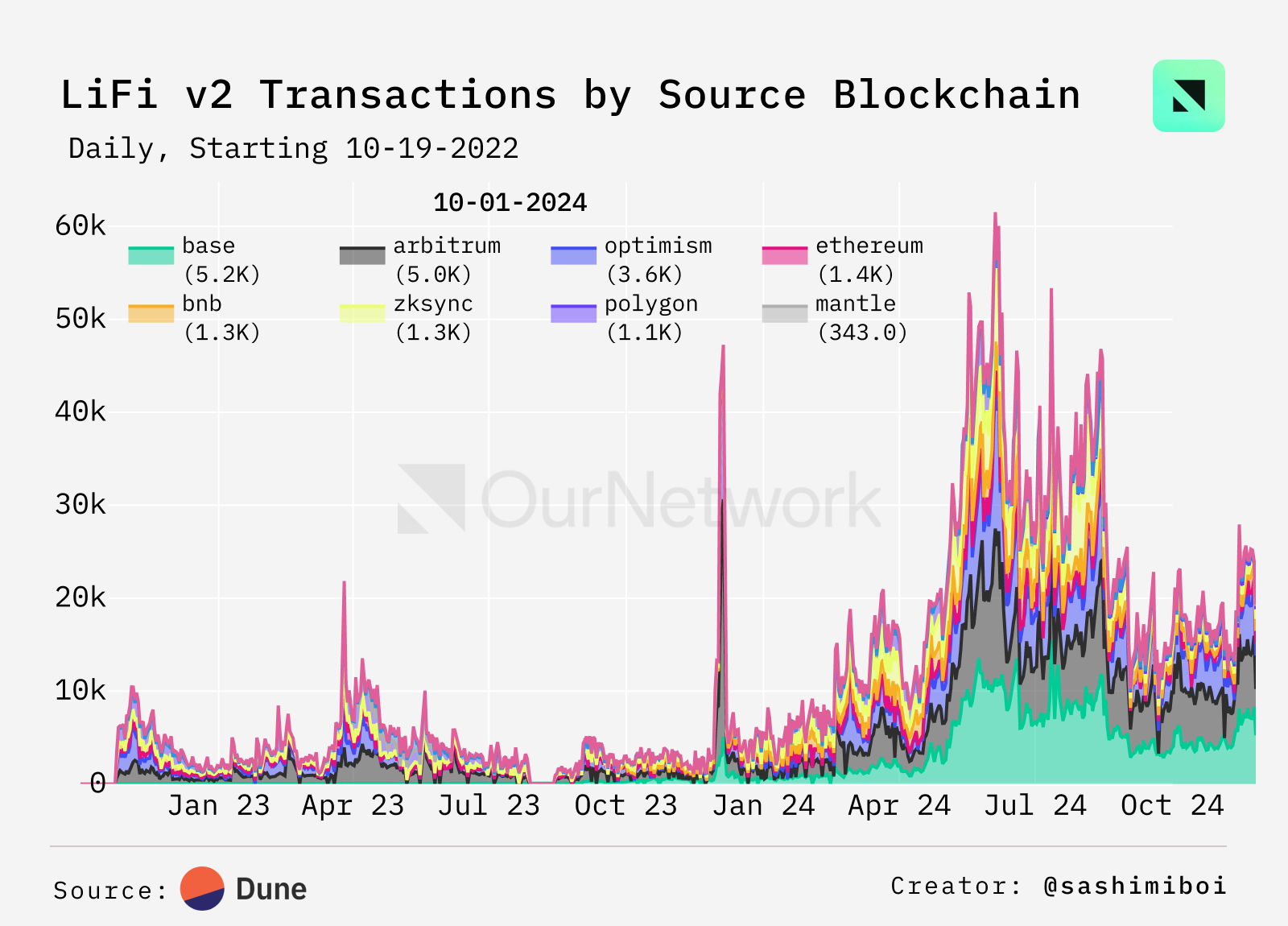

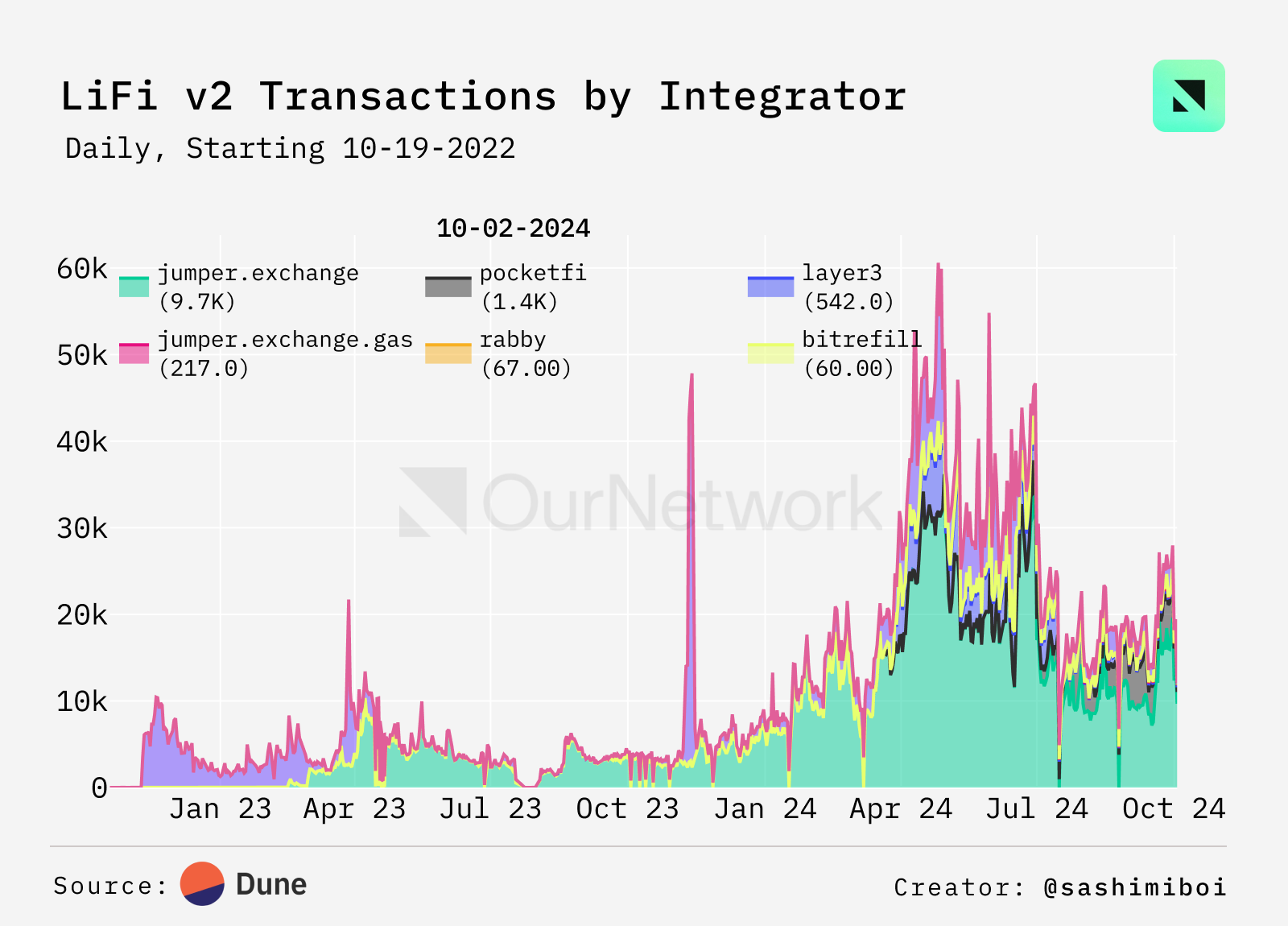

- LiFi is a cross-chain solution that provides price execution for swaps and bridging transactions across major blockchains. Through its API, it integrates with decentralized exchange aggregators, bridges, and intent-based systems to optimize cross-chain operations. LiFi's platform finds the most efficient paths between protocols, allowing its V2 Jumper.exchange to reach 4.2 million transactions, surpassing Metamask Bridge (529,000), Layer3 (450,000), Pocketfi (349,000), and TransferTo.xyz (235,000), thereby enhancing interoperability.

