Lowercase "neiro" is on the rise, and Binance is embroiled in a public opinion crisis.

By: Gyro Finance

A week ago, Gyro Finance wrote an article titled "Which Side Are Exchanges on for 'NEIRO'? MEME Civil War in Progress," mentioning the controversy over exchanges taking sides with the uppercase "NEIRO" in the MEME community. At that time, despite user dissatisfaction with the exchanges, the community still flocked to NEIRO due to the legitimacy of the uppercase NEIRO contracts being successively listed on OKX and Binance, effectively putting an end to the battle between uppercase and lowercase inheritances.

It was thought that this matter had come to an end, but unexpectedly, Binance subsequently listed the lowercase "neiro" spot, and the exchange's extreme operations once again put the "crypto dogs" in the spotlight, sparking strong doubts about Binance and He Yi in the market.

After Binance and OKX listed the uppercase "NEIRO" contract on September 6, the fates of uppercase and lowercase Neiro took drastically different paths.

The biggest bullish news for NEIRO landed, and its trend first rose and then fell, with community users quickly entering the market, driving the price to accelerate from $0.06 to $0.2, followed by a decline, and the market cap also surged to $200 million before falling back. On September 15, NEIRO stabilized at $0.13, with a market cap of approximately $130 million. The lowercase "neiro," considered to be the false Monkey King, suffered a setback, sliding from a market cap of $20 million to $4.81 million, with the price dropping to $0.000039, once again facing the risk of zeroing out. If nothing unexpected happens, as previously expected, after the battle of legitimacy, although the victor is short-lived, the loser can only wait for the final outcome.

However, the turn of events on September 16 made things even more confusing. On September 16, Binance announced the listing of FirstNeiro on Ethereum (Neiro), Turbo (TURBO), and Baby Doge Coin (1MBABYDOGE) for Simple Earn, Spot Trading, and Leveraged Tokens. Binance will add Neiro, TURBO, and 1MBABYDOGE as borrowable assets for cross and isolated margin trading, and add Neiro/USDT, TURBO/USDT, and 1MBABYDOGE/USDT trading pairs for cross and isolated margin trading.

As a leading exchange, Binance's cautious listing of three MEME tokens in a short period of time has attracted attention, and the appearance of lowercase Neiro is even more astonishing. After all, just two weeks ago, Binance seemed to be a supporter of "NEIRO."

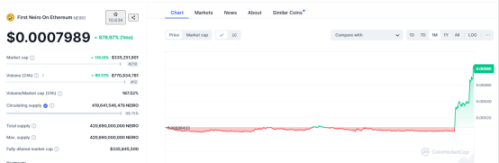

Under the influence of this news, lowercase Neiro experienced a resurgence, with its price soaring from $0.00036 to $0.00082, nearly tripling in two days, and currently trading at $0.00079, with a market cap stabilizing above $300 million. The uppercase NEIRO, on the other hand, suffered a major setback, with the price plummeting by over 30 times to a low of $0.0038, and the market cap falling below $4 million. Although there has been some recovery, the decline is still significant compared to the peak, and its price is currently stable at around $0.072, with a market cap of less than $80 million.

After the intense trading activities in the market, community users finally had a chance to catch their breath, and dissatisfaction with Binance also erupted. Most users expressed that Binance's move was simply unbelievable and treated users as playthings. Some users had only bought the lowercase token after explicitly expressing their support for "NEIRO," becoming holders of the uppercase token, but this reversal undoubtedly caused them significant losses.

On the other hand, the fact that a MEME token with a market cap of less than $16 million and a community of only a few thousand members was listed on the leading exchange Binance also sparked dissatisfaction in the market. Some KOLs expressed strong opinions, with @cozypront stating that Binance had already listed a token with a market cap of $130 million with the same name, but then turned around to support a lowercase token with a market cap of $15 million, which is simply a "stupid move."

