The seed stage financing of Web3 has shown strong resilience in the early stages, reaching a new high in the first half of 2024, raising a total of $189 million.

Author: Cheeky Rolo

Translation: DeepTechFlow

Summary

In the first half of 2024, financing activities in the Web3 sector significantly increased, with 1,240 projects raising $7.52 billion. Compared to the second half of 2023, capital increased by 24%, and the number of transactions increased by 58%. This surpasses the performance of the entire venture capital market, which saw a capital increase of 16.1% but a decrease of 16.7% in the number of transactions.

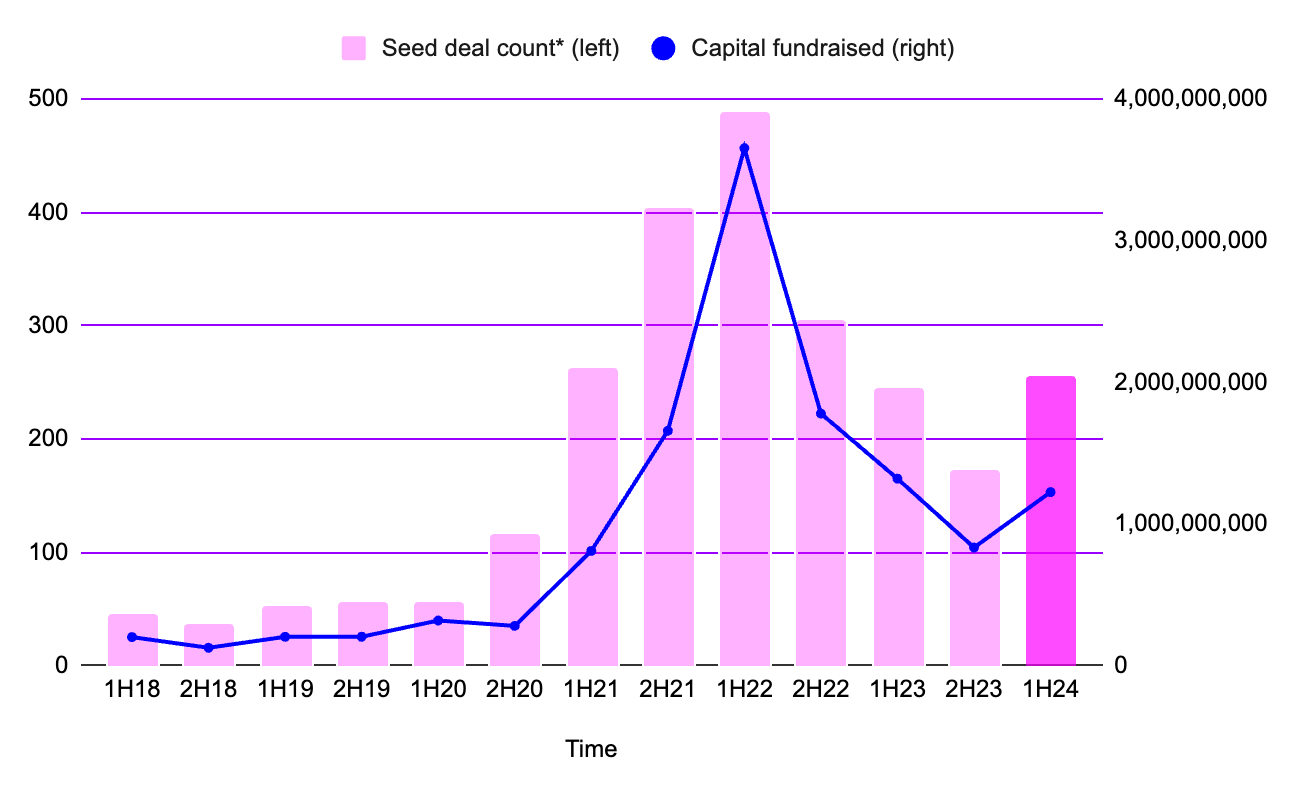

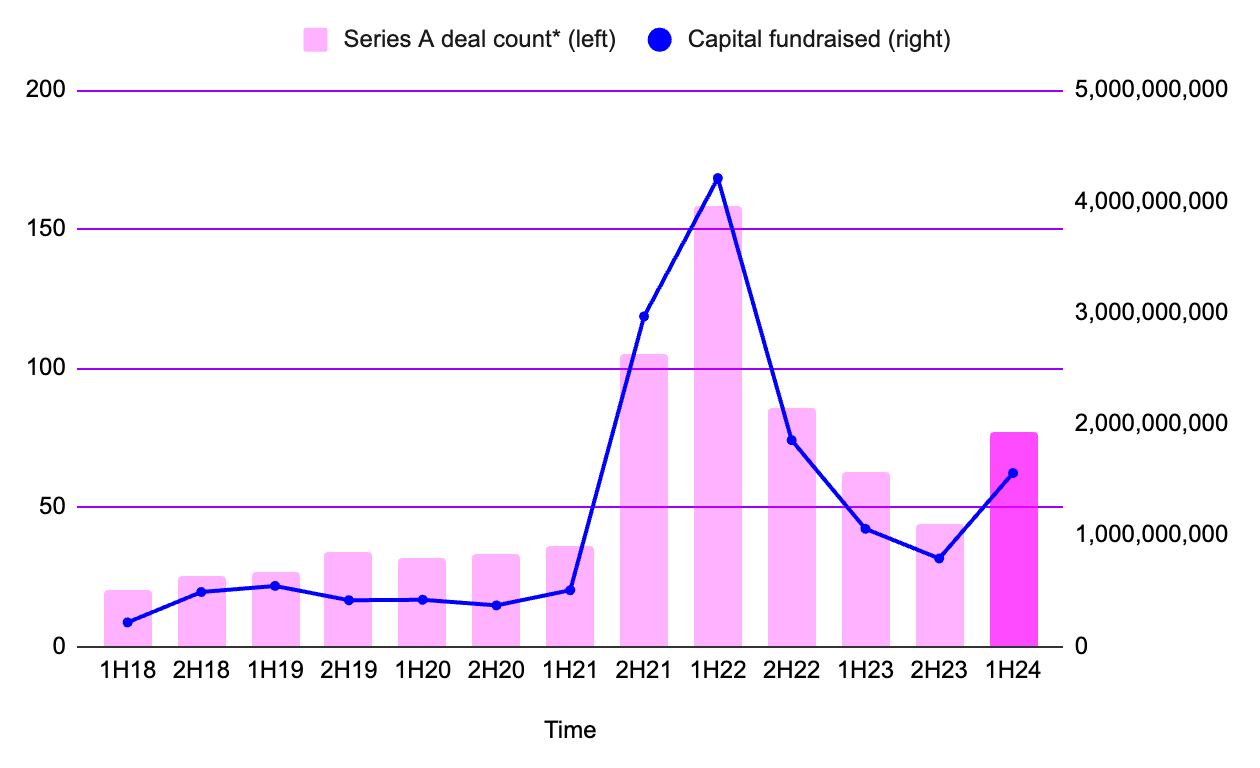

The seed stage financing of Web3 has shown strong resilience, reaching a new high in the first half of 2024, raising a total of $189 million, involving 80 transactions. Series A financing also showed strong growth, raising a total of $1.56 billion, involving 77 transactions, nearly double that of the second half of 2023.

In the second quarter of 2024, the financing environment for global startups improved, mainly due to the increase in large financing rounds and the surge in funds in the field of artificial intelligence, with AI financing doubling to reach $24 billion. Despite market volatility, the overall trend shows a gradual recovery, especially in the seed and Series A stages.

The growth in investment in artificial intelligence and Web3 indicates investor confidence in these high-growth areas, driving the stability and improvement of the 2024 market environment. This trend suggests a potential upward trend in the coming quarters, especially in early-stage transactions.

