In the past 30 days, the total trading volume of the top four blockchains' NFTs exceeded 300 million US dollars.

Author: OurNetwork

Translation: DeepTechFlow

NFTs

Mad Lads | Pudgy Penguins | NodeMonkes | CryptoPunks | Milady Maker

In the high-end NFT market, Ethereum still holds an absolute advantage, accounting for 97% of the sales share

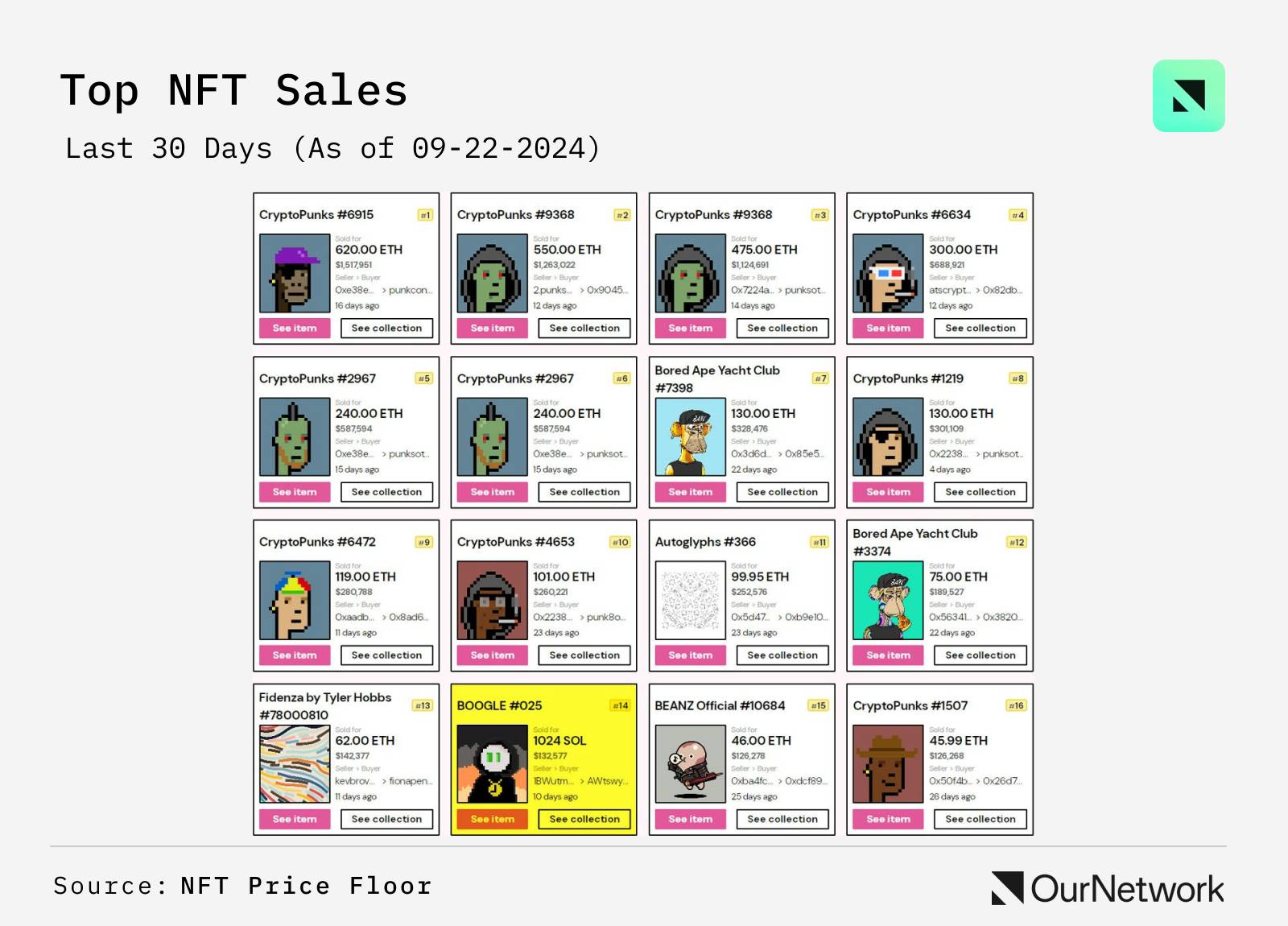

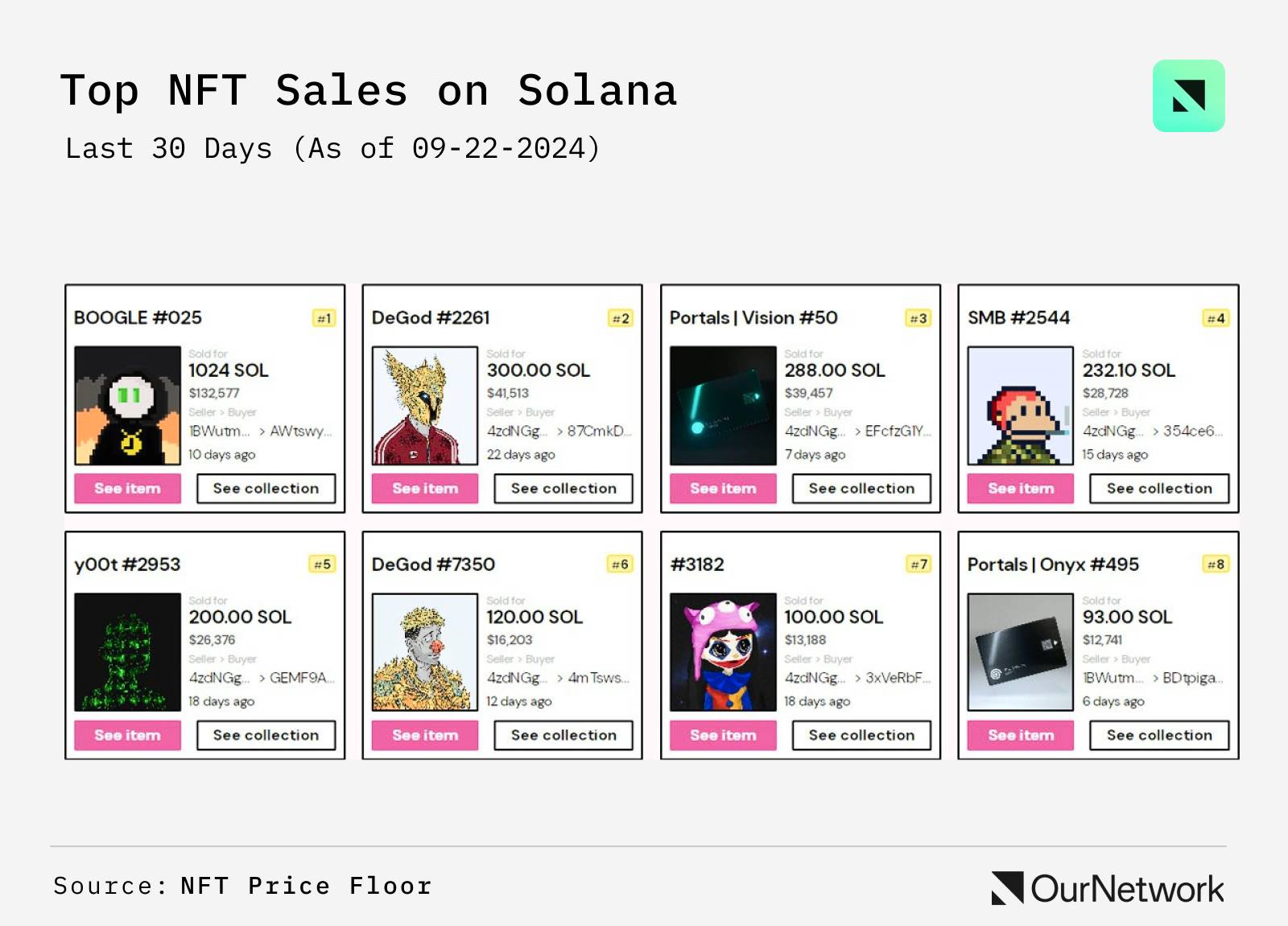

- In the past 30 days, the total trading volume of NFTs on the top four blockchains exceeded 300 million US dollars. Among them, Ethereum accounted for 42%, Solana 23.5%, Bitcoin 18%, and Polygon 16.5%. Although Ethereum's market share has decreased compared to previous years—accounting for about 70% in 2023—it still dominates the high-end NFT market. For example, in the top 30 sales during this period (excluding 1-of-1 NFTs), Ethereum accounted for 29 positions, while Solana only accounted for 1. It is worth mentioning that the top three sales in these Ethereum sales are all CryptoPunks, one with ape features and two with zombie features, each sold for over 1 million US dollars.

