Investing is an art.

Author: Route 2 FI

Translation: DeepTechFlow

How can one become a venture capitalist? How to create your own venture capital firm? What does it take to become a successful venture capitalist?

What are the conditions required to have the opportunity to invest in protocols and stay at the forefront of the market?

These are the questions I want to explore today.

Venture Capital: Do you also want to invest in startups, my friend?

Introduction

Sometimes, you may find yourself dissatisfied with the market's returns, as market downturns lead to losses in your investments.

At other times, you see everyone profiting in the market, but your individual performance still falls short compared to those big teams. So, who are these big teams exactly?

There are various participants in the market, such as market makers, hedge funds, liquidity, and venture capital funds (VCs). The operations of the first three are somewhat similar: they mainly trade existing tokens in the market. Venture capital funds, on the other hand, are different; they invest in tokens before they are listed.

Venture capital funds support the teams you love from the early stages of the project, even starting to invest when the team is developing the MVP (Minimum Viable Product). These investors believe that a certain team can succeed, so they are willing to invest a large amount of capital before the product goes live.

If the project succeeds, the investment can achieve significant growth, but if the project fails, it may also face significant losses.

The risk/return ratio of venture capital is high, but it is not just about capital investment; it also involves supporting the team and working directly with them to ensure the long-term success of the project.

So, how can one become a venture capitalist? How to create a venture capital firm? What does it take to become a successful venture capitalist? What are the conditions required to have the opportunity to invest in protocols and stay at the forefront of the market?

To create a venture capital firm, you first need to understand its basic structure, especially the key roles within it.

