Original Title: PvP

Author: Arthur Hayes, Co-founder of BitMEX

Translator: Ismay, BlockBeats

Editor's Note: In this article, Arthur Hayes delves into the current state of token listings in the crypto market, particularly the impact of high listing fees on CEXs for project teams and investors. The article showcases the advantages of listing on DEXs through the case of Auki Labs and emphasizes the importance of focusing on product development and user growth. For those project teams blindly pursuing listings on CEXs, Hayes reminds them to pay attention to long-term value rather than short-term price fluctuations and market speculation.

The following is the original content:

PvP, or "player versus player," is a term frequently used by shitcoin traders to describe the current market cycle. It conveys a predatory sentiment where victory comes at the expense of others' losses. This notion is quite common in traditional finance (TradFi). The core purpose of the crypto capital market is to allow those willing to take risks with their precious capital to enjoy the benefits of early participation in projects, hoping these projects will grow alongside the development of Web3. However, we have strayed from the bright path laid out by Satoshi Nakamoto, which was further propelled by the highly successful Ethereum ICO led by Vitalik Buterin.

In the current crypto bull market, Bitcoin, Ethereum, and Solana are shining brightly. However, I define "new issuance" as tokens released this year, and these new issuance projects have performed poorly for retail investors. Meanwhile, VC firms are unaffected by this. Thus, the title PvP has been bestowed upon the current market cycle. The result is a series of projects with high FDV but extremely low circulation. After issuance, the prices of these tokens are flushed down the toilet like ordinary waste.

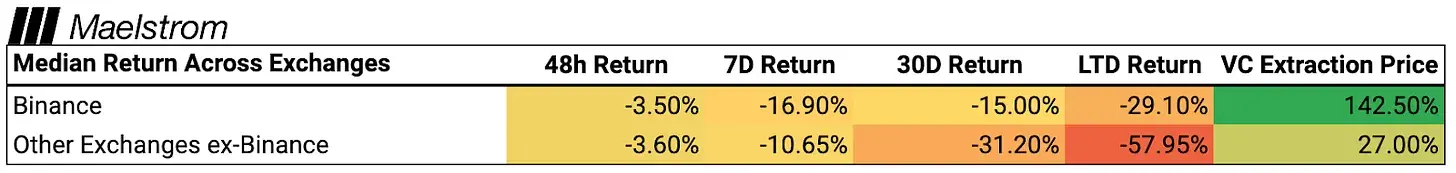

While this reflects market sentiment, what does the data reveal? The clever analysts at Maelstrom conducted some deep digging to answer several puzzling questions:

Is it worth paying the listing fees to a trading platform for better price appreciation of your token?

Are projects launching at overly high valuations?

After I delve into the data to answer these questions, I would like to offer some unsolicited advice to those projects waiting for the market to warm up for their launch. To strengthen my argument, I want to specifically mention a project in the Maelstrom portfolio—Auki Labs. They went against the trend by choosing not to list on CEXs initially, instead opting to list on DEXs with relatively low FDV tokens. They hope that retail investors can profit alongside them as they succeed in building a real-time spatial computing market. They also despise the exorbitant listing fees charged by major trading platforms and firmly believe there are better ways to return more value to end users rather than to the big shots living in my neighborhood in Singapore.

Sample Set

We analyzed 103 projects listed on major shitcoin trading platforms in 2024. This is not the entirety of all listed projects in 2024, but it is a representative sample.

"Pump the price!"

This is a phrase we often hear from founders during advisory calls: "Can you help us get on CEX? That way, our token price will skyrocket." Well… I never fully believe that. I think the secret to a Web3 project's success is to create a useful product or service and continuously increase the number of paying users. Of course, if you have a garbage project whose value only rises because Irene Zhao retweeted your content, then yes, you need a CEX to dump it on those retail users. Most Web3 projects are like this, but I hope the projects invested in by Maelstrom are not… Akshat, take note!