Highlights of the First Half of 2024

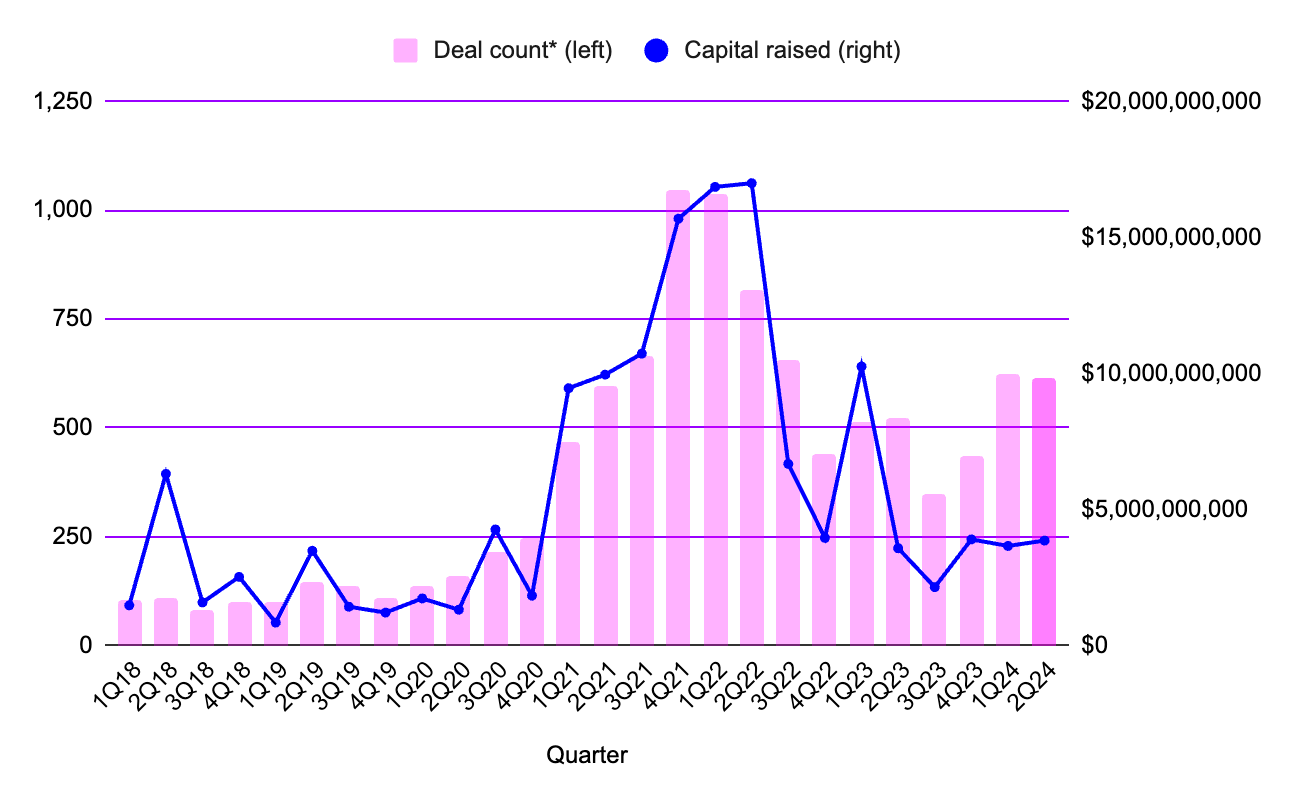

Source: Messari, Quarterly Transactions in Web3 at Various Stages

In the first half of 2024, a total of $7.52 billion was raised across all stages, involving 1,240 projects. This represents a 24% increase in capital and a 58% increase in the number of transactions compared to the second half of 2023.

In the first quarter of 2024, 624 projects raised a total of $3.66 billion, a 6.2% decrease in capital raised compared to the previous quarter.

In the second quarter of 2024, 616 projects across all financing stages raised a total of $3.86 billion, a 5.5% increase in capital raised compared to the previous quarter.

At first glance, the performance of the first half of 2024 is not as strong as that of the first half of 2023, when 1,041 transactions raised a total of $13.9 billion. This means that the funds raised in the first half of 2024 decreased by 45.8% compared to the first half of 2023.

