This article discusses the latest trends in Real World Asset (RWA) tokenization, with a focus on successful pilot projects defining the state of RWA in the second quarter of 2024.

Written by: The Open Platform

Translation: Blockchain in Plain Language

Disclaimer: This article discusses various aspects of Real World Asset (RWA) tokenization, including the involvement of major financial institutions, integration of blockchain technology, and potential advantages and challenges. It is important to note that the legislative and regulatory environment related to RWATokenization is rapidly evolving. Current laws and regulations are still being formed, and future developments may have a significant impact on the views and results discussed in this article. The information provided in this article is based on the current market understanding and status as of the publication date. Readers are advised to closely monitor ongoing legislative changes and consult legal and financial experts when considering investing in tokenized assets.

RWA tokenization involves converting tangible assets such as cash, stocks, bonds, loans, real estate, commodities, or art into digital tokens on the blockchain, making these assets more accessible, liquid, and transparent. This concept has recently gained significant attention, bridging the gap between traditional financial instruments and the digital asset world.

We have previously discussed the topic of real estate tokenization. In the second half of 2023, this area was mostly stagnant. Due to technological, regulatory, and market challenges, RWATokenization experienced several failed attempts. As a result, real estate tokenization has now become a smaller part of the RWA market.

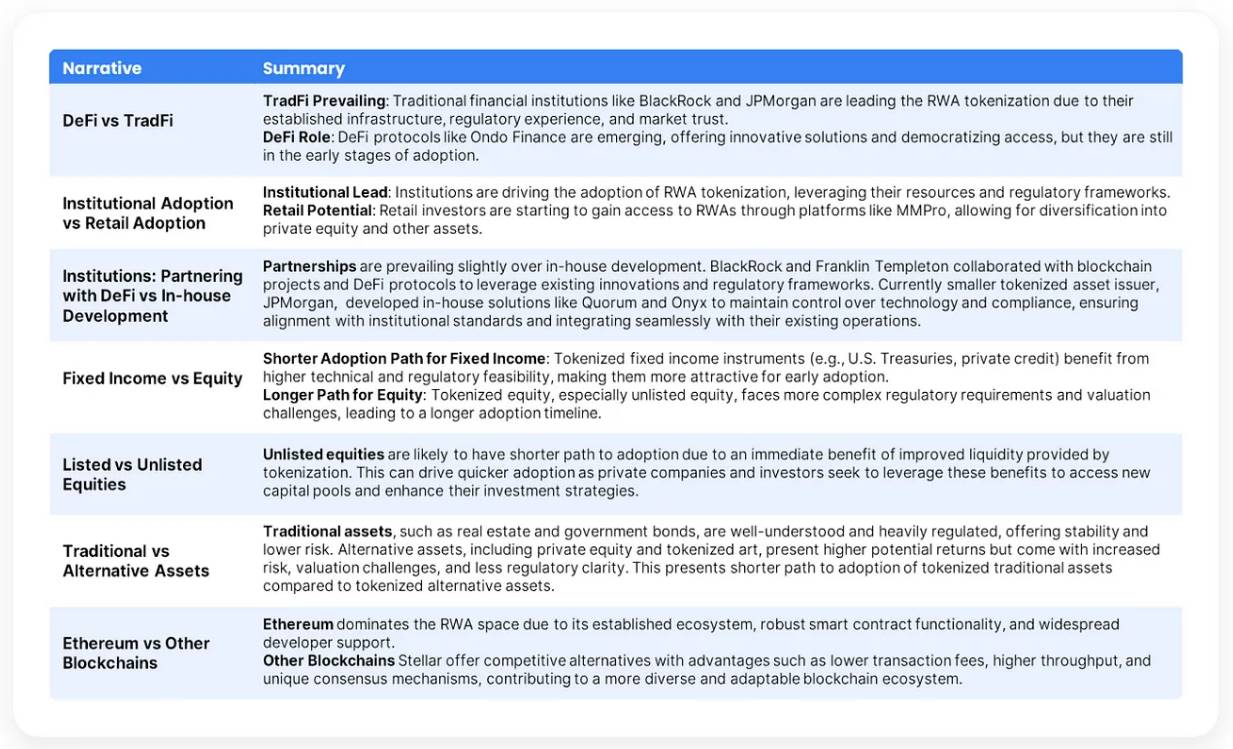

However, in the second quarter of 2024, RWA became the second-largest digital asset narrative, accounting for 11% of the network traffic tracked by CoinGecko. The industry now presents a diverse landscape, covering various markets and involving stakeholders from both decentralized finance (DeFi) and traditional finance (TradFi).

