DeFi is one of the few tracks that can generate real income and is also the cornerstone of overall market liquidity. Aave, dydx, MakerDAO, and Uniswap have a huge overall lock-up volume and are absolute leaders in this track.

Author: FMGResearch

1. Aave

Currently, Aave is leading the entire DeFi sector, and Aave is currently the most top-tier lending platform in the market. Since the outbreak of the DeFi summer in 2020, it has experienced peaks and troughs, withstanding long-term market tests. It has been in a range of $50 to $110 for 2 years and is showing a trend of breaking out of the range and rising in the past month.

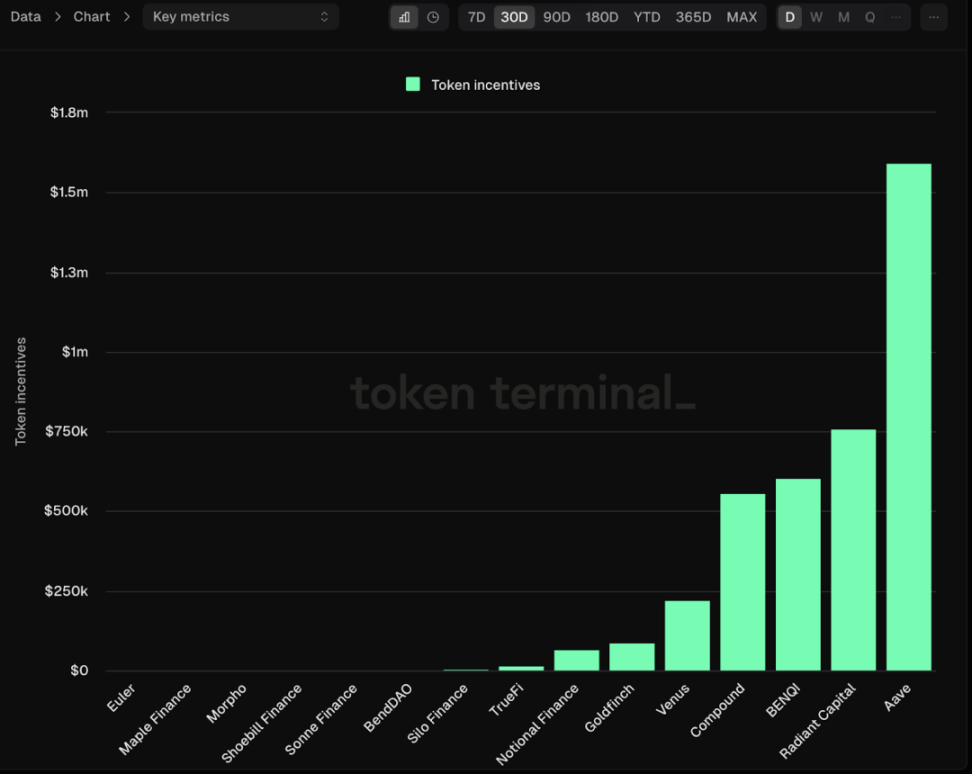

The main reason for Aave's exceptional recent performance is that token staking can earn protocol income. The introduction of the Sky Aave Force proposal empowers DeFi with traditional finance. In the past 30 days, Aave's token rewards have reached as high as 1.59 million.

After the allocation of protocol fees, the remaining portion is the protocol income. Aave's protocol fee and allocation method are as follows:

1) 90% of the interest paid by borrowers is allocated to lenders; 2) Flash loan fees, which are usually 0.09% of the borrowed amount, with 30% going to the protocol treasury and the remaining 70% distributed to depositors; 3) GHO minting fees and interest income. Currently, the total GHO Mint amount is 100 million, with a borrowing interest rate of 1.5%, and all interest income will go to the treasury. (https://gho.xyz/) 4) In V3, there will also be immediate liquidity fees, liquidation fees, and gateway fees paid through bridging protocols, the latter two of which have not been activated.

Aave's platform token AAVE can be used for governance and earning passive income. Aave provides two staking methods for AAVE token holders. AAVE stakers will bear up to 30% of the protocol's security risk. In return, stakers can receive AAVE token rewards and protocol income dividends.

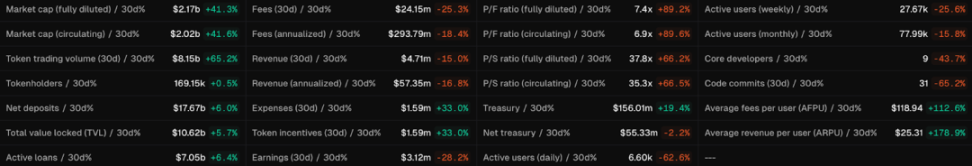

Currently, Aave receives approximately $300 million in fees annually, with protocol income totaling over $50 million.