- However, this significant difference can be explained by a successful case of a company. In March 2023, Stripe raised $6.5 billion. This event accounted for 83% of the funds raised that month, 63% of the funds raised in the first quarter of 2023, and 47% of the total funds raised in the first half of 2023. If we consider Stripe's financing as an exception and exclude it from the data, the fundraising performance in the first half of 2024 is actually 2% higher than that of the first half of 2023 (excluding Stripe), which raised $7.36 billion.

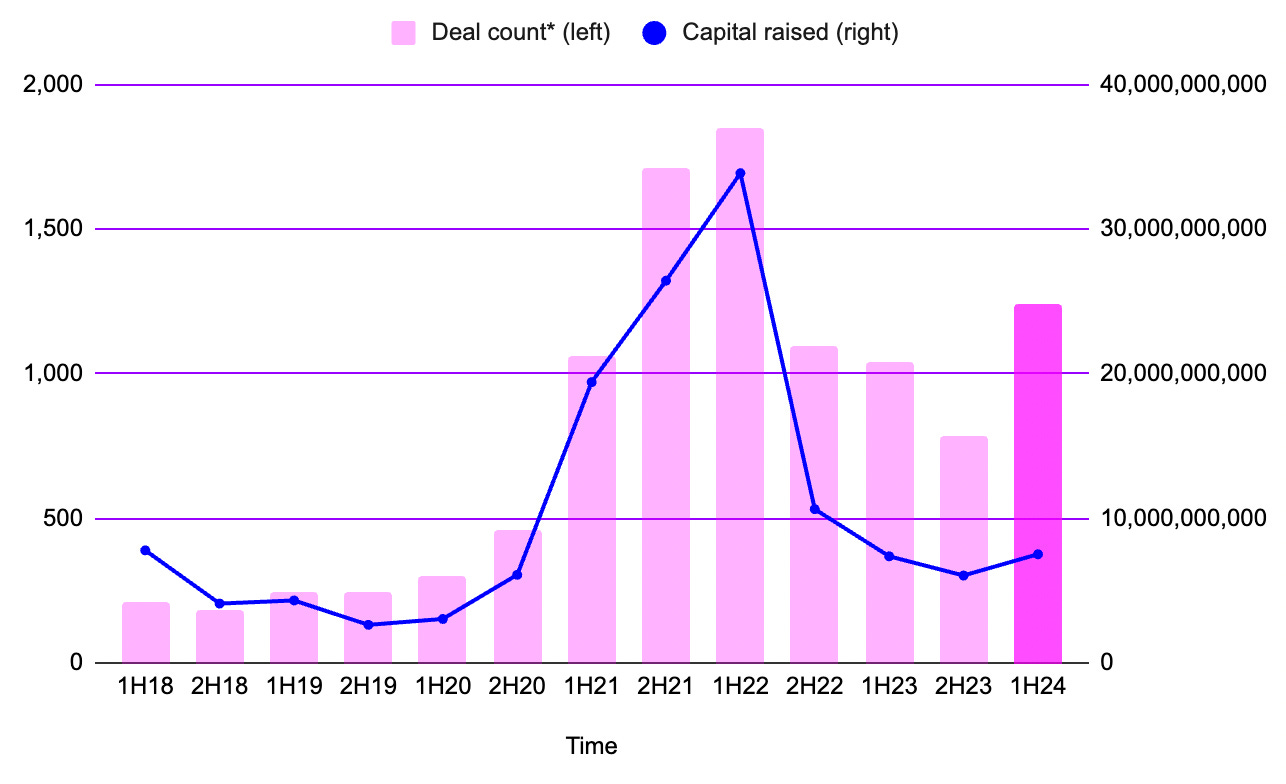

Source: Messari, Semi-annual Transactions at Various Stages in Web3

Note: The $6.5 billion financing of Stripe in March 2023 has been removed from the data in this chart.

