I want to list on Upbit, but I have to list on Binance/OKX, at least Bybit first.

Author: TechFlow of Deep Tide

Mixing shochu with beer turns it into "honey water," and the crowd on the dance floor sways with the rhythm of the DJ, while the Korean beef on the barbecue grill sizzles at nearly 5 minutes rare, with over 300 side events… The Korean blockchain week is lively.

However, beneath the noisy mix of music and alcohol, there is deep anxiety.

The project parties are very anxious, with insufficient market liquidity, a lack of new narratives, and retail investors not buying in. The listing requirements of top exchanges are becoming more stringent, and investors are constantly asking and urging, "WHEN LISTING?"

VCs are very anxious, with a bunch of projects they invested in currently in a "semi-dead" state; projects that have already issued tokens are still locked up, with their market value decreasing daily; the fund's duration is short, and fundraising is becoming increasingly difficult;

Entrepreneurs are very anxious, with the primary market cooling down, and many VCs only observing without investing. After chatting for months, they still haven't completed a new round of financing. Even if VCs are interested, they say they can only choose to follow after confirming a strong lead investor;

The media and community are very anxious, as they are in the middle and lower levels of the industry food chain, needing surplus from the landlords to survive;

Exchanges are also very anxious, with trading volume continuously shrinking, competition intensifying, and they can only console themselves that they are still better off than the project parties.

The only way to dispel worries is a bull market.

Everyone is looking forward to a grand and spectacular altcoin bull market. Many project parties are pinning their hopes on Q4, planning to issue tokens in Q4.

However, "waiting for the bull market" is equivalent to waiting to die, so everyone has started to focus on the Korean market to achieve liquidity exit.

Whether it's the project parties or VCs, coming to Korea, most of them have the same mission and purpose: to list on Korean exchanges; to find Korean KOLs and community for promotion.

In multiple event venues, the most frequently heard words are, "Do you know anyone from Upbit and Bithumb, can you introduce us?" or, curiously inquiring, "How did XXXX and XXXXXX get listed on Upbit?"

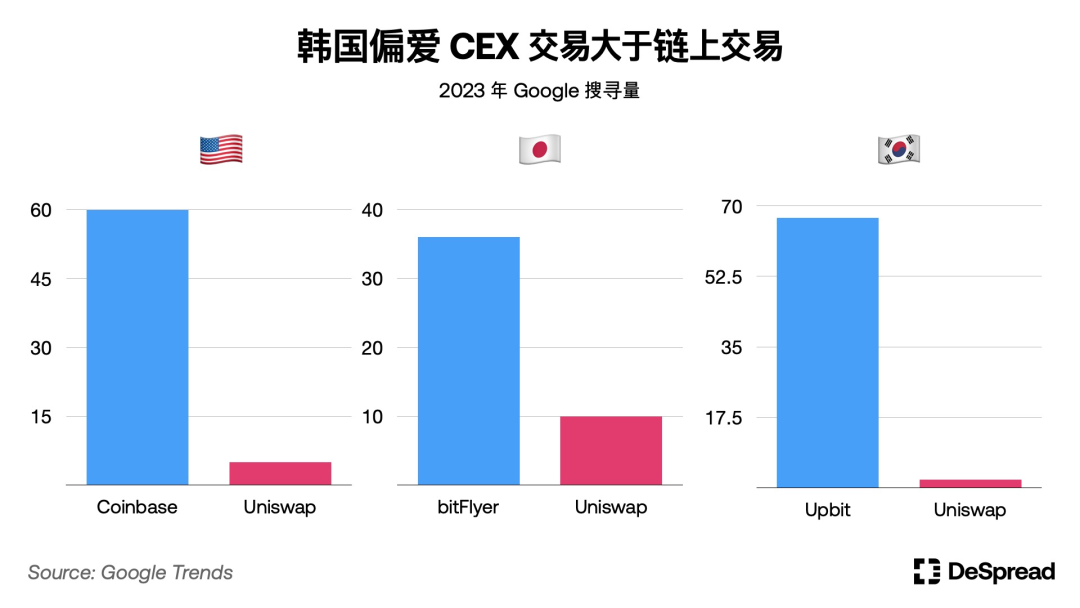

Everyone is increasingly aware that Korean exchanges, especially Upbit, are the world's leading altcoin trading market (liquidity exit venue). Compared to on-chain trading, Korean investors prefer to trade on centralized exchanges.

