Today, the most frequently asked question by my friends is why the non-farm payroll data is good, but both the US stock market and BTC are falling. To be honest, I have searched through many channels and information sources, and spent a lot of time, but I have not found the answer. However, I can provide some more intuitive insights. It's not just the US stock market and BTC that are falling, but US bonds are also experiencing a comprehensive decline, with the one-year, two-year, and three-year US bonds all falling by more than 2%.

Meanwhile, the US dollar index is rising, while gold and oil are both falling. Seeing these data, my immediate feeling is "risk aversion." The decline in US bonds indicates that a large amount of capital is beginning to enter US bonds. From this perspective, it should be that investors have great anxiety about interest rate cuts, and they may believe that an interest rate cut is the key to triggering a decline in the risk market.

So funds are withdrawing from US stocks, cryptocurrencies, and even gold, and directly buying US bonds with higher hedging value. The current yield can still be maintained at over 3.5%, and the one-year yield can still be over 4%. As for why investors are so pessimistic, I personally think there are two reasons.

The first is that interest rate cuts have historically been accompanied by declines in the risk market in the United States, as mentioned in the previous "last fall" tweet. So investors are not trying to distinguish between defensive and remedial actions. As long as the probability of an interest rate cut increases, they will flee. It's hard to say this is wrong, but often in the early stages of interest rate cuts, if the economy does not decline, the risk market can still perform well.

The second reason is that Nvidia's performance has cast doubt on investors' overall faith in AI, which is likely not just due to overvaluation, but also panic. After all, AI as a defensive asset has risen for too long, so even though Nvidia's financial report this time is not bad, it still cannot escape the market's excessively high expectations. So we can see that tech stocks are falling particularly hard.

Unfortunately, whether it's #BTC or #ETH, they are also part of the tech stocks, so it's normal for them to advance and retreat with tech stocks. Macroscopically, I really haven't seen any bearish data, at least not to the extent of being so bearish. It should be the influence of risk aversion. It has been clearly observed recently that after entering the main trading hours in the United States, American investors' selling has intensified, as evidenced in the ETF data.

But I don't believe in an economic recession. Currently, it may be because investors are worried about a recession and are seeking refuge, but so far there have been no signs of a recession. So does an interest rate cut mean blindly bearish? I don't think so, but the market is always right.

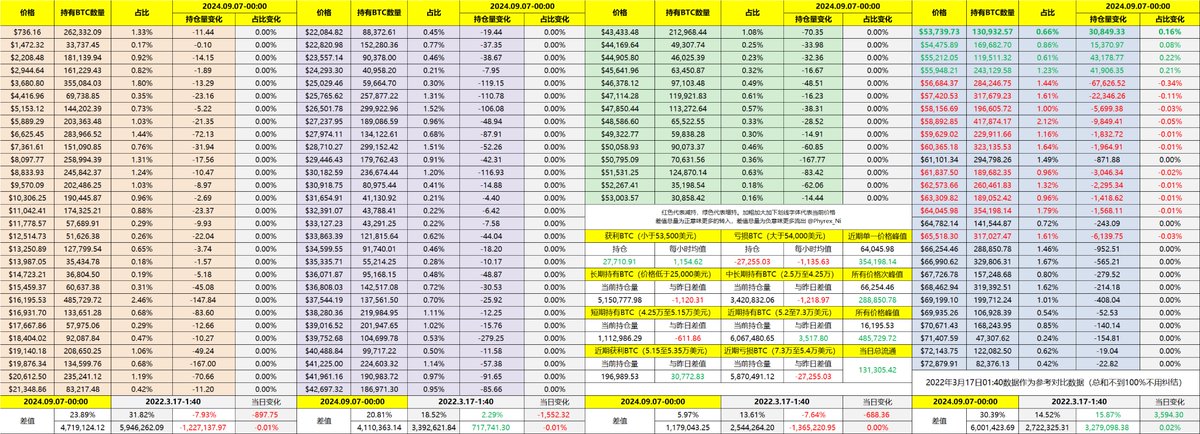

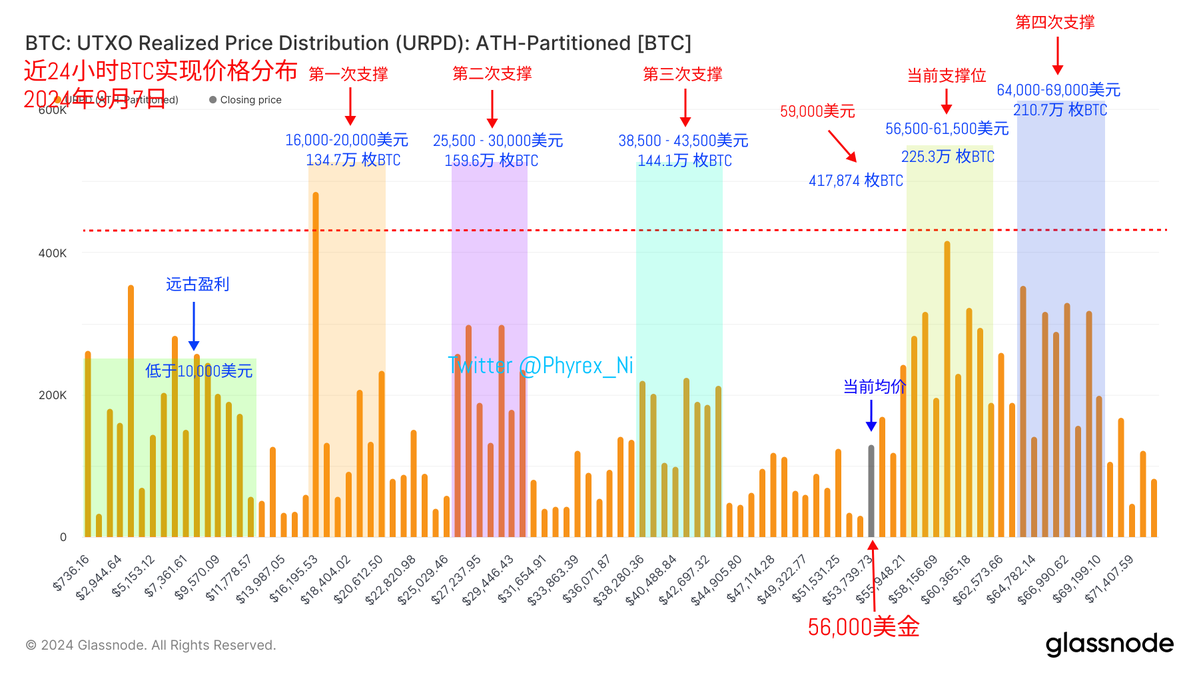

From the data, it's the same. Early investors have not shown signs of panic, still maintaining very low turnover. Only investors who have bottom-fished in the past few days are the main sellers. Currently, more BTC is still being transferred to long-term holders, but low prices still cannot force long-term holders to give up their chips. The circulating BTC in the market is indeed gradually decreasing, but the liquidity and purchasing power are too weak, and even a small decrease can bring about a significant decline.

The next two days will be the weekend again, and liquidity will be even worse. I am concerned that the sentiment of panic may spread. If panic occurs, it will probably be a deep needle.

The data has been updated, link: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。