Author: Frank, PANews

Since the mini-games within the Telegram ecosystem have exploded in popularity, the number of users in the crypto space has surged. Previously prominent projects seem insignificant compared to the tens of millions, or even hundreds of millions, of users in TG mini-games. However, we seem to have overlooked a crucial issue: the discussion of user value. Ethereum has only 400,000 to 500,000 daily active users, yet it remains the second-largest public chain by market capitalization, while TON, with daily active users easily surpassing 2 million, ranks around tenth. Is this a misestimation of market value, or is there indeed a significant gap in user value among these public chains? PANews has conducted an analysis of the real user value across various public chains, attempting to unravel the mystery of public chain user value.

The main research methods are as follows: to more accurately reflect the user value on each public chain, PANews calculated the values of several popular tokens on chains such as Solana, Ethereum, TON, Sui, Base, and BSC. Since there have been no ready-made indicators to display public chain user value, we derived an average value by dividing the market capitalization of the tokens by the number of holders. This average value represents the average holding value per address for these popular tokens. Additionally, to get closer to the real situation, we excluded addresses belonging to exchanges, team holdings, and locked addresses from the calculation. Of course, this method may not be rigorous, as averages do not represent the majority, and market capitalization can include inflated values, but it provides significant reference for ranking public chain user value.

Furthermore, PANews also calculated the average transaction size by dividing the daily transaction volume by the number of daily transactions for each public chain, which can also reflect user value on the chain to some extent.

Ethereum: Average Address Holds $3,516, Average Transaction Reaches $1,160, a Hub for Large Holders

Ethereum's various metrics remain in a leading position. For our analysis, we selected several tokens such as USDT, USDC, SHIB, UNI, and PEPE on Ethereum, looking at the average value after excluding large holder addresses. The average holding amount for these tokens reached around $3,500, significantly higher than other public chains, approximately six times that of Solana, while the market capitalization difference between the two is about five times. From this perspective, Solana's market capitalization seems somewhat overvalued? In terms of transaction size, Ethereum's average transaction size reached $1,160, a figure that also far exceeds other public chains, indicating that Ethereum remains the top choice for large holders.

Solana: Average Address Holds $635, Average Transaction $17, Still Focused on Meme Coins

Solana has now become one of the most representative performance public chains in the industry, and its various metrics can generally serve as a standard for comparison. However, during the research process, PANews found that the governance token SOL on Solana could not be tracked for the number of holders anywhere. Therefore, we could only use some other representative tokens on the Solana chain as data sources, such as JUP, USDC, USDT, BOME, and Bonk.

After calculations, it can be seen that directly dividing the market capitalization of these tokens by the number of holding addresses yields an average holding value of about $2,240 per address, which is second only to Ethereum among all public chains. However, after excluding addresses from exchanges, locked holdings, and other large holders, the average holding amount drops to about $635.

Additionally, when comparing the holding values of these tokens, it is evident that the average amount held by users of MEME tokens is significantly higher than that of stablecoin accounts. This phenomenon is reversed in Ethereum, which may indirectly indicate that Ethereum users tend to prefer DeFi, such as earning yields through stablecoins, while Solana users are more inclined towards meme coins. According to Hello Moon's data, over 86 million user wallets held 0 SOL in the past month, about 15.5 million users held less than 1 SOL, and around 1.5 million users held less than 10 SOL.

On October 8, Solana's entire chain generated about 250 million transactions, of which approximately 26.2% were non-voting transactions. The total transaction volume that day was about $1.15 billion, with an average transaction size of $17.4. This transaction size appears to be primarily driven by MEME token transactions.

