While actively participating in the third anniversary celebration, let's take a look back at the growth path of Arbitrum One and review its successful strategies.

Author: Deep Tide TechFlow

Without experiencing the complete bull and bear market cycle, it is not enough to talk about real success in Web3.

The so-called time test is nothing more than extending the dimension, abandoning the pseudo-trend of misjudgment, and seeing the true essence of demand, which is particularly applicable in the over-competitive L2 track. The DeFi Summer in 2020 further exposed the performance limitations of Ethereum, and L2 emerged as a necessary scaling solution for blockchain to accommodate a large number of users.

In the past four years, L2 has been in fierce competition, and many projects have disappeared in the long bear market. However, there are also projects that have withstood the test of time and gradually built their own ecosystem. Among them, Arbitrum One has made a significant contribution.

On August 31, 2024, Arbitrum One celebrated its third anniversary.

After three years of ups and downs, Arbitrum One has developed into an industry giant in L2 and even Web3: with a TVL exceeding $14.75 billion, it is far ahead in L2, with over 36 million independent addresses and over 2000 ecosystem projects. It is considered by many to be the largest and most diverse L2 ecosystem.

On the occasion of the third anniversary, the Arbitrum official Chinese community also launched a series of celebration activities on September 4, including Twitter Giveaway, Chinese AMA, etc. Participating in these activities not only allows you to win exquisite souvenirs, but also enables you to look back on the past and look forward to the next milestone of Arbitrum One with many well-known industry leaders, outstanding developers, and core contributors.

While actively participating in the third anniversary celebration, let's take a look back at the growth path of Arbitrum One and review its successful strategies.

Birth: Blockchain is under great pressure, and Arbitrum One is born at the right time

Let's rewind to the birth of Arbitrum One in 2021.

Before that, DeFi continued to deepen, NFTs were gaining momentum, and on-chain interactions became more frequent. As the birthplace of DeFi, the Ethereum mainnet could only process about 15 transactions per second, leading to severe on-chain congestion and high gas fees, which also prompted the industry to seek change:

On the one hand, Ethereum embarked on the long road to Ethereum 2.0 upgrade;

On the other hand, new public chains and L2s emerged successively, aiming to expand blockchain performance and capture the overflow value of Ethereum.

Arbitrum One was born in this context.

As an Ethereum L2 scaling solution created based on Optimistic Rollup technology, Arbitrum One's mainnet went live on August 31, 2021. It was one of the first Optimistic Rollups L2 to go live, and in fact, the technology provider behind Arbitrum One, Offchain Labs, was also one of the first teams to focus on L2 development.

As early as 2018, former White House technology official and Princeton University computer science professor Ed Felten, along with two Princeton computer science PhD students, Steven Goldfeder and Harry Kalodner, made forward-looking judgments on the performance challenges Ethereum would face in the future. The three of them then founded Offchain Labs to start L2 research. From 2019 to 2022, Offchain Labs raised a total of $120 million in funding, with a valuation exceeding $1.2 billion.

The strong technical background also gives Arbitrum One outstanding technical advantages in various aspects, and the multi-round interactive fraud proof is one of them.

We know that L2 improves the performance of the main chain by moving a large amount of computation and storage requirements from L1 to L2, and it is necessary to ensure that the data synchronized to L1 is valid during the transfer between L1 and L2.

Arbitrum One proposed a multi-round interactive fraud proof based on Optimistic Rollup fraud proof. Its operation logic can be simply summarized as follows:

L2 validators synchronize compressed data to L1 and pledge digital assets as collateral. If there is a dispute over the transaction data of the Rollup block, a challenger must initiate a challenge and also pledge digital assets as collateral. Validators and challengers use a binary search method on the blockchain to continuously split the disputed steps until the disputed scope is narrowed down to a specific step, and then make a judgment on L1 to efficiently resolve the dispute.

All steps are under contract control, and no party can cheat. In this way, Arbitrum One not only ensures the security and validity of the data, inheriting the security of the Ethereum mainnet, but also achieves extremely low transaction fees, which is very suitable for the development of DeFi and NFTs.

Of course, in the "Ethereum performance has long been suffering" in 2021, with in-depth exploration of market pain points, full research and development in the L2 track over the past three years, and the first-mover advantage of being one of the first Optimistic Rollups L2 to go live, not only did Arbitrum One's birth come at the right time, but it also achieved impressive performance at the beginning.

According to official social media, at the beginning of the launch, Arbitrum One's ecosystem deployment projects exceeded 100+, including leading DeFi protocols such as Uniswap, Sushiswap, and Curve. This is due to Arbitrum One's almost 100% compatibility with EVM, allowing high-quality projects from the Ethereum ecosystem to be easily and efficiently ported.

