Will fall at every meeting?

Author: Crazy Sleep in the Rain

GM September Outlook is here.

September is still a dangerous month for me, and I won't consider trading too much (currently empty).

Wait.

This content aims to describe in simpler and more precise language from my personal perspective the tracks and targets I will focus on in September.

TL;DR

- Bullish on the $BTC ecosystem, BTC staking, wBTC competitors ($T), and glyphs/runes ($SATS $ORDI), as well as $RUNE;

- Bullish on DeFi's Uniswap v4 $UNI, the most important catalyst in the current DeFi ecosystem. ($COW is also making some small moves);

- Solana's ecosystem cooling down may give us a buying opportunity. I think $JTO $CLOUD $DRIFT $KMNO are good targets, let's see which one can attract market attention;

- Be cautious when considering RWA targets, $MPL and $CPOOL are two projects worth paying attention to;

- The renaming of MakerDAO has provided an opportunity for market speculation and may also be beneficial for $LQTY;

- CZ's release from prison is a good expectation for $BNB-related assets;

- Pendle is moving closer to BTCFi.

1/ BTC Ecosystem

The main things related to the BTC ecosystem are as follows:

- The "market's interest in $BTC staking" triggered by Bayblon, in other words, a Ponzi scheme;

- Opportunities for other smaller players at a time when wBTC is widely questioned: 1) Coinbase's launch of $cbBTC; 2) Former little brother Threshold's $tBTC has gained huge growth space; 3) Cross-chain adoption of Stack sBTC after Satoshi's upgrade, etc.

P.S. In the future, competition for various packaged BTC will become more intense, and the market may focus on cross-chain protocols that support native BTC, such as Thorchain $RUNE. Also, tBTC operator Threshold has proposed a merger with wBTC, but I think it's not very realistic.

- The Bitcoin expansion network Fractal Bitcoin is expected to go live on September 9. The market is bullish on this, which is beneficial for the BRC20 ecosystem, and runes will also receive attention (indirectly beneficial).

(If there's anything I haven't mentioned, feel free to add)

2/ DeFi

Many people have been milking old DeFi projects recently, such as $AAVE (Aave's recent fundamental data is very good).

It should be noted that although Aave has made a lot of plans for the future token economy recently, I think it will take a long time to implement these plans. Also, Aave hopes to maintain the peg of GHO to the dollar by integrating with BlackRock's BUIDL.

During this period, I will pay special attention to $UNI. From the announcement on August 15 by Uniswap Labs to launch v4 security competition with a prize pool of 2.35 million dollars in cooperation with Uniswap Foundation and Cantina, the launch of Uniswap v4 is imminent (previously expected to be launched in Q3). The importance of Uniswap v4 has been analyzed by many people, so I won't go into details, here's an article for everyone to read: link

I believe the launch of Uniswap v4 is of great significance and is the most important catalyst in the current DeFi ecosystem (and it seems that there are not many discussions in the Chinese community right now).

It is also worth mentioning that Cow Protocol may also be aware of the threat of Uniswap v4 and is working with Wintermute to seek CEX listings and better on-chain liquidity.

3/ Solana

The most fun part of the Solana ecosystem is memecoins. You can check out which memecoins English KOLs are shilling. You can follow my list here: link

Next is the protocols in the Solana ecosystem that make the most money, such as Jito $JTO / Raydium $RAY / Jupiter $JUP / Banana $BANANA

And some other applications that have captured market attention/liquidity: Drift $DRIFT / Kamino $KMNO / Sanctum $CLOUD

Here are some tokens that I have put on my watchlist⬇️

- Jito — closely related to the prosperity of the Solana ecosystem;

- Sanctum — LST liquidity layer, recently CEX entered the $SOL staking, which is a positive for it;

Here is a more detailed explanation: link

- Kamino — Solana liquidity layer, accounting for 28% of Solana's total TVL.

- Banana — The only TG Bot listed on Binance (excluding Bonk).

Here's another thought of mine: With the market's recent aversion to VC infrastructure tokens, memecoins have become the market's new favorite. As the market gradually returns to rationality, fully liquid application tokens and application tokens with a large amount of real cash income may become the next speculative concept in the market (no offense to memes). Hopefully, this is not just wishful thinking on my part.

