Author: @Web3Mario(https://x.com/web3_mario)

Abstract: First of all, I wish everyone a happy Mid-Autumn Festival. During the holiday, I discovered an interesting topic and researched World Liberty Financial, a DeFi project that has been highly popular in the past few days. This project, deeply involved by members of the Trump family, made more detailed commitments in a Twitter Space event on September 17, including the distribution of WLFI tokens and the project's vision. Trump also spent a long time expressing optimism about the cryptocurrency field during the meeting. So, for a project that doesn't seem very "Web3 style," how should we grasp its value? On this point, the author has done some research and shared some insights with everyone. In general, I believe the core value of World Liberty Financial lies in finding new fundraising channels to alleviate the fundraising disadvantage of Trump's 2024 campaign. Therefore, the essence of investing in WLFI tokens is a bet on Trump's election, a form of political donation.

Controversial Image of World Liberty Financial with Negative Implications and a Lack of Specific Roadmap

Many articles have introduced the background of this project, so I will briefly review it here. In fact, since its announcement, the project has been quite controversial, with the focus of the controversy centered on three aspects:

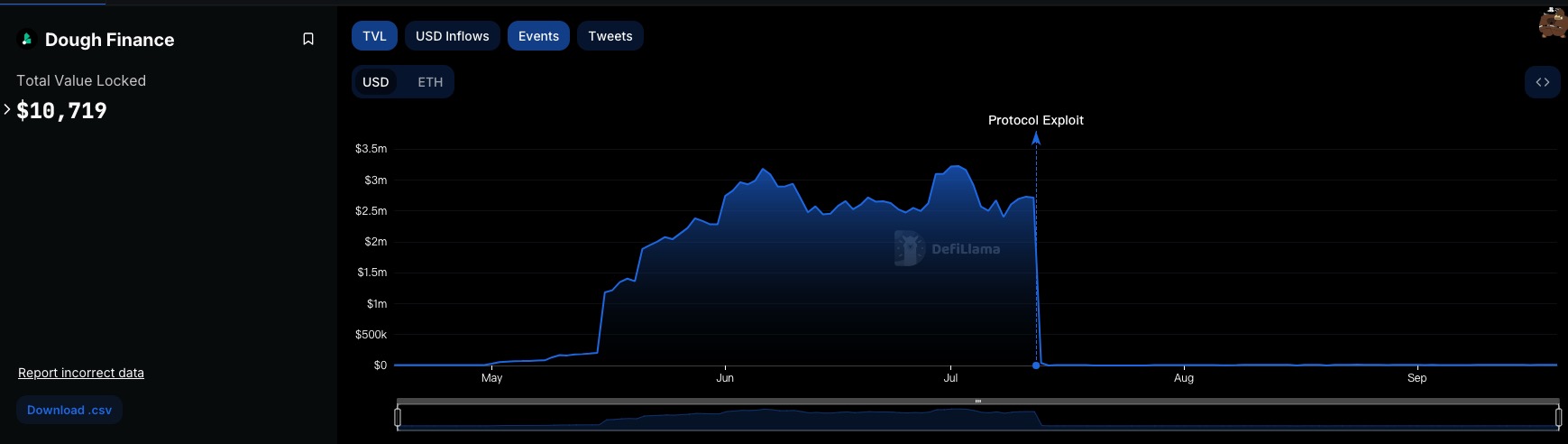

Negative Implications of the Co-founders: Considering the deep involvement of two members of the Trump family, Eric Trump and Donald Trump Jr., in the project, who do not have much experience in the cryptocurrency industry, and whose industry background is still related to real estate, it is widely believed that the actual operators of the project are their two co-founders, Zachary Folkman and Chase Herro. Trump stated in the live broadcast that Herro and Folkman were introduced to Trump's sons by real estate investor Steve Witkoff. Prior to this, these two had already collaborated on a DeFi lending project called Dough Finance, which was founded in April 2024 and suffered a flash loan attack on July 12, resulting in a loss of over $1.8 million, after which the project entered a stagnant state. In addition, the resumes of the two do not follow the typical elite path of most technology or finance industry entrepreneurs. Folkman's previous influential project was called "Data Hotter Girls," which was a dating teaching seminar, and Herro has a criminal record.

