In 2023, the cryptocurrency market rebounded, with the holding rate rising to 40%. The anticipated Bitcoin halving in 2024 and ETF approvals are expected to further drive growth, but investors remain uneasy about price volatility and the lack of government protection.

Author: Tom Blackstone

Translation: Blockchain in Plain Language

In 2023, the cryptocurrency market experienced a healthy recovery after the tumultuous bear market of 2022, during which several cryptocurrency companies went bankrupt. This rebound in cryptocurrency prices aligns with the multi-year economic cycle surrounding Bitcoin's supply halving. The fourth halving is expected to occur in April 2024, and the current price trends are relatively stable compared to previous years.

Meanwhile, the blockchain industry has been buoyed by a series of victories in U.S. courts against regulatory agencies, as well as expectations that the U.S. Securities and Exchange Commission (SEC) will approve Bitcoin ETFs in early 2024, leading to remarkable returns for many cryptocurrencies since October.

Analysts at Security.org have conducted their annual cryptocurrency research for the fourth consecutive year against the backdrop of the cryptocurrency market's recovery. This year's survey gathered insights from over 1,500 Americans, assessing consumer sentiment and key factors influencing cryptocurrency adoption.

Key Findings

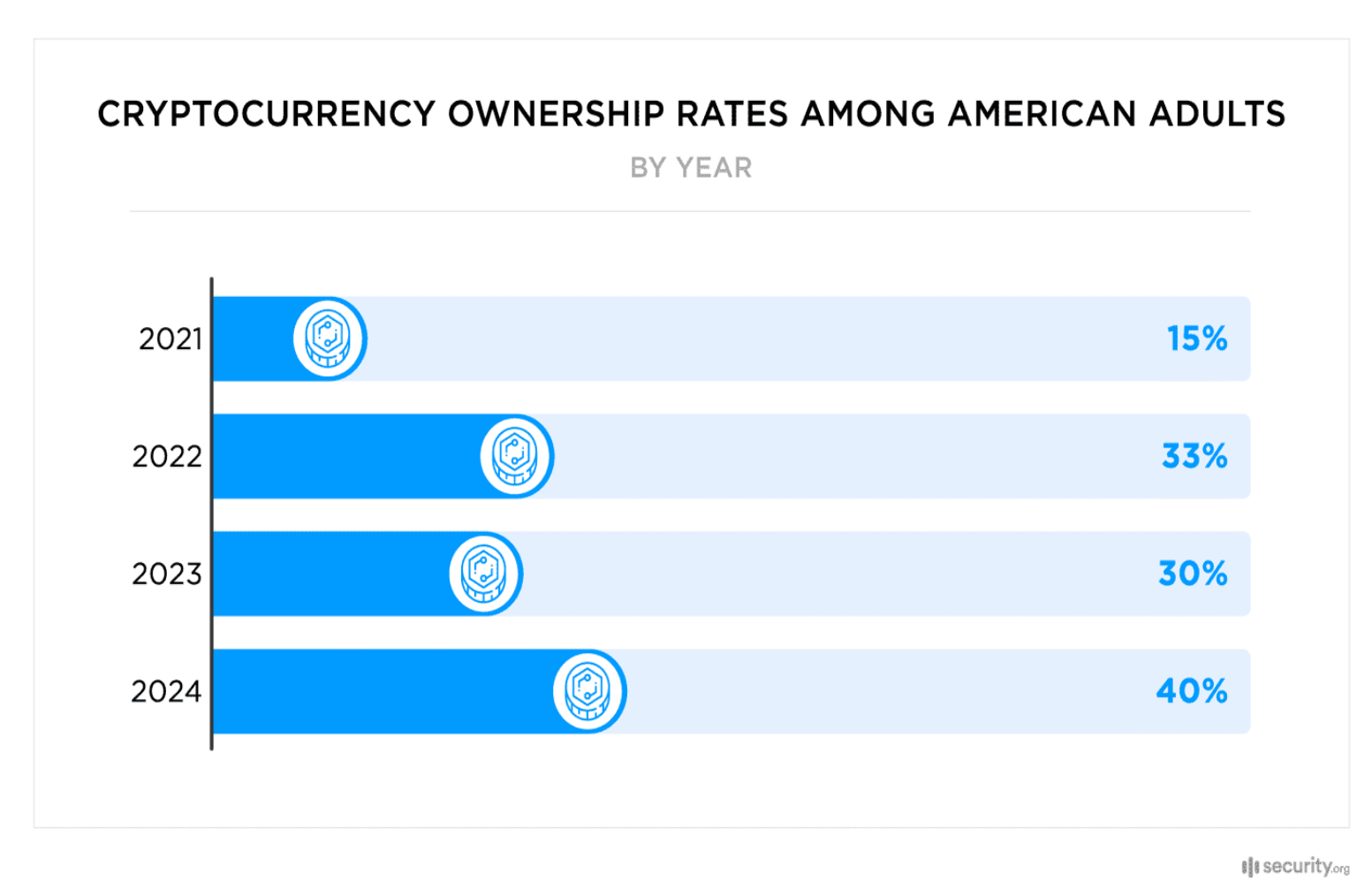

Awareness and holding rates of cryptocurrency have reached an all-time high: 40% of American adults now hold cryptocurrency, up from 30% in 2023, indicating that the number of holders may have reached 93 million.

Among existing cryptocurrency holders, about 63% wish to increase their holdings in the coming year, with Bitcoin, Ethereum, Dogecoin, and Cardano being their most interested currencies.