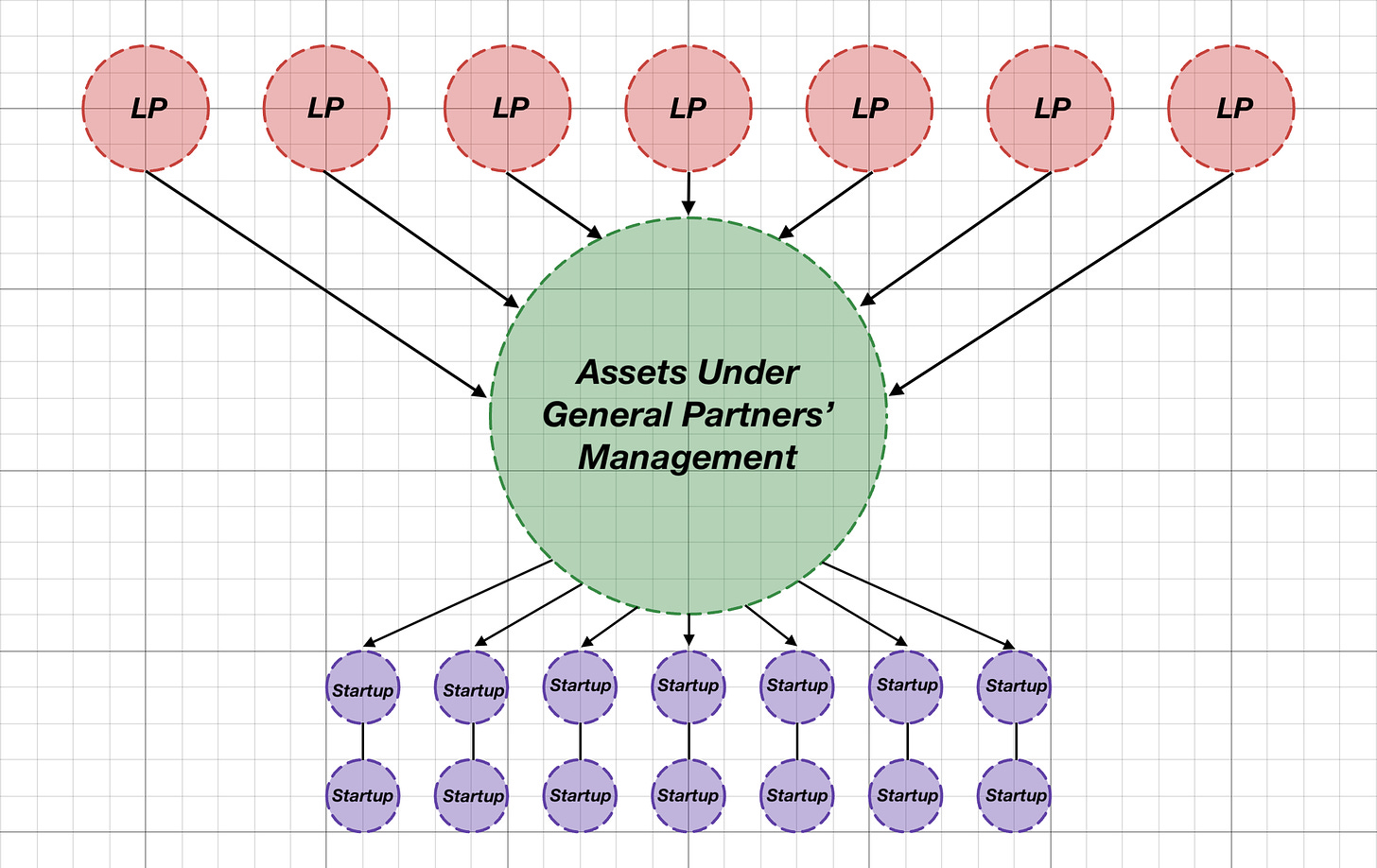

Each venture capital fund typically consists of three main roles: Limited Partners (LPs), General Partners (GPs), and founders:

LPs are those who have a large amount of capital and want to increase their capital through venture capital investments.

GPs are those with rich experience, aiming to increase the investments of LPs through successful transactions and earn fees from them.

Founders are those who develop innovative products or services and want to bring them to the market, requiring investment to start the project. If I were to describe the structure of venture capital in a diagram, I might choose a diagram like this:

The authorization of LPs to GPs is quite clear: they only need to invest capital and wait for returns. The main task of LPs is to select the right people to manage these funds, with the goal of achieving significant returns.

Usually, LPs do not directly participate in the investment process of startups, as due diligence is the responsibility of GPs. However, LPs can use their network to provide potential investment opportunities for GPs and allow GPs to assess their investment value.

GPs typically report to LPs on the status of the venture capital fund on a monthly, quarterly, or annual basis, including changes in investment strategy, market sentiment, completed investments, and unrealized or realized returns.

GPs strive for transparency because everyone knows that venture capital is a high-risk business; typically, only 1 out of 100 startups can become a unicorn, a company valued at $1 billion.

A typical venture capital fund operates on a "2/20" model. This means that GPs annually receive 2% of the total invested capital from LPs as operating expenses (mainly used for paying salaries, establishing partnerships, signing agreements, legal affairs, etc.).

In addition, GPs also receive a 20% fee for each successful investment, also known as "carry." This means that if the total investment return is $1 million, $800,000 goes to LPs, and $200,000 as a successful fee goes to GPs.

It is worth noting that most venture capital funds are not excellent, and their return rates are not high. So why are LPs still willing to invest?

Venture capital typically invests in illiquid assets unrelated to other assets, which can hedge the risk of a small portion of total assets under management (AUM). Large institutions and high-net-worth individuals typically allocate 5-10% of their funds for such investments.

However, the right GP can bring substantial returns. Within 3-5 years, LPs may achieve returns of 3-10 times, which are difficult to achieve in other asset classes.

So, how can one stand out and make LPs choose you over other fund managers?

Sales is an art that improves with practice

Although you want to invest in other startups, initially, you also need to raise funds, otherwise, you will have no way to invest.

Raising funds for your fund is a unique process that allows you to experience the feeling of selling to others, as ultimately, others will also sell to you.

This process is similar to traditional fundraising, but there are also some differences. First, if you are a fund focused on the crypto field, then you will only invest in crypto companies (otherwise, this fund loses its meaning).

