In terms of market trends, the long-term impact is not significant, but the short-term impact is considerable.

Authored by: 1912212.eth, Foresight News

The former Soviet Union had a proverb, "You may not be interested in politics, but politics is very interested in you." Politics has an undeniable impact on the operation of the national machinery, affecting individuals, institutions, companies, and commercial operations. The cryptocurrency market is no exception.

The quadrennial Bitcoin halving event has had minimal impact on the price of BTC. So, does the U.S. presidential election have an impact on the cryptocurrency market? First, let's observe the impact of the election on the traditional financial markets.

Impact of the Election on Traditional Financial Markets

The U.S. presidential election still has a significant short-term impact on the trend of the U.S. stock market. Historically, there has often been significant volatility in the months leading up to the election. Therefore, the market tends to adopt a wait-and-see approach, making major decisions only after the results are announced. It is worth noting that the U.S. stock market often performs even better in the year following the election.

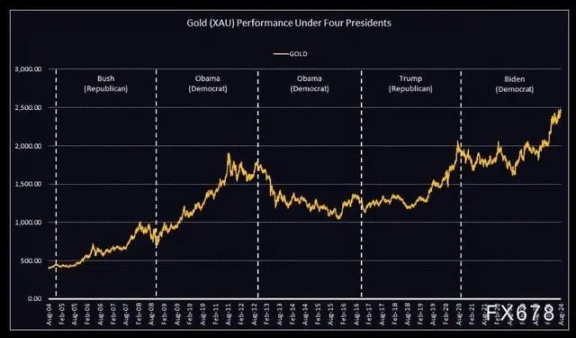

Interestingly, the election also has a certain short-term impact on the price trend of gold. Similar to the U.S. stock market, the demand for gold as a safe haven asset increases during the election period, leading to a continuous rise in the months leading up to the election.

Although the U.S. presidential election may have a significant short-term impact on the U.S. stock market, gold, and other assets, it has a relatively small long-term impact on their price performance and does not cause any abnormality in the financial markets. In fact, in the short term, the election also has little impact on the trend of the U.S. dollar and macroeconomic conditions.

This is because the medium- to long-term performance in the financial markets is often influenced by economic parameters such as inflation trends. The election of the president is not a major influencing factor.

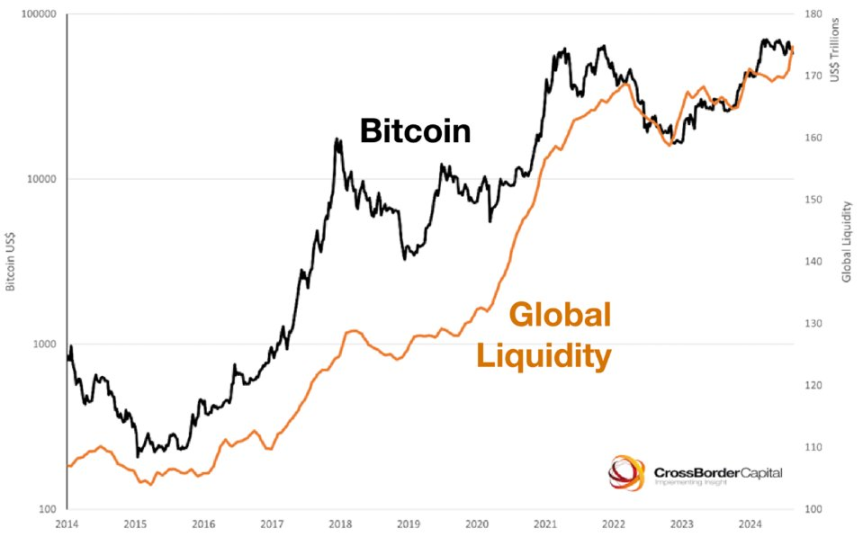

Currently, the cryptocurrency market, led by Bitcoin, has grown to tens of trillions of dollars, and it has moved from being considered an alternative asset to being part of the mainstream. Bitcoin is increasingly influenced by macroeconomic factors, including market liquidity, Federal Reserve interest rate adjustments, and U.S. elections.

When the Federal Reserve lowers interest rates and global capital liquidity significantly increases, it is also a time when BTC continues to rise in price, and macro liquidity still plays a decisive role in the cryptocurrency market.

