In Dubai, any individual or company wishing to engage in activities related to virtual assets, such as cryptocurrency trading, custody, lending, etc., must first obtain a license from VARA.

Author: Aiying

Dubai has rapidly emerged as a global center for cryptocurrency and blockchain technology in the Middle East, known for its innovative tech ecosystem and forward-thinking policies. With its open business environment, diverse cultural background, and pro-business policies, Dubai has attracted the attention of numerous Web3 enterprises and startups. As one of the most important emirates in the UAE, Dubai has transformed from a small fishing village into an international financial and commercial hub, and is now fully transitioning into a hub for the cryptocurrency and blockchain industry.

In 2021, the Dubai Multi Commodities Centre (DMCC) launched the Crypto Center, providing incubation and funding support for cryptocurrency entrepreneurs to facilitate rapid project implementation. Subsequently, the Dubai Virtual Asset Regulatory Authority (VARA), established in 2022, has provided a globally leading regulatory framework for the industry, making Dubai the preferred location for cryptocurrency exchanges and other virtual asset enterprises to establish regional headquarters. Industry giants such as Binance and Bybit have already established regional headquarters in Dubai, further strengthening Dubai's position as a global cryptocurrency center.

According to Aiying, this open and supportive policy has not only attracted a large number of enterprises to settle in Dubai but has also promoted the widespread use of cryptocurrency payments. Multiple industries in Dubai, including airlines, real estate developers, and luxury car dealers, have begun accepting cryptocurrencies such as Bitcoin as a form of payment. Through its unique regulatory system and extensive market applications, Dubai is rapidly consolidating its important position in the global virtual asset industry. Aiying has been closely following this market and has many clients and partners rooted in Dubai. Today, this article is mainly to provide a detailed introduction to the overall regulatory framework of VARA in Dubai.

Introduction and Establishment Background of VARA

1. Establishment Background of VARA

The Dubai Virtual Asset Regulatory Authority (VARA) was established in 2022 with the driving force behind the Dubai government's desire to promote the healthy development of virtual assets and blockchain technology through clear regulatory frameworks. The establishment of VARA is based on the "Dubai Virtual Asset Management Law" of 2022, which clearly defines Dubai's forward-looking position in the global virtual asset industry.

The "Dubai Virtual Asset Management Law" not only provides a legal basis for services such as the issuance, trading, and custody of virtual assets but also demonstrates the Dubai government's vision to attract global virtual asset enterprises to settle through policy support. Through this law, Dubai hopes to further consolidate its position as an international financial technology center, attracting global innovators, investors, and enterprises to enter this rapidly developing market.

2. Responsibilities and Authorities of VARA

As the core regulatory body of the Dubai virtual asset market, VARA bears the heavy responsibility of regulating the entire virtual asset ecosystem. The following are some of VARA's main responsibilities and authorities:

- Establishing Rules and Standards: VARA is responsible for setting detailed regulatory rules and industry standards for activities such as the issuance, trading, and custody of virtual assets. These regulations ensure that all market participants have clear behavioral guidelines, ensuring market transparency and security.

- Issuing Licenses: Any company wishing to engage in virtual asset business in Dubai must apply to VARA and obtain the corresponding license. Different business types (such as exchanges, custody service providers, etc.) have specific licensing requirements and procedures, ensuring that every enterprise entering the market can operate legally and compliantly.

- Supervising Market Operations: VARA is not only responsible for formulating rules but also regularly supervises the market to ensure that companies comply with regulations. If violations are found, VARA has the authority to take measures such as fines, suspension or revocation of licenses, and even legal prosecution for non-compliant behavior.

- Protecting Investors and Consumers: VARA attaches great importance to protecting the rights of investors, ensuring that all virtual asset transactions take place in a secure environment, preventing fraud, money laundering, and other illegal activities. In addition, VARA is committed to ensuring that consumers have access to transparent information, enabling them to make investment decisions with full knowledge.

- Promoting Innovation and Development: In addition to regulation, VARA also strongly encourages innovation in the virtual asset and blockchain fields. Through flexible policies and support for new technologies, VARA hopes to help enterprises achieve technological breakthroughs within a compliant framework, providing impetus for the long-term development of the industry.