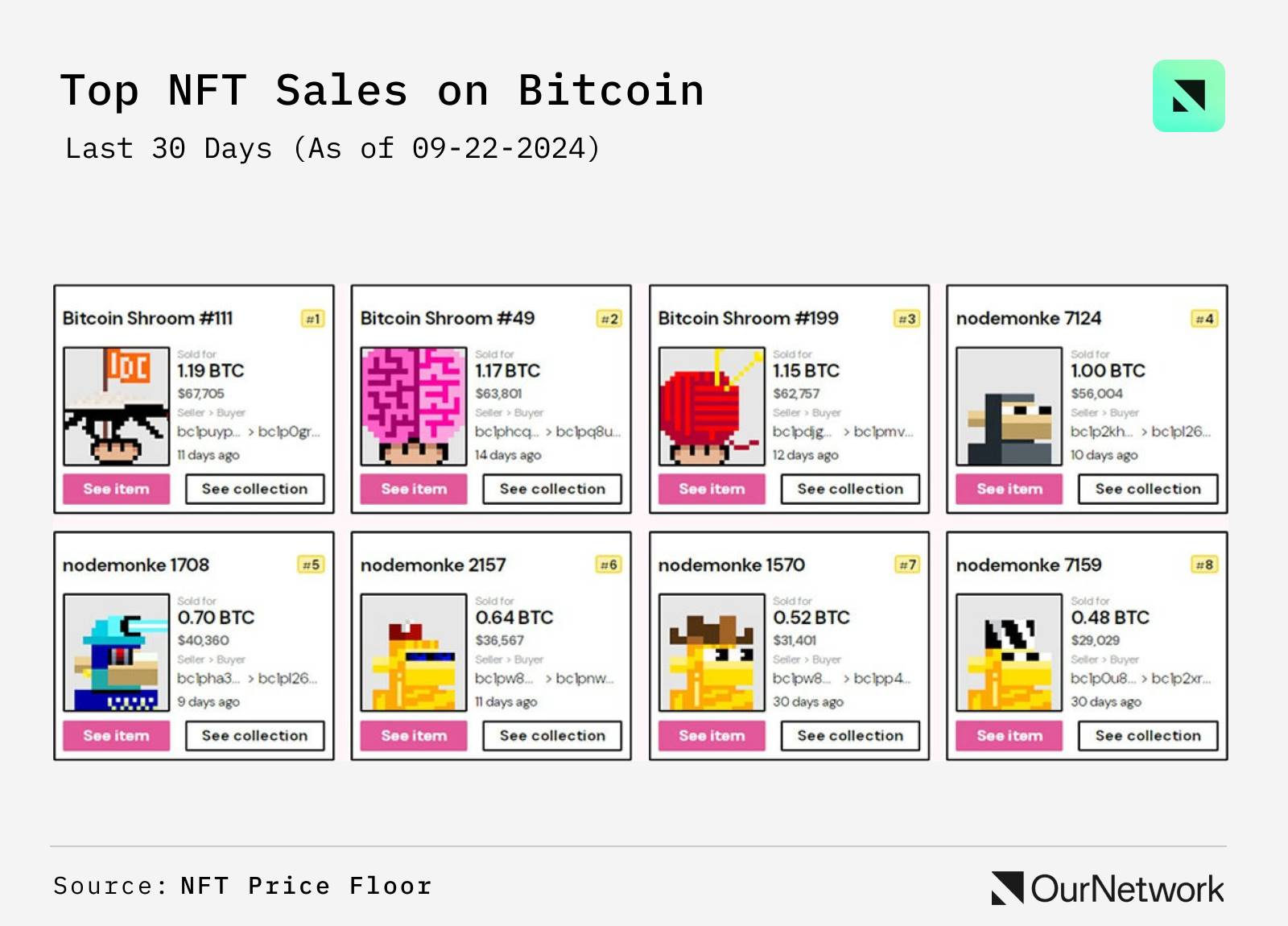

- In contrast, in the past 30 days, only 1 of Solana's top 30 sales exceeded 100,000 US dollars. 13% of sales fell between 30,000 and 40,000 US dollars, while 84% of sales were between 10,000 and 15,000 US dollars. As for Bitcoin, its top 4 sales were all between 60,000 and 65,000 US dollars, with 20% of sales between 25,000 and 40,000 US dollars, and about 66% around 20,000 US dollars.

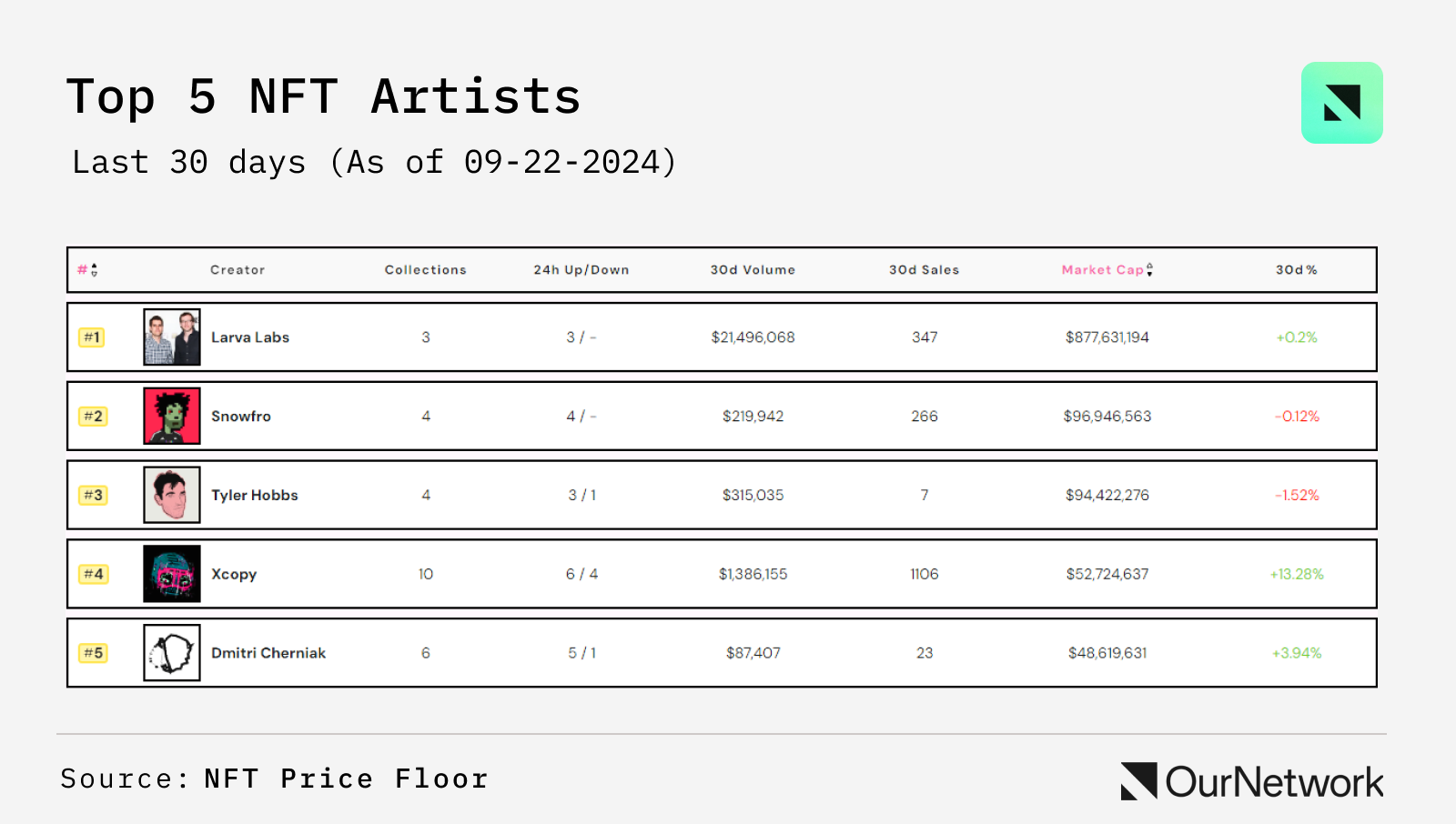

- In the top 30 sales of the previous month—excluding 1-of-1 types—23 were from Larva Labs, and Dmitri Cherniak and Tyler Hobbs each accounted for 1. These two artists are often top sellers in the 1-of-1 collection field. According to the NFT Price Floor's artist ranking, which is ranked by the market value of the artist's collection, the NFT artist XCOPY stood out with a 13% increase in market value, ranking in the top four.

- Trading Highlight: XCOPY's rise in the NFT Price Floor artist ranking reflects the passionate attention of collectors and decentralized autonomous organizations (DAOs) to specific artists and styles. A typical case is Artifaction² recently purchasing The Doomed for 55 ETH, making it one of the top ten most expensive sales in the Known Origin version. Such transactions have promoted XCOPY's market growth, further consolidating his position as a top artist in the NFT field.

Mad Lads

Mad Lads reached a peak of $29,400 in March, with 38% of holders also being long-term Solana users who hold Claynosaurz.