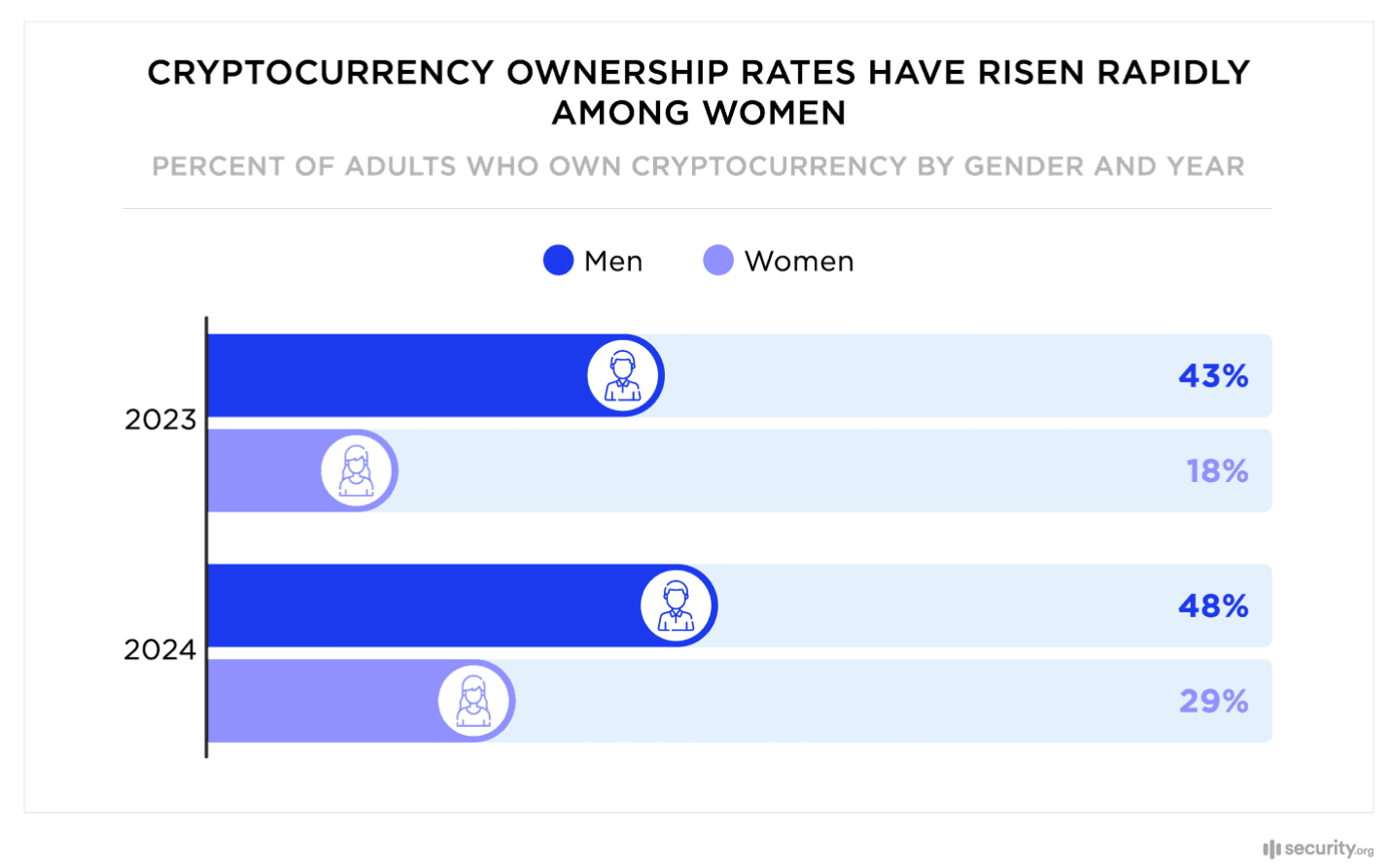

The cryptocurrency holding rate among women surged from 18% a year ago to 29% at the beginning of 2024.