The prosperous ecosystem has also brought enviable on-chain activity:

In terms of TVL, according to L2 Beat data, when Arbitrum One went live on September 14, 2021, the total TVL of all Ethereum L2s was about $3 billion, and the TVL of Arbitrum One reached $2.2 billion just two weeks after the mainnet went live, with a seven-day growth rate of about 2411%.

In terms of the number of addresses, according to arbiscan.io data, within half a month, the number of independent addresses on Arbitrum One had exceeded 100,000, and the 267,608 on-chain transactions on September 12 further demonstrated the community's active participation, while the average gas fees were significantly lower compared to Ethereum.

It can be said that at the beginning of the launch, whether from the ecosystem or on-chain activity, Arbitrum One had firmly established itself as the leader in L2. As the saying goes, "Starting a business is not easy, but maintaining it is even more difficult." Over the past three years, facing the more diversified demands of a larger user base and increasingly fierce competition in the industry, how to maintain a competitive advantage has become a more challenging task than achieving a "successful launch."

From this perspective, reviewing Arbitrum One's achievements at this important three-year milestone seems to be more valuable.

Growth: Arbitrum One, the leader in TVL among L2 giants

Throughout, the community has regarded Arbitrum One as the highest starting point, the earliest start, and the most mature second-layer network ecosystem to date.

Such discussions are not groundless, but are supported by concrete and rich data. We usually judge the volume and prosperity of a chain from the dimensions of TVL, independent addresses, daily active addresses, daily transaction volume, etc. Understanding the growth process of Arbitrum One over the past three years, it is not difficult to find that it has always maintained a leading position in the L2 track.