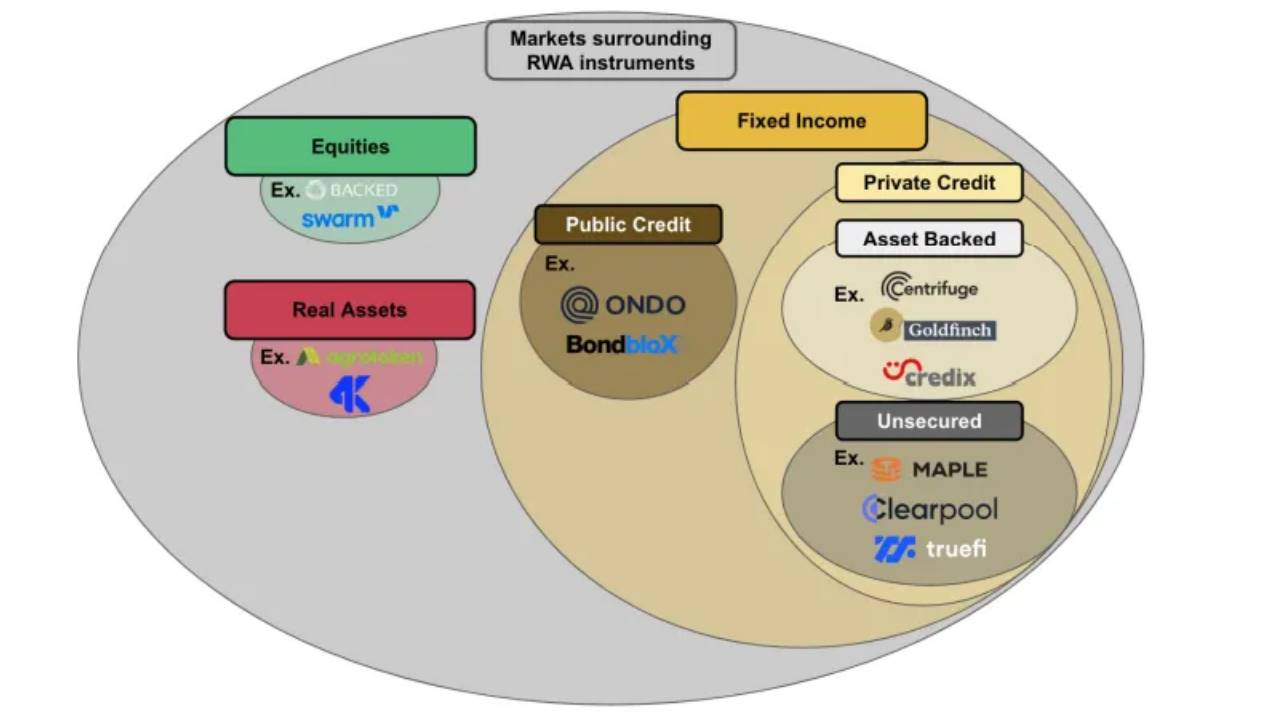

Source: Binance Research, "Real World Assets: Bridging Traditional and Decentralized Finance"

In this article, we explore the latest trends in Real World Asset (RWA) tokenization and focus on successful pilot projects defining the state of RWA in the second quarter of 2024. We also summarize the current narratives surrounding the RWA market and look ahead to the potential wave of tokenization in the future.

1. Institutional Participation Drives the Revival of a Dormant Market

In 2024, several major financial institutions made strategic moves in the RWA field for the first time. The increased attention to RWATokenization may have been driven by successful pilot projects initiated by traditional financial giants (such as BlackRock and Franklin Templeton) and leading decentralized finance (DeFi) participants (such as Ondo Finance).

