Release BTC liquidity and provide more sources of income.

Authored by: Golem, Odaily Star Daily

In 2024, the two hottest narrative directions in the Bitcoin ecosystem are expanding the programmability of Bitcoin and staking for interest. The scalable solutions for Bitcoin are currently in a stage of exploration, while the staking for interest narrative has already identified the "big players".

Babylon, with its user asset self-custody, sharing Bitcoin security for PoS chains, and earning staking rewards, has become mainstream in the narrative of Bitcoin staking for interest. During the first phase of staking on the Babylon mainnet, which started on August 22, Babylon reached the 1000 BTC limit in just 7 blocks, causing network gas fees to soar to over a thousand satoshis per byte.

The heat of the Babylon ecosystem has also given rise to many liquidity staking protocols built around Babylon. Especially for retail investors, these liquidity staking protocols not only provide convenience for participating in Babylon staking, but also further release BTC liquidity on Babylon, providing users with more sources of income. Odaily Star Daily will take stock of the liquidity staking protocols in the Babylon ecosystem in this article. The summary information is as follows, detailed protocol introduction information is in the main text.

Lombard (LBTC)

Lombard is a liquidity staking protocol in the Babylon ecosystem, founded in April 2024, and completed a $16 million seed round of financing on July 2, led by Polychain, with participation from Foresight Ventures, OKX Ventures, Robot Ventures, Babylon, and others.

BTC deposited by users on the Lombard platform will be staked on Babylon to earn staking rewards. At the same time, users can mint LBTC at a 1:1 ratio on the Ethereum chain to participate in DeFi activities, and Babylon's staking rewards will be directly credited to the LBTC token. In the future, LBTC also plans to expand to multiple blockchains such as Solana and Cosmos to expand the liquidity of LBTC.

Lombard uses a secure alliance mechanism and non-custodial key management platform CubeSigner to ensure the security of users' BTC.

On the day before the start of staking on the Babylon mainnet on August 21, Lombard conducted whitelist deposit testing on the mainnet, where eligible users could deposit BTC into Lombard, and then Lombard would help users deposit funds into Babylon when the mainnet started. However, due to intense competition on the day of Babylon staking, Lombard decided not to stake BTC in Babylon temporarily and instead invested the saved fees into ecosystem development.

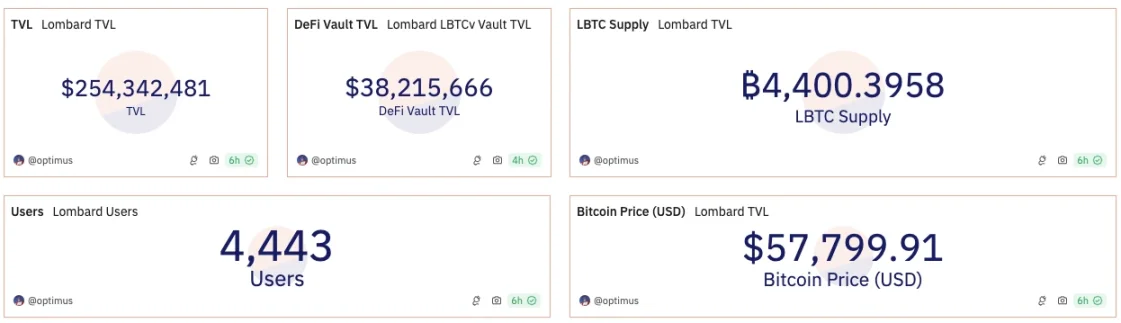

At the same time, Lombard launched a public test version on September 3, where all users can deposit BTC and mint LBTC on the Lombard platform. According to Dune data, the supply of LBTC has exceeded 4400.3958 tokens, with 4443 addresses.

Bedrock (uniBTC)

Bedrock is a multi-asset liquidity staking protocol founded by PoS node service provider Rock X. On May 2, 2024, Bedrock completed financing led by OKX Ventures, LongHash Ventures, and Comma 3 Ventures, with the amount undisclosed. Bedrock currently supports liquidity staking services for Ethereum (uniETH), Bitcoin (uniBTC), and IOTeX (uniIOTX) chains.

Bedrock's feature is to support staking wBTC on Babylon, and users have two staking options: one is proxy staking, staking wBTC on the Ethereum network, and then having a third party stake the corresponding amount of BTC on Babylon; the other is conversion staking, converting wBTC to BTC in one step, and then staking directly on Babylon. Staking rewards are credited as uniBTC, and it currently also supports FBTC for staking.

Bedrock chooses to work with third-party BTC custodians and external verification to separate staking rights from transfer rights, ensuring the security of user funds.

Bedrock is the largest delegator in the first phase of staking on the Babylon mainnet, delegating 297.8 BTC, accounting for nearly 30%. The supply of uniBTC has exceeded 501 tokens, and it is currently in the Cap 2 stage of pre-staking. If the total staked amount reaches 800 tokens, a special reward pool will be unlocked.

PumpBTC (pumpBTC)

PumpBTC is a liquidity staking protocol in the Babylon ecosystem. The project was founded in 2024 and has no publicly disclosed financing information.

Currently, users can stake WBTC, BTCB, and FBTC on PumpBTC and receive pumpBTC at a 1:1 ratio. Then, third-party custodians such as Cobo and Coincover, partnered with PumpBTC, will delegate an equivalent amount of BTC to Babylon to earn rewards for users, and rewards are settled in pumpBTC. PumpBTC has also launched a points incentive program and team mode, where users holding pumpBTC can earn points and stake 0.02 BTC or more to become a team leader and invite others to form a team, with no minimum staking requirement for team members, and successful team formation will receive corresponding pumpBTC point bonuses.