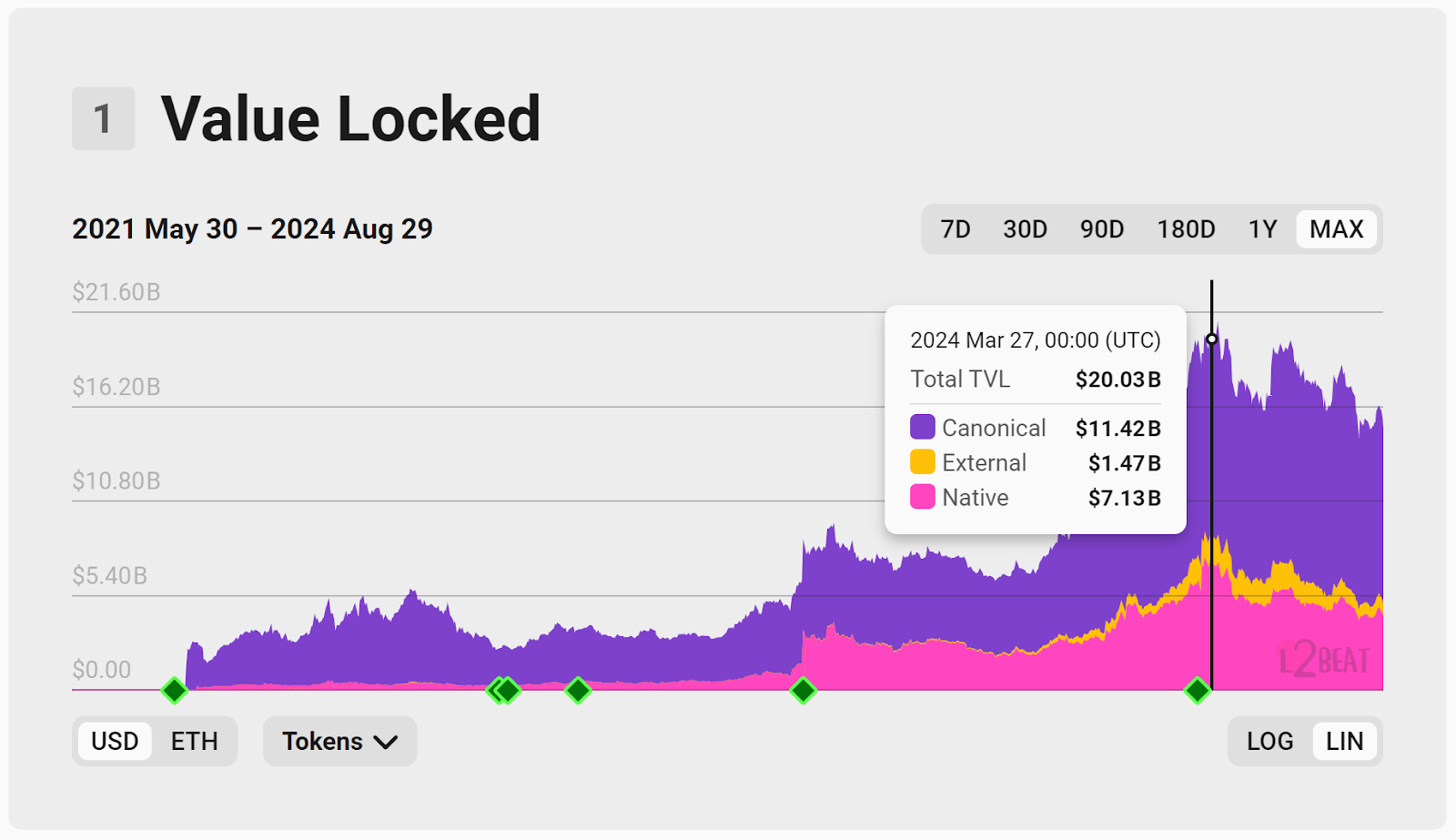

TVL usually represents the volume of funds available in the ecosystem, and since its inception, Arbitrum One's TVL has always remained at the top of L2 for a long time: According to L2 Beat data, on August 31, 2022, the first anniversary of Arbitrum One, its TVL achieved a growth from almost 0 to $3.33 billion; on August 31, 2023, the second anniversary of Arbitrum One, its TVL increased to $6.67 billion, doubling in the deep bear market phase; and by August 31, 2024, the third anniversary of Arbitrum One, its TVL had grown to $14.77 billion, with a peak TVL in April exceeding $20 billion, occupying about 65% of the total L2 TVL market share. With a very large volume of funds, Arbitrum One still achieved a growth of over 450% with the arrival of a new cycle.

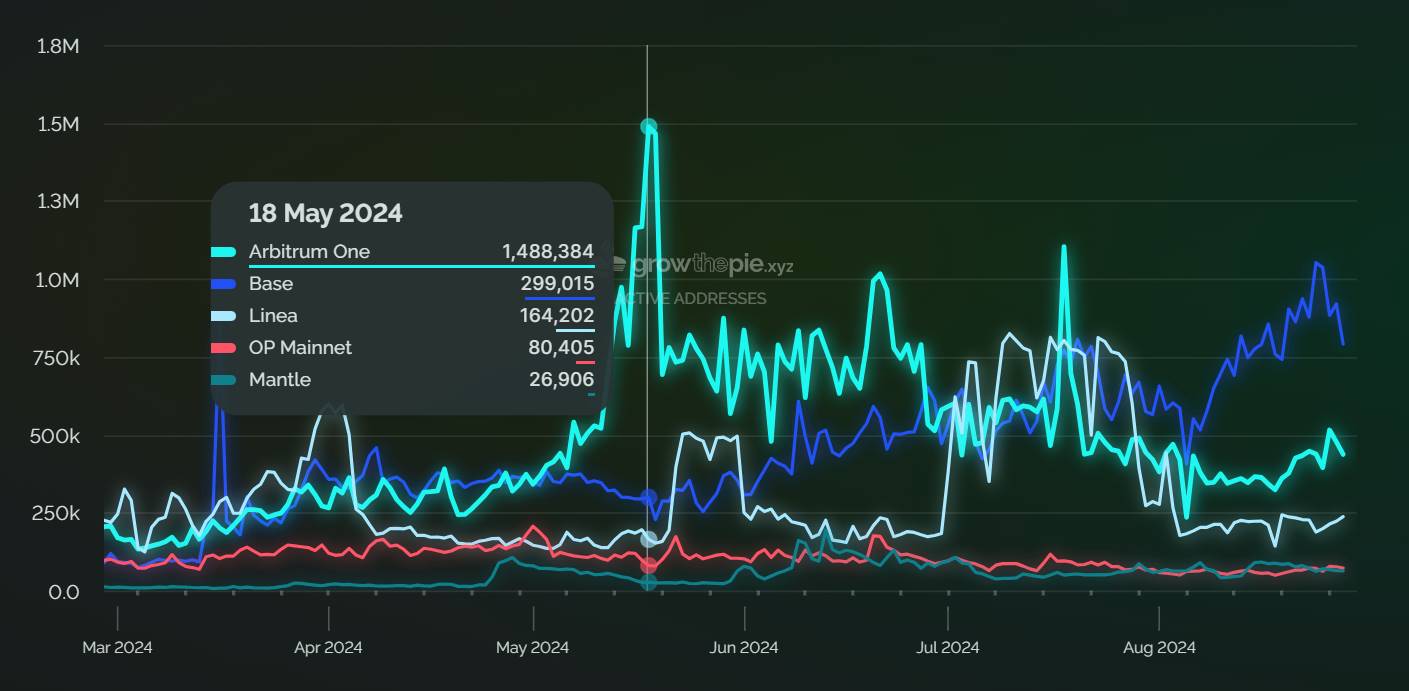

The number of addresses is an important data for measuring the volume of ecosystem users. There are few projects in L2 that have broken through the million-level address mark, and Arbitrum One is one of them: According to arbiscan.io data, as of August 28, 2024, Arbitrum One had 37.47 million independent addresses. According to Growthepie data, on May 18, 2024, the daily active addresses of Arbitrum One were 1.48 million, surpassing Solana, which was at the forefront of the Meme craze.

