Babylon LSTs are emerging one after another. Which one should BTCFi choose to maximize returns?

Written by: Poutine

On September 25, the Bitcoin staking protocol Babylon posted on X that the first phase of the Babylon mainnet Cap 2 will launch in the second week of October. On October 5, Babylon announced that the maximum staking amount for each Bitcoin staking transaction will be modified to 500 BTC, with final confirmation on October 9. At that time, Babylon will briefly open LST deposits, starting at 20:00, with a limit of 10 blocks, from block 864790 to 864799. The gas fees for this round are expected to be relatively high, but it is still worth participating to get involved; it's time to make a decision!

With Babylon LSTs emerging one after another, which one should BTC-Fi choose to maximize returns? What strategy is best suited to my needs?

This article will analyze projects with good staking performance in Babylon Cap1 (Solv/Lorenzo/Bedrock) and the recently rapidly rising Lombard from the perspectives of Cap1 performance, project fundamentals, and yield opportunities, providing you with a flexible financial strategy for BTC Fi, allowing you to enjoy high returns without too much concern about opportunity costs.

TL;DR

- Solv: The earliest project, expected to conduct TGE the fastest. Although the participation ratio is relatively high, there are still good expectations for token issuance, suitable for early positioning.

- Lombard: The largest in scale, good liquidity, led by Polychain with $16M, integrated with Pendle, and has a rich downstream ecosystem collaboration.

- Lorenzo: Invested by Binance and incubated by MVB, with product innovation and unique incentive mechanisms. In addition to points, there are two significant additional airdrop commitments totaling $4.5 million in equivalent. Recent activities are frequent, with expected certainty and high ceilings.

- Bedrock: Rich experience in node operation, backed by RockX, with the deepest qualifications in the field. Recently committed to resolving vulnerabilities and providing compensation, worth ongoing attention.

1. Cap1 Pre-Staking Review

First, let's briefly discuss the role of LSTs: you can deposit native BTC or project-supported wrapped BTC into LSTs, which then stake in Babylon, not only distributing Babylon points to you but also receiving airdrops and project incentives, achieving dual mining.

LST projects will also issue liquid staking tokens to you, allowing you to sell and exit at any time, similar to stETH.

Let's review the pre-staking of Cap1. Babylon Cap1 modified the launch time multiple times, finally starting on 8/22, with a single LST project cap of 250 BTC and a total cap of 1000 BTC. Therefore, each LST project had to compete for shares, resulting in gas fees for the 5 blocks ranging from a minimum of 800+ satoshis/sats to an exaggerated maximum of 5000 satoshis/sats.

It is worth noting that simply depositing more does not mean earning more Babylon points, as it will be diluted into the overall TVL, so the ratio of TVL needs to be considered.