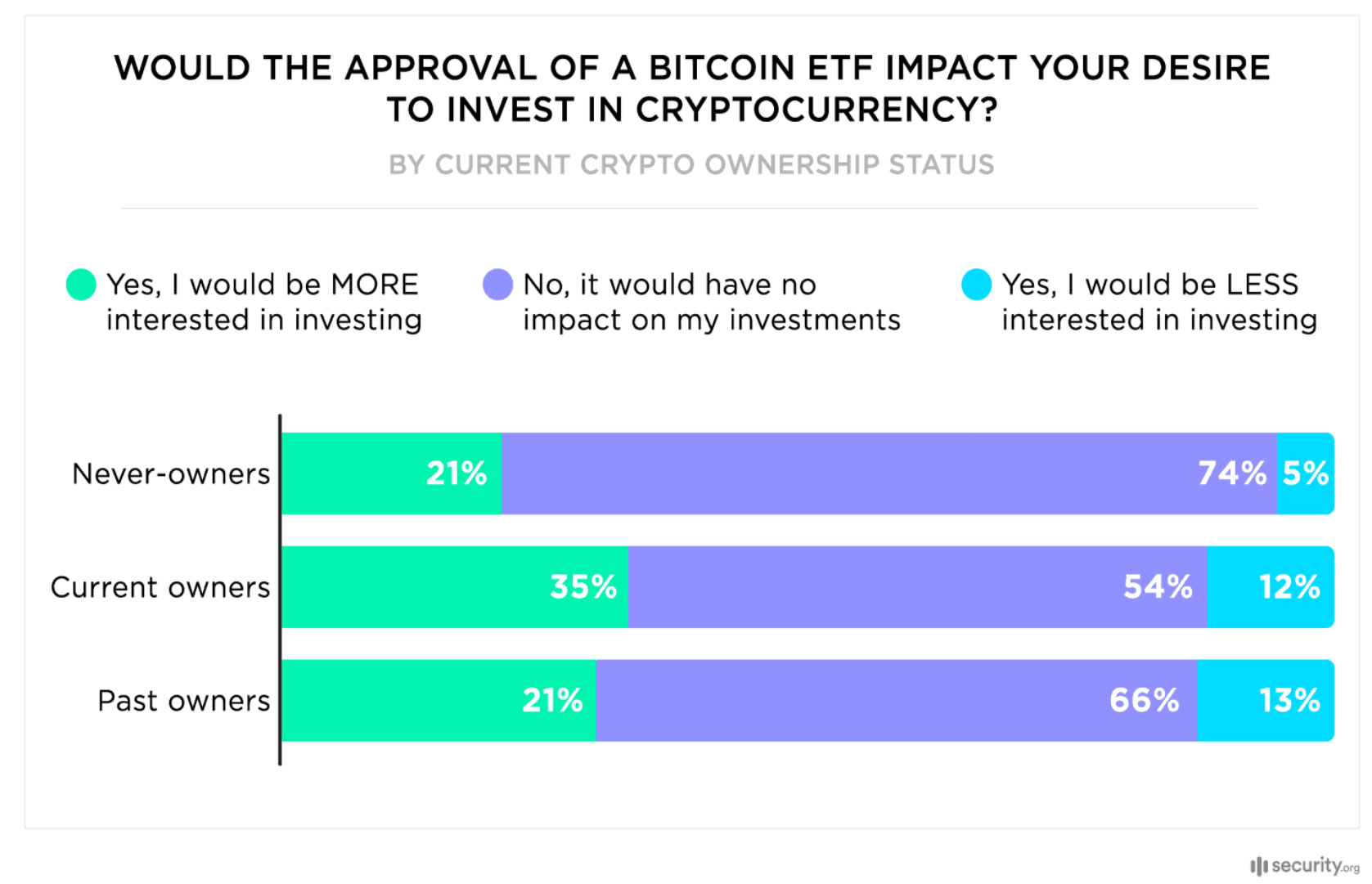

21% of non-holders indicated that the anticipated Bitcoin ETF makes them more likely to invest in cryptocurrency, suggesting that up to 29 million Americans may soon enter the market.

46% of Americans believe that the approval of Bitcoin ETFs in 2024 will have a positive impact on the blockchain industry, with current cryptocurrency holders being even more optimistic.

- Significant Increase in Cryptocurrency Holding Rates Since 2023

Since we first conducted research in 2021, awareness and holding rates of cryptocurrency have continued to grow. In 2021, less than half of respondents were aware of cryptocurrency. Today, over 80% report that they are familiar with this financial technology.

Meanwhile, the cryptocurrency holding rate in the U.S. increased by 10 percentage points in 2023. The holding rate rose from 30% last year to 40% now. According to our estimates, as many as 93 million Americans may hold one or more cryptocurrencies.

Men are still much more likely to hold cryptocurrency than women. However, the past year has seen a significant increase in women's cryptocurrency holding rates. This growth may stem from extensive media coverage of blockchain developments and the increasing number of women investing in cryptocurrency and blockchain companies. For instance, the influence of Laura Shin, host of the "Unchained Crypto" podcast, and Cathie