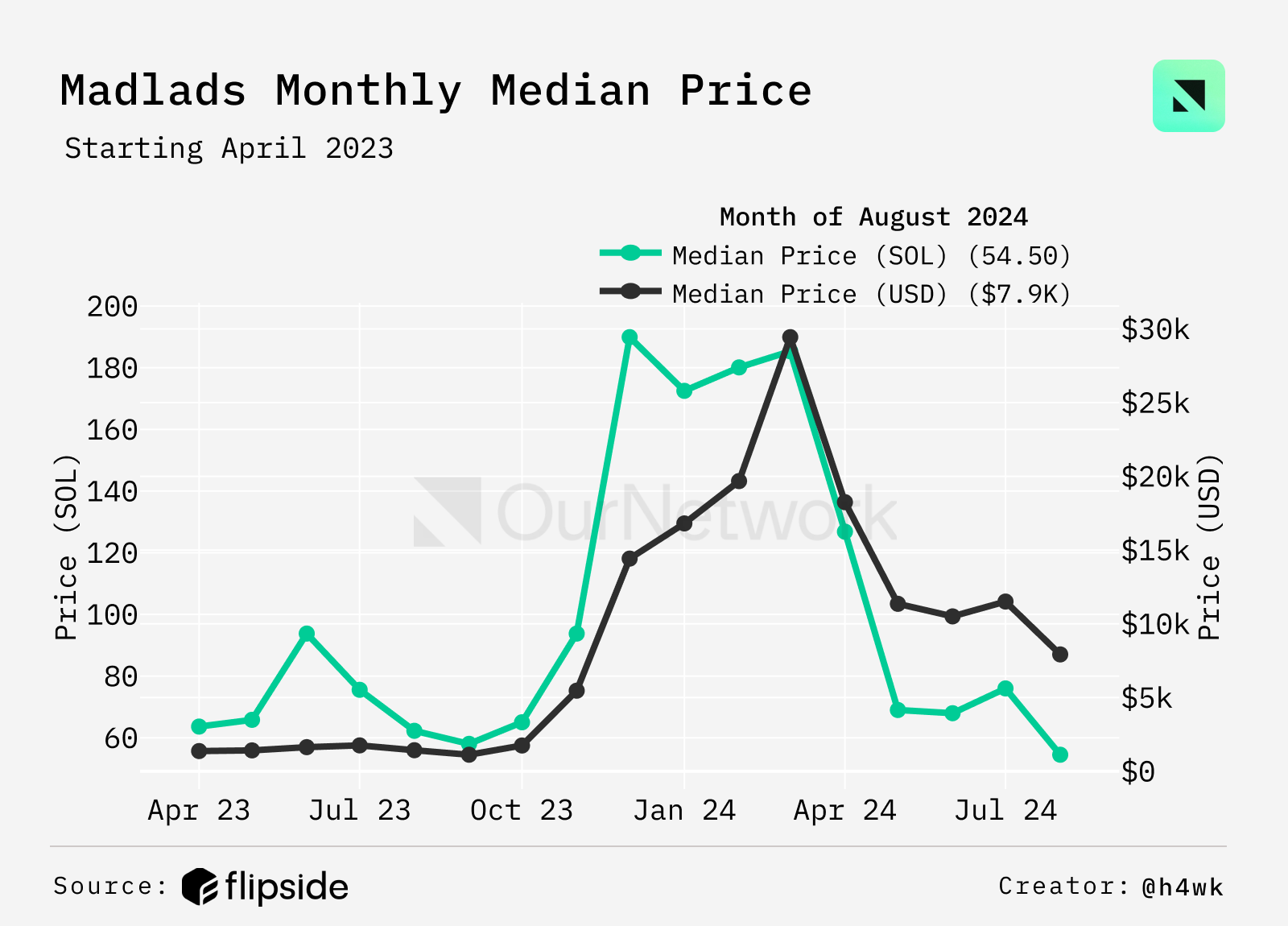

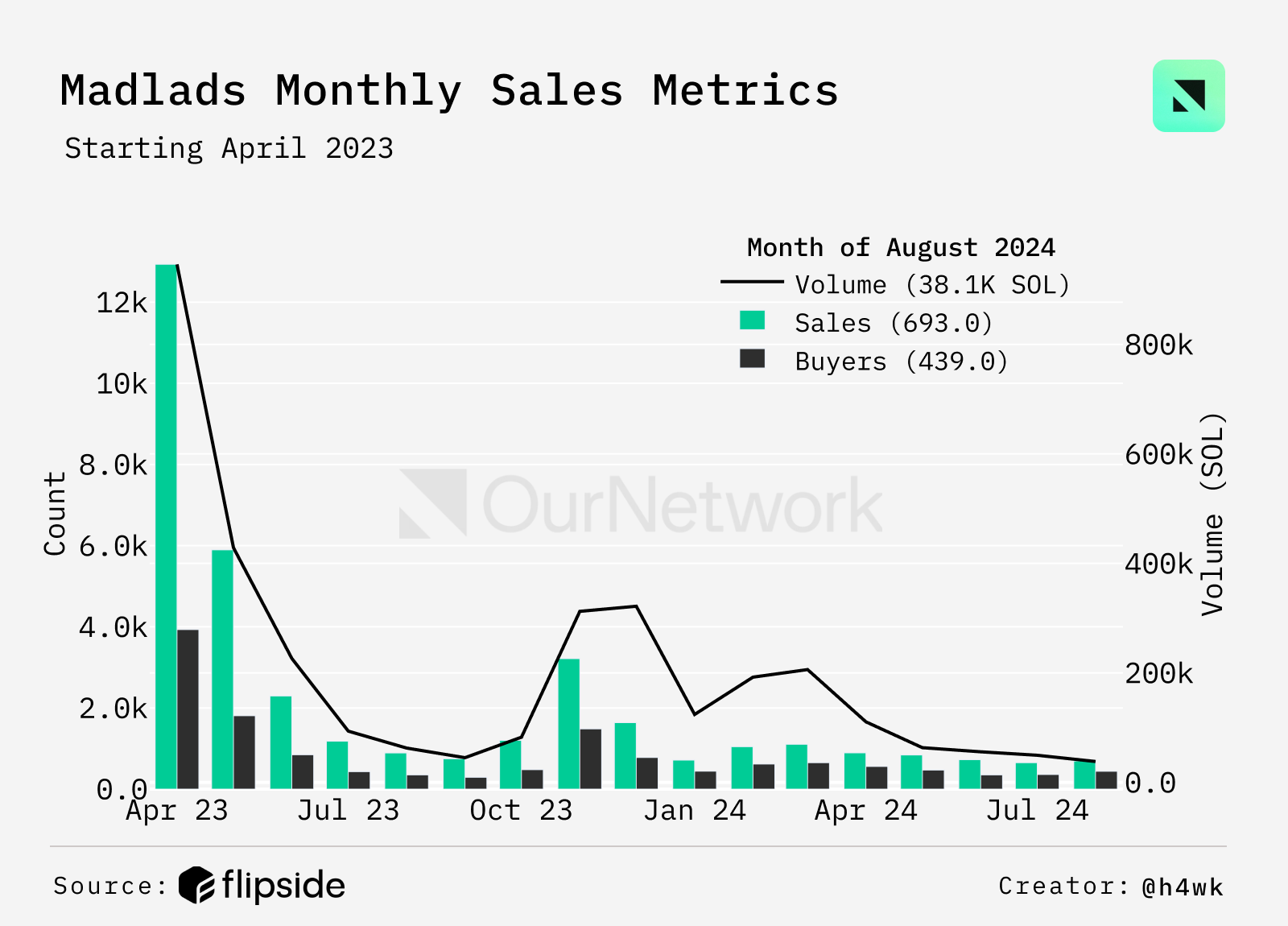

- In the first month after Mad Lads was released in April 2023, 3,900 buyers drove a trading volume of 946,000 SOL, which is approximately 137 million US dollars at the current price. Starting from the middle of 2023, Mad Lads' price slid from a high point of nearly 100 SOL, but rebounded to a median price of 185 SOL (approximately $29,440) in March 2024, and then dropped to and stabilized at 61 SOL (about $8,200) in August 2024. Currently, the price of Mad Lads is 6.25 times that of its first month (in USD).

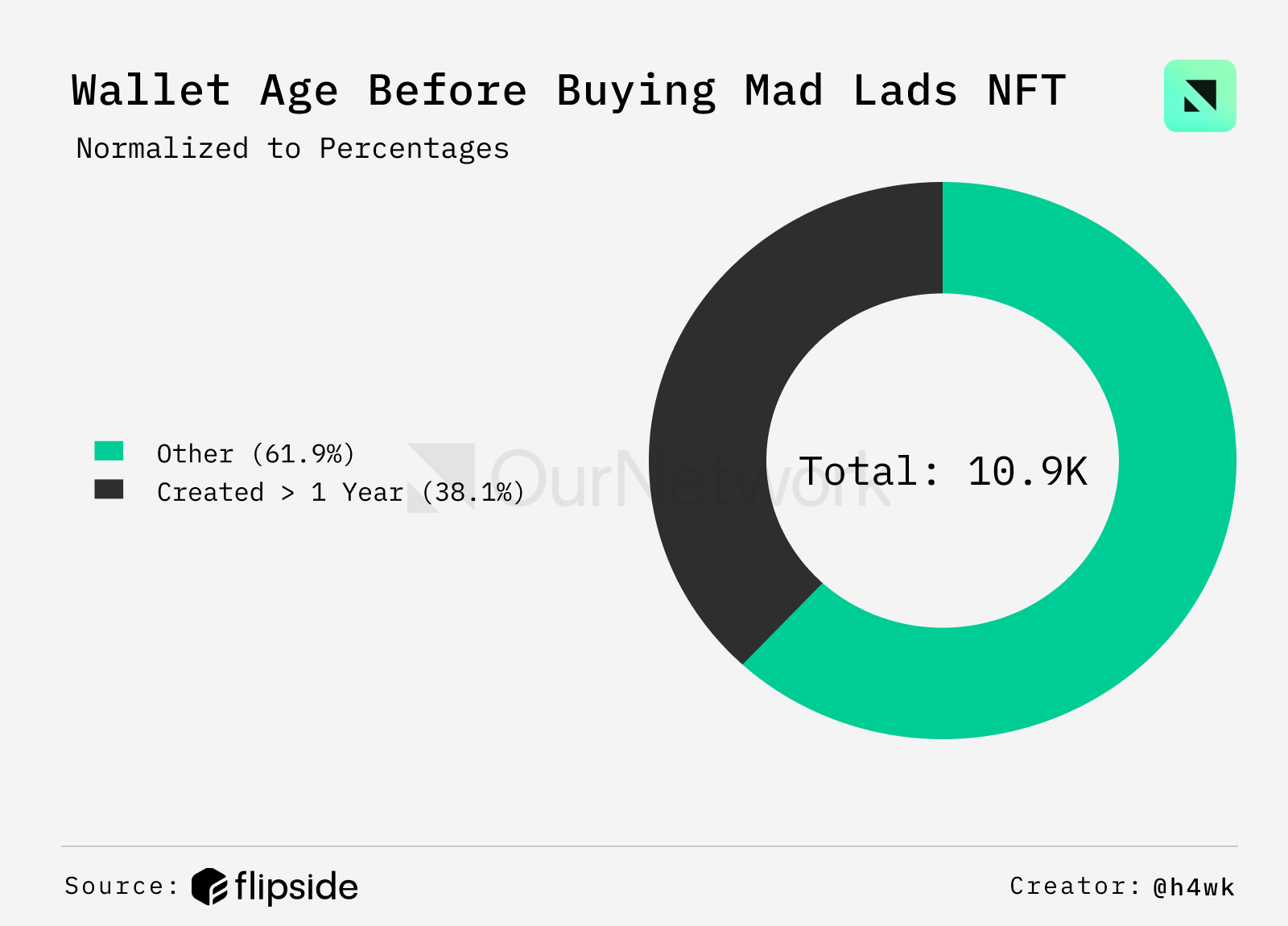

- 38% of Mad Lads holders made their purchases using wallets created before buying NFTs—indicating that a significant portion of Mad Lads purchases come from long-term Solana users, demonstrating their loyalty and deep involvement in the network.

