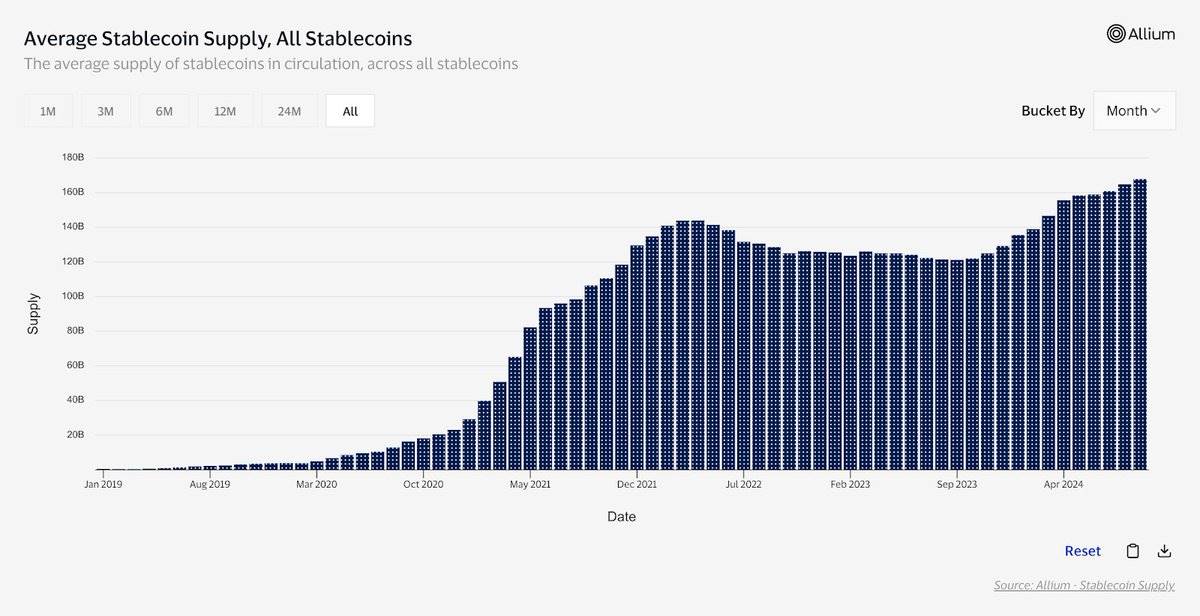

The total supply of stablecoins supported by leading fiat currencies has reached a historic high, with a daily average supply exceeding $168 billion, an increase of $40 billion over the past 12 months.

Author: Cuy Sheffield

Translator: DeepTechFlow

Last week, we released the V2 version of the on-chain analytics dashboard for Visa and AlliumLabs.