According to the L2 report data released by Coin98 Analytics: In the second quarter of 2024, the number of independent addresses of Arbitrum One increased from 19.88 million to 33.24 million, ranking third in the total number of independent addresses among all 11 mainstream L2s surveyed, with a quarterly growth rate of over 67%; in the just past July, the number of independent addresses of Arbitrum One increased to 35.77 million, with a monthly growth rate of over 7%. It is not difficult to see the long-term growth momentum of Arbitrum One.

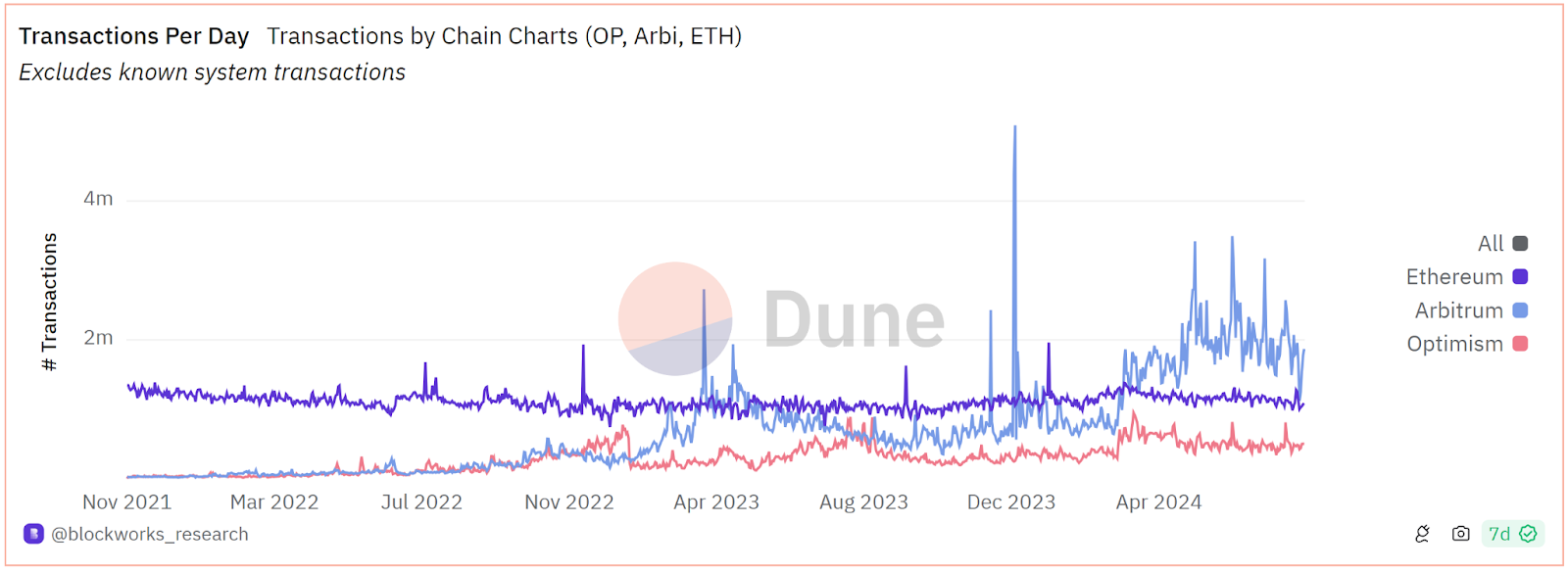

Transaction volume not only represents the level of user activity in the ecosystem, but higher daily transaction volume is also a strong proof of the performance of L2. In this regard, Arbitrum One still has outstanding performance: Currently, Arbitrum One has processed over 900 million transactions. According to Dune data, on December 16, 2023, the daily transaction volume of Arbitrum reached a new high of 5.08 million, and the current daily transaction volume of Arbitrum is about 2 million transactions, second only to Base, which ranks second, with OP, one of the earliest mainnets to go live, at around 500,000 transactions. At the same time, the daily transaction volume of the Ethereum mainnet has mostly remained at around 1.1 million transactions for most of this year.

The Arbitrum One community once had a very vivid metaphor:

If the competition in the past three years in the L2 was a series of exams, then Arbitrum One is like a student who has never fallen out of the top three in terms of single-subject performance or comprehensive strength, and no one can deny its achievements in the L2 track.