Wood, founder and CEO of ARK Invest, has been significant in the crypto space. Thanks to Wood's substantial bets on crypto stocks, her hedge fund ARK Innovation ETF became one of the most profitable ETFs of 2023. ARK has also applied to the SEC for a Bitcoin ETF position.

In terms of politics and regulation, pro-crypto Senator Cynthia Lummis from Wyoming and crypto-supportive SEC Commissioner Hester Pierce have also played important roles.

Meanwhile, the cryptocurrency holding rates are similar across most age groups, with only those over 60 being significantly less likely to hold cryptocurrency compared to younger groups.

- How Might Bitcoin ETFs Change the Cryptocurrency Landscape in 2024?

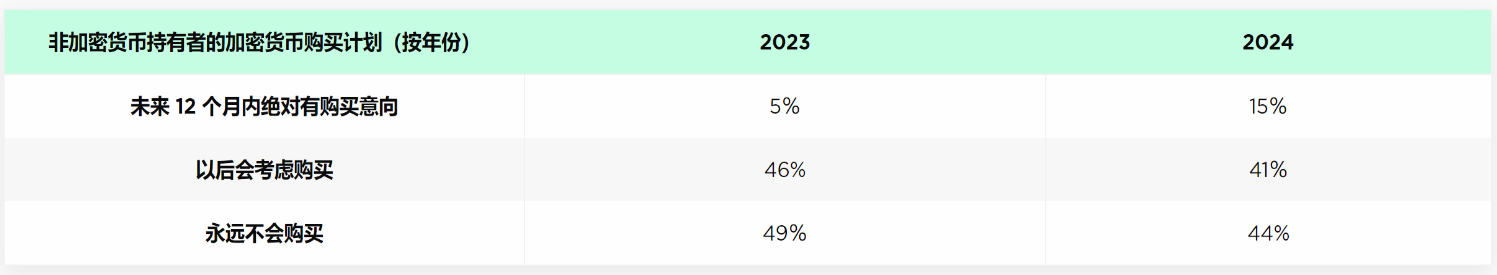

Currently, 56% of existing holders are optimistic about market price increases in 2024. If their predictions are correct, more people may see net gains by the time we conduct our next study in 2025. Among non-holders, 15% plan to purchase cryptocurrency this year, a significant increase from 5% last year.

Existing holders and non-holders who are familiar with cryptocurrency believe that 2024 could be a good year for cryptocurrency prices. The SEC is evaluating how to approve spot Bitcoin trading platform ETFs. ETFs are securities that track the price of a single commodity, allowing people to invest in the stock market without directly purchasing the commodity.

