The shift in prediction markets seems to diverge from mainstream polls. Is the market astute or falling into manipulation?

Written by: Omera Goldberg, Founder of Chaos Labs

Translated by: Pzai, Foresight News

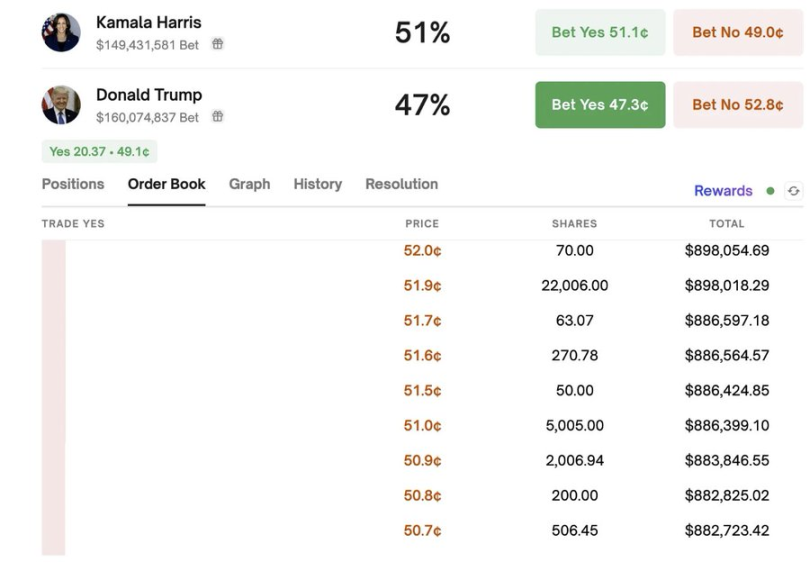

In just a few days, Trump's winning probability on Polymarket surged to 52.6%, while Harris dropped to 46.7%. However, mainstream polls show Harris leading by a narrow margin, creating a 6% discrepancy between the two. Is this a genuine shift in polling or is the market being manipulated?

As of September 23, reversing Trump's/Harris's odds from 47%/51% to 51%/47% is estimated to require $40 million. This indicates that a wealthy campaign team or actor could easily alter voter perceptions, especially in the crucial weeks leading up to the election.

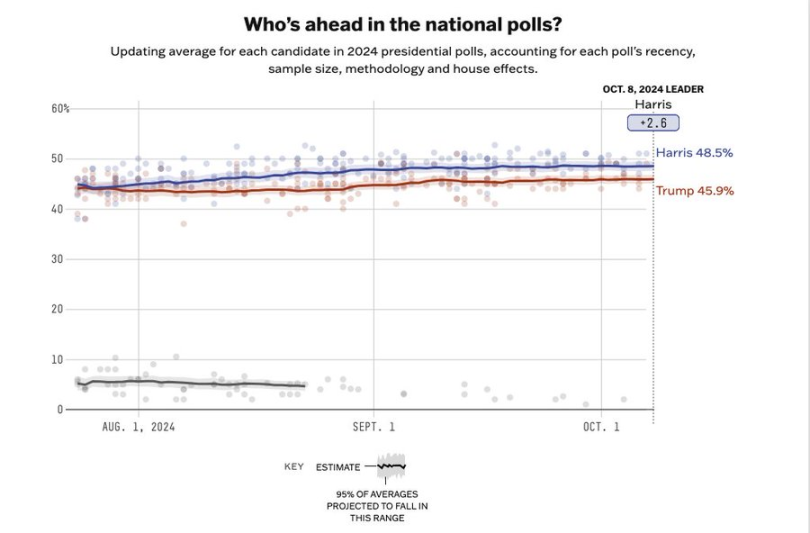

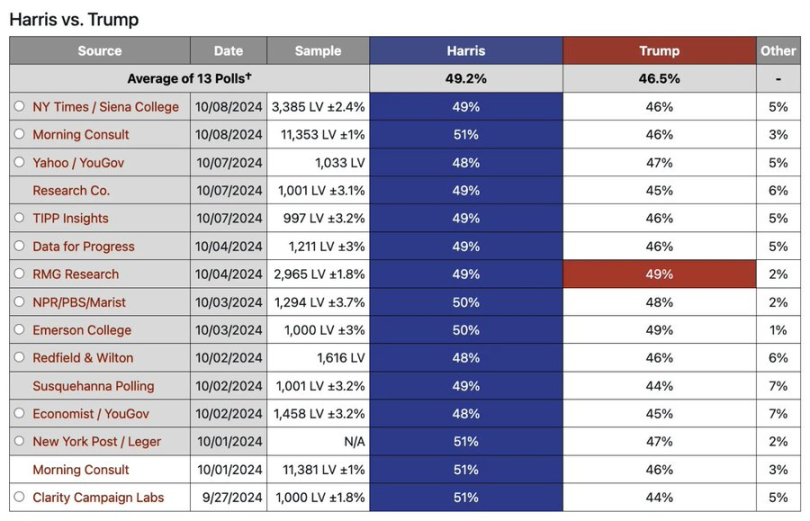

FiveThirtyEight polls show Kamala Harris maintaining a slight lead, contrasting sharply with Polymarket's odds.

