In the past few months, despite the substantial increase in L2 profits, the burning rate of ETH has decreased, leading to a decrease in the value flowing into ETH.

Written by: ParaFi Capital

Translated by: 1912212.eth, Foresight News

We are conducting in-depth research on the development of Ethereum after EIP-4844, with a primary focus on the following three important directions:

What is the latest progress in ETH burning volume?

How attractive is the L2 network?

What is the economic relationship between L2 and Ethereum?

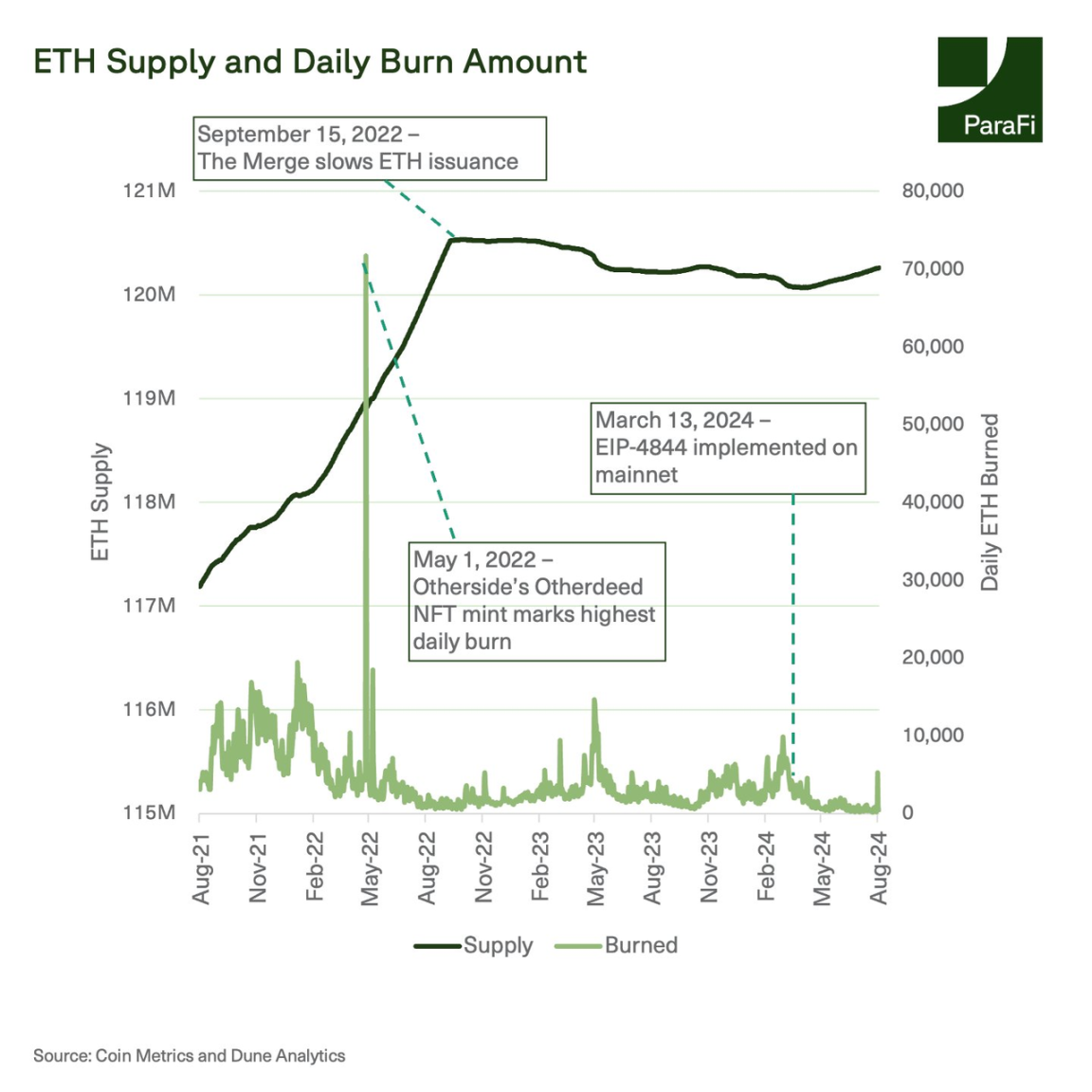

After EIP-1559 and the merge upgrade, people are excited about the economic potential of ETH as a cash-generating asset. After the initial two upgrades, the supply of ETH did decrease, by about 0.38% from September 2022 to April 2024. However, since then, with the slowing burning rate, the supply of ETH has been on the rise.

