Author: Frank, PANews

Recently, the market has been fluctuating downward, and Bitcoin, along with most altcoins, has experienced a significant decline. Against this backdrop, the performance of the whales and whether smart money can resist the downward pressure has become a hot topic of market concern. In response, PANews has taken stock of the asset performance of the top ten whales listed by Arkham over the past three months.

Most of the whales seem to have been unable to escape the downward pressure, with their asset levels shrinking to varying degrees. However, Sun Yuchen and the smart money address @smartestmoney have stood out.

Sun Yuchen: Benefiting from the rise of TRX, outperforming BTC

Sun Yuchen's main holdings are TRX (1.9 billion coins, worth about $291 million), stablecoins (USDD 276 million coins, USDJ 95.39 million coins, USDT 58 million coins, USDC 12.17 million coins, worth about $446 million), ETH (13,000 coins, worth about $30.77 million), BTC (1,450 coins, worth about $82.99 million), BTT (101.6 billion coins, worth about $91.45 million). The total value of the assets is about $1.03 billion. Over the past 40 days, the assets have decreased by $17 million, with a loss rate of about 1.6%. During this period, BTC has declined by about 18% overall.

Sun Yuchen's largest single coin holding is TRX, which still holds 1.9 billion coins. Since the end of June, his TRX holdings have decreased by about 200 million coins. However, due to the recent good performance of TRX, it rose by 45% from August 5th to August 25th, reaching a high of $0.17. Thanks to the rise of TRX, Sun Yuchen has also realized a floating profit of about $62.7 million in this part of his holdings.

In addition, in the past two months, Sun Yuchen's stablecoin holdings have also increased significantly, with the current stablecoin holdings reaching $446 million, accounting for 42.6% of the total position. Therefore, during the overall market fluctuations and downturn, Sun Yuchen's position value has not changed much, basically maintaining around $1 billion. However, it is worth noting that this may not be all of Sun Yuchen's holdings, as only the data displayed on Arkham has been counted.

Rain Lohmus: Lost keys, missing out on life's biggest return

Estonian LHV Bank founder Rain Lohmus invested $75,000 to buy 250,000 ETH during the first token issuance of Ethereum in 2014. Currently, these ETH are worth $580 million, and in March of this year, the assets reached a peak of $1 billion. However, it is regrettable that Rain Lohmus has stated that he has lost the private key to the wallet and may have to watch the value of the holdings continue to rise without being able to do anything about it.

In addition, he holds 21.46% of LHV Bank's shares, valued at $254 million as of August 30. It seems that this investment from years ago will become the biggest return of his life.

Vitalik Buterin: Rarely active, moving in tandem with ETH

Vitalik Buterin's holdings are mainly in Ethereum. As of September 10, Vitalik Buterin holds over 240,000 ETH, worth about $560 million. However, because Vitalik Buterin does not often make asset transactions, his assets have also experienced a significant decline over the past three months. In early June, Vitalik Buterin's total assets exceeded $900 million, and in three months, the assets have shrunk by $355 million, about 40%. Over the past month, Vitalik's address has decreased by about 4,000 ETH (about $9.34 million), with most of it transferred to a multi-signature address. Some netizens speculate that this fund may be used for donations, but Vitalik has not provided an explanation for this.

Stefan Thomas: Another helpless HODL due to lost keys

Former Ripple CTO Stefan Thomas's wallet contains 7,002 bitcoins, but this is a story similar to Rain Lohmus's. Stefan Thomas has also lost the private key to the wallet, and the hard drive has only two chances to enter the password. Currently, these bitcoins are worth about $398 million, and in March of this year, the value of these bitcoins exceeded $500 million. However, this once again proves that HODL may be the best way to accumulate wealth, but remember to keep the private keys of each wallet safe.

James Fickel: Firmly bullish on ETH, educated by the market

Amaranth Foundation founder James Fickel is a staunch Ethereum bull. Before August of this year, he had been continuously increasing his ETH holdings for several months and had borrowed WBTC multiple times to exchange for ETH to go long on the ETH/BTC exchange rate. According to on-chain analyst Yu Jin, from January to July, James Fickel's cost for the ETH/BTC exchange rate was about 0.054. Currently, James Fickel still has 2,316 bitcoins borrowed, worth about $131 million. The ETH/BTC exchange rate has fallen to 0.04, and by this calculation, he has lost about 25.9%, with a loss of about $33.96 million.

