The cryptocurrency market is entering the next stage, which is the stage of large-scale adoption of cryptocurrency technology.

Author: Asher Zhang

Vitalik Buterin, co-founder of Ethereum, stated at TOKEN 2049 that the cryptocurrency industry is no longer in its early stages, but is still in its early stages in terms of "practical usability". Overall, the current state of the cryptocurrency industry is indeed as such. The previous performance bottlenecks are no longer a limiting factor, and actual adoption is the issue.

Currently, on mainstream public chains or Layer2, apart from speculative activities being exceptionally active, there are very few real use cases. Since the beginning of this year, after many airdrops ended, on-chain data saw a cliff-like decline. The main reason for this phenomenon is the lack of breakthrough tracks similar to DeFi and applications like Uniswap. However, the cryptocurrency industry is developing rapidly, with Bitcoin and Ethereum being accepted by mainstream financial markets, and many traditional institutions are also actively deploying different Web3 tracks. The future of the cryptocurrency industry is promising. This article takes a look at the most promising public chains and Layer2 from the adoption perspective.

Ripple

Although Ripple and XRP are not currently hot topics in the cryptocurrency market, their gains have been lackluster this year. However, from the adoption perspective, Ripple still wields considerable influence.

Ripple uses a decentralized consensus mechanism called the Ripple Protocol Consensus Algorithm (RPCA). With Ripple, global transfers and settlements can be completed in seconds. Compared to traditional banking systems, Ripple's transaction confirmation time is greatly reduced, making it an ideal solution for cross-border remittances. Ripple has collaborated with numerous financial institutions, banks, and payment processing companies, including Santander, American Express, and Standard Chartered. Through these partnerships, Ripple's payment technology has been more widely applied in the global financial system.

Despite Ripple's significant success, its token XRP has been quite controversial. Previously, the U.S. Securities and Exchange Commission (SEC) accused Ripple of illegally selling unregistered securities XRP. However, the case has made significant progress recently, with Ripple gradually gaining the upper hand. Below is a brief overview of the case.

In July 2023, a court ruling declared that "XRP itself is not a security", and in October, a federal judge decided to dismiss the SEC's appeal. On October 20, Ripple announced that the U.S. SEC had dropped all charges against its CEO Brad Garlinghouse and Executive Chairman Chris Larsen. On August 8, 2024, Judge Analisa Torres of the Southern District of New York ruled that Ripple did not violate federal securities laws by programmatically selling XRP to retail customers through trading platforms. However, Ripple's 1278 institutional sales transactions violated securities laws, resulting in a fine of $125.035 million, far lower than the SEC's requested $10 billion in disgorgement and pre-judgment interest, as well as a $9 billion civil penalty.

Toncoin

In this round of the cryptocurrency market bull run, there has been a lack of significant innovation, but a constant stream of meme and Ton mini-game projects has attracted a large number of users. In the Ton ecosystem, the first to gain popularity was Notcoin. Since its launch on January 1, 2024, its popularity has soared, and the number of participants in the game quickly exceeded 30 million. After Notcoin gained popularity, "Tap to Earn" projects on the TON ecosystem received a lot of attention, with Hamster Kombat and Catizen being particularly popular. Among them, Catizen is a TON ecosystem idle cat-raising chain game created by the Pluto Studio team, the first game on its GameFi platform, with a registration volume of nearly 20 million in just 2 months. Overall, the narrative of encrypted mini-games in the Ton ecosystem has become an undeniable track in this round of the bull market.

The reason why mini-game projects in the Ton ecosystem have been able to gain popularity is mainly due to Telegram. Ton was developed by the Telegram team, and later, due to U.S. SEC regulation, the Telegram team open-sourced Ton to the community. TON adopts a unique multi-layer and multi-chain architecture to achieve high speed and scalability, allowing it to accommodate a massive number of users. Earlier, Telegram was integrated with Ton, allowing mini-game projects built on TON to quickly acquire users from Telegram.

In fact, many Ton mini-game projects are similar to meme projects, just adding some gameplay, and are not fundamentally innovative. Many are essentially a combination of traditional Web2 mini-games and DeFi gameplay, but due to the backing of the large Telegram user base, their user base is very large. Although there is a lack of significant innovation from an innovative perspective, this is still the first stop for many Web2 users to enter Web3, and its significance is still very significant.