Looking at the overall venture capital market, a total of $39.6 billion was raised through 2,525 transactions in the first half of 2024. In comparison, the second half of 2023 saw $34.1 billion raised through 3,031 transactions. This indicates an increase of 16.1% in funds raised from the second half of 2023 to the first half of 2024, but a decrease of 16.7% in the number of transactions.

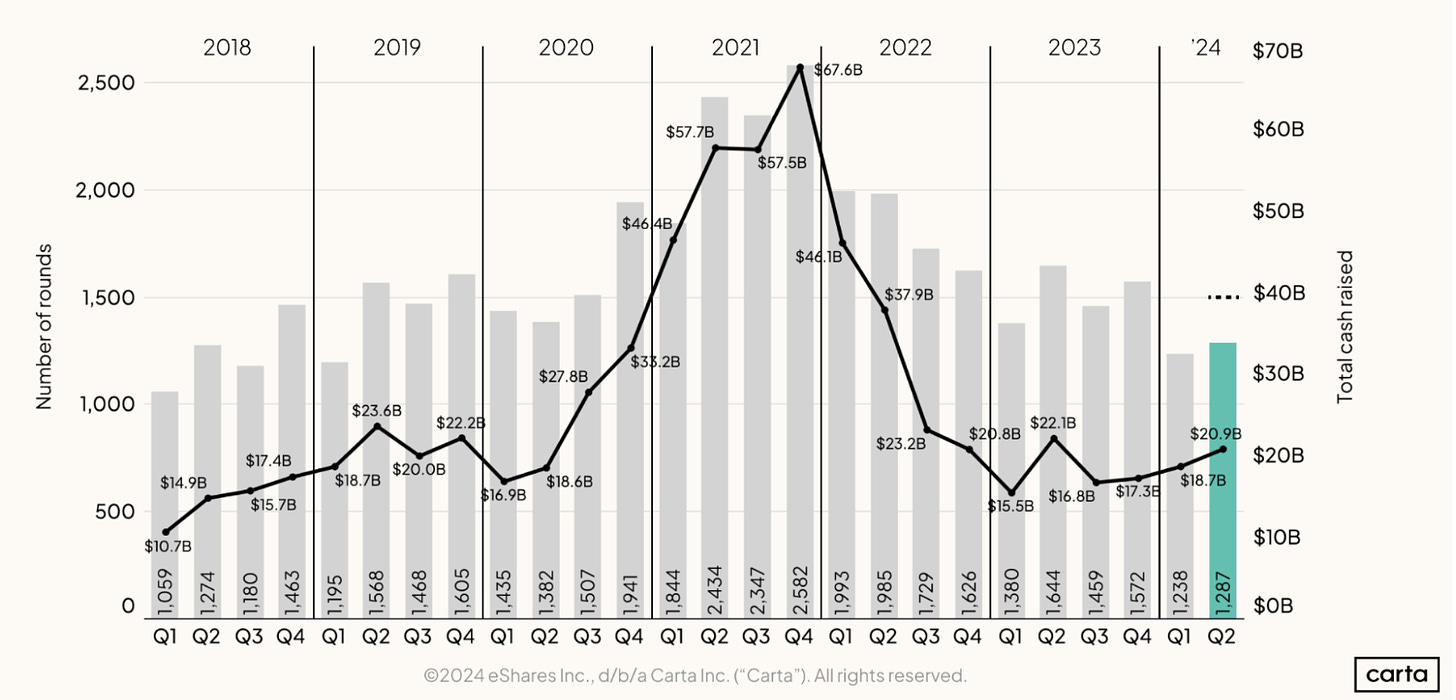

- According to Carta's data, the number of transactions and the total amount raised in the second quarter of 2024 significantly increased compared to the first quarter of 2024, with a total of 1,287 financing rounds completed, amounting to $20.9 billion. This shows a steady increase in venture capital investment levels each quarter since the third quarter of 2023. The second quarter of 2024 recorded the highest level of venture capital investment in the past 12 months.

Source: Carta, Hamza Shad, "State of the Private Markets in Q2 2024," August 2024