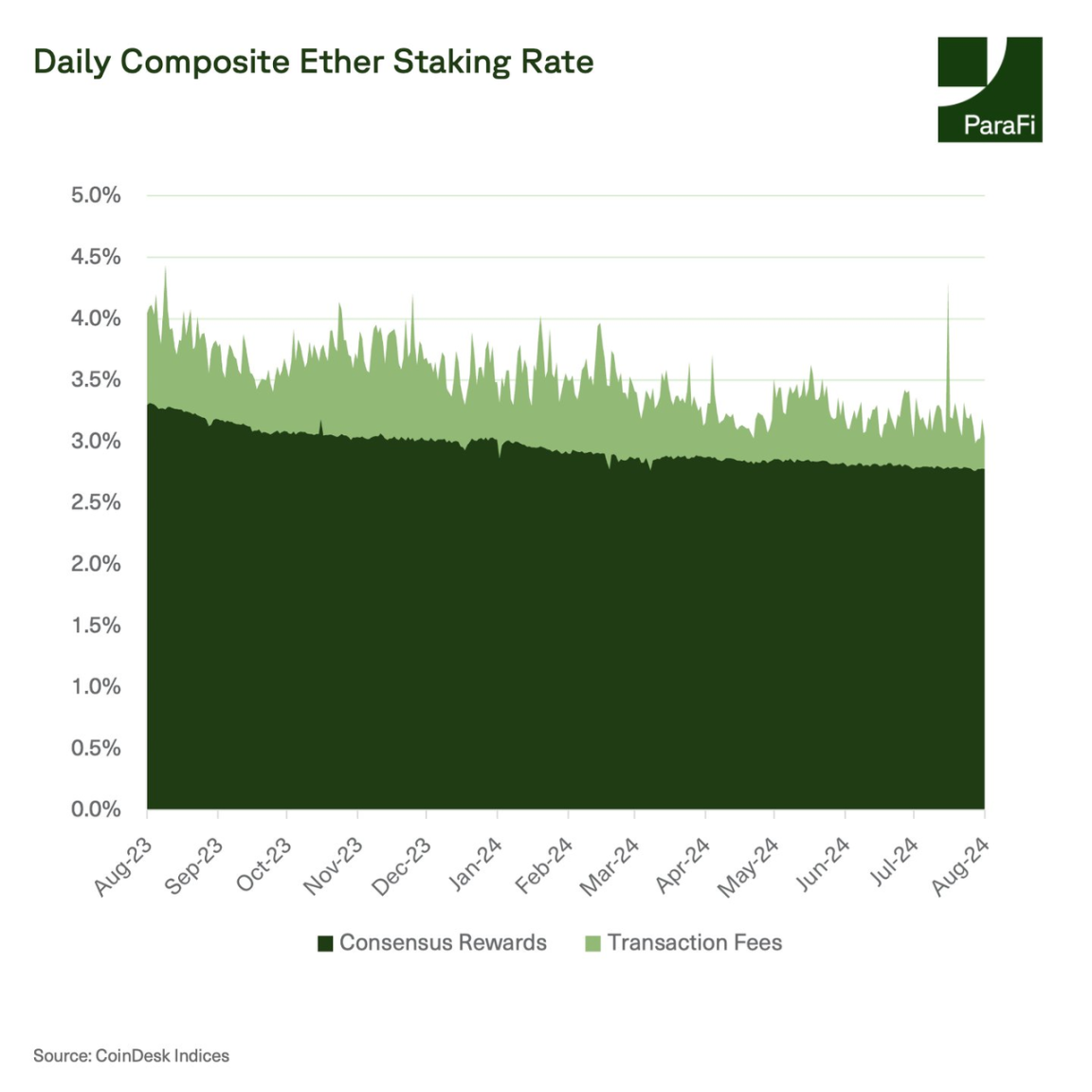

Over the past 12 months, the ETH staking reward rate has been declining, as the number of Ethereum validators has increased by 79% in the past year, while L1 transaction fees have decreased.