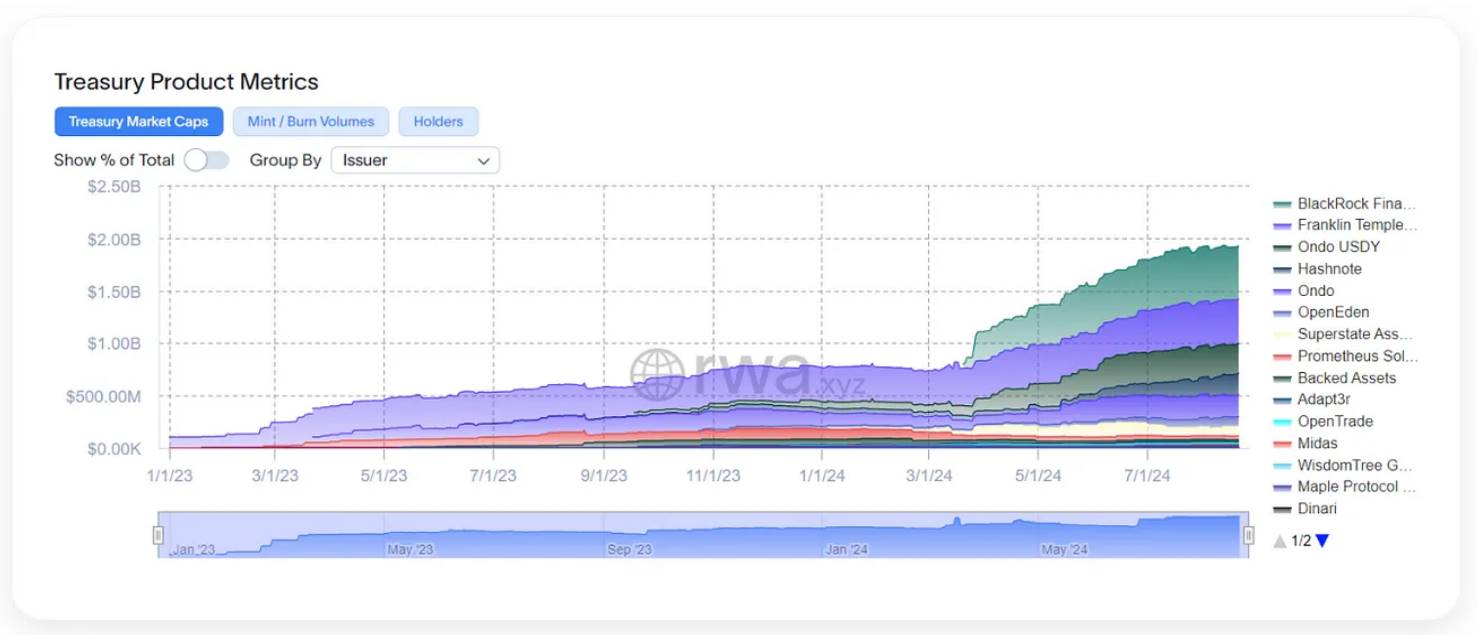

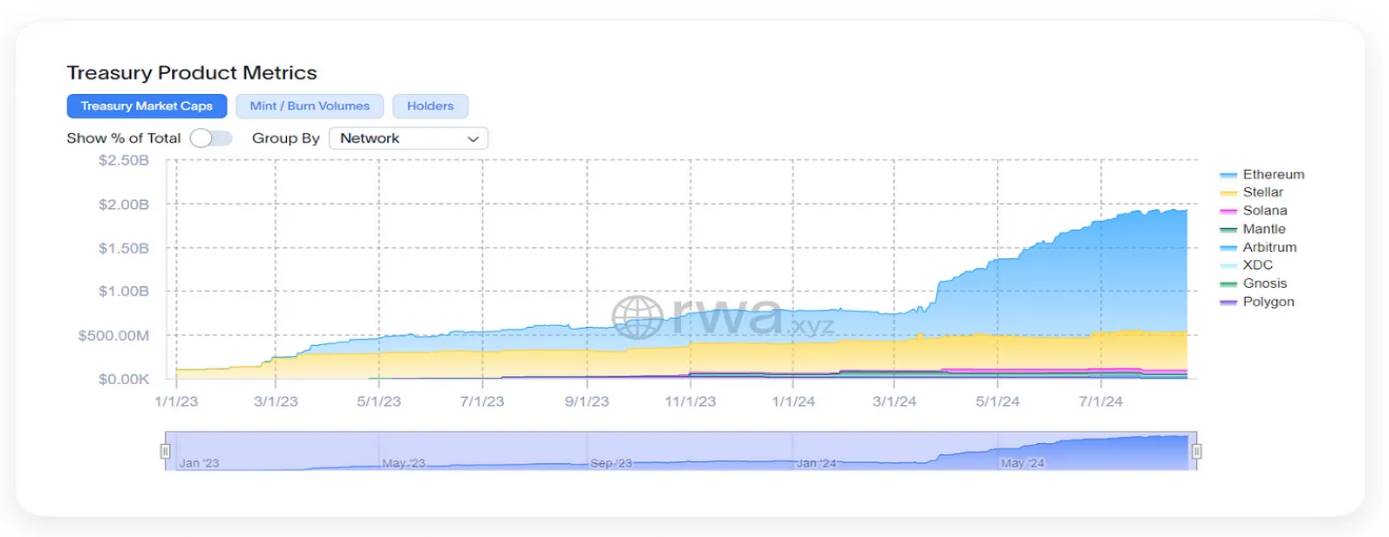

Source: RWA.xyz, accessed on August 22, 2024

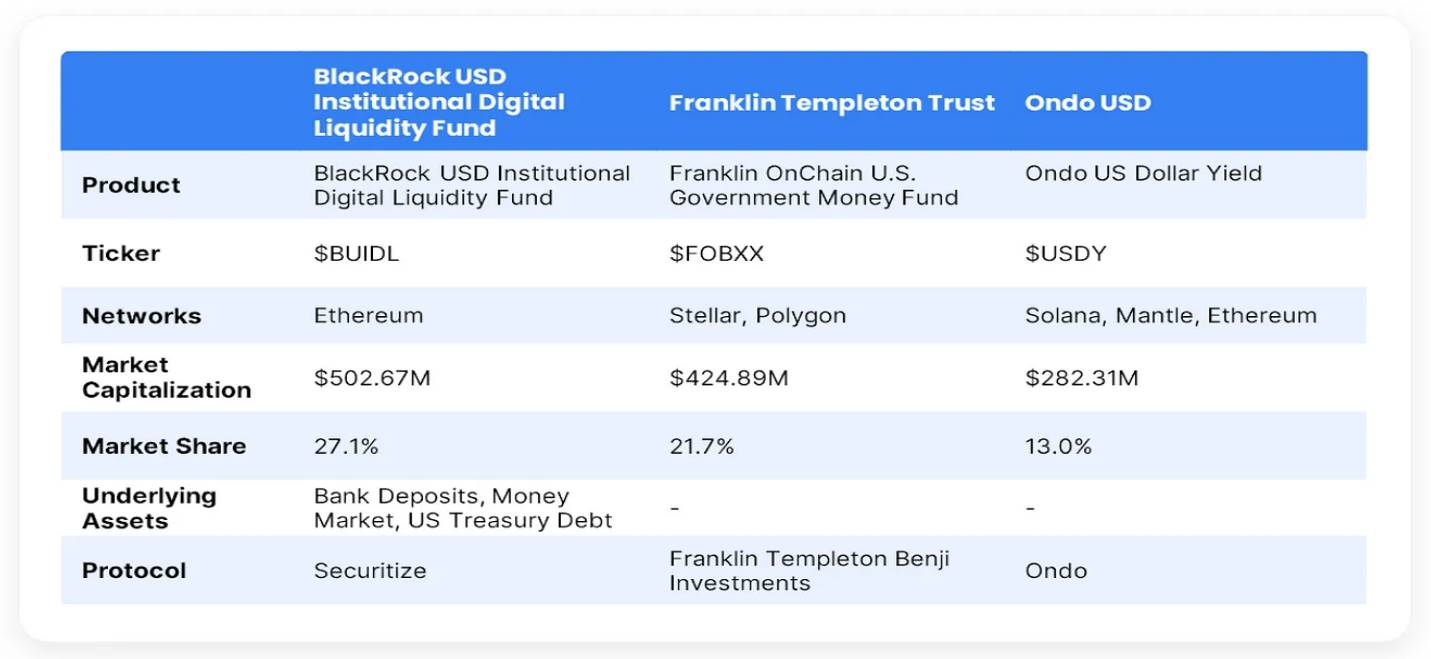

BlackRock, Franklin Templeton, and Ondo's proprietary tokenized financial products account for over 60% of the total market value of tokenized government securities:

Source: RWA.xyz, Dune.com, accessed on August 22, 2024

BlackRock's BUIDL, formally known as the BlackRock Institutional Digital Liquidity Fund, is a tokenized fund based on the Ethereum network, launched on March 20, 2024. The BUIDL fund consists of cash, US government bonds, and repurchase agreements, aiming to provide qualified investors with the opportunity to earn USD returns through blockchain technology.

As of July 2024, BUIDL has grown to become the largest tokenized government bond fund, managing assets exceeding $500 million.