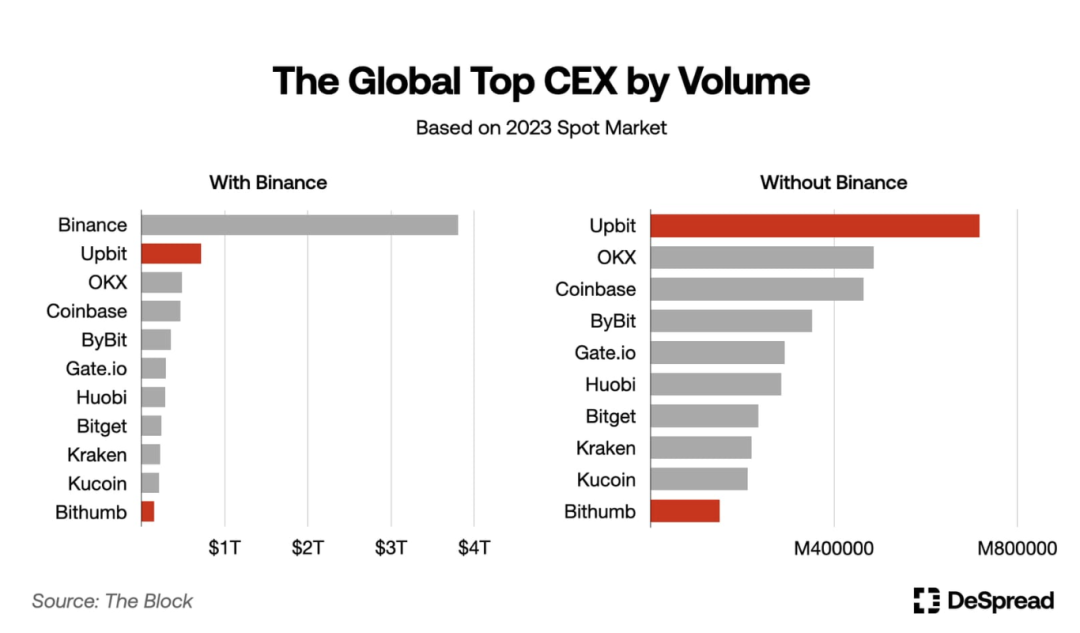

There are four major exchanges in Korea, Upbit, Bithumb, Coinone, and Korbit, with Upbit being the absolute leader in the Korean market, with a market share of 70%-80%. In 2023, Upbit was the world's second-largest cryptocurrency spot market, second only to Binance.

Bithumb has long maintained its position as the second-largest market, accounting for 15%-20% of the total trading volume of the four major exchanges, while Coinone's market share is between 3% and 5%, and Korbit's market share is less than 1%.

Therefore, listing on Upbit has become one of the long-term goals pursued by various project parties.

However, listing on Upbit is not easy. Korean exchanges do not list tokens for the first time, and there are two aspects of the liquidity and listing standards for tokens on Upbit:

Market demand:

Evaluate the trading liquidity and commercial viability of the proposed digital assets.

Review the known market value, concentration of digital assets, number of wallets, or trading volume on other exchanges.

Listing status:

Review the current listing status of the proposed digital assets, including listings on other exchanges. Evaluate the reputation, jurisdiction, and AML/CFT practices of other exchanges.

A relatively open unwritten rule is that to list on Upbit, you have to list on Binance/OKX, at least Bybit.

The relatively closed Korean crypto market has also brought in many intermediaries or brokers who profit from information asymmetry. Some people help overseas projects do GTM in Korea, such as the SEI\SAGA projects, which are executed in the Korean market by individuals rather than institutions; some people do KOL recommendations and management; some people provide guidance for listing on Korean exchanges…

With many intermediaries, the quality varies. A member of a Korean local institution told TechFlow of Deep Tide that the process of listing on Upbit is very standard, and if someone tells you that they can guarantee a listing on Upbit, it is most likely a scam. To achieve liquidity exit, not only do you need to list on an exchange, but you also need retail investors to buy in, finding Korean communities and KOLs for promotion has also become a must.

