Brand and user experience are the sustainable moats of applications.

Author: Adrian

Translation: Luffy, Foresight News

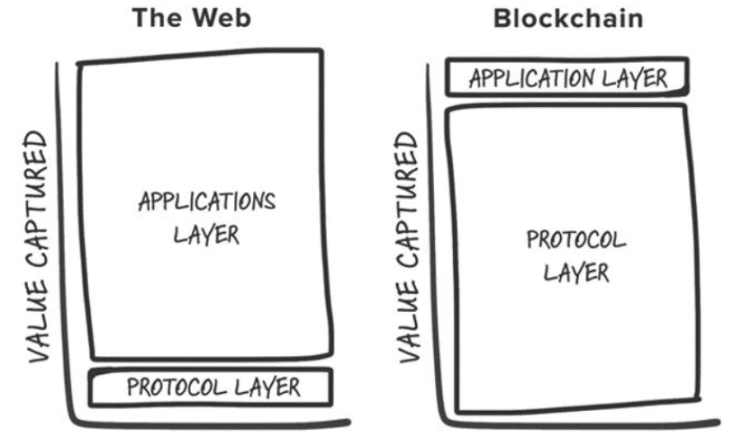

Throughout the history of each crypto cycle, the most lucrative investment returns have been achieved through early bets on new underlying infrastructure primitives (PoW, smart contracts, PoS, high throughput, modularity, etc.). If we look at the top 25 tokens on CoinGecko, we will find that only two are not L1 blockchain native tokens (excluding pegged assets): Uniswap and Shiba Inu. This phenomenon was first theorized by Joel Monegro in 2016, when he proposed the "Fat Protocols Theory". Monegro believed that the biggest difference in value accumulation between Web3 and Web2 is that the value accumulated at the base layer of cryptocurrency is greater than the sum of the value captured by the applications built on top, and the value comes from:

- The blockchain has a shared data layer, where transactions are settled, promoting positive-sum competition and enabling permissionless composability.

- Token appreciation -> introduction of speculative participants -> initial speculators transformed into users -> users + token appreciation attract developers and more users, forming a positive feedback loop.

Fast forward to 2024, the original argument has undergone numerous industry debates, and there have been several structural changes in the industry that challenge the original claims of the fat protocol theory:

- Commodification of block space: With the premium on Ethereum block space, competitive L1s have risen and become the definers of asset categories. Competitive L1s are typically valued in the tens of billions of dollars, attracting builders and investors almost every cycle, leading to new "differentiating" blockchains that excite investors and users, but ultimately become "ghost chains" (such as Cardano). While there are exceptions, overall, this has led to an overly rich block space in the market without enough users or applications to support it.

- Modularization of the base layer: With the increasing number of specialized modular components, the definition of the "base layer" has become increasingly complex, not to mention the value generated by deconstructing each layer of the stack. However, in my view, this shift can be certain:

- The value in modular blockchains is dispersed throughout the stack, and for a single component (e.g., Celestia) to achieve a valuation higher than an integrated base layer, its component (e.g., DA) needs to become the most valuable component in the stack and build "applications" on top of it, thereby having more usage and fee income than an integrated system.

- Competition between modular solutions has driven cheaper execution / data availability solutions, further reducing user costs.

- The future of "chain abstraction": Modularization fundamentally causes fragmentation in the ecosystem, leading to a cumbersome user experience. For developers, this means too many choices for deploying applications; for users, this means overcoming numerous obstacles to switch from application A on chain X to application B on chain Y. Fortunately, many smart people are building a new future where users can interact with crypto applications without knowing the underlying chain. This vision is called "chain abstraction". The question now is, where will value accumulate in the future of chain abstraction?

I believe that crypto applications are the primary beneficiaries of the shift in infrastructure construction. Specifically, intent-centric transaction supply chains, with exclusive order flow and intangible assets such as user experience and brand, will increasingly become the moats of killer applications, enabling them to commercialize more effectively than they do now.