Post-listing returns refer to the number of days after listing, and LTD indicates performance since launch.

Regardless of the trading platform, the token prices did not skyrocket. If you paid the listing fees to the trading platform hoping to see a chart of token prices soaring, then I'm sorry.

Who are the winners? The VCs are the winners because the token prices have risen by 31% based on the FDV from previous private financing rounds. I call this the "VC extraction price." I will explain in detail the distorted incentive mechanisms of VCs in the latter part of this article, which drive projects to delay liquidity events as much as possible. But for now, the vast majority of people are just pure fools! This is why those drinks at conference networking events are free… haha.

Next, I want to stir things up a bit. First, CZ is a hero in the crypto space because he is being tormented by the devils of traditional finance in a moderately secure prison in the U.S. I love CZ and respect his ability to cleverly funnel funds into his pockets across various sectors of the crypto capital market. But… but… paying a huge price for the privilege of listing on Binance is not worth it. To clarify, having Binance as your token's primary listing platform is not that valuable. If Binance were to act as a secondary listing platform for free due to your project's performance and active community, that would be worth it.

Founders often ask us on our calls: "Do you have a relationship with Binance? We must list on Binance, or our token won't go up." This "no Binance, no listing" sentiment is very beneficial for Binance, as it allows them to charge the highest all-inclusive listing fees among any trading platform.

Returning to the table above, while tokens listed on Binance perform better than those on other major trading platforms on a relative basis, on an absolute basis, token prices are still declining. Therefore, listing on Binance does not guarantee that token prices will rise.

A project must provide or sell tokens to the trading platform at a cheap price, and these tokens are often in limited supply, in exchange for the opportunity to list. Some trading platforms are allowed to invest in projects at extremely low FDV, regardless of the FDV from the most recent private financing round. These tokens could have been distributed to users for completing tasks that promote project growth. A simple example is trading applications rewarding traders with tokens for reaching certain trading volume targets, known as liquidity mining.

Selling tokens to a listing trading platform can only be done once, but the positive flywheel effect created by increasing user engagement will continue to yield returns. Therefore, if you give up precious tokens just for the sake of listing and only exceed a few percentage points on a relative basis, you as a project founder are actually wasting valuable resources.

The Price is Not Right

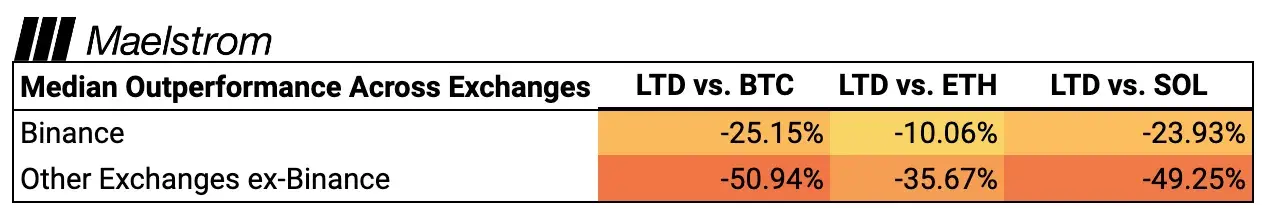

As I often tell Akshat and his team, the reason you have jobs at Maelstrom is that I believe you can build a portfolio of top Web3 projects that can outperform my core holdings of Bitcoin and Ethereum. If that weren't the case, I would continue to buy Bitcoin and Ethereum with my spare cash instead of paying salaries and bonuses. As you can see here, if you buy tokens at the time of listing or shortly thereafter, your performance is far inferior to the hardest currency of all time—Bitcoin—and the two top Layer-1 decentralized computing platforms—Ethereum and Solana. Given these results, retail investors should absolutely not buy newly listed tokens. If you want exposure to cryptocurrency risk, holding Bitcoin, Ethereum, and Solana directly is sufficient.