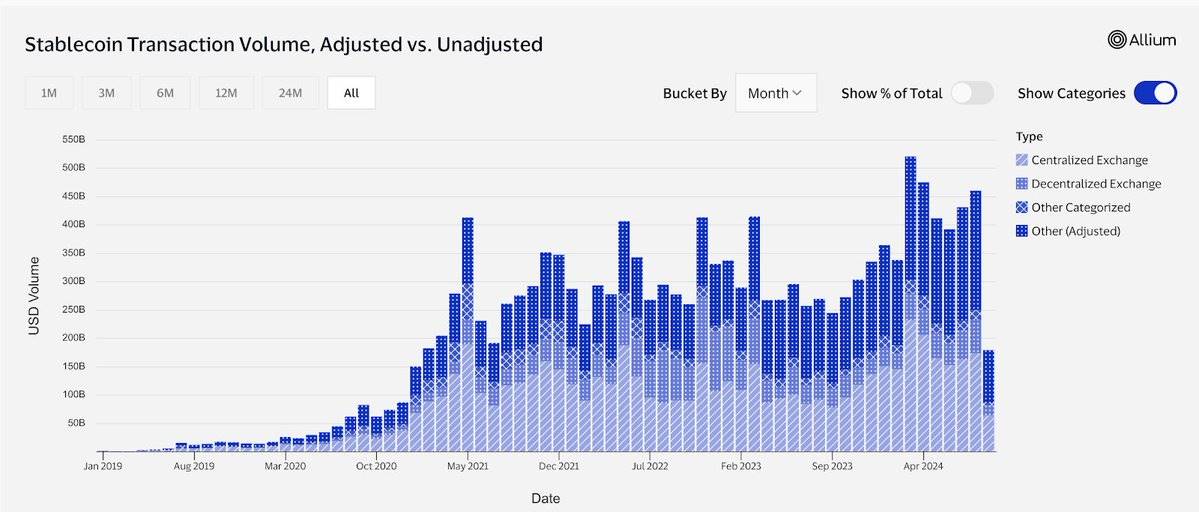

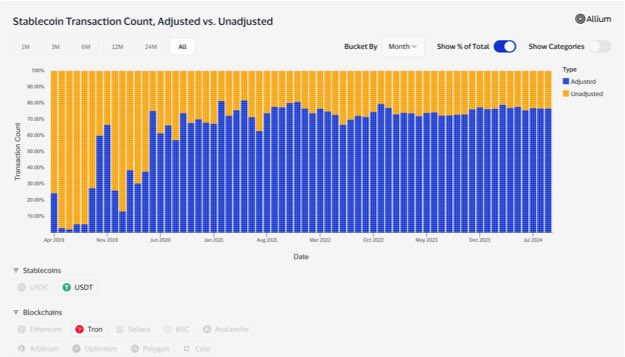

Check out some key insights from the data and view the full revised dashboard here. Since 2019, the annual adjusted stablecoin transaction volume has averaged a 225% increase throughout market cycles. Of the 2024 adjusted transaction volume, 41% is attributed to deposits and withdrawals on centralized exchanges.

The total supply of stablecoins supported by leading fiat currencies has reached a historic high, with a daily average supply exceeding $168 billion, an increase of $40 billion over the past 12 months.