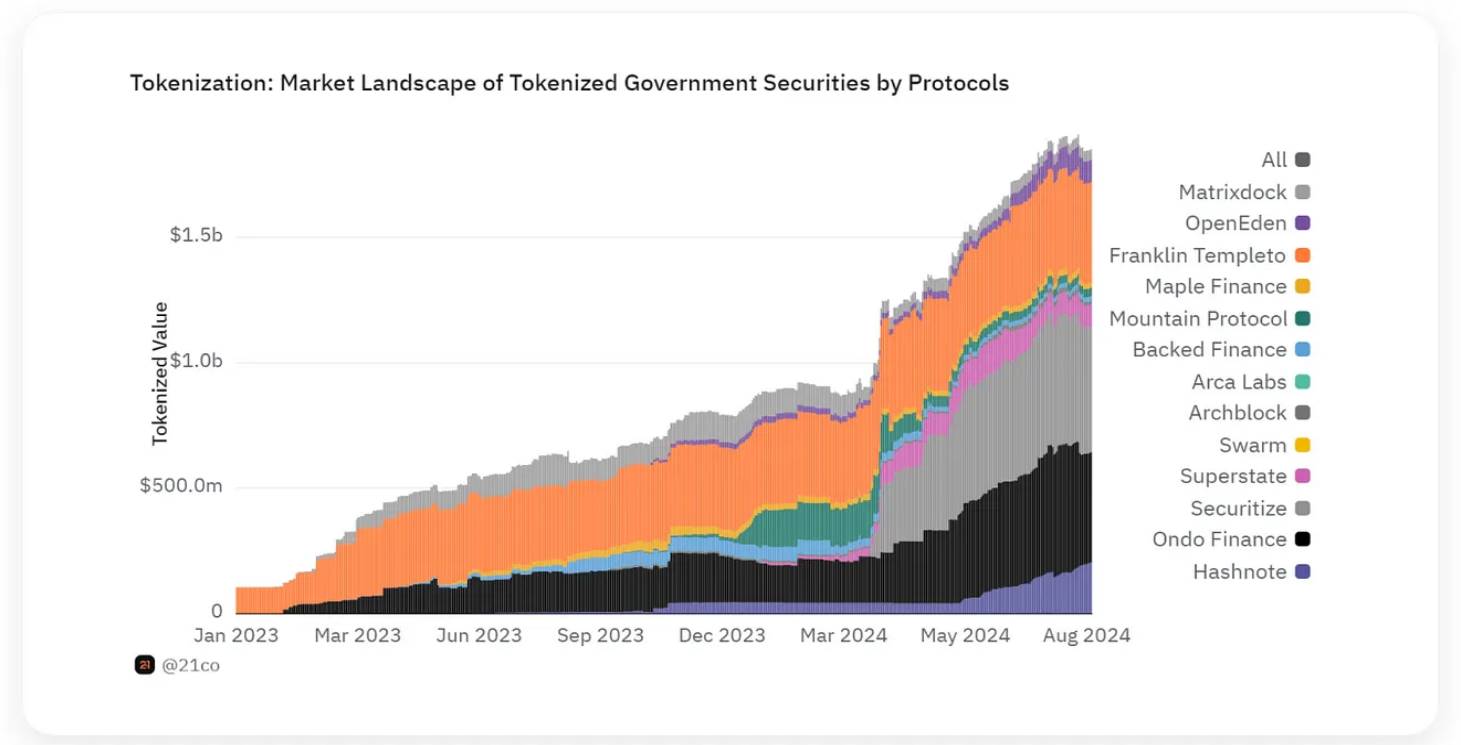

Three projects involved in BUIDL (Ondo Finance, Securitize, Maple Finance) are among the top tokenized government securities protocols. Source: Dune.com, accessed on August 22, 2024

Several blockchain projects have contributed to the success of BUIDL. Securitize is responsible for compliance and investor management, ensuring that tokenized products comply with regulatory standards. Maple Finance provides an on-chain credit market, facilitating the creation and trading of credit products. Swarm Markets, as a licensed decentralized finance (DeFi) platform, has facilitated the tokenization and trading of RWA within a regulatory framework. Boson Protocol enables BlackRock to explore new avenues for tokenization and trading of RWA through a blockchain-based e-commerce market. Polytrade provides a marketplace for managing RWA, democratizing investment opportunities and improving asset liquidity. Finally, Ondo Finance, as the issuer of the tokenized short-term US government bond fund OUSG, has deployed most of its assets in BUIDL, providing practicality for traditional investors (Source: BeInCrypto, CoinDesk, CoinMarketCap, The Defiant).

Franklin Templeton's tokenization project, the Franklin On-Chain US Government Money Fund (FOBXX), is another example of the integration of traditional finance and decentralized finance (DeFi). The fund was launched in 2021 and is the first US registered mutual fund to use blockchain for processing transactions and recording share ownership. The project utilizes the Stellar and Polygon blockchains to support BENJIToken, which represents shares of the FOBXX fund. The program allows peer-to-peer transfer of tokenized shares, aiming to provide investors with stable returns and enhance the liquidity and accessibility of the US government money fund. Franklin Templeton independently developed this project but collaborated with blockchain networks to implement the technology (Source: Franklin Templeton, BeInCrypto).

Franklin Templeton's RWA strategy differs from BlackRock's, with the latter relying mainly on collaborations with existing blockchain projects. BUIDL by BlackRock focuses on integrating various DeFi platforms to tokenize US government bonds and other fixed income products, while Franklin Templeton's strategy focuses on using public blockchains to enhance the transparency and efficiency of traditional money market funds.

Translation: 90% of the market value of tokenized US government bond assets comes from Ethereum and Stellar. Source: RWA.xyz, accessed on August 22, 2024

Ondo Finance is a successful example of non-institutional tokenization of US government bond assets. Ondo Finance's USDY project was launched at the end of 2023 as a stablecoin designed to provide stable and yield-bearing digital assets backed by US government bonds and bank deposits. USDY represents a stable and yield-bearing digital asset that offers returns to holders through integration with traditional financial instruments. Unlike typical stablecoins, USDY generates returns from underlying US government bond assets, making it an attractive choice for DeFi users and institutional investors seeking stable returns.

Ondo Finance's Short-Term US Government Bond Fund (OUSG) represents tokenized short-term US government bonds, complementing USDY and providing a secure and yield-bearing alternative for investors seeking exposure to US government bonds in the DeFi ecosystem. Together, they offer diversified investment options, providing stability for DeFi users while also offering attractive returns.

