Author: Carol, PANews

Throughout, the transition of Ethereum to the PoS mechanism has been considered to help achieve currency deflation and meet the needs of larger-scale applications, which is beneficial for the upward trend of ETH price. However, on the occasion of the second anniversary of the transition, Ethereum is facing many doubts. On the surface, the emergence of these doubts is mainly due to the poor performance of ETH in the recent market cycle, especially compared to BTC and SOL during the same period, the price increase is not as expected.

However, at a deeper level, these doubts reflect two main challenges in Ethereum's development: one is the competition between Layer1 and Layer2, where the core issue is how to position the role of Layer2 and its relationship with Ethereum, and the other is the contradiction between staking and liquidity, where the core issue is how to position the attributes of ETH.

In order to further demonstrate the current development status of Ethereum and the challenges behind the doubts, PANews' data column PAData comprehensively analyzed the changes in Ethereum's transaction fees, Blob fees, and Layer2 demand, as well as the changes in Ethereum's staking amount and lock-up amount, and found that: First, Ethereum has reduced the transaction fee prices, but Layer2 has diverted the on-chain activity demand and interacted with Ethereum at a lower price, leading to challenges in the value feedback and accumulation of ETH. Second, if ETH is positioned as a settlement currency, that is, expecting long-term sustainable high demand for Ethereum to achieve long-term stable appreciation of ETH, but in the face of fierce competition, the market's willingness to pay for this long-term expectation may be shaken.

The main findings of this article include:

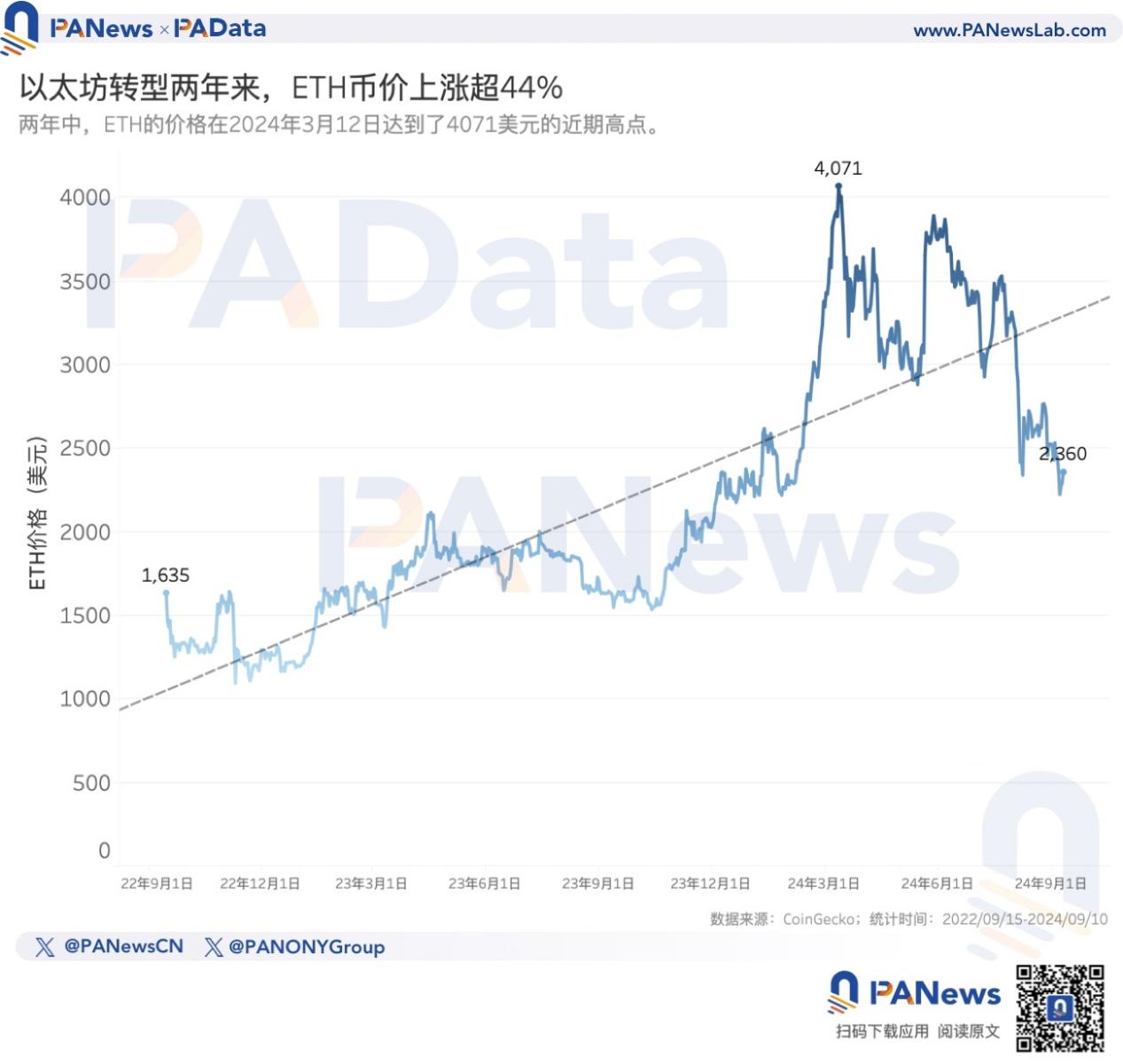

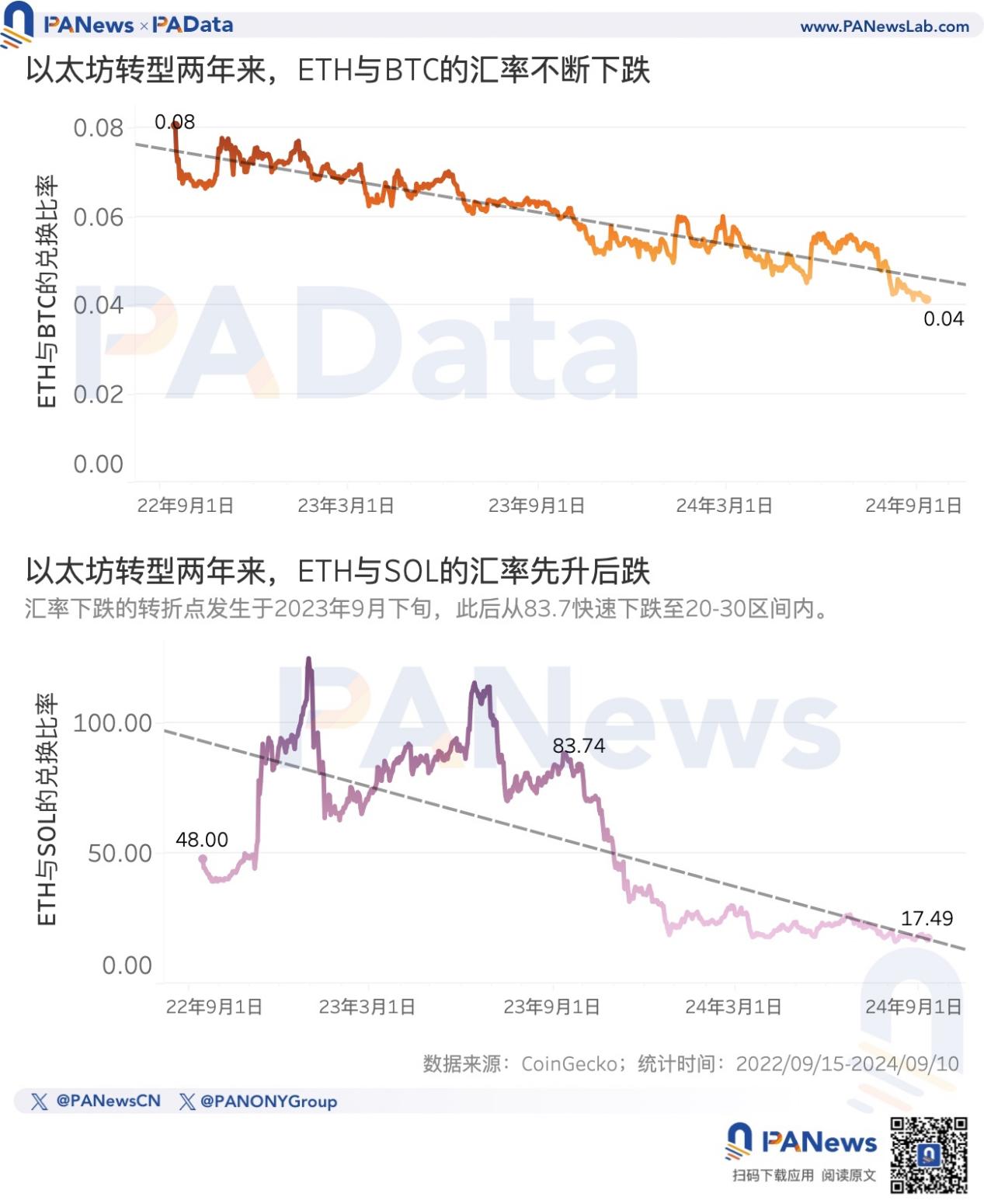

- In the past 2 years, the increase in ETH to USD is about 44.28%, but the decrease in ETH to BTC is about 48.70%, and the decrease in ETH to SOL is about 63.55%.