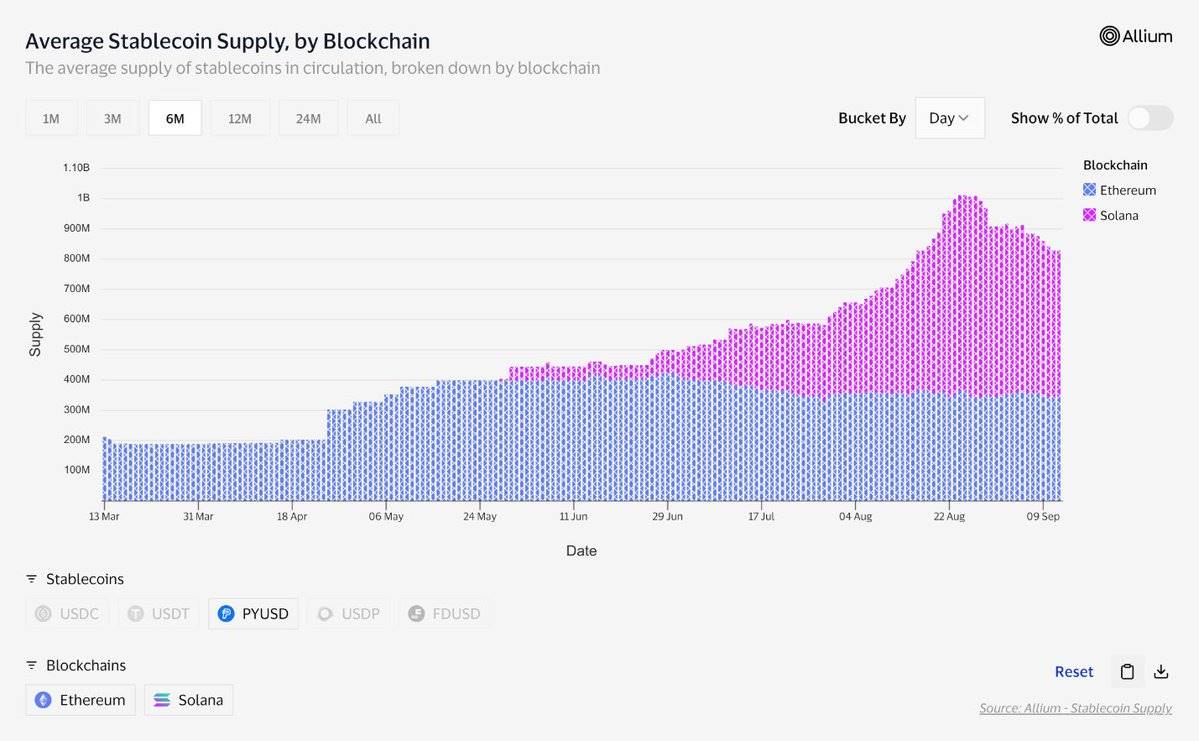

The supply of PayPal's stablecoin PYUSD has increased by over four times in the past 6 months, surpassing $2.08 billion at one point to over $10 billion. This surge is mainly due to its release on SOLANA in May, now accounting for 59% of the total PYUSD supply.

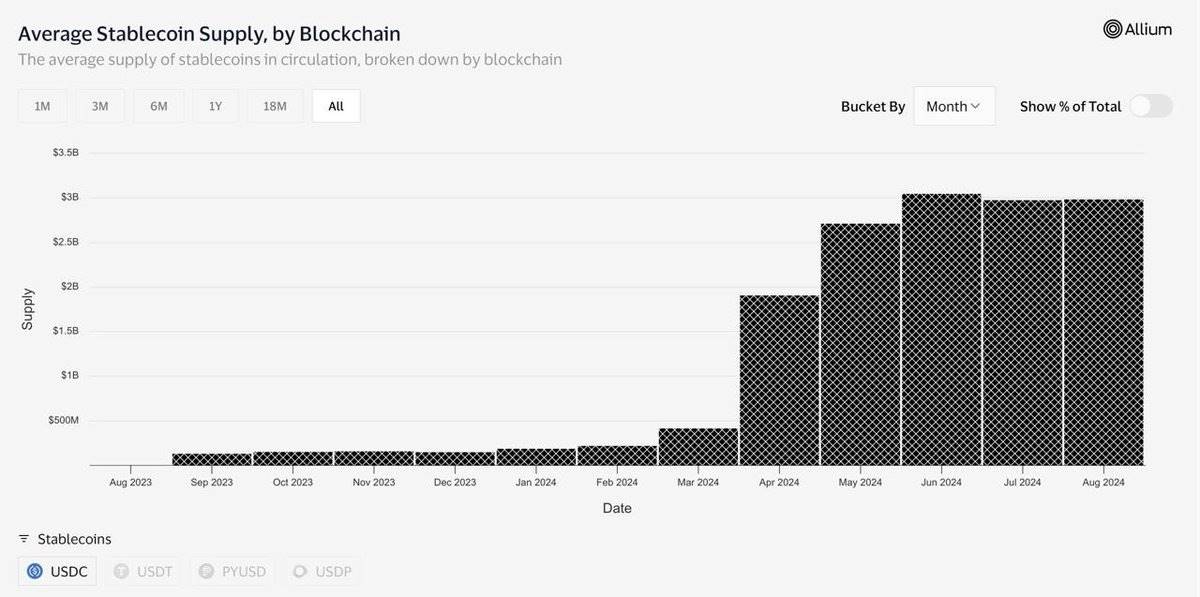

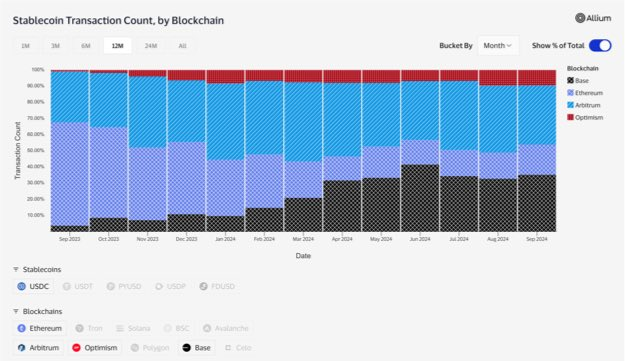

The average adjusted monthly transaction volume of USDC on BASE has increased from $26 billion in March 2024 to $56 billion.

Base now holds approximately 10% of the USDC EVM L1 and L2 supply, totaling $3.2 billion.

In the past 12 months, the adjusted USDT transaction volume on Tron has approached 80%, with Tron's adjusted USDT transaction volume exceeding 50%.