Regulatory Framework for Virtual Assets and Related Activities

1. Licensing System

In Dubai, any individual or company wishing to engage in activities related to virtual assets, such as cryptocurrency trading, custody, lending, etc., must first obtain a license from VARA. The application process includes submitting relevant materials, reviewing business plans, and paying licensing fees. Enterprises not only need to renew their licenses regularly after obtaining initial licenses but also must comply with VARA's specified compliance requirements. The licensing fees for different types of businesses vary, which helps ensure the legal and compliant operation of market participants.

In certain special circumstances, VARA may also issue temporary authorizations, allowing companies to conduct business on a short-term basis before completing the formal licensing process. In addition, VARA may also grant exemptions for certain businesses based on market demand or individual circumstances, but these exemptions usually come with specific conditions and still need to comply with basic legal requirements.

Through this licensing system, VARA can effectively supervise and manage every participant entering the market, ensuring that each enterprise complies with Dubai's regulatory standards and brings transparency and security to the market. To advance these goals, VARA has also formulated the "2023 Virtual Assets and Related Activities Regulations."

2. Sector-Specific Regulation

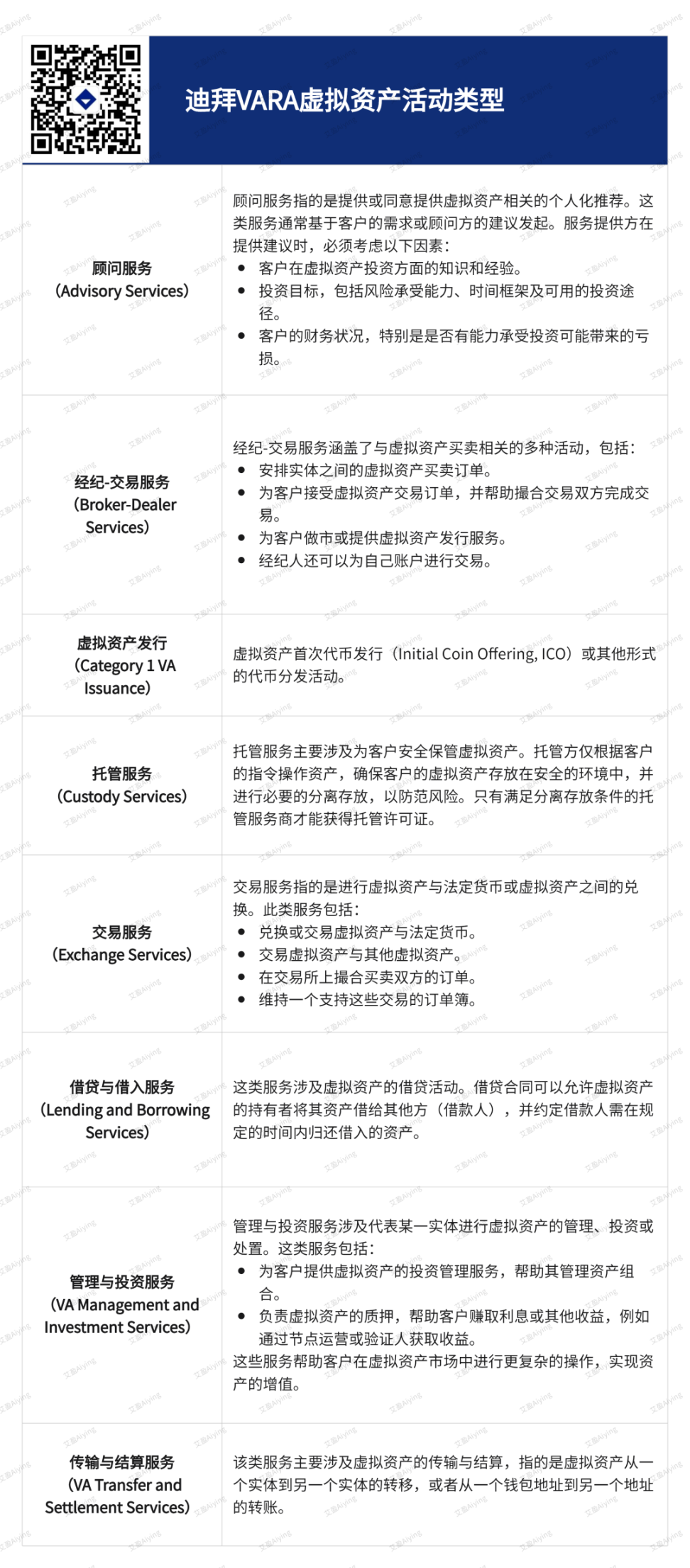

VARA has implemented detailed sector-specific regulation for different types of virtual asset activities. Specifically, here are some of the main regulatory areas:

3. Enforcement and Regulatory Power

VARA has the power to adjust regulatory policies according to market changes. With the rapid changes in the virtual asset market, VARA can issue new directives and guidelines to ensure that the regulatory framework keeps pace with the times and prevents potential risks. For example, if new technologies or business models emerge in the market, VARA may introduce new regulations or adjust existing ones to ensure market safety.

In addition, VARA continuously optimizes its rules based on market feedback, maintaining market flexibility while ensuring the effectiveness of regulation. This change mechanism allows the virtual asset industry to develop rapidly in Dubai while avoiding the risks brought about by excessive market fluctuations.

4. Compliance and Penalty Mechanism

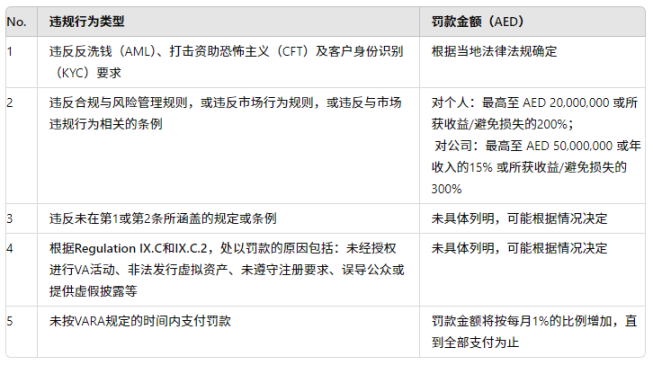

VARA handles non-compliant behavior very strictly. If companies violate VARA's regulations, they may face severe penalties, including fines, suspension of license use, restriction of business activities, and even revocation of licenses. For serious violations, VARA may also take legal action.

(Types and Amounts of Fines)

This rigorous enforcement mechanism ensures market transparency and fairness, preventing fraud, money laundering, and other illegal activities. VARA hopes to ensure the long-term stability of the virtual asset market and provide a safe and trustworthy environment for investors through strict compliance requirements.

Application Process

The application for a Virtual Asset Service Provider (VASP) license is divided into two stages: first, applying for Initial Approval to establish a legal entity and begin operations; second, applying for the formal VASP license.

First Stage

1. Submission of Initial Disclosure Questionnaire (IDQ)

Companies need to submit an Initial Disclosure Questionnaire to the Dubai Department of Economic Development (DET) or the relevant free zone (FZ). This is the first step in the entire application process, aimed at allowing regulatory agencies to understand the basic situation of the company.

Aiying's Reminder: In Dubai, DET is responsible for local (mainland) business registration and management, while free zones (FZ) are responsible for enterprise registration and regulation within specific areas. Although VARA is the regulatory body for the virtual asset field, before a company can officially conduct business, it must first legally register within Dubai's business system. This means that the company needs to complete its registration process through DET or FZ.

2. Provide Additional Documents

The company also needs to provide additional documents as required. These documents typically include the company's business plan, information about the actual beneficiaries of the company, and detailed information about senior management.

3. Pay Initial Fees

The company needs to pay the initial review fee, usually 50% of the license application fee. These fees are used to initiate the review of the company's application.

4. Obtain Initial Approval

Once the application is approved, the company will receive initial approval. At this point, the company can complete legal registration, set up operations, including leasing office space, hiring employees, etc.

Note: At this stage, the company still cannot engage in any virtual asset-related activities.

Second Stage

After obtaining initial approval, the company can apply for the formal VASP license following these steps:

1. Prepare and Submit Documents

The company needs to prepare and submit relevant documents according to the guidance provided by VARA. All documents need to be submitted after receiving initial approval.

2. Communicate with VARA

VARA will provide feedback directly on the submitted materials, which may include holding meetings, conducting interviews, and requesting additional documents.

3. Pay Remaining Fees

The company needs to pay the remaining license application fee and the first year's regulatory fee.

4. Obtain VASP License

Once approved, the company will obtain the VASP license, but the license may come with some operational conditions.