Exclusivity of order flow

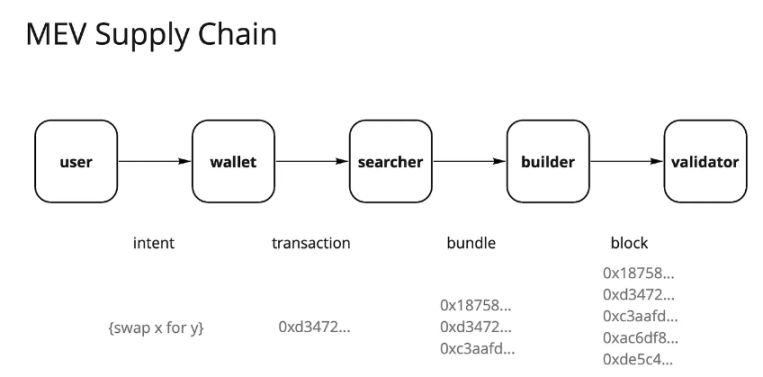

Since the Ethereum merge and the introduction of Flashbots and MEV-Boost, the MEV landscape has undergone significant changes. The once searcher-dominated dark forest has now evolved into a partially commodified order flow market, with the current MEV supply chain mainly dominated by validators, capturing about 90% of MEV in the form of bids from each participant in the supply chain.

The MEV supply chain of Ethereum

Validators have captured most of the extractable value from the order flow, leaving most participants in the transaction supply chain dissatisfied. Users want compensation for generating order flow, applications want to retain value from user order flow, searchers and builders want greater profits. As a result, value-seeking participants have adapted to this change, trying various strategies to extract alpha, one of which is the integration of searchers and builders. The idea is that the higher the determinism of the block packing by searchers, the higher the profit. A large amount of data and literature shows that exclusivity is key to obtaining value in a competitive market, and applications with the most valuable traffic will have pricing power.

This is similar to the business model of Robinhood. Robinhood sells order flow to market makers and receives rebates to maintain a "zero-cost" trading model. Market makers like Citadel are willing to pay for order flow because they can profit from arbitrage and information asymmetry.

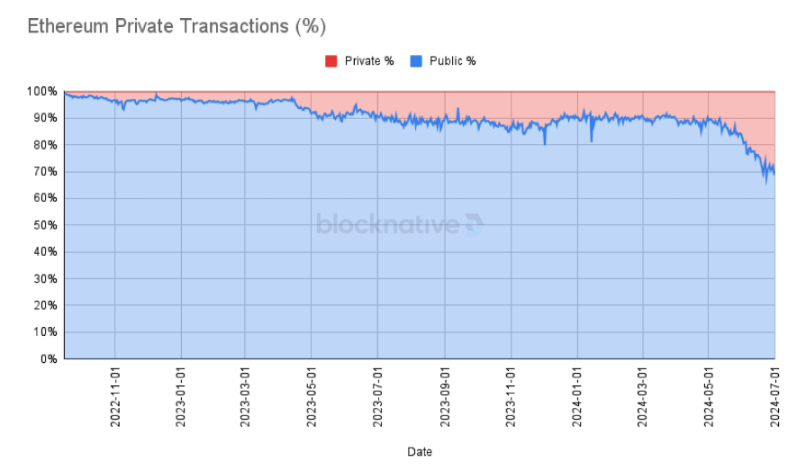

More and more transactions are being conducted through private mempools, which has been further evidenced by a recent historical high of 30% share on Ethereum. Applications have realized that the value of all user order flow is being extracted and leaked into the MEV supply chain, and private transactions allow for more customization and commercialization around sticky users.

https://x.com/mcutler/status/1808281859463565361

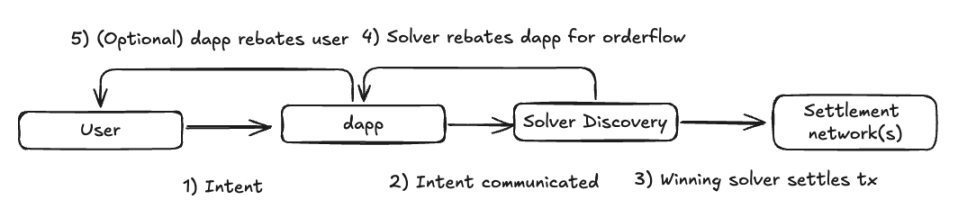

With the era of chain abstraction approaching, I expect this trend to continue. Under an intent-centric execution model, the transaction supply chain may become more decentralized, and applications will direct their order flow to resolver networks that can provide the most competitive execution, driving resolver competition to lower profit margins. However, I expect most value capture to shift from the base layer (validators) to the user-facing layer, where middleware components are valuable but have low profit margins. Frontends and applications that can generate valuable order flow will have pricing power over searchers / resolvers.

Possible ways of value accumulation in the future

We have already seen this happening today, with niche forms of order flow utilizing specific rankings of applications (e.g., oracle extractable value auctions, Pyth, API3, UMA Oval), allowing lending protocols to regain liquidation bid order flow that would originally flow to validators.

