Author: flowie, ChainCatcher

Editor: Nianqing, ChainCatcher

On October 9, U.S. federal prosecutors filed market manipulation and fraud charges against four cryptocurrency "market makers" and their employees, with the SEC and FBI also involved in the investigation. Among those named is Gotbit, the market maker behind "meme" projects DWF, Bonk, and Neiro.

Currently, Gotbit's CEO Aleksei Andriunin has been arrested in Portugal, and two of Gotbit's employees in Russia have also been charged.

As early as a year ago, on-chain detective ZachXBT exposed Gotbit's market-making tactics and warned users to be cautious of any projects collaborating with Gotbit. Since then, Gotbit has been embroiled in controversy due to its involvement in several tokens that allegedly rug pulled.

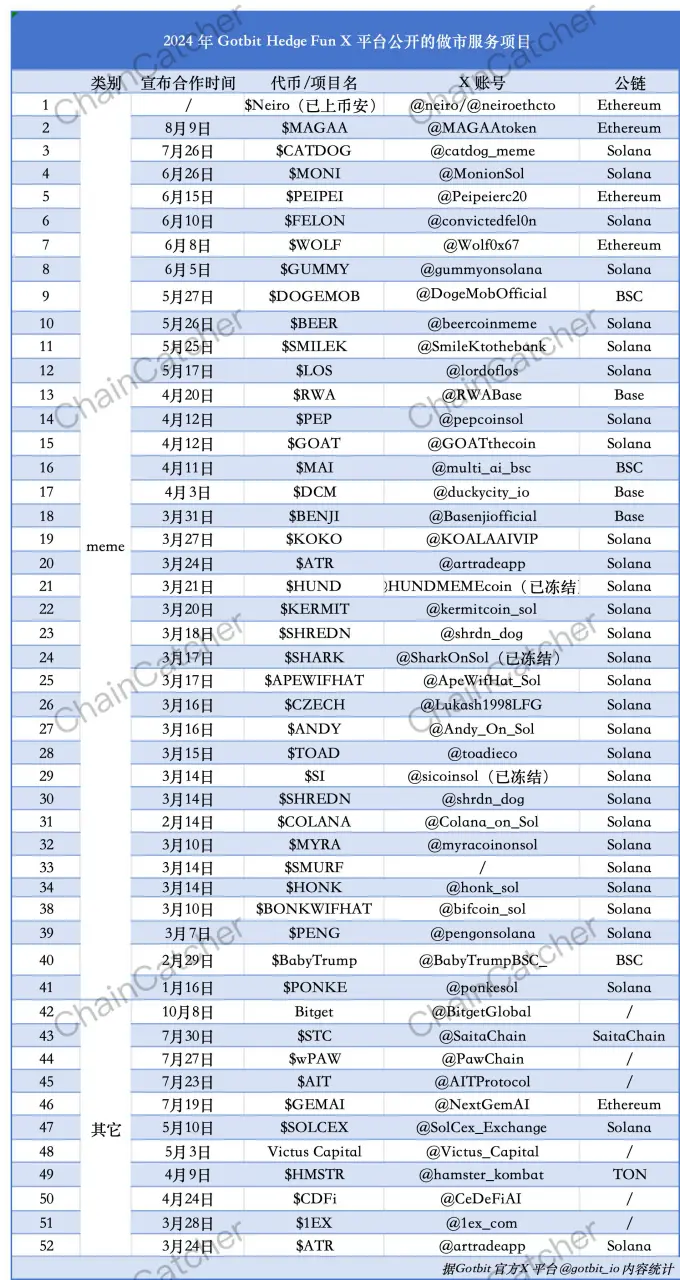

However, Gotbit's market-making services continue to attract a large number of project teams and meme groups. According to Gotbit's official X platform, Gotbit has provided market-making services for around 50 projects this year, most of which are memes, including Neiro and Hamster Kombat.

Starting with Fake Trades, Gaining Fame in Meme Market Making

From the official introduction, Gotbit is a hedge fund specializing in helping tokens achieve market cap growth, primarily focusing on market making and venture capital. Gotbit manages $1.3 billion in assets and has over 400 institutional clients.