In addition, in recent months, the non-farm payroll data and CPI data, which are important references for the Federal Reserve's interest rate decisions, often cause significant fluctuations in the cryptocurrency market when announced. Currently, BTC is becoming increasingly closely linked to the macro financial markets.

As cryptocurrency market investors, the influence of macro factors cannot be ignored.

Continuous Political Donations from Cryptocurrency Companies

Over the years, cryptocurrency companies have continuously donated to U.S. politicians.

As early as May 2022, SBF once boasted that he would donate 1 to 10 billion U.S. dollars in the 2024 U.S. presidential election. Even before 2024, substantial donations began. As of mid-October of that year, Bloomberg's data showed that participants in the cryptocurrency industry had donated $84.1 million to U.S. politicians, with approximately 84% of the amount coming from SBF and other executives of FTX.

Recently, an email from Wall Street revealed that SBF's family was suspected of illegally diverting over $100 million of FTX customer funds to influence the 2022 election, leading to multiple legal disputes. The email detailed SBF's father, Joe Bankman's involvement in formulating financial strategies related to political donations.

After the FTX incident, political donations from the cryptocurrency industry decreased significantly. However, as the time approaches the 2024 election year, political donations from the industry have increased again.

As of May this year, the cryptocurrency industry's political donations for the 2024 U.S. election had reached $94 million, reaching a historical high. Coinbase and Ripple Labs donated $20.5 million and $20 million, respectively.

The sources of political donations from the cryptocurrency industry for the U.S. election can be roughly divided into several categories. First, donations are made to influence presidential candidates and government officials' stance on cryptocurrencies, as policy regulation has a significant impact on the legitimacy of cryptocurrencies, tax systems, and industry development. Second, they aim to protect their own interests from legislative and regulatory impacts. In addition, cryptocurrency companies also use donations to increase brand awareness and build good public relations.

Mike Novogratz, CEO of Galaxy Digital, once predicted that regardless of who wins the 2024 presidential election, cryptocurrencies in the U.S. will receive favorable regulation, as most U.S. politicians tend to support innovation in the cryptocurrency industry.

If the greater impact of donations is on the policy and regulatory front, how much does the election affect the cryptocurrency market trends?

Long-term Impact is Insignificant

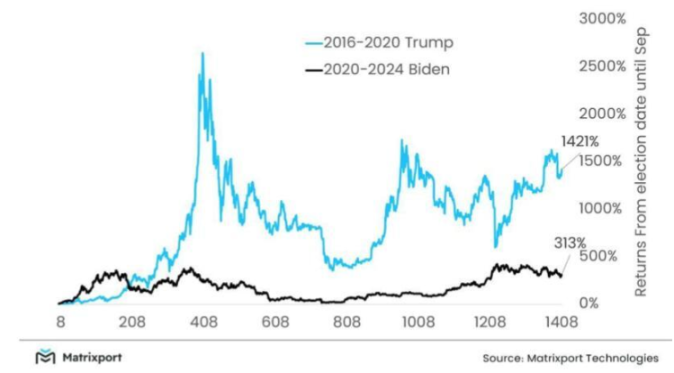

During the bull market period from 2016 to mid-2020, the Republican Trump was in power, and from 2020 to 2024, the Democrat Biden was in power. The cryptocurrency market, led by BTC, experienced strong bull markets during their respective terms in office.

Counting from the election period to September, the chart below shows that although the price of BTC fluctuates during the period, it still achieves a certain return. The earliest period of Trump's presidency had the highest market return.

The bull market cycle in 2017 and the unlimited quantitative easing initiated in 2020 due to the COVID-19 pandemic brought significant capital inflows to the cryptocurrency market.

During Trump's presidency, he mentioned Bitcoin and cryptocurrencies on Twitter but did not acknowledge their value.

During Biden's presidency, there is still a tolerant attitude towards cryptocurrencies. After the FTX incident, the U.S. SEC's crackdown intensified. However, overall, the U.S. still maintains a leading position in technological innovation and capital inflows in the cryptocurrency field.