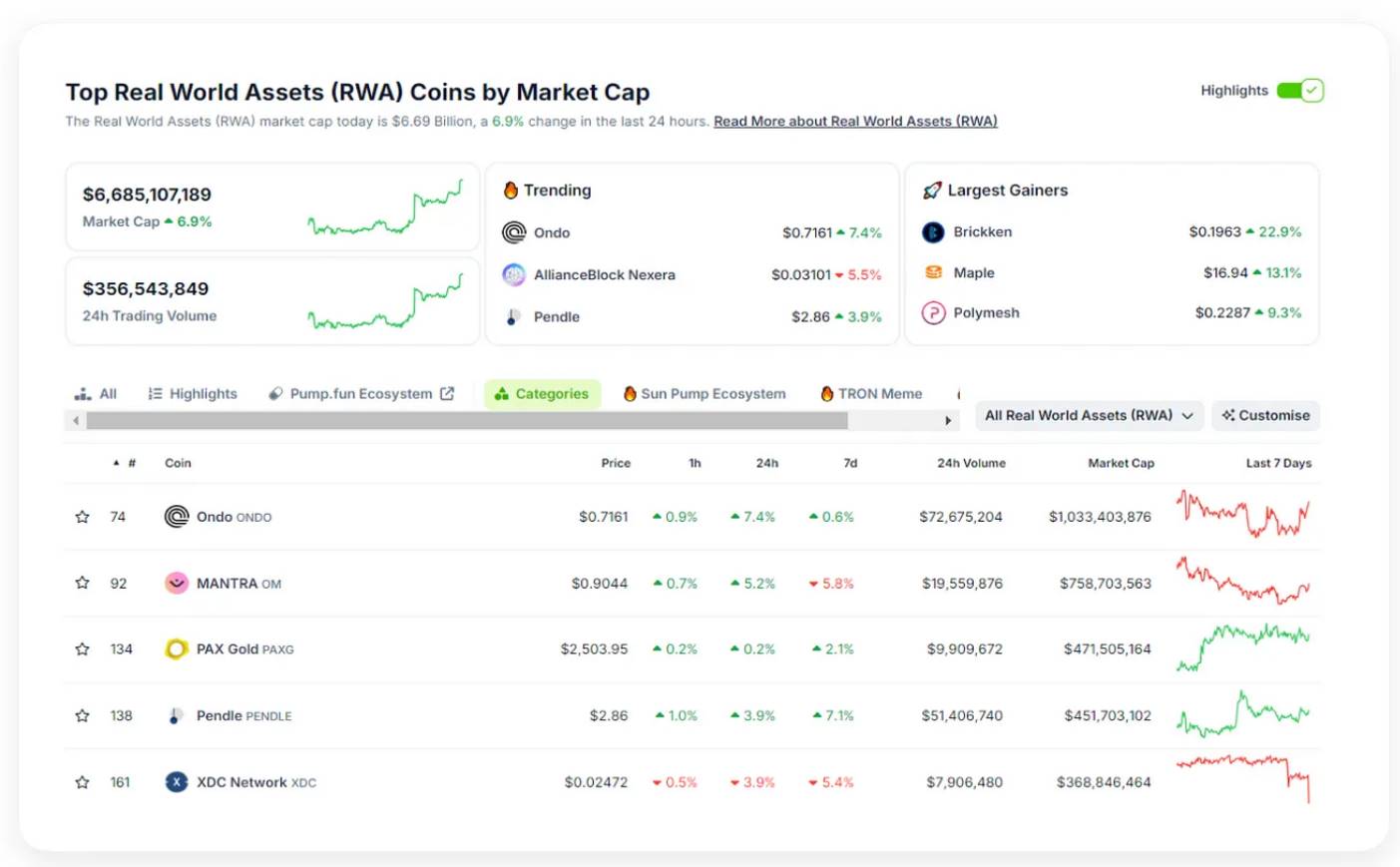

$ONDO is the largest market cap RWAToken. Source: CoinGecko, accessed on August 22, 2024

JPMorgan and Goldman Sachs are also pursuing similar plans in the tokenization of US government bonds, such as JPMorgan's Onyx and Goldman Sachs' RWA Market Concept (J.P. Morgan | Official Website) (BeInCrypto).

These institutions have the resources, expertise, and regulatory influence to navigate the complex environment of tokenization and are expected to be a major driving force in the RWATokenization field. BUIDL demonstrates how traditional finance (TradFi) accelerates the adoption of DeFi protocols (such as Ondo Finance) while incorporating these protocols into its use.

It is worth noting that all the tools discussed in this section are fixed income instruments, which currently dominate the RWATokenization field, and will be further explored in the next section.

2. Trends in the RWA Market: From Equity to Fixed Income

The leadership position in the RWATokenization market has shifted towards the fixed income sector, surpassing US government bonds. Tokenized fixed income securities, such as fundraised credit, have gained significant attention due to their stability and regulatory clarity. These assets offer predictable returns and are easier to integrate into existing regulatory frameworks.

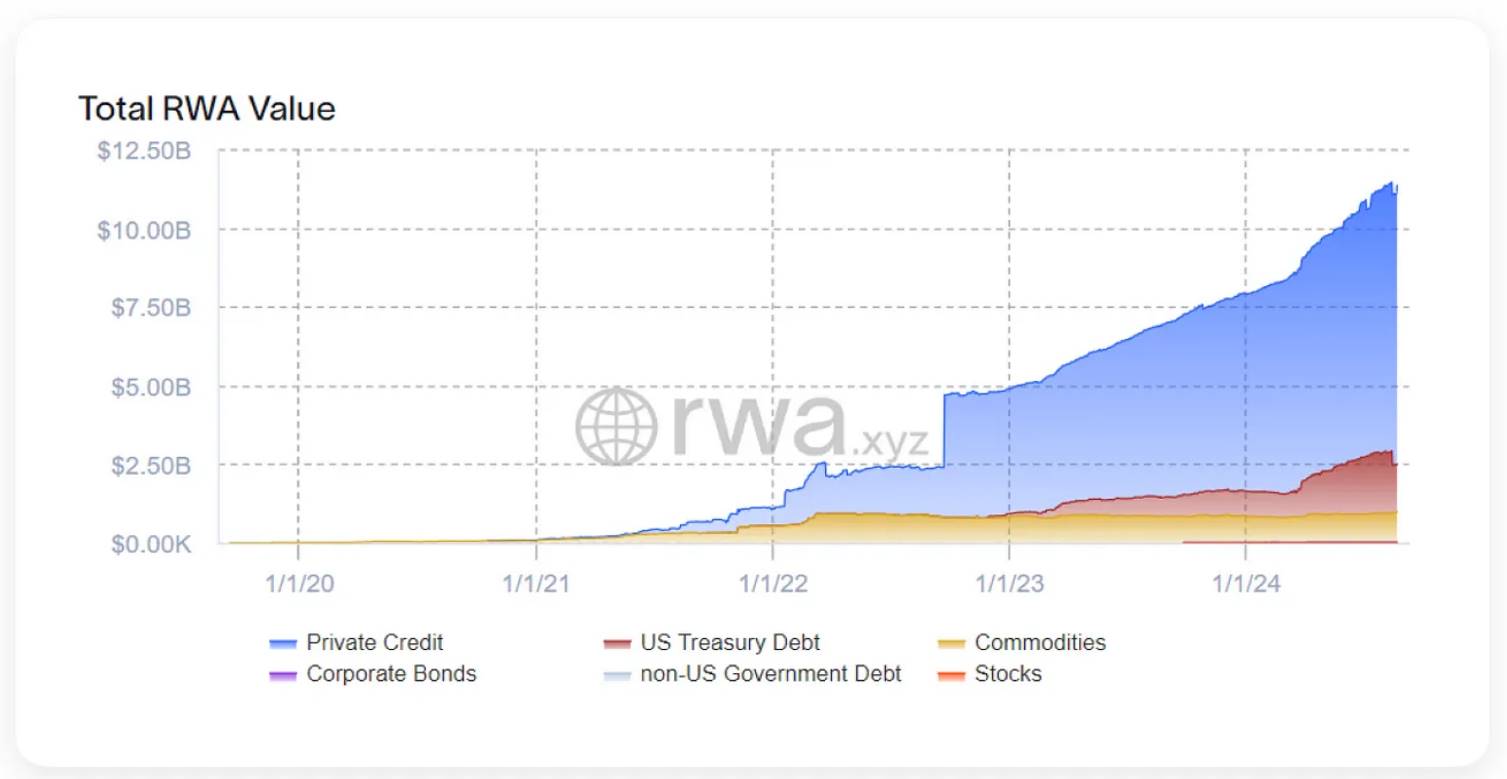

According to RWA.xyz's data, tokenized fundraised credit accounts for the largest share of the total RWA value:

RWA.xyz, accessed on August 22, 2024

Tokenized fundraised credit involves converting traditional debt instruments, such as loans and bonds, into digital tokens on the blockchain. This process is used by various entities such as investment funds, professional financial firms, and fintech startups to generate returns from interest payments on the underlying loans.