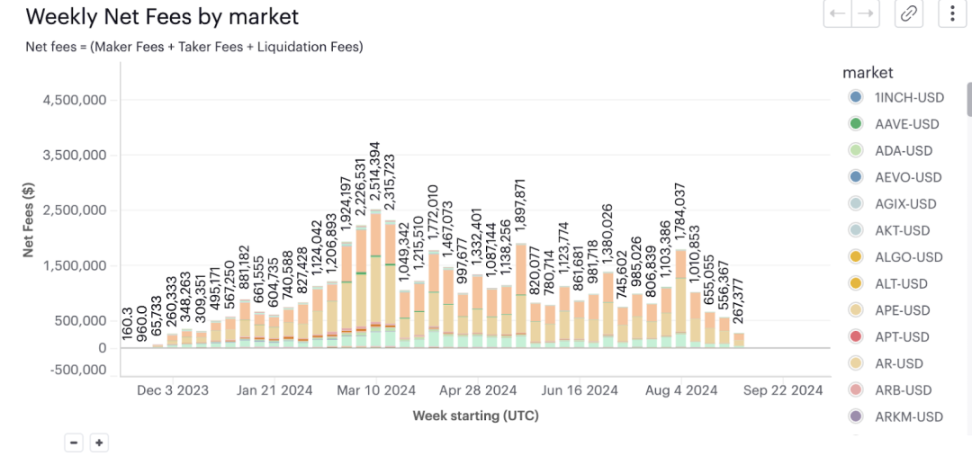

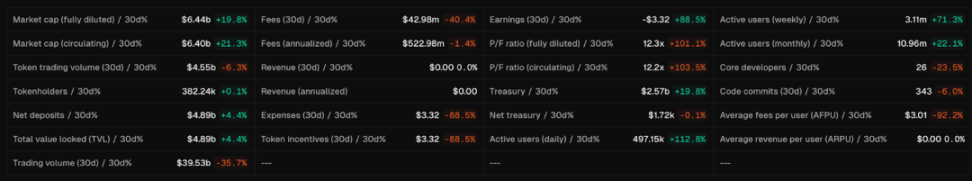

2. Dydx

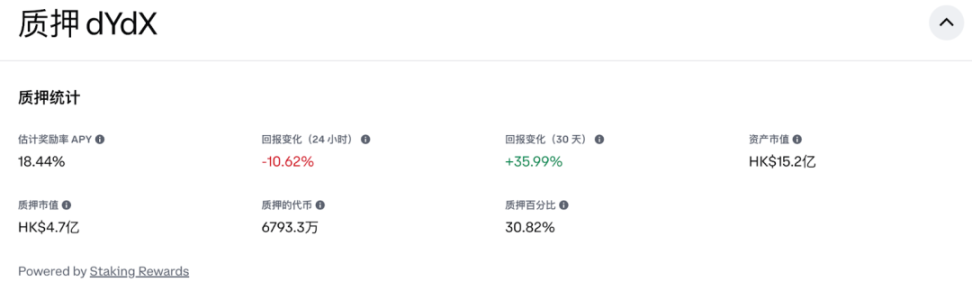

dYdX staking is on the rise this month. The v4 version of dydx currently allows staking dydx tokens to earn dividends, with an annualized yield ranging from 10% to 30%.

The current estimated reward rate for dYdX is 18.44%. This means that if dYdX stakers hold an asset for 365 days, they can earn an average of approximately 18.44%. 24 hours ago, dYdX's reward rate was 20.63%. 30 days ago, dYdX's reward rate was 13.56%. Today, the staking rate or the percentage of eligible tokens staked is 30.82%.

In dYdX's valuation analysis, there is a clear valuation premium, mainly due to limited liquidity supply caused by staking. As the L1 token of the dYdX chain, DYDX is used for fee payment and validator staking to ensure chain security. Currently, the average staking rate of the entire Proof of Stake (PoS) network is 52.4%. Reference staking rates for existing public chains such as Polygon and Solana are between 40% and 70%, and the staking rate of the dYdX chain is likely to exceed 40%.

In the early versions of dYdX, all protocol income went to the team; in V4, the income will be transferred to $DYDX stakers. The economic model of dydx empowers token holders with high staking, and as the staking ratio decreases and/or protocol income increases, the profitability of stakers will only increase. This will significantly reduce the circulation of DYDX. With unchanged token demand, the price will rise significantly.

3. Uniswap

On February 23, Erin Koen, the governance lead of the Uniswap Foundation, proposed a mechanism to reward holders who have delegated and staked UNI tokens through a fee mechanism at the Uniswap governance forum. This proposal has brought the practicality of UNI tokens into governance discussions, attracting widespread attention from holders and driving the rise of UNI and other DeFi tokens. However, the proposal is currently still in the discussion stage and has been delayed due to regulatory pressure from the SEC.