Currently, James Fickel's total assets are about $391 million, and in May of this year, his assets peaked at over $600 million, shrinking by about 35%. Recently, James Fickel has begun to significantly reduce his ETH holdings and return WBTC.

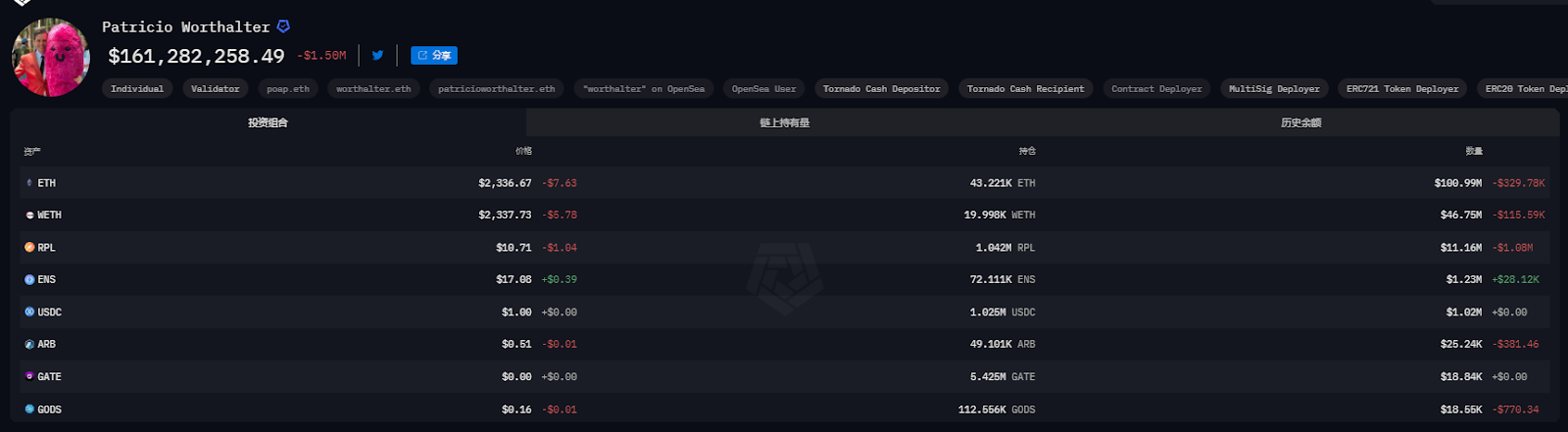

Patricio Worthalter: Shrinking by $100 million in three months

POAP founder Patricio Worthalter is ranked sixth on the Arkham's top ten whales list, currently holding assets worth about $160 million. Over the past three months, Patricio Worthalter's asset returns have significantly declined, decreasing by $100 million. His main holdings include ETH, RPL, ENS, and others. The decline in the value of these assets over the past three months has been over 35%, with RPL dropping by 46%. This directly led to the shrinkage of Patricio Worthalter's assets. However, the main shrinkage is still due to ETH, with the value of his ETH holdings shrinking by about $90 million since June.

POAP founder Patricio Worthalter is ranked sixth on the Arkham's top ten whales list, currently holding assets worth about $160 million. Over the past three months, Patricio Worthalter's asset returns have significantly declined, decreasing by $100 million. His main holdings include ETH, RPL, ENS, and others. The decline in the value of these assets over the past three months has been over 35%, with RPL dropping by 46%. This directly led to the shrinkage of Patricio Worthalter's assets. However, the main shrinkage is still due to ETH, with the value of his ETH holdings shrinking by about $90 million since June.

