Author: Nancy, PANews

Vitalik's tweet led to a double-digit surge in Celo. As an established public chain, Celo, which originally focused on the concept of ReFi (regenerative finance), is accelerating its strategic transformation towards L2 and stablecoins and has achieved impressive results, adding more highlights to its profile.

Advancing the new narrative transformation of L2 and stablecoins

On September 25th, Vitalik Buterin, the co-founder of Ethereum, tweeted about Celo, driving its token CELO to a short-term high of about 22.3%. Vitalik expressed on X, "Improving global access to basic payments/finance has always been a key way for Ethereum to benefit the world, and I am glad to see Celo gaining attention. My impression is that Celo is clearly focused on developing countries. This is good for them because it is where many important challenges and opportunities lie."

In fact, Vitalik's high-profile praise for Celo is inseparable from its narrative shift. On the one hand, Celo is turning to L2 to "surrender" to Ethereum. Since first proposing the migration from an EVM-compatible Layer1 blockchain in July last year, Celo recently announced its transformation into an Ethereum Layer2 solution, aiming to provide a fast, low-cost, and user-friendly seamless user experience. Regarding this transformation, Celo emphasizes its consistency with Ethereum's culture, stating that "becoming L2 not only makes Celo more closely connected to Ethereum's vast network, but also enables the community to innovate with greater confidence and influence."

As part of this transformation, Celo is currently running two second-layer testnets: Dango, built on OP Stack and upgraded to L2 on September 26th, and Alfajores, which will officially launch its L2 mainnet in November this year.

In addition to this significant transformation, Celo is also focusing on stablecoin payments and the entire RWA track. For example, in February of this year, the Celo Foundation announced the deployment of Circle's US dollar stablecoin USDC on the Celo mainnet, and the following month announced a partnership with Tether to complete the deployment of USDT. To increase user adoption, Celo also allows the use of USDC or USDT to pay gas fees. This decision has received support from dozens of protocols, covering areas such as on-chain savings, lending, remittances, peer-to-peer, and cross-border payments.

Furthermore, Celo has launched the Credit Collective through partnerships and provided 2 million cEUR to support RWA projects, integrated with the RWA protocol Centrifuge, and collaborated to launch the RWA Base Camp accelerator program to further expand its RWA layout.

According to official disclosures from Celo, Celo has established partnerships with over 1,000 partners in 150 countries, including the Opera MiniPay ultra-light stablecoin wallet in countries such as Kenya and Ghana, where the number of users has recently exceeded 2 million. This has also given Celo more confidence in rapidly expanding its influence in the L2 and RWA markets.

Multiple data soar this year, possibly stimulated by stablecoins

Multiple rapidly growing data demonstrate the effectiveness of Celo's transformation measures.