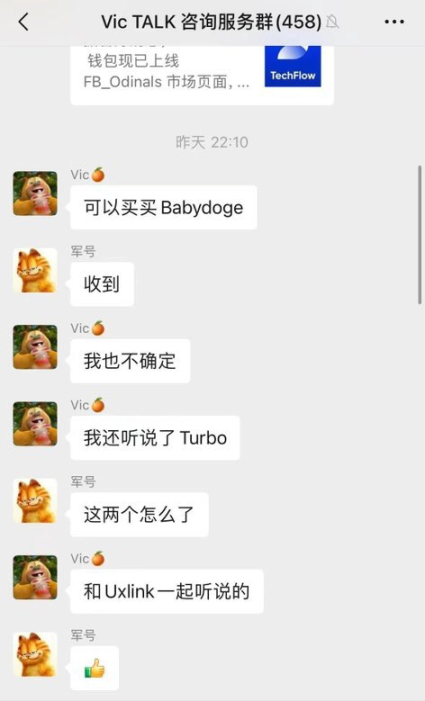

Amidst the criticism, suspicions of insider trading were also brought to light, with a WeChat screenshot from the "Vic TALK Consulting Group" going viral. In it, the group owner Vic suggested buying BabyDoge, mentioned hearing about Turbo, and stated that this was heard at the same time as UXLINK. However, it is a coincidence that Binance listed the UXLINK contract on September 15, and the next day, BabyDoge and Turbo also appeared in Binance's listing announcement.

Is this really just a coincidence, given such accurate predictions? The market clearly does not think so, believing that this is undoubtedly insider information and insider trading by Binance's internal staff. For a time, accusations and doubts were rampant, directly targeting Binance for lowering its listing standards and betraying the community, leading MEME tokens astray.

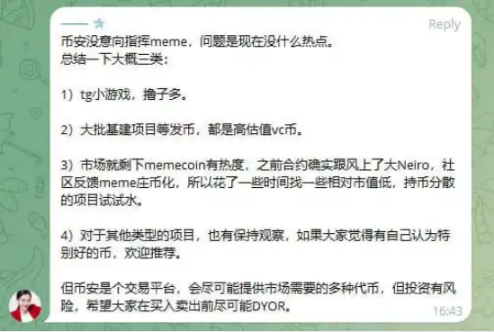

Against this backdrop, He Yi once again stepped in to stabilize the situation. He Yi responded in the TG group, stating that Binance has no intention of directing MEME, and the listing was only due to the lack of hotspots. He summarized the current types of listings, stating that there are only three types of tokens: TG mini-games, high VC tokens for infrastructure projects, and MEME tokens. He also explained the events, stating that they followed the trend and listed the uppercase NEIRO contract, but the community feedback on this token's insider trading was obvious. Therefore, they will take time to find projects with lower market caps and more diversified holdings.

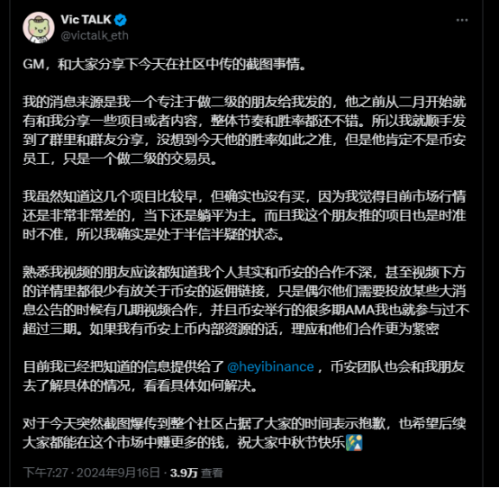

As for the issue of insider trading, Vic TALK also responded on X, stating that the information came from traders focused on secondary trading, and because of their high success rate, they shared it in the group. They are not internal staff of Binance, and their personal cooperation with Binance is very limited, with only a few video placements and AMAs, far from sharing internal resources. The Binance Chinese community also reposted and responded, stating that Binance attaches great importance to any leaks or corruption, and the NEIRO incident was just a misunderstanding. Binance will also thoroughly investigate any staff violations, and serious offenses will be prosecuted, and they called on the market to report corruption, with rewards of up to $5 million.

In response to these various explanations, users clearly remain unconvinced, and some have brought up past issues of information leaks during the listing of other tokens. Coincidentally, regulatory agencies have also intervened, with the U.S. Securities and Exchange Commission (SEC) recently submitting a proposed amended complaint against Binance, focusing on Binance's token listing process, emphasizing BNB's secondary sales and Binance Simple Earn, and accusing Binance of acting as an unregistered securities provider.