A local Korean marketing consulting firm stated that their business volume this year is several times that of last year.

In the past, many people thought that Korean cryptocurrency investors were concentrated on the local chat app Kakao, but the reality is that most cryptocurrency investors, especially young people, are now gathered on Telegram.

In 2023, the top 110 Telegram channels in the Korean crypto market were the most forwarded.

The most forwarded channel is "코인같이투자 (WeCryptoTogether)," with 168,765 forwards, about 34% higher than the second-place "취미생활방 (EnjoyMyHobby)" with 125,919 forwards.

The third to tenth places are @kkeongsmemo, @emperorcoin, @centurywhale, @mujammin123, @masrshallog, @airdropAScenter, @seaotterbtc, @kookookoob.

What information are Korean investors most interested in?

We can still explore this from the viewing and forwarding data in the top 110 Telegram channels in 2023.

In an overview of 2023, the information with the highest views in the Korean cryptocurrency community has three very prominent themes.

First, legal and regulatory issues in the Korean cryptocurrency industry, content related to negative industry issues such as privacy breaches, money laundering, and financial crimes have the highest views;

Second, new token investment opportunities, such as information about the Sui token sale, ranks fourth, showing that Korean investors are very sensitive to new projects and profit opportunities;

Finally, ranking third is content related to macroeconomic indicators (such as CPI), this year's bitcoin market trends are mainly influenced by macro data.

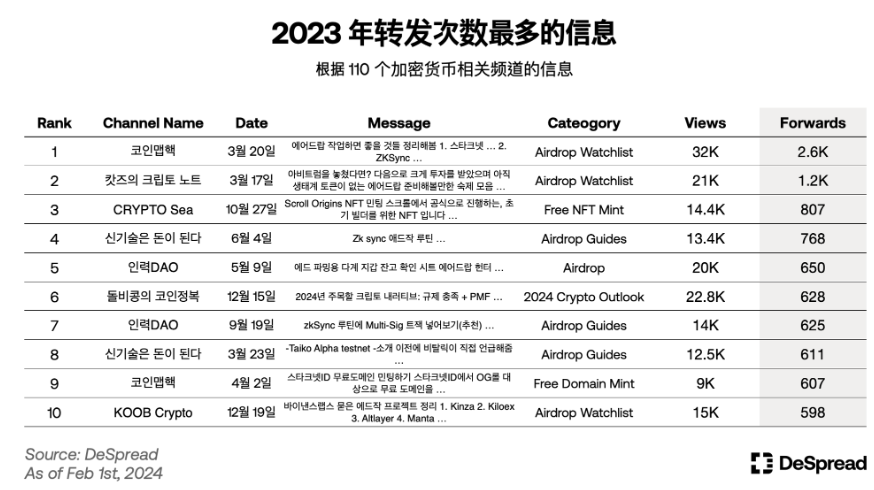

Looking at the most forwarded information in the Korean crypto community in 2023, it is found that everyone is focused on the same topic—airdrops.

The most forwarded information is the "Airdrop Workflow Summary" posted on the "Coinmap Hack" channel on March 20, detailing how to participate in airdrops for major projects such as Starknet, zkSync, and LayerZero, and was forwarded more than 2,600 times, ranking first.

Most of the information ranked from second to tenth is also about airdrops, such as how to get airdrops and free NFTs from projects like zkSync and Starknet.

It seems that airdrops are a consensus familiar and recognized by all cryptocurrency investors, transcending nationality and culture.

As more and more projects enter the Korean market, Korean KOLs/community managers are becoming more and more cautious about projects. A local Korean community leader stated that they prefer to cooperate with projects endorsed by well-known investment institutions, especially those with investments from Binance Labs.

Another piece of information that is difficult to fully verify is that Korean investors currently do not like Korean founders and investment institutions, which is quite similar to the Chinese market. When leaving Seoul, the author asked several VC and project professionals, "How was your trip to Korea?" Most of them said, "Not much gain, more for fun/cosmetic surgery," and some even felt that they were wasting the company's money, which was embarrassing.

This may also be a reflection of the current situation in the Korean market, it looks beautiful, but it is not easy to achieve liquidity exit in the Korean market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。