This tells us that projects must lower their valuations by 40% to 50% at the time of listing to become attractive on a relative basis. Who suffers when tokens are listed at lower prices? VCs and CEXs.

While you might think VCs aim to generate positive returns, the most successful managers understand that they are actually playing the game of asset accumulation. If you can charge management fees on a massive nominal amount, typically 2%, then you can make money regardless of whether the investments appreciate. If you invest in illiquid assets like early-stage token projects as VCs, which are essentially just promises of future tokens, how do you make their value rise? You persuade founders to continue private financing rounds under an ever-increasing FDV.

As the FDV of private financing rounds increases, VCs can revalue their illiquid portfolios at market prices, thus showing huge unrealized returns. These impressive past performances enable VCs to raise the next fund and charge management fees based on a higher fund value. Moreover, if capital is not deployed, VCs cannot earn fees. But this is not easy, especially since most VCs established in Western jurisdictions are not allowed to purchase liquid tokens. They can only invest in some equity of a management company and provide investors with token warrants for the projects they develop through an additional agreement. This is also why the "Simple Agreement for Future Tokens" (SAFT) exists. If you want to secure VC funding while they have a lot of idle capital, you must join this game.

For many VCs, having a liquidity event is very detrimental. When this happens, gravity begins to take effect, and the value of the tokens quickly returns to reality. For most projects, the reality is that they have failed to create products or services that enough users are willing to pay real money for, thus justifying their extremely high FDV. At this point, VCs have to lower their book values, which negatively impacts their reported return rates and the scale of management fees. Therefore, VCs push founders to delay token releases as much as possible and continue to conduct upward private financing rounds. The ultimate result is that when the project finally lists, the token price plummets like a stone, just as we have just witnessed.

Before I thoroughly criticize VCs, let's talk about the "anchoring effect." Sometimes, human thinking is really foolish. If a shitcoin opens with a 10 billion dollar FDV, but it is actually worth only 100 million dollars, you might sell the token, resulting in massive selling pressure that causes the token price to plummet by 90%, down to 1 billion dollars, and trading volume disappears as well. VCs can still account for this illiquid shitcoin at a 1 billion dollar FDV, which is often far above the price they actually paid. Even if the price crashes, opening the market at an unrealistic FDV still benefits VCs.

There are two reasons why CEXs want to see high FDV. First, trading fees are charged as a percentage of the token's notional value. The higher the FDV, the more revenue and fees the trading platform earns, regardless of whether the project rises or falls. The second reason is that high FDV and low circulation benefit trading platforms because there are many unallocated tokens that can be distributed to them. According to our sample data, the median circulation ratio of projects is 18.60%.

Listing Costs

I want to briefly discuss the costs of listing on CEXs. The biggest issue with current token issuances is the excessively high initial prices. Therefore, regardless of which CEX secures the first listing rights, it is almost impossible to achieve a successful issuance. If that weren't bad enough, projects with high prices also have to pay a significant amount of tokens and stablecoins to obtain the privilege of "listing a pile of garbage."

Before commenting on these fees, I want to emphasize that I don't think it's wrong for CEXs to charge listing fees. CEXs invest a lot of money to build their user base, and they need to recoup that investment. If you are an investor or token holder in a CEX, you should be satisfied with their business acumen. However, as an advisor and token holder, if my project gives tokens to a CEX instead of to users, it undermines the project's future potential and negatively impacts the trading price of the token. Therefore, I either advise founders to stop paying listing fees and focus on attracting more users, or I suggest that CEXs significantly lower their prices.

CEXs extract funds from projects in three main ways:

- Directly charging listing fees.

- Requiring projects to pay a deposit, which is refunded if the project delists.

- Mandating that projects spend a specified amount on marketing on the platform.

Typically, the listing teams at each CEX evaluate the projects. The worse the project, the higher the fees. As I often tell founders, if your project doesn't have many users, you need a CEX to dump your "garbage" onto the market. If your project has product-market fit and a healthy, growing ecosystem of real users, then you don't need a CEX because your community will support your token price anywhere.

