According to Foresight News statistics, a total of 20 financing events occurred in the cryptocurrency market from September 14, 2024 to September 20, 2024, including 9 in tools and infrastructure, 6 in the DeFi field, 2 in asset management, 2 in chain games and NFT fields, and 1 in the Web3 field. The disclosed total financing amount is approximately $108 million.

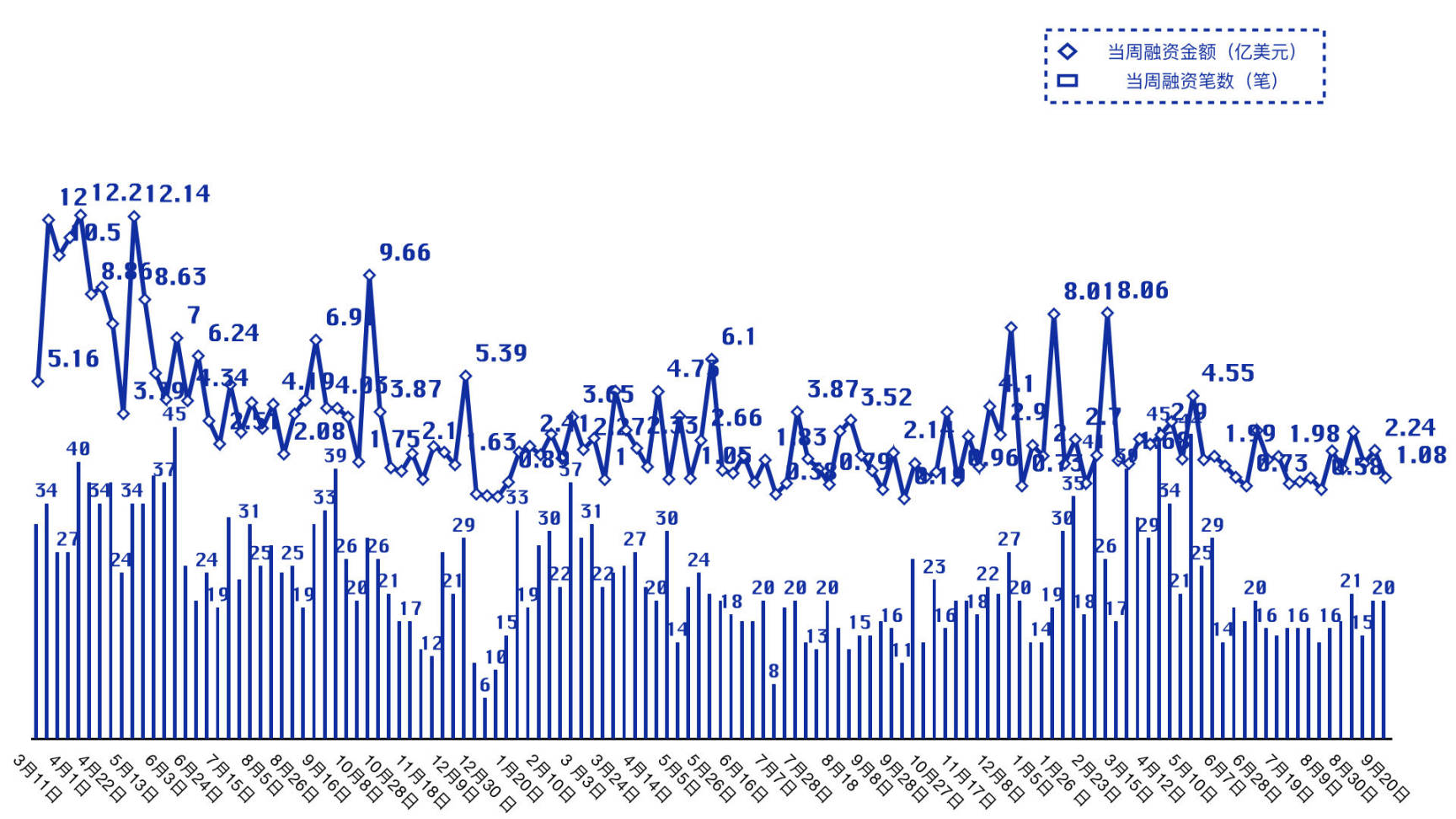

The weekly total financing amount and number of financing projects are summarized in the following chart:

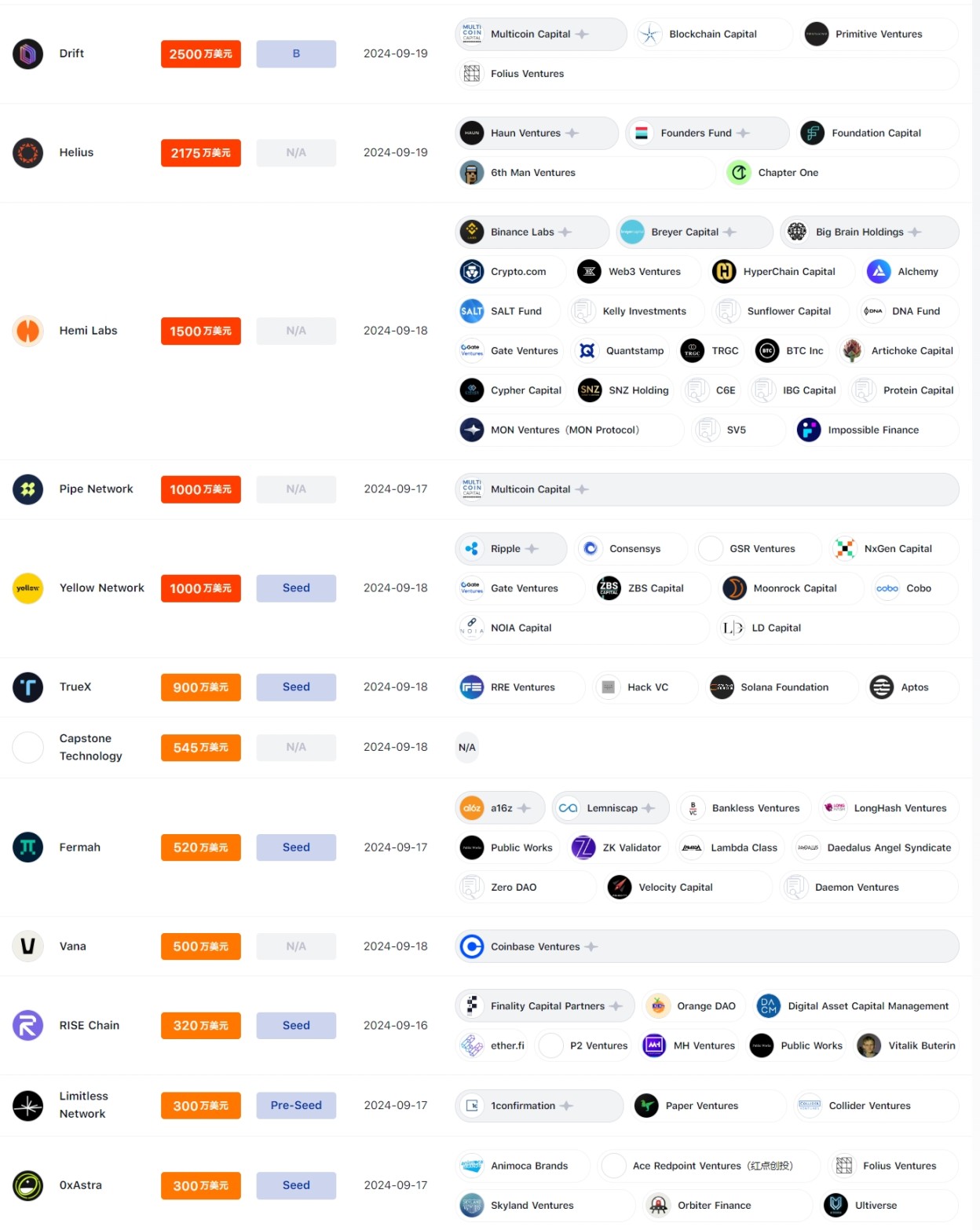

The financing projects for the week, sorted by financing amount, are shown in the following chart:

This week, there were a total of 4 financing events with amounts in the tens of millions of dollars, including Drift completing a $25 million Series B financing, led by Multicoin Capital; Solana infrastructure provider Helius completing a $21.75 million financing, led by Haun Ventures; Yellow Network completing a $10 million seed round financing, led by Ripple co-founder Chris Larsen; and internet infrastructure network Pipe completing a $10 million financing, led by Multicoin Capital.

In the subdivision of financing tracks, the tools and infrastructure fields were relatively active this week, while Web3 was relatively subdued.

In terms of institutions, active institutions this week included Foresight Ventures, Multicoin Capital, and Borderless Capital, mainly focusing on the tools and infrastructure fields.

Tools and Infrastructure

Solana ecosystem edge computing open layer Gradient completes new round of financing

Gradient Network aims to provide cost-effective solutions for AI inference, serverless computing, content delivery, and other scenarios through decentralized edge computing infrastructure. Gradient's first product, Sentry Node browser plugin, has also been launched.