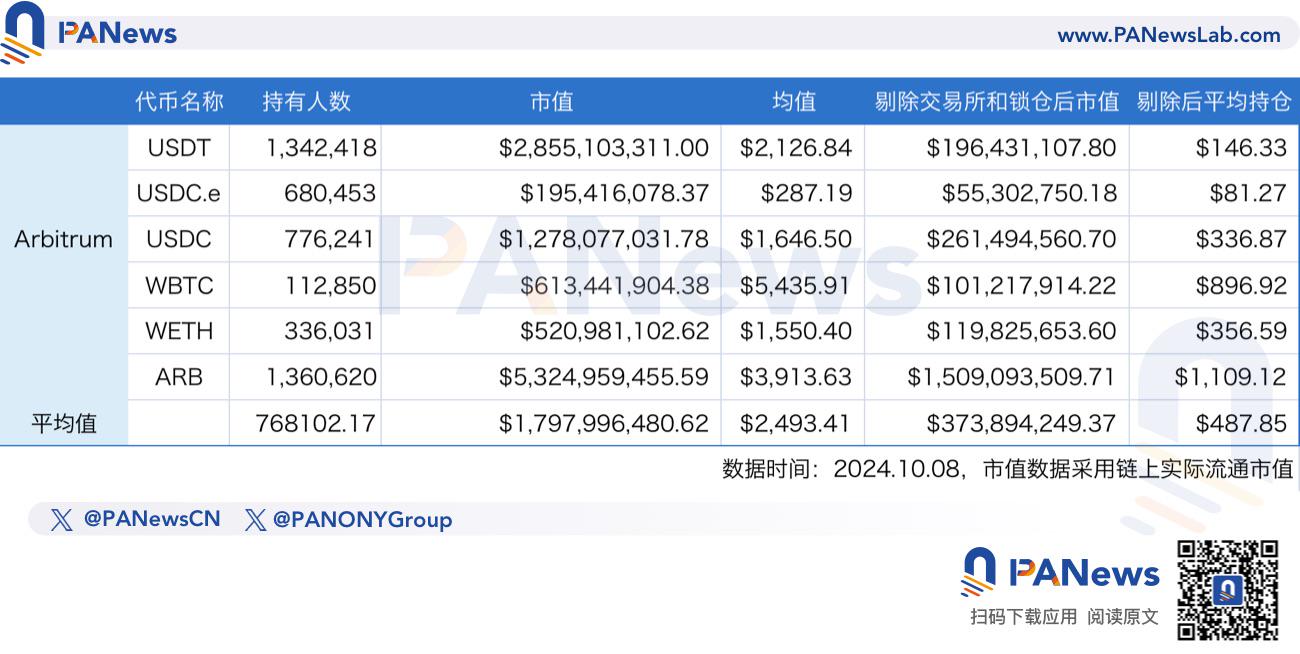

Arbitrum: Average Address Holds $487, Average Transaction Reaches $282, the L2 with the Most Ethereum Genes

Arbitrum is currently one of the best-performing networks among Ethereum L2s. From the data results, it seems that Arbitrum indeed accommodates many high-value users from Ethereum. After excluding exchanges and other large holders, Arbitrum's average address holding amount still reaches $487, only lower than Ethereum and Solana. However, taking USDC as an example, half of the USDC on Arbitrum is held in Hyperliquid, and other tokens also have a high proportion of large holders. Additionally, the tokens with high market capitalization on Arbitrum are mostly stablecoins or staking-type tokens like BTC and ETH, which is similar to the holding characteristics of Ethereum users. From this perspective, Arbitrum can be considered the L2 that inherits the most from Ethereum. The average transaction size on Arbitrum is $282, only lower than Ethereum.

Sui: Average Address Holds $271, Average Transaction $11.4, Is a New Force Catching Up to Solana?

Recently, there has been much talk about Sui becoming the strongest competitor to Solana, and on-chain data indeed shows that Sui performs quite well. On Sui, we selected several high-market-cap tokens such as SUI, wUSDC, USDT, CETUS, and SCA for comparison. The distribution of these tokens on Sui is noticeably more decentralized, so wUSDC and USDT have almost no high-proportion exclusion objects. Overall, the average holding amount for these tokens on Sui is $271, which is higher than TON and about double that of Solana.

However, in terms of transaction size, data from October 8 shows that Sui's average transaction size is $1.8, the lowest among all public chains. This figure may stem from an abnormal surge in transaction numbers on Sui recently, exceeding 100 million transactions. It remains unclear whether this is due to bots inflating the numbers or if another spam-like mining program has emerged. If calculated based on data from October 3, the average transaction size is about $11.47, slightly lower than Solana but much higher than TON (this figure may be closer to Sui's daily level).

BSC: Average Address Holds $167, Average Transaction $237, User Profile Similar to Ethereum

In comparison, BSC's data level is moderate. Unlike Solana and Sui, BSC's characteristics are more similar to Ethereum. On BSC, we selected five tokens for analysis: BETH, BSC-USD, WBNB, USDC, and DOGE. The average holding amount per address is about $167 (after excluding exchanges, locked holdings, and other large holders), while BSC performs better in terms of average transaction size, with an average transaction size of about $237, second only to Ethereum and higher than other public chains.

TON: Average Address Holds $106, Average Transaction $3.3, No Funds from the Meme Coin Crowd

Driven by popular mini-games like Notcoin, Hamster Kombat, and DOGS, TON has become one of the most active public chains today. However, the true popularity of TON and its market recognition seem to remain in a state of ambiguity. According to Cointelegraph, on October 7, the Web3 anti-fraud solution Scam Sniffer shared a screenshot announcing the closure of hacker software based on TON. The hacker stated that there were not enough crypto whales in the community, which was detrimental to their business.

On TON, we analyzed several tokens including DOGS, NOT, TON, USDT, HMSTR, and CATI. The results for these tokens show that the average address amount is only $106, placing it at the bottom among the analyzed public chains, while the transaction size on TON is only $3.38, also at a low level. Perhaps from this perspective, the TON ecosystem currently remains in a state of being lively without substantial capital.

Base: Average Address Holds $96, Average Transaction Reaches $138, Funds Mainly Held in Exchanges and Institutions

The average holding value of users on Base is approximately $96, while this value was $663 before excluding large holders. This change indicates that, as a Layer 2 network relying on Coinbase, most of the funds on the Base chain are essentially concentrated in exchanges and other institutions. In contrast, the scale of funds held by retail investors on Base is much smaller. Additionally, the average transaction size on Base is around $138, which also falls within a high-value transaction level.

In summary, comparing user values across different chains reveals distinct characteristics among them. For instance, emerging chains like Solana and Sui, which are popular for MEME tokens, tend to have smaller transaction sizes and lower individual address holdings, but a high volume of transactions. In contrast, established public chains and L2s, represented by Ethereum, are more favored by large holders, who clearly prefer investment forms such as asset staking. Meanwhile, the performance of the TON ecosystem appears somewhat disconnected from the popularity of Telegram games from various perspectives. However, this user acquisition strategy is still in its early stages, and whether it can successfully break through remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。