Both of these ratios are the highest among any stablecoin and blockchain combination.

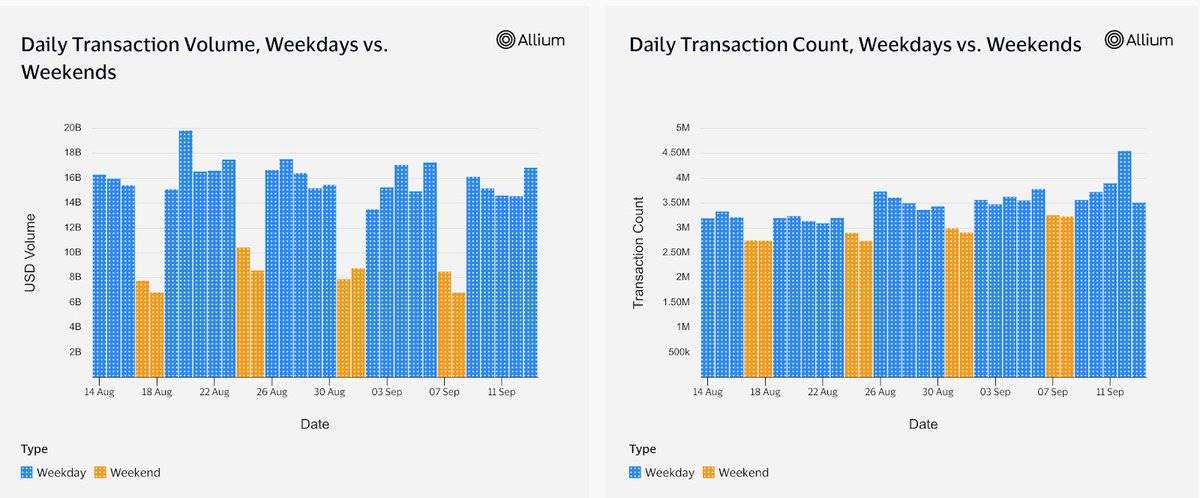

In the past 6 months, the average weekday stablecoin transaction volume has been 93% higher than the average weekend volume, but during the same period, the weekday transaction count was only 17% higher.

The total adjusted stablecoin transaction volume on weekends in the past 6 months was $463.4 billion.

In November, the monthly adjusted stablecoin transaction volume on Ethereum L2 exceeded all stablecoin transaction volumes on Ethereum L1.

A year ago, Ethereum accounted for 64% of the adjusted monthly USDC transaction volume. Now, it only accounts for 19%, while Base accounts for 35%.

