Abstract

Solana is a high-performance blockchain network designed for large-scale applications, with its unique consensus mechanism combining Proof of History (PoH) and Proof of Stake (PoS). The main features of Solana include:

- Fast transaction confirmation: Target time for each transaction is 400 milliseconds.

- Low transaction fees: Median transaction fee is only 0.00064 SOL.

- High throughput: Capable of processing over 65,000 transactions per second.

- Open development ecosystem: Providing a thriving environment for developers.

In early 2023, Solana quickly rebounded from the bear market to become the third largest public chain. Solana's total value locked (TVL) surged more than thirtyfold, and its decentralized exchange (DEX) trading volume in July surpassed that of Ethereum for the first time. Projects such as Render Network and Helium also migrated from Ethereum and its L2 to Solana.

This article will focus on introducing some promising projects in the Solana DeFi ecosystem. Research on Solana's DePIN will be separately released in a detailed report.

Liquidity Staking and Restaking

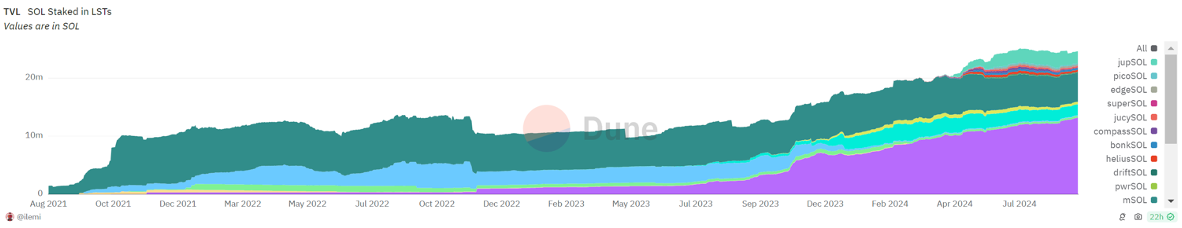

Solana's PoH mechanism is built on top of PoS, but Solana's staking situation differs significantly from that of Ethereum. Solana's staking ratio is approximately 67.7%, much higher than Ethereum's 27.8%. However, Solana's liquidity staking ratio is only 6.4%, significantly lower than Ethereum's 32.4%. This difference is mainly attributed to two key factors: Solana's lack of a minimum staking requirement and lower slashing rules, which reduce the entry barrier for independent validators. The lack of LSTs as a use case for the DeFi ecosystem further limits the demand for SOL LSTs.

Jito

Jito is the first liquidity staking protocol on Solana that includes MEV rewards, distributing staking rewards and MEV rewards to holders of its LST JitoSOL. Currently, 82.46% of validators run Jito-Solana, an open-source and audited Solana validator client, allowing validators to share MEV rewards. Jito's MEV rewards increase the annualized yield of JitoSOL from 7.80% to 8.35%, a 7.05% increase. With the surge in memes trading volume, this additional income will become more significant. The higher annualized yield attracts investors to choose Jito over other liquidity staking protocols.

The recovery of the Solana DeFi ecosystem, the airdrop of JTO tokens, favorable price performance, the exit of its main competitor Lido, and the stable growth of MEV rewards have established Jito as the largest liquidity staking protocol on Solana, with a TVL of $17 billion and a 47% market share. Jito continues to erode Marinade's market share, as Marinade previously charged a 6% fee, while Jito only charges a 4% fee, and MEV earnings are not included in Marinade's mSOL, resulting in an annualized yield of mSOL approximately 12% lower than JitoSOL.

However, concerns about over 80% client adoption, widespread introduction of MEV earnings, and excessive concentration of LST market share have limited further growth of Jito. Other competitors have also introduced measures to increase LST yields to compete. For example, Marinade has waived commission fees and introduced The Stake Auction Marketplace (SAM), allowing Marinade stakers to earn additional rewards from validator bidding, with mSOL's annualized yield now reaching 10%.

To address these limitations and resolve the issue of excessive concentration, Jito has introduced Jito Restaking, an open-source, Solana-tailored, hybrid staking, restaking, and LRT module. Jito has partnered with Renzo to launch Solana's first LRT, ezSOL, minted by JitoSOL. Similar to Ethereum, where the TVL of liquidity restaking accounts for approximately 30% of the TVL of liquidity staking, Solana's restaking market is expected to have a growth potential of around $1 billion. The introduction of Jito Restaking not only expands the application of JitoSOL but also enables Jito to become a combined entity similar to "Lido + Eigenlayer" on Solana. Furthermore, by transferring the management of Jito's staking pool to the decentralized Solana staking pool StakeNet, Jito can further decentralize staking pool operations and reduce concerns about excessive concentration.