It also drives more people to explore:

In an industry accustomed to fleeting performances, what efforts have led to the enduring success of Arbitrum One?

Attribution: Technological iteration + ecosystem incentives, creating a diverse Arbitrum ecosystem

Funds and users do not come for no reason, and the most fundamental driving force is: the ecosystem.

In the eyes of many community members, Arbitrum is Ethereum. This is partly due to the fact that the Arbitrum ecosystem has attracted many leading projects from the Ethereum ecosystem, and also due to the innovative capabilities of the high-quality applications in the Arbitrum ecosystem.

Different from many latecomers in the L2 space, which strive to differentiate themselves in the homogeneous competition and carve out a niche market, Arbitrum, as one of the earliest Optimistic Rollups L2 to go live, has a "big and comprehensive" ecosystem style. According to the Arbitrum Encyclopedia Portal, the current number of projects in the Arbitrum ecosystem has exceeded 2000+, comparable to Ethereum in richness.

A sound infrastructure is a necessary condition for the stable and positive development of the ecosystem. As a fully EVM-compatible L2, Arbitrum can enjoy the complete infrastructure of Ethereum while having greater flexibility. The infrastructure products in the ecosystem include wallet adaptation support, cross-chain bridges, developer tools, and other sectors. According to the Portal, there are 60 bridge projects, 13 centralized exchanges, 76 wallets, 33 data analysis tools, 13 oracles, and 79 developer tools in the ecosystem, further enhancing the network's usability.

DeFi is the cornerstone of the ecosystem, and according to the Portal, there are over 373 DeFi projects in the Arbitrum ecosystem, including 64 Dex projects, 48 lending projects, and 26 stablecoin projects, covering all three elements of the DeFi triumvirate. Other project categories include derivatives, perpetual contracts, DeFi tools, liquidity management, yield aggregation, re-staking, and many other sectors.

Among them, we can see not only a number of well-known DeFi projects such as Uniswap, 1inch, AAVE, Compound, Curve, DODO, Sushiswap, but also native DeFi innovation projects that have quickly grown on Arbitrum, such as perpetual contract product GMX, Dex product Camelot, and others.

In 2024, we can still see the active presence of Arbitrum in the DeFi space, with new projects such as Robinhood, Renzo, and coW Swap making remarkable contributions to Arbitrum's TVL and on-chain activity.

As a L2 project that went live in 2021, Arbitrum certainly did not miss out on the NFT craze: According to the Portal, there are over 74 NFT projects in the Arbitrum ecosystem, including 15 NFT Marketplace projects, 28 NFT projects, 12 NFT tools, and 10 NFTFi projects. Users can not only freely buy/sell, but also participate in DeFi gameplay through NFT. With comprehensive support, the Arbitrum ecosystem has also attracted many well-known NFT projects, including OpenSea, NFTScan, and Azuki, which just joined this year.

When it comes to NFTs, we have to mention the gaming sector deeply linked to NFTs: According to the Portal, there are over 76 gaming projects in the Arbitrum ecosystem, covering GameFi, action, adventure, RPG, casual, and other sectors. The most talked-about project is the metaverse project Treasure DAO, supported by Offchain labs.

As the gaming ecosystem center of Arbitrum, Treasure DAO aims to build a "decentralized Nintendo." It came into the public eye at the end of 2022 due to the popularity of the game The Beacon. In less than 9 days after its launch, the NFT purchase of the founding character of The Beacon game reached a high of 34,394 times (0.031E per founding character). Other on-chain games of Treasure DAO include Bridgeworld, Smolverse, etc. Each game is connected through the native token MAGIC as a shared currency, and in-game NFTs can be traded through the Trove trading platform. With diverse gameplay and a thriving community, Treasure DAO is an important force in the gaming landscape of the Arbitrum ecosystem.

As an important entry point for Web3 incremental users, the Arbitrum ecosystem has always paid high attention to this sector. This year, new projects in the ecosystem include Pirate Nation – Apex Chain, InfiniGods, Avarik Saga, and many other high-quality chain games.

The scale effect formed by the prosperous ecosystem of Arbitrum provides strong support for its consistent leadership position in L2. Behind this prosperity, it benefits from Arbitrum's continuous iteration and optimization as an underlying platform to better empower developers, as well as the comprehensive support for projects within the ecosystem over the past three years.

In terms of technical support, Arbitrum continues to make efforts in two major directions, vertical and horizontal strategies.

The vertical strategy can be simply understood as Arbitrum's continuous deepening of blockchain performance and developer experience, aiming to become the preferred platform for developers to build projects through the introduction of multiple technical iterations and feature innovations.