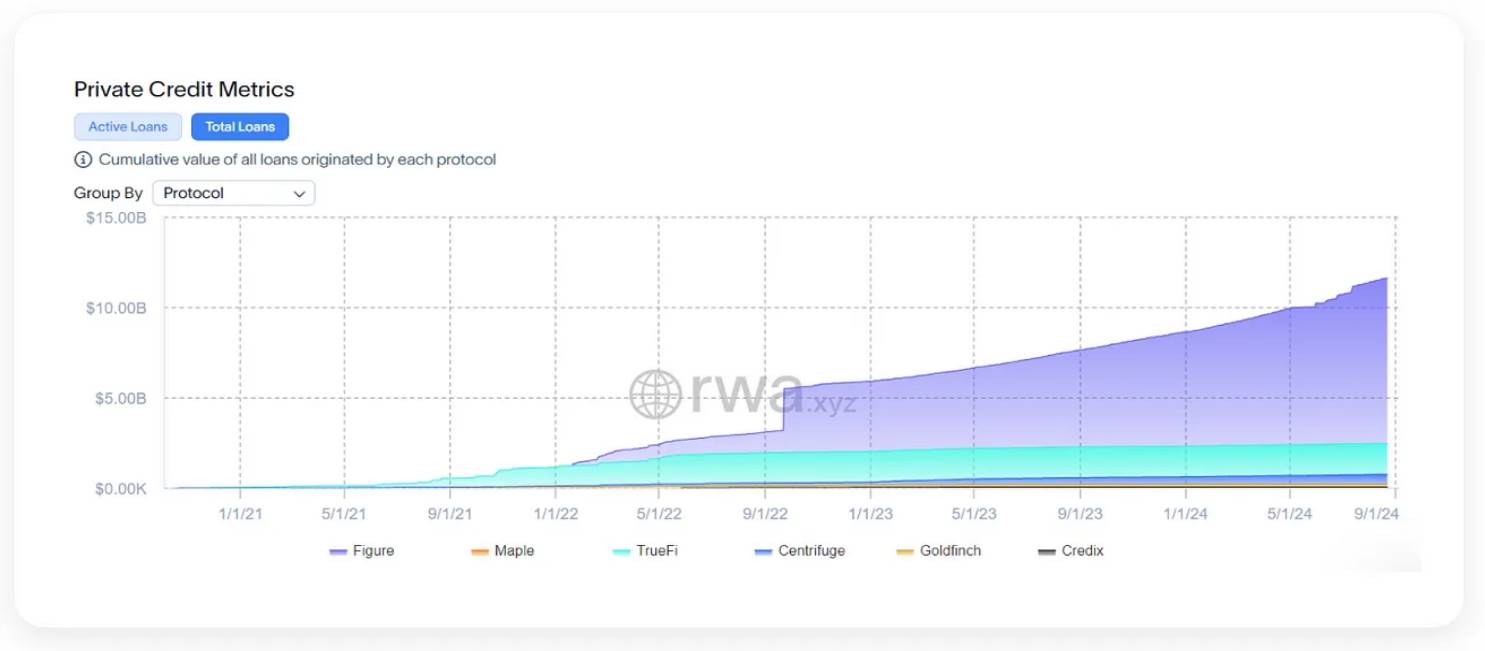

According to RWA.xyz's data, the top fundraised credit tokenization protocols ranked by the total value of all loans are Figure, Maple, and TrueFi:

Source: RWA.xyz, accessed on August 22, 2024

Figure uses blockchain technology to simplify and modernize the lending process, focusing primarily on Home Equity Line of Credit (HELOCs), student loan refinancing, and mortgage refinancing. The platform utilizes its proprietary blockchain, Provenance, to provide these services, aiming to improve efficiency, reduce costs, and enhance the transparency of loan origination, servicing, and trading. Figure's uniqueness lies in its comprehensive use of blockchain throughout the lending lifecycle, distinguishing it from other traditional and tokenized credit platforms (Source: Figure Lending).

Maple Finance provides decentralized infrastructure for institutional lending pools, supporting the use of digital assets as collateral, such as BTC and ETH, to provide high-quality, risk-adjusted returns. The platform operates on Ethereum and Solana and collaborates with blockchain credit risk management companies to offer managed credit investment portfolios (Source: Maple Finance).

TrueFi is a decentralized finance (DeFi) platform focused on uncollateralized lending. TrueFi launched in November 2020, operating on Ethereum and Arbitrum, connecting borrowers and lenders through smart contracts governed by TRUToken. Borrowers undergo rigorous credit assessments, including KYC and AML checks, and are assigned on-chain credit scores to determine loan terms. This process enables TrueFi to provide loans without collateral, increasing accessibility and efficiency in the lending market (Source: TrueFi | Docs).