JTO is the governance token of the platform, with governance rights and a fully diluted valuation of $23.6 billion, but only a circulating supply of 12.4%. A major unlock will begin on December 8, 2024, with an inflation rate of 237% in the coming year.

Sanctum

Sanctum is a liquidity staking protocol on Solana, positioned as a liquidity layer for SOL LST, facilitating exchanges between different SOL LSTs. Sanctum Infinity is a multi-LST LP that supports exchanges between LSTs of any scale, with its LST being INF. The Sanctum reserve pool contains over 410,000 SOL and is a key shared liquidity source for all staked SOL. Sanctum Router efficiently facilitates exchanges between different LSTs by leveraging the essence of LST as staked accounts. Sanctum's positioning has led to a significant 40-fold increase in TVL within three months, currently reaching $745 million.

All LSTs deployed through Sanctum will have full access to Sanctum Router and reserves, enabling trading on Jupiter. They are also eligible to be included in Sanctum Infinity for liquidity. Sanctum has become the issuance platform for Solana LST, with projects (protocols, CEX, and even memes) collaborating with Sanctum to incentivize users to use their services through their own LST. For example, bonkSOL is supported by bonk validators who reduce BONK supply with validator rewards, and holders of over 1 bonkSOL and over 0.01 BONK can receive BONK airdrops. Diversified LSTs reduce concerns about excessive concentration and make Solana's liquidity staking ecosystem more prosperous. In this more decentralized and democratic industry landscape, Sanctum has emerged as the biggest winner. The number of LSTs issued in collaboration with projects and validators with Sanctum (such as JupSOL, INF, BonkSOL) has reached 53. Binance, Bybit, and Bitget have also announced collaborations with Sanctum to issue their SOL LST. The market share of LSTs collaborating with Sanctum has exceeded 20% and continues to grow.

In the roadmap of Sanctum, Sanctum Profiles V2 will allow users to create personalized LSTs, while Sanctum Launchpad will utilize LST to support new projects and products within the Solana ecosystem. Their success will help establish Sanctum as the liquidity layer for SOL LST.

CLOUD is the governance token of the platform, with governance rights and a fully diluted valuation of $2.81 billion, with only 18% in circulation. Over the next year, the circulating supply of CLOUD will remain unchanged until a significant unlock begins on July 18, 2025, at which point 12.5% of the total supply will be allocated to the team and investors.

Solayer

Solayer is a liquidity restaking protocol on Solana, providing endogenous AVS services and enabling native Solana dapps to securely access network bandwidth and throughput on demand. By staking SOL and selected LSTs in exchange for their LRT sSOL, stakers can enjoy annualized yields of up to 9%. The earnings primarily come from three sources: staking income, MEV, and user-paid AVS fees. Solayer uses staking-weighted Quality of Service (swQoS), which increases the probability of successful transaction submission for validators who stake more.

Endogenous AVS is a significant innovation on Solana, and as a result, Solayer has attracted significant investment and participation. Binance Labs has announced an investment in Solayer, and the total value locked (TVL) of Solayer has reached $168 million within two months. The current focus on endogenous AVS rather than exogenous AVS sets Solayer apart from Jito Restaking and provides attractive returns for stakers. However, Solayer's potential depends on whether users are willing to pay for AVS fees. Solayer also plans to introduce exogenous AVS in the future, which would pose a challenge to Jito Restaking.

DEX and Aggregators

The trading volume/TVL of DEX on Solana is approximately four times that of Ethereum. Trading activity on Solana is significantly more active, driven primarily by memes. During peak periods, approximately 100,000 new tokens are issued daily, with tokens like Bome generating substantial returns. The popularity of memes on Solana, rather than other blockchains, can be attributed to four key factors: the widespread presence of gambling culture (including memes and prediction markets), the significant wealth creation effect (such as Bonk, Wif, Bome, and Slerf), the development of infrastructure like Pump.fun and Dumpy.fun, and lower token creation and trading costs. During this bull market cycle, DEX and aggregators on Solana have provided lower entry barriers and a smoother user experience for meme enthusiasts, likely expanding market share and increasing the value of governance tokens through fee collection and revenue distribution, becoming platforms for launching new assets.

