Goodbye, see you at the market's new highs, or at least at the next peak!

Author: Route 2 FI

Translation: Deep Tide TechFlow

The market has performed well over the past 10 days. Does this mean we can finally welcome UPtober?

Is it time now?

Let’s discuss whether it’s time to really “lock in” or if we should “step out.”

When to “lock in profits” and when to “step out and relax”?

Hello friends!

Let me start with a metaphor:

The crypto market is like that girl who scores a 9.5, always playing mind games.

One day, she showers you with all her attention and affection, making you feel special.

The next day, she’s cold, making you doubt every decision you’ve made—worse yet, doubting your self-worth.

Sound familiar?

That’s pretty much what crypto investing is like. But let me tell you one thing: knowing when to go all in on “her” and when to take a step back is the secret to not just surviving but truly thriving in this financial Wild West.

So, friends, let’s dive into how to balance your obsession with crypto and living a normal life.

“Part One: Locking in Profits”

Alright, let’s make one thing clear—I’m not here to preach about holding like some digital hermit 24/7. That’s a one-way ticket to Burnout City, where the only resident is you.

But sometimes, you need to dig in, lock the doors, and ride the crypto wave as if your portfolio depends on it (because, honestly, it kind of does).

- ### “Market Conditions”

Remember March 2020? Yeah, that was something.

The world was heading towards destruction, and Bitcoin decided to take the express elevator straight to the bottom.

But here’s the twist—those who kept their cool and bought at the lows? They’re now sipping margaritas on private islands.

Major economic changes bring the chaos that cryptocurrencies rely on. It’s like the market is playing musical chairs, and you need to be ready to grab a seat when the music stops.

Take the Federal Reserve’s interest rate hikes as an example. Every time Jerome Powell speaks, you can bet there will be some wild volatility.

So how do you navigate this game? Simply put:

Stay Informed: Set alerts, follow key figures in the crypto space and those accounts with fewer than 1000 followers with anime avatars—don’t just skim headlines. Dive into those whitepapers, engage in Discord/TG channels, and maybe attend a crypto conference or two (to be honest, conferences aren’t necessary, but I still enjoy them). Knowledge is power, and knowledge is also money.

Have Capital Ready: Keep some stablecoins on hand. When everyone is panicking, that’s your buying opportunity. But don’t just throw money at every dip; have a plan and look for quality projects that are being sold off due to general market panic.

Know Your Price Points: Set clear entry and exit strategies. Emotions are for writing love letters, not for trading (can someone turn this into a classic quote?). Sure, you can use technical analysis, but don’t become dependent on it. Remember, in crypto, fundamentals can sometimes be overshadowed by market psychology.

Remember, volatility is a double-edged sword. It can make you rich, but it can also bankrupt you faster than a Lamborghini Huracán V10 5.2’s asynchronous ignition. Understand the trends behind the market. Are we in a macro bull or bear market? What’s the overall market sentiment? Is this a short-term correction or the beginning of a long-term decline?

These are the questions you need to ask yourself before deciding to “enter the market.”

- ### “The Next Big Event”

Let’s look back at 2017.

ICOs (Initial Coin Offerings) were all the rage.

Fast forward to 2021.

Everyone was talking about NFTs (Non-Fungible Tokens).

And now?

Now it’s all about those memecoins.