Lack of Clear Product Roadmap: Although the Trump family has been promoting the project vigorously with vague descriptions over the past month, and promising to do many things at the same time, in fact, the project has not publicly disclosed more detailed and accurate plans or descriptions. In this Twitter Space event, Folkman seemed to give some descriptions, stating that the project is not attempting to create entirely new financial tools, but aims to improve the usability of DeFi. During the discussion, Donald Trump Jr. recounted his family's experience of "debanking," which refers to the difficulties some individuals or companies encounter in obtaining credit from traditional financial institutions. So, it is clear that the initial focus of the project should still be on the lending scene. However, such information seems insufficient to convince most people and gain recognition for its vision and business logic.

Centralization Issue of WLFI Token Economics: In this interview, Folkman also provided a detailed distribution plan for WLFI tokens, with 20% of the project tokens allocated to the founding team, including the Trump family, 17% of the tokens used for user rewards, and the remaining 63% of the tokens available for public purchase. However, such a distribution ratio seems to be quite different from traditional Web3 projects. The tokens are basically concentrated in the hands of the team and whales, and there is not even a distribution for community incentives.

So why would a project that doesn't seem very attractive receive strong support from the Trump family, especially at such a sensitive time close to the election? I believe the core reason is to find new fundraising channels to alleviate the fundraising disadvantage of Trump's 2024 campaign. Therefore, the essence of investing in WLFI tokens is a bet on Trump's election, a form of political donation.

Trump's Current Campaign Funding has a Clear Disadvantage and Hopes to Find More Flexible Fundraising Channels

We know that the federal government of the United States is composed of three parts: the legislative, judicial, and executive branches. The executive branch obtains positions through appointment, recruitment, or examination. The legislative branch, specifically the Congress, is composed of the Senate and the House of Representatives, with members of both houses elected, and the judicial branch is between the two, with different regulations in different states. During his presidency, Trump appointed over 200 federal judges, greatly changing the ideological composition of the federal judiciary. This is also the reason why he was able to maintain countermeasures during the legal litigation crisis in the first half of the year.

Elections are essentially a political show, requiring a large amount of funds for publicity to gain more support from voters, covering all aspects both online and offline. Considering that the entire publicity campaign actually began nearly a year before the election, the long cycle compared to events such as movie or concert releases requires a far greater amount of capital. The pace of publicity is affected by some unexpected events, but it is likely to continue to increase to allocate the budget, and the closer to the election, the faster the expenditure.

Due to having legislative power, interest groups are formed between the government and business during this process. Some large-scale entrepreneurs choose to support certain politicians in exchange for the promotion of certain bills that align with their interests after the politician's successful election. This donation is known as political contribution. In order to prevent excessive rent-seeking and the worst forms of corruption, U.S. laws have designed some acts to standardize the entire process, among which "527 organizations" are tax-exempt organizations designed for candidates to raise funds to support elections, with many specific subcategories based on the scale of capital received and the methods of use.

In general, a politician's performance in certain key events or unexpected incidents significantly affects the amount of funds raised, as the support from donors to politicians is also phased. For example, a bad debate or a sudden scandal will affect the confidence of donors in the entire future election situation, leading to a halt in donations. Therefore, the fundraising situation can accurately reflect the performance of the candidates.

After introducing this background knowledge, let's take a look at the gap in fundraising between Trump's 2024 campaign team and the current Harris 2024 campaign team, which mainly manifests in two aspects: the scale of funds and the efficiency of allocation.