However, the bull market for memes on Solana is unlikely to last indefinitely. Currently, about 60% of the trading volume on Solana is related to Pump.fun, and only 1.4% of memes created on the joint curve reach Raydium, with only 3% of users earning over $1,000. The increasing number of rapidly launched memes has diverted users' attention and funds, and more advanced tools have intensified PVP competition. SunPump on Tron and Four.Meme on BSC have also attracted meme enthusiasts to shift to other blockchains for easier profits. The daily trading volume and the number of new memes have decreased by half from the peak. DEX on Solana needs more tradable assets with deep liquidity and stable intrinsic value.

Raydium

Raydium is the largest DEX on Solana and the first hybrid AMM, providing on-chain liquidity for OpenBook's central limit order book. In addition to traditional standard AMMs, Raydium also offers centralized liquidity market makers (CLMM), allowing liquidity providers to specify their liquidity and actively trade within the pool's price range. Highly volatile long-tail assets are typically created in standard AMMs, and burning LPTs in AMM encourages trading, as it means that part of the liquidity will not decrease. The coexistence of both AMMs provides pool creators with diverse choices, especially as low market value memes are more popular in standard AMMs on Solana. This flexibility is a key reason why Raydium has been able to capture market share from its competitor Orca, which previously only offered CLMM (Orca introduced Splash Pools supporting the full range of positions in August 2024).

According to Raydium's documentation, the minimum creation fee for protocol development and operation is only 0.435 SOL, making it very suitable for meme enthusiasts to create new tokens to capture popular culture (such as $FIGHT and $KAMA during the 2024 presidential election). Additionally, the most popular meme issuance platform, Pump.fun, provides a direct and massive injection of users and trading volume for Raydium. Users can create memes on the joint curve through Pump.fun, and memes with a market value of $69,000 on the joint curve can be transferred to Raydium's AMM, with Raydium charging an additional 4 SOL as a listing fee. As of August 22, 2024, Raydium's daily average trading fees are approximately 19 times higher than in 2023, leading to Raydium's market share rising to over 60% and stabilizing at around 45%.

RAY is the governance token with governance rights, value accrual, and staking income, with a fully diluted valuation of 8.33 billion USD and a circulation ratio of 47.5%. Locked RAY mainly comes from mining (34%) and partnerships with the ecosystem (30%), while RAY belonging to investors, the team, and the community has been unlocked. The trading fee for AMM is 0.25%, with 0.03% used for RAY buyback, and CLMM and CPMM also have similar buyback mechanisms. As of August 22, 2024, Raydium's daily average buyback fees are approximately 27 times higher than in 2023, with approximately 5.9% of the maximum supply being bought back annually in 2024. Healthy cash flow and ongoing buybacks alleviate selling pressure on the team and enhance the intrinsic value of RAY.

In addition to the decline in the meme frenzy on Solana discussed earlier, Raydium's low entry barrier is easily replicable, and its position as a leading DEX may be challenged. The prosperity of low market value memes also cannot provide lasting liquidity depth for Raydium. The introduction of Splash Pools, PYUSD liquidity pools, and improved pool creation processes has led to a resurgence in Orca's market share, while Pump.Fun and Jupiter are also likely to establish their own DEX and capture market share from Raydium. Raydium must introduce new tradable assets or new businesses (such as a launchpad) to protect its hard-earned market position.

Jupiter is the largest DEX aggregator on Solana, providing diversified DeFi services. Compared to Ethereum, Uniswap occupies about half of the DEX market share, while Curve is the hub for stablecoin exchanges. The competitive landscape of DEX on Solana is not yet stable, and the liquidity is not concentrated enough, making it especially important to achieve the best price, low slippage, and efficient trade execution through aggregators on Solana. DexScreener and other tools have also helped Jupiter establish a leading position through meme trading. Currently, about 40% of the DEX trading volume comes from Jupiter, almost twice that of the largest DEX, Raydium. Despite the fierce competition in DEX on Solana, the largest aggregator, Jupiter, will still benefit from the revenue growth brought by the overall Solana DEX trading volume increase.

The diversified and continuous product launches have expanded Jupiter's usage and enhanced user stickiness. Jupiter is more like the center of the Solana ecosystem, similar to Binance in CEXs. The following are Jupiter's main DeFi services:

- Limit orders, DCA, and VA provide more investment tools.