The backgrounds of LPs can be very diverse. If you are raising funds for a crypto fund, you do not necessarily need to look for LPs from the crypto field.

The key is that you need to prove that you have the ability to bring them substantial returns. For example, I have a friend who is a GP of a crypto fund, and his LPs come from various fields such as e-commerce, real estate, and oil production.

This strategy is called "fund investment strategy." In fact, this is just a series of optimized parameters to help you make more targeted investments.

Some of these parameters include:

Investment stage. There are usually 6 stages: Pre-seed, Seed, Series A, Series B, Series C, and Series D. In addition, startups sometimes conduct "private rounds" of financing, which is actually to conceal the specific stage they are in. Focus on Pre-seed, Seed, and Private rounds; these stages may bring the highest returns, but also carry greater risks. This will be the key to determining your success.

Value-added services. This may be the most important factor. Investors often prefer to receive "smart money" rather than simple "hands-off investment." Therefore, you need to provide additional value to the investment targets. For example, a16z provides support in almost all aspects, from research, marketing, to product development, and recruitment. Clearly define what you (and your team) can provide in addition to capital and work on this aspect.

It is not difficult to understand that most venture capital funds do not bring any value other than capital, which is the basis for distinguishing between excellent and ordinary venture capital funds. This difference is particularly evident in bull and bear markets.

In a bull market, projects and capital are abundant. Everyone (especially retail investors) is investing wildly, and even the worst tokens can bring returns of around 10 times. Venture capital funds even have to compete for quotas for low-quality projects because the market demand for tokens is very high. In this situation, managing risk and return becomes difficult because everything seems to be growing.

However, in a bear market, although many developers are working hard (because a bear market provides a peaceful environment, which is very suitable for development), capital is relatively scarce because there is almost no growth.

At this time, excellent venture capital shows its value, as they need to rely on various indicators, such as project teams, sustainable token models, technical solutions, and overall vision and market strategy. This requires more skills, experience, and sometimes even intuition!

Therefore, if you plan to start a venture capital firm from scratch, it is best to start in a bear market or near the end of a bull market, so there will be less competition and more opportunities for selection.

Talent is crucial - who should you hire?