Base

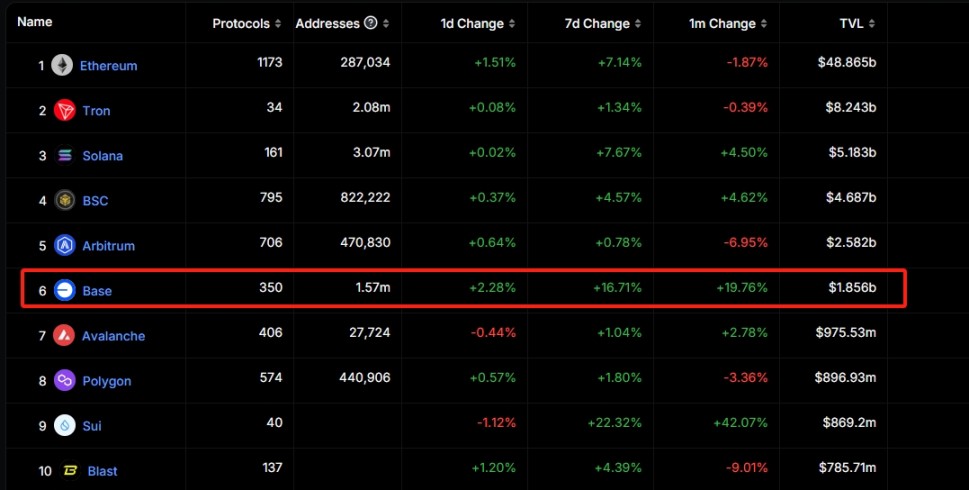

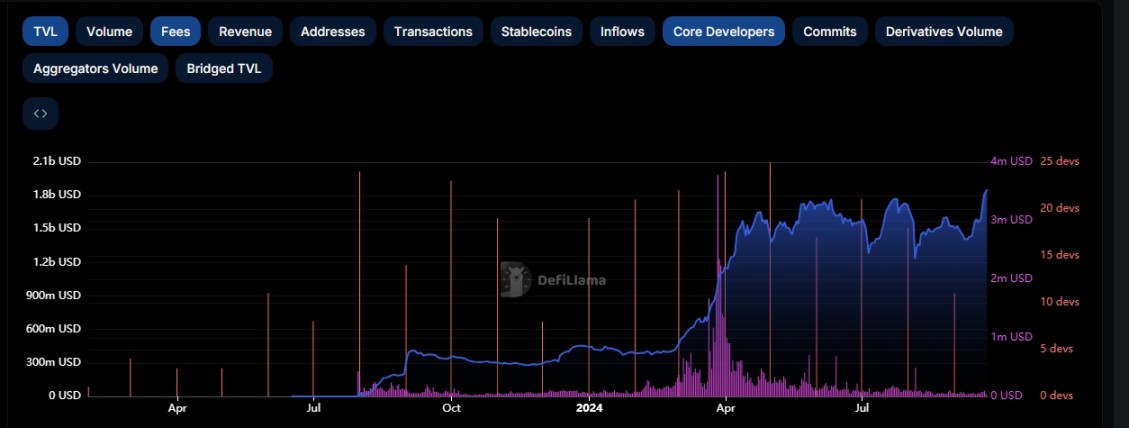

Base is an Ethereum Layer 2 network launched by the largest cryptocurrency exchange in the United States, Coinbase. According to Growthepie data, as of August 15, the number of daily transactions processed by the Ethereum Layer 2 ecosystem has exceeded 13 million (specifically about 13.15 million), with daily transaction volume reaching a historical high, and the driving force behind the overall increase in transaction data in the Layer 2 ecosystem is the Base network. During the same period, Arbitrum had approximately 1.8 million daily transactions, while Op Mainnet had only 470,000, and the daily transaction volume of the Ethereum mainnet has mostly remained around 1.1 million for most of this year. As of September 22, according to Defillama data, Base's TVL currently ranks sixth.

In addition, the developer activity and fee income on Base are both very high, and in just over a year, it has become an undisputed leader in Layer2.