User experience and brand as sustainable moats

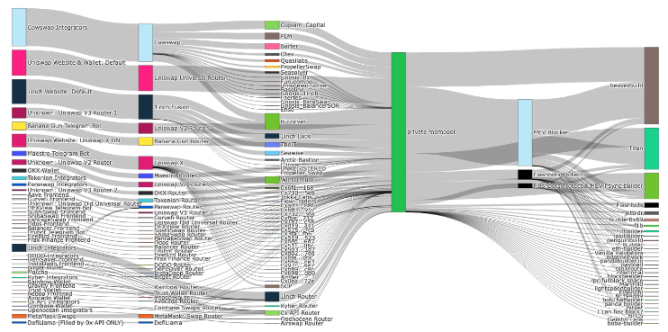

If we further break down the aforementioned 30% of private transactions, most of them come from frontends such as TG Bots, Dexes, and wallets:

Although it has been believed that the attention of native crypto users is not concentrated, we eventually see a certain level of retention. Brand and user experience can both become meaningful moats.

User Experience: Introducing alternative front-end forms that connect wallets to web applications will undoubtedly attract the attention of users who require specific experiences. A great example is Telegram bots like BananaGun and BONKbot, which have generated $150 million in fees, allowing users to trade Memecoins in the comfort of a Telegram chat.

Brand: Well-known brands in the cryptocurrency space can increase revenue by winning user trust. It is well known that the fees for in-app exchanges in wallets are very high, but it is a killer business model because users are willing to pay for convenience. For example, MetaMask swap generates over $200 million in fees annually. Uniswap Labs' frontend fee swap has netted over $50 million since its launch, and any transactions interacting with Uniswap Labs contracts in a way other than the official frontend do not incur this fee, yet Uniswap Labs' revenue continues to grow.

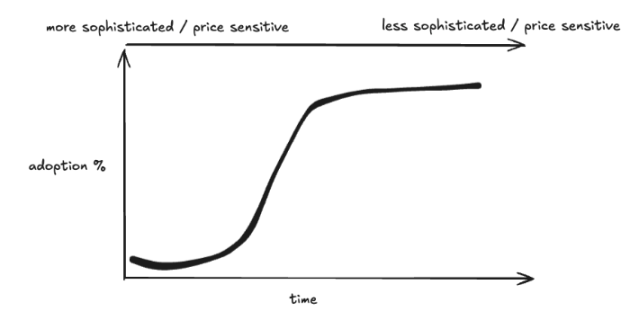

This indicates that the Lindy effect in applications is consistent or even more pronounced than in infrastructure. Typically, the adoption of new technologies (including cryptocurrencies) follows some form of an S-curve, where as we transition from early adopters to mainstream users, the next wave of users will be less mature, thus less sensitive to pricing, allowing brands that reach critical mass to profit in creative ways.

The S-curve of cryptocurrencies

Conclusion

As a cryptocurrency professional primarily focused on infrastructure research and investment, this article is by no means meant to deny the value of infrastructure as an investable asset category in cryptocurrency, but rather a shift in mindset when thinking about entirely new infrastructure categories. These infrastructure categories enable the next generation of applications to serve users above the S-curve. New infrastructure primitives need to bring entirely new use cases at the application level to attract enough attention. At the same time, there is ample evidence that sustainable business models exist at the application level, where user ownership directly guides the accumulation of value. Unfortunately, we may have passed the market stage of L1, where betting on every new shiny L1 would bring exponential returns, although those with meaningful differentiations may still be worth investing in.

Even so, I have spent a lot of time thinking about and understanding different "infrastructures":

- Artificial Intelligence: Agent economies that automate and improve end-user experiences, computing and reasoning markets for continuous resource allocation, and verification stacks that extend blockchain virtual machine computing capabilities.

- CAKE Stack (https://frontier.tech/the-cake-framework): Many of my points above indicate that I believe we should move towards the future of chain abstraction, and there is still a lot of design choices for most components in the stack. As infrastructure supports chain abstraction, the design space for applications will naturally expand, potentially blurring the distinction between applications/infrastructure.

- DePIN: For some time, I have believed that DePIN is a killer real-world use case for cryptocurrencies (second only to stablecoins), and that has not changed. DePIN leverages everything cryptocurrencies are good at: achieving permissionless coordination of resources through incentives, guiding markets, and decentralized ownership. While each specific type of DePIN network still has specific challenges to address, the solution to the validation cold start problem is huge, and I am very excited to see founders with industry expertise bringing their products into the crypto space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。