Author: 1912212.eth, Foresight News

Since the wave of Ethereum re-staking started by EigenLayer, "re-staking" has gradually flourished on Solana and even Bitcoin. Staking for interest has become commonplace, and it is more meaningful to activate more possibilities and protect the ecological security through re-staking.

As the largest economic entity in the blockchain ecosystem, Bitcoin's current market value has exceeded one trillion US dollars, and the ecological development around its staking and re-staking is accelerating.

Recently, the Bitcoin re-staking platform SatLayer completed an $8 million Pre-Seed round of financing, led by Hack VC and Castle Island Ventures. Franklin Templeton, OKX Ventures, Mirana Ventures, Amber Group, Big Brain Holdings, CMS Holdings, and others participated in the investment. Angel investors from protocols such as aPriori, LayerZero, Manta Network, Magic Eden, Sui, and Pendle also participated in this round of financing.

Why can SatLayer attract a large amount of venture capital investment?

Bitcoin re-staking platform based on Babylon

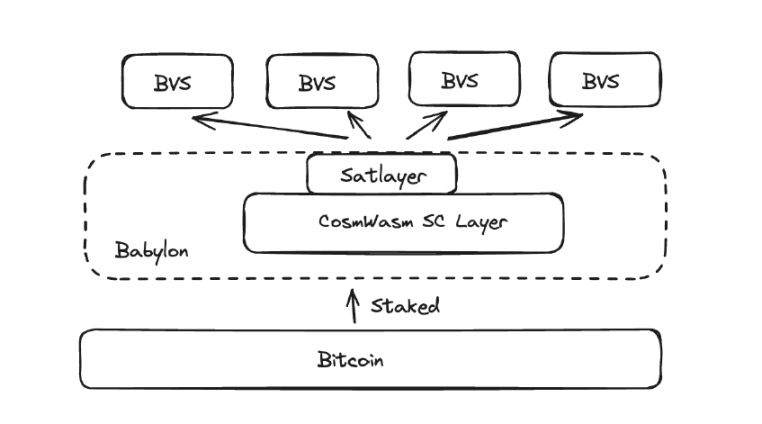

The core architecture of the re-staking protocol Symbiotic supported by Paradigm is on Ethereum, while SatLayer is different. It is a Bitcoin re-collateralization platform based on Babylon. SatLayer leverages the universal security layer of Bitcoin by deploying it as a smart contract on Babylon, allowing Bitcoin stakers to use their BTC for validation services, thereby protecting various types of decentralized applications or protocols.

So, which platforms or protocols will benefit from SatLayer?

First, various types of liquidity re-staking tokens (LST) provide additional earning opportunities for BTC deposits. Secondly, the Bitcoin validation service (BSV) platform enhances BSV security and gains access to new features by re-staking BTC in SatLayer. Finally, if SatLayer develops well, its infrastructure will also benefit and expand its functionality.

Architectural design

SatLayer's ecosystem design is relatively simple, with several important participants:

- Re-stakers: Collateralize BTC assets and re-stake them in SatLayer.

- Operators: Choose Bitcoin validation services (BSV) to provide security and receive re-staking rewards.

- BVS: Use BTC to initiate its PoS network or application for cryptographic economic security.

So where does SatLayer's revenue mainly come from? It includes BTC staking income on Babylon and additional staking income from SatLayer BVS. In addition, it includes its composability, which can be used in other BTCFi to generate further income using satAssets.

How users participate in the re-staking process

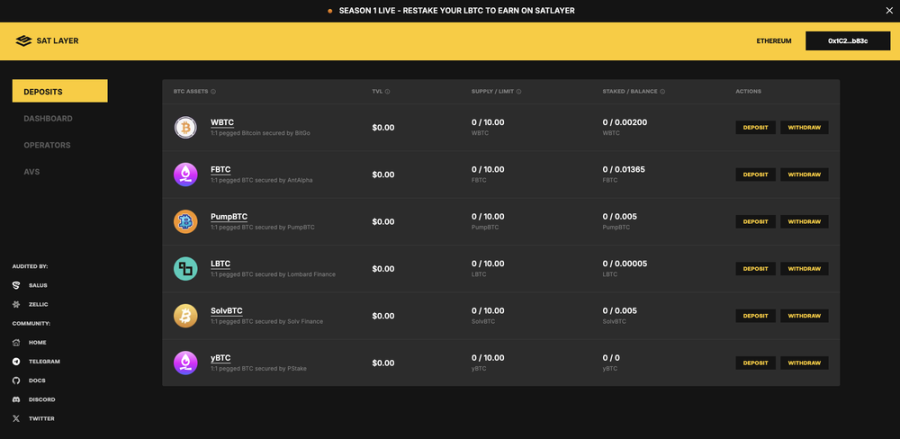

SatLayer has simplified the process of re-staking BTC. Users only need to open the official website and deposit wbtc and liquidity staking tokens (Lombard, PumpBTC, SolvBTC, FBTC, WBTC, yBTC, PStake). After completing the deposit, users will receive voucher tokens, which can then be deposited into the SatLayer application to start earning rewards.

Currently, rewards are distributed to participating users in the form of points.

It is worth mentioning that when asked whether these points will be converted into SatLayer tokens in the future, SatLayer co-founder Luke Xie stated, "We currently do not have a formal token plan. If there is detailed information, we will announce it in the subsequent stages."

The official launch of the first season of activities began on August 23 and will last for 2 weeks. The maximum online deposit for a single activity is 100 BTC. If a user withdraws before the end of the staking period, their point count will be paused, but the accumulated rewards before the withdrawal will be calculated.

Conclusion

Due to the bleak market conditions, the narrative and sector heat of the cryptocurrency industry are not as strong as before. When market liquidity strengthens again, the focus on "Bitcoin," "re-staking," and ecological trends may once again attract the market's attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。