According to Tokenterminal's data, Uniswap has generated a total of $306 million in liquidity provider (LP) fees in the past 180 days. If UNI holders are allowed to receive 1/10 to 1/4 of the fees, the expected income will be between $61 million and $153 million.

During the bear market, Uniswap LP's annual fee income reached $867 million. If the protocol decides to charge 1/5 of the fee, the annual protocol income will reach $173 million. Currently, UNI is priced at $11.6 per token, with a total circulating market value of $12 billion and a circulating market value of $7 billion. If staked based on 50% of the circulating market value, the annual return on investment is 1.73/35=4.94%. If the future brings a bull market and the widespread adoption of Web3, with trading volume doubling or more, the annual return is expected to exceed 10%.

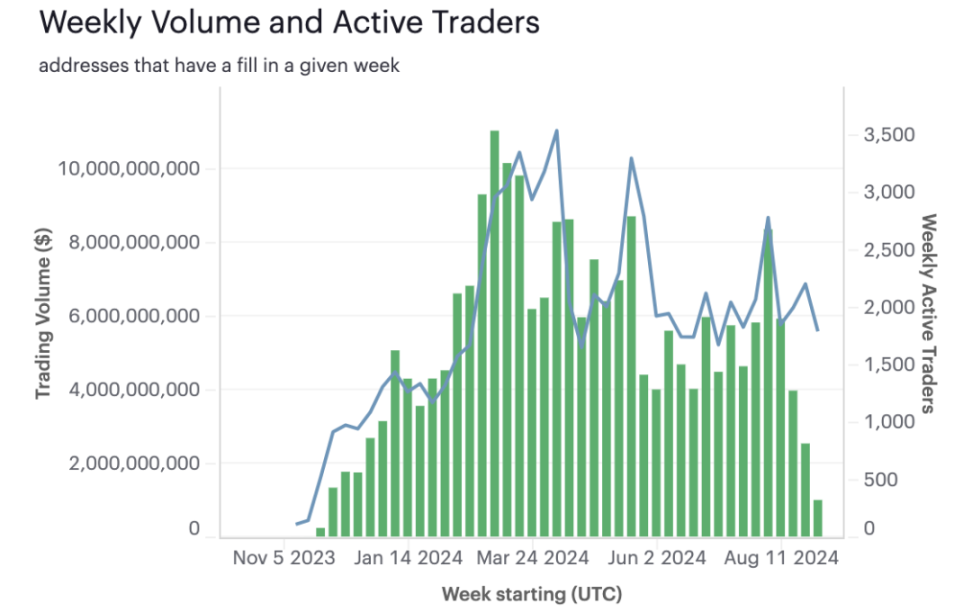

Since the DeFi boom in 2020, Uni has also gone through a cycle of baptism, experiencing volume expansion, contraction, and then expansion again. After the revenue gate is opened, it will usher in a greater explosion.

Is there hope for the AI sector stocks after a big fluctuation?

The movement of the stock sector has a huge impact on the crypto AI sector, with recent significant fluctuations in NVIDIA stock.

On the first trading day of September, the stock price of NVIDIA (NVDA.US) suffered a heavy blow, closing down by 9.5%, marking the largest single-day market value evaporation among U.S. stocks. Since the release of its financial report last Wednesday, NVIDIA's stock price has cumulatively dropped by 14%. The market has different interpretations of this situation. Some analysts believe that this is NVIDIA "digesting the troubles of growth" and still see a bright future for the company. However, there are also views that NVIDIA's financial report has raised concerns in the market about the sustainability of its massive investment in AI hardware. After the sharp drop in stock price, NVIDIA faces a new challenge: the U.S. government has intensified its antitrust investigation into the company.

After the U.S. stock market closed on September 3 (Tuesday) Eastern Time, the U.S. Department of Justice issued subpoenas to NVIDIA and other companies to seek evidence of potential antitrust law violations by this major supplier of artificial intelligence processors, marking a further escalation of the investigation into NVIDIA.

Currently, from the attitude of the Federal Reserve, the falsification of economic data, and the regulatory oversight of the significant fluctuations in NVIDIA's stock, it is evident that the U.S. is committed to supporting the stock market, which essentially means supporting big tech and AI. AI is just beginning to play in the infrastructure, and the application layer has not yet started. It is important to stabilize NVIDIA as the cornerstone. Crypto AI has currently reached a bottom, and the concept of AI should at least reach its peak in the stock market before it tops out.

Therefore, we expect that the near future is a good opportunity for crypto AI to attract funding. Currently, it is only at the infrastructure level, and many AI projects are still in the early stages and have not yet reaped the benefits. The current narrative of AI is not over yet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。