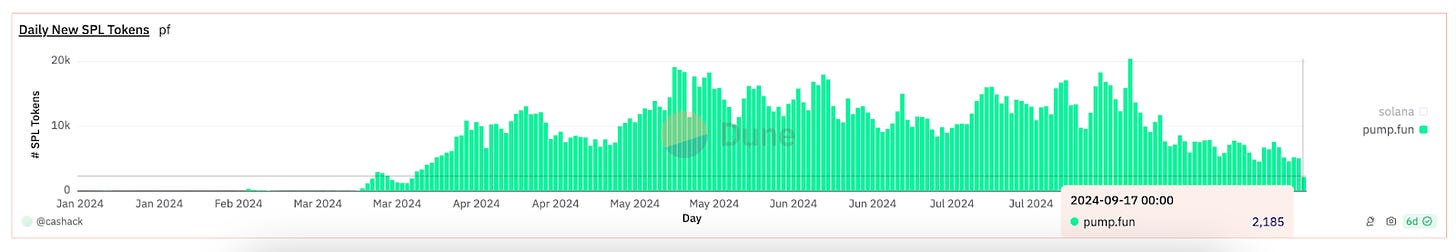

The crypto market loves a trend. It’s like Fashion Week, but instead of expensive clothes, we’re faced with ETH killer projects with no actual products, overpriced APE JPEGs, and new memecoins being released every minute, like pump.fun.

But the key is—if you can spot these trends early, you’ve made a profit.

It’s not just about quick gains (though, to be honest, we all love that).

The focus is on understanding the direction of technological development and adjusting your strategy accordingly.

So how do you stay ahead? Here are my two tips:

Go to where the professionals gather: Telegram group chats, Discord, niche accounts on crypto Twitter (comment sections), and obscure Reddit forums. These places are most likely to yield real alpha. Don’t just lurk—engage in discussions, ask questions, and share your insights. If you participate with genuine curiosity, the crypto community can be very welcoming.

Track Smart Money: Observe the projects that venture capital firms (VCs) and whales are investing in. They’re not always right, but they have resources we can only dream of. We can use tools like Nansen or Dune Analytics to gain insights into whale activity. But remember, just because a big player is investing doesn’t mean you should blindly follow. They’ve been caught in traps too.

Look for Real-World Applications: Projects that survive long-term are often those solving real problems. Think about how blockchain can disrupt industries beyond finance—supply chain, gaming, social media. That’s where the real revolution happens.

Try New Things (Responsibly): Don’t just read about new trends—try them out for yourself. Mint a new standard NFT, provide liquidity on a decentralized exchange like Layer4-zkVM, play a Web3 game. But (this is important) only use funds you can afford to lose.

Be aware that being an early adopter is a risky endeavor. Every Bitcoin corresponds to a thousand BitConnects.

DYOR isn’t just a catchphrase; it’s your lifeline.

But it’s okay to miss some trends. FOMO is real, but the risk of loss is equally real.

3. “Regulatory Dynamics”

Ah, regulation. The nightmare of the crypto world.

One moment we’re enjoying the beauty of decentralization, and the next, the SEC is knocking on Binance’s door.

But here’s a new perspective—regulation isn’t always the enemy. In fact, some degree of regulation might be just what cryptocurrency needs to enter the mainstream.

Take the news of Bitcoin ETF approvals. That news sent Bitcoin skyrocketing. On the other hand, China’s decision to “ban cryptocurrencies” in 2021 coincided perfectly with market peaks.

So how do you navigate the regulatory game?

- Stay Updated on News: Follow major regulatory bodies on social media.

It’s indeed a boring task, but it’s necessary.

But don’t get your regulatory news from Reddit memes.

That said, don’t expect to successfully trade based on these news items.

Understand the Implications: Not all regulations are the same. Learn to distinguish FUD from facts. A crackdown on suspicious exchanges is different from a blanket ban on cryptocurrencies. Develop a deep understanding of how different types of regulation impact various sectors of the crypto market.

Adjust Your Strategy Accordingly: If you know a regulatory storm is brewing, it might be time to prepare (or buy “compliant tokens”). Consider how regulation might affect different projects. For example, privacy coins may face more scrutiny than DeFi protocols aimed at institutional investors.

Global Perspective: Cryptocurrencies do not exist in a regulatory vacuum. A ban in one country might mean an opportunity in another. Keep an eye on crypto-friendly regions and how they position themselves. The next crypto hub might emerge in an unexpected place.

Let’s not forget the variable of politics. One day Trump says Bitcoin is a scam, the next day he’s practically its spokesperson.

Welcome to the crypto space, where the only constant is change.

The key is to stay flexible, stay informed, and maybe have some popcorn ready for the next congressional hearing on crypto.

“Part Two: Step Out and Relax”

Alright, we’ve talked about when to “go all in.”