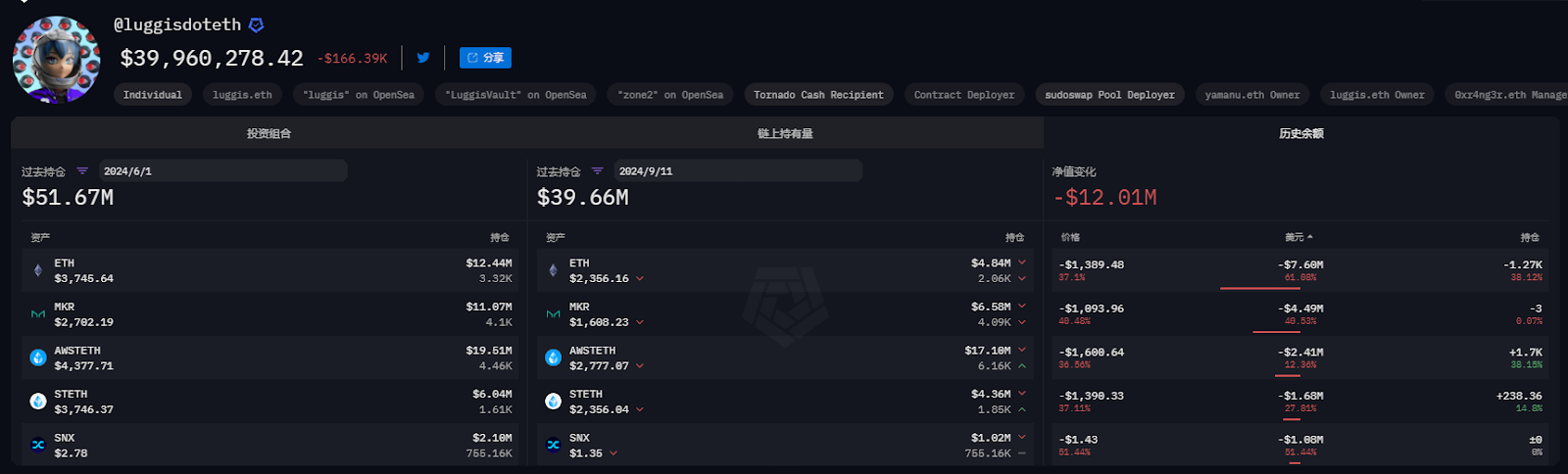

@luggisdoteth: Shrinking by nearly half due to ETH's decline

Whale @luggisdoteth currently holds assets worth about $39.96 million, with his main holdings also being ETH, holding about 10,070 ETH, worth about $23.72 million, accounting for more than half of his total position. Over the past 3 months, his position has reached a peak value of $69 million. Due to the decline in ETH, it has now shrunk by nearly $30 million.

@smartestmoney: Legendary trader beating the market

The owner of the smart money address @smartestmoney is a legendary trader. According to the CoinMarketManager data, @smartestmoney has achieved a profit of $48.84 million from trading since 2020 until August 2024. Currently, most of his assets are in exchanges, and from the trading records, @smartestmoney is good at futures trading. Over the past three months, his profit curve has continued to rise.

