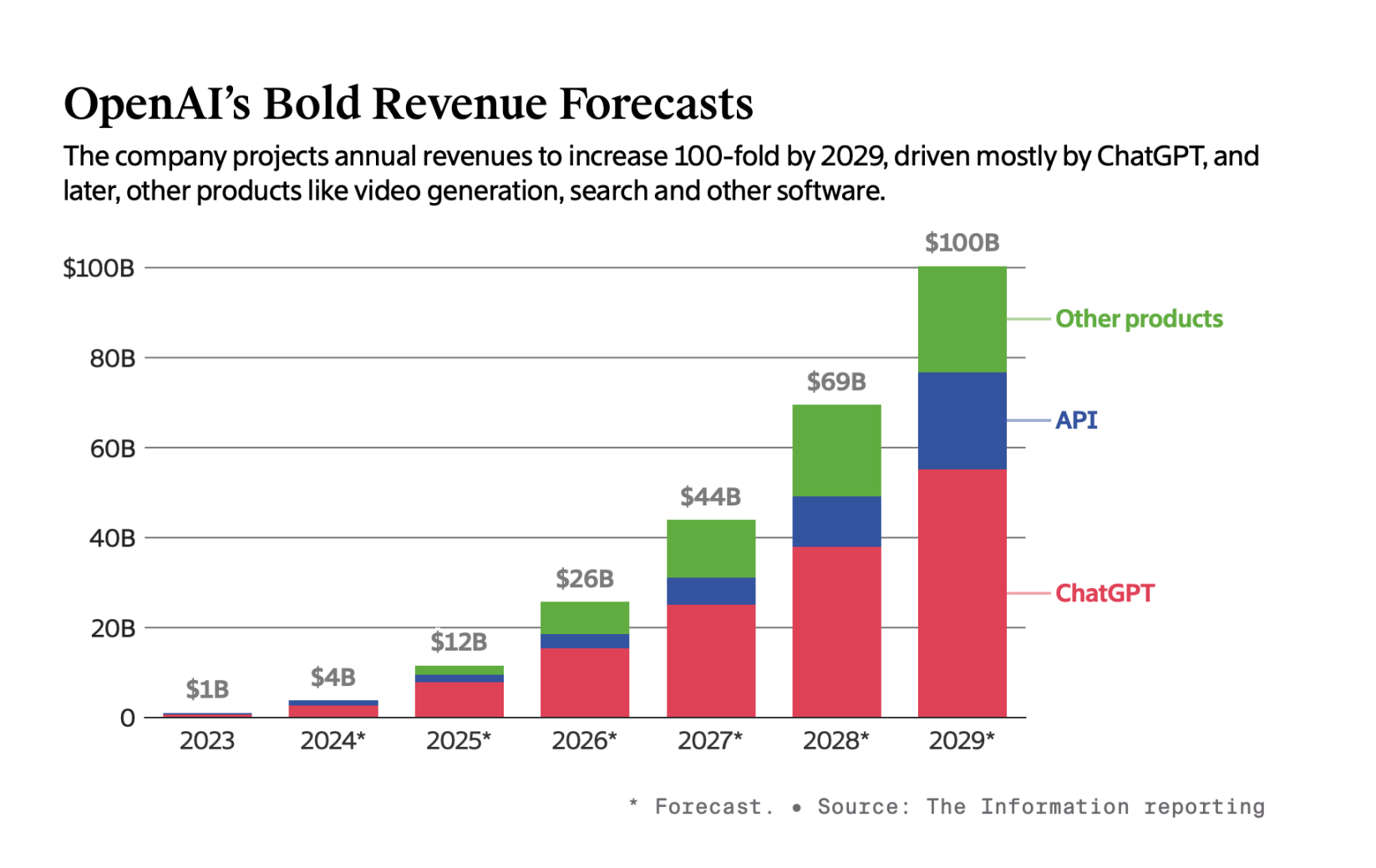

According to media analysis of OpenAI's financial documents, the company is expected to become profitable by 2029, with revenue reaching $100 billion at that time.

Written by: Zhao Yuhe

Source: Wall Street Watch

OpenAI previously completed a $6.6 billion financing round, with a valuation exceeding $150 billion. However, according to media analysis of OpenAI's financial documents, the company's losses next year could reach $14 billion, nearly three times this year's expected losses, and it is projected that the company will not become profitable until 2029, when revenue is expected to reach $100 billion. This estimate does not include stock-based compensation, although this expense is one of OpenAI's largest costs, it is not a cash payment.

According to a report by The Information, OpenAI's financial documents show that the profitability metrics emphasized to investors exclude some major expenses, such as the billions of dollars the company spends annually to train large language models. If these expenses are excluded, OpenAI expects to achieve profitability by 2026.

Despite significant losses, financial expectations are optimistic

Analysts believe that these documents, including financial statements and forecasts, may change some people's views on OpenAI's financial prospects, generating optimism.