Dune - @sashimiboi

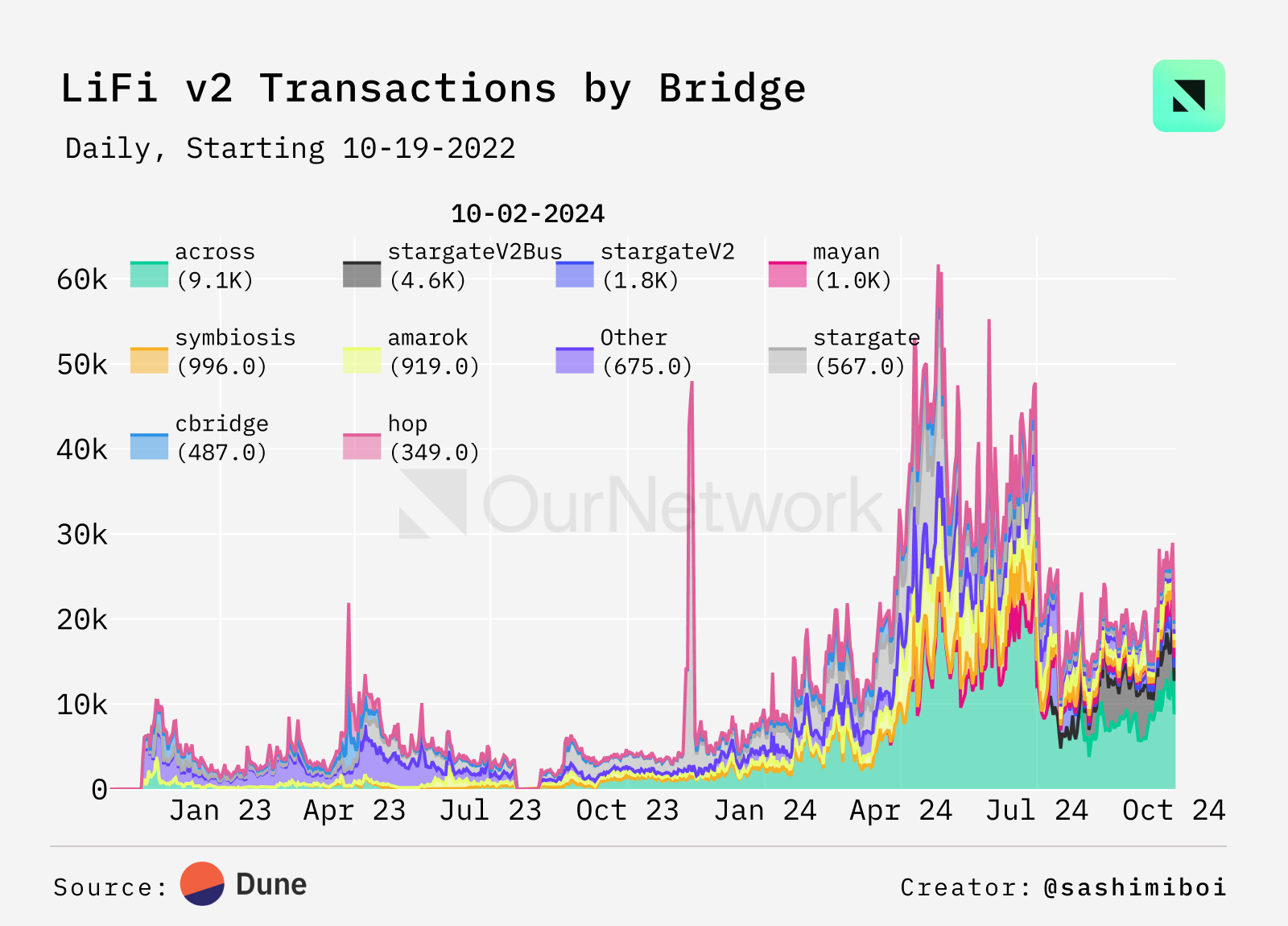

- Bridging activity peaked at the end of 2022 and the beginning of 2023, particularly with high usage of debridge, celerCircle, and omni. However, for most of 2023, this activity has noticeably decreased. As we enter the fourth quarter of 2024, bridging usage is beginning to rebound, with Stargate v2 leading this trend.