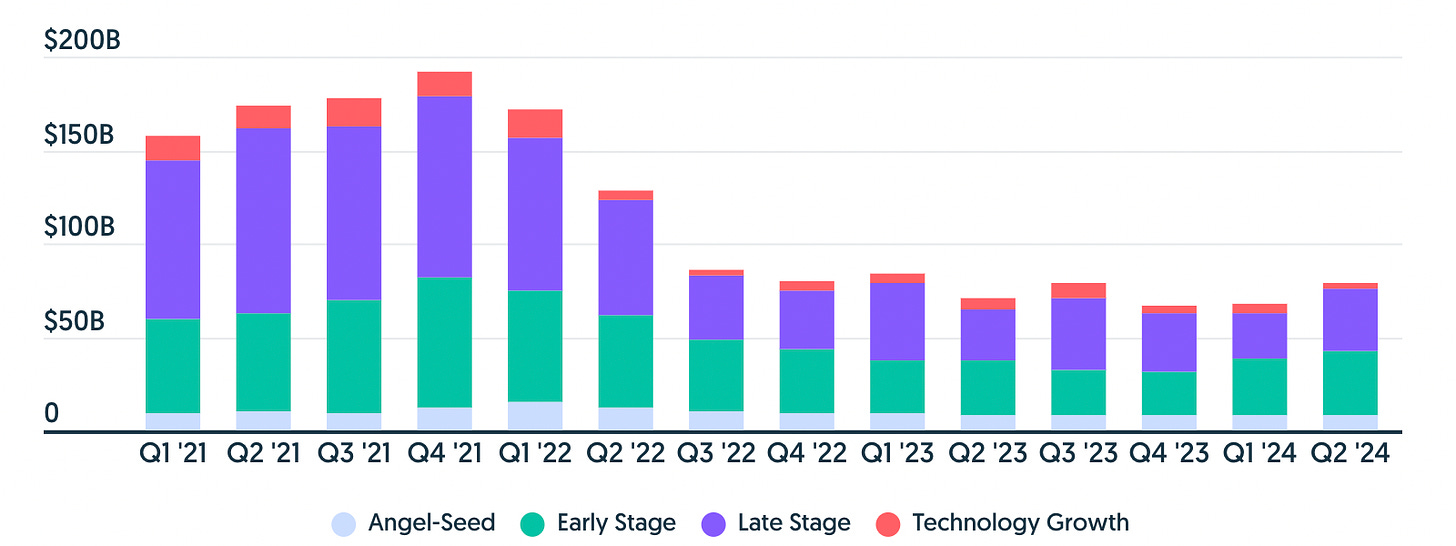

Source: Crunchbase, Gené Teare, "Global Funding and M&A Heat Up in Q2, AI Financing Surges," July 2024

Global startup financing in the second quarter rebounded to $79 billion, a 16% increase from the previous quarter and a 12% increase from the second quarter of 2023. This growth is largely driven by mega-financing rounds exceeding $100 million. Crunchbase data shows that we are currently in the eighth to ninth quarter of a broader trend of declining financing. Although the financing amount in this quarter ranks at the top since the first quarter of 2023, it does not necessarily mean that the venture capital market has fully recovered. Since 2023, financing levels have fluctuated greatly each quarter, mainly due to the increase in large-scale financing rounds for pre-IPO companies and companies in the AI field.

Overall, compared to the broader venture capital market, the fundraising performance in the Web3 sector has slightly improved. This is not only due to the relative increase in funds raised by Web3 (24% increase compared to a 16% increase in the broader market), but also due to the significant increase in the number of Web3 fundraising transactions (58% increase compared to a 17% decrease in the broader market).