Ore establishes Regolith Labs and completes $3 million financing

Ore is a Solana-based mining project.

RISE Chain completes $3.2 million seed round financing

RISE Chain is an L2 protocol.

General proof generation layer developer Fermah completes $5.2 million seed round financing

Fermah aims to solve problems related to zero-knowledge (ZK) proofs by acting as a ZK proof generation market, using affordable and reliable infrastructure to create proofs for ZK Rollups, ZK cross-chain, and other use cases.

Internet infrastructure network Pipe completes $10 million financing

Pipe will be built on the Solana network and plans to launch a test network at the Breakpoint conference in Singapore.

Yellow Network completes $10 million seed round financing

Yellow Network is a Layer-3 P2P protocol that facilitates transactions and settlements through smart clearing using state channels.

Capstone Technology completes $5.45 million financing

Capstone Technology is a leading company in the blockchain technology and artificial intelligence field based in the United Arab Emirates.

Bitcoin infrastructure Bool Network completes $2 million seed round financing

Bool Network is dedicated to providing self-custody solutions for Bitcoin holders, supporting users to seamlessly participate in stablecoins, restaking, cross-chain bridges, and other DeFi scenarios in a self-custody environment through its original DHC technology combined with Taproot.

Helius completes $21.75 million financing

Helius is a Solana infrastructure provider.

DeFi

Gamified full-chain liquidity aggregation innovation protocol 0xAstra completes $3 million seed round financing

The 0xAstra team consists of senior experts in cryptocurrency, gaming, and internet fields, and has successfully launched multiple popular gaming products. Since its launch, 0xAstra has been integrated into dozens of mainstream L1 and L2 networks. Within 2 months, the platform's cumulative trading volume has exceeded $90 million.

Prime Protocol completes $1.25 million strategic financing

Prime Protocol is a cross-chain liquidity and lending protocol.

Bitcoin full-chain lending protocol Blend completes seed round financing

Blend is a full-chain lending protocol for Bitcoin assets, aiming to provide efficient liquidity solutions for users by introducing Bitcoin as collateral. Blend plans to initially deploy its protocol on chains such as Arbitrum and Base, and will integrate decentralized Bitcoin asset solutions such as dlcBTC.

Drift completes $25 million Series B financing

Drift is a derivatives protocol in the Solana ecosystem.

Amnis Finance completes $2 million financing

Amnis Finance is a liquidity staking protocol on the Aptos blockchain.

Sei ecosystem derivatives DEX Filament completes $1.1 million seed round financing

Filament, developed by a team with experience at Goldman Sachs, BlackRock, Persistence, Nethermind, and Open Status, is built on the Sei network. The platform introduces a new hybrid model that combines segmented liquidity pools with an order book, enabling it to operate efficiently under low liquidity conditions.

Asset Management

Velo Labs receives second strategic investment from UOB Venture Management

Velo Labs will provide Web3-based financial solutions and settlement networks for value transfer.

TrueX completes $9 million seed round financing

TrueX's parent company is True Markets, co-founded by Vishal Gupta, who previously served as the head of Coinbase Exchange and Circle's USDC, and former Coinbase engineer Patrick McCreary.

NFT and Chain Games

Ambrus Studio completes multi-million dollar financing

Ambrus Studio is a chain game developer.

Solana upstream game engine MagicBlock completes $3 million Pre-Seed round financing

MagicBlock will expand the engine for real-time on-chain games and consumer applications on Solana, addressing the current limitations of on-chain applications in performance and scalability.

Web3

Limitless Network completes $3 million Pre-Seed round financing

Limitless Network is a prediction market.

Other

Foresight Ventures, MEXC Ventures, and Mirana Ventures establish funds for Aptos ecosystem expansion

Foresight Ventures, MEXC Ventures, and Mirana Ventures have established a fund for the expansion of the Aptos ecosystem. The fund will target promising projects based on the Aptos platform, providing resources for the development of key Web3 use cases, Block-STM, and seamless interoperability with key EVM ecosystems.

LayerZero collaborates with a16z to launch the lzCatalyst program, with participating funds incentivized to invest $3 billion in LayerZero integrated projects

The lzCatalyst program aims to help developers access a large amount of capital and resources. Participating funds will be incentivized to invest $3 billion directly in projects integrated with LayerZero, while maintaining their independent due diligence and investment processes.

Borderless Capital launches $100 million DePIN fund

Borderless Capital has launched its third DePIN fund, with a support amount of $100 million. The fund's investors include blockchain Peaq, which focuses on DePIN, as well as the Solana Foundation and Jump Crypto, among others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。