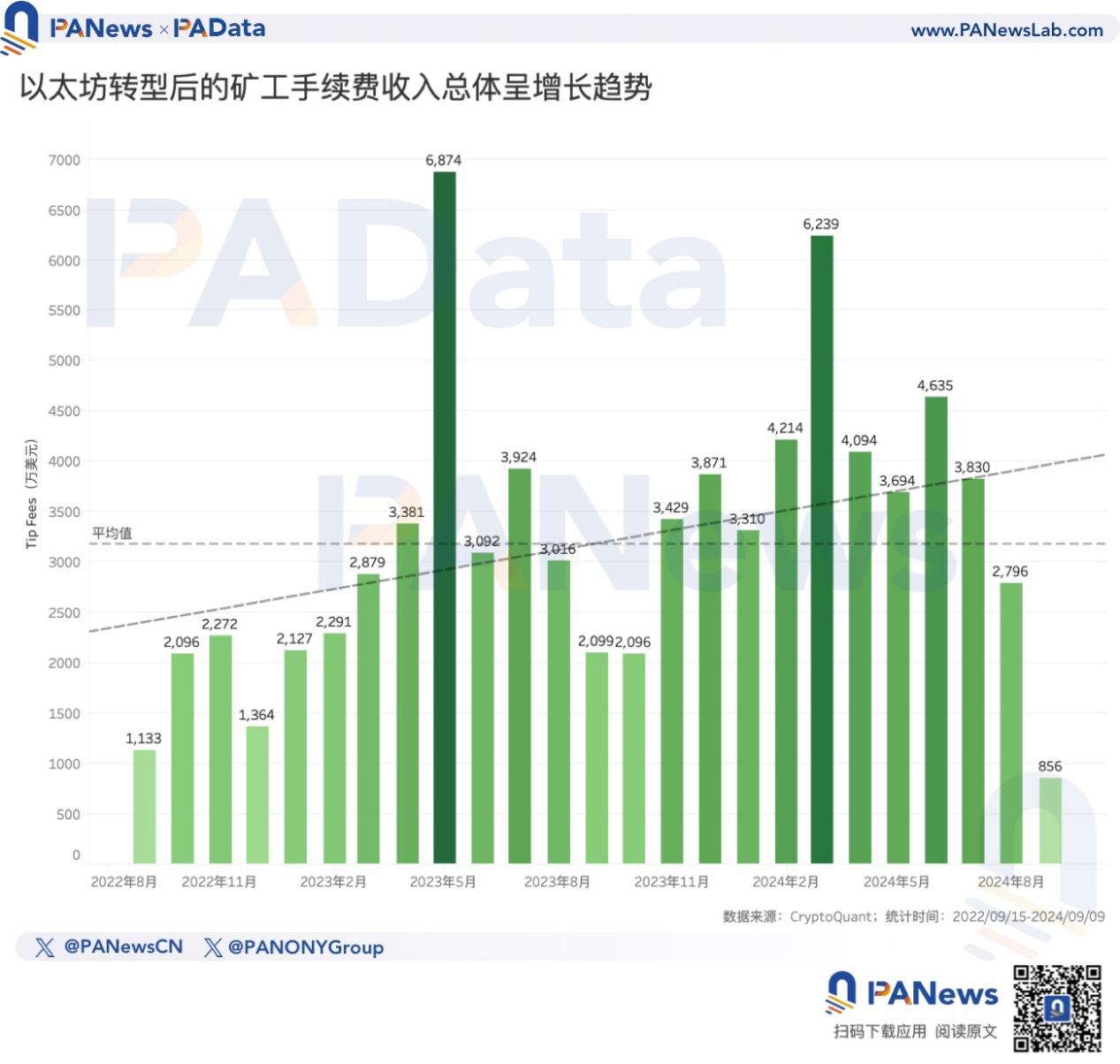

- In the past 2 years, Ethereum's monthly transaction fee income (considering only Tip fees) has shown a clear overall upward trend, with an average monthly fee income of about 32.8156 million USD. However, starting from August this year, the monthly fee income started to decline.

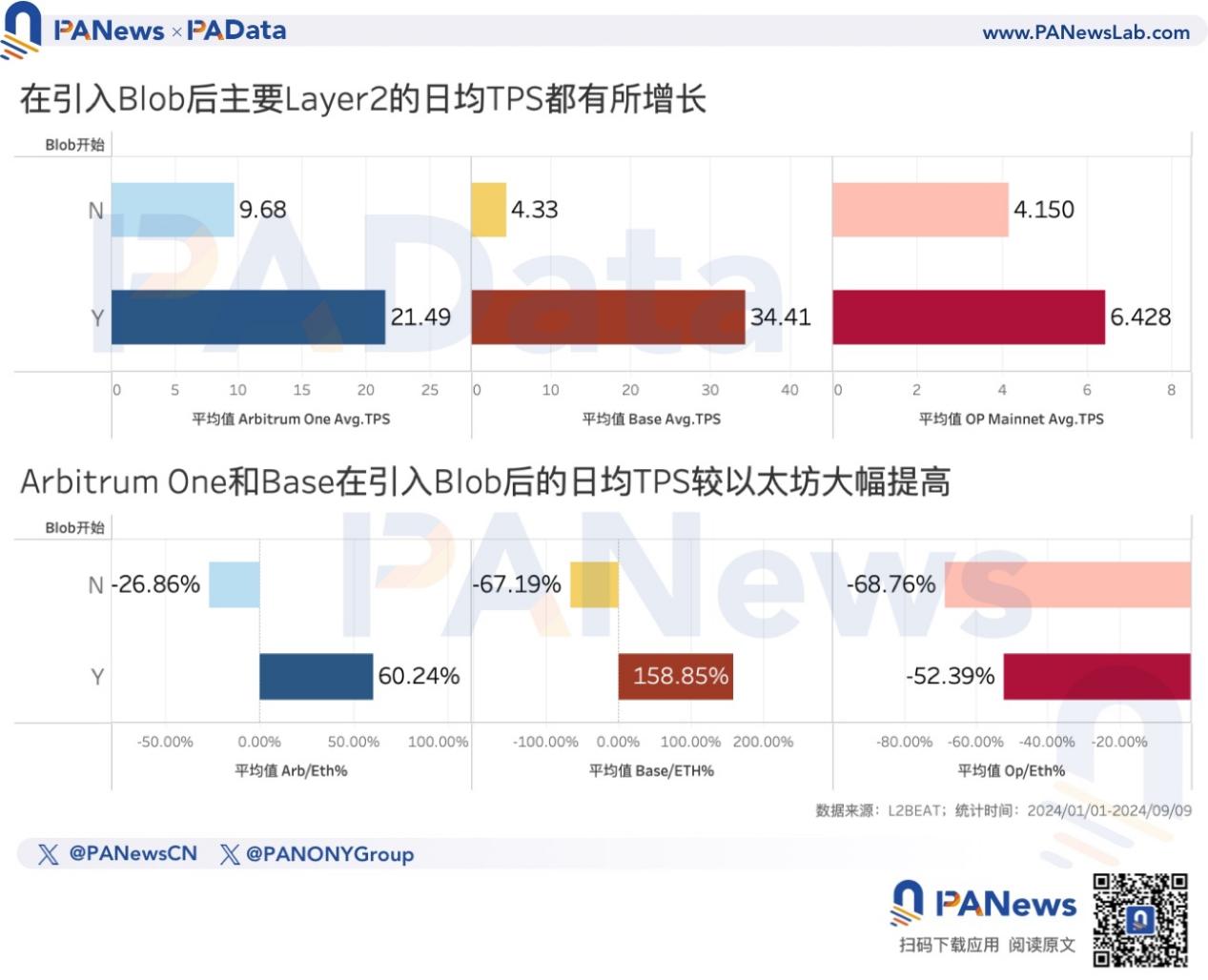

- After the introduction of Blob, the daily average TPS of Arbitrum One, Base, and OP Mainnet increased by 122.00%, 694.69%, and 54.94% respectively. Arbitrum One and Base have TPS that are 60.24% and 158.85% higher than Ethereum's daily average TPS.