Web3 Pre-Seed Stage Financing Situation

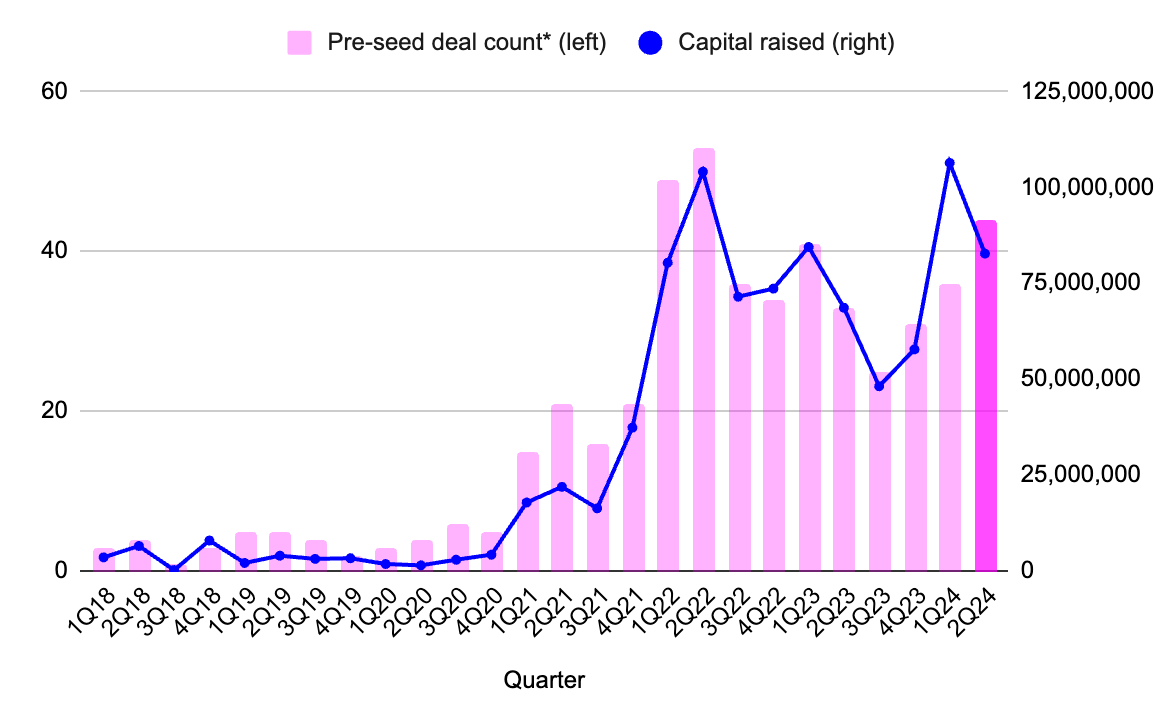

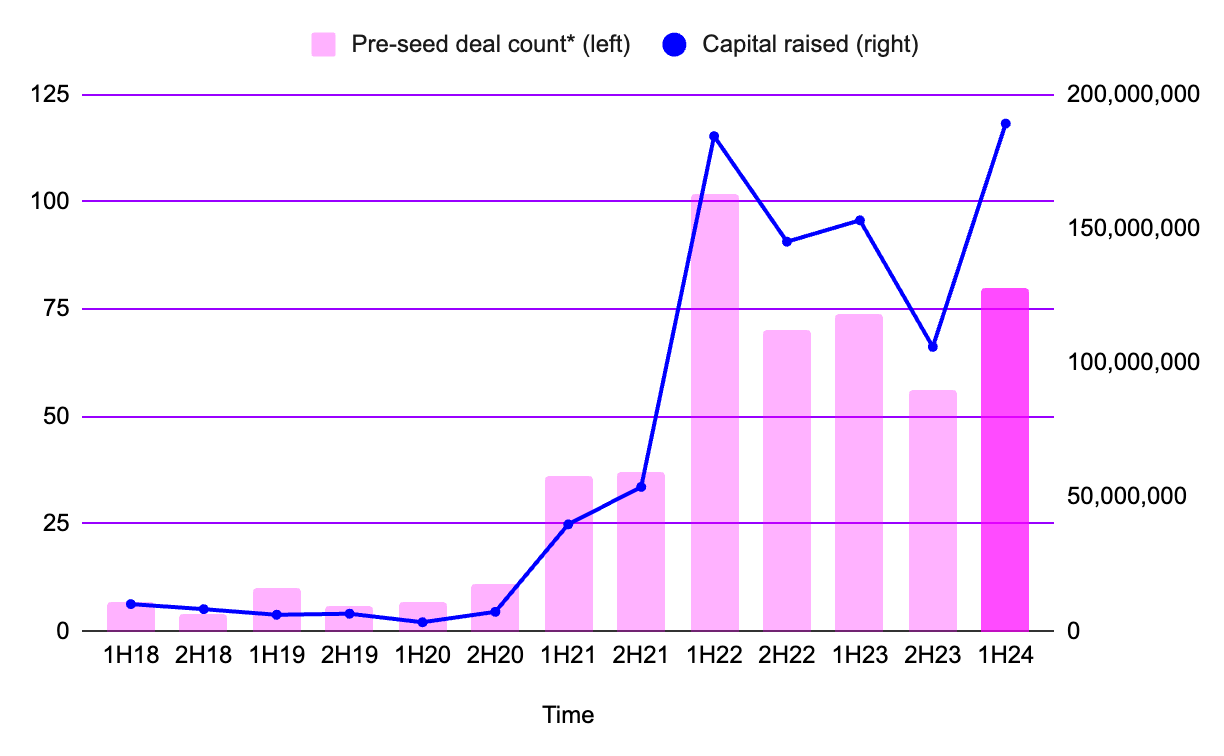

Source: Messari, Pre-Seed Stage Transactions and Quarterly Fundraising in Web3

- Since the second quarter of 2023, pre-seed stage fundraising in the Web3 sector has shown the strongest resistance to bear market trends in both the Web3 sector and the broader venture capital market. Since the third quarter of 2023, the number of pre-seed stage transactions has also shown a quarterly growth trend. In the first quarter of 2024, Web3 venture capital raised a historical high of $106 million through 36 transactions.

Source: Messari, Web3 Pre-Seed Stage Transactions and Semi-Annual Fundraising

- This also set a new record for fundraising in the Web3 pre-seed stage in the first half of 2024: $189 million was raised through 80 transactions, surpassing the previous record of $184 million raised through 102 transactions in the first half of 2022.