Dune - @sashimiboi

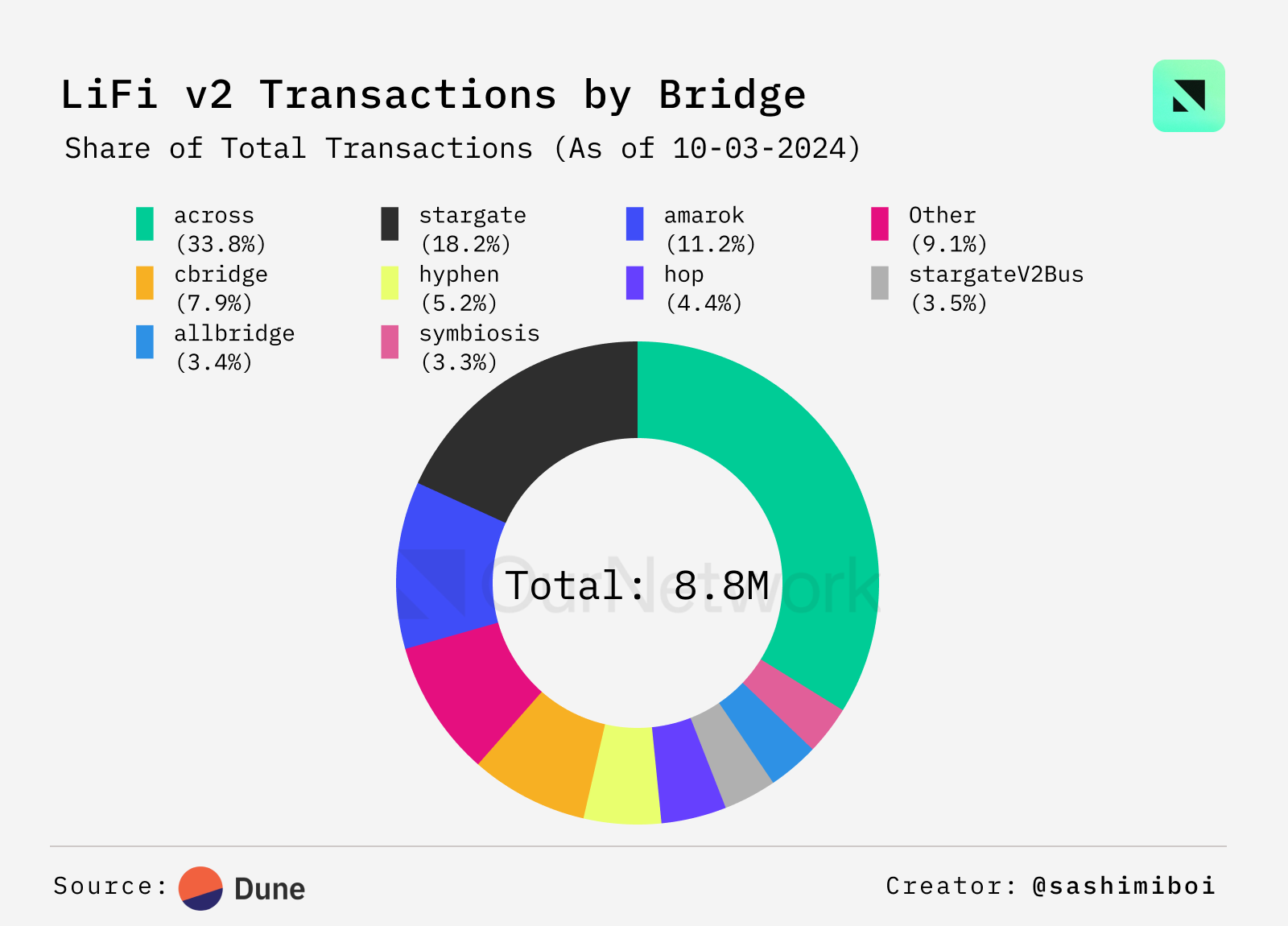

- The charts show that Across dominates the bridging market, holding a 33.8% market share. Its significant proportion of total transaction volume indicates that Across's application and influence in cross-chain transactions surpass other protocols.

Dune - @sashimiboi

- Transaction Highlight: A large USDC transfer was made through the Stargate bridge, totaling 3,219,490.835919 USDC (approximately $3.2 million). The transfer first went from address 0xd553294B to 0x1231DEB6, and then from 0x1231DEB6 to 0xe8CDF27A, with the entire process supported by LiFi Diamond and Stargate's USDC pool.