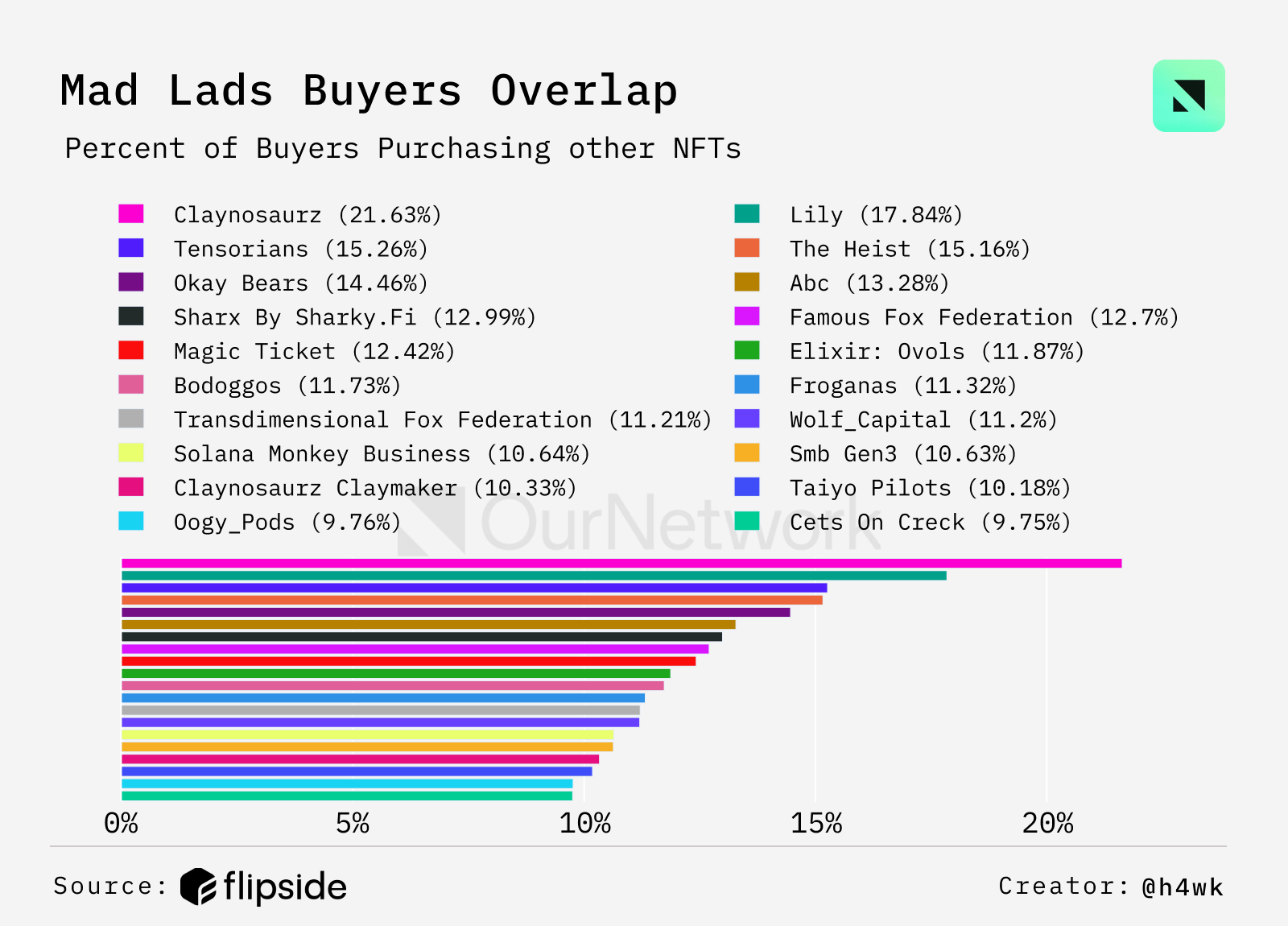

- When analyzing the other NFT collections of Mad Lads holders, it is found that the overlap rate with Claynosaurz's collection reaches 21.67%. Other notable intersections include Lily, Tensorians, The Heist, and Okay Bears, with overlap rates ranging from 14% to 18%.

Pudgy Penguins

Pudgy Penguins currently account for one-tenth of all NFT trading volume

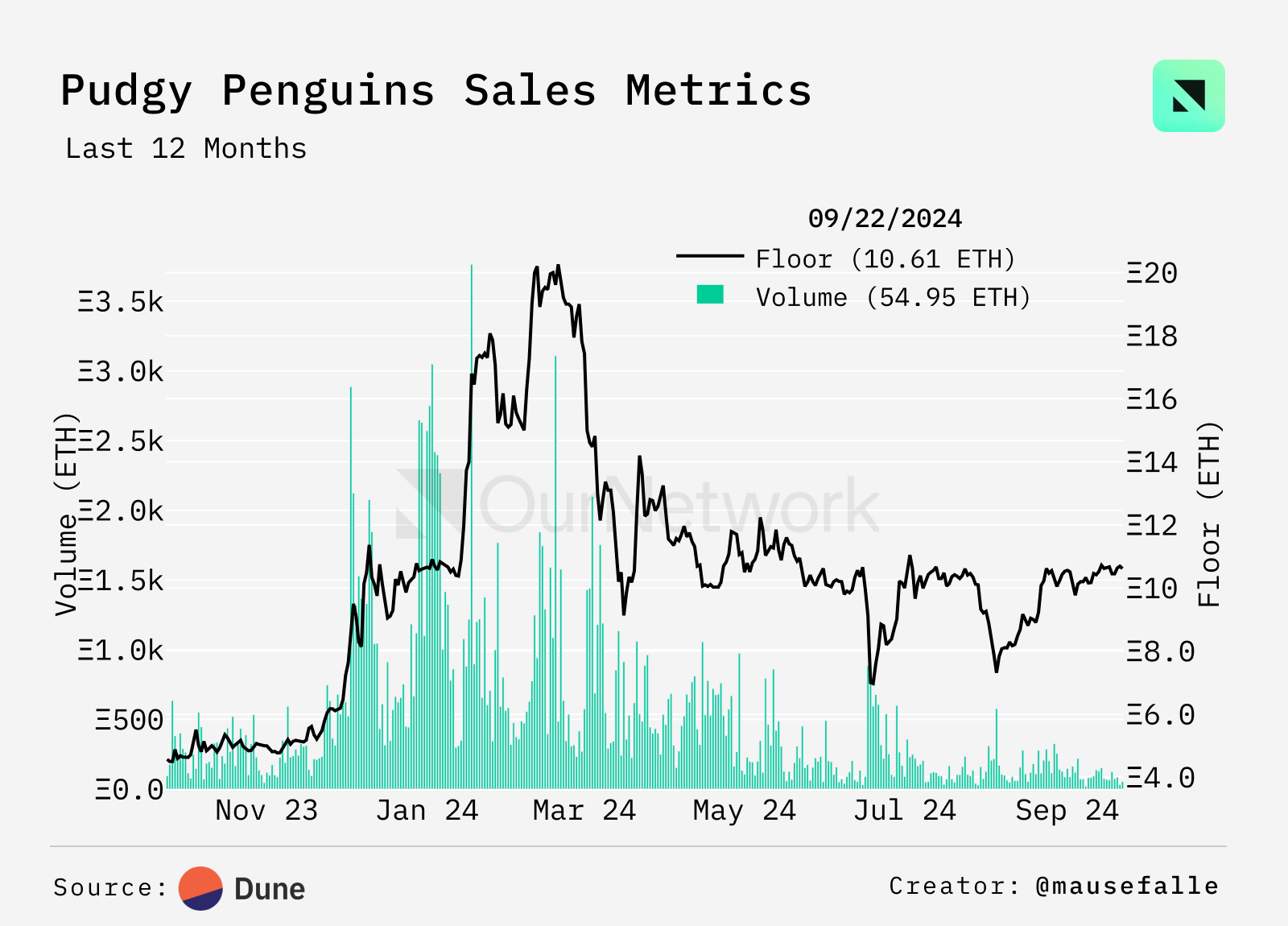

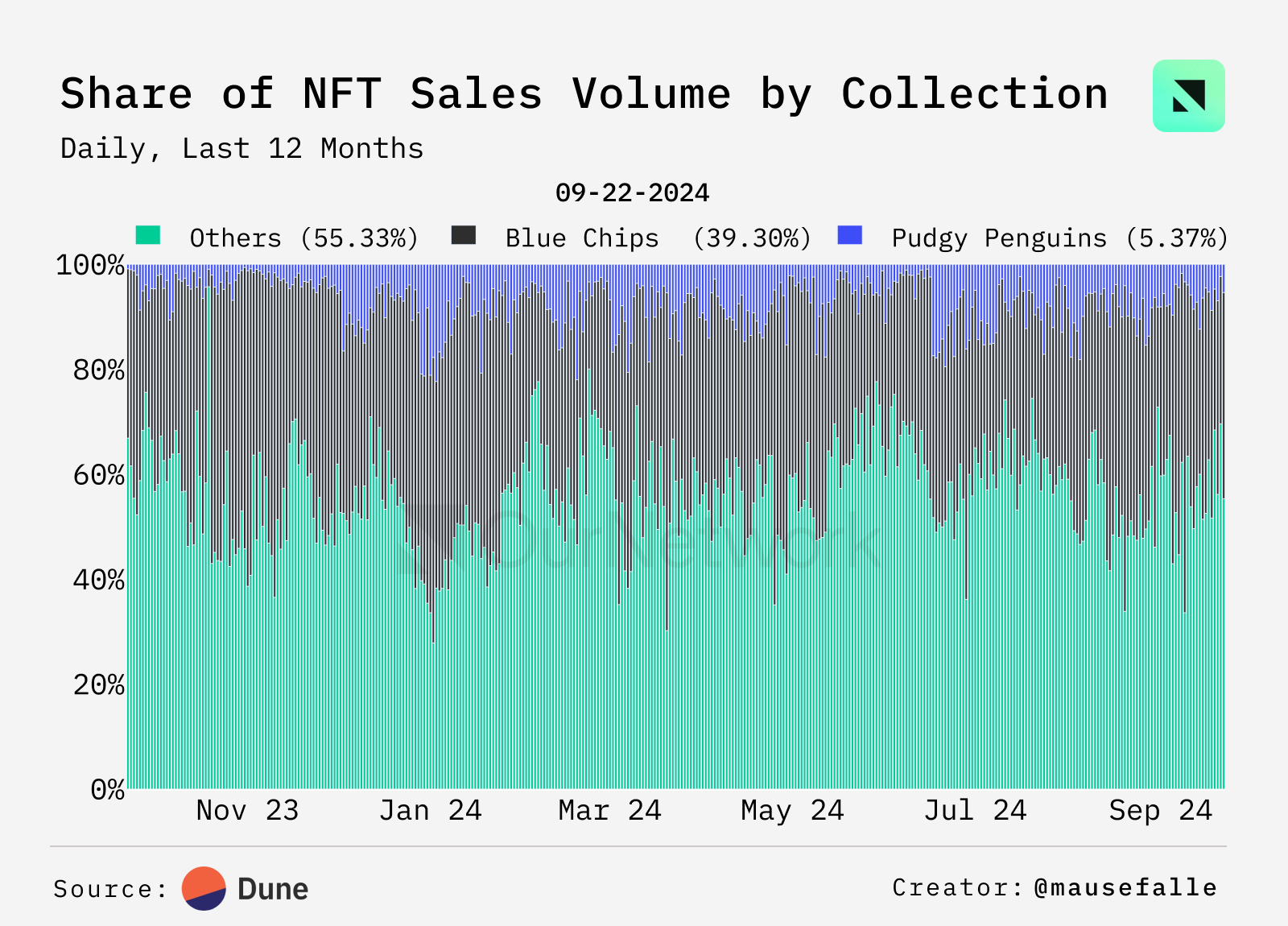

- Pudgy Penguins are currently the third-largest NFT collection by on-chain market value. Since its launch in July 2021, Pudgys have continuously expanded their market share, consistently accounting for 5% to 15% of NFT trading volume priced in ETH since December 2023. This corresponds to a peak price of 20 ETH, followed by a decline. Since April 2024, the lowest price of Pudgys has been hovering around 10 ETH, significantly higher in percentage terms from the historical high compared to other "blue-chip" NFT collections.