After Grayscale sued the SEC for rejecting its Bitcoin ETF application, the D.C. Circuit Court ruled in favor of the hedge fund in October 2023. The court essentially required the SEC to approve the Bitcoin ETF by January 10, 2024. More than a dozen other asset management companies awaiting approval for their Bitcoin ETF applications are also hopeful for approval in early 2024.

Interestingly, before participating in our study, 39% of the public had heard about this news. However, cryptocurrency holders have a significantly higher level of awareness regarding ETFs.

According to CoinGecko, following the court ruling, Bitcoin prices surged 28% in just two weeks, adding approximately $235 billion to the total market capitalization of all cryptocurrencies. Cryptocurrency hedge fund Galaxy Digital, led by former Goldman Sachs partner Mike Novogratz, expects Bitcoin ETFs to bring in $79.5 billion in inflows over their first three years.

46% of the general public believes that the approval of Bitcoin ETFs in 2024 will have a positive impact on the blockchain industry, with current cryptocurrency holders being even more optimistic.

Current cryptocurrency holders are most eager to increase their investments in blockchain in anticipation of the SEC approving ETFs. Even 21% of non-holders indicated that this development would make them more interested in purchasing cryptocurrency.

63% of those who have never owned cryptocurrency believe that it should be subject to more government regulation. A regulated Bitcoin ETF might boost their confidence in investing. In contrast, only 36% of holders believe that cryptocurrency needs more government regulation.

- What Are the Most Popular Currencies in 2024?