The Nitro upgrade is a powerful proof of this: In August 2022, Arbitrum One successfully upgraded to the Nitro version, which supports interactive fraud proofs of Nitro code compiled in WASM for Arbitrum. Nitro enables Arbitrum to achieve higher throughput, faster finality, and more effective dispute resolution. According to official team data, after the launch of Arbitrum Nitro, L2 execution speed increased by 20-50 times, and transaction fees were further reduced.

Another much-discussed technological innovation is AnyTrust: By introducing a new security model with a Data Availability Committee (DAC), AnyTrust achieves ultra-low operating costs and faster withdrawal speeds while maintaining Ethereum mainnet-level security.

At the special time of the third anniversary, Arbitrum Stylus will launch on Arbitrum One and Nova mainnets: As an open-source SDK for building applications in multiple languages developed by Arbitrum, Stylus allows developers to deploy applications using their favorite programming languages (including Rust, C, and C++) without being limited to traditional Solidity language. This undoubtedly opens the door for applications in the entire industry and even the Web2 industry in the Arbitrum ecosystem. As the largest execution layer upgrade in Arbitrum's history, Arbitrum Stylus will take the developer and user experience to the next level.

In addition, more technical support includes completing the Atlas upgrade to integrate blob transaction functionality, reducing the minimum base fee to 0.01 gwei, launching a series of practical Arbitrum SDK tools, detailed development documentation, and active technical community response, further lowering the threshold and providing more support to developers.

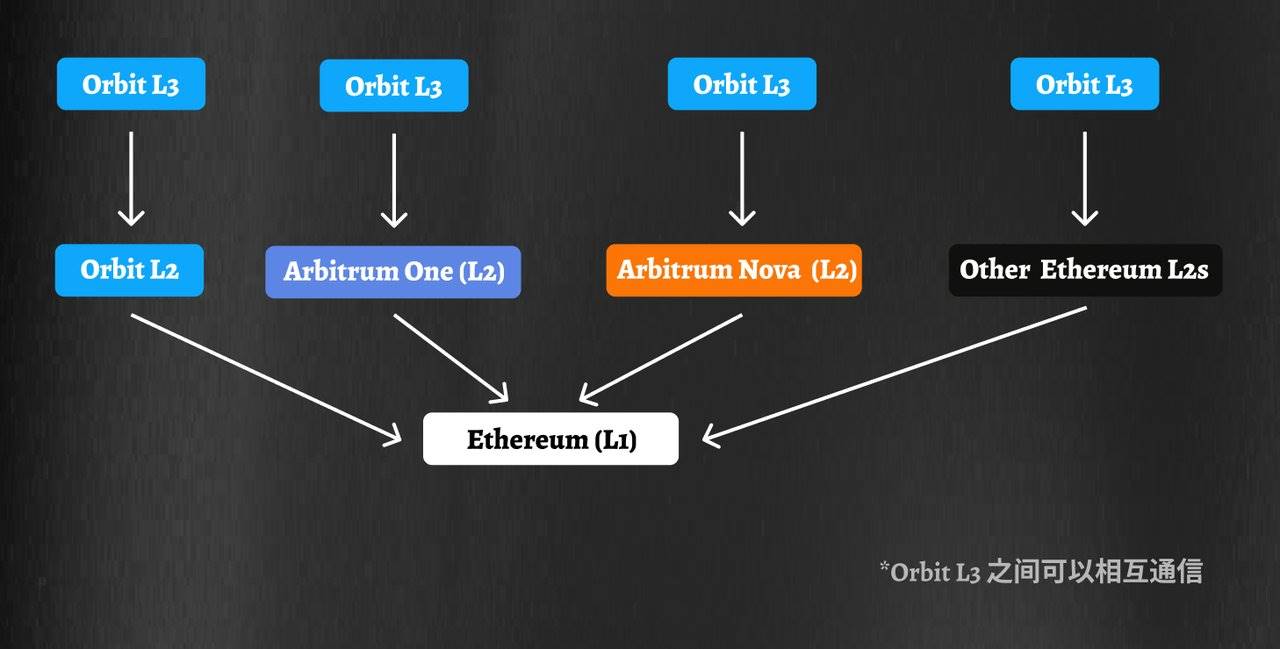

The horizontal strategy can be simply understood as covering a more diverse range of ecological needs and addressing the differentiated considerations of dApp developers in terms of speed, cost, security, etc. Arbitrum has also launched multi-chain products and RaaS services:

Arbitrum One: L2 based on Arb Rollup technology, which inherits the security of the Ethereum mainnet and is more suitable for building products with high security requirements such as DeFi.

Arbitrum Nova: L2 built based on AnyTrust, which significantly reduces on-chain interaction costs by sacrificing some decentralization, making it more suitable for building products with high-frequency trading needs such as GameFi.