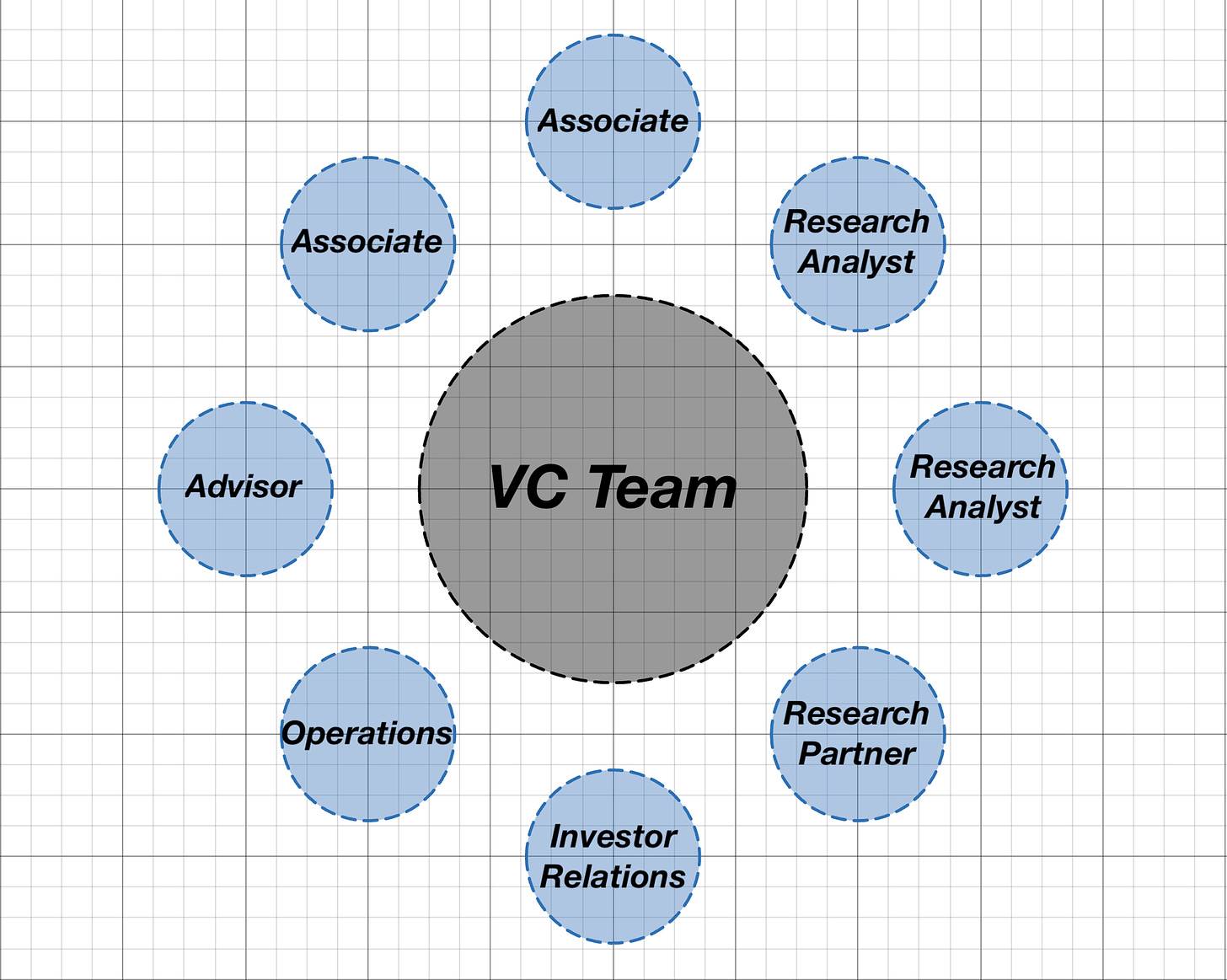

Indeed, the team is the most important, just like in any field. Human capital is the most crucial capital, so how do you build an excellent team? Whom should you hire? The answer is actually quite simple, and somewhat cliché: hire people smarter than you and build a team that can surpass the market.

Typically, venture capital teams are small; managing $50 million or even more does not require more than 10 people. Because the process is actually quite simple: find (or be found by) startups → identify the best ones → invest → help the startups grow → sell your shares (tokens) → get returns.

However, in reality, each step requires rich experience and knowledge. Obviously, you cannot do this alone, so your ideal team should be like this:

Associates are responsible for most of the communication between the venture capital fund and the startups. They are usually responsible for initial screening of startups and providing feedback, as well as maintaining contact with startups at various stages of investment.

They search for projects through various channels, including Twitter, alpha groups, local meetups, conferences, demo days, and hackathons. Associates are also responsible for establishing transaction flow partnerships between different venture capital funds, where these partners share transaction information from their respective networks to facilitate cooperation between funds.

Researchers focus on all research-related work, including token economics, business models, technical solutions, and market analysis.

They are also responsible for observing the market from a macro perspective and predicting trends and development directions. For example, researchers may study a project of a company that has the potential to be part of the investment portfolio.

This is useful, for example, you can predict market trends for the next 6 to 12 months and which companies may create value within it. This allows you to have a more comprehensive understanding of the overall market situation, rather than just focusing on a specific protocol.

Advisors provide expertise and strategic guidance to venture capital firms and their portfolio companies, usually working as part-time advisors.

Their responsibilities include finding potential investment opportunities, conducting due diligence, and providing strategic advice to portfolio companies. Advisors help connect startups to key resources and potential partners by sharing their network resources.

Investor Relations (IR) specialists of venture capital funds are usually responsible for attracting and maintaining investor relations. They work closely with the firm's partners to develop and execute fundraising strategies, create investor materials, manage communications, and handle media inquiries, prepare investor meetings, and track investor sentiment.

