In the recent cryptocurrency market, Pump Fun, as a representative of the new generation of meme token issuance platforms, has sparked an unprecedented speculative frenzy. Everyone fantasizes about exchanging 0.02 SOL for multiple returns, even realizing the dream of getting rich. This article will analyze the phenomenon and profitability of Pump Fun and its future. We will also focus on the Sun Pump project on the XRP chain and discuss whether it can replicate the success of Pump Fun. Personally, when money becomes the core driving force, it will be relatively difficult to build a community that truly represents meme culture.

I. Analysis of the Pump Fun Phenomenon

Background of the Pump Fun project and its rise in the market

The rise of Pump Fun is closely related to the rapid development of Solana. As the public chain for meme tokens this year, Solana's rapid development has provided an ideal environment for Pump Fun with its high speed and low fees.

The success of Pump Fun can be attributed to the following key factors:

1) Low entry barrier: Starting a project on Pump Fun only requires 0.02 SOL, greatly reducing the entry barrier, allowing even retail investors to participate.

2) Source of liquidity: The liquidity on Raydium comes directly from purchases on Pump Fun. This means that even if the project goes to zero, the "developers" have relatively limited losses.

3) Advantage of rapid listing: Compared to traditional projects that require long-term operation and high costs to enter large exchanges, Pump Fun projects can quickly enter Dex Raydium as long as they reach a market value of $60,000, and the first batch of buyers has already gained multiple returns.

Of course, this is only from the perspective of developers or project parties. For ordinary retail investors, the attractiveness of Pump Fun mainly lies in the following points:

1) Recognition of meme culture: These tokens represent the meme culture that mainstream users currently love, in stark contrast to traditional VC projects.

2) Wealth creation myth: The scarcity of secondary market liquidity has created opportunities for huge profits. There are stories of investors investing 1 SOL and making a hundredfold profit, which greatly stimulates market enthusiasm.

Similarities and differences with traditional meme projects

In fact, the tokens deployed on Pump Fun and Bitcoin memes are essentially in the meme category. However, compared to traditional meme projects, Pump Fun has a lower operational threshold and is more user-friendly, which has garnered more widespread attention in the short term. However, this explosive growth also means that its popularity may come and go quickly. In contrast, the lifecycle of meme projects may be longer.

Analysis of community response and market acceptance

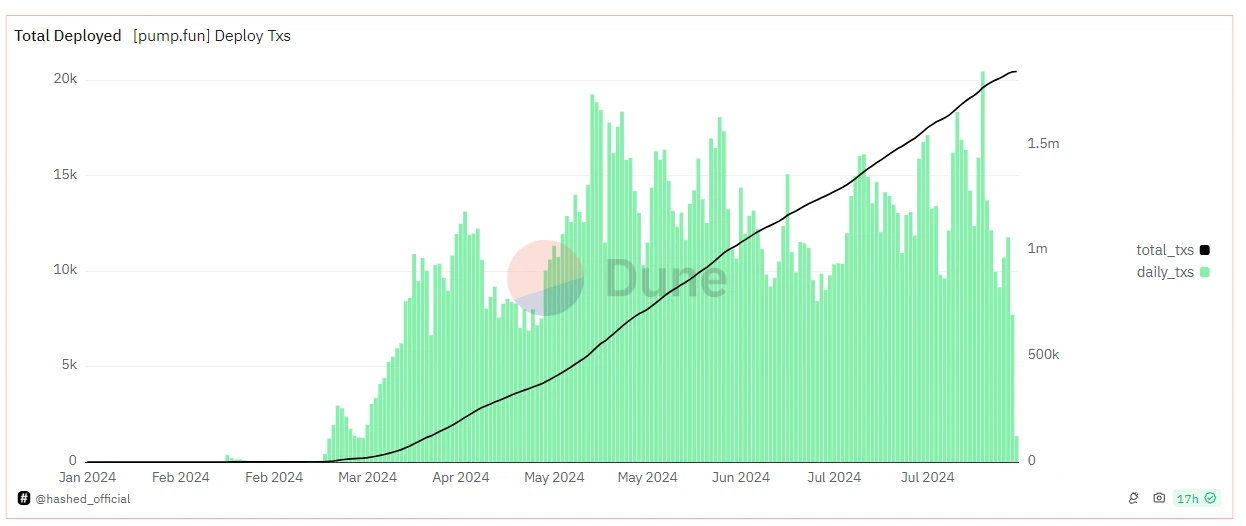

Looking at the market data, the popularity of Pump Fun has been continuously increasing. Since March this year, the daily deployment volume of Pump Fun has continued to increase, reaching an astonishing 1.82 million in August. This indicates that there is still a strong interest in the investment model of small bets for big returns, despite the fact that successful cases from Pump Fun to Raydium are few and far between.

Image source: Dune @hashed_official

However, with the rise of Sun Pump in the XRP ecosystem, users of Pump Fun seem to be shifting their focus. In just 7 days, Sun Pump added 25,000 token deployments, showing strong momentum. This not only drove the popularity of Sun Pump but also indirectly pushed the XRP price from $0.55 to $0.61, a 10% increase.

Image source: Dune @Maditim

The success of Sun Pump seems to be replicating the wealth creation myth of Pump Fun. There are even rumors in the market of traders starting with 1690 yuan and making as much as 20 million yuan in floating profits. Although such extreme cases need to be treated with caution, they do further stimulate the imagination and enthusiasm of investors.