According to RootData, Gotbit has also invested in decentralized cross-chain IDO platform Poolz Finance (POOLX), Layer1 5ireChain (5IRE), and the meme project analoS on Solana.

Gotbit was established during the ICO boom in 2018, when its founder Alexey Andryunin was just a 20-year-old college student.

In 2019, CoinDesk revealed Gotbit's fake trading practices, where they programmed bots to trade tokens back and forth, creating a false impression of an active market to help clients list on at least two unknown exchanges and achieve listing on CoinMarketCap.

Alexey mentioned that exchanges were aware of this manipulation but had no interest in stopping it. At that time, 300 to 500 projects on CoinMarketCap were clients of Gotbit. Alexey also expressed that he did not have long-term hopes for this business, as crypto regulation would inevitably focus on the false trading of these unknown exchanges.

Nevertheless, Gotbit did not slow down its business. At the end of 2022, the first meme coin on the Solana chain, Bonk, launched, and as Bonk's market cap surged, Gotbit, as the market maker behind it, also came to light.

By the end of 2023, during the meme resurgence on Solana, Gotbit's market-making of ANALOS created a wealth myth with a 3700-fold increase in just one week, making Gotbit a wealth code for meme players.

As memes continued to thrive in 2024, Gotbit shifted its focus to providing market-making services for memes. Popular memes like BEER and WATER have Gotbit's involvement behind them.

The earliest tweet on Gotbit's official X platform dates back to March 14. Since then, according to the collaboration content released on its X platform, Gotbit has publicly collaborated with over 50 projects, with more than 90% being meme projects, most of which are on the Solana chain.

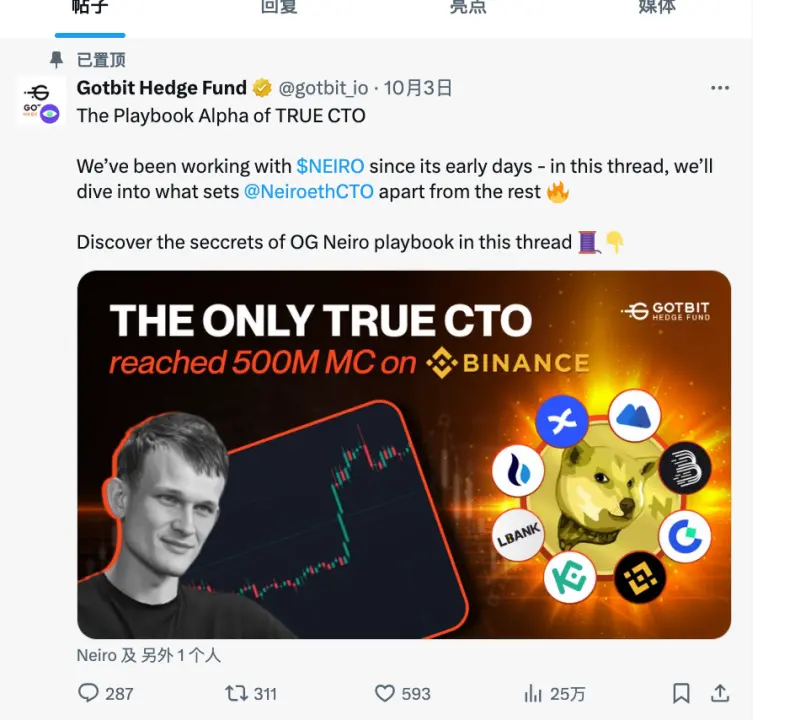

Currently, the pinned tweet on Gotbit's official X platform is about the recently launched lowercase Neiro (First Neiro on Ethereum), revealing its partnership with the Neiro team.

It is worth mentioning that on July 19, Gotbit's official X platform tweeted that it would provide market-making services for the project NextGemAI created by the FBI during this "sting operation."

Continuing to market make for memes has made Gotbit notorious and faced with fraud charges from U.S. prosecutors.