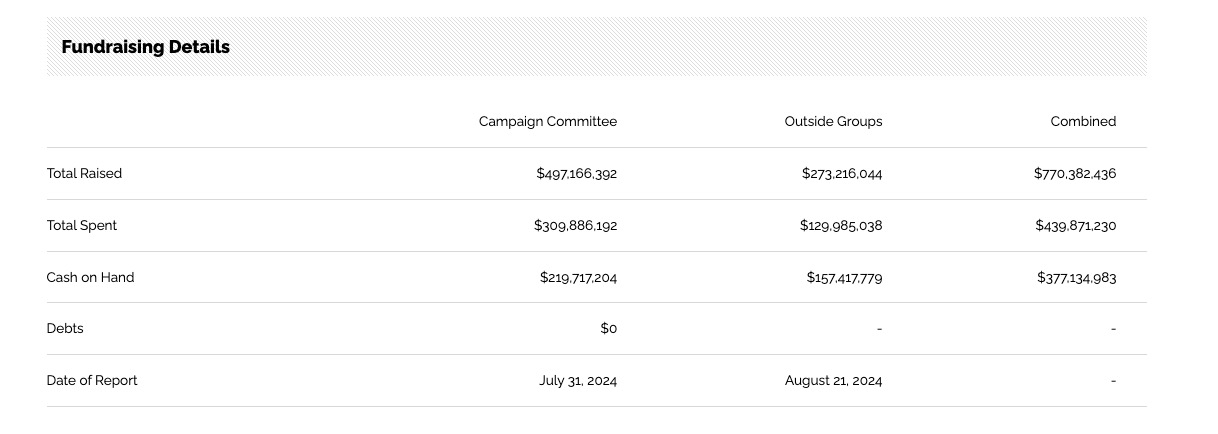

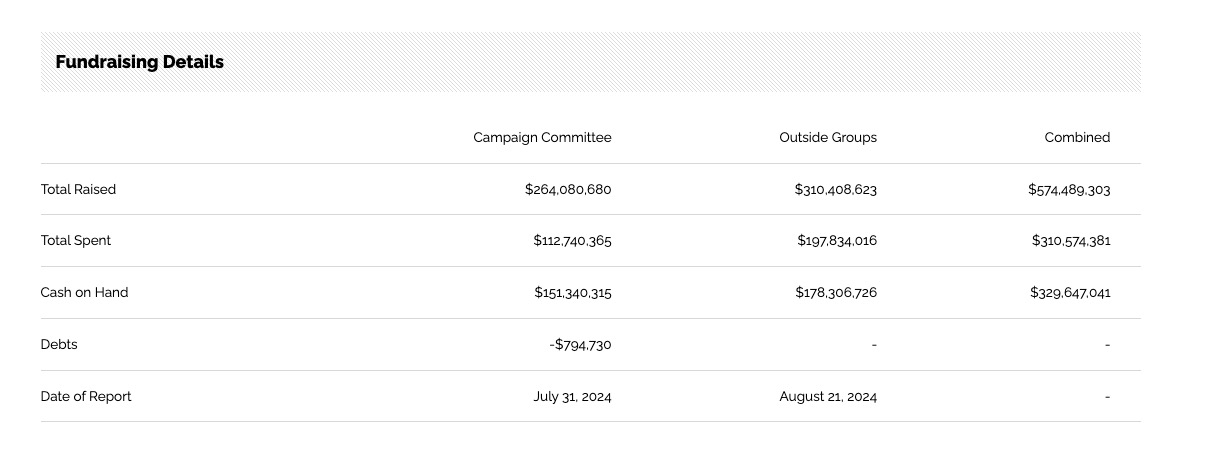

First, in terms of the scale of funds, the Democratic Party has always been ahead of the Republican Party in fundraising. This situation has intensified since Harris was confirmed, and it seems that the support within the Democratic Party has been consolidated, with support for this relatively inexperienced candidate. As of now, the Harris team has raised a total of $770 million and has spent $440 million. The Trump team has raised a total of $570 million and has spent $310 million. Regardless of the remaining funds and the funds already invested, the Trump team undoubtedly has a significant disadvantage. This is also why, after facing an assassination attempt, Trump's momentum has been declining, despite successfully pressuring the Democratic Party to replace Biden. Furthermore, after the first presidential debate last week, in terms of debate skills, Harris undoubtedly performed better, allowing her to raise $50 million within 24 hours after the debate, demonstrating her strong fundraising ability.