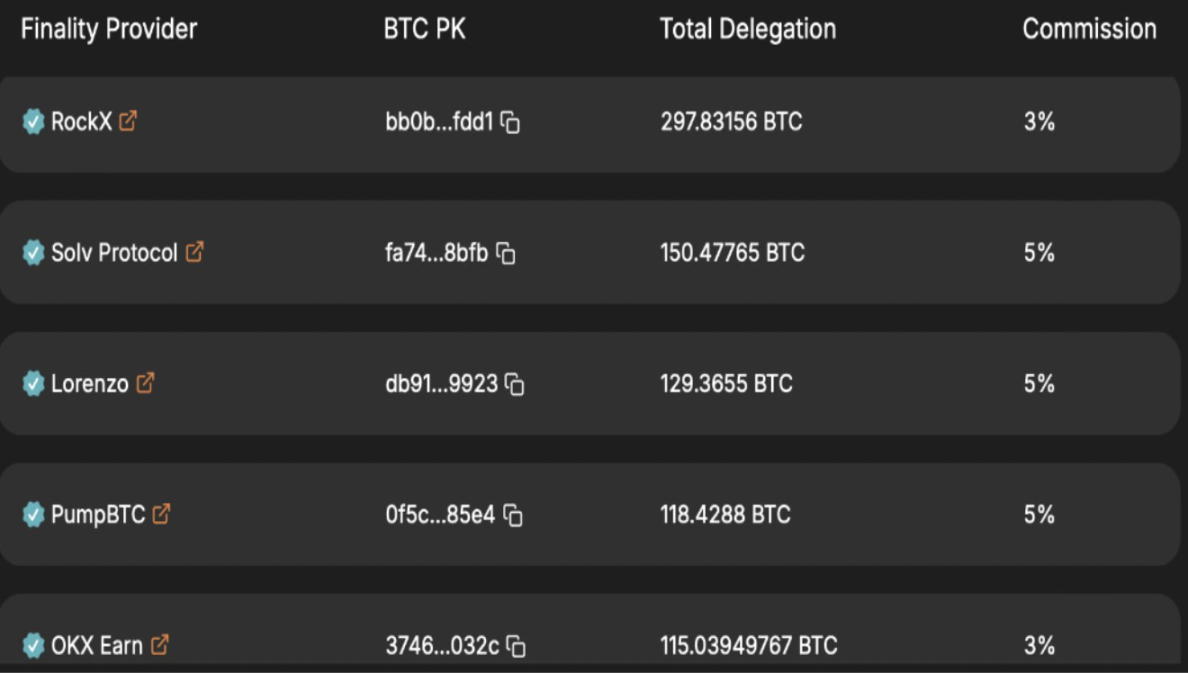

The staking amounts / TVL ratios are as follows:

- Solv: 250 BTC / 3200 BTC = 7.8%

- Lorenzo: 128.6 BTC / 250 BTC = 51.4%

- Bedrock: 230 BTC / 512 BTC = 44.9%

- Lombard did not participate

The highest ratio in Cap1 is Lorenzo, meaning the Babylon points distributed to users are expected to be highest for Lorenzo.

2. Project Analysis: TVL / Fundamentals / Financing / User Structure

Solv

- Solv is currently the second highest LST project by TVL, second only to Lombard. Compared to other projects, only a small portion of Solv is Babylon's LST, while other BTC flows into some CeFi and DeFi mining, appearing in many L2s (including Merlin).

Lombard

- TVL leader, recently attracting the most institutional/large deposits quickly, led by Polychain with $16M, with a good background. Its advantage lies in the speed of BD/DeFi collaborations, currently having good liquidity depth and a rich downstream ecosystem, making mining very convenient. For example, Lombard has already integrated with Pendle.

- It is worth noting that compared to Lorenzo's high proportion of retail stakers (7064 in Cap1 with 250 BTC), Lombard has significantly more large addresses, with around 5000 addresses contributing 5000 BTC. This data may affect Lombard's subsequent attractiveness to retail investors.

Lorenzo

- Lorenzo has built a more complex financial product compared to other LSTs that simply help users stake. It issues LPT and YAT through an internal integration of principal and interest separation, targeting both stable and high-risk yield preferences. In the future, it will also integrate more types of BTC earning channels.

- Lorenzo is also the first LST project directly incubated by Binance and MVB.

- Therefore, in addition to native BTC, it currently accepts native BTC and BTCB on the BNB Chain, leading to deep collaborations with various projects in the BNB Chain ecosystem, including promoting the use of Binance's BTCB asset standard in the entire BTCFi and BTC staking narrative, bringing more BTC staking and financial activities to the BNB ecosystem, providing BNB ecosystem users with more BTC exposure.

- Additionally, compared to other projects, Lorenzo had a hard cap of 250 BTC before Cap1, so the number of people mining Lorenzo points was relatively small, leading to lower dilution; at the same time, the chip structure is quite excellent, with most being retail stakers, making it a dark horse in this round of Cap2.

Bedrock

- Bedrock is a derivative project of the node operator RockX, which is an experienced PoS staking service provider and has also worked on Eigenlayer LRT uniETH. It is the second LST project supported by Binance after Lorenzo.

- Its biggest feature is the advantage of node operation. In Babylon Cap1, its internal node operator RockX successfully staked 300 BTC, making a remarkable impact.

- However, in September, due to vulnerabilities in uniBTC leading to losses, contracts have been suspended. Although Bedrock announced that the BTC in reserves is safe, the estimated total loss from the theft is about $2 million, and the official statement indicated that compensation will be provided to users.

