September is the worst-performing month for Bitcoin to date.

By Matt Hougan, Chief Investment Officer at Bitwise

Translated by Luffy, Foresight News

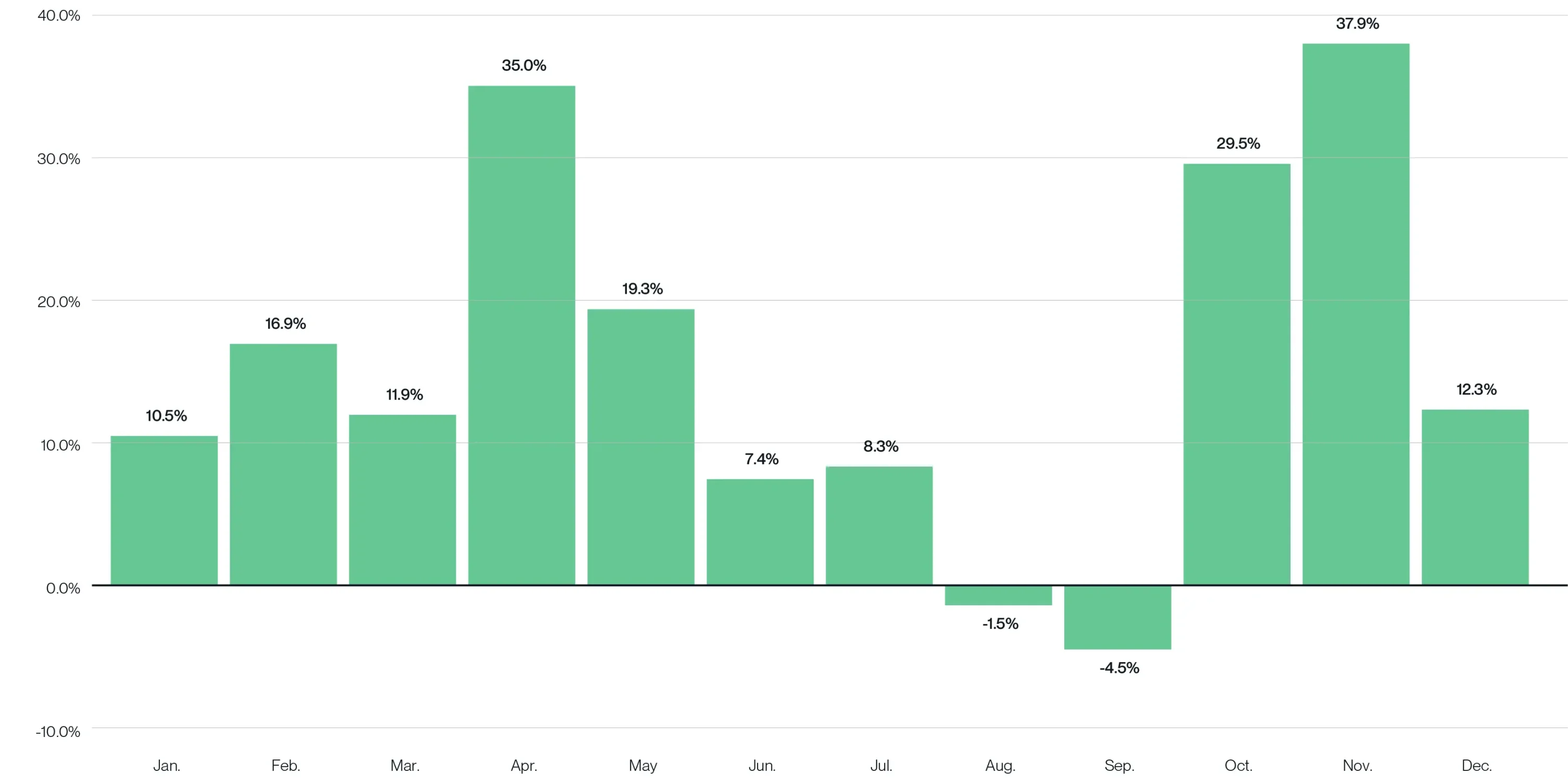

September is brutal. Since its inception in 2010, Bitcoin has averaged a 4.5% decline in September. September is the worst-performing month for Bitcoin to date and one of only two months with an average negative return.

