In this issue, we discussed the emergence of vertical blockchains as an alternative form to general blockchains or specific application chains.

Author: Pillarbear

Translation: Deep Tide TechFlow

Welcome to the third issue of "Consumer Watch," a newsletter covering the latest news and insights on consumer cryptocurrency.

In this issue, we discussed the emergence of vertical blockchains as an alternative form to general blockchains or specific application chains. Vertical blockchains provide a centralized platform with similar interests and characteristics, serving users and applications.

Below, you can also find a market review, an overview of major market news, and our planning insights, showcasing a range of valuable trends and consumer cryptocurrency insights.

The Rise of Vertical Blockchains

Don't try to do everything yourself. When you become the first, you create a good spread effect. Making your customers happy and becoming a leader in your field and region, whatever they are, is very valuable. - Fabrice Grinda

So far, there are mainly two types of blockchains: general blockchains and specific application blockchains.

Most existing and upcoming blockchains are general blockchains. These blockchains can support a variety of applications built on them, making them potentially the largest hub for most blockchain activities. However, these blockchains, especially the newly launched ones, often struggle to differentiate themselves from other blockchains. Despite significant room for improvement, the advantages that applications gain from this advanced infrastructure often fail to fully compensate for the disadvantages of losing a large user base and the composability between tokens and applications within a single chain. Furthermore, the repeated launch and initiation of almost indistinguishable projects in the L1/L2 space have left users and investors feeling fatigued, primarily benefiting liquidity providers.

On the other end are specific application blockchains. While experiments are still ongoing, there are few practical cases of implementation. The limited adoption of application chains may be due to their inability to provide a smooth user experience when exploring multiple applications. Additionally, running a complete blockchain solely for a single application is inefficient for most developers in this field. Although frameworks are being developed to alleviate these challenges and assist users and developers, it seems that some time is still needed to fully implement these solutions and put them into use.

Source: Making Your Marketplace Unit Economically Efficient

An alternative solution with promising prospects and relatively unexplored is the concept of specially built vertical blockchains. While not a completely new concept, it has become more important recently. Vertical blockchains are similar to vertical platforms in Web2 businesses, a trend that often emerges in the mature stage of a market. While general platforms still generate the majority of transaction volume and user behavior, over time, more and more vertical platforms focusing on specific industries or characteristics often attract specific user groups.