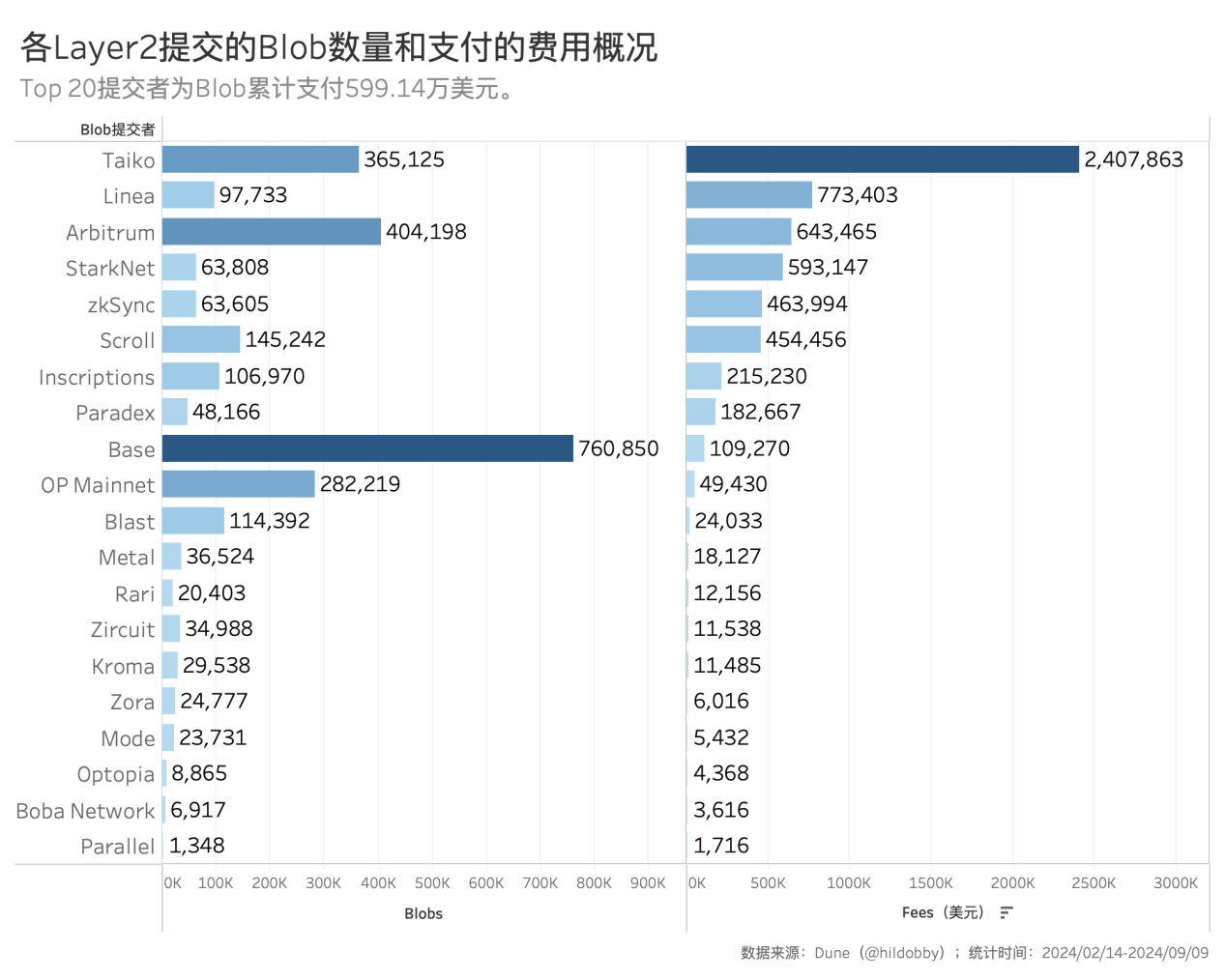

- The top 20 Blob payers have submitted a total of 263.93 Blobs, paying a total of 5.9914 million USD, with an average cost of about 2.27 USD per Blob. Among them, Base, which has the fastest TPS growth, has only paid a total of 109.3 thousand USD.

- The total staking amount of Ethereum has increased by about 150.18% in 2 years, but the marginal growth of the staking amount is slow. The daily average growth rate in the first 9 months of this year is 0.06%, which is a decrease of more than 0.1 percentage points from the daily average growth rate of 0.17% for the whole of last year.