- Explanation of Fee Structure

- License Application Fee: Applicable to all virtual asset activity license applications. If an entity wishes to apply for licenses for multiple virtual asset activities, in addition to the initial application fee, each additional activity requires payment of the corresponding extension fee (which is half of the initial application fee).

- Extension Fee: For enterprises applying for licenses for multiple virtual asset activities, the additional activity fee is 50% of the main application fee.

- Annual Supervision Fee: Each licensed virtual asset activity needs to pay an annual supervision fee. These fees must be paid in advance before commencing operations.

(License Application Fees and Annual Audit Fees)

It should be noted that VARA reserves the right to refuse to issue VASP licenses, especially when a company's activities exceed the scope of regulation or fail to meet appropriate regulatory standards. As for the specific application requirements, they are determined based on the type of activity applied for, which will not be detailed in this article today. Aiying will provide more information on this in the future.

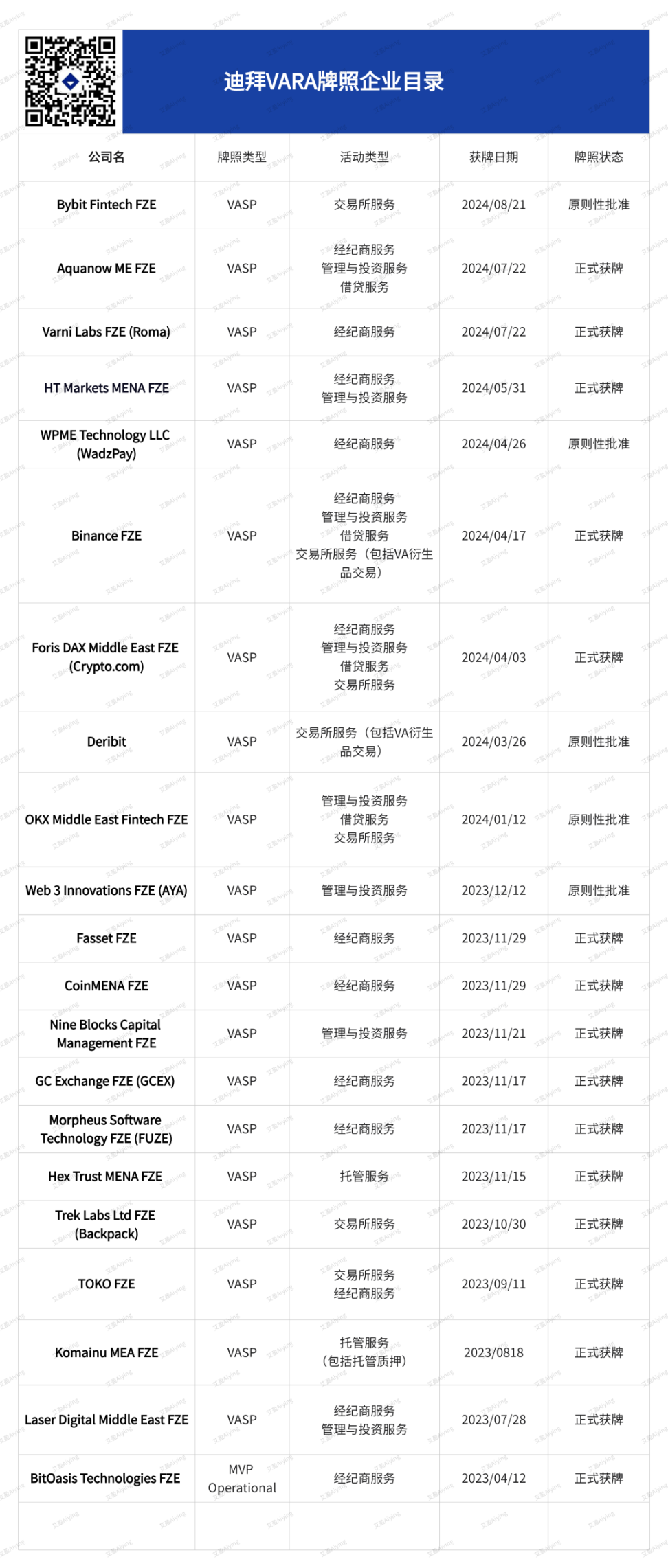

21 Licensed Enterprises

VARA Official Website: https://www.vara.ae/en/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。