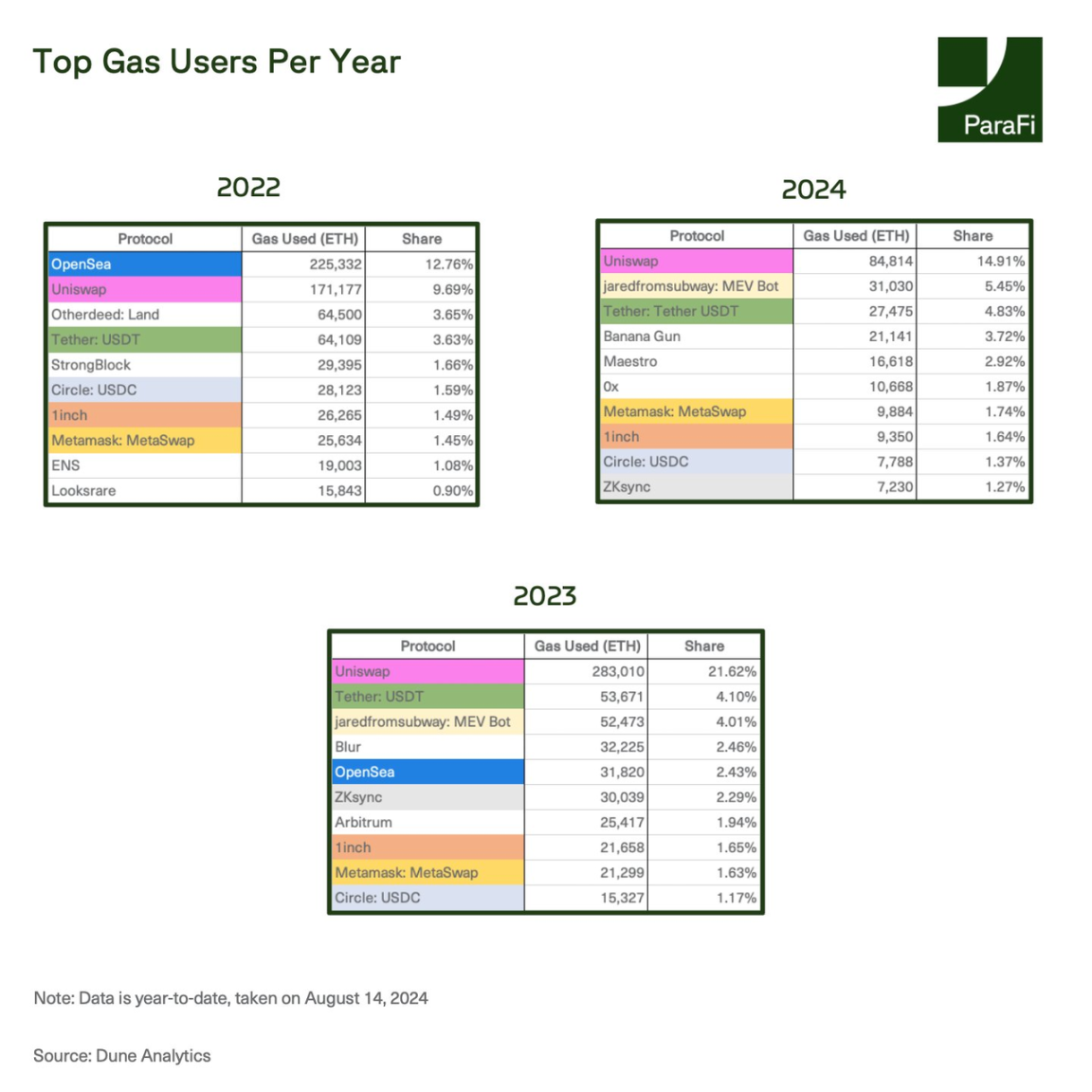

Although the burning rate has slowed down, applications or protocols such as Uniswap, Tether, 1inch, and MetaMask continue to drive most of the Gas consumption on Ethereum. In 2023, Arbitrum and ZKsync were the main Gas consumers, but their data has significantly decreased this year, as the EIP-4844 proposal allows L2 to release data more efficiently, reducing their data storage requirements.