Market Making False Memes to Harvest Players, Gotbit Finally Under FBI's Radar

An investigation document provided by an FBI agent mentioned two cases involving Gotbit, both of which exaggerated trading volumes of crypto companies and manipulated crypto trading prices to induce purchases, thereby inflating crypto prices and profiting by selling at high prices.

Gotbit has repeatedly helped the cryptocurrency company Robo Inu increase its daily trading volume by over a million dollars. The Web3 technology company Saitama also gained tens of millions of dollars through Gotbit's "market-making" services.

In September 2023, on-chain detective ZachXBT shared a document on the X platform revealing Gotbit's market-making strategies.

- Gotbit would push the token price up to 10 times in the first few minutes of the price discovery phase to create FOMO, attracting as much buying power as possible, and then sell all tokens at the subsequent peak.

- In the first 12 trading hours, Gotbit aimed to leverage existing arbitrage opportunities, focusing on earning quick and substantial profits.

- On launch day, Gotbit's target trading volume was over $50 million, with most trades generated for free on CEX through a generating system.

- Gotbit aimed to reach a peak of 20 times the token price within the first month of trading.

ZachXBT has stated that there are issues with the market-making services provided by Gotbit, warning users to be cautious of projects collaborating with Gotbit.

However, Gotbit remains active, collaborating with multiple meme projects to harvest large amounts of user funds.

By the end of 2023, within two weeks of collaborating with Gotbit, ANALOS's market cap peaked at $150 million before plummeting to $19 million, and the token subsequently disappeared, becoming unpurchaseable. The top 10 holders of ANALOS collectively made over $7 million in profits.

In May of this year, the beer-themed MEME token BEER raised 30,000 SOL in its presale, worth nearly $5 million. After its launch, the BEER token price skyrocketed, reaching a maximum increase of 30 times, with a peak market cap of $500 million.

A month later, the price of BEER tokens fell by over 90% from its peak, with the market cap dropping to around $50 million. According to LookonChain's monitoring, associated addresses of the BEER team sold over $3 million worth of tokens after the price increase.

After BEER, Gotbit replicated the BEER strategy. The MEME coin WATER, which participated in market making, raised over $41 million during its presale, attracting over 26,000 wallet addresses to participate. After launching on Solana, the WATER token briefly surged nearly 10 times, with its market cap once exceeding $1 billion, but then plummeted within hours.

Lookonchain exposed the team's insider trading behavior, as they transferred 844 million WATER tokens to 11 wallets that did not participate in the presale, later dumping the tokens. An on-chain sniper lost over $710,000 during this launch.

Additionally, other tokens that Gotbit participated in market making, such as HUND, SHARK, SI, SOMBRERO, MACHO, and SIMBA, are also suspected of rug pulling.

Are Memes and Crypto Market Makers the Focus of Regulatory Crackdowns?

From Gotbit's manipulative behavior, the popularity of memes has also made them a hotspot for fraud.

Regarding the fraud charges against Gotbit, crypto KOL @WazzCrypt believes, "This is a bearish signal for memes. As one of the largest meme market makers, Gotbit has supported conspiracy memes and scam coins. Promoting meme coins without committing a crime has become difficult."

However, in the view of CryptoQuant founder Ki Young Ju, this could be a positive signal, "Regulation will help eliminate its gambling stigma."

Currently, an undeniable trend is that crypto market makers may become a key target for U.S. regulatory agencies.

Following the joint charges by the SEC, FBI, and U.S. Department of Justice against Gotbit, ZM Quant, CLS Global, and MyTrade, the SEC also charged a long-established market maker, Cumberland, founded in 2014, for operating as an unregistered securities dealer.

As important participants in the liquidity of the crypto market, crypto market makers are too close to money and are key targets for accusations of manipulation and fraud. Previously, the newly emerged market maker DWF has also been investigated and exposed by media such as The Wall Street Journal for suspected wash trading, false advertising, and market manipulation.

With the continuous actions of U.S. regulatory agencies, it is expected that more crypto market "conspiracy" groups will come to light.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。