Arbitrum Orbit: Allows the construction of a dedicated chain without permission, with customizable settings for throughput, privacy, Gas tokens, governance, etc., making it more suitable for products with highly customized requirements.

Each of the three products has its own strengths and has developed a thriving ecosystem in its respective field: The Arbitrum Nova ecosystem has deployed over 120+ projects, and from the beginning of the year to the present, the Orbit chain has attracted over 55 projects to launch 17 mainnets, with a cumulative transaction volume exceeding tens of millions. Additionally, over 100 projects are currently in deployment. The comprehensive development of the ecosystems of the three major products further accelerates the multi-chain era based on the Ethereum ecosystem and brings more possibilities for on-chain innovation.

In addition to technical support, ecosystem support is an indispensable important catalyst for application explosion. Arbitrum's strong ecosystem incentive measures further promote Arbitrum as a fertile ground for innovation.

On the user side:

I'm sure everyone still remembers the bustling Arbitrum Odyssey event in 2022. As an ecological experience reward program, participants had the opportunity to receive NFTs and more rewards by completing tasks. With the expected launch of the governance token, a large number of new users flocked to the event, leading to a temporary increase in transaction costs and even downtime. This also prompted Arbitrum to continuously seek performance optimization. In the subsequent stages of the Odyssey event, it also attracted a large number of users to participate.

In addition, ordinary users can participate in the Ambassador Program to contribute to the community through hosting events, creating content, spreading education, building tools, and receive generous rewards and widespread recognition from the Arbitrum community.

On the developer side:

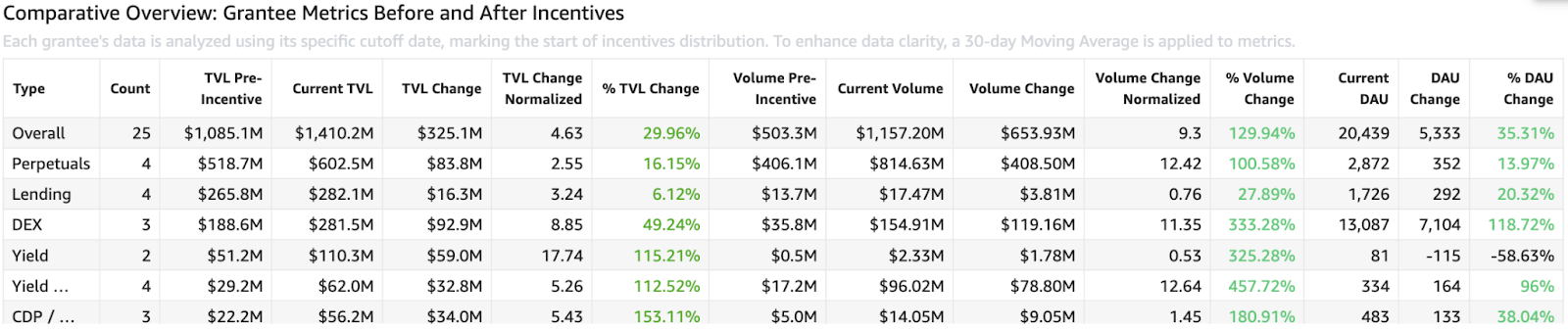

Starting in November 2023, Arbitrum launched the Short-Term Incentive Program (STIP), and through community voting, distributed 50 million ARB tokens to various major protocols in the Arbitrum ecosystem to increase user participation. Out of the 95 projects that participated in the vote, 29 were selected, including Camelot, GMX, Galxe, Pendle, etc. In the end, a total of 71.4 million ARB tokens were distributed to 27 projects. Through on-chain data, we also see the effects of the incentives: various protocols achieved comprehensive growth in daily active users (DAU), TVL, and transaction volume.

Based on the results of the Short-Term Incentive Program (STIP), ArbitrumDAO launched the Long-Term Incentive Pilot Program (LTIPP) this year. The pilot program will distribute 25 to 45 million ARB tokens to protocols based on Arbitrum to attract new users and liquidity to Arbitrum and explore more effective incentive systems.

At the same time, Arbitrum also launched a bug bounty program to encourage developers to participate in security audits and vulnerability discovery. Depending on the severity of the vulnerability, developers will have the opportunity to receive rewards ranging from $1,000 to $2 million, which continues to enhance the security and reliability of the ecosystem.

In addition, the Arbitrum Foundation will conduct more Grant programs and hackathon events. In June of this year, as Arbitrum Stylus approached, Arbitrum also held the Stylus Blitz Hackathon event on the Arbitrum Sepolia testnet. The Arbitrum Foundation has completed three rounds of Grants programs, and according to the Arbitrum official website, the fourth round of Grants funding program will soon open for applications.