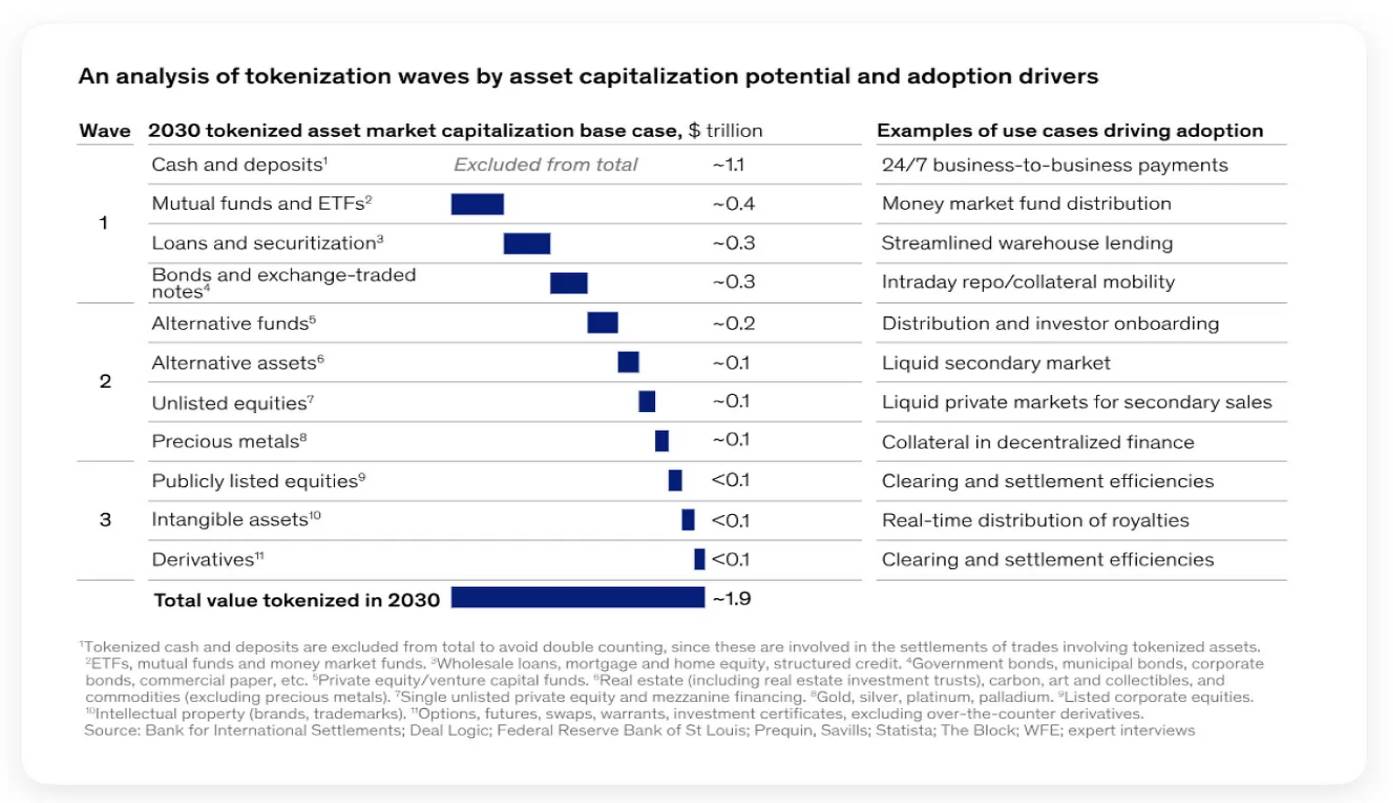

According to a McKinsey report, fundraised credit, along with US government bonds, is part of the first wave of adoption of tokenized assets.

Source: McKinsey, "From Ripples to Waves: The Transformative Power of Tokenized Assets"

McKinsey's report "From Ripples to Waves: The Transformative Power of Tokenized Assets" indicates that interest in tokenized investments is influenced by the efficiency and profitability of current processes, the degree of outsourcing, and key participants and their costs.

US government bonds and fundraised credit typically involve high transaction volumes and relatively low profit margins, making blockchain particularly attractive for cost savings in improving efficiency and automation. These assets' processes are often more standardized and scalable, reducing barriers to tokenization, accelerating the manifestation of impact, and strengthening early adoption business cases. As these activities are often outsourced to achieve economies of scale, there is strong incentive to adopt more efficient blockchain solutions to further reduce costs and increase returns.

The potential for significant cost savings, faster investment returns, and the standardized nature of these financial products make tokenized US government bonds and fundraised credit ideal candidates for early adoption in the tokenization field.