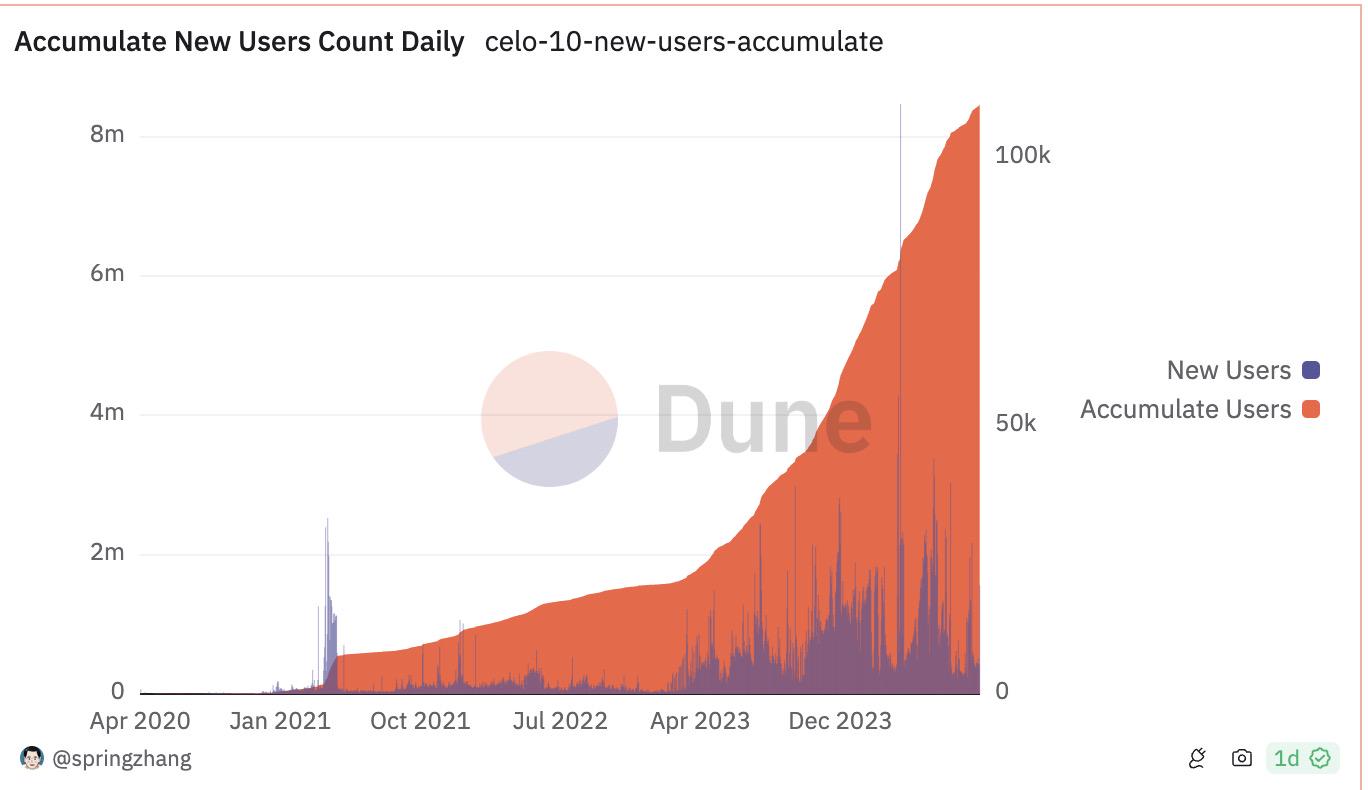

Dune data shows that as of September 25th, the number of transactions on the Celo network has exceeded 470 million, showing a monthly increasing trend, with daily transaction volume more than tripling to 1.2 million transactions since the beginning of this year. The number of user addresses has grown to 8.467 million, with an 84.1% increase this year, and new users accounted for as much as 63.1% in April this year.

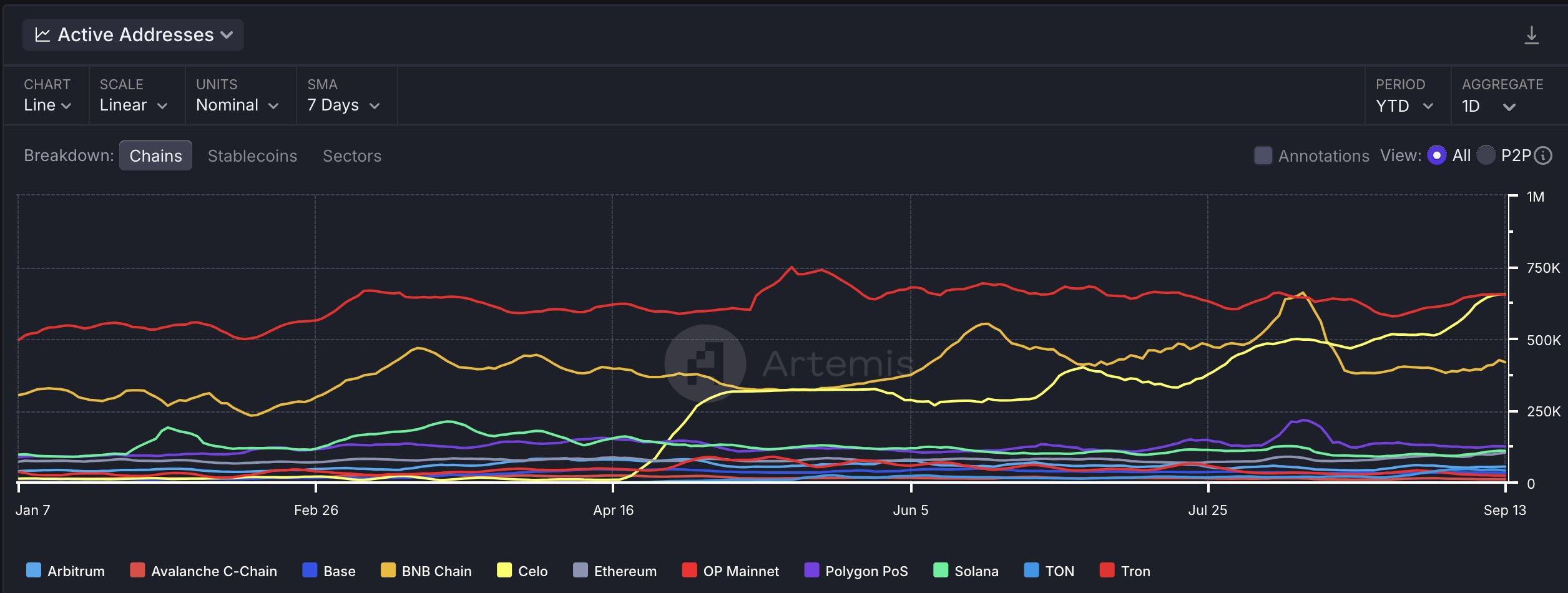

At the same time, Artemis data shows that the recent number of active addresses on Celo has surpassed Tron, BNB Chain, and Polygon PoS. Further data indicates that this increase in the number of addresses is driven by the growth in stablecoin transaction volume on Celo.

Artemis data shows that as of September 25th, the monthly transfer volume of stablecoins on Celo has reached nearly 1.13 billion transactions, with a growth rate of over 28.3% in the past three months, and the stablecoin supply has reached 290 million, a significant increase of about 6.4 times since the beginning of this year. Among them, data from Tether's official transparency page shows that the authorized total amount of Tether on the Celo chain has exceeded 470 million US dollars, surpassing Near and Cosmos, with an authorized but not yet issued amount of Tether on the Celo chain of 269 million US dollars.

In addition, the growth in data based on Celo's ecological wallet applications also confirms the rapid growth of the entire ecosystem. For example, the Web3 payment wallet MiniPay, which was launched in 2023, reached 1 million wallets within five months, and by July of this year, it had increased to 3 million, and has expanded to countries with high cryptocurrency adoption rates such as Kenya, Ghana, and South Africa.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。