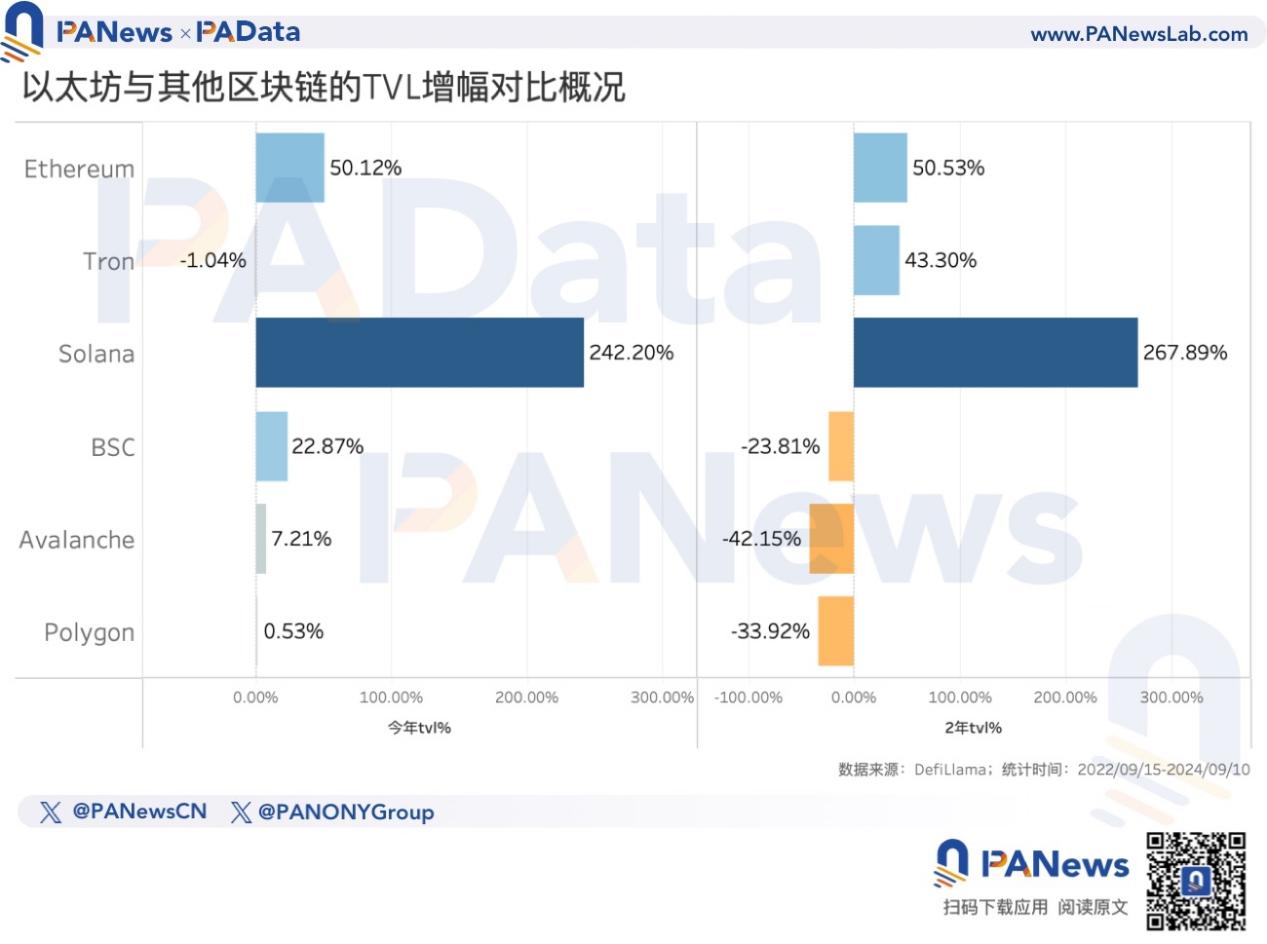

- The lock-up amount of DeFi on Ethereum has increased by 50.12% this year, but Solana has increased by 242.20% this year. Based on the static estimation of the monthly average growth rate this year, it is expected that in another 12 months, Solana's lock-up amount will exceed that of Ethereum.

01. ETH Exchange Rates with BTC and SOL Simultaneously Decline, Ethereum Transaction Fee Income Shifts from Growth to Decline

The direct reason for the doubts about Ethereum is the poor performance of ETH, but in terms of its own trend, post-transition ETH has maintained a significant upward trend. According to CoinGecko's data, in the past 2 years, the increase in ETH is about 44.28%, reaching a high of 4071 USD at one point, and the current price of over 2300 USD is still at a high level in the past two years.

However, when compared with BTC and SOL during the same period, the performance of ETH is not satisfactory. Looking at the trends of these two ratios, in the two years since Ethereum's official transition, BTC's performance has always been better than ETH, and SOL's performance has experienced a process of initially worse and then better compared to ETH.

According to statistics, in the past two years, compared with BTC, the amount of BTC that 1 ETH can be exchanged for has decreased from 0.0807 to 0.0414, a decrease of about 48.70%, and overall, the downward trend of the ETH/BTC exchange rate is evident.

Compared with SOL, before September 2023, 1 ETH could basically be exchanged for over 50 SOL, and the overall trend was increasing, with the highest exchange rate reaching 125.1895 SOL. However, after September 2023, the exchange rate rapidly declined, dragging down the overall exchange rate in the past 2 years. Currently, 1 ETH can only be exchanged for 17.4939 SOL, with an overall decrease of about 63.55%.

Some doubts suggest that the direct reason for the poor performance of ETH is the decrease in transaction fee income, although this is one of the main purposes of a series of upgrades after the transition, it hinders the accumulation of ETH value. However, according to the trend of data statistics from CryptoQuant, in the past two years, Ethereum's monthly transaction fee income (considering only Tip fees) has shown a clear overall upward trend.

As of September this year, the average monthly fee income of Ethereum over the past 25 months is 31.8445 million USD. If September is not considered, then over the past 24 months, the average monthly fee income of Ethereum would increase to 32.8156 million USD. From November 2023 to July 2024, the monthly fee income was higher than 33 million USD, significantly higher than most of the previous time, and even exceeded 60 million USD at one point.

However, in August this year, Ethereum's monthly fee income decreased to 27.96 million USD. If estimated based on the average fee income in the first 10 days of September, the monthly fee income for September may further decrease to 25.6847 million USD. This indirectly confirms the market's concern about the future value accumulation of ETH.

02. TPS of the 3 Major Layer2s Increased Significantly after Introducing Blob, Top 20 Blob Submitters Paid a Total of 5.99 Million USD

The continuous decrease in Ethereum transaction fees should actually be an expected occurrence, but why have recent doubts revolved around this? The possible reason is that the balance between on-chain activity demand and transaction fee prices has not been established.

The ideal expectation is that Ethereum, through Layer2 and other upgrades, has reduced transaction fee prices, which will directly boost or be conducive to long-term boosting of on-chain activity demand, so that the two can achieve a balance, and ETH can still accumulate value from it. However, the current problem is that the total demand for on-chain activity is insufficient, coupled with Layer2 taking on more direct on-chain activity and interacting with Ethereum at a lower price. In this situation, the continuous decrease in transaction fees has challenged the value feedback and accumulation of ETH. In simpler terms, Ethereum's fee optimization plan designed for high demand periods is untimely in low demand periods.