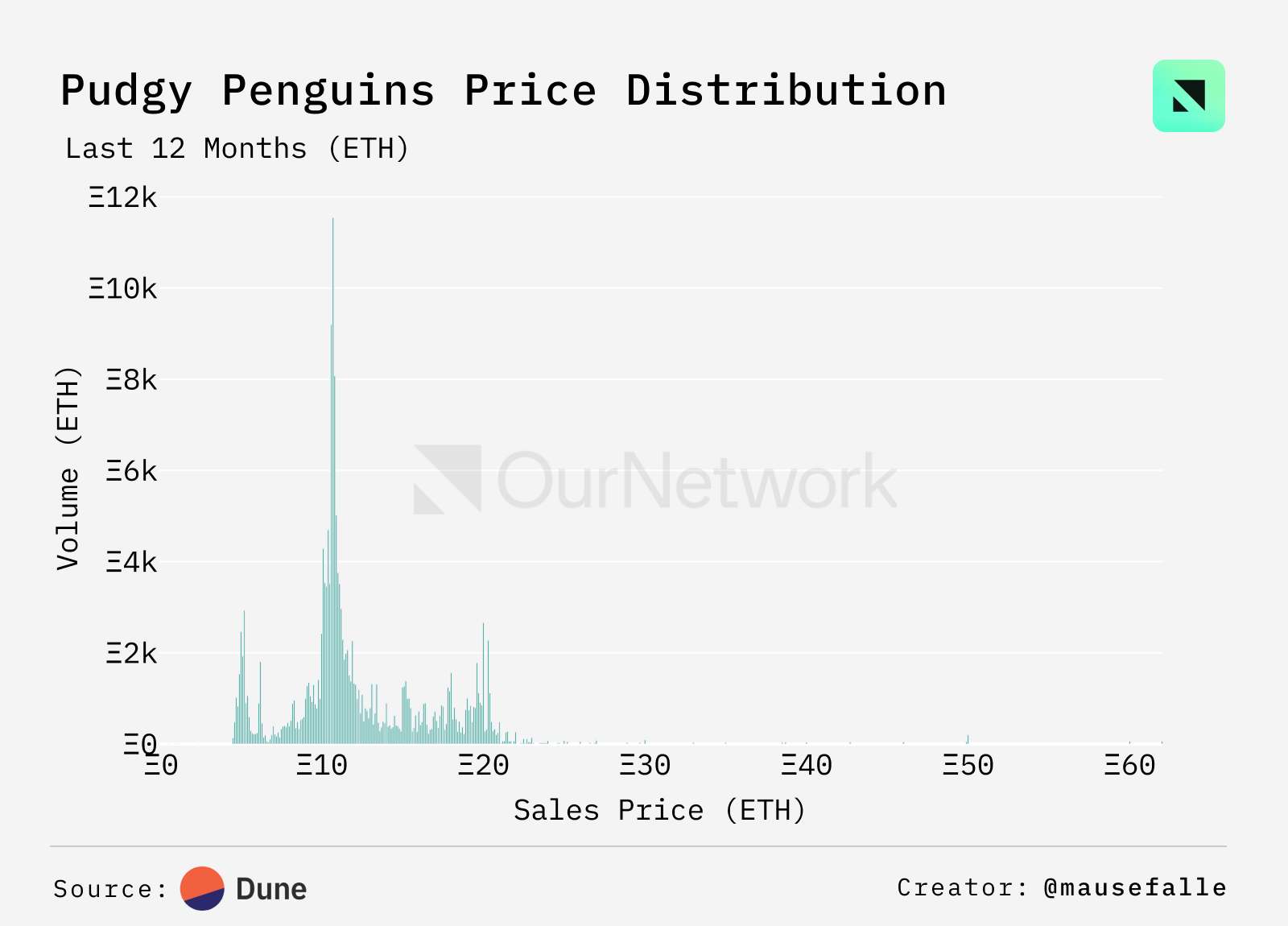

- There have been significant sales at the 10 ETH price point in the past 12 months, indicating a strong consensus in the market on the current floor price of Pudgys. Additionally, minor fluctuations have been observed around 5.9 ETH and 19.9 ETH, indicating secondary price concentration.

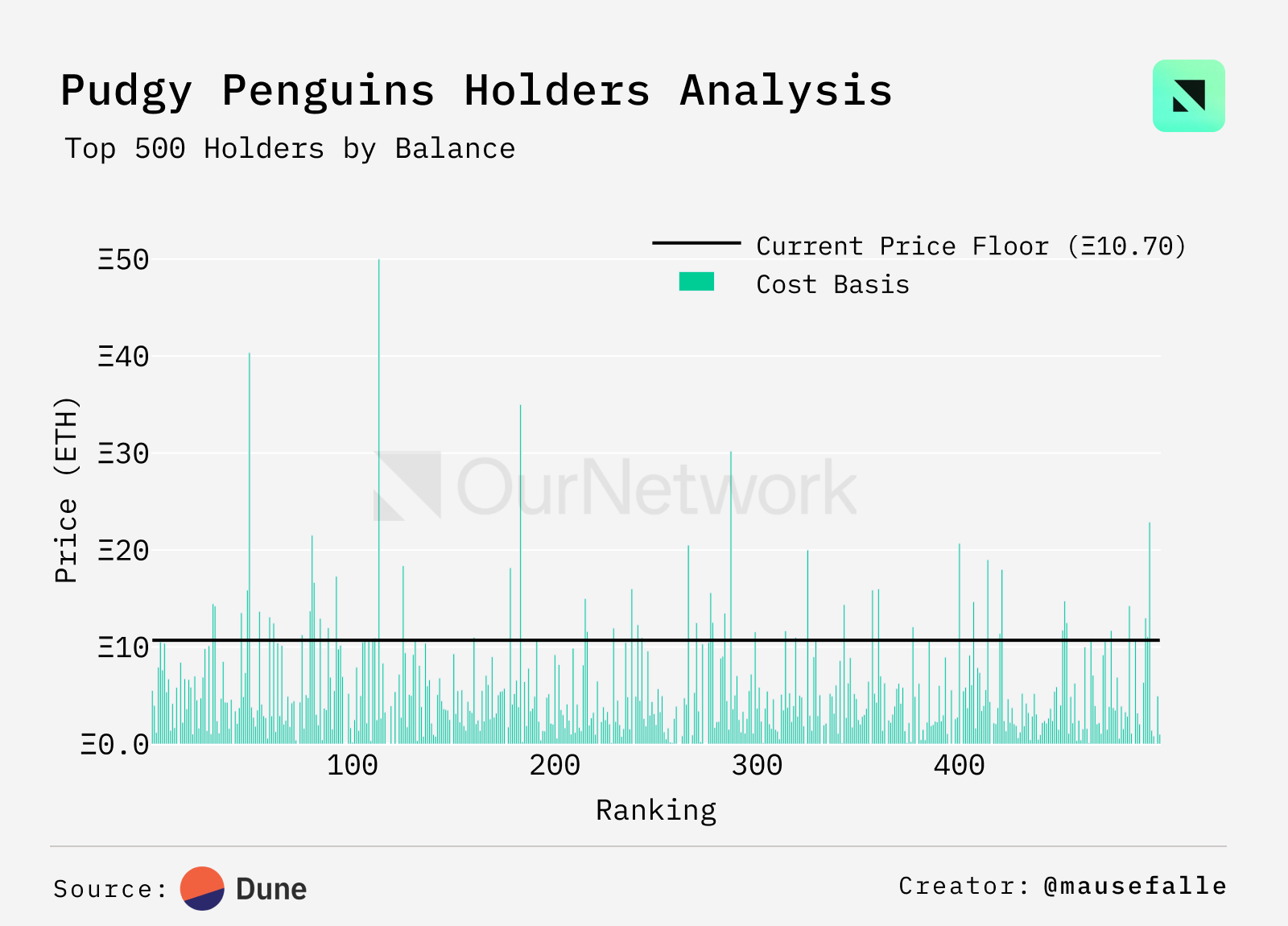

- The cost basis for many holders is much lower than the current price (black line), indicating that most holders are in a profitable state. Some holders have a cost basis much higher than others, reaching up to 40 ETH, indicating that they purchased "rare" Pudgys.

- Trading Highlight: The sale of a Pudgy worth 150 ETH in March 2024 was one of the top 5 sales in the history of this NFT collection and the largest sale of the year. Sale Link

NodeMonkes

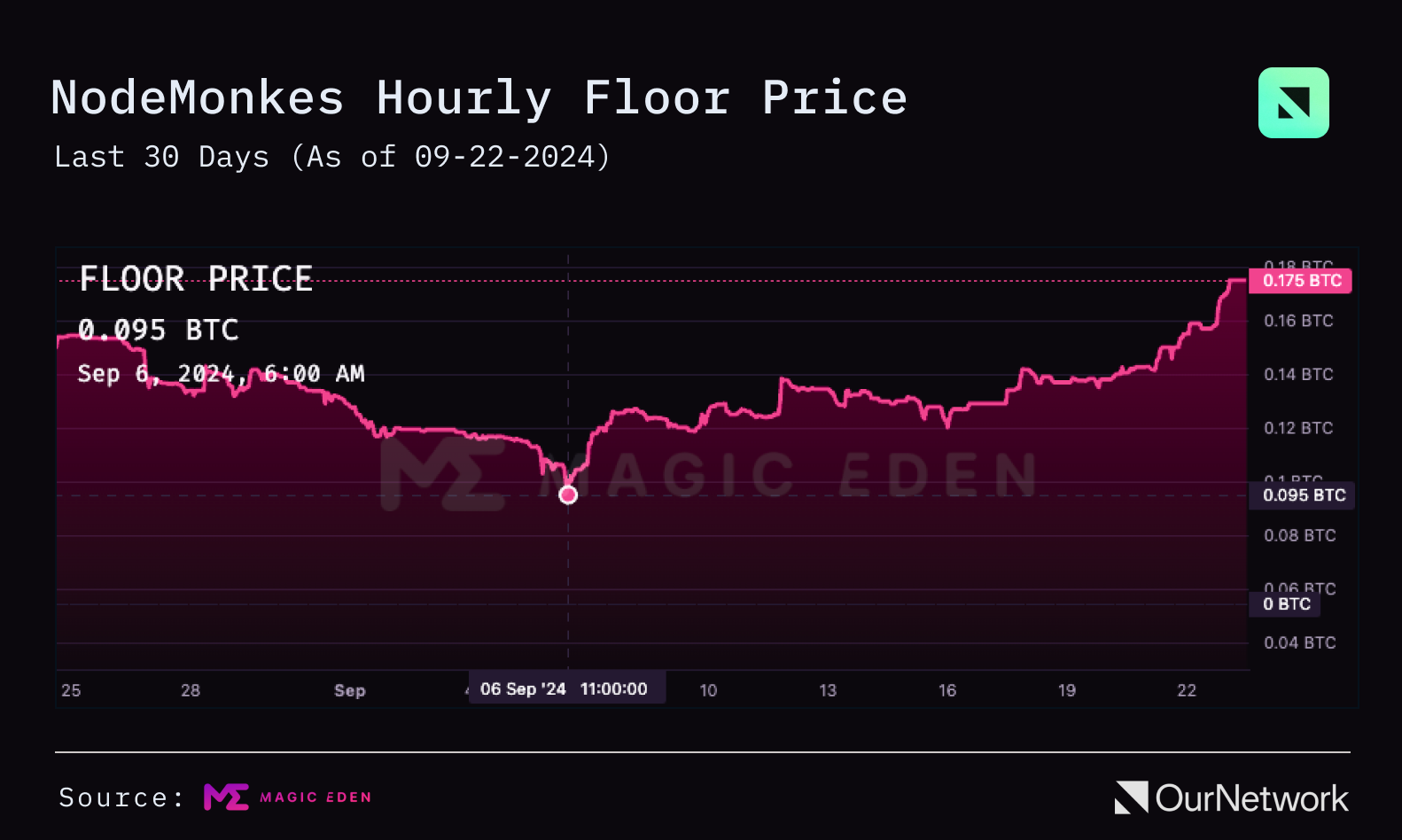

NodeMonkes rebounds by 80%, leading Ordinals to recovery

- The summer was bleak for Ordinals, with leading collections experiencing a 70% to 80% decline. However, there are signs that the bottom may have been formed—NodeMonkes led a rebound in Ordinals, rising 94% from a local low of 0.095 BTC on September 6. They are now priced at 0.18 BTC, the highest level since June 20, effectively recovering from the entire summer decline.