3. Tokenized Real Estate: Achieving Success through Specialization

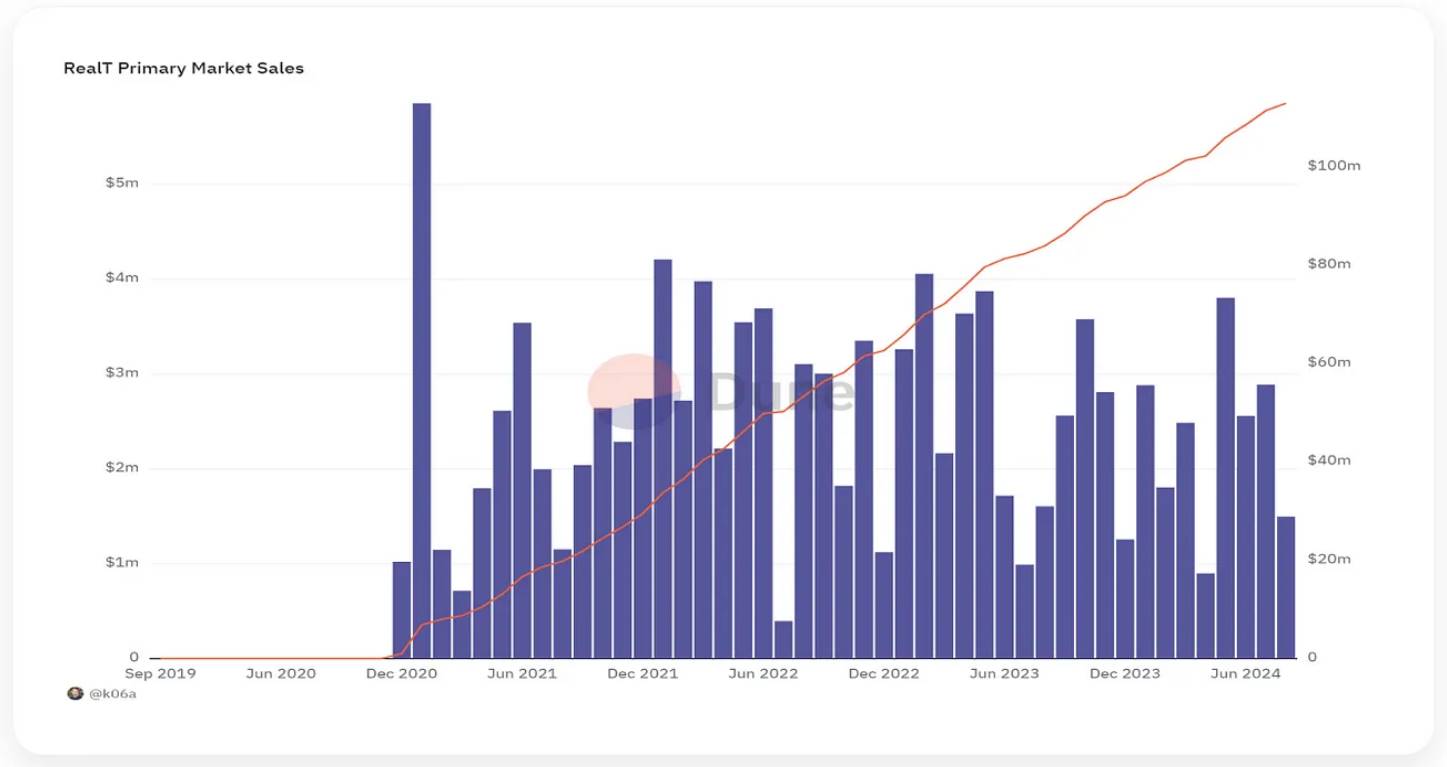

Real estate is a significant part of the RWA field where the benefits of tokenization are particularly evident. Tokenization allows for fractional ownership, increased liquidity, and reduced investment thresholds, making real estate investment more accessible and democratizing opportunities. Despite its significant benefits, this area has been relatively quiet so far and is expected to become an important part of future adoption. Nevertheless, some companies have made significant progress in this area. For example, RealT has become a successful project, offering fractional ownership of US real estate.

RealT is a blockchain platform that enables fractional ownership of real estate through tokenization. The RealT marketplace is a dynamic investment and trading platform representing ownership shares of specific US properties. These tokens provide proportional ownership and rental income and can be traded on the secondary market.

As of August 2024, RealT's monthly primary market sales are approximately $2.9 million, reaching a historical high of $5.9 million.

Source: Dune.com, accessed on August 22, 2024

RealT's monthly primary market sales of $2.9 million are significant, especially when compared to traditional real estate metrics. In the United States, the median home price as of mid-2024 is $412,300 (Source: Federal Reserve Bank of St. Louis, 2024). Traditional real estate companies typically facilitate the sale of individual properties, meaning each transaction may represent a single sale. For example, a real estate agent may handle several property sales per month, with each transaction significantly impacting their monthly sales total. The monthly sales volume handled by typical real estate brokerage firms can vary widely, depending on market size and the number of agents. For a small to medium-sized brokerage firm, achieving a monthly sales volume of $2.9 million may be significant, equivalent to approximately seven sales of median-priced homes. Larger brokerage firms with multiple agents may handle higher transaction volumes, but given the fragmented nature of traditional real estate sales, this still highlights the scale of RealT's achievement.

Large online real estate platforms such as Zillow or Redfin facilitate billions of dollars in annual sales, but these sales are spread across a vast market with millions of property listings. However, these platforms do not directly sell properties but rather connect buyers and sellers, generating revenue from commissions, advertising, and lead generation rather than direct sales. For companies like RealT that directly sell fractional ownership of properties in a market that is still emerging and niche, a monthly sales volume of $2.9 million is particularly significant.

In our previous report, we expressed skepticism about the widespread adoption of tokenized real estate due to its failure to meet the needs of individual investors, lenders, and tax authorities. RealT primarily involves residential properties in the United States, which are suitable for fractional ownership and tokenization. This means that the platform may not be as versatile as others when dealing with more complex real estate transactions, commercial properties, or areas with less favorable legal frameworks. However, by focusing on a specific niche, RealT can create a streamlined and scalable model, attracting a specific group of investors.

4. Tokenized Fundraised Equity and Its Significance for TON

While the aforementioned projects focus on integrating RWAs with traditional financial institutions to attract institutional investors, TON's RWA strategy is more focused on DeFi. TON aims to enable ordinary DeFi users to achieve portfolio diversification by holding equity in private companies, which is traditionally a closed and opaque area. MMPro facilitates the acquisition and trading of tokenized fundraised equity through the TON ecosystem.

MMPro is a new DeFi protocol that offers tokenization services for company equity, such as shares in companies like Ledger, Consensys (Metamask), Ripple, Circle, and Animoca Brands before they go public. Tokenized fundraised equity involves converting shares of private companies into digital tokens on the blockchain, enabling fractional ownership and trading on digital platforms. This process makes fundraised equity investments more accessible, liquid, and transparent, aligning with the characteristics of services provided by MMPro.

Through MMPro Trust, investors can acquire fractional ownership of company shares through RWA NFTs. These NFTs can be traded on the secondary market (such as Getgems) and stored in Tonkeeper.

Source: https://rwa.mmprotrust.com/

Although TON's RWA field is still in its early stages, examples like MMPro Trust demonstrate the potential to mobilize various aspects of the ecosystem, including the secondary market, wallets, and related companies. This approach holds significant value for ecosystem participants, who can now achieve portfolio diversification through equity and provides new opportunities for individuals outside the ecosystem who traditionally invest in public stocks and seek diversification through fundraised equity. By bridging these two worlds, TON's RWA initiative creates new opportunities for DeFi users and traditional investors, injecting vitality and potential into the future of asset tokenization.

However, the adoption of tokenized fundraised equity may undergo a longer process. The regulatory environment for fundraised equity is still evolving, bringing uncertainty and significant compliance challenges. Private companies often have lower financial transparency and more complex ownership structures, making it more difficult to accurately assess their value and risk. Unlike fixed income instruments with predictable returns and mature markets, fundraised equity requires comprehensive due diligence and investor protection, further slowing down the adoption process.

Nevertheless, protocols that successfully address these challenges and establish their position early in the tokenized alternative asset class market can gain a first-mover advantage. By building trust, setting industry standards, and creating network effects, these early adopters can position themselves as leaders in the ecosystem and capture market share as the ecosystem matures and regulatory frameworks improve.

5. Future Outlook

RWAs (Real World Assets) face significant barriers to adoption, hindering their initial uptake. These issues manifest in several ways: a lack of established liquidity and market participants, limited trust and recognition from traditional investors, and slow adoption due to regulatory uncertainty.

There is often a significant mismatch between the tokenized products offered and the target market, often because the apparent benefits of tokenization are not sufficient and there is limited demand from buyers. These challenges have led to significant changes in the RWA field over the past year, with institutions such as BlackRock and Franklin Templeton now driving the adoption of more feasible and attractive tokenized fixed income instruments, which provide clearer advantages and better align with market demand.

Current RWA narrative overview. Source: The Open Platform.

TON is well-positioned for the future wave of adoption of tokenized assets, including both private and public equity, commodities, and real estate. It is expected that the regulatory environment will mature, benefiting from successful cases driven by large institutions. This evolving landscape will provide an opportunity for TON and other blockchains to gain a first-mover advantage in the second and third waves of the market, leveraging its innovative DeFi-centric approach to provide new and attractive investment opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。