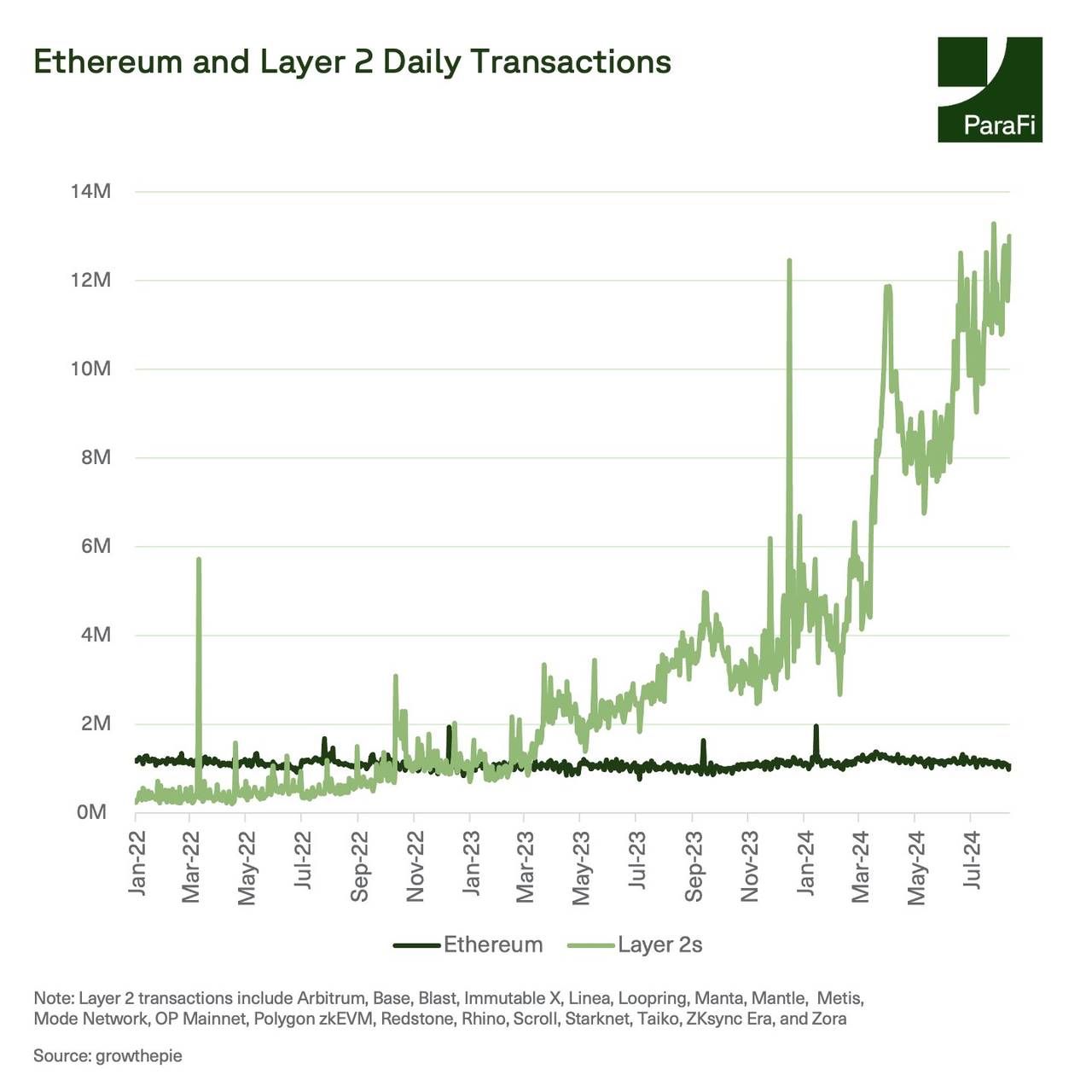

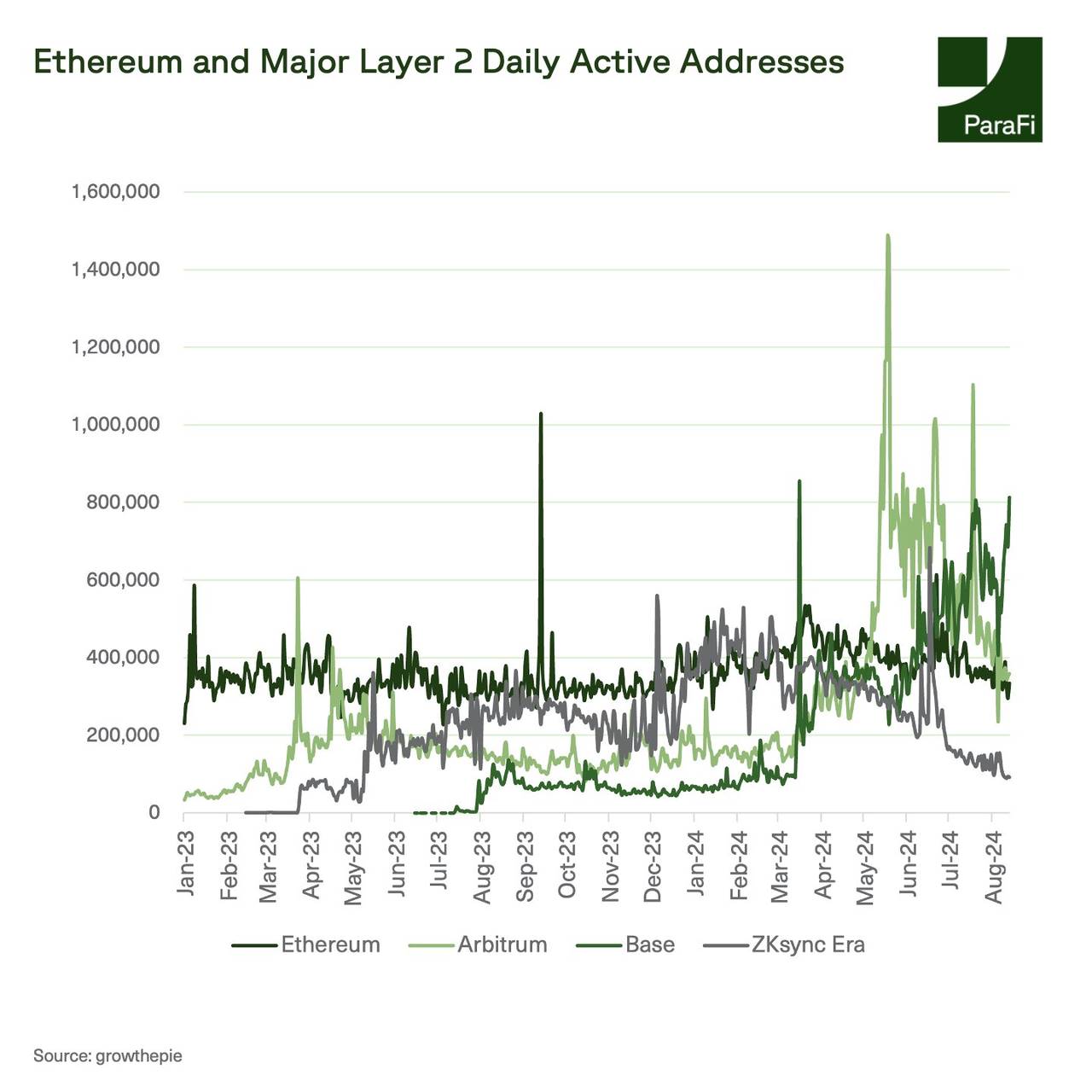

Over the past two and a half years, Ethereum's transaction volume has been relatively stagnant, while the total transaction volume of L2 exceeded L1 by over 10 times in August 2024.

The growth of L2 activity can be attributed to the launch of new L2s and the explosive development of some existing L2s. Since March, the daily transaction volume of Base and Arbitrum has exceeded that of Ethereum. Although this chart summarizes transactions from multiple L2s, each L2 is providing alternative block space for Ethereum, highlighting the major trend of transitioning from L1 to L2.