Now let’s discuss the equally important matter of knowing when to take a break. Because honestly, if you think stepping into reality means scrolling through TikTok, we need to have a serious talk.

- ### “Breathe”

We’ve all been there. The market is free-falling, your portfolio looks redder than a sunburned tomato, and you’re convinced that if you just trade one more time, you can turn it around.

Reminder: You probably won’t.

Continuous losses can cloud your judgment. Before you know it, you start over-leveraging, throwing money at dubious projects out of FOMO, and soon you’re considering selling a kidney to buy the dip (professional advice: don’t do that).

In this situation, stepping back is not just a good thing—it’s necessary.

So how do you break this cycle?

Set Strict Stop-Loss Limits: Decide how much loss you’re willing to tolerate before you start trading. Stick to it as if your portfolio’s life depends on it (because it really does). This isn’t just about money—it’s about maintaining your mental health. No profit is worth sacrificing your sanity.

Identify Emotional Trading: If your decisions are driven by fear or greed rather than strategy, it’s time to step back.

Are you checking prices every five minutes? Dreaming of green candles?

Yes, it’s time to take a break.

Mandatory Breaks: Sometimes, the best trade is to not trade at all. Step away, and delete the app if necessary. The market will still be there tomorrow. Use this time to reconnect with the real world. Remember? The one with trees, the sky, and those who don’t know what CumRocketExtrax1000MoonSonic is.

Focus on Self-Care: As awkward as it sounds: exercise, meditate, read a book that has nothing to do with crypto. I promise, your mind (and trading decisions) will become clearer.

Reflect and Learn: Use this time to analyze your mistakes. Keep a trading journal. Be honest with yourself and see where things went wrong. Was it a poor strategy, or were you just in a weak mindset? Learning from losses is the difference between successful traders and “one-hit wonders.”

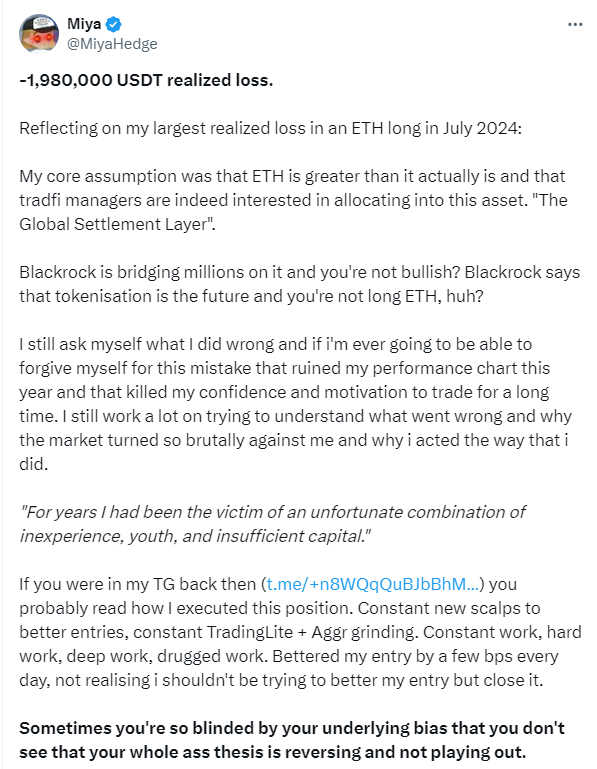

Click here to view the full tweet in the screenshot above. Remember, cryptocurrency is a marathon, not a sprint. Taking a break is not a weakness—it’s a strategy. The most successful traders I know are not the ones glued to their screens all day. They are the ones who know when to engage and when to step back.

2. “The Big Shots”

Imagine this scenario: you’re scrolling through social media, and suddenly you see Elon Musk tweeting about Dogecoin.

Your cousin, who treats Bitcoin like a vitamin supplement, is giving you trading advice.

Pepsi and Budweiser are interacting like there’s no tomorrow.

If this isn’t the peak of hype, I don’t know what is.

Mainstream acceptance is a good thing for cryptocurrency, don’t get me wrong. But when your Uber driver starts giving you leverage advice, it might be time to step back and reassess. The market has a peculiar way of humbling us, especially when everyone thinks they’re a genius.