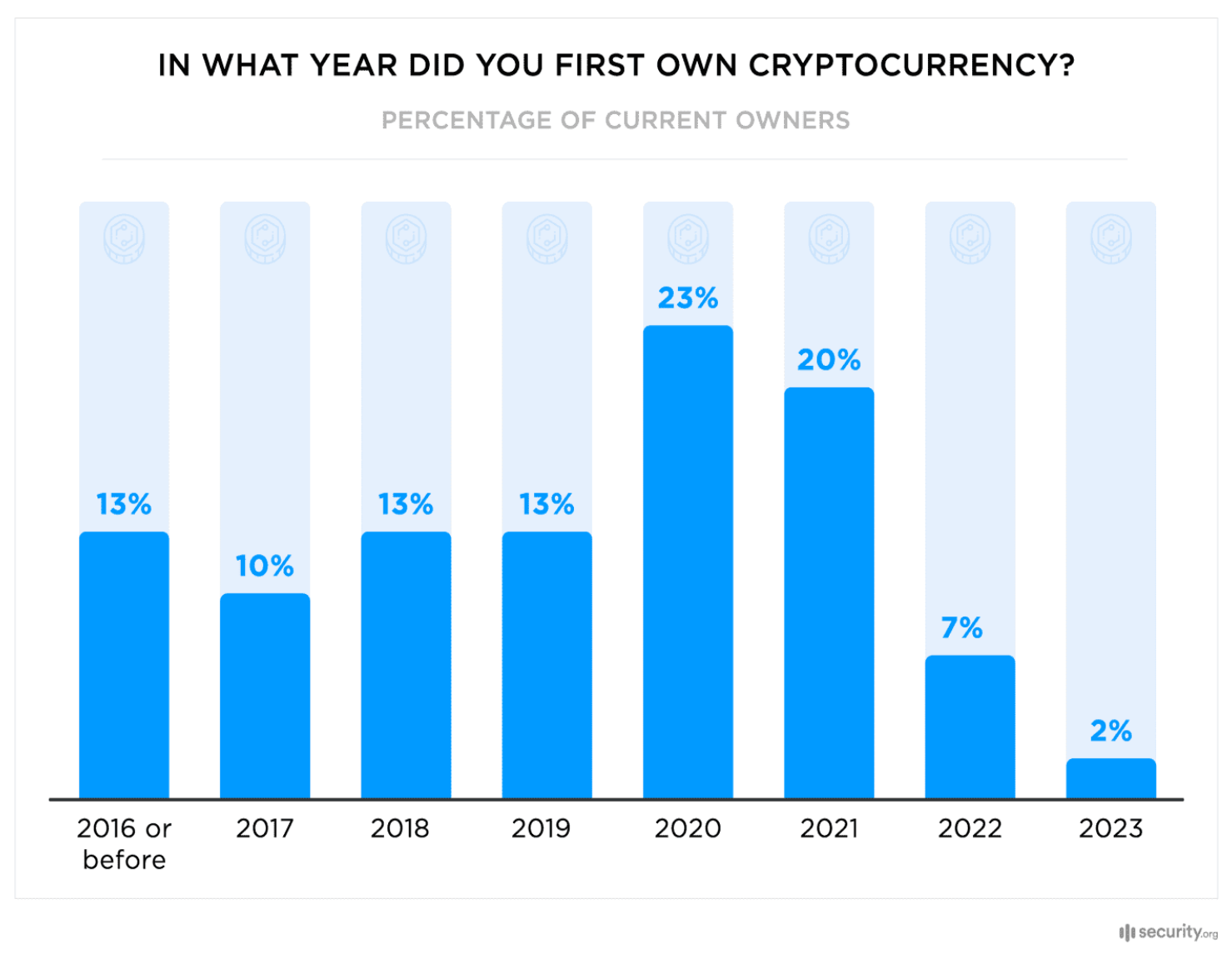

Most survey respondents first purchased cryptocurrency in 2020 and 2021, but since then, the number of new market entrants has decreased due to poor market performance in 2022. The price performance of crypto trading platforms was driven by Bitcoin's third supply halving on May 11, 2020, accelerating blockchain adoption in 2020 and 2021.

The supply halving is programmed into Bitcoin's software and occurs every four years. As the name suggests, the average issuance of new Bitcoin every ten minutes will be halved. The 2020 halving reduced the new Bitcoin supply in each new block from 12.5 BTC to 6.25 BTC. The 2024 halving will reduce the new supply to 3.125 BTC.

Another key factor in 2020 and 2021 was that investors flocked to Bitcoin and other deflationary blockchain currencies to hedge against global inflation and geopolitical risks during the pandemic.

As Bitcoin's new supply decreased by 50%, the Federal Reserve increased the dollar supply by 20% in the first half of 2020 to address the economic recession triggered by the pandemic. This supply-demand dynamic led to a rapid appreciation of Bitcoin relative to the dollar.

Since Bitcoin is the first cryptocurrency launched in 2009 and accounts for over 50% of the market share by market capitalization, it remains the focal point for the exchange rates of other cryptocurrencies such as Ethereum, Ripple, Dogecoin, and Shiba Inu.

- What Are the Most Popular Cryptocurrencies in 2024?

The percentage of existing holders of various currencies, broken down by year.

In our 2024 study, we found that Bitcoin remains the most popular choice, with about three-quarters of cryptocurrency holders owning Bitcoin.

Although Ethereum (ETH) is still the second most popular cryptocurrency, its holding rate has significantly declined from 65% at the end of 2021 to 54% at the end of 2023. This decline follows widespread attention to the Ethereum merge completed on September 15, 2022, which changed Ethereum's security model for ETH, leading many cryptocurrency adopters to view 2022 as a good year to hold Ethereum.

However, since then, competition from other smart contract cryptocurrencies like Solana (SOL) and Binance Coin (BNB), coupled with stubbornly high transaction fees, has led to a decrease in ETH's holding rate.

Meanwhile, we found that after Ripple Labs triumphed in court against the SEC lawsuit, the holding rate of Ripple (XRP) among cryptocurrency adopters rose from 7% to 9% during 2023. Despite this significant victory, the lawsuit is not over and will enter the trial phase in April 2024.

Among existing cryptocurrency holders, about 63% wish to acquire more cryptocurrency in the coming year. Here are the main currencies they plan to invest in:

Bitcoin: This year's supply will be halved, coinciding with the anticipated ETF products creating a pathway for mainstream regulated investors to enter the market, sparking their interest.

Ethereum: Crypto consumers are looking forward to another Ethereum upgrade to enhance speed and reduce fees while awaiting the launch of a spot Ethereum ETF by BlackRock, Inc.

Dogecoin: DOGE does not have a halving like BTC, but it also employs industry-leading 256-bit encryption technology for security.

Cardano: Since joining the smart contract space in September 2021, ADA has been a competitor to ETH. In 2024, the project plans to formalize its governance concepts into smart contract code.

5. Cryptocurrency Portfolio Performance and Public Perception

Among holders, the most popular reason for adopting cryptocurrency is to diversify investments. Since Bitcoin's correlation with stocks has been the most negative since before the pandemic, cryptocurrencies have overall achieved significant success as a portfolio diversification tool in 2023.