Web3 Seed and Series A Financing Situation

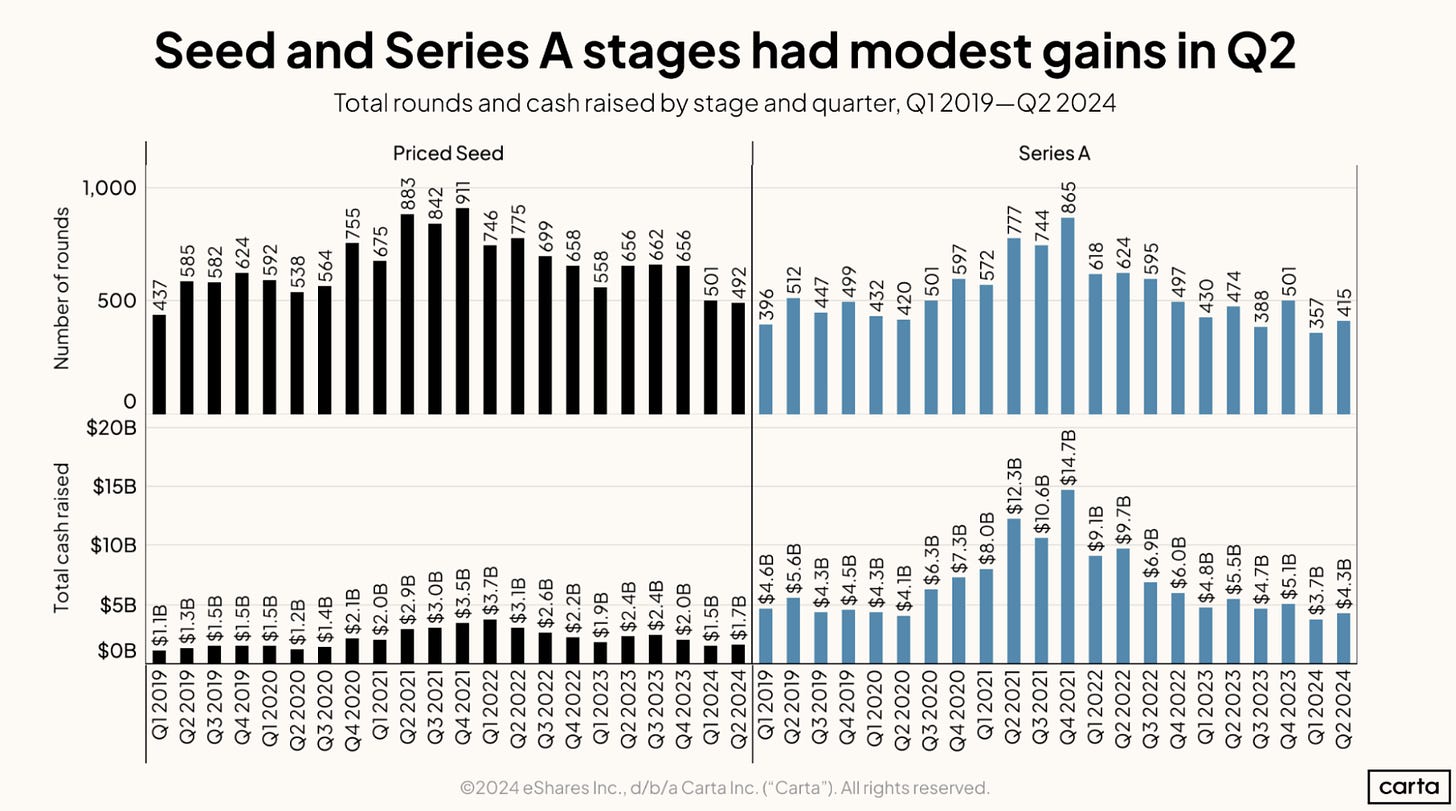

Source: Carta, Hamza Shad, "State of the Private Markets in Q2 2024," August 2024

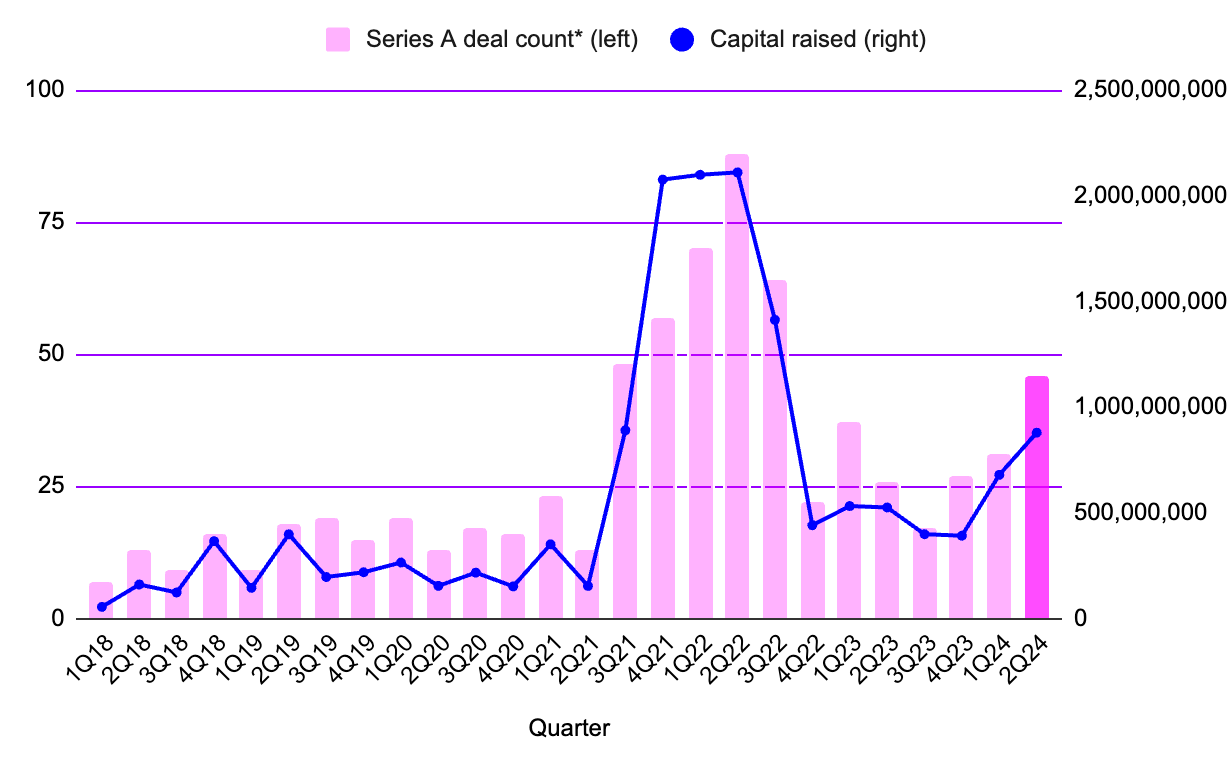

Data provided by Carta shows the performance of seed and Series A transactions in the broader venture capital market. The number of seed transactions in the second quarter of 2024 was almost the same as in the first quarter, while Series A transactions outperformed the previous quarter, indicating that the second quarter may be a turning point from the first quarter, as the number of seed and Series A transactions in the first quarter was the lowest since early 2019. Although the total amount raised in both stages slightly increased in the second quarter, it is worth noting that Series A financing in the first quarter reached its lowest level in five years. While the 16% growth in the second quarter still places it as one of the lower quarters for Series A financing, it may signal the beginning of an upward trend, although this sign is not yet strong enough.