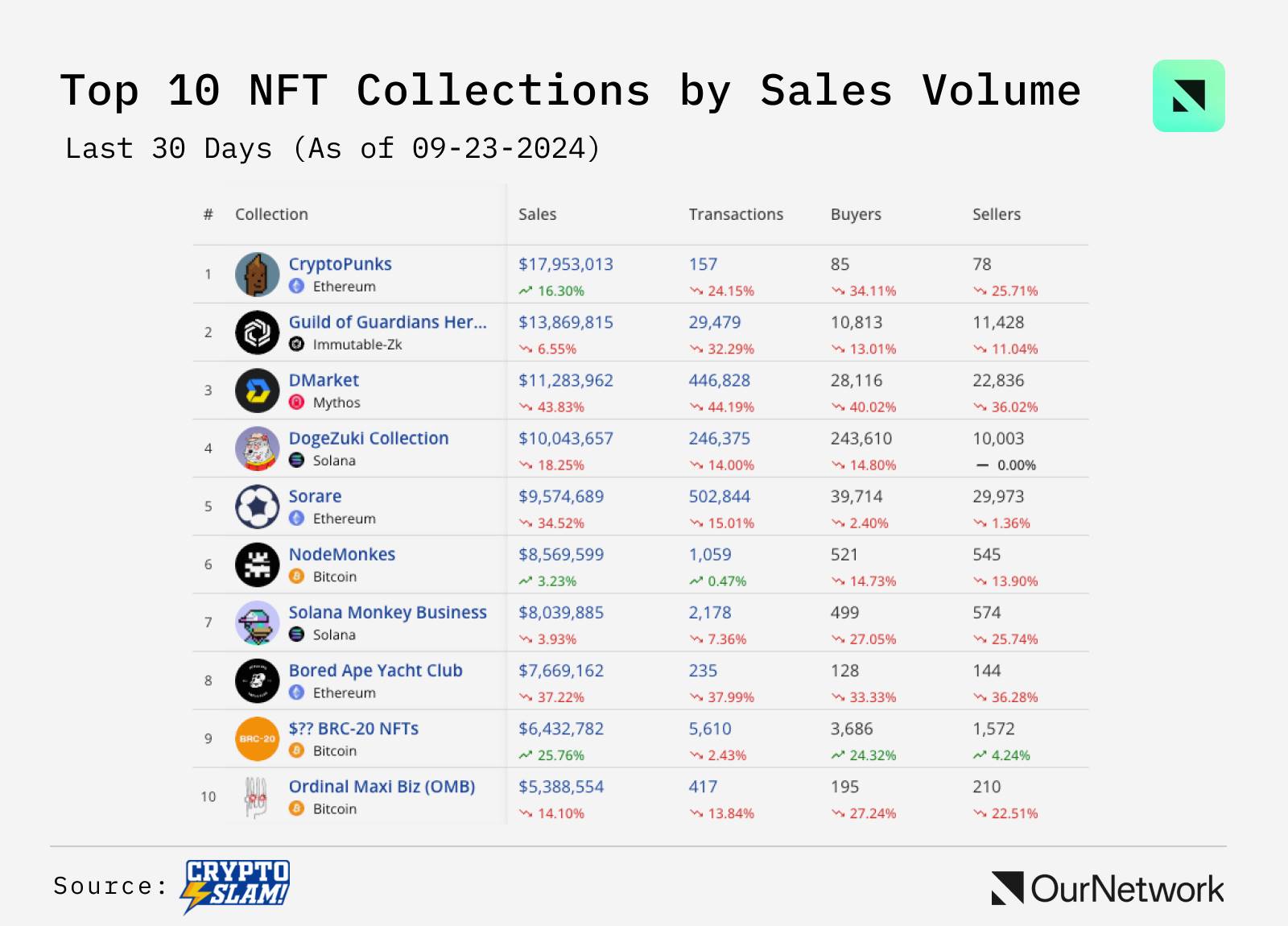

- Cross-chain NFT trading volume indicators reflect the demand for NodeMonkes. According to Cryptoslam data, NodeMonkes ranked 6th in NFT trading volume in the past 30 days, with a volume of 8.6 million US dollars. They are the largest collection in terms of trading volume on Bitcoin, leading by 58%, and second only to CryptoPunks in all Ethereum NFTs.

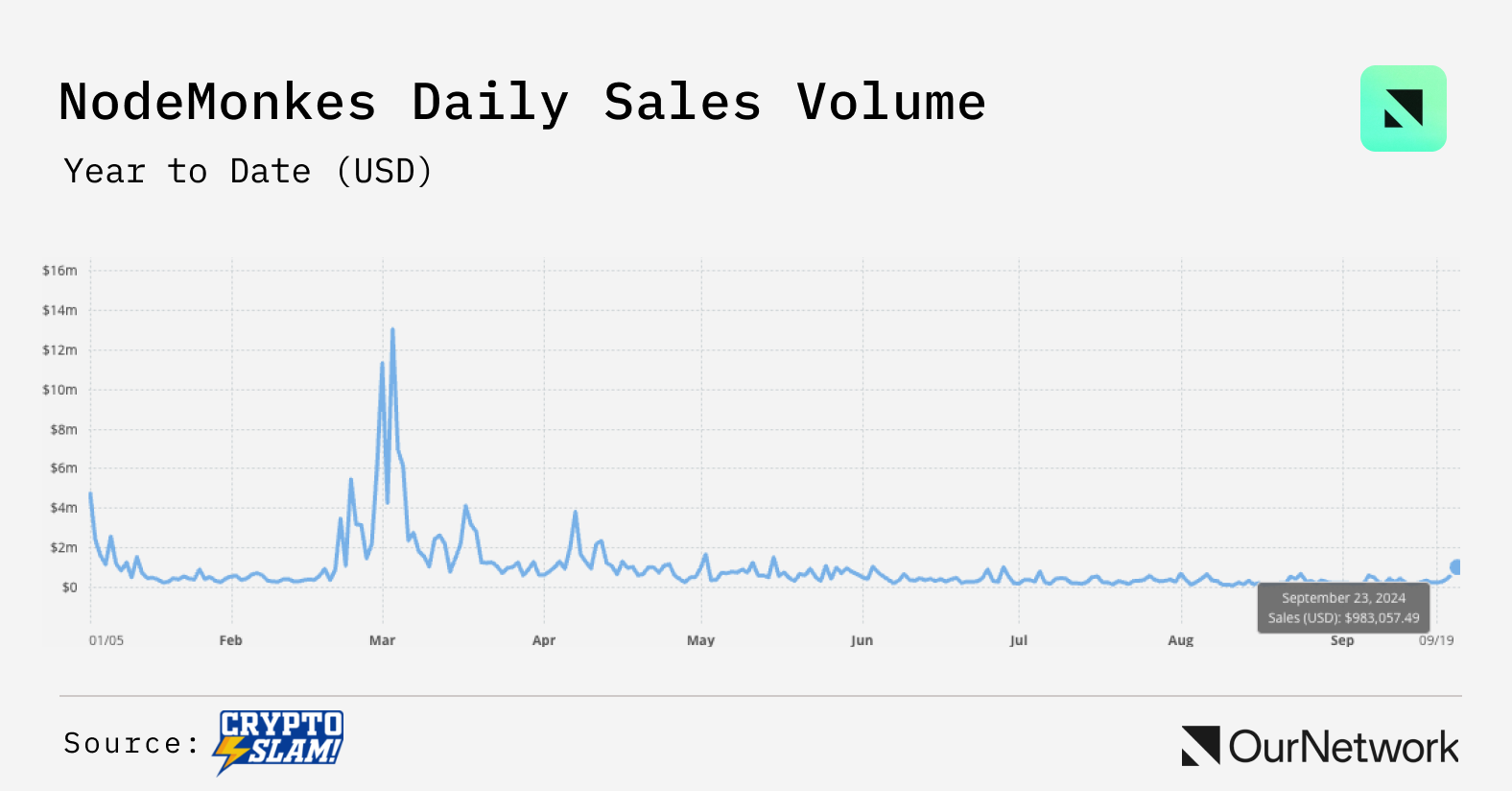

- Not only is the floor price at a local high, but so is the trading volume. NodeMonkes reached a daily trading volume of nearly 1 million US dollars on September 23, specifically 983,057 US dollars. This is the highest daily volume since June 28, almost a record high in 3 months.