According to Dune's (@hildobby) data, after the introduction of Blob transactions, the TPS of the three Layer2s with the highest lock-up amounts has significantly increased, and two of them have TPS that exceed Ethereum. Ethereum's series of optimizations in transaction fees objectively promoted the development of Layer2, especially the development of Base.

From the beginning of this year to March 14, the daily average TPS of Arbitrum One, Base, and OP Mainnet were 9.68, 4.33, and 4.15 respectively. From March 14 to the present, the daily average TPS of the three has increased to 21.49, 34.41, and 6.43, with increases of 122.00%, 694.69%, and 54.94% respectively.

Moreover, from the beginning of this year to March 14, the daily average TPS of Arbitrum One, Base, and OP Mainnet were lower than the daily average TPS of Ethereum during the same period, averaging 26.86%, 67.19%, and 68.76% lower, respectively. However, after the introduction of Blob, the daily average TPS of Arbitrum One and Base has exceeded Ethereum by 60.24% and 158.85%. Although the daily average TPS of OP Mainnet is still lower than Ethereum's, the gap between the two is narrowing.

The growth in Layer2 demand has benefited from the introduction of Blob transaction types, but the fees paid by Layer2 for Blob are very low. In other words, the improvement in Ethereum transaction fees currently cannot be reflected in the accumulation of value for ETH.

According to Dune (@hildobby) statistics, as of now, the top 20 Blob payers have collectively paid 5.9914 million USD, accounting for over 99% of the total fees. Among them, Base, with the fastest TPS growth, has only paid a total of 109.3 thousand USD, Arbitrum has paid 643.5 thousand USD, and OP Mainnet has paid 49.4 thousand USD. Even Taiko, who paid the highest amount, only paid 2.4079 million USD.

These submitters have collectively submitted 263.93 Blobs, which means the average cost per Blob is approximately 2.27 USD. However, this is based on fee data under the current situation of insufficient total on-chain demand. If there is a significant increase in on-chain activity demand in the future, leading to network congestion, Blob prices will also rise, and Layer2 will naturally have to pay more fees to Ethereum. At that time, whether Blob can compensate for the portion of transaction fee income that Ethereum has relinquished remains to be further observed.