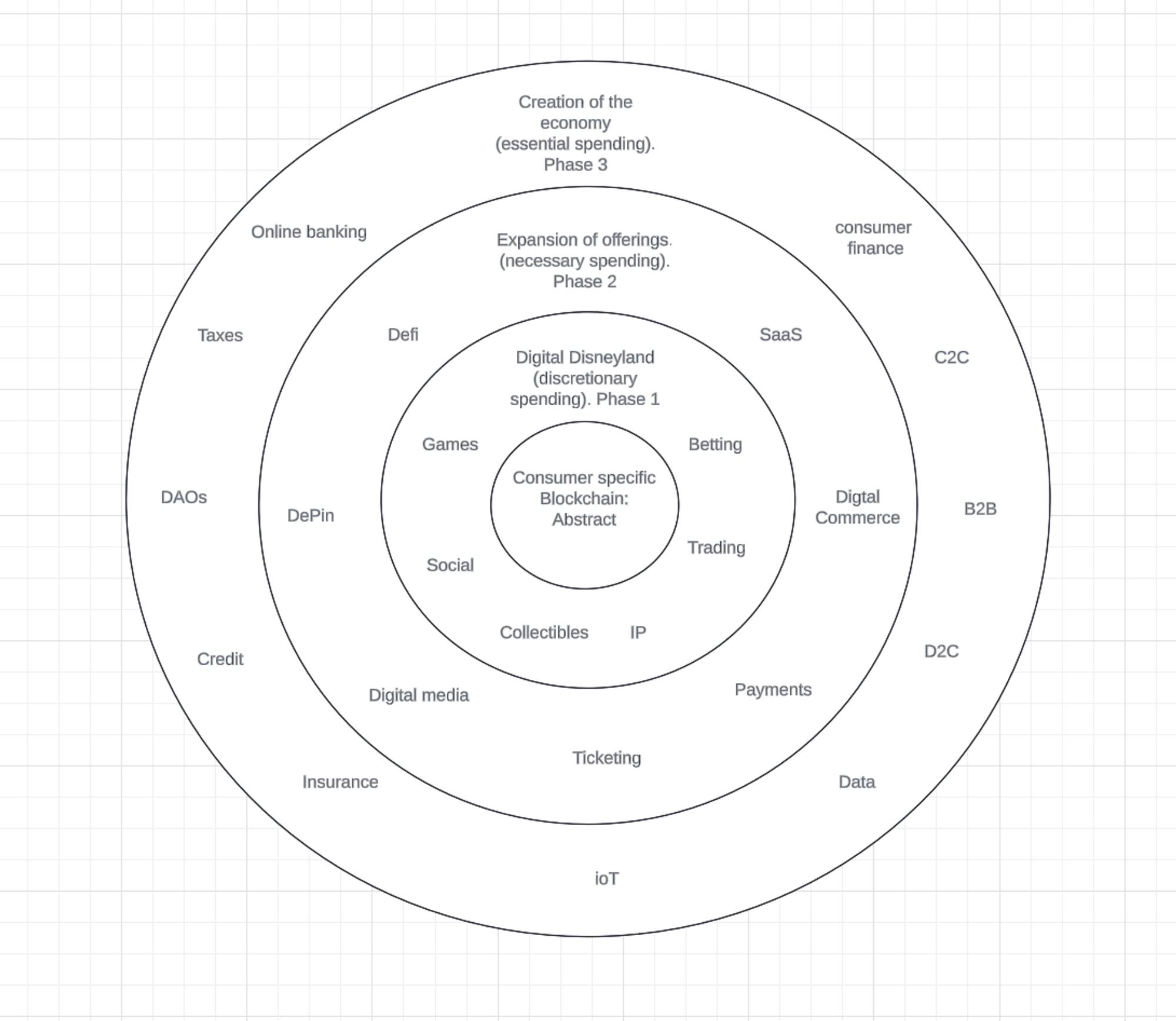

Vertical blockchains are tailored to specific industries or functions, providing users with a seamless multi-application experience. These platforms host applications with similar characteristics, creating an ecosystem focused on specific user groups. For example, there is a clear contrast between users trading memecoins and betting on internet trends and users dealing with government bonds and yield optimization. By meeting the needs of each user base, vertical blockchains eliminate the need for users to switch between different ecosystems.

These specialized chains also leverage network effects to support their onboarding services, addressing the common "cold start" challenge faced by new applications. For emerging applications, these platforms serve as effective distribution channels, providing opportunities for direct access to target audiences and showcasing the platform's value proposition. Some chains go further, offering specialized tools and features that can significantly reduce developers' initial costs and operational expenses. This enables teams to allocate resources more effectively, focusing primarily on service development and innovation.

Source: What is Consumer Cryptocurrency?

In this context, the most obvious but not exhaustive examples are Abstract for consumer applications and Plume Network for RWA projects.

While Abstract is expected to offer special features and tools as a consumer chain, such as the Abstract Global Wallet (AGW), its true value may lie in serving as a comprehensive distribution channel, generating network effects through demographic similarities and application types. Although its detailed strategy and features are still uncertain, Abstract seems most likely to succeed in similar projects.

Unlike infrastructure innovation or B2B services, the success of consumer-facing crypto applications is far more unpredictable than people anticipate. This uncertainty stems from the volatility of user behavior and preferences, especially in areas where most services aim to capture user excitement and interest rather than meet specific needs.

The current cryptocurrency environment emphasizes user engagement and novelty, making it particularly challenging to predict the best user experience. In this case, the key is to create an ecosystem that implements multiple expected value (EV) strategies, thereby increasing the overall probability of success.

Pudgy and Luca have demonstrated excellent marketing and community-building capabilities in the crypto space, planning marketing campaigns that trigger widespread dissemination and building influential communities. Their success relies not only on attention-grabbing strategies but also on maintaining consistent brand strategies and high-quality standards, which are key factors for long-term success of consumer applications. This commitment and skill are particularly rare in the crypto industry, as many projects tend to quickly move on to the next hype cycle.