Of course, it's also interesting to look at the differences in supporters between the two. Following Biden's attraction of support from billionaires such as Michael Bloomberg and LinkedIn co-founder Reid Hoffman, Harris herself has also received support from several billionaires, including Hoffman, Netflix co-founder Reed Hastings, former Meta COO Sheryl Sandberg, and philanthropist Melinda French Gates (wife of Bill Gates). On July 31, over 100 venture capitalists signed a letter supporting Harris's candidacy and pledging to vote for her, including entrepreneur Mark Cuban, investor Vinod Khosla, and Lowercase Capital founder Chris Sacca, among other billionaires. Trump's core supporters include banker Timothy Mellon, wrestling tycoon Linda McMahon, energy executive Kelcy Warren, ABC Supply founder Diane Hendricks, oil tycoon Timothy Dunn, and prominent conservative donors Richard and Elizabeth Uihlein, as well as Tesla founder Elon Musk. However, from this list, it can be seen that Harris's supporters are more from the emerging technology industry, while Trump's supporters focus on traditional industries. In terms of online promotion, Harris undoubtedly has a stronger advantage, especially since Musk acquired Twitter. This has helped Trump alleviate this disadvantage, so you will find that after Trump returned to Twitter, his online marketing efforts undoubtedly revolved around that platform.

Looking at the specific fundraising channels, Harris's external fundraising is mainly through the Carey Committee, while Trump primarily uses SuperPAC. Both of these organizations belong to the 527 organization just introduced, which has the advantage of unlimited funding. However, in terms of fund expenditure, the former has greater flexibility. The Carey Committee has two separate accounts: one for traditional restricted donations (directly to candidates and parties) and another for unrestricted independent expenditures (for advertising, publicity, etc.). Super PACs, on the other hand, cannot coordinate directly with a candidate's campaign team or party, nor can they donate directly to a candidate. This means that Trump's team is far weaker in terms of fund utilization efficiency compared to Harris's team.

This breaks the traditional impression that Trump, as a wealthy businessman, should have an advantage in funding. However, the situation is quite the opposite, with Harris's team currently having a clear funding advantage, and this advantage is further expanding. Therefore, at this time, it is easy to understand the risk of launching an immature crypto project, which also indicates the hope of finding more flexible fundraising channels through the crypto field. This can also be seen as a practical gesture to please the crypto enthusiast voters. So, taking some risks for this is worthwhile. Of course, this also explains why the project, without a detailed roadmap, is based on the explanation that WLFI will follow Regulation D for fundraising, which is a guarantee to control the risk within an acceptable range. This is the key issue.

For the Trump team, there are many ways to benefit from this project, apart from direct ICO sales. There is also an interesting project, which is to cash out using a lending platform. Do you remember the issue mentioned earlier by Donald Trump Jr. about his family experiencing "debanking"? Assuming World Liberty Financial successfully launches as a lending protocol and attracts a certain amount of funds, the team can use a large amount of WLFI tokens they control as collateral to lend out real money without significantly affecting the secondary market price, similar to what the founder of Curve did. This can indeed help alleviate the problem they are facing.

Considering all of this, I have no doubts about the launch of this project, because the essence of investing in WLFI tokens is a bet on Trump's election, a form of political donation. This approach will be loved by many crypto industry tycoons. The future growth of the project depends on the outcome of this game. If Trump is successfully elected, such a resource-driven project will easily find a specific business direction. However, if he fails, undoubtedly, in an environment exhausted by various litigations, the Trump family should also have no time to deal with this. In any case, as small investors, we need to be cautious and careful in our participation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。