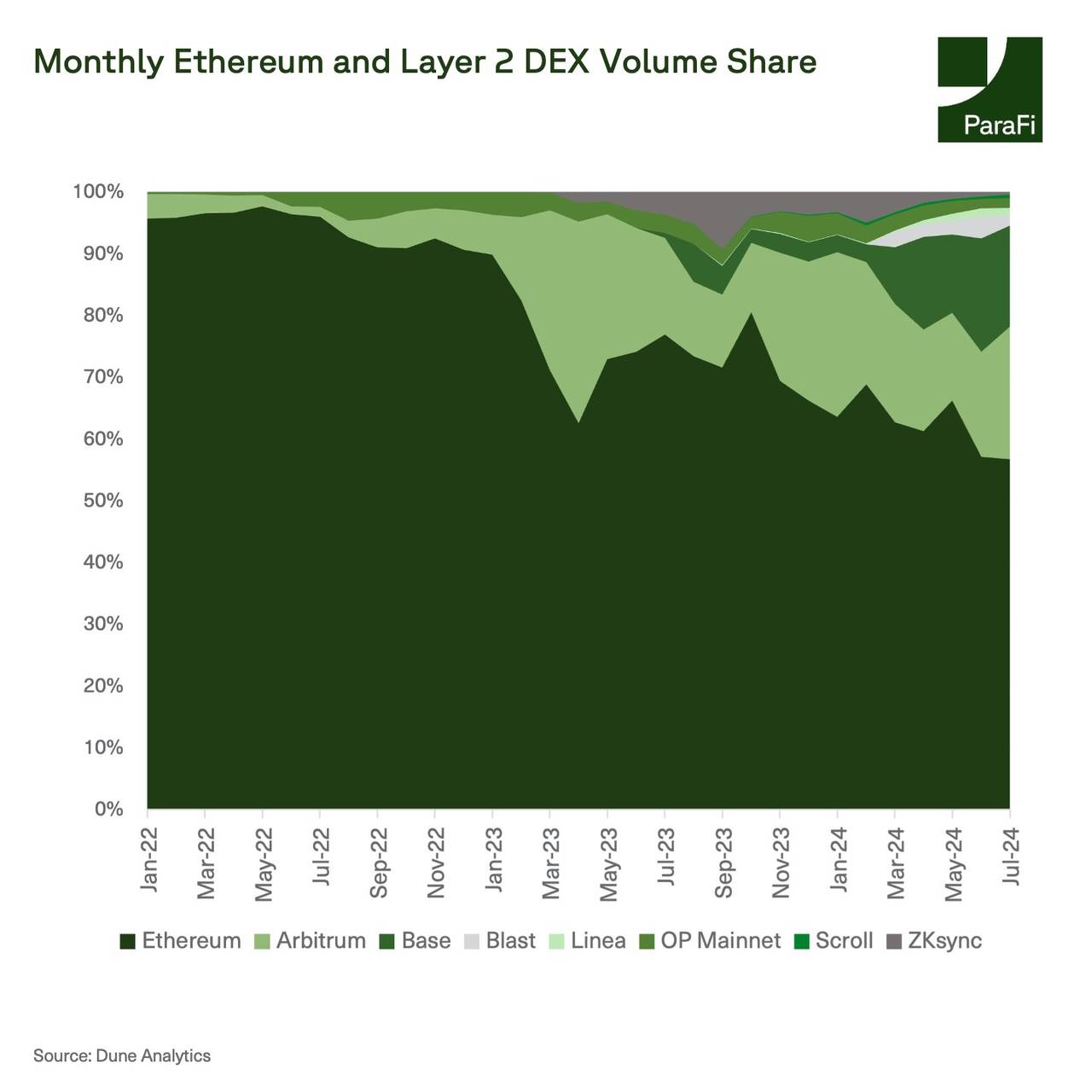

The increasing growth of Ethereum L2 is also reflected in their capturing a large share of the DEX market from Ethereum. After the EIP-4844 upgrade, L2 has reduced the DEX market share on the Ethereum mainnet to below 60%.

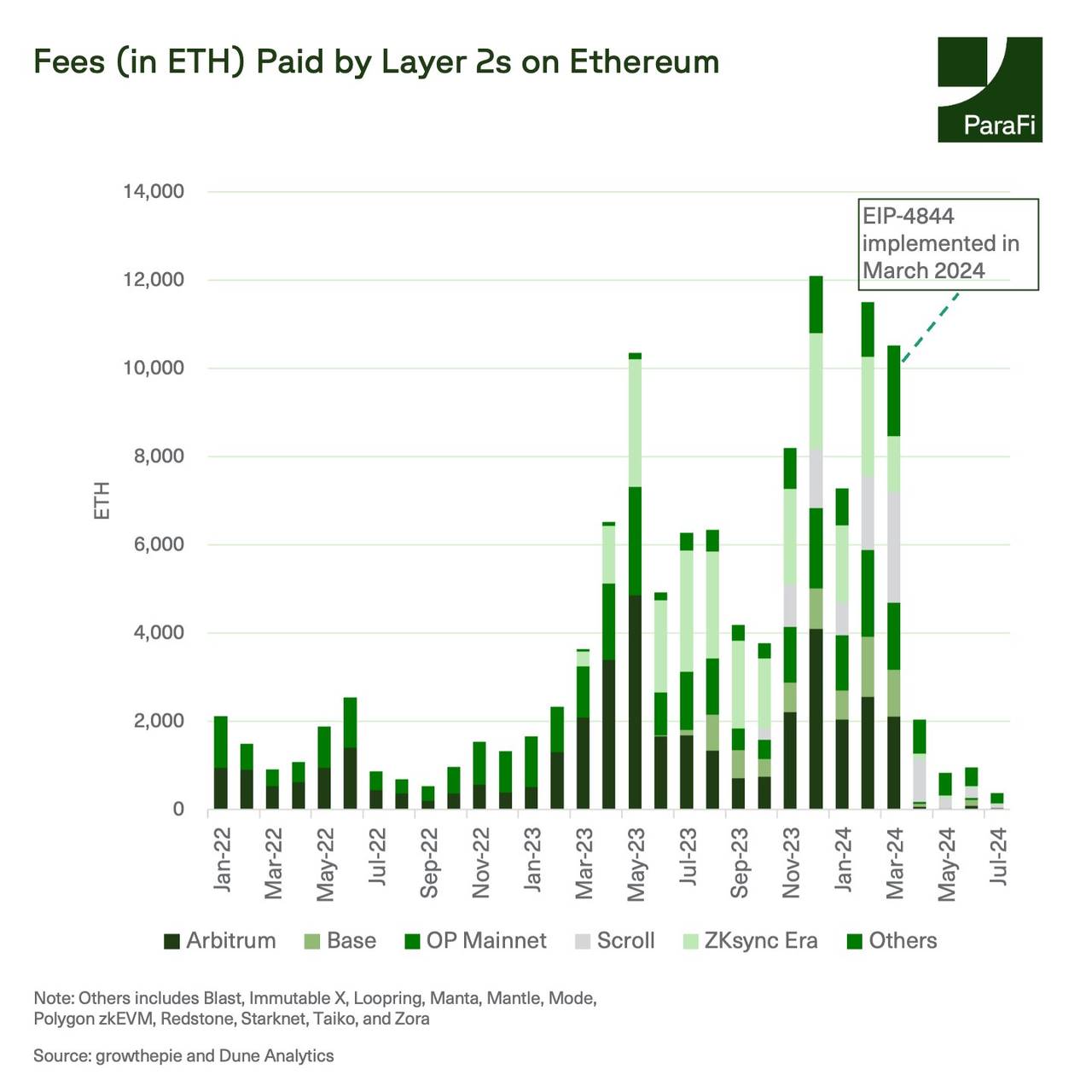

However, this also highlights the issue of liquidity fragmentation caused by the continuous development of Rollup networks. Despite the huge success of these L2s, their cost of publishing data on Ethereum has decreased relative to the upgrade of EIP-4844. Implemented in March 2024, EIP-4844 introduced a new data storage mechanism called "blobs," which is a cheaper alternative to the previous Calldata structure.