As public opinion continues to ferment, He Yi has once again reluctantly written a lengthy article titled "If We Have Different Opinions, Maybe You Are Right" in response to the current anxiety in the cryptocurrency circle, focusing on the listing process. He mentioned that the listing process consists of four stages: business, research group, committee, and compliance review, with the core principle being to list projects with users and traffic, long-lasting projects, and projects with solid business logic. Regarding the issue of insider trading, He Yi also stated that the current Binance listing process is monitored, and any insider trading will be reported to the U.S. Department of Justice and the FinCEN-appointed inspectors, and employees involved will face criminal charges.

At present, this incident seems to be gradually coming to an end, although the controversy has not completely subsided, public opinion is slowly calming down. Beyond the event, Binance's situation is also worth pondering. As a leading exchange, Binance bears many expectations, and most projects, no matter how decentralized they claim to be, ultimately take pride in being listed on the so-called leading exchanges.

In this context, Binance is not just an exchange; it symbolizes the aggregation of traffic and user expectations, serving as a barometer for the industry, naturally possessing significant influence. Therefore, all its actions are magnified under the spotlight. This is why when other exchanges list MEME tokens or TG game tokens, users have no objections, but when Binance does it, it becomes a target of criticism. Currently, Binance seems to be in a dilemma, criticized for deviating from community support for VC-backed infrastructure tokens and for lowering listing standards and manipulating the market with MEME tokens. If it remains unchanged, it will be criticized for lacking innovative spirit and struggling to guide industry development.

On the other hand, as the industry gradually moves towards compliance, the era of wild west and making money at all costs has disappeared. The industry is currently facing the macro resonance and traffic dilemma, and the exchanges that have reaped the benefits are inevitably the first to bear the brunt. Not only are they dancing with regulatory shackles, but they also face a decline in traffic. In this situation, exchanges are finally demystified and return to their role as platforms for eating off traffic.

The core of the public's criticism of exchanges lies in this. The structural mismatch between users' expectations of Binance and Binance's own positioning has emerged. Users expect the exchange to be the "light of righteousness," with industry vision, but the exchange is just a part of the ecosystem. Since it is just a part, Binance must inevitably engage in commercial competition, not to mention the looming threat of compliance. With its natural traffic advantage, the exchange is not worried about profits, but how to earn more money while maintaining industry trust is still a profound issue.

To many users, the so-called "MEME trial" should not be mentioned in the context of Binance. However, from Binance's perspective, even as a leading exchange, it faces fierce competition. While compliant exchanges are hitting hard, offshore exchanges are closely following. If it does not list popular tokens, it will only benefit its competitors. Therefore, there is nothing wrong with innovative trials, especially now that the exchange's influence is rapidly diminishing, and the creation of hotspots is no longer monopolized by exchanges.

Adhering to this principle, after CZ's departure, the 2.0 version of Binance, under the leadership of the new CEO and He Yi, has made many attempts, including the so-called "girlfriend coins" and "air coins." After all, the market is severely lacking in hotspots, and high FDV tokens collapse shortly after listing, so Binance has become more cautious under public pressure.

However, in terms of listing choices, Binance also has room for consideration. TON games and MEME have taken off, but the chosen tokens are not at the forefront of the race track and do not have a strong community. Can they completely eliminate the scam of insider trading? Interestingly, in May of this year, Binance announced that the listing requirements were for small to medium market cap tokens, a large token allocation for community users, a self-sufficient business model, and a sustainable community foundation. However, looking at the tokens listed in recent times, it seems that many do not belong to the above categories.

Ultimately, the most severe criticism in this incident undoubtedly comes from investors who have suffered financial losses. When the uppercase token was listed, the lowercase token community lamented, and when the lowercase token was listed, supporters of the uppercase token once again hurled insults. Ultimately, it is the interests that are the key to making users take sides. Some users even jokingly said, "I don't hate backstage deals, I hate that I'm not part of them."

Despite facing heavy criticism, it is undeniable that Binance is still a leader in the ecosystem. However, regarding the strategic path of this leader, when users and the actual managers are moving from an open to a closed ecosystem, inevitable differences have emerged. Various internal and external uncertainties can become the spark of these differences, such as the increasingly frequent and biased personal attacks on He Yi.

Will returning to the original state be better? Perhaps the market is expecting CZ, who is set to be released on September 29, to provide a new answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。