More than one-third of holders own cryptocurrency due to a strong interest in the technology. They may understand the economic and financial aspects of cryptocurrency, but they also value the technology—partly developed by security agencies like the NSA, which involves advanced mathematical software.

Meanwhile, 22% invest because someone they know recommended it. This is the reason billionaire hedge fund manager Steve Cohen adopted cryptocurrency. Initially skeptical, Cohen became a cryptocurrency enthusiast after some discussions with his son.

The primary motivations for cryptocurrency adopters remain consistent with our findings from a year ago.

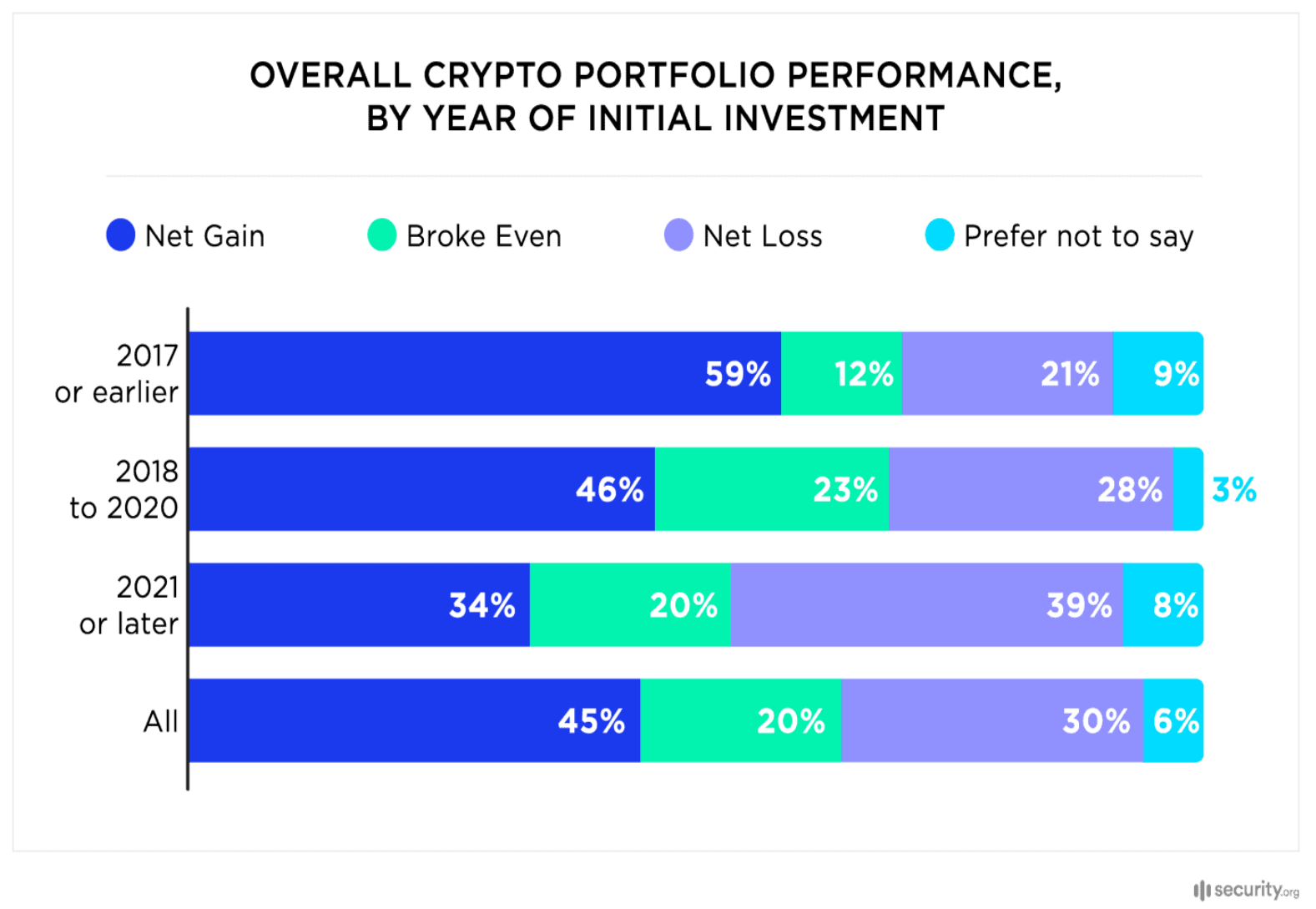

As shown above, more than half of cryptocurrency holders purchase cryptocurrency to enhance asset profitability. Currently, about 45% report that their investments have yielded returns. However, 30% experienced net losses when purchasing cryptocurrency.