In March 2024, the fees paid by L2 on Ethereum exceeded 10,000 ETH, but in July, they paid less than 400 ETH, a decrease of about 96%. With the decrease in costs, L2 now contributes less to the burning of ETH and reduces the Gas fees on the mainnet.

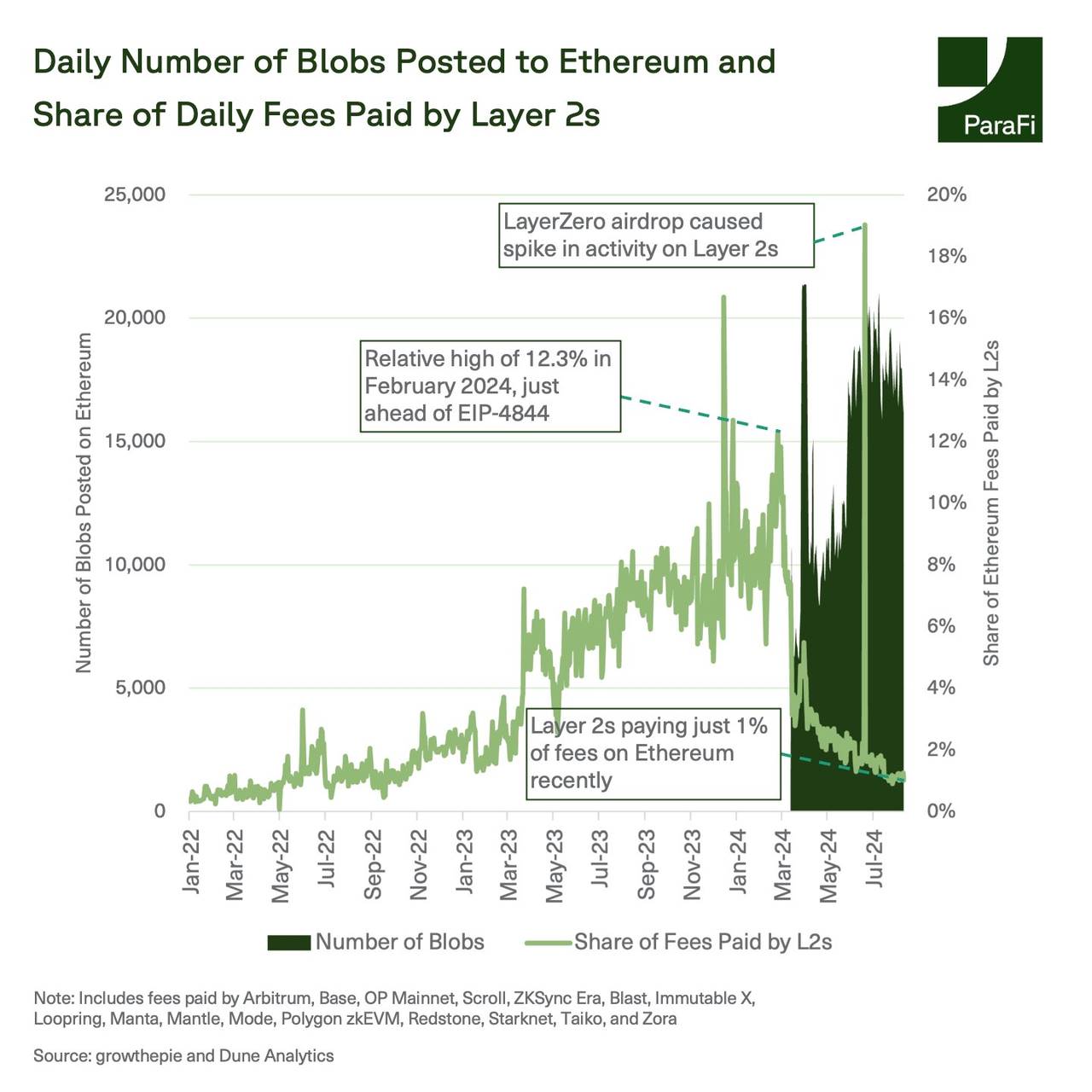

As L2s need to publish a large amount of transaction summary data on-chain, they quickly adopted blobs. Since early June, Ethereum has had at least 16,000 blobs published daily. This has led to a decrease in the proportion of total fees paid by major L2s, from 12% in 2024 to 1%.