- Trading Highlight: NodeMonkes' prices have consistently been higher than the floor price. 11 days ago, a single-featured NodeMonke was sold for 1.02 BTC (57,600 US dollars), 8 times the floor price at the time. In the past month, four NodeMonkes were sold for 0.4 BTC (26,000 US dollars) or higher, with prices ranging from 0.4 BTC to 0.714 BTC. Three of these NodeMonkes have the coveted "golden" skin feature, and the 0.714 BTC Node is considered the 8th rarest in the collection. These sales above the floor price demonstrate genuine collector demand and indicate the overall health of NodeMonkes. Source

CryptoPunks

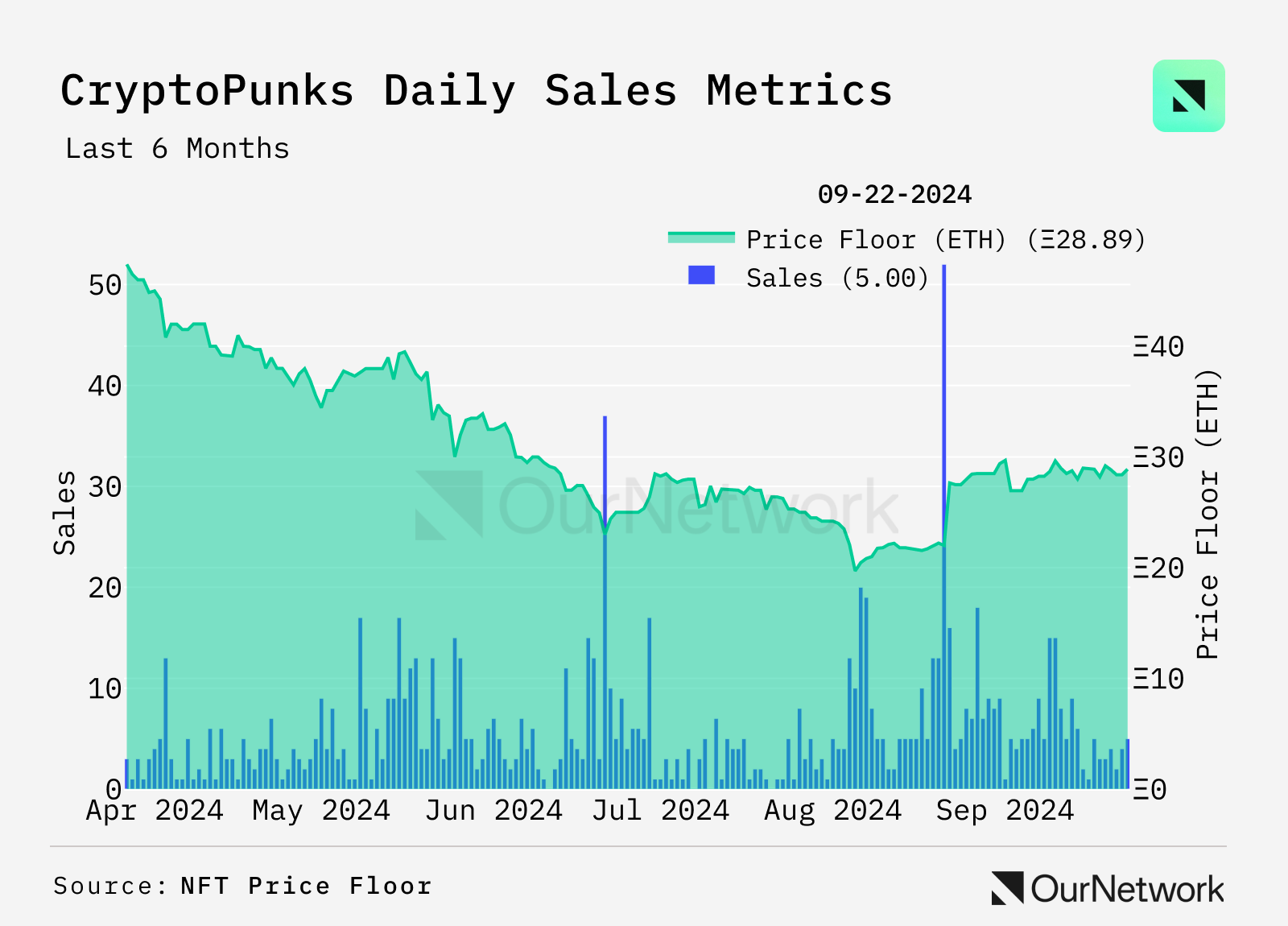

Punks rise by over 45% since early August

- CryptoPunks hit a local low of 19.7 ETH on August 4, after a year of difficult market conditions for the Punks collection and the broader NFT market. However, as of September 22, the floor price has rebounded by 46.6% to reach 28.89 ETH. The collection is still down nearly 75% from its all-time high of 113.9 ETH in October 2021.

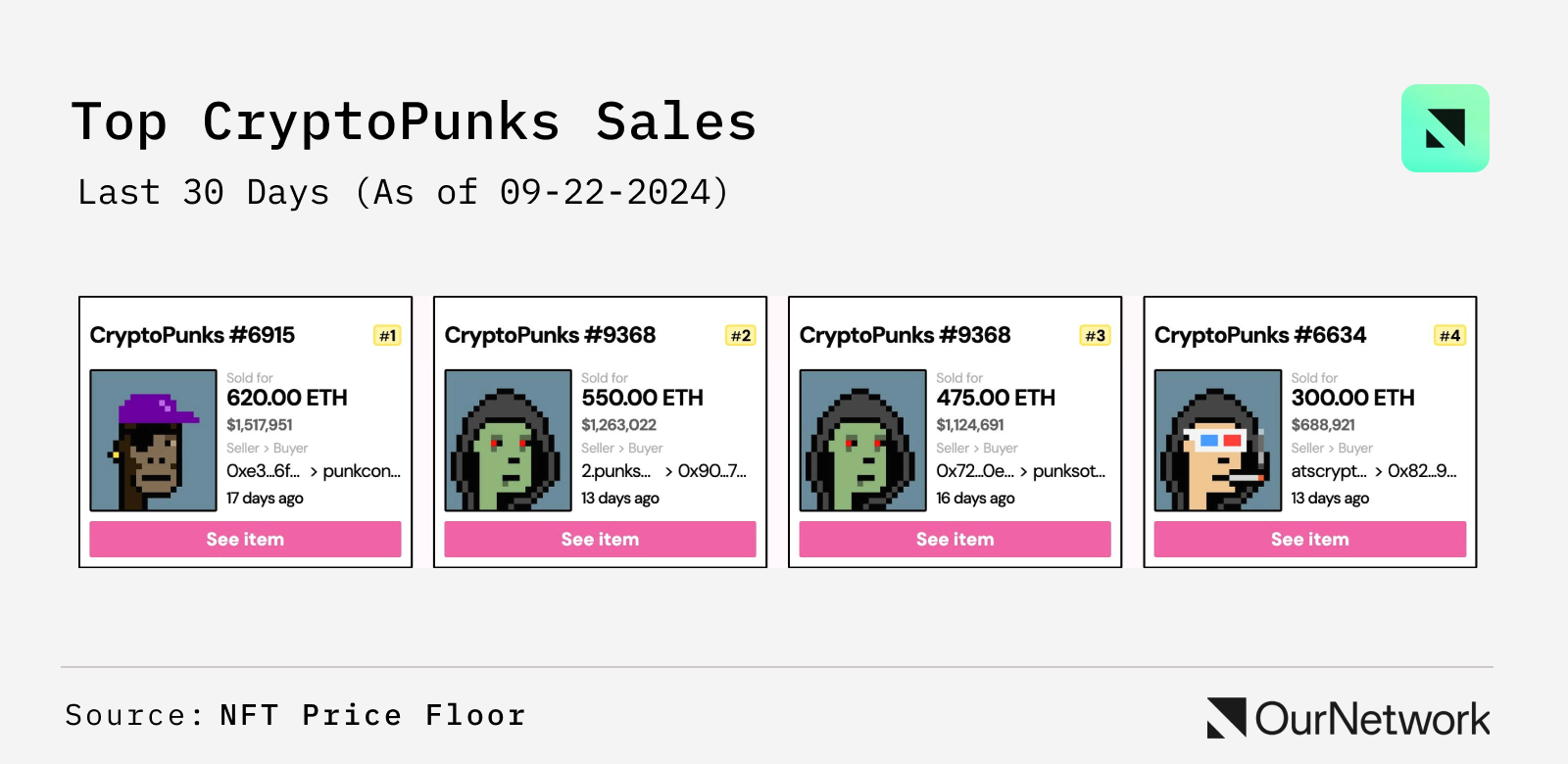

- Several notable Punk sales have occurred in the past 30 days, including an Ape sold for 620 ETH (over $1.6 million), marking the first Ape sale since September 2022. A Punk with zombie and hoodie features was resold for a profit of 75 ETH within three days of purchase. Additionally, the crypto market "whale" known as 0x_b1 purchased a Hoodie Punk with 3D glasses for 300 ETH.