Staking

Brandyn Hamilton | Twitter

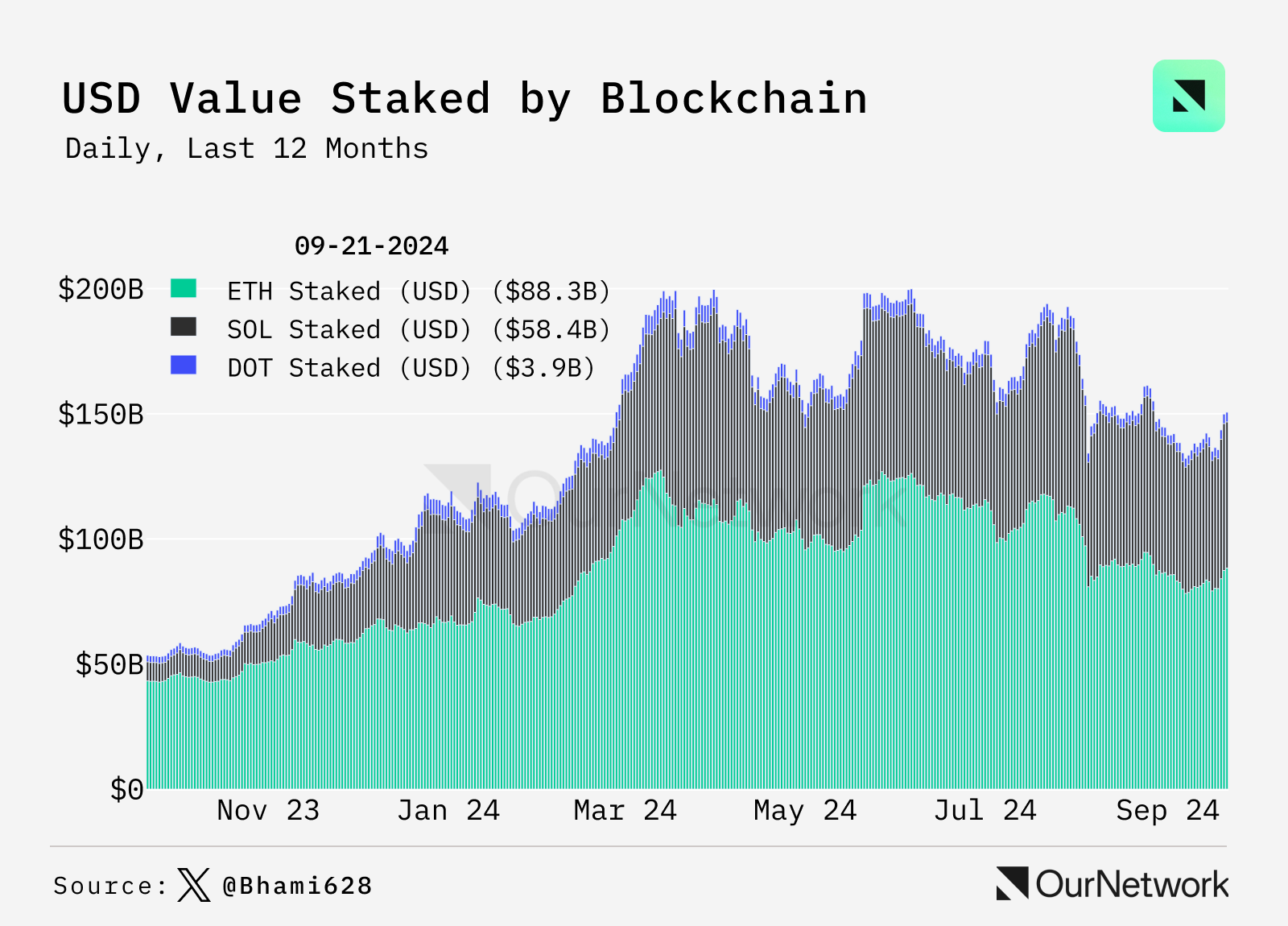

Solana's Total Value Locked (TVL) Reached 66% of Ethereum's in September 2024, with Staking Amounts Exceeding $58 Billion

- Staking is crucial for securing proof-of-stake (PoS) blockchains. Ethereum, Solana, and Polkadot are among the largest PoS blockchains by staked token value. As of September 2024, Ethereum leads in this metric with a total staked amount exceeding $88 billion. However, Solana's staked value has significantly increased from $7.5 billion in September 2023 to over $58 billion in September 2024.