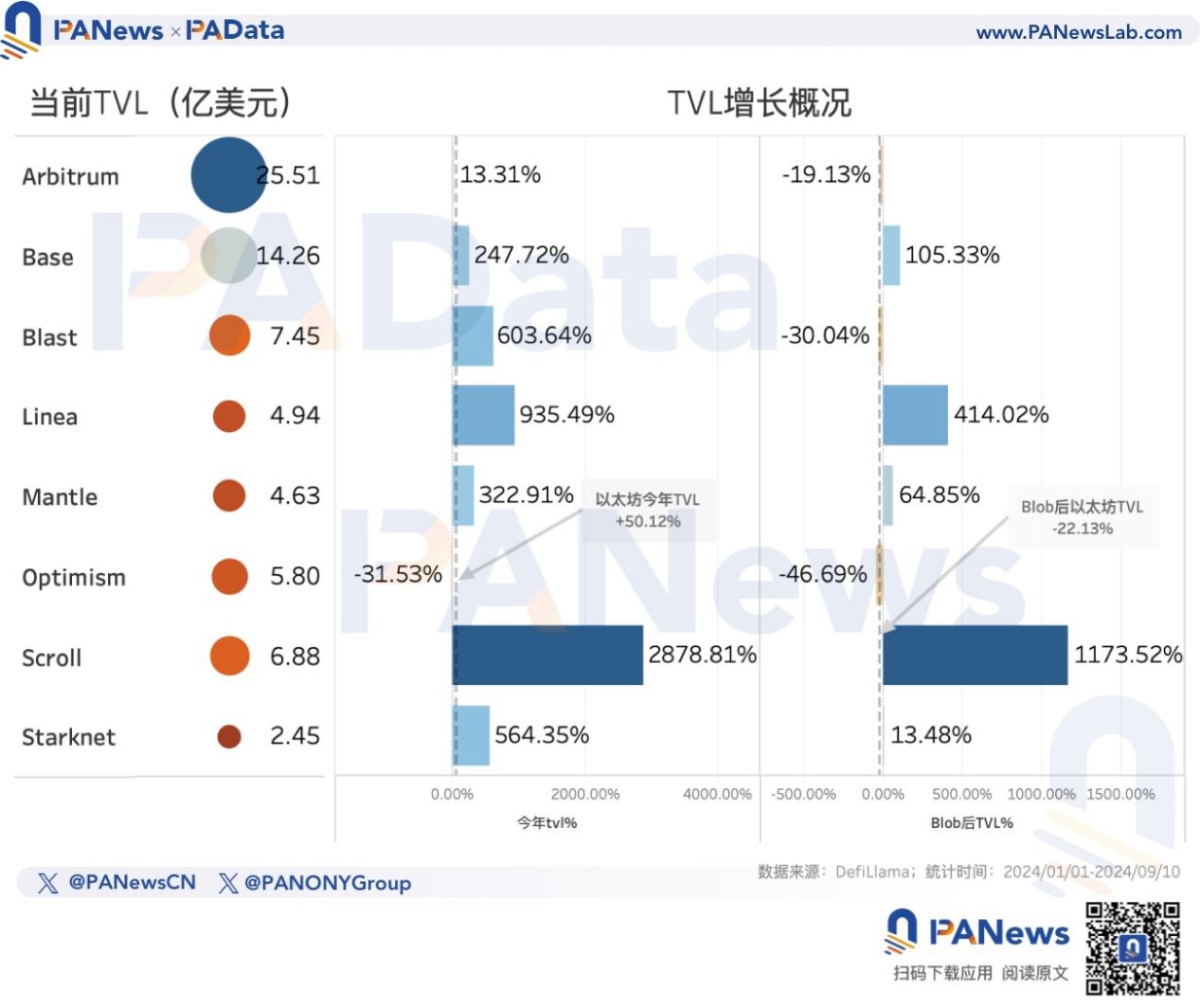

The growth in Layer2 demand is partly reflected in the changes in the lock-up amount. According to DefiLlama's statistics, after the introduction of Blob, Ethereum's lock-up amount has decreased by 22.13%, with only Blast and Optimism experiencing a larger decrease. Base, with the fastest TPS growth, has seen its lock-up amount increase by 105.33%, and Linea, the second-highest payer of Blob fees, has seen its lock-up amount increase by 414.02%. Additionally, although Arbitrum's lock-up amount has also decreased by 19.13%, the decrease is smaller than Ethereum's.

03. Ethereum Staking Growth Rate Declines, TVL Increases but Lags Behind Solana

Another challenge for Ethereum after the transition is how to achieve a balance between staking amount and lock-up amount to ensure that on-chain activity on Ethereum remains at a certain level securely. The mutual variation of ETH price and staking interest rate will be the key to achieving this balance. Essentially, this will determine whether ETH has sufficient liquidity, has ample demand, and this is an important requirement for ETH to become a settlement currency. Another requirement is for ETH to maintain its value over time, which means that significant fluctuations or short-term substantial increases in ETH are not expected.

If it is positioned as a settlement currency, then it is expected that Ethereum will have long-term sustainable high demand to achieve long-term stable appreciation of ETH. The question is whether the market is willing to pay for this long-term expectation. When this long-term expectation is insufficient, the emergence of doubts is natural.

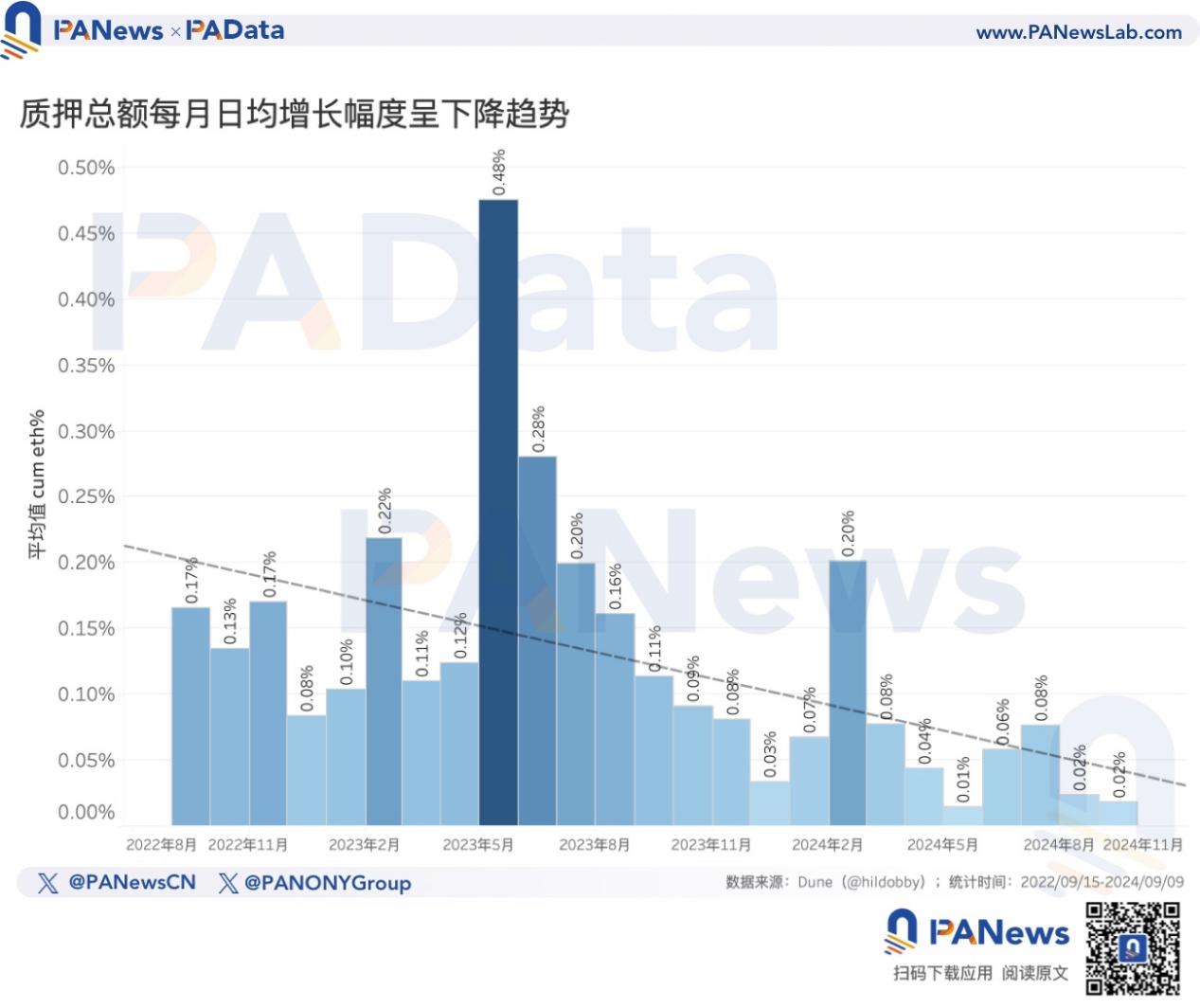

From the demand side reflected in the data, currently, the total staking amount of Ethereum is 34.3842 million ETH, an increase of about 150.18% compared to 2 years ago, showing a significant increase. However, in terms of the growth rate of the staking amount, the daily average growth rate is showing a declining trend, indicating slow marginal growth of the staking amount. The daily average growth rate in September has already decreased to 0.02%, and the daily average growth rate in the first 9 months of this year is 0.06%, a decrease of over 0.1 percentage points from the daily average growth rate of 0.17% for the whole of last year.