First, OpenAI's cash burn rate is much lower than previously expected. In the first half of this year, the company burned approximately $340 million, and before financing, it had $1 billion in cash on its balance sheet. However, the documents suggest that cash consumption may increase sharply in the coming years.

Second, there is a significant gap between OpenAI's cash flow and its loss figures, reflecting different treatments of its major expenses (such as stock-based compensation and computing credits) under standard accounting principles. In the first half of this year, OpenAI reported a net loss of $3 billion.

OpenAI expects total expenditures to exceed $200 billion by 2029, excluding stock-based compensation costs. At the same time, 60% to 80% of annual expenditures will be used for model training or operation.

Document analysis indicates that OpenAI expects total losses from 2023 to 2028 (excluding stock-based compensation) to reach $44 billion. The same analysis also indicates that the company expects profits based on this foundation to reach $14 billion in 2029.

In the first half of this year, the company reported stock-based compensation of $1.5 billion, which may correspond to the revenue for that period.

The documents suggest that Microsoft takes a 20% share of OpenAI's revenue, a higher percentage than previously expected.

OpenAI anticipates that the computing costs for model training may rise significantly in the coming years, potentially reaching $9.5 billion annually by 2026. This is in addition to the amortization of upfront training costs for large language model research, with the financial documents spreading research computing costs over several years. This figure is also rising rapidly, increasing from an expected $1 billion this year to over $5 billion by 2026.

Some of OpenAI's computing costs are not cash payments. Microsoft prepaid computing credits as part of its $10 billion investment in OpenAI last year. According to documents and sources familiar with the matter, approximately $500 million of OpenAI's data center leasing costs in the first half of this year were covered by Microsoft.

It is currently unclear how much computing credit OpenAI has left. However, if the company increases computing expenditures as predicted in the documents, it may need to tap into more of its own funds. Previous reports indicated that OpenAI was also discussing borrowing to build data centers faster than Microsoft.

Nevertheless, analysts believe that if future models prove to be more durable than previous ones, as competitors cannot catch up quickly, or if breakthroughs in the future reduce model training costs, OpenAI could cut computing expenditures. This would reduce the demand for cash resources.

If OpenAI's popular product ChatGPT grows as expected, the company could generate revenue from new products, and investors might overlook expenditures. By 2029, when OpenAI's profitable business has been established for a decade, the company expects to generate revenue comparable to that of Nvidia and Tesla over the past 12 months.

ChatGPT will dominate sales

OpenAI believes that ChatGPT will continue to account for the vast majority of its revenue in the coming years, far exceeding revenue from selling AI models to developers via API. The company also expects new products to surpass API sales by the end of 2025, reaching nearly $2 billion that year.

While it is unclear what these new products are, sources familiar with the matter have indicated to the media that the company is currently developing agent products that can use people's computers to handle complex and monotonous tasks, as well as research assistants.

Additionally, the company has discussed raising subscription prices for its cutting-edge AI technology. Other products that have not yet been fully launched include the Sora video generator, a more direct competitor to Google Search, and software for robot developers.

OpenAI also expects API sales growth to slow significantly. The reasons are unclear, although the company faces a surge of competitors such as Anthropic, Microsoft, and Google in this area.

However, these forecasts may be based on the assumption that the company maintains a lead in AI development, despite facing increasing competition and more employee turnover.

Gross margins may improve

OpenAI expects its gross margin (a profit metric reflecting the percentage of direct business costs relative to revenue) to reach approximately 41% this year. This figure is far below the typical range of 65% to 70% for cloud software startups. The higher costs are primarily attributed to the computing power required to run existing models (referred to as inference computing), which is expected to account for $1.8 billion of this year's projected $3.7 billion in revenue.

Currently, OpenAI's direct business cost expenditures are slightly higher than those of Uber, which reported losses in 2016 and went public three years later.

OpenAI states that as revenue grows faster than computing costs, its business model will improve, with gross margins projected to be 49% next year and 67% by 2028.

One of OpenAI's supporters, Altimeter Capital, stated that this is mainly due to a decrease in inference costs. Altimeter cited OpenAI data indicating that the fees for developers using GPT-4 dropped by 89% from March 2023 to August 2024.

Employee numbers grow, data expenses decrease

OpenAI's largest operating expense is employee costs, which are expected to reach approximately $700 million this year, excluding stock-based compensation. The company anticipates that employee numbers will increase next year, with wage costs nearly tripling to $2 billion. However, after that, the growth of these costs is expected to slow.

OpenAI predicts that another major operating expense, data costs, will balloon to approximately $500 million this year, gradually decreasing to $200 million in the following years. This suggests that the company believes future data expenditures for training models will not be as high as this year's, as it signed numerous licensing agreements with several media companies this year.

Financial forecasts also indicate that OpenAI does not expect to invest heavily in sales and marketing to increase revenue, with these expenses projected to account for 5% to 7% of revenue. This is lower than the typical percentage of revenue spent on sales and marketing by popular consumer subscription businesses like Netflix and Spotify.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。