Twitter | @Bhami628

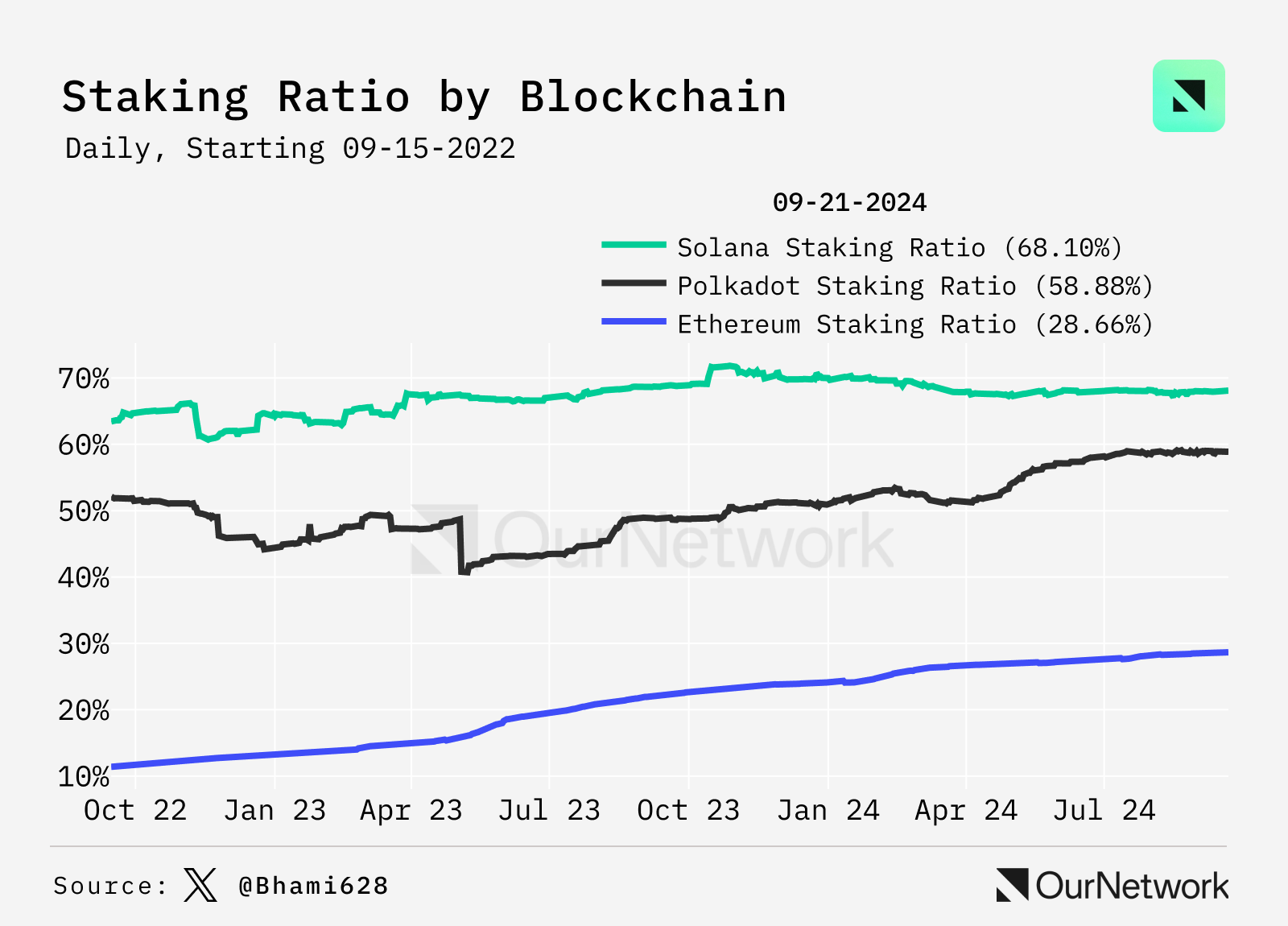

- Another important metric for PoS blockchains is the staking ratio, which is the proportion of tokens participating in staking relative to the total supply. In this regard, Solana and Polkadot have consistently outperformed Ethereum. However, Ethereum's staking ratio has also been steadily increasing, reaching approximately 28% as of September 2024.