Listing Fees

At high-end CEXs, Binance charges up to 8% of the total token supply as a listing fee. Most other CEXs charge between $250,000 and $500,000, usually payable in stablecoins.

Deposits

Binance has designed a clever strategy requiring projects to purchase BNB and stake it as a deposit. If the project delists, the BNB is refunded. Binance requires a deposit of up to $5 million in BNB. Most other CEXs require deposits of $250,000 to $500,000 in stablecoins or the CEX's tokens.

Marketing Expenditures

Binance requires projects to distribute 8% of their token supply to Binance users through platform airdrops and other activities. Mid-tier CEXs may require spending up to 3% of the token supply. At the lower end, CEXs require marketing expenditures of $250,000 to $1 million, payable in stablecoins or project tokens.

In total, listing on Binance could cost you 16% of your token supply and $5 million in BNB purchases. If Binance is not the primary trading platform, the project still needs to spend nearly $2 million in tokens or stablecoins.

For any CEX challenging these numbers, I strongly recommend providing transparent accounts of every fee or mandatory expenditure. I obtained this data from multiple projects that have assessed the costs of major CEXs, and some of the data may be outdated. I reiterate that I don't believe CEXs are doing anything wrong. They have a valuable distribution channel and are maximizing its value. My complaint is that the performance of tokens post-listing does not justify the fees paid by project founders.

My Advice

The game is simple: ensure that your users or token holders gain wealth when your project succeeds. I am speaking directly to you—project founders.

If you must do this, only conduct a small private seed round to create a product for a very limited use case. Then, launch your token. Since your product is far from achieving true product-market fit, the FDV should be very low. This sends a message to your users. First, it is risky, which is why they are entering at such a low price. You might mess up, but your users will continue to support you because they entered the game at a very low price. They believe in you and will give you more time to find a solution. Second, it indicates that you want your users to embark on the journey of wealth creation alongside the project. This will motivate them to tell more people about your product or service because users know that if more people join, they have the potential for substantial returns.

Currently, many CEXs are under pressure to only accept "high-quality" projects due to the poor performance of most newly listed projects. Given that "fake it until you make it" is very easy in the crypto space, it is challenging to choose truly excellent projects. Garbage in, garbage out. Every major CEX has its preferred metrics, which they consider leading indicators of success. Generally, a very young project will not meet their standards. Who cares? There is something called DEX.

On DEXs, creating a new trading market is permissionless. Imagine you are a project that has raised $1 million USD e (Ethena USD) and wants to offer 10% of the token supply to the market. You can create a Uniswap liquidity pool consisting of $1 million USD e and 10% of your token supply. Click a button, and let the automated market maker set the clearing price based on market demand for your token. You don't have to pay any fees for this. Now, your loyal users can immediately purchase your token, and if you truly have an active community, the token price will rise rapidly.