Every part of the team is crucial, and the key task of GPs is to ensure that the team works together and delivers results, while overseeing the fund's strategy and overall performance.

Organizing transaction flow and strategy

Investing is a challenging task, should we just go with the flow? While that can be done, it is too simplistic. To achieve better performance, it is better to establish a sustainable strategy that can progress over time.

So, how do I achieve the right growth over time?

Create a detailed record for each startup. Over time, compile a list of competitors, including their performance and valuations. When you have a database with over 300 startups, summarizing each project will greatly help you gain as much insight as possible.

Strengthen collaboration with associates to explore the best strategies for finding projects. When you are well-known enough, you usually do not need to actively seek out projects - startups will come to you. However, in your growth stage, you need to actively participate in various activities, such as hackathons, demo days, and early-stage groups, to ensure your presence.

Not only be precise, but also maintain flexibility. If you can determine that a startup is not worth attention during the initial interaction, do not waste time. If you come across a very excellent startup and they are about to complete financing, be as flexible as possible to seize the best investment opportunities.

Enhance online influence. Publish articles online, especially on topics related to your fund's focus area. For example, Paradigm conducted extensive research on MEV and eventually invested in Flashbots (a research and development organization established to mitigate the negative impact of MEV).

What to focus on when investing?

When making investments or selecting suitable projects, there are many indicators to consider. But when you are faced with a protocol and deciding whether to invest, there are several key parameters worth paying attention to.

Tokenomics. Study factors such as token inflation rate, circulation, and rewards for stakers. The key is to avoid selling pressure and ensure that the token has a strong mechanism to incentivize continuous purchases.

Technical/fundamental analysis. This area may be the most difficult to research. If the project is very complex, you should seek expert help to identify the key points to focus on. Analyzing NFT collections is relatively simple, but understanding the operation of independent L1 blockchains or developer SDKs is much more complex.

Competitors. Examine the competitors of the protocol you are interested in investing in. How is their performance? What is their market share? What sets them apart from other projects? Do they have more advantages or disadvantages? Through comparative analysis, you can gain a deeper understanding of the project you are researching.

Ecosystem. Typically, most protocols are based on a single ecosystem, such as Ethereum, Solana, certain Layer 2, or Cosmos, among others. The key is to evaluate whether a protocol is suitable for the ecosystem it is in. For example, someone developed an agricultural protocol on Optimism, but since Optimism does not focus on DeFi, there is not enough reason to do so. You need to be aware of these situations to ensure that the protocol finds its product-market fit (PMF).

Investor research. If a project is undergoing a second or third round of financing, it means that there has been previous investor support. You can research these investors, usually they are ranked, and the higher the rank, the better. For example, Multicoin is considered a top-tier first-level investor and is one of the best venture capitalists in the crypto field, while Outlier Ventures is about a fourth level. You can view some fund information in a table.

Team. Ensure that team members have relevant experience and vision to successfully build the project. Do they understand what they are talking about? Are they smart? Do they fully understand the project proposal? Would you feel comfortable working with them?

There are other important parameters to consider, such as sentiment analysis, on-chain data analysis, partner analysis, and differences between the primary and secondary markets. The advice here is to lean towards considering an investment unfavorable unless there is clear evidence that it is a good investment. Therefore, look for parameters and indicators that can prove the investment's value. If you cannot find them, it may indeed be a bad investment.

Conclusion

Starting your own venture capital fund can be very difficult, as building operations and processes are always challenging. It's like moving from one city to another - although it is difficult at first, it will gradually improve.

The goal is to achieve the fund's return. For example, if you have a total investment capital of $100 million, with an average investment of $1 million in 10% of a protocol, you only need a unicorn project for your shares to be worth $100 million, so you can return the capital to the investors.

Remember, investing is an art, sales is an art, communication is an art, and research is also an art. Through continuous practice, you and your fund can become one of the most renowned "artists" in the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。