Twitter | @Bhami628

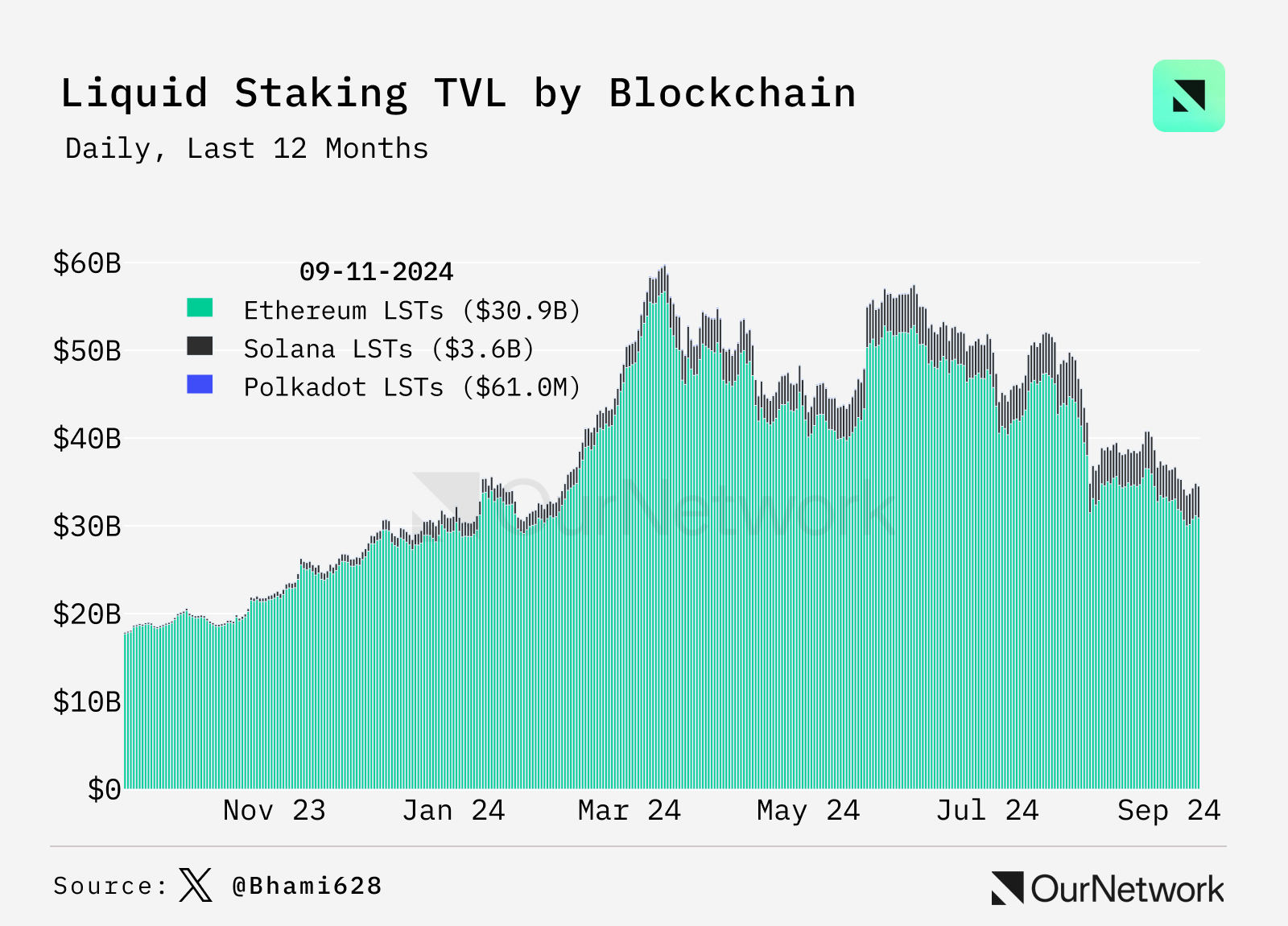

- Liquid Staking Tokens (LSTs) represent assets staked on PoS blockchains, providing users with a straightforward way to earn staking rewards. Although Ethereum's LST market cap exceeds $30 billion, leading the market, Solana's LSTs are also rapidly gaining popularity and may continue to expand their market share.

Twitter | @Bhami628

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。