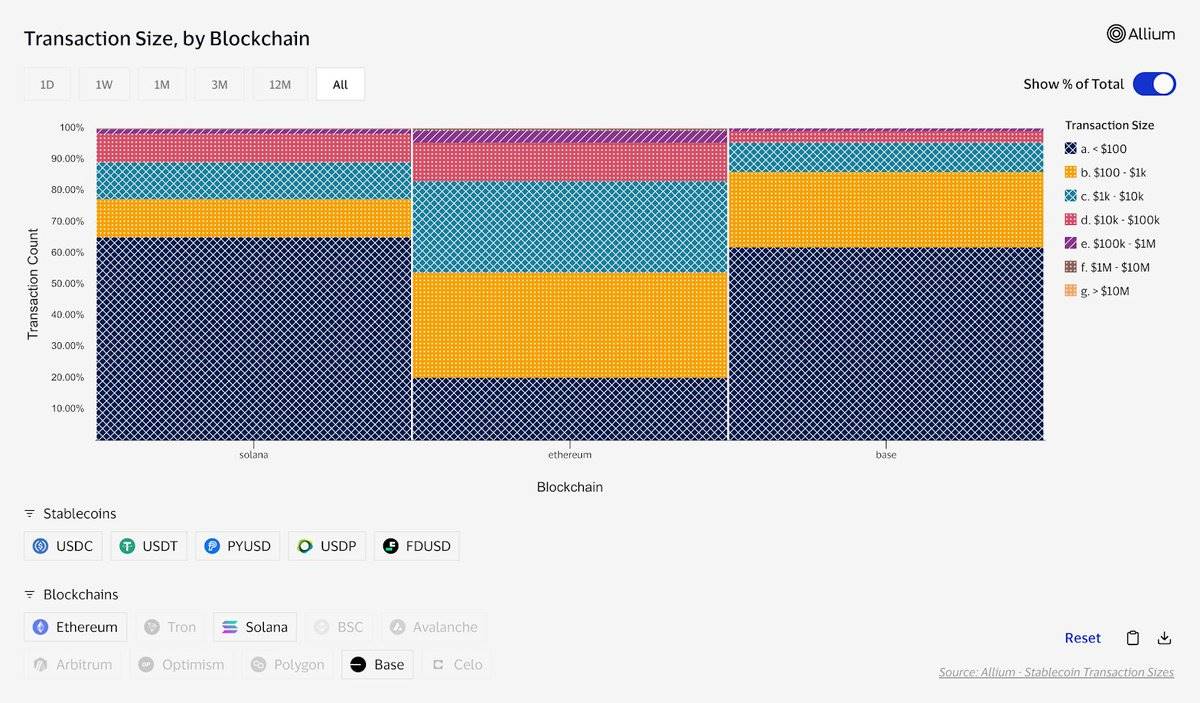

User behavior and consumption patterns differ between high-throughput, low-cost blockchains and high-cost blockchains.

On SOLANA, network fees may be less than 1 cent, with 65% of historical transactions below $100.

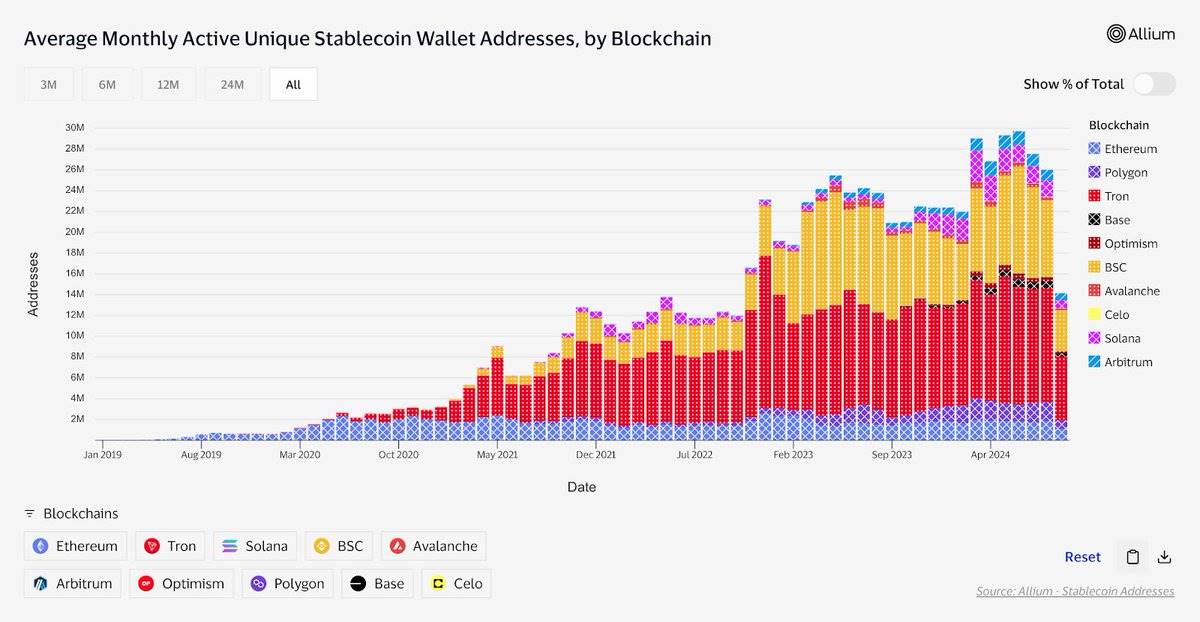

Since 2019, the monthly stablecoin wallet addresses have grown from 23,000 to 26 million.

We hope this dashboard will drive discussions about stablecoins and welcome feedback on how we can continue to improve it. We are excited about the opportunities presented by stablecoins and are always looking to collaborate with the next generation of stablecoin-based fintech companies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。