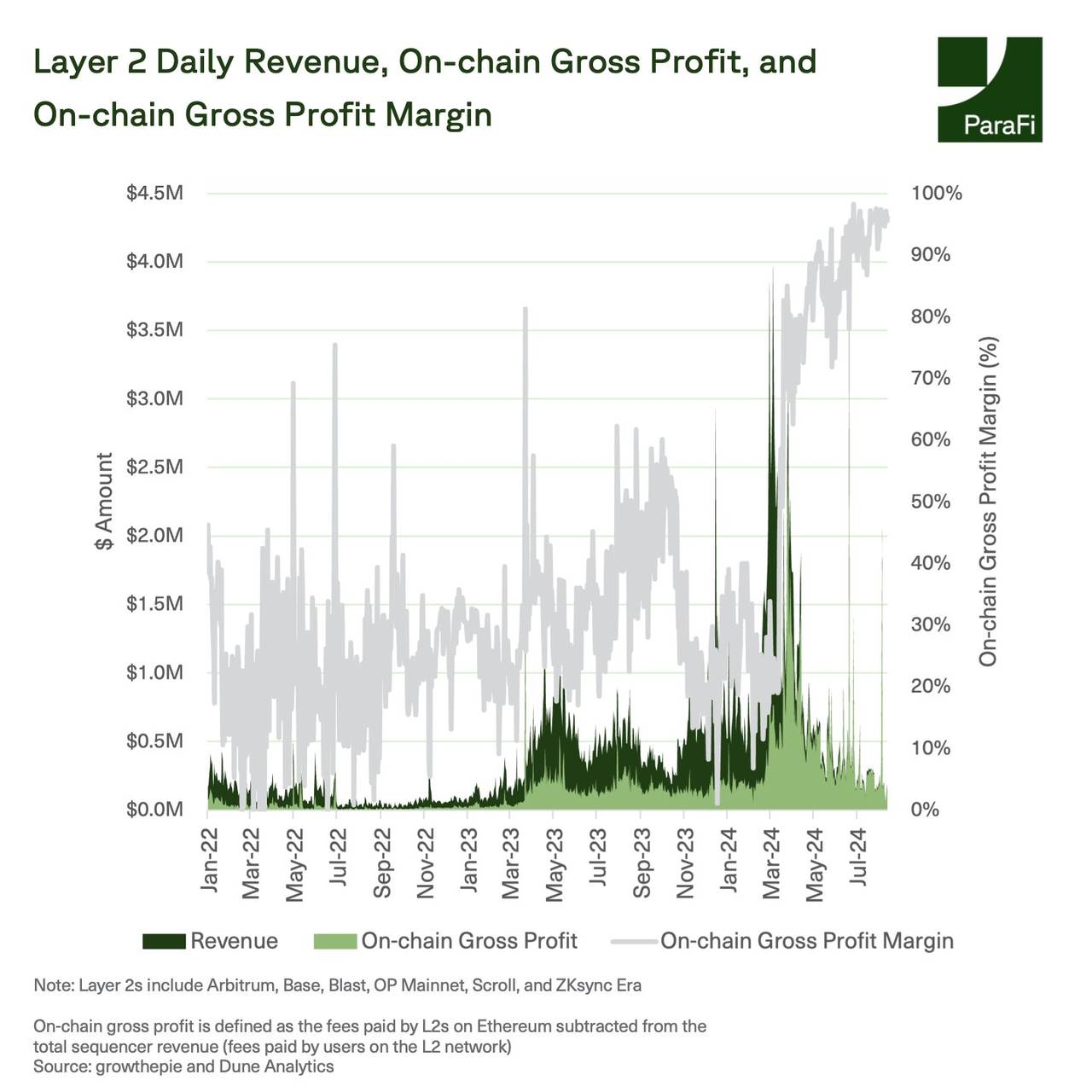

Since the implementation of EIP-4844, the operating profit margin of L2 has significantly increased. Although the total sorter revenue of scaling solutions (i.e., the total fees paid on the L2 network) has averaged a decrease of about 48% this year, operating costs have decreased by about 87%, meaning that Rollup now retains most of the income. The operating profit margin of mainstream L2s now exceeds 90%, even after sending a large portion of the cost savings to users. Users benefit from this, as the fees on networks using blobs have decreased by about 90% in the past year, with the median transaction cost typically being less than $0.01.

EIP-4844 has had a significant impact on Ethereum L1.

Although the usage of L2 has surged, the direct benefits of ETH as an asset are not yet clear. In the past few months, despite the substantial increase in L2 profits, the burning rate of ETH has decreased, leading to a decrease in the value flowing into ETH.

This leaves many questions for the Ethereum ecosystem to ponder:

As the usage of L2 continues to grow, what role will L2 tokens play? How much value will L2 tokens capture compared to ETH?

Is the relative income of Rollup too much compared to Ethereum? Or is this structure ideal to attract more users and developers into the broader Ethereum ecosystem?

How will users and liquidity interoperate among these different networks as more L2s are launched?

With the fees on the Ethereum mainnet now at historic lows, will we see developers reconsider deploying directly on L1, or is L2 still more attractive?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。