Average monthly return of Bitcoin from 2010 to 2024; Data source: Bitwise Asset Management, Glassnode, and ETC Group; Data range from August 2010 to September 2024.

There are no signs of improvement in this situation. According to analysis by NYDIG, Bitcoin has experienced declines in 9 out of the 13 recorded Septembers. September 2011 was the worst-performing month for Bitcoin, with a 41.2% decline. As of the end of this month, Bitcoin has already dropped by 7%.

As the song by the band Green Day goes, "Wake me up when September ends."

What drives the "September effect"?

There are many discussions about the reasons for the September effect, and there is currently no particularly convincing theory. Below are brief introductions to three main theories:

1. September is a bad month for all risk assets

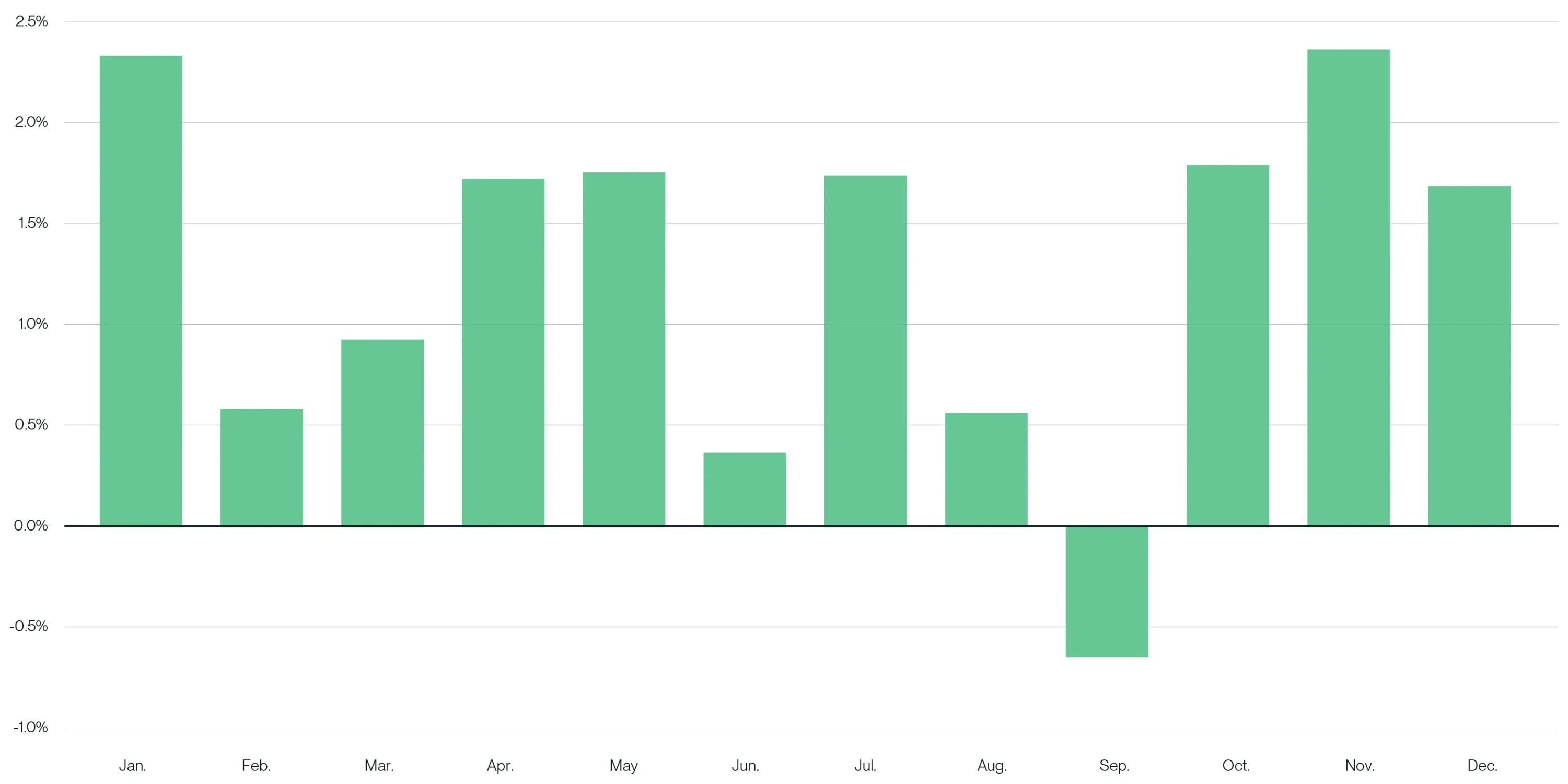

Bitcoin is not the only asset affected by the back-to-school season. Since 1929, September is the only month where the stock market has had more declines than gains. This phenomenon is particularly evident in the Nasdaq 100 index.

Economists have attempted to attribute this to various factors, such as increased volatility after the summer economic slowdown and losses incurred by mutual funds at the end of the fiscal year. But no one can determine the real reason.

Regardless of the reason, this phenomenon has occurred again: as of Friday, September 6, the Nasdaq 100 index has dropped by nearly 6% this month.

Average monthly gain of the Nasdaq 100 index; Data source: ChartoftheDay.com; Data range from January 1985 to December 2023.

2. SEC enforcement season puts pressure on cryptocurrencies

The SEC's enforcement season runs from October to September of the following year. Historically, there have been many enforcement actions in September as lawyers strive to complete their annual tasks. Currently, the SEC enforcement season is heating up: this month, we have already seen the SEC reach a settlement with the cryptocurrency fund provider Galois Capital and a notice from the Rich Bank against the NFT platform OpenSea. Many people predict that by the end of the month, lawsuits and settlements against crypto entities will become more intense. I am not surprised, as I have been hearing rumors about larger-scale enforcement actions since early summer, and we have long warned of the dangers of the SEC enforcement season.