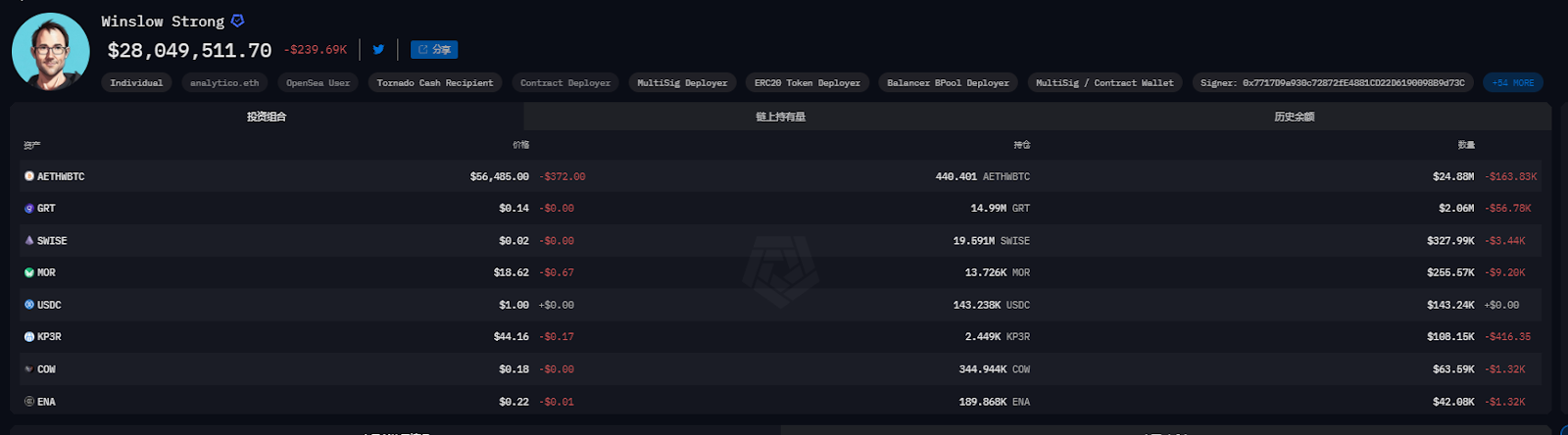

Winslow Strong: Heavy on BTC, little change

Winslow Strong, a partner at Cluster Capital, currently holds assets worth about $28.17 million. His main position is in WBTC, about 440 coins. Over the past three months, Winslow Strong's account has seen little change, with only a $2.58 million shrinkage, mainly from the losses in the GRT holdings, which have dropped by about 52% in the past three months.

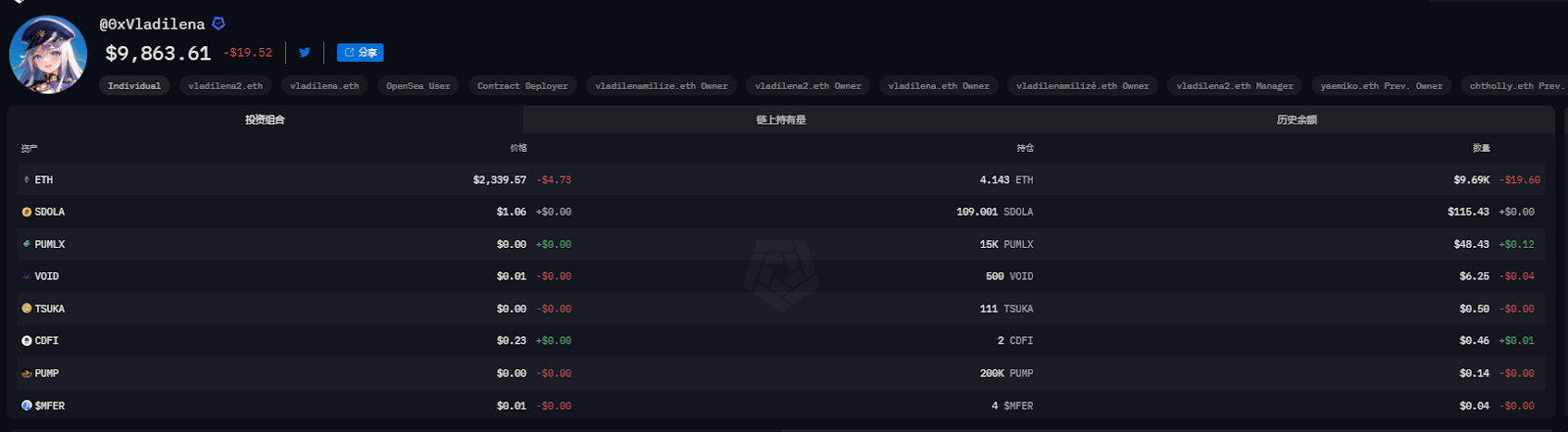

@0xVladilena: Heavy on ETH staking and lending

The smart money address @0xVladilena currently has less than $10,000 in on-chain assets. From the trajectory, his assets were recently transferred to Ether.fi and AAVE, and his heavy holdings are also in ETH. Currently, in AAVE, @0xVladilena holds assets worth over $77 million, with 31,000 ETH being lent for staking.

The smart money address @0xVladilena currently has less than $10,000 in on-chain assets. From the trajectory, his assets were recently transferred to Ether.fi and AAVE, and his heavy holdings are also in ETH. Currently, in AAVE, @0xVladilena holds assets worth over $77 million, with 31,000 ETH being lent for staking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。