The most well-known applications on Base include Farcaster. Farcaster is a decentralized social networking protocol, and at its peak in July of this year, it had over 100,000 daily active users, and it still maintains 70,000 daily active users. Although its daily activity cannot be compared to the mini-program projects on Ton, it is already high in the cryptocurrency market. In addition, Farcaster's products are quite innovative. With the recent popularity of meme tokens, Farcaster's plugin can deliver these messages to users in a timely manner, leading to more and more meme projects releasing information through Farcaster, and at the same time, a large number of users are also flocking to Farcaster to get the most timely information. In addition, Farcaster founder Dan has developed a Warpcast application based on the Farcaster protocol, which, in addition to traditional social functions, also introduces features such as channels and actions, leading to more interactive ways. This kind of encrypted social innovation is quite significant and is expected to become the leader of SocialFi in the true Web3 world.

Solana

Solana has received a lot of attention in this round of the bull market. Early on, the DePIN track in the Solana ecosystem was highly anticipated by the market, and a group of leading projects emerged, such as Render, Helium, and others. Subsequently, leading projects in the full-chain game and AI tracks also emerged in the Solana ecosystem. Recently, despite the overall weak performance of the cryptocurrency market, the MEME track has once again made Solana the center of attention. pump.fun on Solana directly fueled the frenzy of meme coins, allowing users to easily create meme tokens on the platform without providing liquidity. According to DefiLlama data, pump.fun generated $48 million in revenue in the second quarter, with an average daily revenue of $525,000. Along with the popularity of pump.fun, DeFi on Solana has also seen significant development.

Recently, Solana has successively released three major innovative technologies: Actions, Blinks, and ZK Compression, which have been well received by the market. Solana Actions is an API designed to allow websites to interact with the Solana blockchain to facilitate on-chain activities such as transfers, voting, and donations. Blinks is a tangible representation of Actions, which can be a QR code, a URL, a clickable button, and so on. ZK Compression uses a process called state compression, allowing developers to more economically utilize Solana's ledger space by storing certain types of data in a less expensive account space rather than a more expensive one.

However, Solana's development also faces new challenges. From a technological development perspective, with the modularization trend and the continuous development of L2, the cost of developing Dapp application chains is getting lower and lower. In order to capture more value, many Dapps have chosen to launch their own chains. The most well-known example is the decentralized exchange DYDX. Faced with this situation, Solana is now considering a shift to Layer2. However, if Solana adopts a similar L2 expansion model to Ethereum, SOL may become the new ETH, in which case Ethereum is in an absolute leading position in this regard.

Ethereum and its Layer2 Leaders

From a technical perspective, Ethereum and its Layer2 leaders are indeed unquestionable, but from the perspective of application adoption, Ethereum and its Layer2 leaders are indeed lackluster. Before the launch of the leading coins on Ethereum Layer2, its data was very dazzling, but after the launch, the decline was very dismal. The main reason behind this is Ethereum's Layer2 development strategy, which is still in the stage of technical breakthrough. The most important aspect of this is cross-Layer2 interoperability.

Currently, there are too many Layer2 solutions on Ethereum, and each one has different standards, leading to a silo effect and hindering the development of Ethereum applications. Currently, cross-Layer2 interoperability has made significant progress, with Polygon Labs developing aggregation networks such as AggLayer, Avail, Hyperlane, and LayerZero.

In terms of application development, Arbitrum and Optimism have made the most progress. Arbitrum has attracted many companies to participate in ecosystem development, including heavyweight companies like Franklin Templeton and Securitize, which helps BlackRock tokenize assets. The Arbitrum Foundation announced partnerships with popular NFT brands such as Azuki and ApeCoin. Projects developed based on Arbitrum include the once popular Web3 games Xai and XPET. Optimism is focused on expanding its superchain ecosystem, with many Layer2 solutions built using Op Stack, including well-known ones like Base, opBNB, Zora Network, and DeBank Chain.

Conclusion

Currently, the technology in the cryptocurrency market is beginning to mature, but fundamentally, there are still some missing pieces, such as cross-Layer2 interoperability, so the focus of developers is still on the final stage of overcoming obstacles. However, the cryptocurrency market is also entering the next stage, which is the stage of large-scale adoption of cryptocurrency technology. Among them, Ripple has a large scale due to its early involvement in finance; Ton and Base have developed rapidly due to their backing by large entities, but there has not yet been a truly disruptive application. As for other public chains and Layer2 solutions, their development in the application adoption stage is relatively sluggish. In the future, with the realization of cross-Layer2 and cross-chain interoperability, the focus of developers will shift to application development, and they will work together with users who come through channels such as Ton and Base to drive the prosperity of Web3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。