PumpBTC successfully delegated 118.4288 BTC in the first phase of staking on the Babylon mainnet, accounting for 11.8%. According to Dune data, the total supply of PumpBTC is 349.31480504 tokens, with 2333 participating staking addresses.

Lorenzo Protocol (stBTC)

Lorenzo is a Bitcoin liquidity financial layer based on Babylon. The project completed a round of financing on October 4, 2022, with investment from Binance Labs, and the amount was undisclosed.

Lorenzo issues LST using the principle of separating principal and interest. Users staking BTC or BTCB on the Lorenzo platform will receive stBTC at a 1:1 ratio, and staking rewards will be settled in yield accumulation tokens (YAT). Users not only receive the native staking rewards from Babylon, but also earn staking points from Lorenzo.

Lorenzo adopts the Staking Agents mechanism to manage the issuance and settlement of LST. Staking Agents are responsible for staking users' BTC on Babylon, uploading the staking proof to Lorenzo, and issuing stBTC and YAT to users. Although Staking Agents are designed to be composed of a group of trusted Bitcoin institutions and traditional financial giants, Lorenzo is currently the only Staking Agent.

In the first phase of staking on the Babylon mainnet, Lorenzo successfully delegated 129.36 BTC, accounting for 12.9%. Currently, Lorenzo has initiated the Babylon pre-staking activity Cap 2, and the total staked Bitcoin for Cap 1 and Cap 2 has exceeded 507 BTC.

Solv Protocol (solvBTC.BBN)

Solv is a decentralized Bitcoin reserve protocol that allows pledging assets from other chains (such as Ethereum, BSC, Arbitrum, Bitcoin, etc.) in exchange for interest-bearing asset solvBTC, aiming to integrate Bitcoin liquidity from multiple chains. Solv Protocol has raised over $11 million in total financing, with participating institutions including IOSG Ventures, Binance Labs, and Blockchain Capital.

In July, Solv Protocol announced the launch of the liquidity staking token solvBTC.BBN in collaboration with Babylon, allowing users of Bitcoin assets on networks such as Ethereum, BSC, Arbitrum, and Merlin to participate in Babylon staking by minting SolvBTC.BBN and earning points rewards.

Solv Protocol chooses to work with third-party crypto asset custody service provider Ceffu to ensure the security of users' Bitcoin assets.

In the first phase of staking on the Babylon mainnet, Solv Protocol successfully delegated 250 BTC, accounting for 25%, and covered all gas fees for users. Additionally, based on official platform TVL estimates, the total minted supply of solvBTC.BBN has exceeded 3230 tokens.

pSTAKE Finance (yBTC)

pSTAKE is a well-established POS token liquidity staking protocol, with total financing of over $20 million, with participating institutions including Galaxy Digital, DeFiance Capital, and Binance Labs.

On July 29, it announced the launch of a Bitcoin liquidity staking scheme on Babylon, with a deposit limit of 50 BTC. Users depositing BTC into pSTAKE will not immediately receive liquidity staking tokens. According to the official description, yBTC is expected to be launched on Ethereum in September, and users depositing BTC into pSTAKE Finance will receive an equivalent amount of yBTC. Deposits also earn points rewards.

On August 27, pSTAKE also initiated the Babylon pre-staking activity Cap 2, raising the deposit limit to 150 BTC, with a minimum deposit amount of 0.005 BTC. Additionally, pSTAKE ensures the security of user funds through third-party custodian Cobo.

In the first phase of staking on the Babylon mainnet, pSTAKE successfully delegated 10 BTC, accounting for 1%. Currently, pSTAKE's total staked Bitcoin amount is approximately 101 BTC.

Chakra

Chakra is a Bitcoin re-staking protocol based on ZK proofs and a modular BTC settlement network. The project completed a round of financing on April 26, 2024, with participation from ABCDE Capital, Bixin Ventures, StarkWare, and others, with the specific amount undisclosed.

Chakra has launched a Bitcoin staking pool in collaboration with Babylon, synchronized with the Babylon mainnet. This pool allows users to stake BTC on Chakra and seamlessly transition to Babylon, enabling users to not only receive Babylon staking rewards but also earn Chakra Prana and unlock various rewards in the near future.

The BTC staked by users is kept in a multi-signature insurance vault, jointly managed by Chakra and other entities such as Cobo, ensuring the security of user funds.

Chakra did not delegate users' BTC to Babylon in the first phase of staking on the Babylon mainnet. According to official data, the total staked Bitcoin amount for Chakra is 25.75984 BTC.

SatLayer

SatLayer is a liquidity re-staking platform built on Babylon, aiming to use Bitcoin as a universal security layer to protect any type of dApp or protocol in the form of Bitcoin Verification Services (BVS). On August 22, SatLayer completed an $8 million Pre-Seed round of financing, led by Hack VC and Castle Island Ventures, with participation from OKX Ventures, Mirana Ventures, Amber Group, and others.

SatLayer does not deposit BTC into Babylon but provides additional earning opportunities for LSD platform on Babylon. Users can deposit wBTC and staked BTC from the Babylon ecosystem (LBTC, pumpBTC, SolvBTC, etc.) into SatLayer to earn rewards, which are currently distributed in the form of Satlayer points.

On August 23, SatLayer initiated the first season deposit activity with a limit of 100 BTC, which will last for 2 weeks. The current staked amount has exceeded the limit, reaching 132.54 BTC, with over 75% being uniBTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。