Election Prediction Markets

Prediction markets like Polymarket allow people to bet on the outcomes of events such as elections, sports, and even cryptocurrency prices. Recently, prediction markets have garnered significant attention, especially during the U.S. presidential campaign. The principle is simple: the more money bet on a candidate, the higher their perceived chances of winning. These platforms are often seen as real-time barometers of public sentiment, with hundreds of millions of dollars in bets coming into play during major elections. However, unlike traditional polls that aim to fairly reflect voter opinions, prediction markets can be easily swayed by economic influences—raising serious concerns about manipulation, particularly from political candidates looking to tilt the odds in their favor.

How Polymarket Works

In prediction markets, users buy shares corresponding to the likelihood of an event occurring, such as whether a particular candidate will win, indicating "yes" or "no." The prices of these shares reflect the market's collective judgment at any given moment. For example, if the share price for "Trump will win" is $0.52, the market indicates a 52% chance of Trump winning.

Driven by supply and demand, prediction markets can respond quickly to news events, making them more dynamic than traditional polls. It is this responsiveness that often leads platforms like Polymarket to be viewed as real-time indicators of voter sentiment, with their large trading volumes reflecting users' assessments of candidates' chances in a volatile political environment.

Potential for Manipulation

While prediction markets provide valuable insights into political sentiment, their structure makes them highly susceptible to financial manipulation. Wealthy individuals or organizations (such as political campaign teams) can inject large sums of money into the market to distort the odds in favor of a desired outcome. For instance, if Trump's or Harris's team wants to boost their support, they could buy a significant number of "support" shares, artificially inflating their price and creating the illusion of rising support.

This manipulation is particularly concerning because prediction markets are often seen as accurate reflections of public opinion. Biased odds can mislead the media and voters, as well as political insiders who rely on these markets to gauge campaign momentum, thereby fostering misinformation.

It is expected that U.S. political ad spending will reach a record $15.9 billion in 2024, while trading volumes on Polymarket are several orders of magnitude lower—highlighting the vast gap between traditional political influence budgets and prediction market positions and trading volumes.

Why Is Market Manipulation Easier Than Polling?

Traditional polls are based on scientific sampling and employ rigorous methods to minimize bias. In contrast, prediction markets are driven by capital flow, meaning money can influence outcomes. Injecting funds directly into a poll does not change its results, but injecting funds into a prediction market can.

This makes prediction markets more vulnerable to manipulation. Wealthy political campaign teams can simply place large bets on a candidate, shifting the odds in their favor. This creates a misleading narrative that may influence public perception and even trigger a feedback loop, where undecided voters support a candidate because they believe that candidate is likely to win.

While traditional polls are not without flaws—often exhibiting errors—the key difference with platforms like Polymarket is their lack of licensing. Here, we can easily quantify the costs of market manipulation, making it more transparent but also more susceptible to financial interference.

What Is the Cost of Guiding the Market?

The cost of manipulating prediction markets depends on factors such as market size, liquidity, and the stability of current odds. In highly liquid markets, where large sums have already been bet, significant capital is needed to noticeably change the odds. However, in less liquid markets, even relatively small amounts of money can greatly alter the odds.

Polymarket's 2024 presidential election prediction market launched on September 23.

To estimate manipulation costs, let’s look at Polymarket's 2024 U.S. presidential election market, which involves hundreds of millions of dollars. As of September 23, reversing Trump's/Harris's odds from 47%/51% to 51%/47% is estimated to require $40 million. This indicates that a wealthy campaign team or actor could easily change voter perceptions, especially in the crucial weeks leading up to the election.

The costs of U.S. presidential campaigns are enormous, and the economic incentives to manipulate these markets are clear. While such actions could be qualitatively deemed illegal manipulation, the anonymity associated with blockchain wallets makes tracking manipulators extremely difficult, complicating enforcement.

Are Current Results Manipulated?

Polymarket's election market is its largest single prediction market to date, with a recent surge in trading volume. In the past five days, its daily trading volume skyrocketed to $54.5 million, more than four times the average of $12.5 million over the past three months. This surge coincides with the widening gap between Polymarket and traditional polls. Before October 2, both indicated Harris slightly ahead, while now Polymarket shows Trump leading Harris by 52.8% to 46.6%.

While this may highlight the market's responsiveness to new information, the significant discrepancy with polling data raises concerns about potential manipulation. The timing and scale of the increased trading volume suggest that financial influences may be at play, altering market sentiment in a way that is inconsistent with broader public opinion.

Note the sharp spike in trading volume on October 3, which coincides with the sudden change in Polymarket odds.

Election Poll Results Source: 270towin.com

Risks of Market Manipulation

Manipulating prediction markets poses several risks:

- Creating Illusions: By distorting market odds, campaign teams can create the illusion that a candidate is more popular than they actually are, influencing media coverage and voter sentiment.

- Feedback Loops: Voters seeing a candidate with higher odds may be more inclined to support them, believing they are more likely to win. This can distort the democratic process.

- Decreasing Market Credibility: If manipulation becomes increasingly common, prediction markets will lose their credibility in accurately predicting events. This would undermine the role of prediction markets in forecasting political outcomes and providing real-time public opinion data.

Cautious Interpretation of Results

Prediction markets like Polymarket are a valuable and exciting way to gauge public sentiment. They provide real-time insights and engage more people in discussions about significant events. As prediction markets evolve, we have the opportunity to enhance their integrity, making them less susceptible to manipulation.

Importantly, like any financial tool, prediction markets face risks. At Chaos Labs, we have developed products to protect on-chain applications from manipulation, and prediction markets face similar challenges. Staying vigilant is key to maintaining the credibility and utility of these markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。