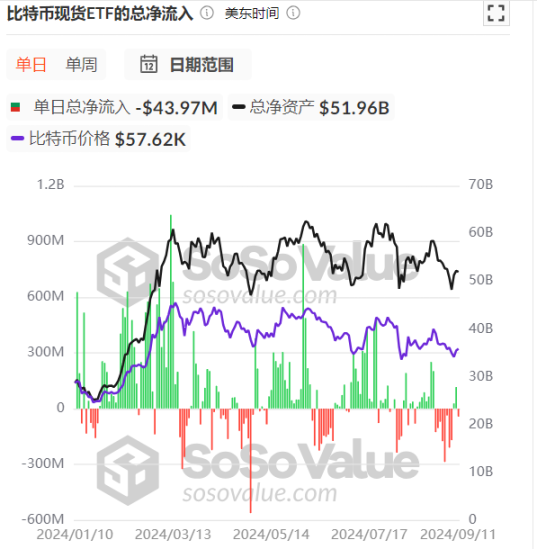

The bull market cycle in 2021 and the approval of a Bitcoin spot ETF by the U.S. SEC in early 2024 also brought considerable enthusiasm to the cryptocurrency market. As of September 11, the total net inflow of BTC spot ETF reached $17 billion.

From the historical market performance in the past two cycles, it can be seen that the rise of the cryptocurrency market was not significantly affected by the presidency of either Republican or Democratic candidates.

Although the impact of the election is limited, the factors that truly have a long-term impact on the cryptocurrency market are the industry's own technological development and key factors such as the Federal Reserve's meeting decisions.

Short-term Impact is Significant

Although the long-term impact of the election is not significant, in the short term, it shows a considerable impact.

On the morning of July 14, when the candidate Trump was assassinated, BTC rose by 2% that day, breaking through the $60,000 mark, and rose by another 6% the next day, reaching around $65,000, and then continued to rise.

On July 28, Trump attended the highly anticipated Bitcoin conference. Subsequently, after the market paused following the end of positive news, negative news emerged. On July 29, after just breaking through $70,000, Bitcoin began to decline, and even experienced panic selling in early August.

On August 23, when independent presidential candidate Robert Kennedy suspended his campaign and supported Trump, Bitcoin surged from $60,000 to around $65,000, with a single-day increase of over 6%.

Recent days of the U.S. presidential candidate debates, as neither Harris nor Trump mentioned cryptocurrencies, the market response has been relatively tepid overall.

The U.S. presidential election day usually falls on the first Tuesday of November every four years. This day is known as "Election Day." Therefore, the next important time point is November 5th. At that time, BTC may experience significant volatility after the election results are announced.

From past cycles, when the strict enforcement of the U.S. SEC leads to a downturn, it often marks the short-term bottom range for the market. And when the dust settles after the U.S. presidential election, the substantial wait-and-see funds in the cryptocurrency market, which previously hesitated, begin to make bold bets.

The U.S. election puts Polymarket in the spotlight

No one expected the prediction market to be so hot this year. As a betting platform, users can directly use cryptocurrencies to bet on their choices, covering a wide range of topics including sports, culture, economy, cryptocurrencies, and election results.

What really made Polymarket explode was the hottest U.S. presidential election event this year. The fluctuating data on Trump's chances of winning after the assassination attempt, Biden's chances of dropping out, and Harris's chances of winning after joining the race have caused continuous changes in various statements and debates.

According to Dune data, Polymarket's trading volume reached $472 million in August, hitting a record high, with a month-on-month growth of over 20%. In addition, its monthly active users exceeded 63,000, reaching a record high, with a month-on-month growth of over 42%. The number of new users in August reached 71,000, also hitting a record high.

Behind these three record-breaking figures, Polymarket has attracted widespread attention in the market. Currently, its election prediction data is often cited and reported by Bloomberg, CNBC, and others, attracting widespread attention outside the industry.

The founder of 1confirmation once wrote that the truth of the market is hard to find, and it is very meaningful for Polymarket to show the market's true opinion through real-money betting. The market seems to be continuously acknowledging that after the November election, news, culture, sports, and other markets will become more popular, and Polymarket is very suitable for any areas of disagreement.

Polymarket has benefited from the out-of-industry effect created by the U.S. election event, making it one of the relatively successful examples in the cryptocurrency product space.

In conclusion

In summary, the U.S. election event will have a certain impact on the regulation and policies of the cryptocurrency industry, but it will not undergo significant changes. The election will also have a certain ripple effect on certain products and protocols such as Polymarket. In terms of market trends, the long-term impact is not significant, but at important time points, it will still bring about significant short-term fluctuations in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。