The diverse incentive measures have attracted the participation of a large number of developers. The abundant funds, resources, and technical support have allowed developers to explore various innovative possibilities in a vibrant environment, from financial applications to games, social platforms, and other fields, injecting more driving force into the growth of the Arbitrum ecosystem.

Looking ahead: The roadmap is progressing steadily, and the future of Arbitrum One is promising

Of course, at such a meaningful moment as the third anniversary, while reviewing the proud achievements of the past is gratifying, it is more important to focus on the future development strategy and growth potential.

On the one hand, with the announcement of the airdrop plan by zkSync in June 2024, the former L2 giants have all launched tokens. On the other hand, facing competition from new L2 players such as Base, Blast, and Mantle, as one of the L2 giants, how will Arbitrum open the second growth curve of the ecosystem and continue to consolidate its position as the leader in TVL among L2 solutions?

In response to the increasingly unpredictable market, Arbitrum has clearly been prepared, as evidenced by recent announcements.

On the technical front, last week, Arbitrum's technical service provider Offchain Labs announced the latest development blueprint. In addition to the previously mentioned launch of Arbitrum Stylus on the Arbitrum One and Nova mainnets during the Arbitrum anniversary, the article also detailed more technical proposals planned by Offchain Labs for Arbitrum, including:

In the third quarter of 2024, Offchain Labs will complete the development of rapid withdrawals on Arbitrum.

In the second half of 2024, Offchain Labs will complete the development of the new verification protocol Bounded Liquidity Delay (BoLD) to achieve permissionless verification and introduce review timeouts based on BoLD to limit the negative impact of repeated reviews or offline sequencers on the Arbitrum chain, providing stronger anti-censorship guarantees for the Arbitrum chain.

In 2025, Offchain Labs' technical focus will include multi-client support, adaptive pricing, chain clusters, and the promotion of decentralized sequencer implementation. In addition, further exploration of ZK + Optimistic hybrid proof is also underway to further improve the performance, efficiency, interoperability, scalability, and decentralization of Arbitrum. These proposals will be voted on by ArbitrumDAO and, if approved, will be steadily implemented.

On the ecosystem front, in the first half of 2024, the Arbitrum ecosystem has achieved several milestones: ApeCoin DAO, a decentralized autonomous organization behind ApeCoin, chose to launch ApeChain on Arbitrum; DuckChain became the first L2 for TON using Arbitrum Orbit; and several leading projects in the social, NFT, and DeFi fields, such as Azuki, Farcaster, and Robinhood, have joined the Arbitrum ecosystem.

These achievements collectively demonstrate the enduring attractiveness of the Arbitrum ecosystem and will be an important driving force for the continued leading position of the Arbitrum ecosystem. In the future, based on the three major products of Arbitrum One, Arbitrum Nova, and Arbitrum Orbit, Arbitrum will actively promote more collaborations and continue to make efforts in improving the ecosystem, inspiring ecosystem innovation, and empowering ecosystem users.

Celebration: Join the community in celebrating and win generous rewards

Finally, for many users, compared to reviewing and looking ahead, the most direct way to celebrate the third anniversary of Arbitrum One is to participate.

Around the third anniversary, the Chinese community of Arbitrum has also launched a series of celebration activities. The most unmissable event will be a unique AMA event to be held on September 5th at 21:00.

The event will be attended by guests including the head of the Azuki ecosystem, @whizwang, the core contributor of GMX, @wiseoftheday, the manager of the Chainlink Chinese community, @legeishere, DuckChain founding member David, and SNZ developer relations manager Leo.

At the same time, by liking and retweeting the event tweet and following the Arbitrum Chinese official Twitter, the event will select 10 lucky fans to receive surprise rewards of exquisite Arbitrum merchandise.

New and old friends will gather to share various interesting stories about Arbitrum and answer questions for new partners. Through communication and collision, they will discuss the future of Arbitrum.

Conclusion

Undeniably, the road ahead is challenging.

Looking at the L2 track, on one side, new L2 players such as Base, Mantle, and others are eyeing the former L2 giants, and it seems that some projects among the former L2 giants are slightly falling behind under the impact. On the other hand, in this cycle, anyone can launch a chain, and everyone is launching a chain. The market is full of competition, and the community's disillusionment with infrastructure narratives has brought more variables to the competition in L2.

However, we can still see that for a true L2 leader like Arbitrum, its accumulated leading advantages cannot be challenged overnight, especially since Arbitrum's leading advantages are more derived from the on-chain activity brought by its rich ecosystem, which is more difficult to replace in the L2 competition.

With Arbitrum's continuous improvement and breakthroughs in technology, users, and the ecosystem, as well as the landing of various milestones, we wish and look forward to Arbitrum bringing more innovative developments to the L2 and the entire industry in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。