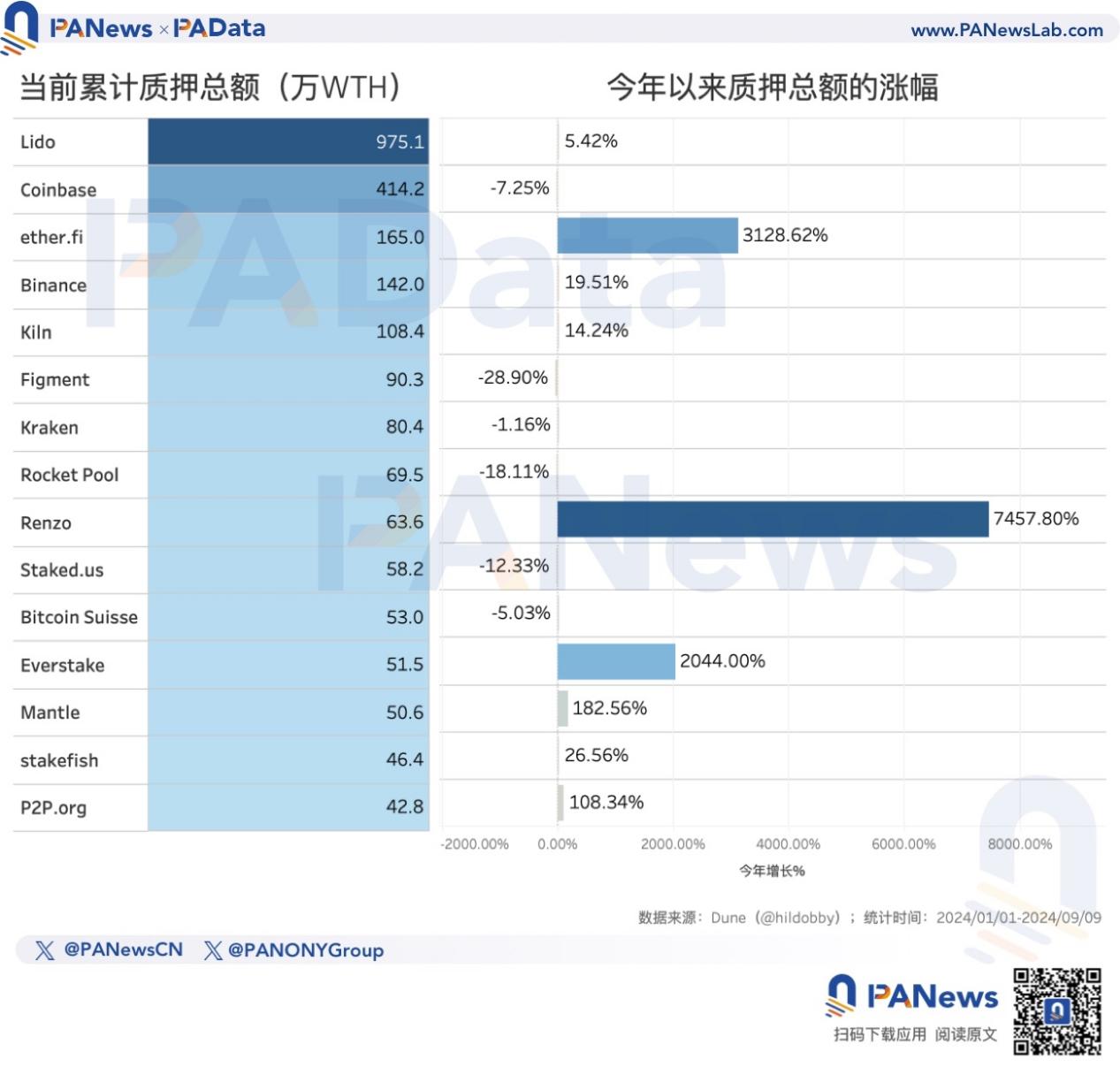

The current top 3 entities with the highest cumulative staking amount are Lido, Coinbase, and ether.fi, with only Lido's staking amount exceeding 9.75 million ETH. Since the beginning of this year, the main contributors to the high-speed growth of the staking amount are Renzo, ether.fi, and Everstake, with growth rates exceeding 7457%, 3128%, and 2044%, respectively.

While the total staking amount is slowly increasing at a high level, the lock-up amount of DeFi on Ethereum reached a short-term high of 67.901 billion USD in June this year, and is currently at 44.468 billion USD, an increase of 50.12% since the beginning of this year, and a 50.53% increase in the past 2 years. This means that there has been some recovery in the demand at the application level for Ethereum this year.

However, compared to Solana, the growth in demand for Ethereum seems to be lacking momentum. Solana's current lock-up amount is about 4.781 billion USD, roughly 1/10 of Ethereum's overall scale. However, this year, Solana's lock-up amount has increased by 242.20%, and in the past 2 years, it has increased by 267.89%, showing rapid development.

In a simple static analysis, if Solana continues at the same monthly average growth rate as this year (this year's growth rate / 254 days * 30 days), it is expected that in another 9 months, its lock-up amount will exceed 46 billion USD. If Ethereum also continues at the same monthly average growth rate as this year, it is expected that in another 12 months, Solana's lock-up amount will surpass that of Ethereum. Competition may be one of the reasons why the market is starting to doubt whether Ethereum's long-term expectations can be realized.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。