No matter if you are an experienced DeFi enthusiast or a "Degen" who hopes to optimize returns in the ever-changing market environment, in this decentralized capital market, do you value capital efficiency? Fund security? Or position flexibility?

Assuming that the DeFi protocol has undergone very strict audits, added real-time active attack protection and monitoring, and the security of funds is guaranteed, have you ever thought about having a super high capital efficiency and flexibility in the lending market, which allows you to manage your positions with maximum flexibility according to the highest yielding leverage opportunities, such as LSTs, LRTs, stablecoin yields, etc.?

The lending market is often considered to be a relatively dull part of DeFi—long-term holding, requiring almost no monitoring. This is also the main reason why individual leading protocols dominate the DeFi market liquidity, building not only high walls based on liquidity but also shaping user habits.

Nevertheless, existing lending market protocols still fall short in meeting the needs of users seeking extreme flexibility. Sumer Money has seen this and aims to create an option for DeFi users that can simultaneously consider capital efficiency, security, and flexibility.

Before we delve into the specific implementation, let's first understand how the design of liquidity pools affects capital efficiency in the current multi-chain DeFi environment.

The Design of Liquidity Pools in DeFi Protocols is the Core of Capital Efficiency

DeFi protocols rely on liquidity pools to operate—but for the same assets, more independent pools often mean fragmented liquidity, leading to lower capital utilization and a poorer user experience for trading and providing liquidity.

DEX protocols such as Uniswap v4 and Balancer v2 have independently introduced innovative designs for shared liquidity pools in the DEX field to reduce liquidity fragmentation. However, the same innovation has not yet been applied to the design of lending pools.

In contrast to shared liquidity pools are independent liquidity pools, which have significant advantages in reducing tail risk for assets. However, when it comes to mainstream assets such as ETH, BTC, USD, and related assets, independent liquidity pools often lead to unnecessary liquidity fragmentation and do not correspondingly reduce risk. These mainstream assets are precisely the most important assets in the lending market.

Capital Efficiency in Multi-Chain DeFi: Combination and Management of Cross-Chain Assets

Typical DeFi users face a steep learning curve when shuttling between different chains, searching for suitable tokens, bridging tools, and yield opportunities. Usually, these yield opportunities come at the expense of asset security because they require interaction with bridging tools and DeFi protocols on multiple chains, not to mention the opportunity cost of users losing yields on the original chain when crossing chains.

Design of Sumer Money

1. Improving Capital Efficiency with Shared Liquidity Pools

Sumer has introduced a new risk control engine that automatically considers the correlation between assets when evaluating risk. Traditional lending protocols typically start from the asset side, statically determining a user's borrowing capacity based on the current value of the collateralized assets. In contrast, Sumer intelligently matches a user's collateralized assets and borrowing assets based on their correlation, automatically matching higher borrowing limits for highly correlated collateral and borrowing combinations, thereby maximizing a user's borrowing capacity without increasing risk. For example, if there are correlated assets in a user's position (such as depositing wstETH and borrowing ETH), Sumer will automatically adapt a higher LTV (loan-to-value ratio), thereby maximizing capital efficiency and asset utilization.

To achieve the same optimization of LTV, many lending protocols need to set up separate liquidity pools for different asset collateral and borrowing combinations, leading to liquidity fragmentation and presenting more complex choices for savings and borrowing users. Sumer's design combines liquidity pools for correlated and non-correlated assets into a shared liquidity pool, significantly improving user capital efficiency and flexibility.

Additionally, Sumer can flexibly combine assets based on their correlation and liquidity, and adjust these combinations flexibly as the liquidity of assets changes.

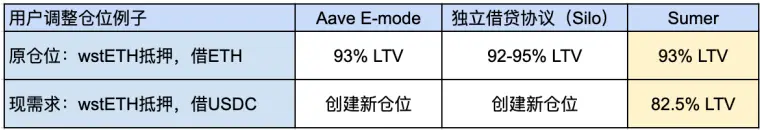

Below are examples of Aave E-mode, independent lending protocols, and Sumer in the lending aspect:

2. Flexibility in User Position Management

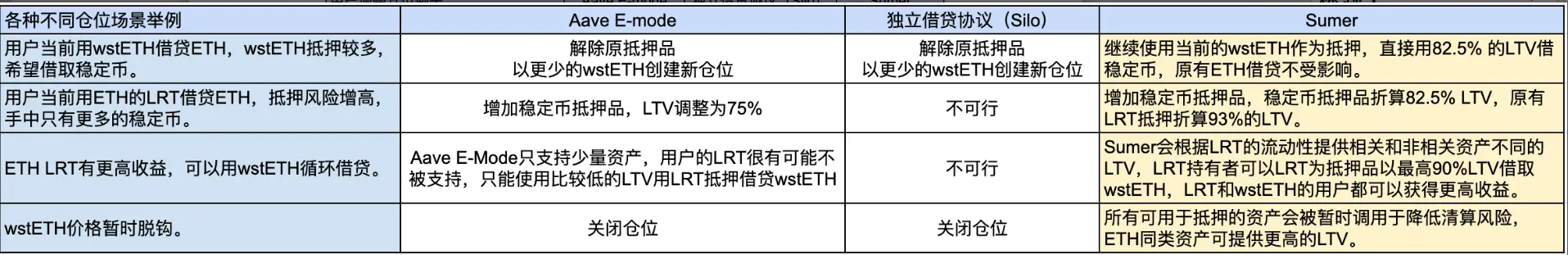

The following shows the position management methods in four typical DeFi scenarios for Aave e-mode, independent lending protocols, and Sumer:

It is obvious that Sumer's highly efficient unified liquidity pool provides considerable flexibility in position management compared to existing lending protocols.

3. Sumer Money Money Multiplier

In traditional finance, there is a concept of money multiplier, where banks can use the assets deposited by depositors to lend to users in need of funds, thereby increasing the market's money supply, leading to concepts like M2 and M3. Drawing inspiration from this, Sumer now allows users to create synthetic suUSD, suETH, and suBTC by collateralizing their deposits in Sumer's application on the native chain, retaining all DeFi yields on the original chain (staking, restaking, borrowing). These su tokens are like a Visa debit card given to users by the bank, allowing users to use them in other chains and new ecosystems, seamlessly participating in new ecosystems without worrying about the opportunity cost of funds on the original chain.

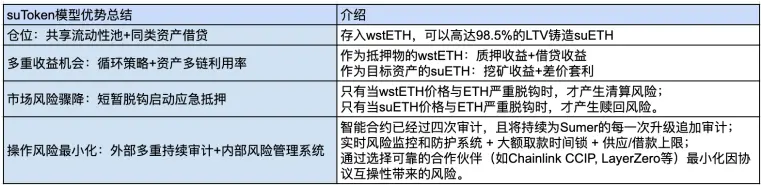

Sumer's shared liquidity pool supports su tokens with up to 98.5% LTV based on correlated assets, and without additional costs. These su tokens can transmit settlement information to supported networks through partners like Chainlink CCIP and LayerZero for cross-chain bridging.

Through its unique intelligent risk control engine, Sumer has merged scenarios that previously required multiple different protocols (highly correlated asset lending, low correlated lending, collateralizing stablecoins/synthetic assets, cross-chain bridge liquidity protocols) and multiple independent liquidity pools into a single protocol and liquidity pool. Users can participate in staking and DeFi activities on new chains through su tokens generated by collateralizing assets in Sumer without losing all DeFi yields on the original chain.

Furthermore, according to Sumer's AMA with zkLink Nova, Sumer mentioned that its su tokens have the potential to become composable modules in the entire DeFi ecosystem. In the near future, su tokens will have more applications and yields through Sumer's own L1. The Sumer team will also contribute to the Cosmos community by providing a more high-performance and decentralized "Supernova Core" engine that is compatible with the existing Cosmos SDK, better supports EVM and parallel EVM consensus, and focuses on providing a Web2-level user experience in highly decentralized networks. Additionally, the Sumer token will serve as the PoS token of the Sumer chain, capturing transaction fees and lending yields generated by DeFi and on-chain transactions.

Currently, Sumer has just released its own point system, with a total value locked (TVL) of approximately $6 million. However, to set the envisioned capital efficiency flywheel in motion, deeper liquidity accumulation is clearly needed. Otherwise, users will find it difficult to experience a complete DeFi ecosystem on the product side, which is also one of the biggest challenges Sumer faces. Additionally, Sumer's TGE time has not been announced, and how to effectively utilize the expected native token will be crucial to attracting more liquidity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。