Abstract seems to be positioning itself to capture this dynamic. Through its outstanding community-building and marketing capabilities, they aim to attract a large number of target users to their platform. This user concentration may in turn attract more outstanding developers to their ecosystem. The potential synergistic effect between high-quality services and an active user base could significantly elevate Abstract's position as a leading vertical blockchain for consumer applications.

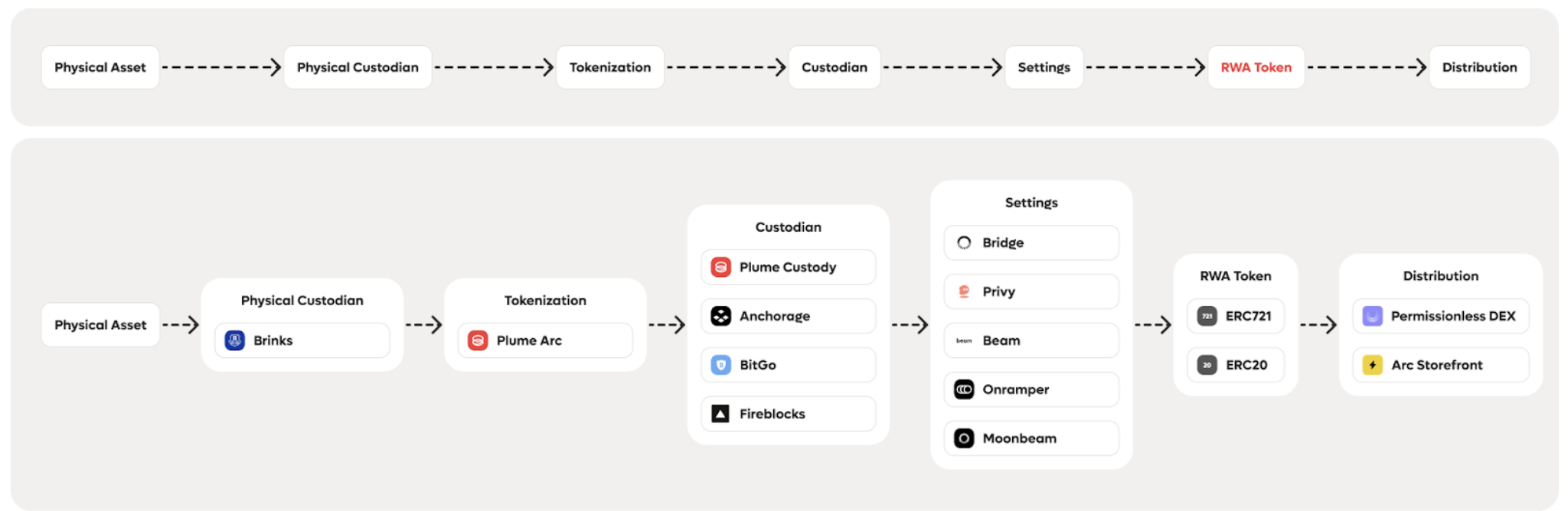

Source: Plume

Another important candidate for a vertical blockchain is Plume Network. Plume is a modular blockchain designed to address the primary challenges of RWA while creating the emerging field of RWAfi. By directly integrating tokenization engines and compliance into its platform, Plume significantly reduces the difficulty of building RWA projects.

Plume is creating a virtuous cycle, lowering barriers to entry and attracting more assets and users to join its ecosystem. In the Plume ecosystem, users will be able to utilize tokenized real-world assets (RWA) in a manner similar to how they currently use other on-chain assets and protocols. This includes using RWA as collateral for loans, staking to generate interest, borrowing against it as collateral, and even engaging in high-leverage speculation through derivative trading. By supporting these diverse activities around RWA, Plume is not only tokenizing assets but also creating a new financial ecosystem, blurring the boundaries between physical and digital assets.

Please note that Abstract and Plume are not the only representatives of vertical blockchains. More and more blockchains are attracting developers through focused operations, branding, and features. As the industry matures, we are witnessing the end of the era focused on building general chains. The next phase will involve the development of platforms targeting specific industries, capable of establishing network effects for applications with similar attributes and interests.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。