4/ RWA (Please consider RWA-related targets carefully)

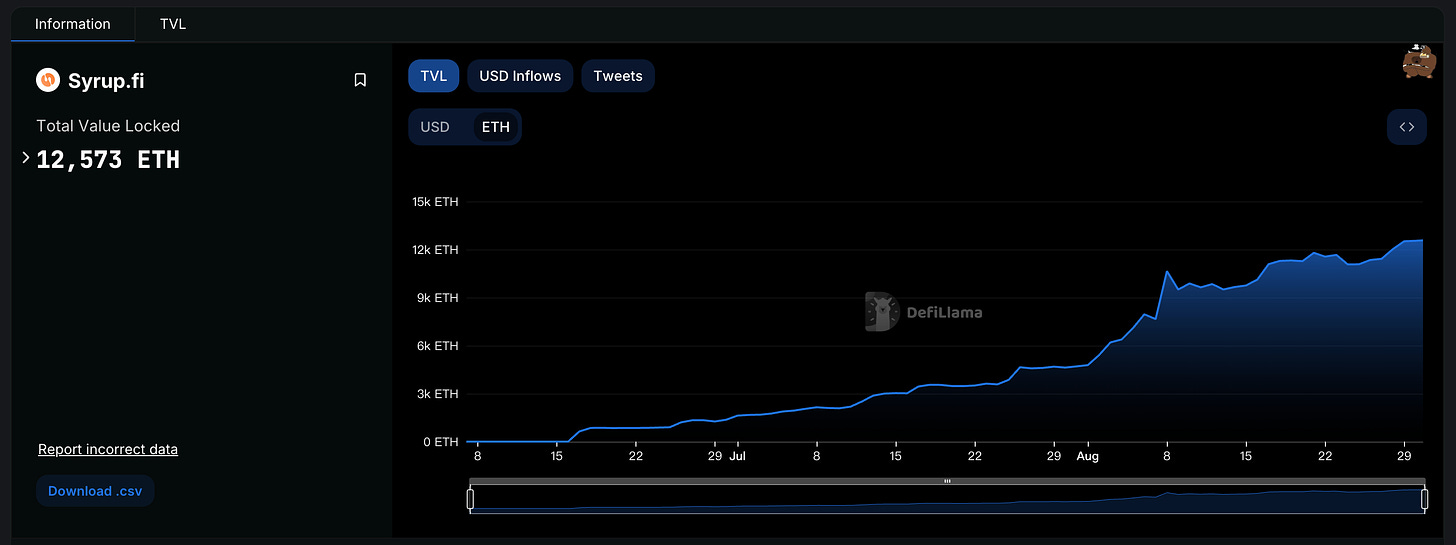

As I mentioned in the August outlook, I really like the Maple project. Here's an update on Maple.

1) Maple's fundamental data is growing well;

2) Coming in Q4, $MPL will undergo a 1:100 split and be renamed SYRUP, and the income from the lending business will be used to repurchase SYRUP.

https://x.com/maplefinance/status/1828089885657534644

Another project worth paying attention to is Clearpool - a protocol for institutional credit.

Clearpool has launched a Layer2 Ozean built on RWA revenue/OP Stack: 1) The gas medium is a stablecoin called USDX; 2) The chain also does account abstraction; 3) $CPOOL will manage Ozean and Clearpool, and $CPOOL can receive income from Ozean's sorter.

However, from the price action, the market is not buying into this.

https://x.com/ClearpoolFin/status/1825880491196821806

However, investing in the RWA track now feels like joining the army in 1949. Please be cautious before pressing the buy button.

5/ Stablecoins

When talking about stablecoins, we can't avoid the renaming of MakerDAO. This renaming and splitting has its pros and cons. The name Sky is simple and easy to remember, and USDS is more direct than DAI, which is beneficial for expanding new increments. At the same time, Sky also creates more adoption scenarios for USDS, such as mining Subdao tokens. The downside, as mentioned by @tmel0211, includes "USDS joining the blacklist freeze feature," which has sparked a series of controversies in the community.

It is also worth mentioning that MakerDAO has set additional rewards to encourage migration.

Join early and get boosted Sky Token Rewards: link

Looking at it from another angle, if DAI is not decentralized, it is bullish for other decentralized stablecoins, such as $LQTY.

6/ Others

9.4 $MATIC - $POL renaming;

Fantom's new Layer1 Sonic testnet;

Arbitrum Stylus upgrade;

9.28 CZ's release from prison;

Eigenlayer Q3 should also have some significant project progress, as well as EIGEN token transfers;

Eigenpie IDO (previously involved in points, remember to participate. A 3M FDV is probably profitable);

Berachain may go live on the mainnet in Q3;

There are some projects that may have TGE (but considering the market downturn, their TGE time may be delayed): Solv, Grass, DappOS, StakeStone, KelpDAO;

Singapore Token2049 (Will it fall at every meeting?)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。