- JupSOL issued through Sanctum allows for staking rewards and MEV rebates from Jupiter validators without fees. JupSOL indicates Jupiter's entry into the liquidity staking field, which will help keep SOL on Jupiter. The market share of JupSOL has risen to 10% in just 4 months.

- Perpetual contract trading expands Jupiter into the derivatives market, making Jupiter the largest sustainable DEX on Solana, with OI reaching $180 million. At the same time, Jupiter Liquidity Provider (JLP) pools, as counterparties to sustainable traders, allow LPT$JLP holders to earn additional income from traders' PnL and 75% of trading fees by providing up to $700 million in TVL. The value of perpetual trading is captured directly by $JLP, with an annualized yield of 27.46%.

- Bridge Comparator supports Allbridge Core, Mayan, deBridge, and Onramper, bringing more funds from other blockchains and fiat currencies to Jupiter.

- APE is an attempt by Jupiter to stabilize and expand meme trading.

- LFG Launchpad is the first community-driven launchpad established by Jupiter, providing a reliable way for large-scale on-chain projects to launch tokens on Solana. Memes Wen, cross-chain interoperability protocol deBridge, liquidity restaking protocol Sanctum, and other diversified projects have been launched on it. The proposal, candidacy, voting (by JUP holders), and final launch of projects can be transparently completed within the Jupiter community. A key mechanism of Jupiter LFG Launchpad is the unilateral, joint curve-based Meteora DLMM pool, which allows project teams to precisely determine the price curve according to their preferences and allocate liquidity (e.g., negative exponential curve to incentivize early adopters). LFG Launchpad gives JUP holders greater governance rights and provides a fair price discovery mechanism. Projects launched by LFG Launchpad also tend to airdrop their tokens to JUP holders. Additionally, projects launched by LFG Launchpad usually maintain good relationships with Jupiter and are more attractive compared to tokens with high valuations but low circulation ratios. Jupiter's LFG Launchpad has the potential to become a super traffic entrance for Solana, comparable to Binance Launchpad in CeFi.

JUP is the governance token with governance rights, staking income, and airdrop eligibility, with an FDV of $7.3 billion and a circulation ratio of 19.9% (the reduced burn of JUP will take place within 6 months after the proposal in August 2024). The team manages 50% of JUP, and the remaining 50% is reserved for the community, with 20% of the team portion set to unlock from February 2025 for a period of two years. Active staking rewards (ASR) allow JUP holders to earn rewards when staking JUP and voting.

Perpetual Contract Trading Platform

Drift Protocol

Drift is a decentralized trading platform built on Solana, offering various functions including spot trading, leverage trading, perpetual contracts, lending, and yield farming. Drift is the second-largest sustainable DEX on Solana, with a TVL of $3.65 billion. Trading on Drift is supported by three liquidity mechanisms in sequence:

- Just-in-Time Auction Liquidity: When the taker submits a market order, it automatically triggers a personalized Dutch auction with specific starting price, ending price (starting price ± slippage), and duration (about 5 seconds). Market makers who place orders with lower profit requirements earlier are more likely to be executed. Just-in-Time Auctions create competition among market makers, providing lower latency and greater trading depth.

- Virtual AMM (vAMMs) Liquidity: If no market makers intervene after the initial window, the taker can complete the trade on Drift's vAMMs. vAMMs provide transparent price discovery and strike a balance between trading depth and slippage risk.

- Decentralized Limit Order Liquidity: Keepers listen, store, sort, and compile all valid open orders found on-chain to fill valid limit orders and organize them into each Keeper's off-chain order book. Keepers listen for trigger conditions, match orders, and charge fees for each trade.

Spot trading volume on DEX is about 10% of CEX, but the open interest (OI) of sustainable contracts on DEX is only 3% of CEX, indicating significant growth potential in this area. DEX and aggregators with mature spot businesses, such as Drift's largest competitor Jupiter, are more likely to expand into the sustainable contract market. However, limited trading depth remains a major challenge for DEX in increasing OI compared to CEX.

To increase product diversity, Drift launched the prediction market BET in August. Prediction markets are expected to gain attention in the year of the U.S. presidential election due to increased demand for betting on political events. The leading prediction market Polymarket has reached a TVL of $100 million on Polygon. Drift's entry into the prediction market has natural advantages: Drift's TVL is four times that of Polymarket, and the strong interest of Solana meme enthusiasts in gambling aligns well with the prediction market. In just half a month, the total bet amount for BET has reached $23 million.