Here are some ways to cope with the hype cycle:

Be cautious of unlikely endorsements: When celebrities who couldn’t even spell Ethereum a week ago start promoting certain coins, proceed with caution. I like Kim Kardashian as much as the next person (just kidding, I don’t), but I wouldn’t take financial advice from her Instagram stories, and neither should you.

Track Google search trends: If “how to buy Bitcoin” suddenly trends alongside “Taylor Swift,” we might be in bubble territory. Use tools like Google Trends to gauge public interest. When your uncle, who you haven’t seen in ten years and knows nothing about crypto, suddenly calls you asking how to buy, it’s usually a sign we’re nearing market peaks.

Stay alert to FOMO (Fear of Missing Out): If you’re buying just because you’re afraid of missing out, it’s time to step outside for a walk. FOMO is a powerful temptation, but it’s also a great way to buy at market peaks and become the liquidity for those who read the first part of this article.

Look for signs of market fatigue: Are there projects with no utility or that are outright jokes skyrocketing? Are people borrowing money to buy cryptocurrencies? These are warning signs, my friends. Short story:

Don’t be that person.

Every party has to end sometime.

3. “This is Ridiculous”

Let’s talk about market irrationality.

Like that friend who always takes things too far—fun at first, but you know it’s going to end in tears.

In cryptocurrency, these crazy times can make you feel like you’re on some wild drug. But recognizing their nature can save your portfolio and your sanity.

Signs the market is going crazy:

Coins with misspelled names are worth more than top-listed companies.

People are mortgaging their homes to buy the aforementioned coins.

Influencers are promoting a new “revolutionary” project almost every day.

Everyone thinks they’re a genius (until they’re not).

The phrase “this time is different” is said with no irony.

When the market loses its mind, it’s time to step back and reassess.

How to stay sane in a crazy market:

Stick to Your Strategy: Don’t abandon your plan just because others seem to be getting rich quickly. If you wouldn’t buy it in a bear market, think twice before buying it at a crazy peak.

Do Your Own Research on These Projects: Don’t trust the shocked-looking YouTuber in the thumbnail. They might be just as clueless as anyone else. Dig into the projects, read the documentation, check GitHub repositories, listen to developer calls. Knowledge is your best defense against market madness.

Remember Basic Truths: If something sounds too good to be true, it probably is. Yes, even in crypto, especially in crypto.

Look at the Bigger Picture: Check long-term charts. How does the current frenzy compare to previous cycles? History doesn’t repeat itself exactly, but it often rhymes. Understanding market cycles helps you stay calm when others lose their cool.

I’ll say it again: Always have an exit strategy. Determine when to take profits before entering a trade. It’s easy to get greedy when the market is rising, but remember—unrealized gains are just paper gains.

“Part Three: Balance”

Mastering the crypto market isn’t about being online 24/7 or completely stepping away from participation, but about finding the optimal balance—knowing when to lock in profits and when to relax. It’s a delicate balance, and believe me, we all trip over our own feet sometimes.

The key is self-awareness. Understand your limits, both financially and mentally.

Cryptocurrency is a wild journey, but it doesn’t have to consume all your time. It’s normal to be passionate about this field—goodness, who wouldn’t be excited when seeing the potential for innovations that can truly change the world?

But remember, you are not just a trader or an investor.

You are a human being first.

As the crypto market continues to evolve, one thing remains constant: the need to find balance.

So go ahead, analyze those charts carefully when the time is right. If you’ve done your research, be bold and try that promising new project. But don’t forget to look up, take a breather, and remember there’s a bigger world beyond your portfolio.

So, cheers to all the holders, traders, developers, and dreamers:

May your candlesticks always be green (but know when to avoid them when they’re not).

May your investments yield bountiful returns.

May you always remember that in the end, it’s not just about the money—it’s about being part of a revolution.

Stay smart, stay calm, and never stop learning.

The future based on blockchain is bright.

Goodbye, see you at the market's new highs, or at least at the next peak!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。