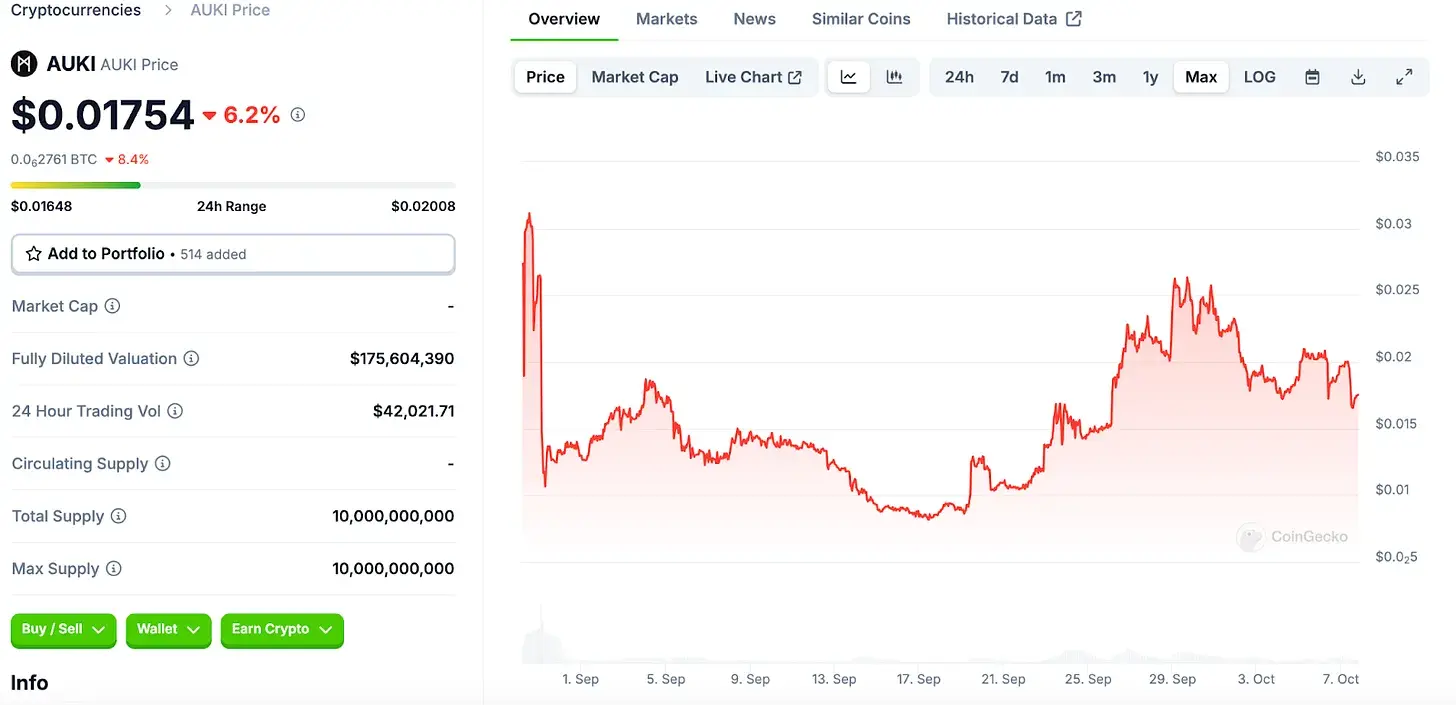

Let's take a look at what Auki Labs did differently when issuing their token. The above is a screenshot from CoinGecko. As you can see, Auki's FDV and 24-hour trading volume are relatively low. This is because it first listed on DEX before subsequently listing on MEXC's CEX. So far, Auki's token price has risen by 78% compared to the previous private sale price.

For Auki's founders, the token listing was just another ordinary day. Their real focus is on building their product. Auki's token was first listed on Uniswap V3 through the AUKI/ETH trading pair on August 28 on Base, which is Coinbase's Layer-2 solution. They then listed on the CEX—MEXC—on September 4. They estimate that they saved about $200,000 in listing fees by doing it this way.

Auki's token vesting plan is also more equitable. Team members and investors have a vesting schedule that spans from one to four years.

Sour Grapes Mentality

Some readers may feel that I am merely disgruntled because I do not own a mainstream CEX that has made a fortune from new token listings. This is indeed true; my income comes from the appreciation of the tokens in my portfolio.

If the projects in my portfolio price their tokens too high, pay hefty fees to get listed on trading platforms, but fail to outperform Bitcoin, Ethereum, and Solana, I have a responsibility to speak out against this. That is my stance. If a CEX chooses to list Maelstrom's projects because they have strong user growth and offer compelling products or services, I fully support that. But I hope the projects we support stop worrying about which CEX will accept them and start focusing on their daily active user data.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。