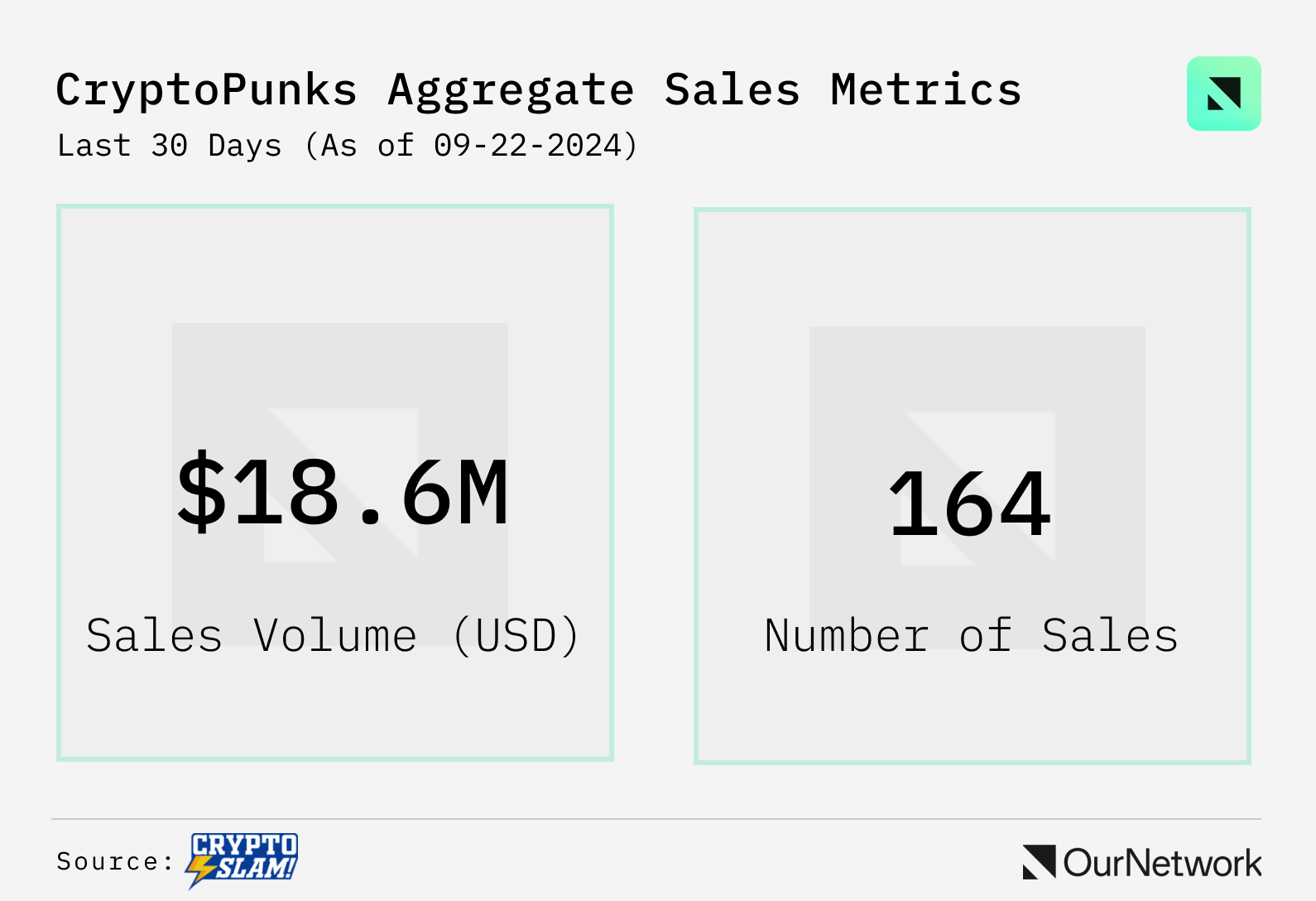

- In the past 30 days, a total of 164 Punk sales have been conducted, totaling over $18.5 million. The busiest day was August 20, with sales exceeding $3.5 million. Transactions include all three tiers—rare, mid-range, and floor price—although reasonably priced mid-range products have received widespread attention.

- Trading Focus: A surprising CryptoPunk transaction occurred, with Ape Punk #2386 selling for only 10 ETH. The asset was initially fractionalized on the now-closed platform Niftex, with the buyer taking advantage of a buyout agreement of 0.001 ETH per share. The proposal was approved after a 14-day shareholder refusal period. This transaction highlights the risk of fractionalizing assets when there are fewer monitors, making it one of the most notable Punk transactions in recent times.

Milady Makers

Dropped by approximately 45% since price discovery

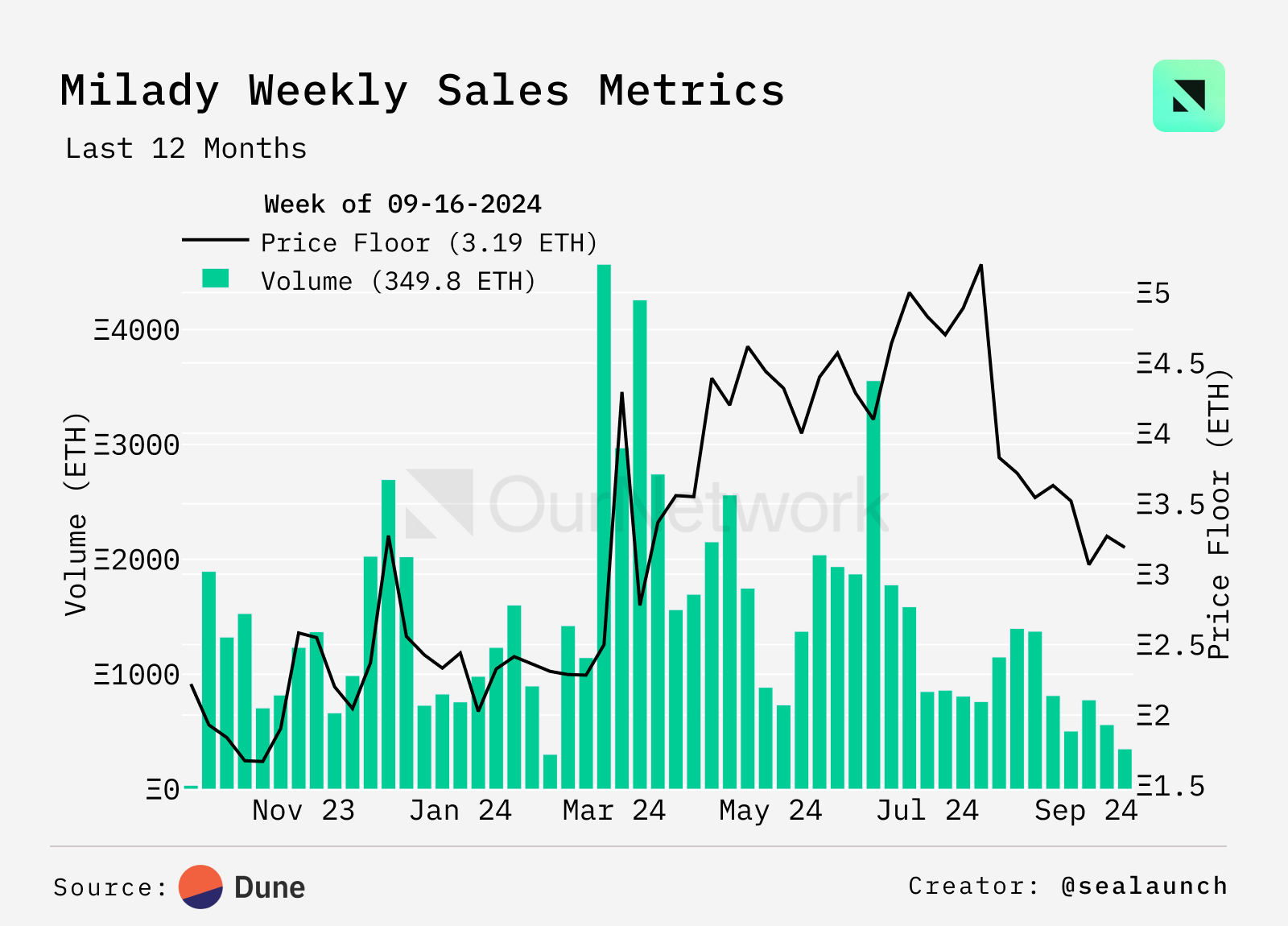

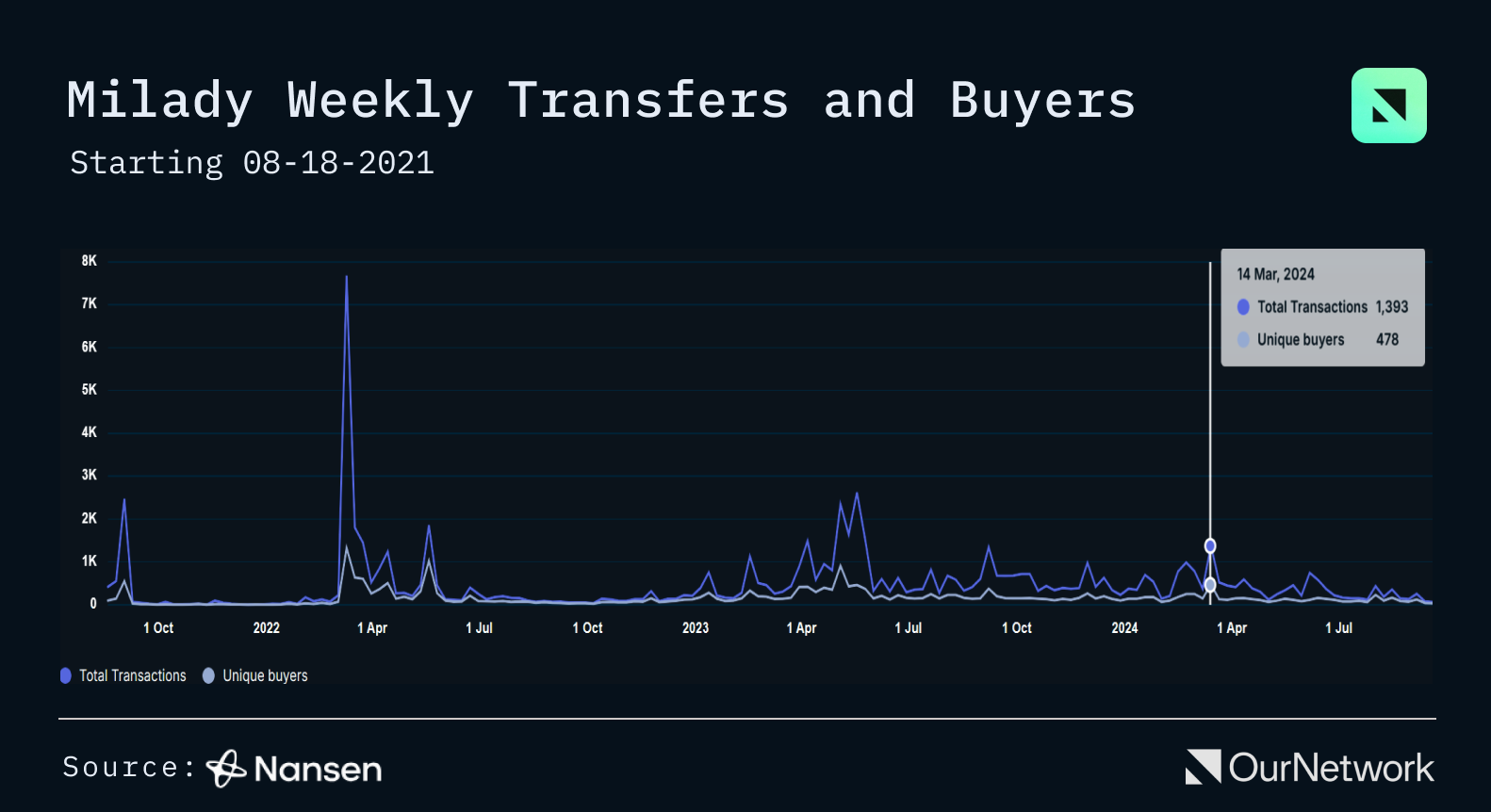

- The trend of NFT airdrops, the concept that holding NFTs can bring airdrops, has greatly promoted the development of the Milady NFT series. In just two months, Milady qualified for three major airdrops from Ethena, Omni, and zkSync (as well as Pudgy Penguins), which drove up prices as buyers anticipated further "free tokens." However, it has been almost three months since Milady holders last received free token airdrops, which may be one of the reasons for the decline in the series' prices and trading volume.

Despite the significant drop in the floor price, the top 100 Milady holders seem unfazed, as they have not reduced their Milady NFT holdings in the past 30 days.

Since reaching its peak at the beginning of the year, Milady's trading volume and the number of independent buyers have continued to decline. However, the Remilia ecosystem token $CULT raised $20 million during the presale, which may activate trading activity and interest—each Milady is eligible for an airdrop worth approximately 2300 USDT.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。