3. Reflexivity

The best explanation for the September effect may be reflexivity. People now expect September to be bad, and it turns out to be so. In general, expectations drive the market.

In contrast, Bitcoin investors have always liked October, which is known as "Uptober." Bitcoin has an average increase of 30% in October, which may ignite investors' enthusiasm. Historically, October and November have been among the best-performing months for cryptocurrencies.

Outlook for the crypto market

Like most people, I don't know how to understand the "September effect." I am not sure how much the above factors have an impact, and there are other forces at play that have not been explored. Regardless, it is affecting the current psychology of the crypto market.

What I do know is: apart from seasonal factors, it is most important to focus on the specific situation of the current market. In doing so, I am beginning to understand the reasons behind the weakness of cryptocurrencies this September.

The market dislikes uncertainty, and there is currently a lot of uncertainty in the market.

The U.S. presidential election will have a significant impact on cryptocurrencies, and the outcome is currently uncertain. I believe that until we have a clearer understanding of our future leadership and policies, the market will struggle to find its footing.

There is intense debate over the timing and magnitude of the Fed's interest rate cuts. Although it is widely believed that loose monetary policy is imminent, investors are readjusting their bets: the likelihood of a 50 basis point cut in September has decreased, but the likelihood of a cut of over 125 basis points in December has increased.

The flow of ETF funds is mixed. Although there has been a decrease in funds flowing into Bitcoin and Ethereum ETFs (the U.S. Bitcoin ETF has just experienced its longest period of net outflows since its launch in January), if you look closely, you will find that investment advisors are adopting Bitcoin ETFs at a faster pace than any new ETF in history.

My prediction is that as this uncertainty dissipates in October and November, we will see a significant rebound in cryptocurrencies. This is consistent with historical trends, which may be a coincidence or may not be. In any case, please be prepared.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。