Personally, whether it's Pump Fun or Sun Pump, when money becomes the core driving force, building a community that truly represents meme culture will face significant contradictions. The future development of these projects depends not only on market enthusiasm but also on finding a balance between speculation and value creation.

II. Profit Model of Pump Fun

Analysis of the token economic model

In fact, the meme tokens launched on the Pump Fun platform do not have the traditional token economics. The process of creating tokens on the Pump Fun platform is unique. When developers create tokens on pump.fun, these tokens can initially only be traded within the platform and cannot be directly circulated on Raydium. The trading mechanism within the platform follows the conventional supply and demand principles: buying raises prices, selling lowers prices.

In the initial stage, the market value of pump.fun tokens is about $4,000. As trading progresses, when the market value of the tokens reaches the critical point of about $60,000, the pump.fun platform will automatically terminate internal trading and migrate the tokens to Raydium. This process represents the minimum market value required for the migration of tokens to Raydium.

Migrating to Raydium is a key point in the lifecycle of the tokens. At this point, the tokens are exposed to a wider range of investors, and the potential buyers increase significantly. However, this is also often the moment when early investors take profits. Many investors who bought in during the low market value stage of pump.fun will cash out at this time, realizing substantial profits.

Image source: The Block

Comparison with other meme coin projects

The design of Pump Fun seems simple and intuitive on the surface, but to profit on this platform, it requires a high level of market insight and operational skills. The closed-source code of the platform further increases the difficulty of operation, putting ordinary investors at an information disadvantage. The only advantage of Pump Fun is that it is built on the Solana chain, with extremely low transaction costs, creating favorable conditions for frequent trading. Therefore, the opportunity for profit compared to other meme coin projects in the secondary market is very low.

Potential risks and sustainability challenges

The activities on the Pump Fun platform exhibit a high degree of speculation, thus accompanying high risks. Currently, the biggest risk on the platform is the presence of many soft rug pulls, with two common types being:

1) Direct selling by developers:

On Pump Fun, the developer's wallet is publicly visible. Some irresponsible developers take advantage of this by selling small portions of their holdings (generally less than 8%) before the tokens reach Raydium or just after reaching Raydium. This behavior often triggers a chain reaction, causing other holders to rush to exit, turning into a competition of "the first to exit wins."

2) Pump Fun bundled wallets:

This is a more complex fraudulent method. Developers use multiple wallets to buy a large amount at the beginning of the project, and then continuously raise the price with 2-3 wallets. They may sell all of their holdings before the tokens reach Raydium, or if the community sentiment is bullish, they may wait until after the listing on Raydium to sell.

Overall, while the Pump Fun platform provides potential opportunities for high returns for investors, it also carries significant risks. It is estimated that about 95% of projects on the platform may involve some form of fraud. In this high-risk, high-return environment, rationality and caution are crucial.

III. Analysis of the Sustainability of Meme Coin Market Trends

Correlation between Meme Coins and the Overall Cryptocurrency Market

There is a certain degree of positive correlation between the meme coin market and the overall cryptocurrency market. Although it cannot fully represent the entire crypto market, meme coins are currently seen as a barometer of market sentiment. Just as the saying goes, "the warm spring water in the river indicates the arrival of ducks," meme coins are currently the "ducks" that can perceive changes in market sentiment first.

However, this relationship is not simply positive. The activity in the meme coin market is particularly prominent in the current market environment. While other sectors are relatively quiet, the meme coin market exhibits greater volatility and more rapid reactions, while other crypto assets may show more stable trends. In the current "bear market" situation, meme coins can be said to be the last active zone in the secondary market of cryptocurrencies. Therefore, the performance of meme coins cannot be directly equated with the overall health of the crypto market.

Investor Psychology Analysis: From FOMO to Rational Decision-Making

The investor psychology of meme coins has undergone significant evolution. The FOMO stage was roughly from early 2024 to April, represented by Pepe Coin, which surged from $0.01 to $0.16, a 16-fold increase. Subsequently, meme coins such as WIF, BOME, FLOKI, and BONK successively exploded, triggering a frenzy of meme speculation. Investors were driven by FOMO psychology and rushed into the market. As meme coins continued to perform well, some traditional investment institutions (commonly known as "old money") began to pay attention and gradually enter the meme coin market, bringing more funds to the market. After the crazy rise and subsequent correction after June 18 and July 5, the existing funds in the market are now taking a more rational view of the meme coin market. They are no longer blindly chasing highs, and many people are starting to adopt more cautious investment strategies, such as setting stop-loss points, diversifying portfolios, etc. This has also led to the emergence of low-cost Pump Fun meme issuance platform.

IV. Evolution of Cryptocurrency Market Trends

The evolution of the cryptocurrency market reflects the vitality and innovative spirit of this industry. From tokens to meme coins, and possibly the upcoming trend of VC coins, we have seen the continuous shift in market focus. In 2023, we witnessed the rise of Bitcoin tokens, which brought new possibilities for the Bitcoin network and became a hot investment in 2023 due to its innovative technology. However, in 2024, the meme coin market became the focus due to its high growth potential, demonstrating remarkable vitality and attracting investors from retail to institutional, shifting from value coins to meme tokens.

Looking ahead to 2025, some views predict that cryptocurrency projects supported by venture capital (VC) may become the next investment hotspot. This is because the cryptocurrency industry is moving towards a more mature and standardized direction, and there may be an increased demand in the market for projects with substantial and long-term development potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。