The earlier one enters the market, the greater the likelihood of obtaining returns. This suggests that cryptocurrency is unlikely to make you rich quickly. However, from October 2022 to October 2023, accumulating Bitcoin weekly through dollar-cost averaging would yield a moderate annual return of 13%. In the same period, the annual return for accumulating the S&P 500 ETF using the same strategy was 2.36%.

6. Concerns About Cryptocurrency in 2024

Although the concept of Bitcoin ETFs has alleviated some hesitations, many cryptocurrency holders and non-holders still harbor concerns. While people may soon be able to trade Bitcoin like other stocks, nearly two-thirds of those with financial managers or advisors remain uneasy about investing in cryptocurrency.

A study conducted by investment bank and asset management firm Needham & Company in December found that this may be because clients prefer to purchase cryptocurrency on cryptocurrency trading platforms. This indeed aligns with the DIY financial philosophy of owning and using cryptocurrency. The study found that nearly all advisors expect client interest to increase if Bitcoin prices continue to rise.

Despite an increasingly open attitude toward cryptocurrency in 2024, 44% of non-holders stated they would never purchase cryptocurrency. The main reasons are value instability and lack of government protection.

Some non-holders are concerned about attacks from cybercriminals (3%), but existing holders are more seriously worried about this (11%).

Concerns about the value instability of cryptocurrency are the primary focus for both non-holders and existing holders. This is understandable, as Bitcoin, being the most popular and capitalized cryptocurrency, has historically seen its price drop more than 50% on six different occasions.

More than a quarter of non-holders express concern about the lack of government or bank regulatory protection. Owning blockchain assets brings several unique risks, such as cyber theft, lost passwords, and irreversible high transaction errors.

While few worry about losing access to their funds, 14% of holders have encountered issues accessing their cryptocurrency. Keeping the private keys of cryptocurrency in one's own possession, rather than storing them with custodians like exchanges or funds, can make losing the private key or forgetting the access password a potential risk.

In summary, here are the main cryptocurrency concerns to watch for in 2024:

1) Investment unease: About two-thirds of those using financial managers feel uneasy about investing in cryptocurrency.

2) Preference for cryptocurrency trading platforms: Many prefer to purchase cryptocurrency on trading platforms.

3) Interest tied to Bitcoin prices: Advisors predict that if Bitcoin prices continue to rise, interest in cryptocurrency will increase.

4) Reluctance: 44% of non-holders state they will never purchase cryptocurrency.

5) Value instability: Both holders and non-holders express concerns about price fluctuations.

6) Lack of government protection: More than a quarter of non-holders worry about the lack of government protection.

7) Cybercrime: Cybercrime raises concerns about cryptocurrency. In fact, 11% of existing holders and 3% of non-holders are worried about this.

8) Volatility: It is no secret that Bitcoin prices can drop. Historically, its price has fallen more than 50% on six different occasions.

9) Accessibility issues: 14% of cryptocurrency holders have encountered difficulties accessing their cryptocurrency.

7. Conclusion

Our cryptocurrency adoption and sentiment survey from a year ago revealed a crisis of confidence in the industry and a cautious outlook on the cryptocurrency market. These results coincided with the bottom prices of the market following the crypto winter of 2022.

In the subsequent years, cryptocurrency prices have rebounded significantly, with digital asset prices on cryptocurrency trading platforms experiencing substantial increases from 2023 to 2024. As the prices of popular cryptocurrencies rise, market prospects, consumer sentiment, and enthusiasm for adoption have also surged significantly over the past year.

The road ahead remains fraught with risks in innovative technology fields and disruptive new industries. However, cryptocurrency also promises the kind of return potential that investors have expected from successful high-tech companies since the 1990s.

Article link: https://www.hellobtc.com/kp/du/10/5446.html

Source: https://www.security.org/digital-security/cryptocurrency-annual-consumer-report/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。