3. Financial Strategy

Currently, the most significant source of FUD regarding Babylon is that it has not promised specific returns. Users are concerned that not many POS Chains will adopt Babylon to generate returns for stakers. Compared to Eigenlayer, since the underlying assets are ETH-related, even if Restaking yields no returns, there will still be a guaranteed yield of 3% to 5% from staking. Meanwhile, users' patience has gradually been worn down by the uncertainty of the points game. Each LST project has different activities and incentive designs. As Babylon Cap2 approaches launch, I personally have a favorable view and will participate in:

Lombard

- Lombard speaks for itself; its TVL has already exceeded 5000 BTC, with good liquidity depth and a rich downstream ecosystem, making mining very convenient.

- Lombard currently does not have specific collaborations or incentive activities for Babylon Cap2. Participating options include trading PT/YT on Pendle, forming LPs, etc. Currently, the APY for purchasing PT can reach 5.135%. It is important to note that the yield for LBTC underlying assets on Pendle is 0%, meaning the yield for YT is -100%, and the yield for PT comes from YT buyers, so YT purchasers need to rationally assess the risks.

- Additionally, for retail investors participating now, the expected returns may be somewhat diluted by institutions and large holders. However, it appears that the downstream application scenarios for LBTC are advancing the fastest, and there is a dual mining collaboration with the emerging BTC L2 Corn, so everyone needs to assess their own risk preferences.

Lorenzo

- In addition to points, an additional equivalent token airdrop (in the form of YAT) has been promised for this Cap2, totaling $3 million in equivalent token airdrops. The combined total for Cap 1 and 2 is expected to provide an additional $4.5 million in equivalent token airdrops. Taking Cap 1 as an example, even without considering the basic Babylon points and Lorenzo points, the yield from these additional subsidies has reached 10% (calculated based on BTC 6w). Assuming by the end of the year, the APY from just the additional earnings would be 33.1%.

- Compared to Lombard's TVL of 5000 BTC, Lorenzo's current TVL appears to be very cost-effective, making it advantageous to stake early in the era of large points.

- The project has been very active recently, with a recent event in collaboration with Binance Web3 Wallet just concluded, adding a pool of 2 million Lorenzo points for Binance Web3 MPC Wallet users (as of the time of writing, this wallet event has ended, but a 20% wallet points bonus will continue for wallet users until the project's TGE).

- In collaboration with B2 Network, Pell Network, and Avalon, a gold miner event is being held on the BNB Chain, where users can cross-chain BTC to B², mint stBTC, cross-chain stBTC to the BNB Chain, and then re-stake stBTC, BTCB, and uBTC to Pell. Multiple tasks provide chances for a lottery, with one lucky draw each week for 11 weeks to win one BNB; at the end of the event, one super lucky draw will win one BTCB, along with a nearly 30% expected yield from the multiple opportunities.

Summary

- In terms of flexibility, Lorenzo and Lombard perform well; Lorenzo can achieve principal and interest separation on its own, while Lombard has integrated with Pendle (however, it should be noted that the underlying asset yield for LBTC in Pendle is 0);

- In terms of returns, Lorenzo has dual incentives of points + YAT, and the project has committed to two consecutive additional token airdrops, providing high clarity on returns; combined with the project's many activities, it allows for multiple benefits;

- In terms of background, Lombard, Lorenzo, and Bedrock are all quite good; Lombard has secured funding from Polychain, while Lorenzo is directly incubated by Binance MVB;

- In terms of progress, Solv is expected to have the fastest TGE according to external expectations;

- Personally, I recommend the strategy of staking BTCB to Lorenzo to participate in Cap2, and then staking Lorenzo's stBTC on the BNB Chain to Pell, which has low gas fees and wear, while also participating in lottery activities and benefiting from multiple sources;

- Other LSTs have slightly lower liquidity and more uncertain discounts compared to the "Four Little Dragons," so they are not mentioned for now. Additionally, various emerging BTC LSTs and new L2 combinations may offer higher yields, but they tend to have poorer liquidity and potentially larger discounts. If you need to withdraw money quickly, you might end up mining for a month without any gains. A more comprehensive mining strategy will be covered in future writings.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。