DRIFT is the governance token with governance rights and fee payment functionality (based on staking DRIFT in the insurance pool, providing fee discounts), with an FDV of $4.56 billion and a circulation ratio of 21.3%. The emission schedule for DRIFT is five years, after which all tokens will be fully circulated, with 53% allocated for ecosystem growth.

Lending Platform

Kamino Finance

Kamino is the first protocol to unify liquidity, lending, and leverage into a secure DeFi product suite. Despite being founded during the bear market of 2022, Kamino quickly became the largest lending and liquidity protocol on Solana, with a market size of $17 billion, accumulated debt exceeding $10 billion, and over 60% market share in lending. As a leading lending protocol, Kamino plays a crucial role in many important projects on Solana. For example, the sixth-largest stablecoin PYUSD, with a market value of $8.4 billion, has 42% or $3.5 billion of its scale managed through Kamino's services. Here is a brief overview of Kamino's main business operations:

Lending: Kamino Lend V2 is built on top of the foundational layer V1 and utilizes modular design in the market layer to create markets for arbitrary asset compositions and risk configurations. Additionally, the single asset lending vault in the Vault Layer can automatically aggregate liquidity across markets. By combining these features with a more powerful liquidation engine (including limit orders and liquidation auctions) and a risk management architecture (isolation mode, cross mode, and interest rate premium), Kamino Lend V2 can become the cornerstone of "DeFi Lego" on Solana. It supports a wide range of use cases, such as RWAs, long-tail assets, P2P lending, and order book lending on the Solana network. As the market trends upward, lending will be the most direct way to leverage the Solana DeFi ecosystem, allowing Kamino to benefit from the growing demand for composable lending services.

Liquidity: Kamino's liquidity insurance vault provides an automated liquidity solution, allowing users to earn returns on their crypto assets by providing liquidity to the CLMM. The automation of the entire LP process, including automatic position rebalancing, automatic compounding of trading fees, and additional incentives, improves capital efficiency while reducing impermanent loss and price fluctuations. Depositors receive yield-bearing, easily liquidated LPT kTokens, which can be used as collateral for K-Lend, creating diversified strategies to make money, such as executing yield farming and delta-neutral strategies through collateralizing or recycling their LP positions.

Leverage: K-Lend uses a single liquidity market to centralize liquidity and improve efficiency, while the "eMode" mechanism allows for higher leverage when borrowing or lending within specific asset compositions.

KMNO is the governance token of Kamino, with governance rights and staking income, with an FDV of $4.82 billion, but a circulation ratio of only 13.5%. The circulating supply of KMNO will remain unchanged until the continuous unlock begins on April 30, 2025. From that day onwards, 2.2% of the total supply of KMNO will be cliff unlocked monthly and allocated to key stakeholders, advisors, and core contributors, continuing until April 30, 2027. The remaining 37.5% of KMNO is allocated to the community and rewards (27.5%) as well as liquidity and treasury (10%), to incentivize the builders and long-term users of Kamino.

Save Finance

Save, formerly known as Solend, is the third-largest lending protocol on Solana, with a TVL of $2.42 billion. Along with the rebranding to Save, new DeFi products have been launched, including LST saveSOL, stablecoin sUSD, and meme coin short platform dumpy.fun.

SLND is the governance token of Save, with governance rights and liquidity mining income, with an FDV of $72 million and a circulation ratio of 40.1%. The mechanism of dumpy.fun implies that shorting assets will help expand the scale of Save's lending services, but the introduction of the new governance token DUMP may directly capture the value of the platform, potentially weakening the position of SLND.

Cross-Chain Interoperability

Wormhole

Wormhole is one of the largest underlying cross-chain interoperability platforms, with its core being a universal messaging protocol that provides developers with access to liquidity and users on over 30 mainstream blockchain networks to build various applications on them. In November 2023, Wormhole raised a total of $225 million from Coinbase Ventures, Multicoin Capital, Jump Trading, and other well-known venture capital firms, with a valuation of $25 billion.