The expected growth trend of seed and Series A transactions is more pronounced in the broader fundraising market context.

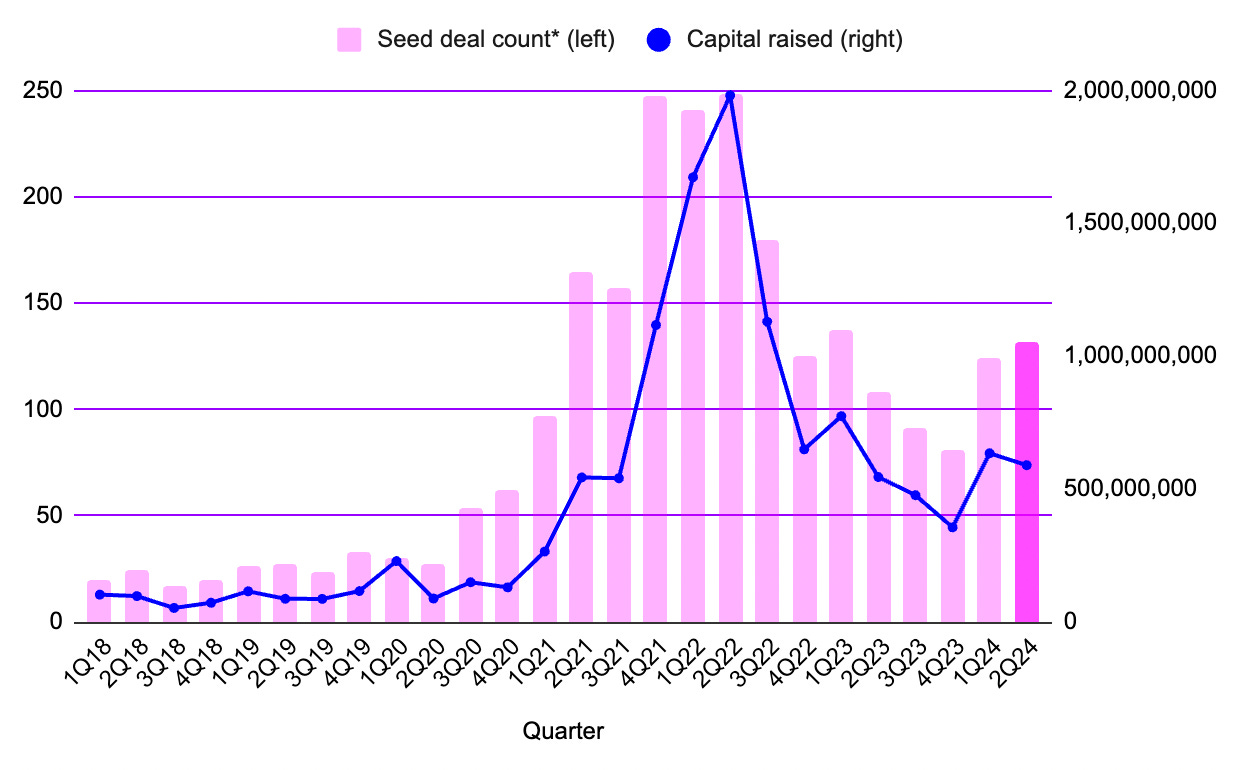

Source: Messari, Web3 Seed Round Transactions and Quarterly Fundraising

Source: Messari, Web3 Seed Round Transactions and Semi-Annual Fundraising

- In the first half of 2024, a total of $1.23 billion was raised in the seed stage, covering 256 transactions. This represents a 47% increase in capital raised compared to the same period last year, and a 49% increase in the number of transactions. Although the fundraising amount in the seed stage decreased by 7% from the first quarter of 2024 to the second quarter, there has been continuous transaction growth for two consecutive quarters. Nevertheless, the total amount raised in the second quarter is still higher than any period from the second to fourth quarters of 2023.

Source: Messari, Web3 Series A Transactions and Quarterly Fundraising

Source: Messari, Web3 Series A Transactions and Semi-Annual Fundraising

The upward trend in Web3 Series A transactions is more significant, with fundraising amounts and transaction numbers increasing each quarter since the end of the fourth quarter of 2023, contrasting with transactions in the pre-seed or seed stages during the same period. Overall, in the first half of 2024, a total of $1.56 billion was raised through 77 Series A transactions, nearly double the amount raised in the second half of 2023 (a 97% increase), with a 75% increase in the number of transactions.

Additionally, there has been a surge in financing in the AI field, doubling quarter-over-quarter to reach $24 billion, occupying a significant portion of total investments. Public token sales continue to dominate, while early-stage venture capital activities remain stable. This indicates that investor confidence in high-growth areas such as AI and Web3 remains strong, contributing to the stabilization and improvement of the market environment in 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。