Wormhole's organizational structure is based on a Proof of Authority (PoA) mechanism, consisting of 19 Guardians who are reputable entities supported by capital and reputation. These Guardians form the off-chain Guardian network, serving as the oracle of Wormhole. Each Guardian independently signs verified operation approvals (VAA), which are ultimately combined into a multi-signature, and when at least 2/3 of the Guardians (e.g., 13 out of 19) sign the same message, the signature is considered valid. The core contract receives cross-chain requests from source chain applications, sends messages to Guardians, and verifies VAA on the target chain. Relays are responsible for transmitting VAA to the core contract on the target chain. The Guardian network operates as "external validators," providing high scalability and wide applicability while avoiding single points of failure (SPOF). However, its security depends on unified and non-fraudulent validation by Guardians, which may be a potential vulnerability in cross-chain messaging and asset transfers.

Wormhole has launched four main products: the universal messaging protocol "Messaging," the cross-chain bridge tool "Connect," the Cosmos-SDK chain "Gateway," and the cross-chain query tool "Query." Additionally, the Wormhole Foundation has launched several programs to promote project development, including the xGrant program, Base Camp, and the Cross-Chain Ecosystem Fund (CCEF), with a total value of $50 million. These programs provide funding, guidance, and resources to support ecosystem growth. As of August 31, 2024, Wormhole has sent over 1.047 billion messages, 7.7 times more than the second-ranked LayerZero. The roadmap of Wormhole indicates that Wormhole Institutional will be launched in the future, providing enterprise-level interoperability solutions for global enterprises and financial institutions.

W is the governance token with governance rights, with an FDV of $21 billion and a circulation ratio of 25.8%. W was initially launched as a native Solana SPL token and will enable ERC20 functionality through Wormhole's native token transfer (NTT) after the launch. W holders can stake their W and participate in proposals across different chains through Wormhole's NTT. Multi-chain governance will aggregate capital and users from different chains to build a larger community and consensus. If W holders can participate in relevant DeFi activities and earn income from the protocol, the intrinsic value of W will be more stable.

Oracle

Pyth Network

Pyth Network is the third-largest oracle, with a TVS of $48.5 billion, providing real-time price data for over 350 protocols on more than 55 blockchains from over 100 trusted first-party sources for cryptocurrencies, stocks, forex pairs, ETFs, and commodities. The core team of Pyth Network has previously worked at Jump Trading. Delphi Digital, HTX Venture, Multicoin Capital, and other well-known venture capital firms have invested in Pyth.

The core mechanism of Pyth is a pull-based oracle update mode. Unlike push-based oracles (such as Chainlink), pull-based oracles only update on-chain prices when requested. Users can request the latest prices from off-chain services, and anyone can submit updated prices to the on-chain Pyth contract, which verifies their authenticity and stores them for future use. Pyth empowers and incentivizes the original owners of financial data to contribute data directly to Pythnet, an exclusive blockchain operated by Pyth's data providers. Pythnet then securely aggregates the prices provided by data providers into a single Pyth aggregate price to be fed out and transmits the price to other chains through the Wormhole cross-chain messaging protocol. The price server Hermes continuously monitors Pythnet and Wormhole, stores the latest price messages, and provides them to Dapps and smart contracts. Pyth provides a transparent data retrieval mechanism with high resolution and fidelity, as well as low latency and high-frequency updates (every 400 milliseconds). Collaboration with Wormhole allows Pyth to easily expand to different chains through Wormhole's universal messaging protocol. Pyth is well-suited for use in financial scenarios, especially in situations where market volatility is high or rapid trade execution is crucial, such as derivatives and margin trading.

PYTH is the governance token with governance rights, with an FDV of $27 billion and a circulation ratio of 36.2%. 52% of PYTH is allocated to ecosystem growth, and 22% of PYTH is allocated as publisher rewards to encourage accurate and timely price data. There will be a large-scale unlocking of PYTH lasting about a month every May, continuing until 2027. Therefore, caution is needed when increasing positions during this period.

Summary

Compared to Ethereum, Solana provides a more dynamic and innovation-driven environment. Its high throughput and low fees significantly enhance the efficiency of decentralized applications (dApps) and have attracted a diverse range of projects to join its ecosystem, promoting rapid growth. The Solana Foundation has played a crucial role in driving a product-centric, decentralized, and democratic environment, accelerating mass adoption. Innovative projects like Blink, Pump.Fun, and dumpy.fun have quickly emerged and developed to meet the evolving market demands. With more capital and talent converging on Solana, its ecosystem provides compelling investment opportunities in the face of technological breakthroughs or favorable market conditions.

However, the positive correlation between Solana and its ecosystem is more pronounced than that of Ethereum and its ecosystem, indicating that Solana's ecosystem is still in an earlier stage of development compared to Ethereum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。